Superior Group of Companies, Inc. Reports Operating Results for the Second Quarter June 30, 2019

July 30 2019 - 7:10AM

Superior Group of Companies, Inc. (NASDAQ: SGC), today announced

its second quarter operating results for 2019.

The Company announced that for the second

quarter ended June 30, 2019, net sales increased 12.0 percent to

$92.3 million, compared to second quarter 2018 net sales of $82.4

million. Pretax Income was $3.7 million compared to $5.1 million in

2018. Net income was $2.8 million or $0.18 per diluted share,

compared to $0.25 per diluted share in 2018.

Michael Benstock, Chief Executive Officer,

commented, “Across all of our segments, we continue to perform well

in a challenging business environment. We’re currently investing in

our companies and making the organizational changes necessary to

support our current business and prepare for our next level of

growth; all while realizing increased sales for our 27th

consecutive quarter.

Our uniform segment sales were up 7.7% from last

year, as we reached the first anniversary of our acquisition of CID

Resources. We’re making good progress on the integration of

our uniform businesses enabling operational efficiencies, improved

resource alignment, product sourcing, and sales channels.

Technology upgrades are moving forward in our distribution centers

in Arkansas and Texas, and construction continues on our second

manufacturing facility in Haiti. Our investments in these

initiatives are designed to generate cost efficiencies, improve

working capital usage, and better serve the needs of our

customers.

We continue to see strong growth at BAMKO and

The Office Gurus. During the second quarter, BAMKO, our promotional

products segment posted sales growth of 24.9% to $23.7 million

compared to the second quarter of last year. The Office Gurus, our

remote staffing segment, continues to perform to our expectations

with quarterly net sales growth to outside customers of 11.6% over

the comparable period.” CONFERENCE

CALL

Superior Group of Companies will hold a

conference call on Tuesday, July 30, 2019 at 2:00 p.m. Eastern Time

to discuss the Company’s results. Interested individuals may join

the teleconference by dialing (844) 861-5505 for U.S. dialers and

(412) 317-6586 for International dialers. The Canadian Toll Free

number is (866) 605-3852. Please ask to be joined into the Superior

Group of Companies call. The live webcast and archived replay can

also be accessed in the investor information section of the

Company’s website at www.superiorgroupofcompanies.com.

A telephone replay of the teleconference will be

available one hour after the end of the call through 2:00 p.m.

Eastern Time on August 13, 2019. To access the replay, dial (877)

344-7529 in the United States or (412) 317-0088 from international

locations. Canadian dialers can access the replay at (855)

669-9658. Please reference conference number

10132243 for all replay access.

About Superior Group of Companies, Inc.

(SGC):

Superior Group of Companies™, formerly Superior

Uniform Group, established in 1920, is a combination of companies

that help customers unlock the power of their brands by creating

extraordinary brand experiences for employees and customers. It

provides customized support for each of its divisions through its

shared services model.

Fashion Seal Healthcare®, HPI™ and CID Resources

are signature uniform brands of Superior Group of Companies. Each

is one of America’s leading providers of uniforms and image apparel

in the markets it serves. They specialize in innovative uniform

program design, global manufacturing, and state-of-the-art

distribution. Every day, more than 6 million Americans go to work

wearing a uniform from Superior Group of Companies.

BAMKO®, Tangerine Promotions® and Public

Identity® are signature promotional products and branded

merchandise brands of Superior Group of Companies. They provide

unique custom branding, design, sourcing, and marketing solutions

to some of the world’s most successful brands.

The Office Gurus® is a global provider of custom

call and contact center support. As a true strategic partner, The

Office Gurus implements customized solutions for its customers in

order to accelerate their growth and improve their customers’

service experiences.

SGC’s commitment to service, technology, quality

and value-added benefits, as well as its financial strength and

resources, provides unparalleled support for its customers’ diverse

needs while embracing a “Customer 1st, Every Time!” philosophy and

culture in all of its business segments.

Visit www.superiorgroupofcompanies.com for more information.

| Contact: |

|

|

| Michael Attinella |

|

Hala Elsherbini |

| Chief Financial Officer & Treasurer

|

OR |

Halliburton Investor Relations |

| (727) 803-7170 |

|

(972) 458-8000 |

Comparative figures are as follows:

| |

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

| |

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

THREE MONTHS ENDED JUNE 30, |

|

| |

(Unaudited) |

|

| |

(In thousands, except shares and per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

2019 |

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net sales |

|

|

|

|

$ |

92,270 |

$ |

82,392 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Costs and expenses: |

|

|

|

|

|

|

|

|

| |

|

Cost of goods sold |

|

|

|

|

59,927 |

|

53,114 |

|

| |

|

Selling and administrative expenses |

|

|

|

26,885 |

|

23,327 |

|

| |

|

Other periodic pension costs |

|

|

|

|

547 |

|

96 |

|

| |

|

Interest expense |

|

|

|

|

1,259 |

|

758 |

|

| |

|

|

|

|

|

|

|

|

88,618 |

|

77,295 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income before taxes on income |

|

|

|

|

3,652 |

|

5,097 |

|

| |

Income tax expense |

|

|

|

|

871 |

|

1,280 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income |

|

|

|

|

$ |

2,781 |

$ |

3,817 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average

number of shares outstanding during the period |

|

|

|

|

| |

|

(Basic) |

|

|

|

|

|

14,952,802 |

|

14,956,221 |

|

| |

|

(Diluted) |

|

|

|

|

|

15,287,357 |

|

15,559,404 |

|

| |

Per Share

Data: |

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

|

|

|

|

|

|

|

| |

|

Net income |

|

|

|

$ |

0.19 |

$ |

0.26 |

|

| |

Diluted |

|

|

|

|

|

|

|

|

|

|

| |

|

Net income |

|

|

|

$ |

0.18 |

$ |

0.25 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash dividends per common share |

|

|

|

$ |

0.100 |

$ |

0.095 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

| |

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

SIX MONTHS ENDED JUNE 30, |

|

| |

(Unaudited) |

|

| |

(In thousands, except shares and per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

2019 |

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net sales |

|

|

|

|

$ |

178,822 |

$ |

155,479 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Costs and expenses: |

|

|

|

|

|

|

|

|

| |

|

Cost of goods sold |

|

|

|

|

116,211 |

|

101,326 |

|

| |

|

Selling and administrative expenses |

|

|

|

52,748 |

|

44,509 |

|

| |

|

Other periodic pension costs |

|

|

|

|

806 |

|

192 |

|

| |

|

Interest expense |

|

|

|

|

2,429 |

|

1,035 |

|

| |

|

|

|

|

|

|

|

|

172,194 |

|

147,062 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income before taxes on income |

|

|

|

|

6,628 |

|

8,417 |

|

| |

Income tax expense |

|

|

|

|

1,471 |

|

2,150 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income |

|

|

|

|

$ |

5,157 |

$ |

6,267 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average

number of shares outstanding during the period |

|

|

|

|

| |

|

(Basic) |

|

|

|

|

|

14,940,072 |

|

14,888,940 |

|

| |

|

(Diluted) |

|

|

|

|

|

15,275,006 |

|

15,508,517 |

|

| |

Per Share

Data: |

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

|

|

|

|

|

|

|

| |

|

Net income |

|

|

|

$ |

0.35 |

$ |

0.42 |

|

| |

Diluted |

|

|

|

|

|

|

|

|

|

|

| |

|

Net income |

|

|

|

$ |

0.34 |

$ |

0.40 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash dividends per common share |

|

|

|

$ |

0.20 |

$ |

0.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

(Unaudited) |

|

|

(In thousands, except share and par value data) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

June 30, |

|

December 31, |

|

| |

|

|

|

|

|

|

2019 |

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

| |

Cash and cash

equivalents |

|

|

$ |

8,267 |

|

$ |

5,362 |

|

|

| |

Accounts

receivable, less allowance for doubtful accounts |

|

|

|

|

|

| |

of $2,141

and $2,042, respectively |

|

|

|

70,927 |

|

|

64,017 |

|

|

| |

Accounts

receivable - other |

|

|

|

1,463 |

|

|

1,744 |

|

|

| |

Inventories |

|

|

|

|

63,370 |

|

|

67,301 |

|

|

| |

Contract

assets |

|

|

|

|

43,674 |

|

|

49,236 |

|

|

| |

Prepaid expenses

and other current assets |

|

|

12,090 |

|

|

9,552 |

|

|

| |

TOTAL CURRENT

ASSETS |

|

|

|

|

199,791 |

|

|

197,212 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| PROPERTY, PLANT

AND EQUIPMENT, NET |

|

|

31,448 |

|

|

28,769 |

|

|

| OPERATING LEASE

RIGHT-OF-USE ASSETS |

|

|

4,716 |

|

|

- |

|

|

| INTANGIBLE ASSETS,

NET |

|

|

|

64,437 |

|

|

66,312 |

|

|

| GOODWILL |

|

|

|

|

|

36,321 |

|

|

33,961 |

|

|

| OTHER ASSETS |

|

|

|

|

10,299 |

|

|

8,832 |

|

|

| TOTAL ASSETS |

|

|

|

$ |

347,012 |

|

$ |

335,086 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

| |

|

|

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

| |

Accounts

payable |

|

|

|

$ |

25,903 |

|

$ |

24,685 |

|

|

| |

Other current

liabilities |

|

|

|

15,375 |

|

|

14,767 |

|

|

| |

Current portion of

long-term debt |

|

|

|

15,286 |

|

|

6,000 |

|

|

| |

Current portion of

acquisition-related contingent liabilities |

|

2,212 |

|

|

941 |

|

|

| |

TOTAL CURRENT

LIABILITIES |

|

|

|

58,776 |

|

|

46,393 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| LONG-TERM

DEBT |

|

|

|

|

108,035 |

|

|

111,522 |

|

|

| LONG-TERM PENSION

LIABILITY |

|

|

|

8,532 |

|

|

8,705 |

|

|

| LONG-TERM

ACQUISITION-RELATED CONTINGENT LIABILITIES |

|

3,605 |

|

|

5,422 |

|

|

| LONG-TERM

OPERATING LEASE LIABILITIES |

|

|

2,864 |

|

|

- |

|

|

| DEFERRED TAX

LIABILITY |

|

|

|

6,730 |

|

|

8,475 |

|

|

| OTHER LONG-TERM

LIABILITIES |

|

|

|

4,350 |

|

|

3,648 |

|

|

| COMMITMENTS AND

CONTINGENCIES (NOTE 5) |

|

|

|

|

|

| SHAREHOLDERS'

EQUITY: |

|

|

|

|

|

|

|

| |

Preferred stock,

$.001 par value - authorized 300,000 shares (none issued) |

|

- |

|

|

- |

|

|

| |

Common stock,

$.001 par value - authorized 50,000,000 shares, issued and |

|

|

|

|

|

| |

|

outstanding -

15,255,694 and 15,202,387, respectively. |

|

15 |

|

|

15 |

|

|

| |

Additional paid-in

capital |

|

|

|

57,166 |

|

|

55,859 |

|

|

| |

Retained

earnings |

|

|

|

|

104,165 |

|

|

103,032 |

|

|

| |

Accumulated other

comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

Pensions |

|

|

|

|

(6,924 |

) |

|

(7,673 |

) |

|

| |

|

Cash flow

hedges |

|

|

|

102 |

|

|

113 |

|

|

| |

|

Foreign currency

translation adjustment |

|

(404 |

) |

|

(425 |

) |

|

| TOTAL

SHAREHOLDERS' EQUITY |

|

|

|

154,120 |

|

|

150,921 |

|

|

| TOTAL LIABILITIES

AND SHAREHOLDERS' EQUITY |

$ |

347,012 |

|

$ |

335,086 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

| |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| |

SIX MONTHS ENDED JUNE 30, |

| |

(Unaudited) |

| |

(In thousands) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

|

| |

Net income |

|

|

$ |

5,157 |

|

$ |

6,267 |

|

| |

Adjustments to reconcile net income |

|

|

|

|

| |

to net cash provided by (used in) operating activities: |

|

|

|

|

| |

|

Depreciation and amortization |

|

4,211 |

|

|

3,646 |

|

| |

|

Provision for bad debts - accounts receivable |

|

361 |

|

|

323 |

|

| |

|

Share-based compensation expense |

|

1,032 |

|

|

1,490 |

|

| |

|

Deferred income tax benefit (provision) |

|

(1,979 |

) |

|

302 |

|

| |

|

Gain on sale of property, plant and equipment |

|

(3 |

) |

|

- |

|

| |

|

Change in fair value of acquisition-related contingent

liabilities |

|

417 |

|

|

(840 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

Changes in assets and liabilities, net of acquisition of

business: |

|

|

|

|

| |

|

|

Accounts receivable - trade |

|

(7,230 |

) |

|

(3,492 |

) |

| |

|

|

Accounts receivable - other |

|

280 |

|

|

(674 |

) |

| |

|

|

Contract assets |

|

|

5,562 |

|

|

(972 |

) |

| |

|

|

Inventories |

|

|

2,113 |

|

|

2,953 |

|

| |

|

|

Prepaid expenses and other current assets |

|

(2,625 |

) |

|

242 |

|

| |

|

|

Other assets |

|

|

(2,102 |

) |

|

(1,827 |

) |

| |

|

|

Accounts payable and other current liabilities |

|

(14 |

) |

|

(7,368 |

) |

| |

|

|

Long-term pension liability |

|

812 |

|

|

195 |

|

| |

|

|

Other long-term liabilities |

|

759 |

|

|

(497 |

) |

| |

|

Net cash provided by (used in) operating activities |

|

6,751 |

|

|

(252 |

) |

| |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

| |

|

Additions to property, plant and equipment |

|

(4,979 |

) |

|

(2,414 |

) |

| |

|

Proceeds from disposals of property, plant and equipment |

|

3 |

|

|

- |

|

| |

|

Acquisition of businesses, net of acquired cash |

|

- |

|

|

(85,597 |

) |

| |

|

Net cash used in investing activities |

|

(4,976 |

) |

|

(88,011 |

) |

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

| |

|

Proceeds from long-term debt |

|

94,466 |

|

|

146,157 |

|

| |

|

Repayment of long-term debt |

|

(88,667 |

) |

|

(56,289 |

) |

| |

|

Payment of cash dividends |

|

|

(3,023 |

) |

|

(2,827 |

) |

| |

|

Payment of acquisition-related contingent liability |

|

(961 |

) |

|

(3,033 |

) |

| |

|

Proceeds received on exercise of stock options |

|

280 |

|

|

405 |

|

| |

|

Tax benefit from vesting of acquisition-related restricted

stock |

|

30 |

|

|

105 |

|

| |

|

Tax withholding on exercise of stock rights |

|

- |

|

|

(17 |

) |

| |

|

Common stock reacquired and retired |

|

(1,036 |

) |

|

- |

|

| |

Net cash provided

by financing activities |

|

1,089 |

|

|

84,501 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Effect of currency

exchange rates on cash |

|

41 |

|

|

(204 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

Net increase (decrease) in cash and cash equivalents |

|

2,905 |

|

|

(3,966 |

) |

| |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents balance, beginning of year |

|

5,362 |

|

|

8,130 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents balance, end of period |

$ |

8,267 |

|

$ |

4,164 |

|

| |

|

|

|

|

|

|

|

|

|

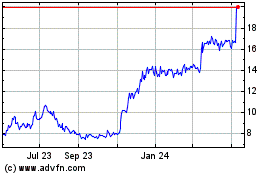

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

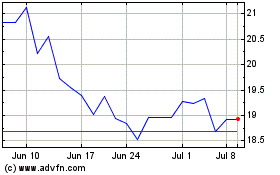

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Apr 2023 to Apr 2024