Today's Top Supply Chain and Logistics News From WSJ

May 03 2016 - 7:08AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The U.S. factory sector is barely growing and it's offering

little hope for stronger expansion in the future. The Institute for

Supply Management's latest index of manufacturing activity fell a

full percentage point to 50.8 in April, the WSJ's Ben Leubsdorf

reports, staying just above the 50 reading that divides expansion

from contraction. Perhaps more significant for shipping business,

the New Orders index fell back 2.5 percentage points, still above

the threshold growth but suggesting that companies are looking more

critically at bulking up business amid uncertain demand. That fits

with comments from several freight operators that reported in the

wake of their first-quarter earnings statements that shipping

demand eased back in early April. Trucker Saia Inc. said its

early-April shipment count was off 4.3% from a year ago, adjusting

for Good Friday, signaling a "pretty soft" industrial economy. Old

Dominion Freight Line Inc. says its second quarter started

surprisingly "flattish." Based on the ISM reading, factories aren't

promising much more than that.

Pricing power in the world-wide commodities business is shifting

toward an obscure market exchange in China that is exerting growing

influence on core industrial materials and the companies that move

them. Chinese investors have been pouring billions of dollars into

iron-ore futures traded on the Dalian Commodity Exchange in

northeastern China, the WSJ's Rhiannon Hoyle reports, fueling

surging prices even as forecasters project an iron-ore glut this

year. The price-climb is reaching the hard-hit dry bulk shipping

market, where the Baltic Dry Index has climbed 413 points since

reaching a historic low of 290 in February. Iron-ore futures on the

Dalian exchange have climbed 46% since the start of the year and

prices for physical iron ore have risen 52%, sparking concerns that

the volatile market is pushing miners to keep production high and

creating a bubble. The supply is good news for bulk carriers now,

and they can only hope that enough demand develops to keep the

business going.

Oculus, the virtual-reality company, is trying to solve a

manufacturing problem by effectively dividing its supply chain in

two. Facing a parts shortage that will produce significant delays

in production of its high-end Rift headsets, the company is

arranging with Best Buy Co. to create demonstration areas in stores

for people to try the devices, the WSJ's Nathan Olivarez-Giles

reports. It's a bid for a workaround around a production slip-up

that threatens to undermine the company's marketing buzz. Some of

the Rifts will ship, and they'll be available for purchase at Best

Buy and online in "extremely limited" supplies while the company

catches up to the orders it has already taken. The company is

hoping that in the end, its fans are so taken with the technology

that they forget that the production and shipping takes place in

the real world.

TRANSPORTATION

CSX Corp. is warning customers of shipment delays as it clears

up a derailment that spilled hazardous chemicals in busy

neighborhood in Washington, D.C. Crews were preparing to excavate

soil where one of the tank cars leaked about 750 gallons of sodium

hydroxide, the WSJ's Scott Calvert and Anna Louie Sussman report .

The derailment near a subway station, and about three miles from

the U.S. Capitol, highlighted how the freight trains, including

tank cars and those carrying potentially hazardous chemicals,

travel through population centers in the Northeast. There were no

injuries or evacuations in the derailment, but officials said

Amtrak services that share the track with CSX were disrupted.

Besides the sodium hydroxide, derailed cars leaked ethanol and

nonhazardous calcium chloride.

QUOTABLE

IN OTHER NEWS

Apparel retailer Aéropostale Inc. is preparing to file for

bankruptcy protection this week and close more than 100 stores.

(WSJ)

Greenpeace released internal documents for the trade pact being

discussed by the European Union and the U.S., saying the papers

raise serious concerns for consumers and the environment. (WSJ)

International Paper Co. will acquire the fluff-pulp operations

of Weyerhaeuser Co.'s cellulose fibers unit, which includes several

mills and other facilities. (WSJ)

Saudi Binladin Group laid off 50,000 people as the construction

giant copes with business hammered by low oil prices. (WSJ)

Food and supplies distributor Sysco Corp. reported a 23% profit

gain in fiscal third quarter profit on a 3.6% gain in sales volume.

(WSJ)

South Korea's Hanjin Shipping Ltd. asked chartered fleet owners

and terminal operators for help with its debt-restructuring

efforts. (WSJ)

Tesla Motors Inc. is offering to place a distribution center in

Connecticut to gain the right to sell vehicles there directly to

customers. (Hartford Courant)

FedEx Corp. says it doesn't believe logistics expansion at

e-commerce giants Amazon and Alibaba threatens its delivery

business. (South China Morning Post)

A U.S. Marine Corps logistics unit is testing 3D printing to cut

the wait times for equipment maintenance parts. (Marine Corps

Times)

Greater delivery demands from online shopping are driving

greater cooperation between Qantas Airways Ltd. and Australian

Post. (Sydney Morning Herald)

TraPac may move from its Port of Jacksonville cargo terminal

site if the port doesn't undertake an expensive harbor deepening

project. (Florida Times-Union)

A years-long project to deepen the Delaware River is nearly

complete and the Port of Philadelphia expects new shipping services

to follow. (WPVI)

Gary LaGrange will retire as president and chief executive of

the Port of New Orleans next April and chief operating officer

Brandy Christian will likely replace him. (New Orleans

Times-Picayune)

Truck manufacturer Paccar Inc. opened a $32 million parts

distribution center in Renton, Wash. (Fleet Owner)

South Dakota sued four online retailers under a new state law

that requires them to collect tax even if they have no physical

presence there. (Internet Retailer)

DistributionNow will buy Wyoming-based industrial parts

distributor Power Service Inc. (Industrial Distribution)

A solar-powered airplane left California for Arizona on an

around-the-world trip using only energy from the sun.

(Manufacturing.net)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @RWhelanWSJ and @EEPhillips_WSJ, and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

With one click, subscribe to this email newsletter.

(END) Dow Jones Newswires

May 03, 2016 06:53 ET (10:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

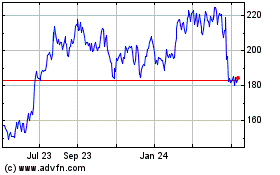

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Dec 2024 to Jan 2025

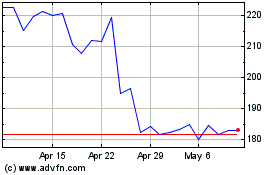

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Jan 2024 to Jan 2025