0001872525

true

0001872525

2023-06-01

2023-06-01

0001872525

SWAG:CommonStockParValue0.0001PerShareMember

2023-06-01

2023-06-01

0001872525

SWAG:WarrantsEachWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf4.81375Member

2023-06-01

2023-06-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 1, 2023

| STRAN

& COMPANY, INC. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

001-41038 |

|

04-3297200 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 2 Heritage Drive, Suite 600, Quincy, MA |

|

02171 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| 800-833-3309 |

| (Registrant’s

telephone number, including area code) |

| |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

SWAG |

|

The

NASDAQ Stock Market LLC |

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375 |

|

SWAGW |

|

The NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

Growth Company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note:

On

June 1, 2023, Stran & Company, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original 8-K”)

reporting the completion of the previously announced purchase of substantially all the assets of T R Miller Co., Inc., a Massachusetts

corporation (“T R Miller”). In that filing, the Company indicated that it would amend the Original 8-K at a later date to

include any financial statements and any pro forma financial information required by Item 9.01 of Form 8-K. This amendment to the Original

8-K is being filed to provide such financial statements and financial information, which are attached to this report as Exhibit 99.1,

Exhibit 99.2, Exhibit 99.3, and Exhibit 99.4. The disclosure contained in Item 2.01 of the Original 8-K is repeated below for convenience.

No other changes have been made to the Original 8-K except to remove Item 7.01 and related disclosure regarding a press release that

was issued in connection with the completion of the acquisition of substantially all the assets of T R Miller.

Item 2.01

Completion of Acquisition or Disposition of Assets.

As

previously disclosed in its Current Report on Form 8-K filed on January 31, 2023 (the “Prior Form 8-K”), on January 25, 2023,

Stran & Company, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Purchase Agreement”)

with T R Miller Co., Inc., a Massachusetts corporation (“T R Miller”), and Thomas R. Miller (the “Miller Stockholder”),

pursuant to which the Company agreed to acquire substantially all of the assets of T R Miller used in T R Miller’s branding, marketing

and promotional products and services business (the “T R Miller Business”). The T R Miller Business has existing operations

and has generated revenues. As previously reported, the Purchase Agreement provided that the aggregate purchase price (“Purchase

Price”) for the T R Miller Business would consist of cash payments by the Company to T R Miller at and following the consummation

of the transactions contemplated by the Purchase Agreement (the “Closing”), subject to certain adjustments, as described

in the Prior Form 8-K.

On

June 1, 2023, the Closing was completed. Pursuant to the Purchase Agreement, the Company paid T R Miller $2,154,230.21 in cash, reflecting

the purchase price of $1,000,000 as adjusted by a $1,123,071.82 working capital adjustment; no adjustment for indebtedness as of the

date and time of the Closing (the “Closing Date”) that was not part of the Assumed Liabilities (as defined in the Purchase

Agreement); no separate amount for any Inventory (as defined in the Purchase Agreement) that was on hand and owned by Seller as of the

Closing Date, as such amount was included in the working capital adjustment; and first and last month’s rent under the Lease Agreement

(as defined below) of $14,962.50 and $16,195.89, respectively.

Following

the Closing, the Company will make (a) installment payments equal to (i) $400,000 on the first anniversary of the Closing Date, (ii)

$300,000 on the second anniversary of the Closing Date, (iii) $200,000 on the third anniversary of the Closing Date, and (iv) $200,000

on the fourth anniversary of the Closing Date, each such installment payment subject to adjustment for certain uncollected accounts receivable

amounts outstanding after the first 12 months following the Closing; and (b) four annual payments (the “Earn Out Payments”),

each equal to (i) 45% of the annual Gross Profit (as defined in the Purchase Agreement) of T R Miller above $4,000,000 with respect to

certain customers of T R Miller or primarily resulting from the efforts of the Stockholder or certain employees or independent contractors

of T R Miller, plus (ii) 25% of the annual Gross Profit above $4,000,000 with respect to customers primarily resulting from the past

or future efforts of the Buyer that are assigned to and primary responsibility of any employee or independent contractor of T R Miller

as designated by the Purchase Agreement, for the trailing 12-month period, as of the first, second, third, and fourth anniversary of

the Closing Date, each such Earn Out Payment subject to adjustment as set forth in the Purchase Agreement.

The

timing and manner of the remaining working capital adjustments or payments and the Earn Out Payments, and the resolution of any disagreements

as to such adjustments or payments, will follow the procedures provided by the Purchase Agreement.

In

addition, as of the Closing Date, the Company undertook to perform or otherwise pay, satisfy and discharge as of the Closing the Assumed

Liabilities (as defined in the Purchase Agreement).

The

Purchase Agreement also contained additional representations, warrants, covenants, indemnification provisions and other terms which are

described in the Prior Form 8-K.

Pursuant

to the Purchase Agreement, in connection with the Closing, the Company, as tenant, and Miller Family Walpole LLC, as landlord (the “Landlord”),

entered into a lease agreement for a warehouse facility used by the T R Miller Business, dated May 31, 2023 (the “Lease Agreement”).

The Lease Agreement provides for base rent of $179,550.00 in the first year of the lease and an increase of 2% per annum in each subsequent

year. We may extend the term for an additional five years upon the same base rent terms upon 12 months’ notice. We will be responsible

for all property and other taxes and expenses related to the facility except for maintenance of certain structural elements. The initial

lease term commenced on June 1, 2023 and terminates on May 31, 2028. We may assign our rights to the lease and property at the facility

as collateral to a lender. The Landlord is also required to execute a landlord lien waiver and collateral access agreement upon request.

The Lease Agreement contains provisions for minimum insurance, mutual indemnification from certain claims relating to the Lease Agreement,

and customary default and related termination and remedy provisions. The foregoing description of the lease agreement is qualified in

its entirety by reference to the full text of the agreement, a copy of which is filed as Exhibit 10.1 to this Current Report.

In

addition, the Company entered into (i) a consulting agreement with the Miller Stockholder providing for certain consulting services to

the Company for a period of three years following the Closing Date and (ii) an employment agreement with Stacy Miller.

The

foregoing references to the terms and conditions of the Purchase Agreement do not purport to be complete and are qualified in their entirety

by reference to the Prior Form 8-K, and to the full text of the agreement attached to the Prior Form 8-K and to this report as Exhibit

2.1, and which is incorporated herein by reference.

There

were no material relationships, other than in respect of the transaction, between T R Miller, the Miller Stockholder, and the Company

or any of the Company’s affiliates, including any director or officer of the Company, or any associate of any director or officer

of the Company.

Item 9.01 Financial Statements and Exhibits.

(a)

Financial statements of businesses or funds acquired.

The

audited financial statements of T R Miller as of and for the year ended June 30, 2022, the related notes, and the report of the independent

auditor with respect thereto, are attached hereto as Exhibit 99.1 and incorporated by reference herein.

The

unaudited condensed interim financial statements of T R Miller, consisting of the unaudited condensed balance sheet as of March 31, 2023

and the related unaudited condensed statement of operations and retained earnings for the nine months ended March 31, 2023 are attached

hereto as Exhibit 99.2 and incorporated by reference herein.

(b)

Pro forma financial information.

The

unaudited pro forma condensed combined balance sheet of the Company and T R Miller as of December 31, 2022, the unaudited pro forma condensed

combined statement of income of the Company and T R Miller for the 12 months ended December 31, 2022, and the related notes to the unaudited

pro forma condensed combined financial information, are attached hereto as Exhibit 99.3 and incorporated by reference herein.

The

unaudited pro forma condensed combined balance sheet of the Company and T R Miller as of March 31, 2023, the unaudited pro forma condensed

combined statement of income of the Company and T R Miller for the three months ended March 31, 2023, and the related notes to the unaudited

pro forma condensed combined financial statements, are attached hereto as Exhibit 99.4 and incorporated by reference herein.

(d)

Exhibits

Exhibit

No. |

|

Description

of Exhibit |

| 2.1 |

|

Asset Purchase Agreement, dated as of January 25, 2023, by and among Stran & Company, Inc., T R Miller Co., Inc. and Thomas R. Miller (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed on January 31, 2023) |

| 10.1 |

|

Land and Building Lease Agreement, dated May 31, 2023, between Miller Family Walpole LLC and Stran & Company, Inc. (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on June 1, 2023) |

| 23.1 |

|

Consent

of BF Borgers CPA PC |

| 99.1 |

|

The

audited financial statements of T R Miller Co., Inc. as of and for the year ended June 30, 2022, the related notes, and the report

of the independent auditor with respect thereto |

| 99.2 |

|

The

unaudited condensed interim financial statements of T R Miller Co., Inc., consisting of the unaudited condensed balance sheet as

of March 31, 2023 and the related unaudited condensed statement of operations for the nine months ended March 31, 2023 |

| 99.3 |

|

The

unaudited pro forma condensed combined balance sheet of Stran & Company, Inc. and T R Miller Co., Inc. as of December 31, 2022,

and the unaudited pro forma combined condensed statement of income for the 12 months ended December 31, 2022, and the related notes

to the unaudited pro forma condensed combined financial statements |

| 99.4 |

|

The unaudited pro forma combined condensed balance sheet of Stran & Company, Inc. and T R Miller Co., Inc. as of March 31, 2023, the unaudited pro forma condensed combined statement of income for the three months ended March 31, 2023, and the related notes to the unaudited pro forma condensed combined financial statements |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

August 17, 2023 |

STRAN

& COMPANY, INC. |

| |

|

| |

/s/

Andrew Shape |

| |

Name: |

Andrew Shape |

| |

Title: |

President and Chief Executive Officer |

5

Exhibit 23.1

CONSENT OF INDEPENDENT PUBLIC ACCOUNTING FIRM

We consent to the inclusion in this Current Report

on Form 8-K and the incorporation by reference in the Registration Statement on Form S-3 (File No. 333-271337) and the Registration Statement

on Form S-8 (File No. 333-261050) of Stran & Company, Inc. of our report dated August 17, 2023, with respect to our audits of the

financial statements of T R Miller Co., Inc., which comprise the balance sheet as of June 30, 2022, and the results of its operations

and its cash flows for the fiscal year ended June 30, 2022 in accordance with accounting principles generally accepted in the United States

of America.

| /s/ BF Borgers CPA PC |

|

|

BF Borgers CPA PC (PCAOB ID 5041)

Lakewood, CO |

|

| August 17, 2023 |

|

Exhibit 99.1

T R

MILLER CO., INC.

AUDITED

financial statements

YEAR

ENDED JUNE 30, 2022

Report of Independent Registered Public Accounting

Firm

To the shareholders and the board of directors

of T R Miller Co., Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheet

of T R Miller Co., Inc. (the “Company”) as of June 30, 2022, the related statement of operations, stockholders’ equity

(deficit), and cash flows for the year then ended, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30,

2022, and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally

accepted in the United States.

Basis for Opinion

These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our

audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged

to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial

statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as

evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s BF Borgers CPA PC

BF Borgers CPA PC (PCAOB ID 5041)

We have served as the Company’s auditor since

2023

Lakewood, CO

August 17, 2023

T R MILLER CO., INC.

BALANCE SHEET

JUNE 30, 2022

| ASSETS | |

| |

| Current Assets | |

| |

| Cash | |

$ | 2,066,838 | |

| Accounts Receivable, Net | |

| 2,568,639 | |

| Deposits | |

| 29,902 | |

| Due from Stockholders, Current | |

| 350,000 | |

| Inventory | |

| 683,719 | |

| Note Receivable, Current | |

| 3,351 | |

| Prepaid Expenses | |

| 31,001 | |

| Total Current Assets | |

| 5,733,450 | |

| | |

| | |

| Property and Equipment | |

| | |

| Leasehold Improvements | |

| 192,299 | |

| Furniture and Fixtures | |

| 624,198 | |

| Vehicles | |

| 213,220 | |

| | |

| 1,029,717 | |

| Accumulated Depreciation | |

| (890,543 | ) |

| Total Property and Equipment | |

| 139,174 | |

| | |

| | |

| Other Assets | |

| | |

| Due from Stockholders, Net of Current Portion | |

| 702,781 | |

| Note Receivable, Net of Current Portion | |

| 71,829 | |

| Total Other Assets | |

| 774,610 | |

| TOTAL ASSETS | |

$ | 6,647,234 | |

| | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | |

| Current Liabilities | |

| | |

| Accounts Payable and Accrued Expenses | |

$ | 467,332 | |

| Accrued Payroll and Related | |

| 351,823 | |

| Corporate Tax Payable | |

| 68,282 | |

| Unearned Revenue | |

| 950,079 | |

| Due to Stockholders | |

| 37,805 | |

| Sales Tax Payable | |

| 83,355 | |

| Total Current Liabilities | |

| 1,958,676 | |

| | |

| | |

| Stockholders’ Equity | |

| | |

| Common Stock, No Par Value, 12,500 Shares Authorized, 4,000 Shares Issued and Outstanding | |

| 8,830 | |

| Retained Earnings | |

| 4,679,728 | |

| Total Stockholders’ Equity | |

| 4,688,558 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 6,647,234 | |

The accompanying notes are an integral part

of these financial statements.

T R MILLER CO., INC.

STATEMENT OF OPERATIONS AND RETAINED EARNINGS

FOR THE YEAR ENDED JUNE 30, 2022

| SALES | |

$ | 20,373,324 | |

| | |

| | |

| COST OF SALES | |

| | |

| Purchases | |

| 13,023,014 | |

| Freight | |

| 1,644,134 | |

| Total Cost Of Sales | |

| 14,667,148 | |

| | |

| | |

| GROSS PROFIT | |

| 5,706,176 | |

| | |

| | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | |

| 4,513,844 | |

| | |

| | |

| EARNINGS FROM OPERATIONS | |

| 1,192,332 | |

| | |

| | |

| OTHER INCOME (EXPENSE) | |

| | |

| Interest Income (Expense), Net | |

| 24,626 | |

| Gain on Sale of Fixed Asset | |

| 33,118 | |

| Other Income (Expense) | |

| (29,011 | ) |

| Total Other Income | |

| 28,733 | |

| | |

| | |

| EARNING BEFORE INCOME TAXES | |

| 1,221,065 | |

| | |

| | |

| INCOME TAXES | |

| | |

| Federal | |

| 171,998 | |

| State | |

| 73,264 | |

| | |

| 245,262 | |

| | |

| | |

| NET EARNINGS | |

| 975,803 | |

| | |

| | |

| RETAINED EARNINGS, BEGINNING | |

| 3,703,925 | |

| RETAINED EARNINGS, ENDING | |

$ | 4,679,728 | |

The accompanying notes are an integral part

of financial statements.

T R MILLER CO., INC.

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED JUNE 30, 2022

| CASH FLOW FROM OPERATING ACTIVITIES | |

| |

| Net Earnings | |

$ | 975,803 | |

| Noncash Items Included in Net Earnings: | |

| | |

| Depreciation and Amortization | |

| 24,389 | |

| (Increase) Decrease in: | |

| | |

| Accounts Receivable, Net | |

| (787,822 | ) |

| Deposits | |

| (24,239 | |

| Inventory | |

| 85,740 | |

| Prepaid Expenses | |

| (3,565 | ) |

| Prepaid Income Taxes | |

| 176,980 | |

| Notes Receivable | |

| 17,349 | |

| Increase (Decrease) in: | |

| | |

| Accounts Payable and Accrued Expenses | |

| (826,634 | ) |

| Accrued Payroll and Related | |

| 184,836 | |

| Corporate Tax Payable | |

| 68,282 | |

| Deferred Revenue | |

| 485,731 | |

| Sales Tax Payable | |

| (63,595 | ) |

| Net Cash Provided By Operating Activities | |

| 313,255 | |

| | |

| | |

| CASH FLOW FROM INVESTING ACTIVITIES | |

| | |

| Additions to Property and Equipment | |

| (66,625 | ) |

| Property Disposed, Net | |

| 25,790 | |

| Net Cash Used By Investing Activities | |

| (40,835 | ) |

| | |

| | |

| CASH FLOW FROM FINANCING ACTIVITIES | |

| | |

| Payment of Long-Term Debt | |

| (44,805 | ) |

| | |

| | |

| NET INCREASE IN CASH | |

| 227,615 | |

| | |

| | |

| CASH AT BEGlNNlNG OF YEAR | |

$ | 1,839,223 | |

| CASH AT END OF YEAR | |

$ | 2,066,838 | |

| | |

| | |

| SUPPLEMENTAL DISCLOSURES: | |

| | |

| Interest Paid | |

$ | 24,626 | |

| Income Taxes Paid | |

$ | - | |

The accompanying notes are an integral part

of these financial statements.

T R MILLER CO., INC.

NOTES TO THE FINANCIAL STATEMENTS

| A. | ORGANIZATION AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES: |

| 1. | Organization – T R Miller Co.,

Inc., (the Company) was incorporated under the laws of the Commonwealth of Massachusetts

and commenced operations on August 5, 1980. |

| 2. | Operations - The Company is an outsourced

marketing solutions provider that sells branded products to customers. The Company purchases

products and branding through various third-party manufacturers and decorators and resells

the finished goods to customers. |

| 3. | Method of Accounting - The Company’s

financial statements are prepared using the accrual basis of accounting in accordance with

accounting principles generally accepted in the United States of America. (“U.S. GAAP”). |

| 4. | Cash and Cash Equivalents - For purposes

of the statement of cash flows, the Company considers all highly liquid investments with

an initial maturity of three months or less to be cash equivalents. |

| 5. | Concentration of Credit Risk - Financial

instruments that potentially subject the Company to concentrations of credit risk consist

primarily of accounts receivable and deposits in excess of federally insured limits. These

risks are managed by performing ongoing credit evaluations of customers’ financial

condition and by maintaining all deposits in high quality financial institutions. |

| 6. | Inventory - Inventory consists of finished goods (branded products)

and goods in process (un-branded products awaiting decoration). All inventory is stated at

the lower of cost (first-in, first-out method) or net realizable value. |

| 7. | Property and Equipment - Property and

equipment are recorded at cost. Maintenance and repairs are charged to expense as incurred

whereas major betterments are capitalized. Depreciation is provided using straight-line and

accelerated methods over five years. |

| 8. | Fair Value of Financial Instruments -

The Company’s financial instruments include cash and cash equivalents, accounts receivable,

note receivable, accounts payable and accrued expenses. The recorded values of cash and cash

equivalents, accounts receivable, accounts payable, and accrued expenses approximate their

fair values based on their short-term nature. |

| 9. | Revenue Recognition - In May 2014, the

Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2014-09, Revenue from Contracts with Customers (“ASU 2014-09”),

which is aimed at creating common revenue recognition guidance for GAAP and the International

Financial Reporting Standards (“IFRS”). This new guidance provides a comprehensive

model for entities to use in accounting for revenue arising from contracts with customers

and supersedes most current revenue guidance issued by the FASB. ASU 2014-09 also requires

both qualitative and quantitative disclosures, including descriptions of performance obligations. |

On January 1, 2019, the Company adopted

ASU 2014-09 and all related amendments (“ASC 606”) and applied its provisions to all uncompleted contracts using the modified

retrospective basis. The application of this new revenue recognition standard resulted in no adjustment to the opening balance of retained

earnings.

Performance Obligations

- Revenue from contracts with customers is recognized when, or as, the Company satisfies its performance obligations by transferring

goods or services to customers. A good or service is transferred to a customer when, or as, the customer obtains control of that good

or service. A performance obligation may be satisfied over time or at a point in time. Revenue from a performance obligation satisfied

at a point in time is recognized at the point in time that the company determines the customer has obtained control over the promised

good or service. The amount of revenue recognized reflects the consideration of which the Company expects to be entitled in exchange

for the promised goods or services.

The following provides detailed information

on the recognition of the Company’s revenue from contracts with customers:

Product Sales - The Company

is engaged in the development and sale of promotional programs and products. Revenue on the sale of these products is recognized after

orders are shipped.

All revenue performance obligations

are satisfied at a point in time.

| 10. | Freight - The Company includes freight

charges as a component of cost of goods sold. |

| 11. | Uncertainty in Income and Other Taxes

- The Company adopted the standards for Accounting for Uncertainty in Income Taxes

(income, sales, use, and payroll), which required the Company to report any uncertain tax

positions and to adjust its financial statements for the impact thereof. As of June 30, 2022,

the Company determined that it had no tax positions that did not meet the “more likely

than not” threshold of being sustained by the applicable tax authority. The Company

files tax and information returns in the United States Federal, Massachusetts, and other

state jurisdictions. These returns are generally subject to examination by tax authorities

for the last three years. |

| 12. | Income Taxes - Income taxes are provided

for the tax effects of transactions reported in the financial statements and consist of taxes

currently due plus deferred taxes. Deferred taxes are provided for differences between the

basis of assets and liabilities for financial statements and income tax purposes. The Company

has historically utilized accelerated tax depreciation to minimize federal income taxes. |

| 13. | Sales Tax - Sales tax collected from

customers is recorded as a liability, pending remittance to the taxing jurisdiction. Consequently,

sales taxes have been excluded from revenues and costs. The Company remits sales and use

to Massachusetts and to other state jurisdictions, respectively. |

| 14. | Effective July 1, 2021, the Company

adopted early implemented Accounting Standards Update (ASU) 2016-02, Leases (ASC Topic 842)

and subsequent amendments. ASC 842 affects all companies that enter into lease arrangements,

with certain exclusions under limited scope limitations. Under ASU 2016-02, an entity recognizes

right-of-use assets and lease obligations on its balance sheet for all leases with a lease

term of more than 12 months. Short-term rentals under year-to-year leases or remaining lease

terms of 12 months or less are exempt from being capitalized. As of June 30, 2022, the Company

did not hold any leases with a term greater than 12 months. See Note G for short-term lease

arraignments. |

| 15. | Use of Estimates - The preparation of

financial statements in conformity with generally accepted accounting principles requires

management to make estimates and assumptions that affect certain reported amounts and disclosures.

Accordingly, actual results could differ from those estimates. |

| B. | ALLOWANCE FOR DOUBTFUL ACCOUNTS: |

The Company uses the allowance method

to account for uncollectible accounts receivable balances. Under the allowance method, an estimate of uncollectible customer balances

is made based on the Company’s prior history and other factors such as credit quality of the customer and economic conditions of

the market. Based on these factors, at June 30, 2022, there was an allowance for doubtful accounts of $9,000.

The Company has multiple loans to

stockholders with various payment terms. At June 30, 2022 the total amount due from stockholders was $1,052,781.

The amounts due from the stockholders

are unsecured and non-interest bearing. There is no formal repayment plan and, accordingly, this amount has been recorded as long-term.

At June 30, 2022, the amount due from stockholder was $702,782.

The amounts due from the stockholder

are unsecured and accrue interest at a rate of 1.91% per annum. The amount due from stockholders is repaid in monthly interest payments

of $557 with a balloon payment in 2023. At June 30, 2022, the current portion due from stockholder was $350,000.

Inventory consists of the following

as of June 30, 2022:

| Finished Goods (Branded) | |

$ | 430,767 | |

| Goods in Process (Un-branded) | |

| 252,952 | |

| | |

$ | 683,719 | |

The note receivable is unsecured and

accrues interest at a rate of 3.32% per annum. The note receivable is repaid in monthly payments of $483. At June 30, 2022, the current

portion of the note receivable was $3,351. At June 30, 2022, the long-term portion of the note receivable was $71,829.

Unearned revenue includes customer

deposits and deferred revenue which represent prepayments from customers. At June 30, 2022, the Company had unearned revenue totaling

$950,079.

| Balance at July 1, | |

$ | 464,349 | |

| Revenue recognized | |

| (20,295,394 | ) |

| Amounts collected or invoiced | |

| 20,781,124 | |

| Unearned Revenue | |

$ | 950,079 | |

| G. | Operating

Leases - Related party: |

The Company leases certain facilities

from related parties as a tenant-at-will. For the year ended June 30, 2022, total rent expense paid and charged to operations amounted

to $184,650.

The determination has been made that

a variable interest does not exist between the Company and these affiliates. Accordingly, the financial results included in the accompanying

combined financial statements do not include any financial results related to these affiliates.

The Company follows the policy of

charging the costs of advertising to expense as incurred. For the year ended June 30, 2022, advertising costs amounted to $13,198.

For the year ended June 30, 2022,

the Company had no major customers.

| J. | EMPLOYEE

BENEFIT PROGRAM: |

Effective July 1985, the Company has

a discretionary profit-sharing retirement plan covering all employees who meet certain requirements. Employer contributions accrued and

charged to this plan for the year ended June 30, 2022 amounted to zero.

Management has evaluated events occurring after the balance sheet

date through August 17, 2023, the date in which the financial statements were available to be issued.

8

Exhibit 99.2

T R MILLER CO., INC.

BALANCE SHEET

MARCH 31, 2023

| ASSETS | |

| |

| Current Assets | |

| |

| Cash | |

$ | 2,432,941 | |

| Accounts Receivable, Net | |

| 1,373,822 | |

| Deposits | |

| 6,940 | |

| Due from Stockholders, Current | |

| 350,000 | |

| Inventory | |

| 232,273 | |

| Note Receivable, Current | |

| 3,241 | |

| Prepaid Corporate Taxes | |

| 135,126 | |

| Prepaid Expenses | |

| 8,909 | |

| Total Current Assets | |

| 4,543,252 | |

| | |

| | |

| Property and Equipment, net: | |

| 145,671 | |

| | |

| | |

| Other Assets: | |

| | |

| Due from Stockholders, Net of Current Portion | |

| 702,781 | |

| Note Receivable, Net of Current Portion | |

| 69,718 | |

| | |

| 772,499 | |

| Total Assets | |

$ | 5,461,422 | |

| | |

| | |

| Liabilities and Stockholders’ Equity | |

| | |

| | |

| | |

| Current Liabilities | |

| | |

| Accounts Payable and Accrued Expenses | |

$ | 301,988 | |

| Accrued Payroll and Related | |

| 165,279 | |

| Due to Stockholder | |

| 37,805 | |

| Unearned Revenue | |

| 218,622 | |

| Sales Tax Payable | |

| 37,886 | |

| Total Current Liabilities | |

| 761,580 | |

| Total Liabilities | |

| 761,580 | |

| | |

| | |

| Stockholders’ Equity | |

| | |

| Common Stock, No Par Value, 12,500 Shares Authorized, 4,000 Shares Issued and Outstanding | |

| 8,830 | |

| Retained Earnings | |

| 4,691,012 | |

| Total Stockholders’ Equity | |

| 4,699,012 | |

| Total Liabilities & Stockholders’ Equity | |

$ | 5,461,422 | |

T R MILLER CO., INC.

STATEMENT OF OPERATIONS AND RETAINED EARNINGS

NINE MONTHS ENDED MARCH 31, 2023

| SALES | |

$ | 10,967,501 | |

| | |

| | |

| COST OF SALES | |

| 7,706,929 | |

| | |

| | |

| GROSS PROFIT | |

| 3,260,572 | |

| | |

| | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | |

| 3,279,672 | |

| | |

| | |

| LOSS FROM OPERATIONS | |

| (19,100 | ) |

| | |

| | |

| OTHER INCOME | |

| | |

| Other Income (Expense) | |

| 3,246 | |

| Interest Income (Expense), Net | |

| 27,138 | |

| | |

| 30,384 | |

| | |

| | |

| NET EARNINGS | |

$ | 11,284 | |

| | |

| | |

| RETAINED EARNINGS, BEGINNING | |

$ | 4,679,728 | |

| RETAINED EARNINGS, ENDING | |

$ | 4,691,012 | |

Exhibit 99.3

STRAN & COMPANY, INC. AND T R MILLER CO.,

INC.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT

AS OF AND FOR THE 12 MONTHS ENDED DECEMBER 31,

2022

| | |

Stran &

Company,

Inc. | | |

T R Miller

Co., Inc. | | |

Pro Forma

Adjusting

Entries | | |

Pro Forma

Combined

Balances | |

| Assets | |

| | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| | |

| |

| Cash | |

$ | 15,253,756 | | |

$ | 2,024,486 | | |

$ | (4,178,716 | )(a) (e) | |

$ | 13,099,526 | |

| Short-Term Investments | |

| 9,779,355 | | |

| - | | |

| - | | |

| 9,779,355 | |

| Accounts Receivable, Net | |

| 14,442,626 | | |

| 2,115,748 | | |

| (388,372 | )(b) | |

| 16,170,002 | |

| Deposits | |

| - | | |

| 5,270 | | |

| (5,270 | )(b) | |

| - | |

| Due from Stockholders, Current | |

| - | | |

| 350,000 | | |

| - | (a) | |

| 350,000 | |

| Deferred Income Taxes | |

| 841,000 | | |

| - | | |

| - | | |

| 841,000 | |

| Inventory | |

| 6,867,564 | | |

| 312,352 | | |

| (111,674 | ) | |

| 7,068,242 | |

| Notes Receivable, Current | |

| - | | |

| 2,500 | | |

| (2,500 | )(a) | |

| - | |

| Prepaid Corporate Taxes | |

| 87,459 | | |

| 51,718 | | |

| (57,718 | )(a) | |

| 87,459 | |

| Prepaid Expenses | |

| 386,884 | | |

| 7,278 | | |

| (2,147 | )(b) | |

| 392,015 | |

| Security Deposits | |

| 910,486 | | |

| - | | |

| - | | |

| 910,486 | |

| Total current assets | |

| 48,569,130 | | |

| 4,869,352 | | |

| (4,740,397 | ) | |

| 48,698,085 | |

| | |

| | | |

| | | |

| | | |

| | |

| Property and Equipment, Net | |

| 1,000,090 | | |

| 151,838 | | |

| (151,838 | )(b) | |

| 1,000,090 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Assets | |

| | | |

| | | |

| | | |

| | |

| Due from Stockholder, Net of Current Portion | |

| - | | |

| 702,781 | | |

| (702,781 | )(a) | |

| - | |

| Intangible Assets - Customer Lists, Net | |

| 6,272,205 | | |

| - | | |

| 4,995,985 | (c) | |

| 11,268,190 | |

| Note Receivable, Net of Current Portion | |

| - | | |

| 71,019 | | |

| (71,019 | )(a) | |

| - | |

| Right of Use Asset - Office Leases | |

| 784,683 | | |

| - | | |

| - | | |

| 784,683 | |

| Total Other Assets | |

| 7,056,888 | | |

| 773,800 | | |

| 4,222,185 | | |

| 3,426,070 | |

| Total assets | |

$ | 56,626,108 | | |

$ | 5,835,323 | | |

$ | (710,383 | ) | |

$ | 61,751,048 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities and shareholders’ equity | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | | |

| | |

| Current Portion of Contingent Earn-Out Liabilities | |

$ | 1,809,874 | | |

$ | - | | |

$ | - | (g) | |

$ | 1,809,874 | |

| Current Portion of Lease Liability | |

| 324,594 | | |

| - | | |

| - | | |

| 324,594 | |

| Accounts Payable and Accrued Expenses | |

| 4,051,657 | | |

| 237,693 | | |

| 149,933 | (b) | |

| 4,439,283 | |

| Accrued Payroll and Related | |

| 608,589 | | |

| 299,886 | | |

| (172,516 | )(b) | |

| 735,959 | |

| Due to Stockholder | |

| - | | |

| 37,805 | | |

| (37,805 | )(a) | |

| - | |

| Unearned Revenue | |

| 633,148 | | |

| 340,512 | | |

| (45,394 | )(b) | |

| 928,266 | |

| Rewards Program Liability | |

| 6,000,000 | | |

| - | | |

| - | | |

| 6,000,000 | |

| Sales Tax Payable | |

| 365,303 | | |

| 72,852 | | |

| (72,852 | )(a) | |

| 365,303 | |

| Income tax payable | |

| 162,358 | | |

| - | | |

| - | | |

| 162,358 | |

| Total current liabilities | |

| 13,955,523 | | |

| 988,748 | | |

| (178,634 | ) | |

| 14,765,637 | |

| | |

| | | |

| | | |

| | | |

| | |

| Long-term liabilities | |

| | | |

| | | |

| | | |

| | |

| Long-Term Contingent Earn-Out Liabilities | |

| 2,845,944 | | |

| - | | |

| 4,551,095 | (g) | |

| 7,397,039 | |

| Long- Term Lease Liability | |

| 460,089 | | |

| - | | |

| - | | |

| 460,089 | |

| Total Long-Term Liabilities | |

| 3,306,033 | | |

| - | | |

| 4,551,095 | | |

| 7,857,128 | |

| Shareholders’ equity | |

| | | |

| | | |

| | | |

| | |

| Common Stock | |

| 1,848 | | |

| 8,830 | | |

| (8,830 | ) | |

| 1,848 | |

| Additional Paid-In Capital | |

| 38,279,151 | | |

| - | | |

| - | | |

| 38,279,151 | |

| Retained Earnings | |

| 1,083,553 | | |

| 4,797,412 | | |

| (4,797,412 | ) | |

| 1,083,553 | |

| Total Stockholders’ Equity | |

| 39,364,552 | | |

| 4,846,575 | | |

| (4,846,575 | ) | |

| 39,364,552 | |

| Total Liabilities and Stockholders’ equity | |

$ | 56,626,108 | | |

$ | 5,835,323 | | |

$ | (474,114 | ) | |

$ | 61,987,317 | |

| | |

Stran &

Company,

Inc. | | |

T R Miller

Co., Inc. | | |

Pro Forma

Adjustments | | |

Pro Forma

Combined

Balances | |

| Sales | |

$ | 58,953,467 | | |

$ | 19,320,747 | | |

$ | - | | |

$ | 78,274,214 | |

| Cost of Sales | |

| 42,383,793 | | |

| 13,778,785 | | |

| - | | |

| 56,162,578 | |

| Gross profit | |

| 16,569,674 | | |

| 5,541,962 | | |

| | | |

| 22,111,636 | |

| Operating Expenses | |

| 18,075,369 | | |

| 4,532,784 | | |

| 555,110 | (f) | |

| 23,163,263 | |

| Earnings (Loss) from Operations | |

| (1,505,695 | ) | |

| 1,009,178 | | |

| (555,110 | ) | |

| (1,051,627 | ) |

| Other Income and (Expense) | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| 112,507 | | |

| (33,153 | ) | |

| - | | |

| 79,354 | |

| Interest Income (Expense) | |

| 94,680 | | |

| 40,093 | | |

| - | | |

| 134,773 | |

| Unrealized Gain (Loss) on Short-Term Investments | |

| (179,120 | ) | |

| - | | |

| - | | |

| (179,120 | ) |

| | |

| 28,067 | | |

| 6,940 | | |

| | | |

| 35,007 | |

| Earnings (Loss) Before Income Taxes | |

| (1,477,628 | ) | |

| 1,016,118 | | |

| (555,110 | ) | |

| (1,016,620 | ) |

| Provision for Income Taxes | |

| (699,187 | ) | |

| 245,262 | | |

| - | | |

| (453,925 | ) |

| Net Earnings (Loss) | |

| (778,441 | ) | |

| 770,856 | | |

| (551,110 | ) | |

| (562,695 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Earnings (Loss) Per Share - Basic & Diluted | |

$ | (0.04 | ) | |

$ | - | | |

$ | - | | |

$ | (0.03 | ) |

| Weighted-Average Shares Outstanding - Basic & Diluted | |

| 19,202,619 | | |

| | | |

| | | |

| 19,202,619 | |

Exhibit 99.4

STRAN & COMPANY, INC. AND T R MILLER CO.,

INC.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT

AS OF AND FOR THE THREE MONTHS ENDED MARCH 31,

2023

| | |

Stran &

Company,

Inc. | | |

T R Miller

Co., Inc. | | |

Pro Forma

Adjusting

Entries | | |

Pro Forma

Combined

Balances | |

| Assets | |

| | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 10,596,595 | | |

$ | 2,432,941 | | |

$ | (4,587,171 | )(a) (e) | |

$ | 8,442,365 | |

| Short Term Investments | |

| 10,269,101 | | |

| - | | |

| - | | |

| 10,269,101 | |

| Accounts Receivable, Net | |

| 11,914,586 | | |

| 1,373,822 | | |

| 353,554 | (b) | |

| 13,641,962 | |

| Deposits | |

| | | |

| 6,940 | | |

| (6,940 | )(b) | |

| - | |

| Due from Stockholders, Current | |

| - | | |

| 350,000 | | |

| (350,000 | )(a) | |

| - | |

| Deferred Income Taxes | |

| 1,205,000 | | |

| - | | |

| - | | |

| 1,205,000 | |

| Inventory | |

| 5,665,924 | | |

| 232,273 | | |

| (31,595 | ) | |

| 5,866,602 | |

| Notes Receivable, Current | |

| - | | |

| 3,241 | | |

| (3,241 | )(a) | |

| - | |

| Prepaid Corporate Taxes | |

| 87,459 | | |

| 135,126 | | |

| (135,126 | )(a) | |

| 87,459 | |

| Prepaid Expenses | |

| 611,320 | | |

| 8,909 | | |

| (3,778 | )(b) | |

| 616,451 | |

| Security Deposits | |

| 1,172,754 | | |

| - | | |

| - | | |

| 1,172,754 | |

| Total Current Assets | |

| 41,522,739 | | |

| 4,543,252 | | |

| (4,764,297 | ) | |

| 41,301,694 | |

| | |

| | | |

| | | |

| | | |

| | |

| Property and Equipment, Net | |

| 1,193,356 | | |

| 145,671 | | |

| (145,671 | )(b) | |

| 1,193,356 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Assets | |

| | | |

| | | |

| | | |

| | |

| Due from Stockholders, Net of Current Portion | |

| - | | |

| 702,781 | | |

| (702,781 | )(a) | |

| - | |

| Intangible Assets, Net | |

| 5,654,804 | | |

| - | | |

| 4,857,208 | (c) | |

| 10,512,012 | |

| Note Receivable, Net of Current Portion | |

| - | | |

| 69,718 | | |

| - | (a) | |

| 69,718 | |

| Right of Use Asset - Office Leases | |

| 775,742 | | |

| - | | |

| - | | |

| 775,742 | |

| Total Other Assets | |

| 6,430,546 | | |

| 772,499 | | |

| 4,154,427 | | |

| 11,357,472 | |

| Total Assets | |

$ | 49,146,641 | | |

$ | 5,461,222 | | |

$ | (795,874 | ) | |

$ | 53,852,522 | |

| Liabilities and shareholders’ equity | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | | |

| | |

| Current Portion of Contingent Earn-Out Liabilities | |

$ | 2,171,603 | | |

$ | - | | |

$ | - | (g) | |

$ | 2,171,603 | |

| Current Portion of Lease Liability | |

| 320,197 | | |

| - | | |

| - | | |

| 320,197 | |

| Accounts Payable and Accrued Expenses | |

| 2,938,995 | | |

| 301,988 | | |

| 85,638 | (b) | |

| 3,326,621 | |

| Accrued Payroll and Related | |

| 674,123 | | |

| 165,279 | | |

| (37,909 | )(b) | |

| 801,493 | |

| Due to Stockholder | |

| - | | |

| 37,805 | | |

| (37,805 | )(a) | |

| - | |

| Unearned Revenue | |

| 1,871,846 | | |

| 218,622 | | |

| 76,496 | (b) | |

| 2,166,964 | |

| Rewards Program Liability | |

| - | | |

| - | | |

| - | | |

| - | |

| Sales Tax Payable | |

| 259,633 | | |

| 37,886 | | |

| (37,886 | )(a) | |

| 259,633 | |

| Notes Payable - Wildman | |

| 162,358 | | |

| - | | |

| - | | |

| 162,358 | |

| Total Current Liabilities | |

| 8,398,755 | | |

| 761,580 | | |

| 48,534 | | |

| 9,208,869 | |

| Long-Term Liabilities | |

| | | |

| | | |

| | | |

| | |

| Long-Term Contingent Earn-Out Liabilities | |

| 1,594,944 | | |

| - | | |

| 4,551,095 | (g) | |

| 6,146,039 | |

| Long- Term Lease Liability | |

| 455,545 | | |

| - | | |

| - | | |

| 455,545 | |

| Total Long-Term Liabilities | |

| 2,050,489 | | |

| - | | |

| 4,551,095 | | |

| 6,601,584 | |

| Stockholders’ equity | |

| | | |

| | | |

| | | |

| | |

| Common Stock | |

| 1,849 | | |

| 8,830 | | |

| (8,830 | ) | |

| 1,849 | |

| Additional Paid-In Capital | |

| 38,306,533 | | |

| - | | |

| - | | |

| 38,306,533 | |

| Retained Earnings | |

| 389,015 | | |

| 4,691,012 | | |

| (4,691,012 | ) | |

| 389,015 | |

| Total Stockholders’ Equity | |

| 38,697,397 | | |

| 4,699,012 | | |

| (4,740,175 | ) | |

| 38,697,397 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 49,146,641 | | |

$ | 5,461,422 | | |

$ | (140,546 | ) | |

$ | 54,507,850 | |

| | |

Stran &

Company,

Inc. | | |

T R Miller

Co., Inc. | | |

Pro Forma

Adjustments | | |

Pro Forma

Combined

Balances | |

| Sales | |

$ | 15,776,247 | | |

$ | 2,998,834 | | |

$ | - | | |

$ | 18,775,081 | |

| Cost of Sales | |

| 11,082,294 | | |

| 2,085,521 | | |

| - | | |

| 13,167,815 | |

| Gross profit | |

| 4,693,953 | | |

| 913,313 | | |

| - | | |

| 5,607,266 | |

| Operating Expenses | |

| 6,079,095 | | |

| 1,025,136 | | |

| 138,777 | (f) | |

| 7,243,008 | |

| Earnings (Loss) from Operations | |

| (1,385,142 | ) | |

| (111,823 | ) | |

| (138,777 | ) | |

| (1,635,742 | ) |

| Other Income and (Expense) | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| 56,637 | | |

| 1,055 | | |

| - | | |

| 57,692 | |

| Interest Income (Expense) | |

| 138,082 | | |

| 4,368 | | |

| - | | |

| 142,450 | |

| Unrealized Gain (Loss) on Short-Term Investments | |

| 131,885 | | |

| - | | |

| - | | |

| 131,885 | |

| | |

| 326,604 | | |

| 5,423 | | |

| - | | |

| 332,027 | |

| Earnings (Loss) Before Income Taxes | |

| (1,058,538 | ) | |

| (106,400 | ) | |

| (138,777 | ) | |

| (1,303,715 | ) |

| Provision for Income Taxes | |

| (364,000 | ) | |

| - | | |

| - | | |

| (364,000 | ) |

| Net Earnings (Loss) | |

$ | (694,538 | ) | |

$ | (106,400 | ) | |

$ | (138,777 | ) | |

$ | (939,715 | ) |

| Net Earnings (Loss) Per Share - Basic & Diluted | |

| (0.04 | ) | |

| | | |

| - | | |

| (0.05 | ) |

| Weighted-Average Shares Outstanding - Basic & Diluted | |

$ | 18,477,604 | | |

| | | |

| | | |

$ | 18,477,604 | |

STRAN & COMPANY,

INC.

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND MARCH 31, 2023

| A. | TRANSACTION AND BASIS OF PRESENTATION: |

On May 31, 2023, Stran & Company,

Inc. (“Stran” or the “Company”) acquired substantially all the assets of

T R Miller Co., Inc., a Massachusetts Corporation (“T R Miller”). Located in

Walpole, T R Miller is a promotional products company.

The

Acquisition was consummated pursuant to an Asset Purchase Agreement, dated as of January 25, 2023 (the “Purchase Agreement”),

by and among the Company, as the purchaser, T R Miller, as the seller, and Thomas R. Miller, the majority stockholder of T R Miller.

The board of directors of the Company approved the Purchase Agreement and the transactions contemplated thereby. The purchase price for

T R Miller consisted of approximately $2.2 million in cash, $1.1 million in an installment note payable, and $3.5 million in a contingent

earn-out based off of gross profit over the next 4 years. The acquisition was effective as of June 1, 2023.

The accompanying unaudited pro forma

condensed combined balance sheet presents the historical financial position of Stran combined with T R Miller as if the acquisition had

occurred on December 31, 2022 and the unaudited pro forma condensed combined statement of income presents the combined results of Stran’s

operations with T R Miller as if the acquisition had occurred on January 1, 2022. The accompanying pro forma condensed combined financial

statements include management’s assumptions and certain adjustments described in greater detail below.

The historical consolidated financial

statements have been adjusted in the pro forma condensed combined financial statements to give effect to pro forma events that are (1)

directly attributable to the business combination, (2) factually supportable and (3) with respect to the pro forma condensed combined

statements of operations, expected to have a continuing impact on the combined results following the business combination.

The business combination was accounted

for under the acquisition method of accounting in accordance with ASC Topic 805, Business Combinations. As the acquirer for accounting

purposes, the Company has estimated the fair value of T R Miller’s assets acquired and liabilities assumed and conformed the accounting

policies of T R Miller to its own accounting policies.

The pro forma combined financial statements

do not necessarily reflect what the combined company’s financial condition or results of operations would have been had the acquisition

occurred on the dates indicated. They also may not be useful in predicting the future financial condition and results of operations of

the combined company. The actual financial position and results of operations may differ significantly from the pro forma amounts reflected

herein due to a variety of factors.

The unaudited pro forma condensed combined

financial information does not reflect any cost savings from operating efficiencies or synergies that could result from the acquisition.

Additionally, the unaudited pro forma condensed combined financial information does not reflect additional revenue opportunities following

the acquisition. The unaudited pro forma condensed combined financial information also does not impute any on-going financing costs which

the Company may or may not incur related to the transaction.

As a result of the continuing review

of T R Miller’s accounting policies, Stran may identify differences between the accounting policies of the two businesses that,

when conformed, could have a material impact on the combined financial statements. The unaudited pro forma combined condensed financial

statements do not assume any differences in accounting policies other than as described in Note D.

| C. | PURCHASE PRICE AND ALLOCATION: |

The following table sets forth the

purchase consideration paid to shareholders of T R Miller on June 1, 2023, the date of acquisition. The preliminary purchase price allocation

set forth below assumes the acquisition had closed on December 31, 2022:

| Consideration paid to T R Miller’s members: | |

| |

| Cash | |

$ | 2,154,230 | |

| Installment Note Payable | |

| 1,100,000 | |

| Contingent Earn-Out | |

| 3,451,095 | |

| Total consideration | |

$ | 6,674,167 | |

| | |

| | |

| Preliminary purchase price allocation | |

| | |

| Accounts Receivable | |

$ | 1,727,375 | |

| Inventory | |

| 200,678 | |

| Prepaid Expenses | |

| 5,131 | |

| | |

| | |

| Accounts payable | |

| (289,403 | ) |

| Accrued expenses | |

| (98,223 | ) |

| Accrued Commissions | |

| (127,370 | ) |

| Customer Deposits | |

| (295,116 | ) |

| Total tangible assets acquired and liabilities assumed | |

| 1,123,072 | |

| Intangible Assets | |

| 5,551,095 | |

| Total pro forma net assets acquired | |

$ | 6,674,167 | |

The final determination of the purchase

price allocation and the amount of intangible asset acquired will be based on T R Miller’s assets acquired and liabilities assumed

as of June 1, 2023, the date of acquisition.

For the purposes of this pro forma

analysis, the purchase price has been preliminarily allocated based on an estimate of the fair value of assets acquired and liabilities

assumed as of the date of acquisition. The determination of estimated fair value requires management to make significant estimates and

assumptions. The final valuation of net assets is expected to be completed as soon as possible but no later than one year from the acquisition

date. The Company will adjust its estimates as needed based upon the final valuation. The following is a summary of preliminary valuation

estimates along with management’s assumptions included in the adjustments reflected in the pro forma condensed combined financial

information:

Tangible assets and liabilities:

Tangible assets and liabilities were valued at their respective carrying amounts which management believes approximate their fair values

as of the assumed date of acquisition.

Accrued and other liabilities:

Accrued expenses were adjusted to record combined estimated transaction costs incurred. These costs were incurred after December 31, 2022,

but are included as an adjustment to accrued and other liabilities and accumulated deficit for purposes of presenting the pro forma condensed

combined balance sheet as if the transaction had occurred on December 31, 2022. These transaction expenses are not reflected in the pro

forma condensed combined statement of income for the year ended December 31, 2022, as they are not expected to have a continuing impact

on future operations.

Identifiable intangible assets:

At this time, the Company’s estimates of the fair values of intangible assets are still subject to considerable uncertainty, as

substantial amounts of T R Miller’s data must be thoroughly analyzed before more precise valuations can be determined. The Company

anticipates that these analyses will be completed during the measurement period following the closing date.

Pro forma adjustments are necessary

to reflect the consideration paid to T R Miller’s stockholders and to adjust amounts related to the tangible and intangible assets

and liabilities of T R Miller to reflect the preliminary estimate of their fair values and the impact on the combined statement of income

as if Stran and T R Miller had been combined during the periods presented. The pro forma adjustments included in the unaudited pro forma

combined financial statements are as follows:

| |

(a) |

To record an adjustment to remove T R Miller assets and liabilities not included or acquired. |

| |

|

|

| |

(b) |

To record an adjustment to accounts to align with opening balance amounts based on preliminary fair value assessment. |

| |

|

|

| |

(c) |

To record intangible asset based on preliminary purchase price allocation. |

| |

|

|

| |

(d) |

To remove T R Miller retained earnings. |

| |

|

|

| |

(e) |

To record the aggregate consideration including cash payment of $2,154,230 and installment payments of $4,691,012. |

| |

|

|

| |

(f) |

To record an adjustment for amortization of intangibles based on purchase accounting adjustments. |

| |

|

|

| |

(g) |

To record the issuance of the contingent earn-out and installment note payable. |

5

v3.23.2

Cover

|

Jun. 01, 2023 |

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

On

June 1, 2023, Stran & Company, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original 8-K”)

reporting the completion of the previously announced purchase of substantially all the assets of T R Miller Co., Inc., a Massachusetts

corporation (“T R Miller”). In that filing, the Company indicated that it would amend the Original 8-K at a later date to

include any financial statements and any pro forma financial information required by Item 9.01 of Form 8-K. This amendment to the Original

8-K is being filed to provide such financial statements and financial information, which are attached to this report as Exhibit 99.1,

Exhibit 99.2, Exhibit 99.3, and Exhibit 99.4. The disclosure contained in Item 2.01 of the Original 8-K is repeated below for convenience.

No other changes have been made to the Original 8-K except to remove Item 7.01 and related disclosure regarding a press release that

was issued in connection with the completion of the acquisition of substantially all the assets of T R Miller.

|

| Document Period End Date |

Jun. 01, 2023

|

| Entity File Number |

001-41038

|

| Entity Registrant Name |

STRAN

& COMPANY, INC.

|

| Entity Central Index Key |

0001872525

|

| Entity Tax Identification Number |

04-3297200

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2 Heritage Drive

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Quincy

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02171

|

| City Area Code |

800

|

| Local Phone Number |

833-3309

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

SWAG

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375 |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375

|

| Trading Symbol |

SWAGW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SWAG_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SWAG_WarrantsEachWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf4.81375Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

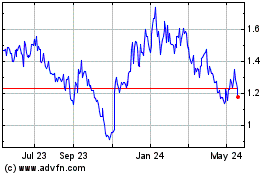

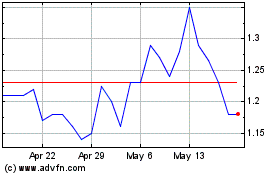

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Apr 2023 to Apr 2024