Provident Bank’s Community Partnership Program Donates Over $892,000 to Local Non-Profit Organizations Since 2006

April 30 2024 - 7:16PM

Provident Financial Holdings, Inc., NASDAQ GS: PROV, the holding

company for Provident Savings Bank, F.S.B. (“Provident Bank”) has

donated over $892,000 to local non-profits with their Community

Partnership Program (“Program”) since the Program’s inception in

2006. For the year ending 2023, Provident Bank donated more than

$49,000 to local non-profit organizations such as service groups,

parent teacher associations, homeowner’s associations, booster

clubs, foundations, church groups and societies, among others in

Riverside and San Bernardino Counties.

“The Bank realizes the importance of giving bank

to local, non-profit organizations that improve the quality of life

in the communities we serve. By empowering our customers to help

direct the Bank’s charitable campaigns, we assist in fulfilling the

goals of these admirable organizations,” stated Gwen Wertz, Senior

Vice President of Retail Banking.

Provident Bank’s Community Partnership Program

allows participating non-profit organizations to receive annual

donations by simply linking their unique ID number to their members

who are customers of Provident Bank. Organizations can earn more as

more of their members link their accounts to their unique ID. Of

course, some restrictions apply and interested groups are

encouraged to contact Provident Bank for more information about the

Program. You can reach Provident Bank at (800) 745-2217 to ask

about the Community Partnership Program or by visiting

www.myprovident.com.

With approximately $1.3 billion in total assets,

Provident Bank is the largest independent community bank

headquartered in Riverside County, California, and has been serving

the financial needs of its customers since 1956.

Safe-Harbor Statement

Certain matters in this News Release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements may relate to, among others,

expectations of the business environment in which the Company

operates, projections of future performance, perceived

opportunities in the market, potential future credit experience,

and statements regarding the Company’s mission and vision. These

forward-looking statements are based upon current management

expectations, and may, therefore, involve risks and uncertainties.

The Company’s actual results, performance, or achievements may

differ materially from those suggested, expressed, or implied by

forward-looking statements as a result of a wide range of factors

including, but not limited to, the general business environment,

interest rates, the California real estate market, competitive

conditions between banks and non-bank financial services providers,

regulatory changes, and other risks detailed in the Company’s

reports filed with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

June 30, 2023.

Contacts:

Donavon P. TernesPresident and Chief Executive Officer

Tam B. NguyenSenior Vice President andChief Financial

Officer

(951) 686-6060

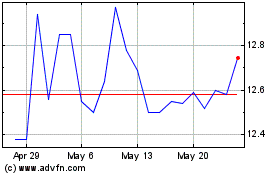

Provident Financial (NASDAQ:PROV)

Historical Stock Chart

From Oct 2024 to Nov 2024

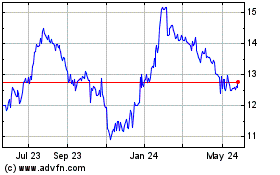

Provident Financial (NASDAQ:PROV)

Historical Stock Chart

From Nov 2023 to Nov 2024