false

--12-31

0001624326

0001624326

2023-12-05

2023-12-05

0001624326

PAVM:CommonStockParValue0.001PerShareMember

2023-12-05

2023-12-05

0001624326

PAVM:SeriesZWarrantsToPurchaseCommonStockMember

2023-12-05

2023-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December

5, 2023

| PAVMED

INC. |

| (Exact

Name of Registrant as Specified in Charter) |

| Delaware |

|

001-37685 |

|

47-1214177 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 360

Madison Avenue, 25th

Floor |

|

10017 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (917) 813-1828

| N/A |

| (Former

Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, Par Value $0.001 Per Share |

|

PAVM |

|

The

Nasdaq Stock Market LLC |

| Series

Z Warrants to Purchase Common Stock |

|

PAVMZ |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

3.03. | Material

Modification to Rights of Security Holders. |

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K (this “Current

Report”) is incorporated by reference herein.

| Item

5.03. | Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

The

board of directors (the “Board”) of PAVmed Inc., a Delaware corporation (the “Company”), has approved

a reverse stock split of the Company’s issued and outstanding shares of common stock, par value $0.001 per share (“Common

Stock”), at a ratio of 1-for-15 (the “Reverse Split”). The Reverse Split will become effective on Thursday,

December 7, 2023 at 12:01 a.m. Eastern Time (the “Effective Time”).

As

previously disclosed, at a special meeting of the Company’s stockholders held on March 31, 2023, the Company’s stockholders

approved the Reverse Split, at a specific ratio, within a fixed range, to be determined by the Board in its sole discretion.

Reason

for the Reverse Split

The

Company is effecting the Reverse Split in order to regain compliance with the continued listing requirements for the Capital Market of

The Nasdaq Stock Market LLC (“Nasdaq”).

As

previously disclosed, on December 29, 2022, the Company received a notification letter from the Nasdaq Listing Qualifications Department

stating that, for the prior 30 consecutive business days (through December 28, 2022), the closing bid price of the Company’s common

stock had been below the minimum of $1 per share required for continued listing on the Nasdaq Capital Market under Nasdaq Listing Rule

5550(a)(2). The initial notification letter stated that the Company would be afforded 180 calendar days (until June 27, 2023) to regain

compliance, and that the Company could be eligible for additional time. Although the Company did not regain compliance within the initial

180 calendar day period, Nasdaq determined that the Company was eligible for an additional 180 calendar day period to regain compliance

(until December 26, 2023).

By

effecting the Reverse Split, the Company expects that the closing bid price of the Common Stock will increase above $1 per share. In order to regain compliance with Nasdaq Listing Rule 5550(a)(2), the closing bid price of the Company’s common

stock must remain above $1 per share for a minimum of ten consecutive business days.

Although no assurances can be provided, the Company further believes that Reverse Split will enable the Company to maintain its

Nasdaq listing.

Effects

of the Reverse Split

Effective

Time; Symbol; CUSIP Number

The

Reverse Split will become effective at the Effective Time and the Common Stock will began trading on a split-adjusted basis at the open

of business on December 7, 2023. In connection with the Reverse Split, the CUSIP number for the Common Stock will change to 70387R 403.

The trading symbol for the Company’s common stock, “PAVM,” will remain unchanged.

Split

Adjustment; Treatment of Fractional Shares

At

the Effective Time, the total number of shares of Common Stock held by each stockholder of the Company will be converted automatically

into the number of shares of Common Stock equal to the number of issued and outstanding shares of Common Stock held by each such stockholder

immediately prior to the Effective Time divided by 15. The Company will issue one whole share of the post-Reverse Split Common

Stock to any stockholder who otherwise would have been entitled to receive a fractional share as a result of the Reverse Split. As a

result, no fractional shares will be issued in connection with the Reverse Split and no cash or other consideration will be paid in connection

with any fractional shares that would otherwise have resulted from the Reverse Split.

Also

at the Effective Time: (i) all options and warrants of the Company outstanding immediately prior to the Reverse Split, including the

Company’s Series Z Warrants to Purchase Common Stock, will be adjusted by dividing the number of shares of Common Stock into which

such options and warrants are exercisable by 15 and multiplying the exercise price thereof by 15, all in accordance with the terms of

the plans, agreements or arrangements governing such options and warrants and subject to rounding pursuant to such terms; (ii) all the

convertible securities of the Company outstanding immediately prior to the Reverse Split, including the Company’s Series B convertible

preferred stock and the Company’s convertible notes, will be adjusted by multiplying the conversion price thereof by 15, in accordance

with the terms of the plans, agreements or arrangements governing such convertible securities and subject to rounding pursuant to such

terms; and (iii) the number of shares of Common Stock reserved for issuance under the Company’s long-term incentive equity plan

and employee stock purchase plan, as well as the other amounts expressed in a number of shares set forth in such plans, will be proportionately

adjusted.

Certificated

and Non-Certificated Shares

Stockholders

who are holding their shares in electronic form at brokerage firms do not need to take any action, as the effect of the Reverse Split

will automatically be reflected in their brokerage accounts.

Stockholders

holding paper certificates may send the certificates to the Company’s transfer agent and registrar, Continental

Stock Transfer & Trust Company (“Continental”) at the address set forth below. Continental will issue a new stock

certificate reflecting the Reverse Split to each requesting stockholder.

Continental

can be contacted at:

Continental

Stock Transfer & Trust Company

Reorganization Department

1 State Street, 30th Floor

New York, NY 10004-1561

(917) 262-2378

Delaware

State Filing

On

December 5, 2023, the Company filed a Certificate of Amendment to its Amended and Restated Certificate of Incorporation (the “Charter

Amendment”) with the Secretary of State of the State of Delaware, pursuant to which, effective at 12:01 a.m. Eastern Time on

December 7, 2023, the Reverse Split will be effected. A copy of the Charter Amendment is attached to this Current Report as Exhibit 3.1

and is incorporated herein by reference.

Capitalization

As

a result of the Reverse Split, every 15 outstanding shares of Common Stock will be combined into one share of Common Stock. The number

of shares of Common Stock authorized for issuance under the Company’s Amended and Restated Certificate of Incorporation will be

reduced from 250,000,000 to 50,000,000 shares. The number of shares of preferred stock authorized for issuance under the Company’s

Amended and Restated Certificate of Incorporation will remain unchanged at 20,000,000 shares. The Reverse Split will not change the par

value of the Common Stock or the Company’s preferred stock.

Immediately

after the Reverse Split, each stockholder’s percentage ownership interest in the Company and proportional voting power will remain

unchanged, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and

privileges of the holders of shares of Common Stock will be substantially unaffected by the Reverse Split.

The

above description of the Charter Amendment and the Reverse Split is qualified in its entirety by reference to the Charter Amendment,

a copy of which is attached to this Current Report as Exhibit 3.1 and is incorporated herein by reference.

| Item

7.01. | Regulation

FD Disclosure. |

On

December 4, 2023, the Company issued a press release announcing (i) a dividend to the holders of the Company’s capital stock of

approximately 3.3 million shares of common stock of its majority-owned subsidiary, Lucid Diagnostics Inc. (the “Lucid Stock

Dividend”), (ii) the Reverse Split, and (iii) that it will be extending the maturity date of the Company’s Series Z Warrants

to Purchase Common Stock, by 12 months, to April 30, 2025. A copy of that press release is furnished as Exhibit 99.1 to this Current

Report, and is incorporated herein by reference.

The

accredited institutional investor that holds each of the Company’s Senior Secured Convertible Note, dated April 4, 2022, and the

Company’s Senior Secured Convertible Note, dated September 8, 2022, has waived its right to participate in the Lucid Stock Dividend

on an as-converted basis pursuant to the terms of such notes.

The

information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1,

shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing.

This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required

to be disclosed solely by Regulation FD.

Forward-Looking

Statements

This

Current Report, including Exhibit 99.1 attached hereto, contains certain forward-looking statements that involve substantial risks and

uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes,”

“will” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking

statements in this Current Report, including Exhibit 99.1 attached hereto, involve known and unknown risks, uncertainties and other factors

which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance

(financial or operating) or achievements expressed or implied by such forward-looking statements. Such forward-looking statements

are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks,

uncertainties and other factors include, but are not limited to, those set forth herein and in the other documents filed by

the Company with the Securities and Exchange Commission, each of which could adversely affect our business and the accuracy of the forward-looking

statements contained herein. The Company’s ability to maintain its listing on Nasdaq and its actual results, performance or achievements

may differ materially from those expressed or implied by such forward-looking statements.

| Item

9.01. |

Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

December 5, 2023 |

PAVMED

INC. |

| |

|

|

| |

By: |

/s/

Dennis McGrath |

| |

|

Dennis

McGrath |

| |

|

President

and Chief Financial Officer |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT

OF

CERTIFICATE

OF INCORPORATION

OF

PAVMED

INC.

—————————————————-

Pursuant

to Section 242 of the

General

Corporation Law of Delaware

—————————————————-

The

undersigned Chairman of the Board and Chief Executive Officer of PAVmed Inc. (the “Corporation”) does hereby certify:

FIRST:

The name of the Corporation is PAVmed Inc.

SECOND:

Upon the Effective Time (as defined below) of this Certificate of Amendment of Certificate of Incorporation of the Corporation, each

fifteen (15) shares of the Corporation’s Common Stock, par value $0.001 per share, issued and outstanding immediately prior to

the Effective Time shall automatically be combined into one (1) validly issued, fully paid and non-assessable share of Common Stock without

any further action by the Corporation or the holder thereof, subject to the treatment of fractional share interests as described below

(the “Reverse Split”). No fractional shares shall be issued at the Effective Time and, in lieu thereof, each stockholder

who otherwise would have been entitled to receive a fractional share as a result of the Reverse Split shall instead be entitled to receive

one additional whole share. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (“Old

Certificates”), shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented

by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above.

THIRD:

Upon the Effective Time, the Certificate of Incorporation of the Corporation is hereby amended by deleting the first paragraph of Article

FOURTH in its entirety and by substituting the following new first paragraph of Article FOURTH in lieu thereof:

“FOURTH:

The total number of shares of all classes of capital stock which the Corporation shall have authority to issue is 70,000,000 of which

50,000,000 shares shall be Common Stock of the par value of $.001 per share and 20,000,000 shares shall be Preferred Stock of the par

value of $.001 per share.

FOURTH:

This Certificate of Amendment of Certificate of Incorporation of the Corporation shall become effective as of December 7, 2023 at 12:01

a.m. Eastern Time (the “Effective Time”).

FIFTH:

The foregoing amendment to the Corporation’s certificate of incorporation was duly adopted in accordance with the provisions of

Sections 242 of the Delaware General Corporation Law.

IN

WITNESS WHEREOF, the undersigned has signed this certificate of amendment on this 5th day of December, 2023.

| |

/s/

Lishan Aklog, M.D. |

| |

Lishan

Aklog, M.D. |

| |

Chairman

of the Board and Chief Executive Officer |

Exhibit

99.1

PAVmed

Announces Dividend of Lucid Diagnostics Common Stock and Reverse Stock Split

PAVmed

shareholders as of January 15, 2024 will participate in distribution of approximately 3.3 million shares of Lucid common stock

1-for-15

reverse stock split to be effective as of market open on December 7, 2023

NEW

YORK, December 4, 2023 - PAVmed Inc. (Nasdaq: PAVM, PAVMZ) (“PAVmed” or the “Company”), a diversified

commercial-stage medical technology company, operating in the medical device, diagnostics, and digital health sectors today announced

a dividend of approximately 3.3 million shares of common stock of its majority-owned subsidiary, Lucid Diagnostics Inc. (Nasdaq:

LUCD), which equals the number of shares PAVmed will receive in the contemporaneous partial settlement of outstanding intercompany debt

owed to PAVmed by Lucid. PAVmed shareholders as of January 15, 2024, will participate in the dividend distribution. PAVmed also announced

that it will conduct a 1-for-15 reverse stock split of its own common stock.

Lucid

Common Stock Dividend

The

PAVmed Board of Directors has declared a dividend of approximately 3.3 million shares of Lucid common stock with a record date of January

15, 2024. All holders of PAVmed capital stock as of such date will participate in the dividend on a pro rata basis.

Contemporaneous

with the dividend, Lucid will issue to PAVmed an equivalent number of shares of Lucid common stock as payment for the portion of intercompany

debt owed to PAVmed that Lucid incurred during fiscal year 2022. As a result, the number of shares of Lucid common stock held by PAVmed

will remain unchanged following the distribution.

“This

distribution is emblematic of our strong commitment to maximizing value for our shareholders,” said Lishan Aklog, M.D., PAVmed’s

Chairman and Chief Executive Officer. “We believe, in light of market conditions for both PAVmed and Lucid, that it is in our shareholders’

best interests to allow them to directly hold a portion of Lucid shares in which they have or would have a beneficial interest through

PAVmed. I am particularly pleased that we were able to structure the distribution in conjunction with the repayment of intercompany debt

such that PAVmed’s ownership of Lucid shares remains unchanged. We will continue to closely monitor market conditions as we consider

other such opportunities to deliver value for our shareholders in the future.”

PAVmed

expects the distribution to be made within 30 days of the January 15, 2024 record date.

Reverse

Stock Split

The

reverse stock split will become effective on December 7, 2023, at 12:01 a.m. Eastern Time. The Company’s common stock will continue

to trade on the Nasdaq Capital Market (“Nasdaq”) under the symbol “PAVM” and will begin trading on a split-adjusted

basis at the opening of the market on December 7, 2023 with the new CUSIP number, 70387R403. The reverse stock split is intended for

the Company to regain compliance with the $1.00 per share minimum bid price requirement for continued listing of our common stock on

Nasdaq.

The

reverse stock split was approved by the Company’s stockholders at a special meeting of stockholders held on March 31, 2023, with

the specific ratio to be determined at the discretion of the Company’s board of directors within approved parameters. The ratio

of 1-for-15 was approved by the board on November 28, 2023. At the effective time of the reverse stock split, the authorized shares of

our common stock will be reduced from 250,000,000 to 50,000,000 (which reduction was approved, subject to completion of the reverse stock

split, by the Company’s stockholders at the same March 31, 2023 special meeting).

As

a result of the reverse stock split, the number of shares of common stock available for issuance under the Company’s equity incentive

plan and employee stock purchase plan immediately prior to the reverse stock split will be proportionately reduced. In addition, the

exercise prices of and number of shares subject to the Company’s outstanding Series Z Warrants, stock options and convertible securities,

and the conversion price of the Company’s outstanding convertible debt will likewise be proportionately adjusted in accordance

with their respective terms. In conjunction with the reverse stock split, the Company will also be extending the maturity date of the

Series Z warrants by twelve months, to April 30, 2025.

No

fractional shares of our common stock will be issued in connection with the reverse stock split. Stockholders that would hold a fractional

share of common stock as a result of the reverse stock split will have such fractional shares rounded up to the nearest whole share.

About

PAVmed and its Subsidiaries

PAVmed

Inc. is a diversified commercial-stage medical technology company operating in the medical device, diagnostics, and digital health sectors.

Its majority-owned subsidiary, Lucid Diagnostics, is a commercial-stage cancer prevention medical diagnostics company that markets the

EsoGuard® Esophageal DNA Test and EsoCheck® Esophageal Cell Collection Device—the first and only

commercial tools for widespread early detection of esophageal precancer to mitigate the risks of esophageal cancer deaths. Its other

majority-owned subsidiary, Veris Health Inc., is a digital health company focused on enhanced personalized cancer care through remote

patient monitoring using implantable biologic sensors with wireless communication along with a custom suite of connected external devices.

Veris is concurrently developing an implantable physiological monitor, designed to be implanted alongside a chemotherapy port, which

will interface with the Veris Cancer Care Platform.

For

more information about PAVmed, please visit pavmed.com.

Forward-Looking

Statements

This

press release includes forward-looking statements that involve risks and uncertainties. Forward-looking statements are any statements

that are not historical facts. Such forward-looking statements, which are based upon the current beliefs and expectations of PAVmed’s

and Lucid’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking

statements. Risks and uncertainties that may cause such differences include, among other things, volatility in the price of PAVmed’s

and Lucid’s common stock; PAVmed’s Series Z warrants; general economic and market conditions; the uncertainties inherent

in research and development, including the cost and time required to advance PAVmed’s and Lucid’s products to regulatory

submission; whether regulatory authorities will be satisfied with the design of and results from PAVmed’s and Lucid’s clinical

and preclinical studies; whether and when PAVmed’s and Lucid’s products are cleared by regulatory authorities; market acceptance

of PAVmed’s and Lucid’s products once cleared and commercialized; PAVmed’s and Lucid’s ability to raise additional

funding as needed; and other competitive developments. In addition, new risks and uncertainties may arise from time to time and are difficult

to predict. For a further list and description of these and other important risks and uncertainties that may affect PAVmed’s and

Lucid’s future operations, see Part I, Item 1A, “Risk Factors,” in PAVmed’s and Lucid’s most recent Annual

Report on Form 10-K filed with the Securities and Exchange Commission, as the same may be updated in Part II, Item 1A, “Risk Factors”

in any Quarterly Report on Form 10-Q filed by PAVmed or Lucid after its most recent Annual Report. PAVmed and Lucid disclaim any intention

or obligation to publicly update or revise any forward-looking statement to reflect any change in its expectations or in events, conditions,

or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those

contained in the forward-looking statements.

Investor

and Media Contact

Michael

Parks

PAVmed

and Lucid Diagnostics

484.356.7105

mep@pavmed.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PAVM_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PAVM_SeriesZWarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

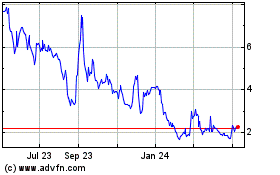

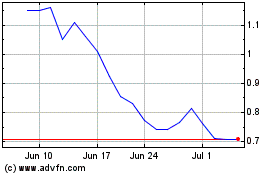

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Apr 2024 to May 2024

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From May 2023 to May 2024