Definitive Materials Filed by Investment Companies. (497)

June 05 2013 - 11:16AM

Edgar (US Regulatory)

Supplement to

Calvert Tax-Free Reserves Prospectus

dated April 30, 2013

Summary Prospectus for

Calvert Tax-Free Reserves Money Market Portfolio

dated April 30, 2013

Calvert Income Funds Prospectus

Class A, B, C, O and Y

dated January 31, 2013

Summary Prospectus for

Calvert Money Market Portfolio

dated January 31, 2013

Calvert First Government Money Market Fund Prospectus

Class O, B and C

dated April 30, 2013

Summary Prospectus for

Calvert First Government Money Market Fund

dated April 30, 2013

Calvert Income Funds Prospectus

Class I (Institutional)

dated January 31, 2013

Summary Prospectus for

Calvert Cash Reserves Institutional Prime Fund

dated January 31, 2013

Date of Supplement: June 5, 2013

The Board of Directors (the

“Board”) for (i) Calvert Tax-Free

Reserves Money Market Portfolio (“CTFR Portfolio”), a series of Calvert

Tax-Free Reserves, (ii) Calvert Money Market Portfolio (“CSIF Portfolio”), a

series of Calvert Social Investment Fund, (iii) Calvert First

Government Money Market Fund (“First Government Fund”), a series of First

Variable Rate Fund for Government Income, and (iv) Calvert Cash Reserves

Institutional Prime Fund (“CCR Prime Fund”, and together with CTFR Portfolio,

CSIF Portfolio and First Government Fund, the “Merging Portfolios” and

each a “Merging Portfolio”), a series of Calvert Cash Reserves, has approved the reorganization of each Merging

Portfolio into Calvert Ultra-Short Income Fund, a series of The Calvert Fund

(each,

a “Reorganization”) and has recommended approval of each Reorganization by the shareholders of the applicable Merging Portfolio. In August 2013, a Prospectus/Proxy Statement will be mailed to the record date shareholders of the Merging Portfolios that will contain additional information about each Reorganization and voting instructions. If the shareholders of a Merging Portfolio approve the related Reorganization, that Merging Portfolio will be merged into Class A shares of Calvert Ultra-Short Income Fund on or prior to December 31, 2013. Each Reorganization is an independent transaction that may be consummated even if the shareholders of another Merging Portfolio do not approve the related Reorganization.

If you remain invested in shares of a Merging Portfolio at the time the related Reorganization is consummated, your Merging Portfolio shares will be replaced by Class A shares of Calvert Ultra-Short Income Fund and thereafter the value of your Account will depend on the performance of the Calvert Ultra-Short Income Fund’s Class A shares, rather than that of the applicable Merging Portfolio.

Calvert Ultra-Short Income Fund is not a money market fund and does not seek to maintain a per share net asset value of $1.00. Although Calvert Ultra-Short Income Fund invests in short-term securities and typically maintains a duration of less than one year, the value of Calvert Ultra-Short Income Fund’s Class A shares will fluctuate based on the value of the investments that it holds.

as a result, investment in the calvert ultra-short income fund entails risk, including possible loss of principal invested.

In connection with its approval of the Reorganizations, the Board also closed the Merging Portfolios to new investors. Calvert Investment Distributors, Inc. (“CID”) will not accept applications for new accounts that are held directly with it, and will work with its distribution partners to avoid the acceptance of applications for new accounts that are held by them on a fully disclosed basis or through an omnibus account.

Effective as of August 31, 2013, the Board also approved the termination of the checkwriting service that is currently available to Merging Portfolio shareholders. After August 31, 2013, checkwriting will not be a service that is offered by any Calvert Fund and any checks that are written on a Merging Portfolio will be returned to the applicable shareholder unpaid. Accordingly, Merging Portfolio shareholders who require this service should begin the process of transitioning to an account at another financial institution that offers checkwriting services. All statements in any Merging Portfolio prospectus or summary prospectus relating to the checkwriting service are hereby deleted effective as of August 31, 2013.

CID will no longer accept orders for new checks. Merging Portfolio shareholders who do not have an adequate supply of checks may process a redemption of shares by telephone, wire or ACH as described in more detail in the applicable Merging Portfolio prospectus.

Additional Information and Where to Find It

In connection with the proposed reorganizations, The Calvert Fund will file with the Securities and Exchange Commission (“SEC”), and will furnish to the shareholders of the applicable Merging Portfolio, a prospectus/proxy statement and other relevant documents. These materials do not constitute a solicitation of any vote or approval.

Shareholders of each Merging Portfolio are urged to read the prospectus/proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the proposed reorganizations, or incorporated by reference in the prospectus/proxy statement, because they will contain important information about the proposed reorganizations.

Investors will be able to obtain a free copy of documents filed with the SEC at the SEC’s website at

http://www.sec.gov

. In addition, investors may obtain a free copy of the SEC filings made by The Calvert Fund and each registered investment company of which a Merging Portfolio is a series (each, a “Merging RIC”) by directing a request to: Calvert Investments, Inc., Attention: Client Services, 4550 Montgomery Avenue, Suite 1125N, Bethesda, Maryland 20814; (800) 368-2745. With respect to each Reorganization, The Calvert Fund, each Merging RIC and their trustees and officers may be deemed to be “participants” in the solicitation of proxies from shareholders of the applicable Merging Portfolio in favor of that Reorganization. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the shareholders of each Merging Portfolio is set forth in the Statement of Additional Information dated January 31, 2013 or April 30, 2013, as applicable, of each Merging Portfolio, and in the Statement of Additional Information of Calvert Ultra-Short Income Fund dated January 31, 2013. These documents have been filed with the SEC and are available at

www. calvert.com

.

3

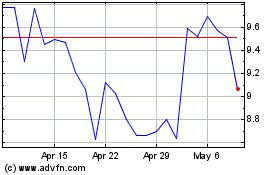

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Jul 2024 to Aug 2024

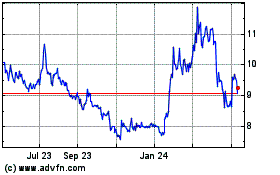

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Aug 2023 to Aug 2024