UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under §240.14a-12

|

Organovo Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

|

No fee required.

|

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Explanatory Note

This Definitive Additional Proxy Materials includes a Current Report on Form 8-K filed by Organovo Holdings, Inc. (the “Company”) with the Securities and Exchange Commission on September 3, 2020 (the “Form 8-K”) and a press release issued by the Company on September 3, 2020, which was filed with the Form 8-K as Exhibit No. 99.1.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 2, 2020

|

|

ORGANOVO HOLDINGS, INC.

|

|

(Exact name of registrant as specified in its charter)

Commission File Number: 001-35996

|

|

Delaware

|

|

27-1488943

|

|

(State or other jurisdiction

of incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

|

440 Stevens Avenue, Suite 200

Solana Beach, CA 92075

|

|

(Address of principal executive offices, including zip code)

|

|

(858) 224-1000

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

(Title of each class) (Trading symbol(s)) (Name of each exchange on which registered)Common Stock, $0.001 par value ONVO The Nasdaq Stock Market LLC

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed, on June 25, 2019, Organovo Holdings, Inc. (the “Company”) received a letter from the Listing Qualifications Staff of the Nasdaq Stock Market, Inc. (“Nasdaq”) indicating that it did not comply with the minimum $1.00 per share bid price requirement for continued listing over the previous consecutive 30 days, as set forth in Nasdaq’s continued listing requirements (the “Minimum Bid Price Requirement”). On December 26, 2019, the Company obtained an additional compliance period of 180 calendar days by electing to transfer to The Nasdaq Capital Market to take advantage of the additional compliance period offered on that market. On April 17, 2020 the Company received an additional notice letter from Nasdaq indicating that in response to the COVID-19 pandemic and related extraordinary market conditions, Nasdaq has determined to toll the compliance periods for bid price and market value of publicly held shares requirements through June 30, 2020. Accordingly, since the Company had 66 calendar days remaining in the compliance period as of April 16, 2020, the Company had 66 calendar days from July 1, 2020, or until September 4, 2020, to regain compliance with the Minimum Bid Price Requirement.

On September 2, 2020, the Company received notification from Nasdaq that the closing bid price of its Common Stock had been at $1.00 per share or greater for ten (10) consecutive business days. Accordingly, Nasdaq confirmed that the Company had regained compliance with the Minimum Bid Price Requirement and that it had closed the matter.

In connection with receipt of this notice, the Company issued a press release on September 3, 2020, a copy of which is attached hereto as Exhibit 99.1.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Cooperation Agreement and 2020 Annual Meeting

As previously announced, on July 14, 2020, the Company entered into a Cooperation Agreement with Keith Murphy, the founder and former chief executive officer of the Company. Pursuant to the Cooperation Agreement, the Company’s Board of Directors (the “Board”) appointed Mr. Murphy and Adam Stern as directors on the Board, with terms expiring at the Company’s 2020 Annual Meeting of Stockholders to be held on September 15, 2020 (the “2020 Annual Meeting”). The Board also agreed, in connection with the 2020 Annual Meeting, to recommend, support and solicit proxies for (i) the re-election of Messrs. Murphy and Stern and (ii) an advisory stockholder vote (the “Advisory Nominees Proposal”) to appoint three individuals, Douglas Jay Cohen, David Gobel and Alison Tjosvold Milhous (collectively, the “Advisory Nominees”), to the Board. Mr. Murphy identified each of the Advisory Nominees.

In accordance with the Cooperation Agreement, the Company filed a definitive proxy statement for the 2020 Annual Meeting of Stockholders with the Securities and Exchange Commission on August 6, 2020 (the “Proxy Statement”), in which the Board is recommending, supporting and soliciting proxies for the re-election of Messrs. Murphy and Stern and in favor of the Advisory Nominees Proposal. If the final vote tabulation for the Advisory Nominees Proposal receives more votes cast “FOR” than “AGAINST” its approval, the Board has approved the appointment of the Advisory Nominees, to be automatically effective immediately following the final adjournment of the 2020 Annual Meeting. In addition, immediately following the appointment of the Advisory Nominees, each of our existing directors (other than Messrs. Murphy and Stern) will resign from the Board, which will result in Messrs. Murphy and Stern and the Advisory Nominees constituting the full membership of the Board (collectively, the “New Director Slate”).

As discussed in the Proxy Statement, the New Director Slate has advised the Board that if the Advisory Nominees Proposal is approved at the Annual Meeting, the New Director Slate intends to recommence the Company’s operations and focus its efforts on developing highly customized human tissues as living, dynamic models of human biology and disease for use in drug discovery and development.

Conditional Director Agreements

To enable the potential transition to the New Director Slate, the Company’s continuing directors, including Carolyn Beaver, Taylor Crouch, Mark Kessel and Kirk Malloy, submitted irrevocable resignation letters, which provide for their resignations from the Board contingent upon and effective immediately following the final adjournment of the

2020 Annual Meeting if the Advisory Nominees Proposal receives more votes cast “FOR” than “AGAINST” its approval.

On September 2, 2020, in accordance with the terms of the Cooperation Agreement, the Company entered into Separation and Mutual Release Agreements (collectively, the “Director Agreements”) with Ms. Beaver and Messrs. Crouch, Kessel and Malloy. The effectiveness of the Director Agreements is contingent upon the resignations of such directors following the final adjournment of the 2020 Annual Meeting if the Advisory Nominees Proposal receives more votes cast “FOR” than “AGAINST” its approval. Under the Director Agreements, the Company will release each resigning director, and each resigning director will release the Company, from any and all claims that such party may have against the other for acts or omissions that occurred on or before the date of the respective Director Agreement. The resigning directors also agreed to certain standstill provisions and cooperation services. In the Director Agreements, the Company agreed to purchase a six-year director and officer liability insurance tail policy and clarified that any existing director resignations as contemplated by the Director Agreements would constitute a “change in control” pursuant to the terms of the respective equity award agreements and the Company’s 2012 Equity Incentive Plan, as amended, which results in the acceleration of any unvested equity awards held by the resigning directors.

Conditional Executive Officer Resignations and Officer Agreements

To enable the New Director Slate to hire a new management team to implement its proposed business plan for the Company following the 2020 Annual Meeting, each of the Company’s existing executive officers, including Mr. Crouch, the Company’s Chief Executive and President, Craig Kussman, the Company’s Chief Financial Officer, and Jennifer Kinsbruner Bush, the Company’s General Counsel, Corporate Secretary and Compliance Officer, submitted contingent resignation letters on September 2, 2020 (collectively, the “Contingent Resignation Letters”). The Contingent Resignation Letters provide for the resignation of each of these executive officers from their employment and officer positions with the Company, contingent upon and automatically effective immediately following the final adjournment of the 2020 Annual Meeting if the Advisory Nominees Proposal receives more votes cast “FOR” than “AGAINST” its approval.

In accordance with the terms of the Cooperation Agreement, the Company entered into a Separation Agreement and Mutual Release (collectively, the “Officer Agreements”) with each of Messrs. Crouch and Kussman and Ms. Bush on September 2, 2020. The effectiveness of the Officer Agreements is contingent upon the resignations of the executive officers following the final adjournment of the 2020 Annual Meeting if the Advisory Nominees Proposal receives more votes cast “FOR” than “AGAINST” its approval. Pursuant to the Officer Agreements, the Company will release each resigning officer, and each resigning officer will release the Company, from any and all claims that such party may have against the other for acts or omissions that occurred on or before the date of the respective Officer Agreement. It also clarifies that the appointment of the Advisory Nominees to the Board will constitute a “change in control” under the Company’s Severance and Change in Control Plan, as amended (the “Plan”), which will entitle each resigning officer to the severance benefits set forth in the Plan. Pursuant to the terms of the Plan, each of the executive officers is entitled to receive a cash severance payment equal to two times such executive officer’s base salary, paid in a lump sum, plus a pro-rated target bonus for 2021 fiscal year, health benefit continuation for up to 18 months, and outplacement assistance for 18 months. Each executive officer will also receive full accelerated vesting of all outstanding equity awards and a one-year time period to exercise any stock options. The Officer Agreements requires each of the resigning officers to comply with certain standstill provisions.

The Company also entered into Consulting Agreements with each of Messrs. Crouch and Kussman and Ms. Bush on September 2, 2020 (collectively, the “Consulting Agreements”), in which each of these executives agreed to provide management transition services to the Company, contingent upon their resignations becoming effective following the 2020 Annual Meeting. The Consulting Agreements provide for a per hour fee to be paid by the Company for any consulting services agreed to by the Company and the former executive. The Company is not obligated to use any consulting services, or make any minimum payments under the Consulting Agreements.

Contingent Officer Appointment

To help prepare for the potential transition to the New Director Slate following the 2020 Annual Meeting, the Company has entered into a consulting agreement with Danforth Advisors, LLC for Chris Heberlig, CPA, MBA, to provide management transition services to the New Director Slate. Contingent upon the 2020 Annual Meeting

Advisory Nominees Proposal receiving more votes cast “FOR” than “AGAINST” its approval, the New Director Slate has advised the Company that it intends to appoint Mr. Heberlig as Chief Financial Officer of the Company.

Mr. Heberlig is a seasoned executive with significant experience in managing and leading teams as well as overseeing the financial and operational responsibilities of private and publicly traded bio-technology companies. He has over twenty years of experience primarily focused on the life sciences industry. His experience includes senior management roles including previously serving as Executive Vice President and Chief Financial Officer of publicly held Kiniksa Pharmaceuticals Ltd. and Senior Vice President, Finance and Business Operations and Chief Accounting Officer of publicly held Synageva Biopharma Corp. Earlier in his career, he held senior financial management positions at Panacos Pharmaceuticals Inc. and EPIX Pharmaceuticals Inc., both publicly traded biotechnology companies. Mr. Heberlig began his career at PwC, a national audit, tax, and advisory services firm. He received an MBA degree from Boston University and a BA in economics from St. Lawrence University. He is also a Certified Public Accountant.

The New Director Slate plans to take an active role in assisting Mr. Heberlig to manage and restart the Company’s operations. Mr. Heberlig will also be assisted in his responsibilities by the Company’s continuing financial and administrative staff, and will be able to draw on the support of the Company’s former executive officers, each of whom have entered into the Consulting Agreements discussed above to support transition activities as necessary.

The foregoing summary of the Cooperation Agreement, the Director Agreements, the Officer Agreements, the Consulting Agreements, the 2012 Equity Incentive Plan and the Severance and Change in Control Plan (as amended) does not purport to be complete and is qualified in its entirety by reference to the full text of such agreements. The Company filed the Cooperation Agreement, the form of Director Agreement and the form of Officer Agreement with the Securities and Exchange Commission (the “SEC”) on July 15, 2020 as Exhibits 10.1, 10.3 and 10.4, respectively, to the Company’s Current Report on Form 8-K and are incorporated herein by reference. The form Consulting Agreement was filed as Exhibit B to the Officer Agreement, which was filed as Exhibit 10.4 to the Current Report on Form 8-K filed with the SEC on July 15, 2020. The Company filed its 2012 Equity Incentive Plan with the SEC on February 13, 2012 as Exhibit 10.15 to the Company’s Current Report on Form 8-K and is incorporated herein by reference. The Company filed the Severance and Change in Control Plan with the SEC on November 9, 2015 as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q and is incorporated herein by reference. The Company’s Amendment to the Severance and Change in Control Plan was filed with the SEC on May 20, 2020 as Exhibit 10.1 to the Company’s Current Report on Form 8-K and is incorporated herein by reference.

Forward Looking Statements

Any statements contained in this Current Report on Form 8-K that do not describe historical facts constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on current expectations, but are subject to a number of risks and uncertainties. These risks and uncertainties and other factors are identified and described in more detail in the Company’s filings with the SEC, including its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 10, 2020. You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that the Company may issue in the future. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect to the Company’s 2020 Annual Meeting of Stockholders to be held virtually on Tuesday, September 15, 2020 at 9:00 a.m. (Pacific Daylight Time) (the “2020 Annual Meeting”). On August 6, 2020, the Company filed a definitive proxy statement with the SEC and mailed a Notice of Internet Availability of Proxy Materials to its stockholders containing instructions on how to access the proxy materials for the 2020 Annual Meeting, including the Company’s definitive proxy statement and annual report for the fiscal year ended March 31, 2020, over the internet. BEFORE MAKING ANY VOTING OR INVESTMENT

DECISION, INVESTORS AND STOCKHOLDERS ARE URGED TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MATTERS TO BE CONSIDERED AT THE 2020 ANNUAL MEETING. Investors and stockholders may obtain, free of charge, copies of the definitive proxy statement and any other documents filed by the Company with the SEC in connection with the 2020 Annual Meeting at the SEC’s website (http://www.sec.gov) and on the investor relations section of the Company’s website at ir.organovo.com.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the 2020 Annual Meeting. Information regarding the special interests of the Organovo directors and executive officers in the matters to be considered at the 2020 Annual Meeting is included in the definitive proxy statement referred to above. The definitive proxy statement is available free of charge from the sources indicated above.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Cooperation Agreement, dated July 14, 2020, between the Company and Keith Murphy. (incorporated by reference from Exhibit 10.1 to the Company’s Current Report on Form 8-K, as filed with the SEC on July 15, 2020).

|

|

|

|

|

|

10.2

|

|

Form of Separation and Mutual Release Agreement with the Company’s directors (incorporated by reference from Exhibit 10.3 to the Company’s Current Report on Form 8-K, as filed with the SEC on July 15, 2020).

|

|

|

|

|

|

10.3

|

|

Form of Separation Agreement and Release with the Company’s officers (incorporated by reference from Exhibit 10.4 to the Company’s Current Report on Form 8-K, as filed with the SEC on July 15, 2020).

|

|

|

|

|

|

10.4

|

|

Form of Consulting Agreement with the Company’s officers (incorporated by reference from Exhibit B to Exhibit 10.4 to the Company’s Current Report on Form 8-K, as filed with the SEC on July 15, 2020).

|

|

|

|

|

|

10.5

|

|

Organovo Holdings, Inc. 2012 Equity Incentive Plan (incorporated by reference from Exhibit 10.15 to the Company’s Current Report on Form 8-K, as filed with the SEC on February 13, 2012).

|

|

|

|

|

|

10.6

|

|

Organovo Holdings, Inc. Severance and Change in Control Plan (incorporated by reference to Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q, as filed with the SEC on November 9, 2015).

|

|

|

|

|

|

10.7

|

|

Amendment to the Organovo Holdings, Inc. Severance and Change in Control Plan (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, as filed with the SEC on May 20, 2020).

|

|

|

|

|

|

99.1

|

|

Press Release, dated September 3, 2020.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ORGANOVO HOLDINGS, INC.

|

|

|

|

|

Date: September 3, 2020

|

/s/ Taylor Crouch

|

|

|

Taylor Crouch

|

|

|

Chief Executive Officer and President

|

|

|

|

Exhibit 99.1

Organovo Regains Compliance with Nasdaq Minimum Bid Price Requirement

San Diego, CA, September 3, 2020 – Organovo Holdings, Inc. (“Organovo” or the “Company”) (Nasdaq: ONVO) announced today that it has regained compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market (the “Minimum Bid Price Requirement”). On September 2, 2020, Organovo received a letter from the Listing Qualifications Department of The Nasdaq Stock Market, Inc. stating that because Organovo’s common stock had a closing bid price at or above $1.00 per share for a minimum of ten (10) consecutive business days, Organovo had regained compliance with the Minimum Bid Price Requirement and that Nasdaq had closed the matter.

About Organovo

The Company has historically focused its efforts on developing its in vivo liver tissues to treat end-stage liver disease and a select group of life-threatening, orphan diseases, for which there are limited treatment options other than organ transplantation. On August 6, 2020, the Company filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) for its 2020 Annual Meeting of Stockholders to be held virtually on Tuesday, September 15, 2020 at 9:00 a.m. (Pacific Daylight Time). Please refer to the proxy statement for information about the proposals to be voted on at the 2020 Annual Meeting, including the membership of the Company’s Board of Directors and the potential future direction of the Company.

Forward Looking Statements

Any statements contained in this press release that do not describe historical facts constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding the Company’s ability to satisfy the continued listing requirements of The Nasdaq Capital Market. Any forward-looking statements contained herein are based on current expectations, but are subject to a number of risks and uncertainties. These risks and uncertainties and other factors are identified and described in more detail in the Company’s filings with the SEC, including its Quarterly Report on Form 10-Q filed with the SEC on August 10, 2020. You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that the Company may issue in the future. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect to the Company’s 2020 Annual Meeting of Stockholders to be held virtually on Tuesday, September 15, 2020 at 9:00 a.m. (Pacific Daylight Time) (the “2020 Annual Meeting”). On August 6, 2020, the Company filed a definitive proxy statement with the SEC and mailed a Notice of Internet Availability of Proxy Materials to its stockholders containing instructions on how to access the proxy materials for the 2020 Annual Meeting, including the Company’s definitive proxy statement and annual report for the fiscal year ended March 31, 2020, over the internet. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND STOCKHOLDERS ARE URGED TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE

COMPANY AND THE MATTERS TO BE CONSIDERED AT THE 2020 ANNUAL MEETING. Investors and stockholders may obtain, free of charge, copies of the definitive proxy statement and any other documents filed by the Company with the SEC in connection with the 2020 Annual Meeting at the SEC’s website (http://www.sec.gov) and on the investor relations section of the Company’s website at ir.organovo.com.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the 2020 Annual Meeting. Information regarding the special interests of the Organovo directors and executive officers in the matters to be considered at the 2020 Annual Meeting is included in the definitive proxy statement referred to above. The definitive proxy statement is available free of charge from the sources indicated above.

Organovo:

Taylor J. Crouch

858 224 1000

info@organovo.com

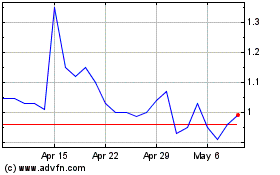

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

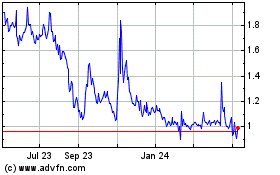

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Apr 2023 to Apr 2024