SI International Completes Acquisition of Shenandoah Electronic Intelligence, Inc.

February 09 2005 - 4:10PM

PR Newswire (US)

SI International Completes Acquisition of Shenandoah Electronic

Intelligence, Inc. Acquisition Contributes to SI International's

Focus Area of Homeland Defense RESTON, Va., Feb. 9

/PRNewswire-FirstCall/ -- SI International, Inc. (NASDAQ:SINT), an

information technology and network solutions (IT) company,

announced today that it completed the purchase of Shenandoah

Electronic Intelligence, Inc. (SEI) on February 9, 2005. SEI is a

provider of critical business process outsourcing primarily for the

Department of Homeland Security (DHS). SEI's services include: data

and records management; applications processing; file and mail

management; analytical support services; and secure optical card

processing at one of the largest facilities of its kind. The

acquisition supports SI International's strategic growth plan to

broaden its customer base in one of its key focus areas -- Homeland

Defense. The SEI acquisition strengthens SI International's

relationships with DHS agencies and expands SI International's

portfolio of mission-critical outsourcing services. Founded in

1986, SEI performs facilities and records management functions for

several government entities and produces personalized

identification cards at a secure optical card processing facility,

which is considered one of DHS' "Centers for Excellence." SEI has

approximately 1,600 employees with over 99 percent holding security

clearances. Under the terms of the definitive stock purchase

agreement, SI International acquired SEI for $75 million in cash,

subject to certain adjustments. The transaction was funded through

cash-on-hand and borrowings from a new $160 million credit

facility. The purchase price is subject to adjustment as a result

of certain tax elections. The definitive stock purchase agreement

also provides that the SEI stockholders will retain certain

non-operating assets and contingent accounts receivable. SI

International expects the acquisition to be accretive to earnings.

SEI's trailing twelve months revenue ended September 30, 2004 was

approximately $73.9 million. "We believe that the combined

strengths of SI International and SEI can better serve our Federal

government clients' growing requirements, and create more

opportunities to provide our service offerings to a larger client

base," said Ray Oleson, Chairman and CEO of SI International.

"Combined, we have over 3,500 employees that will enable us to take

on larger scale assignments." "SEI has some tremendous talent and

experience in key areas of the business process outsourcing sector

for the Federal government," added SI International's President and

Chief Operating Officer, Brad Antle. "This acquisition is an

excellent fit within our company and will blend well with our

culture." About SI International: SI International, a member of the

Russell 2000 index, is a provider of information technology and

network solutions (IT) primarily to the Federal government. The

company combines technological and industry expertise to provide a

full spectrum of state-of-the-practice solutions and services, from

design and development to documentation and operations, to assist

clients in achieving their missions. More information about SI

International can be found at http://www.si-intl.com/. This press

release contains various remarks about the future expectations,

plans and prospects of SI International, Inc. that constitute

forward-looking statements for purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995. The actual results of SI International, Inc. may differ

materially from those indicated by these forward-looking statements

as a result of various risks and uncertainties, including the

following risks and uncertainties that relate specifically to the

acquisition: (i) the risk that the transaction will not be

consummated, including as a result of any of the conditions

precedent; (ii) the ability to obtain government approvals required

for closing the acquisition; (iii) the risk that the Shenandoah

Electronic Intelligence, Inc. will not be integrated successfully

into SI International; (iv) the risk that the expected benefits of

the acquisition may not be realized, including the realization of

accretive effects from the acquisition; and (v) SI International's

increased indebtedness after the acquisition. Other non-acquisition

related risks and uncertainties include: differences between

authorized amounts and amounts received by SI International under

government contracts; government customers' or prime contractors'

failure to exercise options under contracts; changes in federal

government (or other applicable) procurement laws, regulations,

policies and budgets; SI International's ability to attract and

retain qualified personnel; and the important factors discussed in

the Risk Factors section of the annual report on Form 10-K/A filed

by SI International, Inc. with the Securities and Exchange

Commission and available directly from the Commission at

http://www.sec.gov/. SI International disclaims any obligation to

update or correct any forward-looking statements made herein due to

the occurrence of events after the issuance of this news release.

CONTACT: Alan Hill of SI International, +1-703-234-6854, .

DATASOURCE: SI International, Inc. CONTACT: Alan Hill of SI

International, +1-703-234-6854, Web site: http://www.si-intl.com/

Copyright

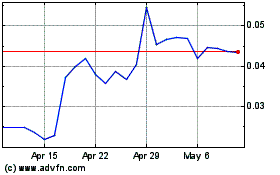

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jun 2024 to Jul 2024

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jul 2023 to Jul 2024