Current Report Filing (8-k)

November 13 2020 - 4:18PM

Edgar (US Regulatory)

QUIDEL CORP /DE/0000353569false--12-3100003535692020-11-092020-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2020

|

|

|

|

|

|

|

|

|

QUIDEL CORPORATION

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

0-10961

|

94-2573850

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

9975 Summers Ridge Road, San Diego, California 92121

(Address of principal executive offices, including zip code)

(858) 552-1100

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.12a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value

|

QDEL

|

The Nasdaq Stock Market

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 1.01 Entry Into A Material Definitive Agreement.

On November 9, 2020, the Board of Directors (the “Board”) of Quidel Corporation (the “Company”) approved an amended form of indemnification agreement (the “Indemnification Agreement”) to be entered into between the Company and individuals who may serve from time to time as directors or officers of the Company. The Indemnification Agreement supplements indemnification provisions contained in the Company’s Amended and Restated Bylaws, and supersedes the Company’s current indemnification agreements with its directors and officers.

Under the Indemnification Agreement, the Company agrees to indemnify directors and officers against liability arising out of the performance of their duties to the Company and to other entities where they serve at the request of the Company as a director, officer, employee, agent or fiduciary. The Indemnification Agreement provides that the Company will indemnify directors and officers to the fullest extent permitted by the Delaware General Corporation Law for amounts that directors and officers become legally obligated to pay in connection with Proceedings (as defined in the Indemnification Agreement), including reasonable attorneys’ fees, on the terms and conditions set forth in the Indemnification Agreement. The Indemnification Agreement also requires the advancement of defense expenses, on the terms and conditions set forth in the Indemnification Agreement. The Indemnification Agreement provides procedures for obtaining indemnification and advancement of expenses, and defines various terms relating to indemnification and advancement.

The foregoing description of the form of Indemnification Agreement is a general description only and is qualified in its entirety by reference to the form of Indemnification Agreement, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On November 9, 2020, the Board adopted Amended and Restated Bylaws of the Company (the “Bylaws”), which became effective immediately. The amendments are summarized below.

•The amendments update the notice procedures applicable to stockholder meetings to provide for electronic delivery of notice to stockholders, as permitted by Delaware law. (Section 2.4)

•The amendments provide for additional informational requirements for persons to be eligible to be a nominee for election or re-election as a director of the Company, including directors nominated for election to the Board by stockholders. The amendments also update the advance notice deadlines for stockholder nominations for directors. (Section 2.6)

•The amendments add a provision to require that whenever stockholders are required to deliver a document or information to the Company under Article II of the Bylaws, such document or information shall be in writing exclusively and delivered exclusively by hand or by certified or registered mail, return receipt requested. (Section 2.19)

•The amendments update the provision for Board action by written consent to provide that a director may provide that a consent to action be effective at a future time, no later than sixty days after such provision is made, and that any such consent may be revoked prior to becoming effective, as permitted by Delaware law. (Section 3.11)

•The amendments include an emergency bylaw that is applicable in an emergency condition as contemplated by Section 110 of the Delaware General Corporation Law. (Section 3.14)

•The amendments clarify the quorum and voting threshold required for the transaction of business by a committee of the Board. (Section 4.3)

•The amendments remove the provision addressing the order in which vice presidents would assume the duties of the President in the event of the President’s absence or disability. (Section 5.7)

•The amendments define “officer” for indemnification purposes as those appointed by the Board under Article V of the Bylaws, and clarifies that directors and officers (as defined in the Bylaws) are entitled to indemnification as a matter of right to the extent that such director or officer is successful on the merits or otherwise in defense of a proceeding, and that such indemnification shall not be subject to satisfaction of a standard of conduct, in accordance with Delaware law. (Article VI)

•The amendments provide that, unless the Company in writing selects or consents to the selection of an alternative forum, the federal district courts of the United States of America shall, to the fullest extent permitted by law, be the sole and exclusive forum for the resolution of any complaint asserting a cause of action under the Securities Act of 1933. (Article VII).

•Additional amendments make minor updating changes, clarifying or conforming changes, and immaterial language changes.

The foregoing description is qualified in its entirety by reference to the Bylaws, which are filed herewith as Exhibit 3.1 and are incorporated herein by reference.

Item 8.01 Other Events.

Amendment of Stock Ownership Guidelines

On November 9, 2020, the Board amended the Company’s Stock Ownership Guidelines relating to the retention and ownership of the Company’s common stock by each of its non-employee directors, the Chief Executive Officer, Section 16 officers, Senior Vice Presidents and Vice Presidents to, among other matters, increase the requirements relating to the ownership of the Company’s common stock to six times annual base salary for the Company’s Chief Executive Officer and to five times the annual cash retainer for Board service for non-employee directors. The requirements remain at two times annual base salary for the Company’s Section 16 officers and one times annual base salary for the Company’s non-Section 16 officer Senior Vice Presidents and Vice Presidents.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

3.1

|

|

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 13, 2020

|

|

|

|

|

|

|

|

|

|

|

|

QUIDEL CORPORATION

|

|

|

|

|

|

By:

|

/s/ Phillip S. Askim

|

|

|

Name:

|

Phillip S. Askim

|

|

|

Its:

|

Secretary

|

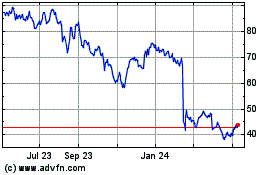

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From May 2024 to Jun 2024

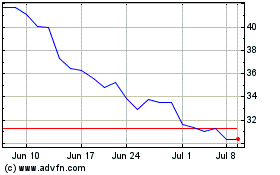

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Jun 2023 to Jun 2024