Paying On Time + In School = $1 Million in Rewards for Sallie Mae Private Education Loan Customers

March 15 2012 - 10:21AM

Business Wire

Good habits can pay off, and Sallie Mae’s Smart Option Student

Loan customers proved it. These students earned $1 million back in

Smart Rewards for making payments on time while in school. The

Smart Reward, introduced in 2010 by the nation’s No. 1 financial

services company specializing in education, allows Smart Option

Student Loan customers to earn back 2 percent of their scheduled

in-school payments simply for making their payments on time.

“A borrower making in-school payments on a Smart Option Student

Loan is a sensible way for today's students to establish a good

credit history while managing their student loan debt," said Cheryl

Williard, associate director of financial aid at Baldwin-Wallace

College in Berea, Ohio.

Sallie Mae’s Smart Option Student Loan, designed to supplement

federal student loans, assists students to save money, build

credit, and repay their student loan faster. Customers are

encouraged to make payments while in school to help minimize

finance charges and the overall cost of the loan.

When Smart Option Student Loan customers choose to make payments

on their student loans while in school, they can earn 2 percent of

that scheduled on-time payment. They can choose either monthly

interest payments or fixed, low monthly payments. That reward goes

into their Upromise by Sallie Mae account and can be used to pay

down their eligible Sallie Mae loan, transferred into a Sallie Mae

High-Yield Savings Account or turned into a check for expenses like

books.

“With the Smart Reward, good habits can turn into cash. By

getting into the routine of successful loan repayment early in

life, students can build a credit history and are better able to

achieve other financial goals such as home ownership,” said Joe

DePaulo, executive vice president of Sallie Mae. “We’re very proud

of these customers who are making responsible financial choices and

we’re happy to help them along the way.”

Sallie Mae advises families to follow its 1-2-3 approach to

paying for college: first, tap college savings and maximize

scholarships and grants. Second, explore federal student loans.

Third, fill the gap with a responsible private education loan with

your choice of in-school payment options to help you save

money.

***

Join the conversation on how to save, plan and pay for college

at Facebook.com/SallieMae.

***

Sallie Mae (NASDAQ: SLM) is the nation’s No. 1 financial

services company specializing in education. Whether college is a

long way off or just around the corner, Sallie Mae turns education

dreams into reality for its 25 million customers. With products and

services that include college savings programs, scholarship search

tools, education loans, tuition insurance, and online banking,

Sallie Mae offers solutions that help families save, plan, and pay

for college. Sallie Mae also provides financial services to

hundreds of college campuses as well as to federal and state

governments. Learn more at SallieMae.com. Commonly known as Sallie

Mae, SLM Corporation and its subsidiaries are not sponsored by or

agencies of the United States of America.

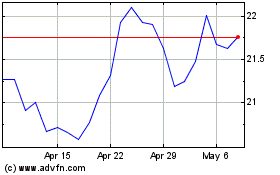

SLM (NASDAQ:SLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

SLM (NASDAQ:SLM)

Historical Stock Chart

From Jul 2023 to Jul 2024