|

PROSPECTUS SUPPLEMENT

|

Filed pursuant to Rule 424(b)(5)

|

|

(To prospectus dated October 1, 2020)

|

Registration No.: 333-249238

|

Up to $3,308,842

Common Stock

SILVERSUN TECHNOLOGIES, INC.

We have entered into an At The Market Issuance Sales Agreement, or sales agreement, with H.C. Wainwright & Co., LLC or Wainwright, relating to shares of our common stock offered by this prospectus supplement. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $3,308,842 from time to time through Wainwright acting as our sales agent.

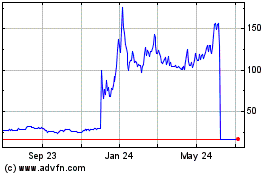

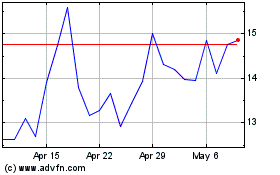

Our common stock is traded on The NASDAQ Capital Market, or Nasdaq, under the symbol “SSNT.” The last reported sale price of our common stock on February 25, 2021 was $7.71 per share. You are urged to obtain current market quotations of our common stock.

Sales of our common stock, if any, under this prospectus supplement will be made by any method permitted that is deemed an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, including sales made directly on or through Nasdaq or any other existing trading market in the United States for our common stock, sales made to or through a market maker other than on an exchange or otherwise, directly to Wainwright as principal, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices and/or in any other method permitted by law. If we and Wainwright agree on any method of distribution other than sales of shares of our common stock on or through Nasdaq or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act. Wainwright is not required to sell any specific number or dollar amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Wainwright will be entitled to compensation at a commission rate equal to 3.0% of the gross sales price per share sold. In connection with the sale of the common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities under the Securities Act or the Exchange Act of 1934, as amended, or the Exchange Act.

As of February 26, 2021, the aggregate market value of our outstanding common stock held by non-affiliates is $20,391,886.02, based on 4,667,877 shares of outstanding common stock, of which 2,644,862 shares are held by non-affiliates, and a per share price of $7.71, which was the closing sale price of our common stock as quoted on the Nasdaq Capital Market on February 25, 2021. During the 12 calendar months prior to and including the date of this prospectus supplement, we have sold our securities pursuant to General Instruction I.B.6 of Form S-3 in the aggregate amount of $3,488,453.01, as calculated under such General Instruction. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. Following the sale of shares of common stock in this offering, we will have sold securities with an aggregate market value of approximately $6,797,295 pursuant to General Instruction I.B.6 of Form S-3 during the 12-month calendar period that ends on and includes the date hereof.

Investing in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-12 of this prospectus supplement, and under similar headings in other documents filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

H.C. WAINWRIGHT & CO.

The date of this prospectus supplement is February 26, 2021

TABLE OF CONTENTS

Prospectus Supplement

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of the registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process and consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

If information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date – for example, a document incorporated by reference in the accompanying prospectus – the statement in the document having the later date modifies or supersedes the earlier statement. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find More Information” and “Incorporation by Reference.”

You should rely only on this prospectus supplement, the accompanying prospectus, the documents incorporated or deemed to be incorporated by reference herein or therein and any free writing prospectus prepared by us or on our behalf. We have not, and the underwriters have not, authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We and the underwriters are not offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus, or incorporated by reference herein, is accurate as of any date other than as of the date of this prospectus supplement or the accompanying prospectus or any free writing prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

When we refer to “SilverSun,” “we,” “our,” “us” and the “Company” in this prospectus, we mean SilverSun Technologies, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement or the accompanying prospectus applicable to that jurisdiction.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors” section contained in this prospectus, our consolidated financial statements and the related notes thereto and the other documents incorporated by reference in this prospectus.

Our Company

Overview

We are a business application, technology and consulting company providing strategies and solutions to meet our clients’ information, technology and business management needs. Our services and technologies enable customers to manage, protect and monetize their enterprise assets whether on-premise or in the “Cloud”. As a value-added reseller of business application software, we offer solutions for accounting and business management, financial reporting, Enterprise Resource Planning (“ERP”), Human Capital Management (“HCM”), Warehouse Management Systems (“WMS”), Customer Relationship Management (“CRM”), and Business Intelligence (“BI”). Additionally, we have our own development staff building software solutions for various ERP enhancements. Our value-added services focus on consulting and professional services, specialized programming, training, and technical support. We have a dedicated Information Technology (“IT”) network services practice that provides managed services, cybersecurity, application hosting, disaster recovery, business continuity, cloud and other services. Our customers are nationwide, with concentrations in the New York/New Jersey metropolitan area, Arizona, Southern California, North Carolina, Washington, Oregon and Illinois.

Our core business is divided into the following practice areas:

ERP (Enterprise Resource Management) and Accounting Software

We are a value-added reseller for a number of industry-leading ERP applications. We are a Sage Software Authorized Business Partner and Sage Certified Gold Development Partner. We believe we are among the largest Sage partners in North America, with a sales and implementation presence complemented by a scalable software development practice for customizations and enhancements. Due to the growing demand for cloud-based ERP solutions, we also have in our ERP portfolio Acumatica, a browser-based ERP solution that can be offered on premise, in the public cloud, or in a private cloud. We develop and resell a variety of add-on solutions to all our ERP and accounting packages that help customize the installation to our customers’ needs and streamline their operations.

Value-Added Services for ERP

We go beyond simply reselling software packages; we have a consulting and professional services organization that manages the process as we move from the sales stage into implementation, go live, and production. We work inside our customers’ organizations to ensure all software and IT solutions are enhancing their business needs. A significant portion of our services revenue comes from continuing to work with existing customers as their business needs change, upgrading from one version of software to another, or providing additional software solutions to help them manage their business and grow their revenue. We have a dedicated help desk team that fields hundreds of calls every week. Our custom programming department builds specialized software packages as well as “off the shelf” enhancements and time and billing software.

Network and Managed Services

We provide comprehensive IT network and managed services designed to eliminate the IT concerns of our customers. Businesses can focus on their core strengths rather than technology issues. We adapt our solutions for virtually any type of business, from large national and international product and service providers, to small businesses with local customers. Our business continuity services provide automatic on-site and off-site backups, complete encryption, and automatic failure testing. We also provide application hosting, IT consulting and managed network services. Our focus in the network and managed services practice is to focus on industry verticals in order to demonstrate our ability to better understand our customers’ needs.

Industry Overview

As a value-added reseller of business application software, we offer solutions for accounting and business management, financial reporting, managed services, ERP, HCM, WMS, CRM, and BI. Additionally, we have our own development staff building software solutions for various ERP enhancements. Our value-added services focus on consulting and professional services, specialized programming, training, and technical support. The majority of our customers are small and medium businesses (“SMBs”).

Potential Competitive Strengths

|

•

|

Independent Software Vendor. As an independent software vendor we have published integrations between ERPs and third-party products which differentiates us from other business application providers because, as a value-added reseller of the ERPs that our proprietary products integrate with, we have specific software solution expertise in the ERPs we resell, which ensures that our products tightly integrate with the ERPs. We own the intellectual property related to these integrations and sell the solutions both directly and through other software resellers within the Sage and Acumatica channel.

|

|

•

|

Sage Certified Gold Development Partner. As a Sage Certified Gold Development Partner, we are licensed to customize the source code of the Sage ERPs. Very few resellers are master developers, and in fact, we provide custom programming services for many other resellers. We have full-time programmers on staff, which provides us with a depth and breadth of expertise that we believe very few competitors can match.

|

|

•

|

Ability to Recruit, Manage and Retain Quality Personnel. We have a track record of recruiting, managing and retaining skilled labor and our ability to do so represents an important advantage in an industry in which a shortage of skilled labor is often a key limitation for both clients and competitors alike. We recruit skilled labor from competitors and from amongst end users with experience using the various products we sell, whom we then train as consultants. We believe our ability to hire, manage and maintain skilled labor gives an edge over our competitors as we continue to grow.

|

|

•

|

Combination of Hardware/Software Expertise. Many competitors have software solution expertise. Others have network/hardware expertise. We believe we are among the very few organizations with an expertise in both software and hardware, affording us the opportunity to provide turnkey solutions for our customers without the need to bring in additional vendors on a project.

|

|

•

|

Technical Expertise. Our geographical reach and substantial technical capabilities afford our clients the ability to customize and tailor solutions to satisfy all of their business needs.

|

Our Growth Strategy

General

Our strategy is to grow our business through a combination of intra-company growth of our software applications, technology solutions and managed services, as well as expansion through acquisitions. We have established a national presence via our internal marketing, sales programs, and acquisitions and now have ERP customers throughout most of the United States.

Intra-Company Growth

Our intra-company growth strategy is to increase our market penetration and client retention through the upgrade of, and expanded sales efforts with, our existing products and managed services and development of new and enhanced software and technology solutions. Our client retention is sustained by our providing responsive, ongoing software and technical support and monitoring and maintenance services for both the solutions we sell and other client technology needs we provide.

Repeat business from our existing customer base has been key to our success and we expect it will continue to play a vital role in our growth. We focus on nurturing long-standing relationships with existing customers while also establishing relationships with new customers.

Acquisitions

The markets in which we provide our services are occupied by a large number of competitors, many substantially larger than us, and with significantly greater resources and geographic reach. We believe that to remain competitive, we need to take advantage of acquisition opportunities that arise which may help us achieve greater geographic presence and economies both within our existing footprint and expanded territories. As such, we have completed 33 acquisitions and/or collaborative agreements in the past sixty (60) months. We may also utilize acquisitions, whenever appropriate, to expand our technological capabilities and product offerings. We focus on acquisitions that are profitable and fit seamlessly with our existing operations.

We believe our markets contain a number of attractive acquisition candidates. We foresee expanding through acquisitions of one or more of the following types of software and technology organizations:

Managed Service Providers (“MSPs”). MSPs provide their small and medium-sized business clients with a suite of services, which may include 24/7/365 remote monitoring of networks, application hosting, disaster recovery, business continuity, data back-up, cyber-security and the like. There are hundreds of providers of such services in the U.S., most with annual recurring revenue of less than $10 million. We believe that we may be able to consolidate a number of these MSPs with our existing operation in an effort to become one of the more significant providers of these services in the U.S.

Independent Software Vendors (“ISVs”). ISVs are publishers of both stand-alone software solutions and integrations that integrate with other third party products. Our interest lies with ISVs selling into the small and medium-sized business marketplace, providing applications addressing e-commerce, mobility, security, and other functionalities. Since we have expertise in both selling directly to end-users and selling through a sales channel, we believe we can significantly enhance the sales volume of any potential acquisition via our existing infrastructure, our sales channel, and our internal marketing programs. There are many ISVs in North America, constituting a large and significant target base for our acquisition efforts.

Value-Added Resellers (“VARs”) of ERP, Human Capital Management (“HCM”), Warehouse Management Systems (“WMS”), CRM and BI Software. VAR’s gross margins are a function of the sales volume they provide a publisher in a twelve (12) month period, and we are currently operating at the highest margins. Smaller resellers who sell less and operate at significantly lower margins, are at a competitive disadvantage to companies such as ours and are often amenable to creating a liquidity event for themselves by selling to larger organizations. We have benefitted from completing such acquisitions in a number of ways, including but not limited to: (i) garnering new customers to whom we can upsell and cross-sell our broad range of products and services; (ii) gaining technical resources that enhance our capabilities; and (iii) extending our geographic reach.

Our business strategy provides that we will examine the potential acquisition of businesses within and outside our industry. In determining a suitable acquisition candidate, we will carefully analyze a target’s potential to add to and complement our product mix, expand our existing revenue base, improve our margins, expand our geographic coverage, strengthen our management team, add technical resources and expertise, and, above all, improve stockholder returns. More specifically, we have identified the criteria listed below, by which we evaluate potential acquisition targets in an effort to gain the synergies necessary for successful growth of the Company:

|

|

●

|

Access to new customers and geographic markets;

|

|

|

|

|

|

|

●

|

Recurring revenue of the target;

|

|

|

|

|

|

|

●

|

Opportunity to gain operating leverage and increased profit margins;

|

|

|

|

|

|

|

●

|

Diversification of sales by customer and/or product;

|

|

|

|

|

|

|

●

|

Improvements in product/service offerings; and

|

|

|

|

|

|

|

●

|

Ability to attract public capital and increased investor interest.

|

We are unable to predict the nature, size or timing of any acquisition. We can give no assurance that we will reach agreement or procure the financial resources necessary to fund any acquisition, or that we will be able to successfully integrate or improve returns as a result of any such acquisition.

We continue to seek out and hold preliminary discussions with various acquisition candidates. However, currently we have not entered into any agreements or understandings for any acquisitions that management deems material.

Enterprise Resource Planning Software Strategy

Our ERP software strategy is focused on serving the needs of our expansive installed base of customers for our Sage 100cloud, Sage 500 ERP, and Sage BusinessWorks practices, while rapidly growing the number of customers using Sage X3 and Acumatica. We currently have approximately 8,000 active ERP customers using one of these five solutions, including customers using certain add-on support products to these solutions. In the past we, have focused primarily on on-premise mid-market Sage Software solutions but in the past three years have focused on larger enterprise-type offerings and cloud ERP solutions. This has allowed us to increase our average deal size and also to keep pace with the changing trends that we see in the industry.

Managed Services Strategy

The IT Managed Services market is broadly segmented by types of services, for example, managed data-center, managed network, managed mobility, managed infrastructure, managed communications, managed information, managed security and other managed services. In addition, the market is segmented by market verticals, such as public sector, banking, financial services and insurance, education, retail, contact centers and service industries, high tech and telecommunications, healthcare and pharmaceuticals, travel and logistics, manufacturing, energy and utilities among others.

The recent trend in the industry shows that there is a high demand for managed services across every industry vertical. The implementation of managed services can reduce IT costs by 30% to 40% in such enterprises. This enables organizations to have flexibility and technical advantage. Enterprises having their services outsourced look forward to risk sharing and to reduce their IT costs and IT commitments, so that they are able to concentrate on their core competencies. Organizations implementing managed services have reported almost a 50% to 60% increase in the operational efficiency of their outsourced processes. Enterprises have accepted outsourcing services as a means to enable them to reduce their capital expenditure (CapEx) and free up internal sources. Newer managed services that penetrate almost all the industry domains, along with aggressive pricing in services, are being offered. This results in an increase in the overall revenues of the managed services market. It is observed that there is an increase in outsourcing of wireless, communications, mobility and other value-added services, such as content and e-commerce facilities. With increasing technological advancements and the cost challenges associated with having the IT services in-house, we believe the future seems optimistic for managed services providers.

Our strategy is to continue to expand our product offerings to the small and medium sized business marketplace, and to increase our scale and capabilities via acquisition throughout the United States, but initially in those regions where we currently have existing offices.

Geographic Expansion

Generally, our technology offerings require some on-premise implementation and support. When we expand into new geographic territories, we prefer to find qualified personnel in an area to augment our current staff of consultants to service our business. The need for hands-on implementation and support may also require investment in additional physical offices and other overhead. We believe our approach is conservative.

We may accelerate expansion if we find complementary businesses that we are able to acquire in other regions. Our marketing efforts to expand into new territories have included attendance at trade shows in addition to personal contact.

Our Products and Services

Enterprise Resource Planning Software

Substantially all our initial sales of ERP financial accounting solutions consist of pre-packaged software and associated services to customers in the United States.

The Company resells ERP software published by Sage Software, Acumatica and other providers for the financial accounting requirements of small- and medium-sized businesses focused on manufacturing and distribution, and the delivery of related services from the sales of these products, including installation, support and training. The programs perform and support a wide variety of functions related to accounting, including financial reporting, accounts payable and accounts receivable, and inventory management.

We provide a variety of services along with our financial accounting software sales to assist our customers in maximizing the benefits from these software applications. These services include training, technical support, and professional services. We employ class instructors and have formal, specific training in the topics they are teaching. We can also provide on-site training services that are highly tailored to meet the needs of a particular customer. Our instructors must pass annual subject-matter examinations required by Sage to retain their product-based teaching certifications.

We provide end-user technical support services through our support/help desk. Our product and technology consultants assist customers calling with questions about product features, functions, usability issues, and configurations. The support/help desk offers services in a variety of ways, including prepaid services, time and materials billed as utilized and annual support contracts. Customers can communicate with the support/help desk through e-mail, telephone, and fax channels. Standard support/help desk services are offered during normal business hours five (5) days per week.

Warehouse Management Systems

We are resellers of the Accellos Warehouse Management System software published by High Jump, Inc. (“High Jump”). High Jump develops warehouse management software for mid-market distributors. The primary purpose of a WMS is to control the movement and storage of materials within an operation and process the associated transactions. Directed picking, directed replenishment, and directed put-away are the key to WMS. The detailed setup and processing within a WMS can vary significantly from one software vendor to another. However, the basic WMS will use a combination of item, location, quantity, unit of measure, and order information to determine where to stock, where to pick, and in what sequence to perform these operations.

The Accellos WMS software improves accuracy and efficiency, streamlines materials handling, meets retail compliance requirements, and refines inventory control. Accellos also works as part of a complete operational solution by integrating seamlessly with radio frequency hardware, accounting software, shipping systems and warehouse automation equipment.

We market the Accellos solution to our existing and new medium-sized business customers.

IT Managed Network Services and Business Consulting

We provide IT managed services, cybersecurity, business continuity, disaster recovery, data back-up, network maintenance and service upgrades for our business clients. We are a Microsoft Solutions Provider. Our staff includes engineers who maintain certifications from Microsoft and Sage Software. They are Microsoft Certified Systems Engineers and Microsoft Certified Professionals, and they provide a host of services for our clients, including remote network monitoring, server implementation, support and assistance, operation and maintenance of large central systems, technical design of network infrastructure, technical troubleshooting for large scale problems, network and server security, and backup, archiving, and storage of data from servers. There are numerous competitors, both larger and smaller, nationally and locally, with whom we compete in this market.

Cybersecurity

We provide enterprise level security services to the mid-market. Our cybersecurity-as-a-service offering includes a security operations center, incident response, cybersecurity assessments, and hacking simulations. The service is particularly well-suited for customers in compliance-driven and regulated industries, including financial services, pension administration, insurance, and the land and title sector.

Application Hosting

Through our wholly owned subsidiary, Secure Cloud Services, Inc., we acquired the assets of Nellnube, Inc. to further market application hosting services throughout the country.

Product Development

We are continually looking to improve and develop new products. Our product initiatives include various new product offerings, which are either extensions of existing products or newly conceptualized product offerings. We are using a dual-shore development approach to keep product development costs at a minimum. All our product development is led by U.S. based employees. The project leaders are technical resources who are involved in developing technical specifications, design decisions, usability testing, and transferring the project knowledge to our offshore development team. Several times per week, the product development leadership team meets with our project leaders and development teams to discuss project status, development obstacles, and project timelines.

Arrangements with Principal Suppliers

Our revenues are primarily derived from the resale of vendor software products and services. These resales are made pursuant to channel sales agreements whereby we are granted authority to purchase and resell the vendor products and services. Under these agreements, we either resell software directly to our customers or act as a sales agent for various vendors and receive commissions for our sales efforts.

We are required to enter into an annual Channel Partner Agreement with Sage Software whereby Sage Software appoints us as a non-exclusive partner to market, distribute, and support Sage 100cloud, Sage 500 ERP and Sage X3. The Channel Partner Agreement is for a one-year term, and automatically renews for an additional one-year term on the anniversary of the agreement’s effective date. These agreements authorize us to sell these software products to customers in the United States. There are no clauses in this agreement that limit or restrict the services that we can offer to customers. We also operate a Sage Software Authorized Training Center Agreement and also are party to a Master Developers Program License Agreement.

For the years ended December 31, 2019 and 2018, purchases from Sage Software were approximately 24% and 19%, respectively, of the Company’s total cost of revenue. Generally, the Company does not rely on any one specific supplier for all its purchases and maintains relationships with other suppliers that could replace its existing supplier should the need arise.

Customers

We market our products primarily throughout North America. For the years ended December 31, 2019 and 2018, our top ten (10) customers accounted for 10% ($3,903,702) and 14% ($5,219,755), respectively, of our total revenues. Generally, we do not rely on any one specific customer for any significant portion of our revenue base. No single customer accounted for ten percent or more of our consolidated revenues base.

Intellectual Property

We regard our technology and other proprietary rights as essential to our business. We rely on copyright, trade secret, confidentiality procedures, contract provisions, and trademark law to protect our technology and intellectual property. We have also entered into confidentiality agreements with our consultants and corporate partners and intend to control access to, and distribution of our products, documentation, and other proprietary information.

Competition

Our markets are highly fragmented, and the business is characterized by a large number of participants, including several large companies, as well significant number of small, privately-held, local competitors. A significant portion of our revenue is currently derived from requests for proposals (“RFPs”) and price is often an important factor in awarding such agreements. Accordingly, our competitors may underbid us if they elect to price their services aggressively to procure such business. Our competitors may also develop the expertise, experience and resources to provide services that are equal or superior in both price and quality to our services, and we may not be able to enhance our competitive position. The principal competitive factors for our professional services include geographic presence, breadth of service offerings, technical skills, quality of service and industry reputation. We believe we compete favorably with our competitors on the basis of these factors.

Employees

As of February 19, 2021, we had approximately 162 full time employees with 48 of our employees engaged in sales and marketing activities, 75 employees are engaged in service fulfillment, and 39 employees performing administrative functions.

Our future success depends in significant part upon the continued services of our key sales, technical, and senior management personnel and our ability to attract and retain highly qualified sales, technical, and managerial personnel. None of our employees are represented by a collective bargaining agreement and we have never experienced a work stoppage.

Our Corporate History

We were incorporated on October 3, 2002, as a wholly owned subsidiary of iVoice, Inc. (“iVoice”). On February 11, 2004, the Company was spun off from iVoice and became an independent publicly traded company. On September 5, 2003, we changed our corporate name to Trey Resources, Inc. In March 2004, Trey Resources, Inc. began trading on the OTCBB under the symbol TYRIA.OB. In June 2011, we changed our name to SilverSun Technologies, Inc., trading under the symbol SSNT.

Prior to June 2004, we were engaged in the design, manufacture, and marketing of specialized telecommunication equipment. On June 2, 2004, our wholly-owned subsidiary, SWK Technologies, Inc. (“SWK”) completed its acquisition of SWK, Inc. Since the acquisition of SWK, Inc. we have focused on three (3) core business sectors, including acting as the following: (i) a managed service provider for computer networks, providing cybersecurity, 24/7 remote monitoring of networks, data backup, hosting, and business continuity and disaster recovery services; and (ii) a value added reseller and master developer for Sage Software’s Sage 100cloud, Sage 500 ERP and Sage EM (formerly Sage ERP X3) enterprise resource planning (“ERP”) financial software. We also publish twenty (20) other assorted software solutions. We focus on the business application software and the information technology consulting market for small and medium-sized businesses (“SMB’s”), selling services and products to various end users, manufacturers, wholesalers and distributors located throughout the United States.

Our strategy is to grow our business through a combination of intra-company growth of our software applications and technology solutions, as well as expansion through acquisitions, both within our existing geographic reach and through geographic expansion. To that end, since 2006, we have completed a number of acquisitions that have increased our client base, technical expertise and geographic footprint.

On June 2, 2006, SWK completed the acquisition of certain assets of AMP-Best Consulting, Inc. (“AMP”) of Syracuse, New York. AMP is an information technology company and value-added reseller of licensed ERP software published by Sage Software. AMP sold services and products to various end users, manufacturers, wholesalers and distribution industry clients located throughout the United States, with special emphasis on companies located in the upstate New York region.

During 2011, SWK acquired Sage’s Software’s customer accounts in connection with IncorTech, LLC (“IncorTech”), a Southern California-based Sage business partner. This transaction increased our geographical influence in Southern California for the sale and support of our MAPADOC integrated EDI solution and the marketing of our Sage EM (formerly Sage ERP X3) to both former IncorTech customers as well as new consumers. IncorTech had previously provided professional accounting, technology, and business consulting services to over 300 clients.

In June 2012, SWK acquired selected assets and obligations of Hightower, Inc., a Chicago-based reseller of Sage software applications. In addition to the strategic geographic benefits that this acquisition brings to SWK, there is also a substantial suite of proprietary enhancement software solutions.

In May 2014, we completed the purchase of selected assets of ESC Software (“ESC”), a leading Arizona-based reseller of Sage Software and Acumatica applications. Founded in 2000, ESC has implemented technology solutions at prominent companies throughout the Southwest. In addition to the strategic benefits of this acquisition, it has given us additional annual revenues, approximately 300 additional Sage Software ERP customers and affords us market penetration in the Southwest.

On March 11, 2015 SWK entered into an Asset Purchase Agreement with 2000 SOFT, Inc. d/b/a Accounting Technology Resource (“ATR”), a California corporation. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from the approximately 250 additional customers.

On July 6, 2015 SWK entered into an Asset Purchase Agreement with ProductiveTech, Inc. (“PTI”), a Southern New Jersey corporation. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from the approximately 85 additional customers.

On October 1, 2015, SWK entered into an Asset Purchase Agreement with The Macabe Associates, Inc., (“Macabe”) a Washington based reseller of Sage Software and Acumatica applications. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from the approximately 180 additional customers.

On October 19, 2015, SWK entered into an Asset Purchase Agreement with Oates & Company, (“Oates”) a North Carolina reseller of Sage Software applications. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from the approximately 185 additional customers.

On May 31, 2018, SWK entered into an Asset Purchase Agreement with Info Sys Management, Inc., (“ISM”) an Oregon based reseller of Sage Software and Acumatica applications. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from the approximately 700 additional customers.

In May 2018, the Company formed a wholly owned subsidiary, Secure Cloud Services, Inc. (“SCS”), a Nevada corporation, for the purpose of providing application hosting services. On May 31, 2018, Secure Cloud Services entered into an Asset Purchase Agreement with Nellnube, Inc. (“Nellnube”) an Oregon based application hosting provider.

In May 2018, the Company formed a wholly owned subsidiary, Critical Cyber Defense Corp. (“CCD”), a Nevada corporation, for the purpose of providing cyber defense products and services.

On January 1, 2019, SWK entered into an Asset Purchase Agreement with Partners in Technology, Inc., (“PIT”) an Illinois based reseller of Sage Software. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from the approximately 170 additional customers.

On August 26, 2019 SWK entered into and closed that certain Asset Purchase Agreement (the “MAPADOC Asset Purchase Agreement”) by and among the Company, SPS Commerce, Inc., as buyer (“SPS”), and SWK as seller, pursuant to which SPS agreed to acquire from SWK substantially all of the assets related to the MAPADOC business.

On July 31, 2020, SWK entered into an Asset Purchase Agreement with Prairie Technology Solutions Group, LLC , (“PT”) an Illinois based managed service provider for the purpose of enhancing the strategic geographic reach of our managed service division.

On October 1, 2020, the Company acquired certain assets of Computer Management Services, LLC (“CMS”) pursuant to an Asset Purchase Agreement. CMS is in the business of selling and supporting enterprise resource planning and similar software for small and middle market companies. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from its additional customers.

On December 1, 2020, the Company acquired certain assets of a company d/b/a Business Software Solutions (“BSS”) pursuant to an Asset Purchase Agreement. BSS is an Oregon based reseller of Sage Software and Acumatica applications. In addition to the strategic geographic benefits of this acquisition, it has provided additional revenues from its additional customers.

Recent Developments

On February 22, 2021, SWK signed a non-binding letter of intent to acquire CT-Solution, Inc. (“CT”), a leading Indianapolis-based reseller of Sage Software solutions. SWK is one of the largest Sage business partners in North America. It is anticipated that the transaction, which is subject to the signing of definitive agreements and customary closing conditions, will close in the second quarter of 2021.

THE OFFERING

|

|

|

|

|

Common stock offered by us pursuant to this prospectus

|

|

Shares of our common stock having an aggregate offering price of up to $3,308,842.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

Up to 5,097,039 shares, assuming the sale of 429,162 shares at a assumed sales price of $7.71 per share, which was the closing price on the Nasdaq Capital Market on February 25, 2021. The actual number of shares issued and outstanding will vary depending on the price at which shares may be sold from time to time during this offering.

|

|

|

|

|

|

Manner of offering

|

|

“At the market offering” that may be made from time to time on The NASDAQ Capital Market or other market for our common stock in the U.S. through our sales agent, H.C. Wainwright & Co., LLC. See the section entitled “Plan of Distribution” on page S-14 of this prospectus.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds of this offering for general corporate purposes. See the section entitled “Use of Proceeds” on page S-13 of this prospectus.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” beginning on page S-12 of this prospectus supplement and the other information included in, or incorporated by reference into, our prospectus for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock.

|

|

|

|

|

|

NASDAQ Capital Market symbol

|

|

SSNT

|

The number of shares of our common stock to be outstanding immediately after this offering is based on 4,667,877 shares of our common stock outstanding as of February 25, 2021. The number of shares outstanding as of February 25, 2021 excludes:

|

|

●

|

4,988 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $4.01

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements of historical fact contained in this prospectus, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Risks Associated with this Offering

We have broad discretion in the use of the net proceeds of this offering and may not use them effectively.

We intend to use the net proceeds from this offering for general corporate purposes. However, our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our product candidates.

You may experience immediate and substantial dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an aggregate of 429,162 shares of our common stock are sold at a price of $7.71 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on February 25, 2021, for aggregate gross proceeds of $3,308,842, and after deducting commissions and estimated offering expenses payable by us, if you purchase common stock in this offering, you will experience immediate dilution of $6.64 per share, representing the difference between our as adjusted net tangible book value per share as of September 30, 2020 after giving effect to this offering and the assumed offering price. The exercise of outstanding stock options and warrants, or the conversion of outstanding preferred stock into common stock, will result in further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

The common stock offered hereby will be sold in “at-the-market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

The actual number of shares we will issue under the sales agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a sales notice to Wainwright at any time throughout the term of the sales agreement. The number of shares that are sold by Wainwright after we deliver a sales notice will fluctuate based on the market price of the common stock during the sales period and limits we set with Wainwright. Because the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $3,308,842 from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We estimate that the net proceeds from the sale of the shares of common stock that we are offering may be up to approximately $3,154,577, after deducting Wainwright’s commission and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering for general corporate purposes.

DIVIDEND POLICY

We have paid cash dividends on our common stock in each of the past 4 years. Any future determination to pay dividends will be at the discretion of our board of directors, subject to applicable laws, and will depend on our financial condition, results of operations, capital requirements, general business conditions and other factors that our board of directors considers relevant.

DILUTION

If you invest in our common stock, your interest will be diluted to the extent of the difference between the price per share you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value of our common stock as of September 30, 2020 was approximately $2,295,809 or approximately $0.51 per share of common stock based upon 4,501,271 shares outstanding. Net tangible book value per share is equal to our total tangible assets, less our total liabilities, divided by the total number of shares outstanding as of September 30, 2020.

After giving effect to the sale of our common stock in the aggregate amount of $3,308,842 at an assumed offering price of $7.71 per share, the last reported sale price of our common stock on The NASDAQ Capital Market on February 25, 2021, and after deducting estimated offering commissions payable by us, our net tangible book value as of September 30, 2020 would have been $5,450,386 or $1.07 per share of common stock. This represents an immediate increase in net tangible book value of $0.56 per share to our existing stockholders and an immediate dilution in net tangible book value of $6.64 per share to new investors in this offering.

The following table illustrates this calculation on a per share basis:

|

Assumed Offering price per share

|

|

$

|

7.71

|

|

|

Net tangible book value per share as of September 30, 2020

|

|

$

|

0.51

|

|

|

Increase in net tangible book value per share attributable to the offering

|

|

$

|

0.56

|

|

|

As-adjusted net tangible book value per share after giving effect to the offering

|

|

$

|

1.07

|

|

|

Dilution in net tangible book value per share to new investors

|

|

$

|

6.64

|

|

The number of shares of our common stock to be outstanding immediately after this offering is based on 4,501,271 shares of our common stock outstanding as of September 30, 2020. The number of shares outstanding as of September 30, 2020 excludes:

|

|

•

|

|

4,988 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $4.01;

|

The foregoing table does not give effect to the exercise of any outstanding options or warrants or the conversion of preferred stock to common stock. To the extent options and warrants are exercised, or to the extent preferred stock is converted to common stock, there may be further dilution to new investors.

The table above assumes for illustrative purposes that an aggregate of 429,162 shares of our common stock are sold at a price of $7.71 per share, the last reported sale price of our common stock on The NASDAQ Capital Market on September 30, 2020, for aggregate gross proceeds of $3,308,842. The shares, if any, sold in this offering will be sold from time to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $7.71 per share shown in the table above, assuming we sell the same aggregate 429,162 shares, would increase our as-adjusted net tangible book value per share after this offering to $1.15 per share and would increase the dilution in net tangible book value per share to new investors in this offering to $7.56 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $7.71 per share shown in the table above, assuming we sell the same aggregate 429,162 shares, would decrease our as-adjusted net tangible book value per share after this offering to $0.99 per share and would decrease the dilution in net tangible book value per share to new investors in this offering to $5.72 per share, after deducting commissions and estimated aggregate offering expenses payable by us.

PLAN OF DISTRIBUTION

We have entered into an At The Market Issuance Sales Agreement, or the sales agreement, with H.C. Wainwright & Co., LLC, or Wainwright, under which we may issue and sell our common stock from time to time through Wainwright acting as sales agent, subject to certain limitations, including the number of shares registered under the registration statement to which the offering relates. The sales, if any, of shares made under the sales agreement will be made by any method that is deemed an “at the market offering” as defined in Rule 415 promulgated under the Securities Act. If we and Wainwright agree on any method of distribution other than sales of shares of our common stock on or through the Nasdaq Capital Market or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act.

Each time we wish to issue and sell common stock under the sales agreement, we will notify Wainwright of the number of shares to be issued, the dates on which such sales are anticipated to be made, any minimum price below which sales may not be made and other sales parameters as we deem appropriate. Once we have so instructed Wainwright, unless Wainwright declines to accept the terms of the notice, Wainwright has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of Wainwright under the sales agreement to sell our common stock are subject to a number of conditions that we must meet. We may instruct Wainwright not to sell common stock if the sales cannot be effected at or above the price designated by us from time to time. We or Wainwright may suspend the offering of common stock upon notice and subject to other conditions.

We will pay Wainwright commissions for its services in acting as agent in the sale of common stock. Wainwright will be entitled to a commission in an amount equal to 3.0% of the gross proceeds from the sale of common stock offered hereby. In addition, we have agreed to reimburse Wainwright for fees and disbursements related to its legal counsel in an amount not to exceed $50,000. We estimate that the total expenses for the offering, excluding compensation payable to Wainwright under the terms of the sales agreement, will be approximately $55,000.

Settlement for sales of common stock will generally occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and Wainwright in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of the common stock on our behalf in this “at the market offering,”, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Wainwright against certain civil liabilities, including liabilities under the Securities Act or the Exchange Act.

The offering of our common stock pursuant to the sales agreement will terminate upon the earlier of (i) the sale of all of our common stock provided for in this prospectus or (ii) termination of the sales agreement as provided therein.

Wainwright and its affiliates may in the future provide various investment banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, Wainwright will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus.

LEGAL MATTERS

The validity of the common stock offered hereby will be passed upon by Lucosky Brookman LLP. Ellenoff Grossman & Schole LLP is counsel for Wainwright in connection with this offering.

EXPERTS

Our consolidated balance sheets as of December 31, 2019 and 2018, and the related consolidated statements of operations, stockholders’ equity and cash flows for each of those two years have been audited by Friedman LLP, an independent registered public accounting firm, as set forth in its report incorporated by reference and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is https://www.silversuntech.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or through the SEC’s website, as provided above.

INCORPORATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

|

|

●

|

Our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 26, 2020.

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 13, 2020.

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, filed with the SEC on August 12, 2020.

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, filed with the SEC on November 10, 2020.

|

|

|

|

|

|

|

●

|

Our Current Reports on Form 8-K filed with the SEC on April 23, 2020, May 21, 2020, October 16, 2020, November 12, 2020, December 21, 2020, and January 8, 2021.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

SilverSun Technologies, Inc.

120 Eagle Rock Ave

East Hanover, NJ 07936

(973) 396-1720

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

$3,308,842

Common Stock

PROSPECTUS SUPPLEMENT

H.C. Wainwright & Co.

February 26, 2021

PROSPECTUS

SILVERSUN TECHNOLOGIES, INC.

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer and sell up to $50 million in the aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 10 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our common stock is listed on The NASDAQ Capital Market under the symbol “SSNT”. On September 30, 2020, the last reported sale price of our common stock on The NASDAQ Capital Market was $2.65 per share.

The aggregate market value of our outstanding common stock held by non-affiliates is $10,468,499, based on 4,501,271 shares of outstanding common stock, of which 2,562,660 are held by affiliates, and a per share price of $5.40 based on the closing sale price of our common stock on August 4, 2020. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 1, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings up to a total dollar amount of $50 million as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

When we refer to “SilverSun,” “we,” “our,” “us” and the “Company” in this prospectus, we mean SilverSun Technologies, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. Information filed with the SEC by us can be inspected and copied at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information by mail from the Public Reference Room of the SEC at prescribed rates. Further information on the operation of the SEC’s Public Reference Room in Washington, D.C. can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is https://www.silversuntech.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

|

|

|

|

|

|

●

|

Our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 26, 2020.

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 13, 2020.

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, filed with the SEC on August 12, 2020.

|

|

|

|

|

|

|

●

|

Our Current Reports on Form 8-K filed with the SEC on April 23, 2020 and May 21, 2020.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

SilverSun Technologies, Inc.

120 Eagle Rock Ave

East Hanover, NJ 07936

(973) 396-1720

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

THE COMPANY