PHILADELPHIA, Oct. 21 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK), (the "Company") the holding company

for Republic First Bank (PA), today reported an increase in third

quarter 2008 earnings to $1.5 million or $.14 per diluted share,

from $1.2 million or $.12 per share in third quarter 2007. It also

represented an increase when compared to the linked quarter's net

income of $1.2 million or $.11 per diluted share. Income Statement

(dollars in thousands, except per share data) Three months ended %

% 9/30/08 6/30/08 Change 9/30/07 Change Total revenues $8,290

$7,840 6% $8,564 -3% Net income $1,533 $1,189 29% $1,236 24%

Diluted net income per share $0.14 $0.11 27% $0.12 17% Balance

Sheet (dollars in millions) % % 9/30/08 6/30/08 Change 9/30/07

Change Total assets $965 $948 2% $1,040 -7% Total deposits $729

$729 0% $770 -5% Total loans (net) $764 $784 -2.5% $833 -8% Chief

Executive Officer's Statement In commenting on the Company's

financial results, Harry D. Madonna, Chief Executive Officer noted

the following highlights: -- Credit quality improved as

nonperforming assets were reduced to $15.9 million at September 30,

2008, down from $26.0 million at December 31, 2007. -- The net

interest margin increased to 3.48% in the quarter compared to 3.19%

in the linked quarter. -- Net income of $1.5 million and earnings

per share of $.14 for the quarter represented increases from linked

and prior year quarters. -- Tier one leverage capital amounted to

11.02% at September 30, 2008. Harry D. Madonna, Chief Executive

Officer, stated, "The third quarter showed continuing improvements

in performance in several areas. First , non performing assets

declined to $15.9 million from $26.0 million at December 31, 2007

and $17.4 million at June 30, 2008. And, we continue to emphasize

credit quality in our lending decisions. So, while loans decreased

modestly during the quarter, we have begun developing loan programs

which should increase volume in the future. Notwithstanding charges

related to other real estate owned sold during the quarter, net

income increased to $1.5 million and $.14 per share. Reflected in

that increase was an increase in the interest margin to 3.48%.

Further, we are implementing strategies to increase core deposits,

which will have a positive impact on future margins. We continue to

gather momentum in the creation of a new 'killer brand' with new

stores, new products, new excitement and new people including

several long time Commerce Bank team members including Rhonda

Costello, Chief Retail Officer; Andrew Logue, Chief Operating

Officer; Janet Roig, Cash Management and Government Banking and

several others." Income Statement (dollars in thousands, except per

share data) Three months ended % % 9/30/08 6/30/08 Change 9/30/07

Change Total revenues* $8,290 $7,840 6% $8,564 -3% Total operating

expenses $6,008 $6,061 -1% $5,488 9% Net income $1,533 $1,189 29%

$1,236 24% Diluted earnings per share $0.14 $0.11 27% $0.12 17%

Nine months ended % 9/30/08 9/30/07 Change Total revenues* $24,017

$25,034 -4% Total operating expenses $18,517 $15,766 17% Net income

$(56) $5,308 -101% Diluted earnings per share $(0.01) $0.50 -102% *

Net interest income plus noninterest income Total revenues of $8.3

million for the third quarter represented a 6% increase over the

linked quarter. The increase resulted primarily from increased net

interest income, which reflected the maturity of higher rate retail

certificates of deposit. The lower revenues in 2008 compared to the

prior year, reflected lower loan balances which contributed to a

lower net interest margin. Operating expenses were reduced 1% to

$6.1 million compared to the linked quarter. Expenses were higher

in 2008 compared to the prior year, primarily as a result of other

real estate owned expense for properties sold during the quarter.

Balance Sheet Highlights (dollars in thousands) % % 9/30/08 6/30/08

Change 9/30/07 Change Total assets $964,732 $947,589 2% $1,040,119

-7% Total loans (net) 764,245 784,115 -2.5% 832,983 -8% Total

deposits 729,487 728,559 0% 769,889 -5% Total core deposits*

350,215 346,885 1% 359,310 -3% * Core deposits exclude all

certificates of deposit. Our primary focus is to build core

deposits to fund our local lenders making local loans. We are

additionally developing loan programs which should increase loan

growth in a safe and sound manner in the future. Core deposits,

which exclude all certificates of deposit, increased to $350

million at September 30, 2008, an increase of $3.3 million, or 1%

from June 30, 2008. A decrease compared to the prior year reflected

intentional reductions of higher cost deposits. Lending Gross loans

at September 30, amounted to $771 million, a decrease of $19.8

million or 2.5% compared to June 30, 2008. The composition of the

Company's loan portfolio is as follows: % of % of $ % of 9/30/08

Total 6/30/08 Total Incr/(Decr) 9/30/07 Total Commercial: Real

estate secured $457,440 59% $466,328 59% $(8,888) $482,242 57%

Construction & land development 218,018 28% 220,104 28% (2,086)

245,905 29% C & I 68,853 9% 77,729 9% (8,876) 87,425 11% Total

commercial 744,311 96% 764,161 96% (19,850) 815,572 97% Residential

real estate 5,722 1% 5,870 1% (148) 6,006 1% Consumer & other

21,019 3% 20,844 3% 175 20,196 2% Gross loans $771,052 100%

$790,875 100% $(19,823) $841,774 100% Asset Quality The Company's

asset quality ratios are highlighted below: Quarter Ended 9/30/08

6/30/08 9/30/07 Nonperforming assets/total assets 1.65% 1.84% 2.45%

Net loan charge-offs/average total loans 0.00% 1.73% 0.07% Loan

loss reserve/gross loans 0.88% 0.85% 1.04% Nonperforming loan

coverage 93% 215% 35% Nonperforming assets/capital and reserves 19%

20% 29% Non-performing assets at September 30, 2008 dropped to

$15.9 million, or 1.65% of total assets, a reduction from $17.4

million or 1.84% of total assets at June 30, 2008 and $25.5 million

or 2.45% of total assets a year ago. The continuing reductions in

the quarter reflected the sale of OREO properties. Core Deposits

Core deposits by type of account are as follows: 3rd Qtr 2008 % %

Cost of 9/30/08 6/30/08 Change 9/30/07 Change Funds Demand

non-interest- bearing $77,728 $77,404 0% $80,451 -3% 0.00% Demand

interest-bearing 32,432 30,167 8% 32,548 0% 0.87% Money market and

savings 240,055 239,314 0% 246,311 -3% 2.69% Total core deposits

$350,215 $346,885 1% $359,310 -3% 1.96% Core deposits, which

exclude all certificates of deposit, increased to $350 million at

September 30, 2008, an increase of $3.3 million or 1% from June 30,

2008. A decrease compared to the prior year reflected intentional

reductions of higher cost deposits. Capital The Company's capital

ratios at September 30, 2008 were: Republic Regulatory Guidelines

First "Well Capitalized" Leverage Ratio 11.02% 5.00% Tier I 12.28%

6.00% Total Capital 13.09% 10.00% Three months ended Nine months

ended 9/30/08 6/30/08 9/30/07 9/30/08 9/30/07 Return on equity

7.76% 6.12% 6.29% -0.09% 9.21% Total shareholders' equity stood at

$79.3 million with a book value per share of $7.47 at September 30,

2008, based on common shares of approximately 10.6 million.

Republic First Bank (PA) is a full-service, state-chartered

commercial bank, whose deposits are insured by the Federal Deposit

Insurance Corporation (FDIC). The Bank provides diversified

financial products through its twelve offices located in Abington,

Ardmore, Bala Cynwyd, Plymouth Meeting, Media and Philadelphia,

Pennsylvania and Voorhees, New Jersey. The Company may from time to

time make written or oral "forward-looking statements", including

statements contained in this release and in the Company's filings

with the Securities and Exchange Commission. These forward- looking

statements include statements with respect to the Company's

beliefs, plans, objectives, goals, expectations, anticipations,

estimates, and intentions that are subject to significant risks and

uncertainties and are subject to change based on various factors,

many of which are beyond the Company's control. The words "may",

"could", "should", "would", "believe", "anticipate", "estimate",

"expect", "intend", "plan", and similar expressions are intended to

identify forward-looking statements. All such statements are made

in good faith by the Company pursuant to the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

The Company does not undertake to update any forward-looking

statement, whether written or oral, that may be made from time to

time by or on behalf of the Company. Republic First Bancorp, Inc.

Selected Consolidated Financial Data (Unaudited) At or for the

Three months ended % % (in thousands, except per 9/30/08 6/30/08

Change 9/30/07 Change share amounts) Income Statement Data: Net

interest income $7,618 $7,004 9% $7,804 -2% Provision for loan

losses 43 43 0% 1,282 -97% Noninterest income 672 836 -20% 760 -12%

Total revenues 8,290 7,840 6% 8,564 -3% Noninterest operating

expenses 6,008 6,061 -1% 5,488 9% Net income 1,533 1,189 29% 1,236

24% Per Common Share Data: Net income: Basic $0.14 $0.11 27% $0.12

17% Net income: Diluted 0.14 0.11 27% 0.12 17% Book Value $7.47

$7.43 $7.59 Weighted average shares outstanding: Basic 10,581

10,445 10,345 Diluted 12,310 10,862 10,598 Balance Sheet Data:

Total assets $964,732 $947,589 2% Loans (net) 764,245 784,115 -3%

Allowance for loan losses 6,807 6,760 1% Investment securities

92,949 84,572 10% Total deposits 729,487 728,559 0% Core deposits*

350,215 346,885 1% Trust preferred 22,476 22,476 0% Stockholders'

equity 79,257 78,399 1% Capital: Stockholders' equity to total

assets 8.22% 8.27% Leverage ratio 11.02% 10.69% Risk based capital

ratios: Tier 1 12.28% 11.63% Total Capital 13.09% 12.41%

Performance Ratios: Cost of funds 2.77% 2.96% 4.42% Deposit cost of

funds 2.69% 2.98% 4.21% Net interest margin 3.48% 3.19% 3.33%

Return on average assets 0.65% 0.51% 0.50% Return on average total

stockholders' equity 7.76% 6.12% 6.29% Asset Quality Net

charge-offs to average loans outstanding 0.00% 1.73% Nonperforming

assets to total period-end assets 1.65% 1.84% Allowance for loan

losses to total period-end loans 0.88% 0.85% Allowance for loan

losses to nonperforming loans 93% 215% Nonperforming assets to

capital and reserves 19% 20% At or for the Nine months ended % (in

thousands, except per share 9/30/08 9/30/07 Change amounts) Income

Statement Data: Net interest income $21,844 $22,879 -5% Provision

for loan losses 5,898 1,425 314% Noninterest income 2,173 2,155 1%

Total revenues 24,017 25,034 -4% Noninterest operating expenses

18,517 15,766 17% Net income (56) 5,308 -101% Per Common Share

Data: Net income: Basic $(0.01) $0.51 -102% Net income: Diluted

(0.01) 0.50 -102% Weighted average shares outstanding: Basic 10,463

10,413 Diluted 11,230 10,698 Balance Sheet Data: Total assets

$964,732 $1,040,119 -7% Loans (net) 764,245 832,983 -8% Allowance

for loan losses 6,807 8,791 -23% Investment securities 92,949

91,291 2% Total deposits 729,487 769,889 -5% Core deposits* 350,215

359,310 -3% Trust preferred 22,476 11,341 98% Stockholders' equity

79,257 78,372 1% Capital: Stockholders' equity to total assets

8.22% 7.53% Leverage ratio 11.02% 9.16% Risk based capital ratios:

Tier 1 12.28% 9.90% Total Capital 13.09% 10.87% Performance Ratios:

Cost of funds 3.08% 4.42% Deposit cost of funds 3.05% 4.22% Net

interest margin 3.29% 3.31% Return on average assets -0.01% 0.73%

Return on average total stockholders' equity -0.09% 9.21% Asset

Quality Net charge-offs to average loans outstanding 1.27% 0.11%

Nonperforming assets to total period-end assets 1.65% 2.45%

Allowance for loan losses to total period-end loans 0.88% 1.04%

Allowance for loan losses to nonperforming loans 93% 35%

Nonperforming assets to capital and reserves 19% 29% * Core

deposits exclude certificates of deposit Republic First Bancorp,

Inc. Average Balances and Net Interest Income (unaudited) For the

For the three months ended three months ended September 30, 2008

June 30, 2008 Interest Interest Average Income/ Yield/ Average

Income/ Yield/ Balance Expense Rate Balance Expense Rate Federal

funds sold and other interest- earning assets $8,568 $45 2.09%

$10,618 $58 2.20% Securities 92,525 1,334 5.77% 82,392 1,167 5.67%

Loans receivable 775,642 12,208 6.26% 797,233 12,160 6.13% Total

interest-earning assets 876,735 13,587 6.17% 890,243 13,385 6.05%

Other assets 57,371 55,336 Total assets $934,106 $945,579

Interest-bearing liabilities: Demand-non interest bearing $71,990

$74,126 Demand interest-bearing 31,090 $68 0.87% 31,236 $69 0.89%

Money market & savings 240,554 1,625 2.69% 211,281 1,371 2.61%

Time deposits 381,820 3,216 3.35% 441,069 4,169 3.80% Total

deposits 725,454 4,909 2.69% 757,712 5,609 2.98% Total

interest-bearing deposits 653,464 4,909 2.99% 683,586 5,609 3.30%

Other borrowings 122,709 1,005 3.26% 101,186 715 2.84% Total

interest-bearing liabilities $776,173 $5,914 3.03% $784,772 $6,324

3.24% Total deposits and other borrowings 848,163 5,914 2.77%

858,898 6,324 2.96% Non interest-bearing liabilities 7,393 8,532

Shareholders' equity 78,550 78,149 Total liabilities and

shareholders' equity $934,106 $945,579 Net interest income $7,673

$7,061 Net interest spread 3.14% 2.81% Net interest margin 3.48%

3.19% For the For the three months ended nine months ended

September 30, 2007 September 30, 2008 Interest Interest Average

Income/ Yield/ Average Income/ Yield/ Balance Expense Rate Balance

Expense Rate Federal funds sold and other interest- earning assets

$10,817 $139 5.10% $10,478 $199 2.54% Securities 89,042 1,399 6.28%

87,506 3,814 5.81% Loans receivable 837,417 16,209 7.68% 796,782

37,821 6.34% Total interest-earning assets 937,276 17,747 7.51%

894,766 41,834 6.25% Other assets 40,513 51,915 Total assets

$977,789 $946,681 Interest-bearing liabilities: Demand-non interest

bearing $80,646 $76,487 Demand interest-bearing 35,009 $109 1.24%

34,760 $283 1.09% Money market & savings 249,450 2,816 4.48%

219,877 4,663 2.83% Time deposits 358,192 4,750 5.26% 402,235

11,825 3.93% Total deposits 723,297 7,675 4.21% 733,359 16,771

3.05% Total interest-bearing deposits 642,651 7,675 4.74% 656,872

16,771 3.41% Other borrowings 162,268 2,198 5.37% 125,140 3,046

3.25% Total interest-bearing liabilities $804,919 $9,873 4.87%

$782,012 $19,817 3.38% Total deposits and other borrowings 885,565

9,873 4.42% 858,499 19,817 3.08% Non interest-bearing liabilities

14,266 8,955 Shareholders' equity 77,958 79,227 Total liabilities

and shareholders' equity $977,789 $946,681 Net interest income

$7,874 $22,017 Net interest spread 2.64% 2.87% Net interest margin

3.33% 3.29% For the nine months ended September 30, 2007 Interest

Average Income/ Yield/ Balance Expense Rate Federal funds sold and

other interest- earning assets $14,424 $543 5.03% Securities 98,571

4,436 6.00% Loans receivable 819,243 47,166 7.70% Total

interest-earning assets 932,238 52,145 7.48% Other assets 39,029

Total assets $971,267 Interest-bearing liabilities: Demand-non

interest bearing $78,502 Demand interest-bearing 39,766 $327 1.10%

Money market & savings 275,249 9,370 4.55% Time deposits

347,292 13,671 5.26% Total deposits 740,809 23,368 4.22% Total

interest-bearing deposits 662,307 23,368 4.72% Other borrowings

139,188 5,694 5.47% Total interest-bearing liabilities $801,495

$29,062 4.85% Total deposits and other borrowings 879,997 29,062

4.42% Non interest-bearing liabilities 14,184 Shareholders' equity

77,086 Total liabilities and shareholders' equity $971,267 Net

interest income $23,083 Net interest spread 2.63% Net interest

margin 3.31% The above tables are presented on a tax equivalent

basis. Republic First Bancorp, Inc. Summary of Allowance for Loan

Losses and Other Related Data (unaudited) Year Three months ended

ended Nine months ended (dollar amounts in thousands) 9/30/08

6/30/08 9/30/07 12/31/07 9/30/08 9/30/07 Balance at beginning of

period $6,760 $10,156 $7,661 $8,058 $8,508 $8,058 Provisions

charged to operating expense 43 43 1,282 1,590 5,898 1,425 6,803

10,199 8,943 9,648 14,406 9,483 Recoveries on loans charged-off:

Commercial 2 - - 81 119 81 Tax refund loans 8 - - 283 77 256

Consumer - - - 2 2 1 Total recoveries 10 - - 366 198 338 Loans

charged-off: Commercial - (3,434) (152) (1,503) (7,778) (1,028) Tax

refund loans - - - - - - Consumer (6) (5) - (3) (19) (2) Total

charged-off (6) (3,439) (152) (1,506) (7,797) (1,030) Net

charge-offs 4 (3,439) (152) (1,140) (7,599) (692) Balance at end of

period $6,807 $6,760 $8,791 $8,508 $6,807 $8,791 Net charge-offs as

a percentage of average loans outstanding 0.00% 1.73% 0.07% 0.14%

1.27% 0.11% Allowance for loan losses as a percentage of period-end

loans 0.88% 0.85% 1.04% 1.04% 0.88% 1.04% Republic First Bancorp,

Inc. Summary of Non-Performing Loans and Assets (unaudited) Sept.

30, June 30, March 31, Dec. 31, Sept. 30, 2008 2008 2008 2007 2007

Nonaccrual loans: Commercial real estate $6,369 $2,366 $2,427

$14,757 $13,986 Construction - - - 6,747 10,902 Consumer and other

918 780 640 776 547 Total nonaccrual loans 7,287 3,146 3,067 22,280

25,435 Loans past due 90 days or more and still accruing - - - - -

Renegotiated loans - - - - - Total nonperforming loans 7,287 3,146

3,067 22,280 25,435 Other real estate owned 8,580 14,245 16,378

3,681 42 Total nonperforming assets $15,867 $17,391 $19,445 $25,961

$25,477 Nonperforming loans to total loans 0.95% 0.40% 0.38% 2.71%

3.02% Nonperforming assets to total assets 1.64% 1.84% 1.95% 2.55%

2.45% Nonperforming loan coverage 93% 215% 331% 38% 35% Allowance

for loan losses as a percentage of total period-end loans 0.88%

0.85% 1.27% 1.04% 1.04% Nonperforming assets/capital plus allowance

for loan losses 19% 20% 22% 29% 29% DATASOURCE: Republic First

Bancorp, Inc. CONTACT: Paul Frenkiel, CFO of Republic First

Bancorp, Inc., +1-215-735-4422, ext. 5255

Copyright

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

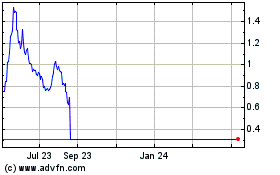

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024