| | | | | |

| SEC FILE NUMBER |

| 001-31932 |

| |

CUSIP NUMBER 683373302 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| | | | | | | | | | | | | | | | | |

| | | | | | |

| (Check one): | Form 10-K Form 20-F Form 11-K Form 10-Q Form 10-D Form N-SAR Form N-CSR | |

| | | | | |

| For Period Ended: | | September 30, 2023 | |

| | | | |

| Transition Report on Form 10-K | | |

| Transition Report on Form 20-F | | |

| Transition Report on Form 11-K | | |

| Transition Report on Form 10-Q | | |

| Transition Report on Form N-SAR | |

| | | | | |

| For the Transition Period Ended: | | _______________________________________________________ | |

| | | | |

| | |

Read Instruction (on back page) Before Preparing Form. Please Print or Type. Nothing in this form shall be construed to imply that the Commission has verified any information contained

herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

Ontrak, Inc.

Full Name of Registrant

333 S. E. 2nd Avenue Suite 2000

Address of Principal Executive Office (Street and Number)

Miami, FL 33131

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| | | | | | | | |

| | |

| x | (a) | The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| | |

| x | (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| | |

| (c) | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

As previously reported, on October 31, 2023, Ontrak, Inc. (the “Company,” “we,” “us” or “our”), certain of its subsidiaries, Acuitas Capital LLC (“Acuitas”) and U.S. Bank Trust Company, National Association, entered into an amendment (the “Fifth Amendment”) to the Master Note Purchase Agreement, dated as of April 15, 2022, among the parties, as amended by that certain First Amendment to Master Note Purchase Agreement made as of August 12, 2022, that certain Second Amendment to Master Note Purchase Agreement made as of November 19, 2022, that certain Third Amendment to Master Note Purchase Agreement made as of December 30, 2022, and that certain Fourth Amendment to the Master Note Purchase Agreement made as of June 23, 2023 (as amended by the Fifth Amendment, the “Keep Well Agreement”).

On November 14, 2023, the Company closed its previously announced public offering (the “Offering”). In the Offering, the Company issued (a) 4,592,068 shares of its common stock and 9,184,136 warrants to purchase up to 9,184,136 shares of its common stock at a combined public offering price of $0.60 per share of common stock and accompanying warrants, and (b) 5,907,932 pre-funded warrants to purchase up to 5,907,932 shares of its common stock and 11,815,864 warrants to purchase up to 11,815,864 shares of its common stock at a combined public offering price of $0.5999 per pre-funded warrant and accompanying warrants, which represents the per share public offering price for the common stock and accompanying warrants less the $0.0001 per share exercise price for each pre-funded warrant. The Company received gross proceeds of $6.3 million from the Offering, and therefore the Offering constituted a Qualified Financing under the Keep Well Agreement.

In accordance with the Fifth Amendment, on November 14, 2023 and before the closing of the Offering, the Company issued 18,054,791 shares of its common stock to Acuitas upon the conversion of the aggregate principal amount of all the outstanding senior secured convertible notes (the “Keep Well Notes”) previously issued by the Company to Acuitas under the Keep Well Agreement, plus all accrued and unpaid interest thereon, minus $7.0 million (the “Notes Conversion”).

In accordance with the Fifth Amendment, concurrent with the closing of the Offering, the Company issued to Acuitas in a private placement (the “Private Placement”) an unregistered pre-funded warrant to purchase up to 18,333,333 shares of the Company’s common stock and an unregistered warrant to purchase up to 36,666,666 shares of the Company’s common stock, for a total consideration of $11.0 million. The consideration for the securities purchased by Acuitas in the Private Placement consisted of (a) the $6.0 million Acuitas previously delivered to the Company in June 2023 and September 2023 in accordance with the Keep Well Agreement and (b) a reduction of the aggregate amounts outstanding under the Keep Well Notes (after giving effect to the Notes Conversion) to $2.0 million.

The Company needs additional time to complete the preparation of appropriate disclosures, and reach a conclusion with respect to whether, giving effect to the Notes Conversion and the closing of the Offering and the Private Placement, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern. The Company expects to reach the conclusion that no such conditions or events exist and that the Company has sufficient cash to meet its obligations for at least the twelve months from the date the financial statements to be included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 (the “Form 10-Q”) are

released. The Company is actively working on these activities and intends to file the Form 10-Q within the 5-day extension period (the “Extension Period”) afforded by Rule 12b-25 under the Securities Exchange Act of 1934.

Forward-Looking Statements

This Form 12b-25 contains forward-looking statements within the meaning of applicable United States securities laws. These forward looking statements include statements regarding the Company’s expectation to file the Form 10-Q within the Extension Period, the Company’s expectations that it will complete activities necessary to permit such filing within the Extension Period, and that the Company expects to reach a conclusion that no conditions or events exist, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for at least the twelve months from the date the financial statements to be included in the Form 10-Q are released. Forward-looking statements are based on management’s current expectations or beliefs about the Company’s future plans, expectations and objectives. These forward-looking statements are not historical facts and are subject to risks and uncertainties that could cause the actual results to differ materially from those projected in these forward-looking statements. These risks include, but are not limited to those risk factors included in the Company’s Form 10-Q for the quarter ended June 30, 2023. Readers of this Form 12b-25 are cautioned not to place undue reliance on forward-looking statements contained herein, which speak only as of the date of this Form 12b-25.

PART IV — OTHER INFORMATION

| | | | | | | | | | | | | | | | | | | | |

| (1) | | Name and telephone number of person to contact in regard to this notification |

| | | | | |

| James J. Park | | 310 | | 444-4300 |

| (Name) | | (Area Code) | | (Telephone Number) |

| | | | | | | | |

| (2) | | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). |

| | | Yes No |

| | | |

| (3) | | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? |

| | | Yes No |

| | | |

| | | | | | | | |

| | |

| | | If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

As reported in the Company’s earnings release issued on November 14, 2023 announcing the Company’s third quarter 2023 financial results, the Company’s (a) revenue for the third quarter of 2023 was $3.7 million, representing a 31% increase compared to the same period in 2022; (b) operating loss for the third quarter of 2023 was $(4.1) million compared to an operating loss of $(11.1) million for the same period in 2022; (c) net loss for the third quarter of 2023 was $(6.4) million, or an $(1.76) diluted net loss per common share (after deduction for undeclared preferred stock dividends), compared to net loss of $(12.8) million, or a $(3.70) diluted net loss per common share (after deduction for undeclared preferred stock dividends) for the same period in 2022. Other of the Company results of operations for the three and nine months ended September 30, 2023 and September 30, 2022 are also in that earnings release. |

| | | |

Ontrak, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Date | | November 15, 2023 | | By | | /s/ James J. Park |

| | | | | | | James J. Park |

| | | | | | | Chief Financial Officer |

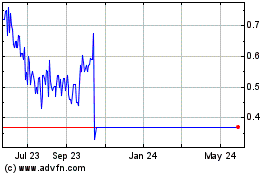

Ontrak (NASDAQ:OTRKP)

Historical Stock Chart

From Apr 2024 to May 2024

Ontrak (NASDAQ:OTRKP)

Historical Stock Chart

From May 2023 to May 2024