0001499717

false

0001499717

2023-07-31

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

July

31, 2023

Date

of Report (Date of earliest event reported)

STAFFING

360 SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37575 |

|

68-0680859 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

757

3rd Avenue

27th

Floor

New

York, NY 10017

(Address

of principal executive offices)

(646)

507-5710

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock |

|

STAF |

|

NASDAQ |

Item

1.01 Entry Into a Material Definitive Agreement.

On

July 31, 2023, Staffing 360 Solutions, Inc. (the “Company”), Chapel Hill Partners, L.P. (“Chapel

Hill”) and Jean-Pierre Sakey (“Sakey”) entered into a letter agreement (the “Letter

Agreement”) in connection with the Stock Purchase Agreement (the “Purchase Agreement”), dated

April 20, 2022, as amended on May 18, 2022, by and among the Company, Headway Workforce Solutions Inc. and Chapel Hill.

Pursuant

to the Letter Agreement, if on or prior to September 30, 2023, the Company pays an aggregate of $11,340,000 (the “Agreed

Amount”) to the holders of the Series H Convertible Preferred Stock (the “Series H Preferred Stock”)

and Chapel Hill for the redemption of the 9,000,000 shares of Series H Preferred Stock issued and outstanding with the remaining amount

to be paid to Chapel Hill, less $525,000 to be paid to third-parties to satisfy existing incentives and fees due, with such fees and

incentive payments to be allocated at the discretion of Chapel Hill and Sakey, then the Company’s obligation to redeem the Series

H Preferred Stock pursuant to the Purchase Agreement and Certificate of Designation of Preferences, Rights and Limitations of Series

H Convertible Preferred Stock, as amended (the “Series H COD”), shall be deemed satisfied, and the contingent

liabilities, covenants and indemnification obligations of the Company pursuant to the Purchase Agreement shall be extinguished and of

no further force and effect.

Pursuant

to the Letter Agreement, if on or prior to September 30, 2023, the Company does not redeem the Series H Preferred Stock and remit the

Contingent Payment (as defined in the Purchase Agreement), then the Company shall make the Contingent Payment in the amount of $5,000,000,

as set forth in the Purchase Agreement, in five equal installments of $1,000,000 each, less $134,000 per installment to be paid to third-parties

to satisfy existing incentives and fees due, with such fees and incentive payments to be allocated at the discretion of Chapel Hill and

Sakey (the “Contingent Payment Installments”), with such Contingent Payment Installments to be made on or before

December 31, 2023, March 31, 2024, June 30, 2024, September 30, 2024 and December 31, 2024 (each such date, a “Contingent

Installment Payment Date”). On each Contingent Installment Payment Date, the Company shall additionally redeem 100,000

shares of Series H Preferred Stock at a price per share equal to $0.0000001 per share.

Pursuant

to the Letter Agreement, the Company shall also have no obligation to pay the Preferred Dividend (as defined in the Series H COD) on

June 30, 2023, September 30, 2023 and December 31, 2023.

The

foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full

text of the Letter Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

*Certain

of the schedules (and similar attachments) to this Exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K under

the Securities Act because they do not contain information material to an investment or voting decision and that information is not otherwise

disclosed in the Exhibit or the disclosure document. The registrant hereby agrees to furnish a copy of all omitted schedules (or similar

attachments) to the Securities and Exchange Commission upon its request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

August 4, 2023 |

STAFFING

360 SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

|

Brendan

Flood |

| |

|

Chairman

and Chief Executive Officer |

Exhibit

10.1

LETTER

AGREEMENT

This

LETTER AGREEMENT (the “Agreement”) is entered into as of July 31st, 2023 (the “Effective Date”)

between STAFFING 360 SOLUTIONS, INC., a Delaware corporation (the “Corporation”), CHAPEL HILL PARTNERS,

L.P. (“CHP”)., as Sellers’ Representative (“CHP”), and Jean-Pierre

Sakey (“Sakey”, and together with the Corporation, CHP, and each Holder, each a “Party”

and together the “Parties”). Capitalized terms used herein but not otherwise defined, if any, shall have the respective

meanings attributed to them in the SPA (as defined below).

WHEREAS

A.

The Corporation has entered into that certain Stock Purchase Agreement, dated as of April 18, 2022, by and between the Corporation, Headway

Workforce Solutions, Inc. and CHP related to the purchase of all of the stock of Headway Workforce Solutions, Inc. (the “SPA”).

B.

In connection with the SPA: (i) the Corporation issued certain Series H Preferred Stock pursuant to the terms of that certain Certificate

of Designation of Preferences, Rights and Limitations of Series H Convertible Preferred Stock, as amended (the “CoD”),

(ii) entered into an amendment of that certain First Amendment to the Consulting, Strategic Advisory & Management Agreement between

the Corporation and Sakey (the “Consulting Agreement”) and (iii) agreed to pay the Contingent Payment in the manner

and subject to the terms set forth in the SPA.

C.

The Parties wish that in the event that the Corporation redeems all of the outstanding Series H Preferred Stock of the Corporation (the

“Series H Preferred Stock”) prior to September 30, 2023, the Corporation shall pay an aggregate of $11,340,000 for

the redemption of the Series H Preferred Stock, payment of the Contingent Payment and extinguishment of all obligations of the Parties

under the SPA and the CoD;

D.

The Parties wish that in the event the Corporation does not redeem the Series H Preferred Stock on or prior to September 30, 2023, the

obligations of the Corporation under the SPA and the CoD shall be changed as further described in this Agreement;

E.

The Parties wish to amend certain terms of the SPA through this Agreement.

NOW,

THEREFORE, in consideration of the foregoing premises and the mutual covenants herein contained, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

| |

1. |

Effective

upon execution of this agreement which is an accommodation to the Buyer and Corporation except for the obligations set forth in:

(i) Section 7.2(a)(i) soley as it relates to a breach of a Fundamental Representation or an Indefinite Representation; (ii) Section

7.2(a)(vii) or (iii) fraud, the covenants, representations and warranties, and obligations (including without limitation the indemnification

obligations set forth in the SPA) of CHP, in its capacity as Sellers’ Representative, Sakey and the Sellers pursuant to the

SPA shall be terminated and no longer in force and effect. Notwithstanding the foregoing, CHP shall remain in its capacity of Sellers’

Representative, with all rights as provided in the SPA unless and until CHP resigns from such capacity or designates a replacement

in accordance with the terms of the SPA. |

| |

2. |

Redemption

of the Series H Preferred Stock and payment of the Contingent Payment occurs on or prior to September 30, 2023. In the event

that the Corporation submits a Redemption Notice as set forth in Section 8b of the COD, and remits payment of the Contingent Payment

prior to September 30, 2023: |

a.

Such Redemption Notice shall be for the redemption of all of the Nine Million (9,000,000) shares of Series H Preferred Stock, with an

aggregate stated value of Nine Million ($9,000,000) Dollars, at a price per share equal to $1 per share of Series H Preferred Stock.

The total amount remitted by the Corporation for the redemption of all Series H Preferred Stock and payment of all other contingent liabilities,

including any fees and incentives due, shall be equal to Eleven Million Three Hundred Thousand ($11,340,000) Dollars (the “Agreed

Amount”). The Corporation shall remit the Agreed Amount, less Five Hundred Twenty Five Thousand ($525,000) Dollars, which shall

be paid to third-parties to satisfy existing incentives and fees due, to the Series H Preferred Stockholders in accordance with the attached

allocation table by immediately available fund by wire transfer pursuant to the instructions provided by CHP. Allocation of the fees

and incentive payments is at the full discretion of CHP and Sakey .CHP agrees that upon receipt and distribution of the Agreed Amount,

such payment shall satisfy the Corporation’s obligation to redeem the Series H Preferred stock pursuant to the SPA and CoD, and

the Corporation’s obligation to make the Contingent Payment.

b.

Upon payment of the Agreed Amount on or prior to September 30, 2023, the obligations, contingent liabilities, covenants, and indemnification

obligations of the Corporation pursuant to the SPA shall be extinguished and of no further force or effect.

| |

3. |

Redemption

of the Series H Preferred Stock and Contingent Payment does not occur prior to or on September 30, 2023. In the event that the

Corporation does not submit a Redemption Notice pursuant to Section 8 of the CoD and remit payment of the Contingent Payment prior

to or on September 30, 2023: |

a.

The Corporation shall make the Contingent Payment as set forth in Section 2.5(d) of the SPA in the amount of Five Million ($5,000,000)

Dollars. Such Contingent Payment shall be made in five equal installments of One Million ($1,000,000) Dollars, less One Hundred thirty-Four

Thousand ($134,000) Dollars per installment (for an aggregate total of $670,000, which shall be paid to third-parties to satisfy existing

incentives and fees due (such aggregate amount being a “Contingent Payment Installment”) with payment to be made on

or before: (i) December 31, 2023, (ii) March 31, 2024; (iii) June 30, 2024, (iv) September 30, 2024, and (v) December 31, 2024.. Allocation

of the fees and incentive payments is at the full discretion of CHP and Sakey. Upon payment of the final Contingent Installment Payment,

all obligations of the Corporation pursuant to Section 2.5 of the SPA shall be extinguished.

b.

The Corporation shall have no obligation to pay the Preferred Dividend (as defined in the CoD) on: (i) June 30, 2023; (ii) September

30, 2023, and (iii) December 31, 2023. For the avoidance of doubt, the Corporation will be required to pay the Preferred Dividend due

on March 31, 2024, and on each subsequent Quarterly Dividend Payment Date (as defined in the CoD).

c.

Concurrent with each Contingent Payment Installment, The Corporation shall submit a Redemption Notice as set forth in Section 8b of the

COD and redeem 100,000 shares of the Series H Preferred Stock (on a pro rata basis from Escrow held at Becker LLC) as set forth in Section

8 of the CoD at a price per share equal to $0.0000001 per share of Series H Preferred Stock on (i) December 31, 2023, (ii) March 31,

2024; (iii) June 30, 2024, (iv) September 30, 2024 and (v) December 31, 2024. CHP agrees that the Series H Preferred Stock shall be redeemed

from shares held in Escrow at Becker LLC. For the avoidance of doubt, on December 31, 2024 after the redemption on December 31, 2024,

the Corporation shall have redeemed a total of 500,000 shares of Series H Preferred Stock and there shall only be 8,500,000 shares of

Series H Preferred Stock outstanding as of December 31, 2024.

| |

4. |

Unless

otherwise specified in the letter all protections identified in the SPA remain in place in the event of a default of or failure to

pay these obligations. |

| |

|

|

| |

5. |

Amendments;

Waivers. No provision of this Agreement may be waived or amended except in a written instrument signed, in the case of an amendment,

by the Party against whom enforcement of any such waiver is sought. No waiver of any default with respect to any provision, condition

or requirement of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or

a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of any Party to exercise any right

hereunder in any manner impair the exercise of any such right. |

| |

|

|

| |

6. |

Governing

Law; Venue; Waiver of Jury Trial. ALL QUESTIONS CONCERNING THE CONSTRUCTION, VALIDITY, ENFORCEMENT, AND INTERPRETATION OF THIS

AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE. THE PARTIES HEREBY IRREVOCABLY

SUBMIT TO THE EXCLUSIVE JURISDICTION OF THE STATE AND FEDERAL COURTS SITTING IN THE CITY OF NEW YORK, BOROUGH OF MANHATTAN FOR THE

ADJUDICATION OF ANY DISPUTE BROUGHT BY THE PARTIES HEREUNDER, IN CONNECTION HEREWITH OR WITH ANY TRANSACTION CONTEMPLATED HEREBY

OR DISCUSSED HEREIN, AND HEREBY IRREVOCABLY WAIVE, AND AGREE NOT TO ASSERT IN ANY SUIT, ACTION OR PROCEEDING BROUGHT BY THE PARTIES,

ANY CLAIM THAT IT IS NOT PERSONALLY SUBJECT TO THE JURISDICTION OF ANY SUCH COURT, OR THAT SUCH SUIT, ACTION OR PROCEEDING IS IMPROPER.

EACH PARTY HEREBY IRREVOCABLY WAIVES PERSONAL SERVICE OF PROCESS AND CONSENTS TO PROCESS BEING SERVED IN ANY SUCH SUIT, ACTION OR

PROCEEDING BY MAILING A COPY THEREOF VIA REGISTERED OR CERTIFIED MAIL OR OVERNIGHT DELIVERY (WITH EVIDENCE OF DELIVERY) TO SUCH PARTY

AT THE ADDRESS IN EFFECT FOR NOTICES TO IT UNDER THIS AGREEMENT AND AGREES THAT SUCH SERVICE SHALL CONSTITUTE GOOD AND SUFFICIENT

SERVICE OF PROCESS AND NOTICE THEREOF. NOTHING CONTAINED HEREIN SHALL BE DEEMED TO LIMIT IN ANY WAY ANY RIGHT TO SERVE PROCESS IN

ANY MANNER PERMITTED BY LAW. THE PARTIES HEREBY WAIVE ALL RIGHTS TO A TRIAL BY JURY. |

| |

|

|

| |

7. |

All

other terms and conditions of the SPA shall remain in full force and effect. In the event of conflict between this Agreement and

the SPA, this Agreement shall control. |

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date.

| STAFFING 360 SOLUTIONS, INC. | |

| |

|

|

| By:

| /s/ Brendan Flood |

|

| Name: |

Brendan Flood |

|

| Title: |

Chairman, CEO and President |

|

| |

|

|

CHAPEL

HILL PARTNERS, L.P.,

|

|

| as

Sellers’ Representative |

|

| |

|

|

| By:

|

/s/ Jean-Pierre Sakey |

|

| Name: |

Jean-Pierre Sakey |

|

| Title: |

General Partner |

|

| |

|

|

| JEAN-PIERRE SAKEY |

|

| |

|

|

| By:

|

/s/ Jean-Pierre Sakey |

|

ALLOCATION

TABLE

(See

attached)

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

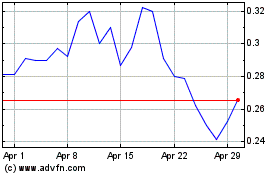

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2024 to May 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From May 2023 to May 2024