Today's Top Supply Chain and Logistics News From WSJ

March 27 2018 - 7:01AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The White House may have provided a template for new trade

agreements in the pact just struck with South Korea. The deal came

in part because the two allies have a bigger common challenge ahead

in disarming North Korea, the WSJ's Kwanwoo Jun writes, but it also

sets a potential framework for other negotiations the U.S. has

underway or may be coming in the future. One trade expert in Seoul

says the new deal provides an "exemplary case" for Canada and

Mexico to follow, for instance, in renegotiating the North American

Free Trade Agreement. Seoul officials say they made only "modest"

concessions, and the deal is unlikely to shift trans-Pacific trade

flows much if at all. U.S. auto makers appear to be the biggest

winners, for instance, getting sharply higher quotas for exports to

South Korea. But the car makers are nowhere near reaching even the

current quota. South Korea also won a permanent exemption to new

U.S. steel tariffs, demonstrating the tariffs will likely be on the

table in negotiations with other countries.

Kansas City Southern's focus on international transport may

prove costly under the new U.S. tax law. A provision in the law

aimed at overseas income earned by U.S. technology and

pharmaceutical firms is hitting some unexpected companies, the

WSJ's Richard Rubin report, potentially including KCS freight rail

operations that lean heavily on U.S.-Mexico trade. KCS says the new

minimum tax will cost the company $25 million annually, the result

of a measure aimed at trademarks and patents held by tech and

pharma firms. KCS's assets are railcars, not patents, but the

provision resets the math on foreign tax credits that companies use

to calculate the taxes they pay abroad, and hits companies in

high-tax countries -- like Mexico. It's a quirk of the new tax

code, and it comes with another twist: U.S. companies could lessen

the impact by transferring some spending to a foreign country, and

out of the U.S.

China's automotive supply chain is getting much more global.

Volvo Cars plans to start producing sport-utility vehicles for the

business it jointly owns with Zhejiang Geely Holding Group Co., the

WSJ's William Boston reports, the latest step by the Chinese

company to take its Geely Auto business international. Under the

new plan, Sweden-based Volvo will produce vehicles at a plant in

Belgium for Lynk & Co, the business launched last year under

Volvo and Zhejiang Geely. The new operation follows the

announcement last month that the owner of Zhejiang Geely Holding

had amassed a nearly 10% stake in Germany's Daimler AG, the owner

of Mercedes-Benz cars, and it extends the technology and

operational tie-ups that are pushing the Chinese auto maker onto

the bigger international stage. Volvo will use technology it

developed for its own compact SUV in the new Lynk vehicle, saving

on costs and allowing the company to ramp up production

quickly.

SUPPLY CHAIN STRATEGIES

Sometimes suppliers just have to draw a line. Newell Brands

Inc., the maker of Sharpie markers and Paper Mate pens, has been

fighting in the aisles with Office Depot Inc., contending the

office-supply store wasn't doing enough to showcase its products

and even pulling back shipments to the retailer over the past year.

The WSJ's Sharon Terlep reports the impact hit Newell's

fourth-quarter sales, triggered a string of director resignations

and drew interest from activist investors. It's the latest and

perhaps most extreme example of the fraying relations between

vendors and store operators in a fast-changing retail environment.

Office-supply outlets are increasingly under pressure as customers

head online to buy staples, cutting into foot traffic and sales of

other products. Historically, retailers and manufacturers have

worked together to bolster sales. But conflicts are growing as

retailers lower prices to win back shoppers from Amazon and other

online sellers.

QUOTABLE

IN OTHER NEWS

The Federal Reserve Bank of Chicago's measure of U.S. economic

growth rose at a sharp rate in February. (WSJ)

China's central bank guided the yuan to its strongest level

against the U.S. dollar since its devaluation more than 2 1/2 years

ago. (WSJ)

Cosco Shipping Ports Ltd. more than doubled its net profit in

2017 to $512 million. (WSJ)

The Mexican government's airport company raised around $1.6

billion to partly finance construction of a new Mexico City

airport. (WSJ)

Britain's JD Sports Fashion is buying U.S. retailer Finish Line

Inc. for $558 million. (WSJ)

Building-materials supplier USG Corp. rejected a buyout offer

from Germany's Gebr. Knauf KG. (WSJ)

New Zealand's imports rose to a new high for a February.

(MarketWatch)

Singapore's manufacturing output jumped 8.9% last month on

strong semiconductor production. (Channel NewsAsia)

FedEx Corp. reserved 20 Tesla Semi trucks to test in its FedEx

Freight fleet. (Memphis Commercial Appeal)

Amazon.com Inc. is stepping up collections of state sales tax

but often leaves city taxes out of the mix. (New York Times)

Walmart Inc. named Simon Belsham, formerly of British retailer

Tesco PLC, as president of its Jet.com e-commerce business.

(TechCrunch)

Apple Inc. supplier Huayou Cobalt Co. is joining a group

promoting the ethical sourcing of cobalt. (Bloomberg)

Yang Ming Marine Transport Ltd. swung to a $10.8 million net

profit in 2017 on a 13.6% gain in revenue. (The Loadstar)

Bulk carrier Polaris Shipping entered the tanker sector under a

vessel-pooling agreement with Navig8 Ltd. (IHS Fairplay)

A Romanian state-owned group will buy a controlling stake in the

Daewoo Mangalia Heavy Industries shipyard. (MarineLink)

Shipping tycoon Evangelos Marinakis was charged in Greece with

drug trafficking and financing a criminal enterprise. (The

Guardian)

Persistent congestion at the Port of Montreal is delaying

shipments and raising shipping costs. (Journal of Commerce)

DP World will spend up to $1 billion to build a deepwater port

at the Democratic Republic of the Congo. (Port Technology)

Businesses run by two freight brokers will pay $900,000 to

settle a federal investigation into accusations they cheated

owner-operators. (Commercial Carrier Journal)

Starbucks Inc. will test blockchain technology for tracking its

coffee beans. (Supply Chain Dive)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the WSJ Logistics Report team:

@jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ Logistics Report

on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 27, 2018 06:46 ET (10:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

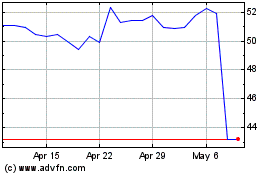

ODP (NASDAQ:ODP)

Historical Stock Chart

From May 2024 to Jun 2024

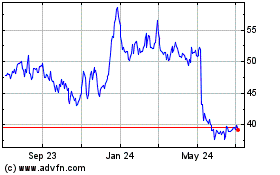

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jun 2023 to Jun 2024