Photronics, Inc. (Nasdaq:PLAB), a worldwide leader in supplying

innovative imaging technology solutions for the global electronics

industry, today reported fiscal 2009 fourth quarter results for the

period ended November 1, 2009.

Sales for the fourth quarter were $94.7 million, down 8.3%

compared to $103.3 million for the fourth quarter of fiscal year

2008. Sales of semiconductor photomasks accounted for $73.8

million, or 77.9% of revenues during the fourth quarter of fiscal

2009, and sales of flat panel display (FPD) photomasks accounted

for $20.9 million, or 22.1% of revenues. GAAP net income for the

fourth quarter of fiscal 2009 was $1.2 million, or $0.11 loss per

diluted share. The diluted loss per share reflects the assumed

conversion of warrants to acquire 1.4 million shares originally

issued in connection with the Company's May 2009 credit facility

amendment as well as the associated assumed reversal of $6.5

million in mark-to-market gains which were recorded in other

income. This compares to net income of $0.2 million, or $0.01

earnings per diluted share, for the fourth quarter of fiscal

2008.

Sales for the 2009 fiscal year were $361.4 million, down 14.5%

from $422.5 million for fiscal 2008. Sales of semiconductor

photomasks accounted for $272.9 million, or 75.5% of revenues

during the 2009 fiscal year, and sales of FPD photomasks accounted

for $88.5 million, or 24.5% of revenues. GAAP net loss for the 2009

fiscal year amounted to $41.9 million, or $0.97 loss per diluted

share, as compared to 2008 fiscal net loss of $210.8 million, or

$5.06 loss per diluted share.

Pro forma net loss for the fourth quarter of fiscal year 2009

was $3.2 million, or $0.07 loss per diluted share, as compared to

pro forma net income of $0.6 million or $0.01 earnings per diluted

share for the fourth quarter of fiscal year 2008. Pro forma net

loss for the 2009 fiscal year was $26.2 million, or $0.63 loss per

diluted share, as compared to pro forma net loss for the 2008

fiscal year of $11.2 million or $0.27 loss per diluted share. The

section below entitled “Non-GAAP Financial Measures” provides a

definition and information about the use of pro forma financial

measures in this press release and the attached financial

supplement reconciles pro forma financial information with

Photronics, Inc.’ financial results under GAAP.

Constantine (“Deno”) Macricostas, Photronics’ chairman and chief

executive officer commented, “During the fourth quarter we

successfully recapitalized our balance sheet and paid down $65

million in debt. We also benefited from continued traction at the

nanoFab where we gained additional market share with new qualified

and volume production customers, while sequentially improving its

operating cash flow. For the year Photronics significantly reduced

fixed operating costs and realigned its global manufacturing

network to better match customer demand. We enter 2010 in a solid

position to capitalize on market improvement,” concluded

Macricostas.

Non-GAAP Financial Measures

Pro forma net income (loss) and pro forma earnings (loss) per

share are “non-GAAP financial measures,” as such term is defined by

the Securities and Exchange Commission, and may differ from

non-GAAP financial measures used by other companies. Photronics,

Inc. believes that pro forma net income (loss) and pro forma

earnings (loss) per share that exclude certain non-cash or

non-recurring income or expense items are useful for analysts and

investors to evaluate Photronics, Inc.’ future on-going performance

because they enable a more meaningful comparison of Photronics,

Inc.’ projected earnings and performance with its historical

results from prior periods. These pro forma metrics, in particular

pro forma net income (loss) and pro forma earnings (loss) per

share, are not intended to represent funds available for

Photronics, Inc.’ discretionary use and are not intended to

represent or be used as a substitute for operating income (loss),

net income (loss) or cash flows from operations data as measured

under GAAP. The items excluded from these pro forma metrics, but

included in the calculation of their closest GAAP equivalent, are

significant components of consolidated statements of operations and

must be considered in performing a comprehensive assessment of

overall financial performance. Pro forma financial information is

adjusted for the following items:

- Consolidation and restructuring

charges are excluded because they are not a part of ongoing

operations

- Gain on sale of building is

excluded because it is not a part of ongoing operations

- Deferred financing fees

write-off net of interest savings is excluded because it is not a

part of ongoing operations and was not anticipated when

establishing forecast guidance for Q4-2009

- Impact of warrant mark-to-market

gains (losses) are excluded because it does not affect cash

earnings

- Primarily goodwill and

long-lived asset impairment charges are excluded because they do

not affect cash earnings and are not a part of ongoing

operations

The presentation of this financial information should not be

considered in isolation or as a substitute for the financial

information prepared and presented in accordance with generally

accepted accounting principles in the United States. The attached

financial supplement reconciles pro forma financial information

with Photronics, Inc.' financial results under GAAP.

A conference call with investors and the media to discuss these

results is scheduled for 8:30 a.m. Eastern time on Wednesday,

December 9, 2009. The live dial-in number is 913-312-0713. The call

can also be accessed by logging onto Photronics’ web site at

www.photronics.com.

Photronics is a leading worldwide manufacturer of photomasks.

Photomasks are high precision quartz plates that contain

microscopic images of electronic circuits. A key element in the

manufacture of semiconductors and flat panel displays, photomasks

are used to transfer circuit patterns onto semiconductor wafers and

flat panel substrates during the fabrication of integrated

circuits, a variety of flat panel displays and, to a lesser extent,

other types of electrical and optical components. They are produced

in accordance with product designs provided by customers at

strategically located manufacturing facilities in Asia, Europe, and

North America. Additional information on the Company can be

accessed at www.photronics.com.

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for forward-looking statements made by or on behalf

of Photronics, Inc. and its subsidiaries (the Company). The

forward-looking statements contained in this press release and

other parts of Photronics’ web site involve risks and uncertainties

that may affect the Company’s operations, markets, products,

services, prices, and other factors as discussed in filings with

the U. S. Securities and Exchange Commission (SEC). These risks and

uncertainties include, but are not limited to, economic,

competitive, legal, governmental, and technological factors.

Accordingly, there is no assurance that the Company’s expectations

will be realized. The Company assumes no obligation to provide

revisions to any forward-looking statements.

20-2009

PLAB - E

PHOTRONICS, INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations

(in thousands, except per share amounts)

Three Months Ended

Year Ended November 1, November 2, November

1, November 2, 2009 2008 2009

2008 Net sales $ 94,677 $ 103,306 $ 361,353 $ 422,548

Costs and expenses: Cost of sales (77,660 ) (85,354 )

(304,282 ) (349,841 ) Selling, general and administrative

(10,166 ) (11,547 ) (41,162 ) (55,167 ) Research and

development (3,768 ) (4,327 ) (15,423 ) (17,475 )

Consolidation, restructuring and related charges (811 ) (510 )

(13,557 ) (510 ) Impairment of goodwill and long-lived

assets - - (1,458 ) (205,408 ) Gain on sale of facility

2,034 - 2,034 -

Operating income (loss) 4,306 1,568 (12,495 )

(205,853 ) Other income (expense), net (1,765 )

24 (24,609 ) (6,316 ) Income

(loss) before income taxes and minority interest 2,541 1,592

(37,104 ) (212,169 ) Income tax (provision) benefit

(1,398 ) (1,438 ) (4,323 ) 2,778

Income (loss) before minority interest 1,143 154 (41,427 ) (209,391

) Minority interest 98 81

(483 ) (1,374 ) Net income (loss) $ 1,241 $

235 $ (41,910 ) $ (210,765 ) Earnings (loss) per

share: Basic

$ 0.03 $

0.01 $ (0.97

) $ (5.06 )

Diluted

$ (0.11 )

$ 0.01 $

(0.97 ) $ (5.06

)

Weighted average number of common

shares outstanding:

Basic

47,522 41,703

43,210 41,658

Diluted

48,907

41,996 43,210

41,658

PHOTRONICS, INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(in thousands)

November 1, November 2, 2009 2008

Assets

Current assets:

Cash, cash equivalents and

short-term investments

of $148 in 2009 and $1,343 in

2008

$ 88,687 $ 85,106 Accounts receivable 66,920 68,095 Inventories

14,826 17,548 Other current assets 9,564 11,748

Total current assets 179,997 182,497 Property, plant

and equipment, net 347,889 436,528 Investment in joint venture

60,945 65,737 Other intangibles, net 55,054 62,386 Other assets

19,771 10,859 $ 663,656 $ 758,007

Liabilities and Shareholders'

Equity

Current liabilities: Current portion of long-term borrowings

$ 10,301 $ 20,630 Accounts payable and accrued liabilities

80,154 95,448 Total current liabilities 90,455

116,078 Long-term borrowings 112,137 202,979 Deferred income

taxes and other liabilities 11,368 6,552 Minority interest 49,941

49,616 Shareholders' equity 399,755 382,782

$ 663,656 $ 758,007

PHOTRONICS, INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of Cash

Flows

(in thousands)

Year Ended

November 1, November 2, 2009 2008

Cash flows from operating activities: Net loss $

(41,910 ) $ (210,765 )

Adjustments to reconcile net loss

to net cash provided by operating activities:

Depreciation and amortization 90,474 103,932 Gain on sale of

facility (2,034 ) - Minority interest in income of consolidated

subsidiaries 483 1,374 Consolidation, restructuring and related

charges - non-cash 10,514 510 Impairment of goodwill and long-lived

assets 1,458 205,408 Changes in assets and liabilities and other

9,163 (8,379 ) Net cash provided by

operating activities 68,148 92,080

Cash flows from investing activities: Purchases of property,

plant and equipment (34,995 ) (105,125 ) Distribution from joint

venture 5,000 5,000 Proceeds from sale of facility 4,321 - Proceeds

from sales of investments 1,252 3,815 Investment in joint venture -

(2,598 ) Other (256 ) (327 ) Net cash used in

investing activities (24,678 ) (99,235 ) Cash

flows from financing activities: Repayments of long-term borrowings

(161,841 ) (183,509 ) Proceeds from long-term borrowings 28,112

139,640 Net proceeds from convertible debt and common stock

offerings 97,961 - Deferred financing costs and other (4,734

) (3,790 ) Net cash used in financing activities

(40,502 ) (47,659 ) Effect of exchange rate

changes on cash 1,808 (7,472 ) Net

increase (decrease) in cash and cash equivalents 4,776 (62,286 )

Cash and cash equivalents, beginning of period 83,763

146,049 Cash and cash equivalents, end

of period $ 88,539 $ 83,763 Supplemental

disclosure of cash flow information: Change in accrual for

purchases of property, plant and equipment $ (13,551 ) $ (46,769 )

Capital lease obligation for

purchases of property, plant and equipment

$ (28,244 ) $ 61,662 Issuances of common stock warrants $ 5,320 $ -

PHOTRONICS, INC. AND

SUBSIDIARIES

Reconciliation of GAAP to Pro Forma Financial

Information

(in thousands, except per share data) (Unaudited)

Three

Months Ended Year Ended November 1,

November 2, November 1, November 2,

2009 2008 2009 2008

Reconciliation of GAAP to Pro Forma Net

Loss

GAAP net income (loss) $ 1,241 $ 235 $ (41,910 ) $ (210,765

)

(a) Consolidation and restructuring charges, net of

tax 626 367 12,913 367

(b) Gain on sale of building,

net of tax (1,474 ) - (1,474 ) -

(c) Deferred

financing fees net of interest savings, net of tax 2,942 - 2,942 -

(d) Warrant mark-to-market (gains)/charges, net of

tax (6,544 ) - 304 -

(e) Primarily goodwill and

long-lived assets impairment, net of tax - - 1,050 199,177

Pro forma net income (loss) $ (3,209 ) $ 602 $

(26,175 ) $ (11,221 )

Three Months Ended Year

Ended November 1, November 2, November

1, November 2, 2009 2008 2009

2008 Reconciliation of GAAP Pro Forma Net

Income/Loss

Applicable to Common

Shareholders

GAAP weighted average number of diluted shares outstanding

48,907 41,996 43,210 41,658

(f) Adjustment to exclude

equivalent shares issued September 16, 2009

(5,603 ) - (1,401 ) - Pro

forma weighted average number of diluted shares outstanding

43,304 41,996 41,809 41,658

Net income (loss) per diluted share GAAP $

(0.11 ) $ 0.01 $ (0.97 ) $ (5.06 ) Pro forma $ (0.07 ) $

0.01 $ (0.63 ) $ (0.27 )

(a)

Includes charges related to

announced restructurings in China and United Kingdom.

(b)

Represents net gain recognized on

sale of Manchester, United Kingdom facility.

(c)

Represents write-off of deferred

financing fees of $3.7 million recorded in interest expense as a

result of reduced debt offset by $0.8 million of reduced interest

expense resulting from the $98 million debt repayment with the

proceeds of the common stock and senior unsecured debt

issuance.

(d)

Represents market value impact of

outstanding warrants and the clawback of 1.2 million warrants ($6.0

million) both of which are recorded in other income.

(e)

Represents goodwill and long-lived

assets impairment charge, net of tax

(f)

Adjustment to reflect the excluded

impact on weighted average shares outstanding during quarter and

year of the equivalent shares issued on September 16, 2009.

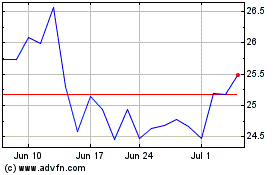

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

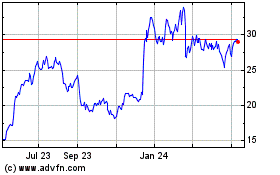

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From Jul 2023 to Jul 2024