0001357874false--12-31NASDAQ00013578742024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 13, 2024 |

Precision BioSciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38841 |

20-4206017 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

302 East Pettigrew St. Suite A-100 |

|

Durham, North Carolina |

|

27701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 919 314-5512 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.000005 per share |

|

DTIL |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 13, 2024, Precision BioSciences, Inc. (the “Company”) effected a 1-for-30 reverse stock split of its common stock (the “Reverse Stock Split”). As previously disclosed, at its special meeting of stockholders held on January 18, 2024 (the “Special Meeting”), the stockholders of the Company approved a proposal to authorize the Company’s Board of Directors (the “Board”), in its discretion following the Special Meeting, to amend the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split of all of the outstanding shares of the Company’s common stock, par value $0.000005 per share, in a ratio within the range from each whole number between and including ten (10) and thirty (30) (the “Reverse Split Ratios”). On February 6, 2024, following the Special Meeting, the Board approved the Reverse Stock Split at a ratio of 1-for-30. On February 13, 2024, the Company filed with the Secretary of State of the State of Delaware a certificate of amendment (the “Certificate of Amendment”) to amend the Certificate of Incorporation to effect the Reverse Stock Split. The Reverse Stock Split will become effective at 5:00 p.m., Eastern Time, on February 13, 2024.

As a result of the Reverse Stock Split, every 30 shares of the Company’s common stock issued or outstanding were automatically reclassified into one new share of common stock, subject to the treatment of fractional shares as described below, without any action on the part of the holders. Proportionate adjustments will be made to the exercise prices and the number of shares underlying the Company’s outstanding equity awards, as applicable, as well as to the number of shares issuable under the Company’s equity incentive plans and certain existing agreements. The common stock issued pursuant to the Reverse Stock Split remain fully paid and non-assessable. The Reverse Stock Split did not affect the number of authorized shares of common stock or the par value of the common stock.

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the Reverse Stock Split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing sales price per share of the common stock (as adjusted to give effect to the Reverse Stock Split) on The Nasdaq Capital Market on February 13, 2024, the last trading day immediately preceding the effective time of the Reverse Stock Split.

Trading of the Company’s common stock on The Nasdaq Capital Market is expected to commence on a split-adjusted basis when the market opens on February 14, 2024, under the existing trading symbol “DTIL.” The new CUSIP number for the Company’s common stock following the Reverse Stock Split is 74019P 207.

The foregoing description of the Certificate of Amendment is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the expected timing of the reverse stock split, the impact of the reverse stock split on the Company’s share price, and the Company’s ability to meet the minimum per share bid price requirement for continued listing on The Nasdaq Capital Market. In some cases, you can identify forward-looking statements by terms such as “aim,” “anticipate,” “approach,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “goal,” “intend,” “look,” “may,” “mission,” “plan,” “possible,” “potential,” “predict,” “project,” “pursue,” “should,” “target,” “will,” “would,” or the negative thereof and similar words and expressions. Forward-looking statements are based on management’s current expectations, beliefs and assumptions and on information currently available to us. Such statements are neither promises nor guarantees, and involve a number of known and unknown risks, uncertainties and assumptions, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, without limitation, the risks referred to under the section “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, as any such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website under SEC Filings at investor.precisionbiosciences.com. All forward-looking statements speak only as of the date of this Current Report on Form 8-K and, except as required by applicable law,

we have no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PRECISION BIOSCIENCES, INC. |

|

|

|

|

Date: |

February 13, 2024 |

By: |

/s/Dario Scimeca |

|

|

|

Dario Scimeca

General Counsel |

CERTIFICATE OF AMENDMENT

TO

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

PRECISION BIOSCIENCES, INC.

Precision BioSciences, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify as follows:

FIRST: That the Board of Directors of the Corporation duly adopted resolutions recommending and declaring advisable that the Amended and Restated Certificate of Incorporation of the Corporation be amended and that such amendments be submitted to the stockholders of the Corporation for their consideration, as follows:

RESOLVED, that the first sentence of Article FOURTH of the Amended and Restated Certificate of Incorporation be, and hereby is, amended and restated in its entirety to read as follows:

“That, effective at 5:00 p.m., Eastern Time, on the date this Certificate of Amendment to the Amended and Restated Certificate of Incorporation is filed with the Secretary of State of the State of Delaware (the “Effective Time”), a one-for-thirty reverse stock split of the Common Stock (as defined below) shall become effective, pursuant to which each thirty shares of Common Stock issued and held of record by each stockholder of the Corporation (including treasury shares) immediately prior to the Effective Time shall be reclassified and combined into one validly issued, fully paid and nonassessable share of Common Stock automatically and without any action by the holder thereof upon the Effective Time and shall represent one share of Common Stock from and after the Effective Time (such reclassification and combination of shares, the “Reverse Stock Split”). No fractional shares of Common Stock shall be issued as a result of the Reverse Stock Split and, in lieu thereof, (a) with respect to holders of one or more certificates, if any, which formerly represented shares of Common Stock that were issued and outstanding immediately prior to the Effective Time, upon surrender after the Effective Time of such certificate or certificates, any holder who would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split, following the Effective Time, shall be entitled to receive a cash payment (the “Fractional Share Payment”) equal to the fraction of which such holder would otherwise be entitled multiplied by the closing price per share of Common Stock as reported by The Nasdaq Stock Market LLC (as adjusted to give effect to the Reverse Stock Split) on the date of the Effective Time; provided that, whether or not fractional shares would be issuable as a result of the Reverse Stock Split shall be determined on the basis of (i) the total number of shares of Common Stock that were issued and outstanding immediately prior to the Effective Time formerly represented by certificates that the holder is at the time surrendering and (ii) the aggregate number of shares of Common Stock after the Effective Time into which the shares of Common Stock formerly represented by such certificates shall have been reclassified; and (b) with respect to holders of shares of Common Stock in book-entry form in the records of the Corporation’s transfer agent that were issued and outstanding immediately prior to the Effective Time, any holder who would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split (after aggregating all fractional shares), following the Effective Time, shall be entitled to receive the Fractional Share Payment automatically and without any action by the holder.

The total number of shares of all classes of stock which the Corporation shall have authority to issue is 210,000,000 shares, consisting of (a) 200,000,000 shares of Common Stock, $0.000005 par value per share (“Common Stock”), and (b) 10,000,000 shares of Preferred Stock, $0.0001 par value per share (“Preferred Stock”).”

SECOND: That, at a meeting of stockholders of the Corporation, the aforesaid amendment was duly adopted by the stockholders of the Corporation.

THIRD: That the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its General Counsel and Secretary on this 13th day of February 2024.

PRECISION BIOSCIENCES, INC.

By: /s/ Dario Scimeca

Name: Dario Scimeca

Title: General Counsel and Secretary

v3.24.0.1

Document And Entity Information

|

Feb. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 13, 2024

|

| Entity Registrant Name |

Precision BioSciences, Inc.

|

| Entity Central Index Key |

0001357874

|

| Current Fiscal Year End Date |

--12-31

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-38841

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

20-4206017

|

| Entity Address, Address Line One |

302 East Pettigrew St.

|

| Entity Address, Address Line Two |

Suite A-100

|

| Entity Address, City or Town |

Durham

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27701

|

| City Area Code |

919

|

| Local Phone Number |

314-5512

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.000005 per share

|

| Trading Symbol |

DTIL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

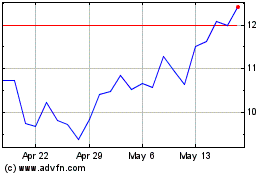

Precision BioSciences (NASDAQ:DTIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

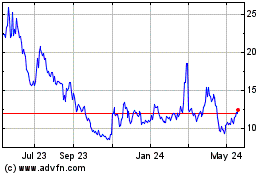

Precision BioSciences (NASDAQ:DTIL)

Historical Stock Chart

From Apr 2023 to Apr 2024