REHOVOT, Israel, February 19 /PRNewswire-FirstCall/ -- Nova

Measuring Instruments Ltd. (NASDAQ:NVMI), provider of leading edge

stand alone metrology and the market leader of integrated metrology

solutions to the semiconductor process control market, today

reported its 2007 fourth quarter and full year financial results,

including record revenues and positive cash flow from operations.

Highlights - Revenues of $58.1 million in 2007, up 20% from 2006. -

Positive operating cash flow of $4.6 million in 2007. - Revenues of

$16 million for the fourth quarter of 2007, up 14%+ from Q4 2006. -

Q4 2007 non-GAAP net income of $1 million, or 0.05 per diluted

share; Q4 2007 GAAP net loss of $0.7 million, or $0.04 per share.

2007 Fourth Quarter Results Total revenues for the fourth quarter

of 2007 were $16 million, an increase of 14% over the fourth

quarter of 2006, and an increase of 15% over the third quarter of

2007. Gross margin for the fourth quarter of 2007 increased to 43%,

compared with 41% for the fourth quarter of 2006, and compared with

38% for the third quarter of 2007. Operating expenses in the fourth

quarter of 2007 decreased to $6.3 million, compared with $6.6

million in the fourth quarter of 2006, and $9.2 million in the

third quarter of 2007. During the fourth quarter of 2007, the

company recorded a $1.4 million impairment charge, related to short

term investments in Auction Rate Securities. Excluding amortization

of acquired intangibles, stock based compensation expenses and

other non-cash charges, on a non-GAAP basis, the company reported

net income of $1 million, or $0.05 per diluted share, for the

fourth quarter of 2007. This compares with a non-GAAP net loss of

$0.2 million, or $0.01 per share, in the fourth quarter of 2006,

and a non-GAAP net income of $0.8 million, or $0.04 per diluted

share, in the third quarter of 2007. On a GAAP basis, the company

reported a $0.7 million net loss for the fourth quarter of 2007, or

$0.04 per share, as compared to a net loss of $0.8 million, or

$0.05 per share, for the fourth quarter of 2006, and a net loss of

$3.7 million, or $0.19 per share, for the third quarter of 2007.

The company generated $4 million in cash flow from operating

activities during the fourth quarter of 2007. 2007 Yearly Results

Total revenues for 2007 were $58.1 million, a 20% increase over

total revenues of $48.3 million reported for 2006. Gross margin in

2007 was 43%, similar to the gross margin in 2006. Operating

expenses in 2007 were $28 million, compared with $23.1 million in

2006. Excluding amortization of acquired intangibles, stock based

compensation expenses and other non-cash charges, on a non-GAAP

basis, the company reported net income of $3 million for year 2007,

or $0.16 per diluted share, compared to a non-GAAP net loss of $1.1

million, or $0.07 per share, in year 2006. On a GAAP basis, the

company reported net loss of $3.9 million in year 2007, or $0.21

per share, compared with a net loss of $1.9 million, or $0.12 per

share, in year 2006. During 2007, the company generated $4.6

million in cash flow from operating activities. Cash reserves at

the end of 2007 were $22.9 million, an increase of $7.7 million

compared to the end of 2006 and an increase of $2.4 million

compared to the end of the third quarter of 2007. Management

Comments and Outlook for 2008 "We are proud of our performance

during 2007," said Gabi Seligsohn, President and CEO. "Our team

continued to execute to our plan, achieving our strategic goals of

market share gains and new market penetration. We reported record

revenues in Q4 and the year as a whole, and excluding charges, we

achieved our goal of profitability for the third consecutive

quarter and for the year. In addition, we are generating positive

cash flow and are pleased to report higher cash balances at year

end." "In our last earnings release, we indicated our expectation

that overall capital expenditure in the semiconductor industry

would be down 10%-15% in 2008," added Seligsohn. "Although the

current quarter remains robust, we are seeing indications that the

industry decline might actually be higher, driven primarily by

postponements in DRAM investments and overall economic uncertainty.

However, the NAND flash space, which has a strong dependency on

Nova's integrated metrology products, is expected to grow this

year. In addition, our successful penetration into the foundry

space with stand alone metrology will somewhat offset the weakness

in overall capital expenditure." "In Summary", concluded Seligsohn,

"we expect industry wide capital expenditure to be down, however,

and as mentioned above, we are targeting further growth in revenues

and profitability in 2008." The Company will host a conference call

today, February 19, 2008, at 10:00am EST. To participate, please

dial in the US: +1-888-407-2553; U.K.: +44(0)-800-917-5108; or

internationally: +972-3-918-0609. A recording of the call will be

available on Nova's website, within 24 hours following the end of

the call. In addition, the conference call will also be webcast

live from a link on Nova's website at http://www.nova.co.il/. This

press release provides financial measures that exclude non-cash

charges for inventory write-off, stock-based compensation and

impairment charges and are therefore not calculated in accordance

with generally accepted accounting principals (GAAP). Management

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding Nova's performance because they

reflect our operational results and enhances management's and

investors' ability to evaluate Nova's performance before charges

considered by management to be outside Nova's ongoing operating

results. The presentation of this non-GAAP financial information is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

GAAP. Management believes that it is in the best interest of its

investors to provide financial information that will facilitate

comparison of both historical and future results and allows greater

transparency to supplemental information used by management in its

financial and operational decision making. A reconciliation of each

GAAP to non-GAAP financial measure discussed in this press release

is contained in the accompanying financial tables. About Nova Nova

Measuring Instruments Ltd. develops, produces and markets advanced

integrated and stand alone metrology solutions for the

semiconductor manufacturing industry. Nova is traded on the NASDAQ

& TASE under the symbol NVMI. The Company's website is

http://www.nova.co.il/. This press release contains forward-looking

statements within the meaning of safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 relating to future

events or our future performance, such as statements regarding

trends, demand for our products, expected deliveries, transaction,

expected revenues, operating results, earnings and profitability.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied in those forward-looking

statements. These risks and other factors include but are not

limited to: our dependency on a single integrated process control

product line; the highly cyclical nature of the markets we target;

our inability to reduce spending during a slowdown in the

semiconductor industry; our ability to respond effectively on a

timely basis to rapid technological changes; risks associated with

our dependence on a single manufacturing facility; our ability to

expand our manufacturing capacity or marketing efforts to support

our future growth; our dependency on a small number of large

customers and small number of suppliers; risks related to our

intellectual property; changes in customer demands for our

products; new product offerings from our competitors; changes in or

an inability to execute our business strategy; unanticipated

manufacturing or supply problems; changes in tax requirements;

changes in customer demand for our products and risks related to

our operations in Israel. We cannot guarantee future results,

levels of activity, performance or achievements. The matters

discussed in this press release also involve risks and

uncertainties summarized under the heading ``Risk Factors' in

Nova's Annual Report on Form 20-F for the year ended December 31,

2006 filed with the Securities and Exchange Commission on May 11,

2007. These factors are updated from time to time through the

filing of reports and registration statements with the Securities

and Exchange Commission. Nova Measuring Instruments Ltd. does not

assume any obligation to update the forward-looking information

contained in this press release. (Tables to Follow) NOVA MEASURING

INSTRUMENTS LTD. CONSOLIDATED BALANCE SHEET (U.S. dollars in

thousands) As of As of December 31, December 31, 2006 2007 CURRENT

ASSETS Cash and cash equivalents 15,324 4,176 Short-term

interest-bearing bank deposits -- 466 Short-term investments --

2,400 Held to maturity securities 2,251 3,265 Trade accounts

receivable 9,146 10,252 Inventories 8,524 8,968 Other current

assets 1,703 1,917 36,948 31,444 LONG-TERM ASSETS Long-term

interest-bearing bank deposits 2,245 3,172 Long-term investments

1,562 -- Held to maturity securities 1,489 1,704 Other Long-term

assets 169 222 Severance pay funds 2,488 2,249 7,953 7,347 FIXED

ASSETS, NET 3,484 2,601 INTANGIBLE ASSETS, NET -- 3,027 Total

assets 48,385 44,419 CURRENT LIABILITIES Trade accounts payable

7,482 6,424 Deferred income 1,496 3,048 Other current liabilities

7,310 6,099 16,288 15,571 LONG-TERM LIABILITIES Liability for

employee severance pay 3,561 3,224 Deferred income 901 979 Other

long-term liability 51 70 4,513 4,273 SHAREHOLDERS' EQUITY 27,584

24,575 Total liabilities and shareholders' equity 48,385 44,419

NOVA MEASURING INSTRUMENTS LTD. YEARLY CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except per share data) Year

ended 2007 2006 2005 REVENUES Product sales 45,604 38,258 21,985

Services 11,707 10,034 8,157 IP Licensing 766 -- -- 58,077 48,292

30,142 COST OF REVENUES Product sales 22,251 18,728 11,413

Inventory write-off related to Hypernex assets and liabilities

acquisition 303 -- -- Services 10,697 9,015 7,893 33,251 27,743

19,306 GROSS PROFIT 24,826 20,549 10,836 OPERATING EXPENSES

Research & Development expenses, net 9,143 9,166 9,301 Sales

& Marketing expenses 10,175 8,754 6,950 General &

Administration expenses 4,830 5,136 3,626 Impairment loss on

intangibles and equipment related to Hypernex assets and

liabilities acquisition 3,831 -- -- 27,979 23,056 19,877 OPERATING

LOSS (3,153) (2,507) (9,041) Interest income, net 602 573 627

Impairment of short-term investments (1,366) -- -- NET LOSS FOR THE

YEAR (3,917) (1,934) (8,414) Loss per share (0.21) (0.12) (0.55)

Shares used for calculation of loss per share 18,606 15,976 15,394

NOVA MEASURING INSTRUMENTS LTD. YEARLY CONSOLIDATED STATEMENTS OF

CASH FLOWS Year ended 2007 2006 2005 CASH FLOW - OPERATING

ACTIVITIES Net loss for the year (3,917) (1,934) (8,414)

Adjustments to reconcile net loss to net cash used in operating

activities: Depreciation and amortization 1,743 1,413 894

Impairment of intangibles and fixed assets 3,918 -- -- Amortization

of deferred stock-based 1,052 662 28 compensation Increase

(decrease) in liability for employee termination benefits, net 219

254 (66) Impairment of short-term investments 1,366 -- -- Net

recognized losses (gains) on 6 (226) (380) investments Decrease

(increase) in trade accounts 1,106 (3,411) 9 receivables Increase

in inventories (1,890) (786) (252) Decrease (increase) in other

current and long term assets 529 (736) 148 Increase in trade

accounts payables and other long term liabilities 1,058 137 904

Increase in other current liabilities 1,014 (1,089) 2,315 Decrease

in short and long term deferred (1,630) 604 (2,567) income Net cash

from (used in) operating 4,574 (5,112) (7,381) activities CASH FLOW

- INVESTMENT ACTIVITIES Decrease in short-term interest-bearing 466

567 931 bank deposits Acquisition of Assets and liabilities --

(1,577) -- Decrease (increase) in short-term (528) 1,100 (3,500)

investments Investment in short term held to maturity (491) (664)

-- securities Proceeds from held to maturity securities 3,205 5,261

5,612 Investment in long term held to maturity (1,491) -- --

securities Decrease (Increase) in long-term interest-bearing bank

deposits 927 (25) (1,050) Additions to fixed assets (1,183) (1,233)

(1,282) Net cash from investment activities 905 3,429 711 CASH FLOW

- FINANCING ACTIVITIES Shares issued in private placement 4,982 --

-- Shares issued under employee share-based 687 83 275 plans Net

cash from financing activities 5,669 83 275 Increase (decrease) in

cash and cash 11,148 (1,600) (6,395) equivalents Cash and cash

equivalents - beginning of 4,176 5,776 12,171 period Cash and cash

equivalents - end of period 15,324 4,176 5,776 NOVA MEASURING

INSTRUMENTS LTD. QUARTERLY CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except per share data) Three months

ended December 31, December September 30, 2007 31, 2006 2007

REVENUES Product sales 12,831 11,463 10,202 Services 3,177 2,603

2,924 IP Licensing -- -- 766 16,008 14,066 13,892 COST OF REVENUES

Product sales 6,341 5,562 5,558 Inventory write-off related to

Hypernex assets and liabilities acquisition -- -- 303 Services

2,751 2,751 2,695 9,092 8,313 8,556 GROSS PROFIT 6,916 5,753 5,336

OPERATING EXPENSES Research & Development expenses, 2,410 2,587

2,197 net Sales & Marketing expenses 2,896 2,747 2,553 General

& Administration expenses 944 1,283 615 Impairment loss on

intangibles and equipment related to Hypernex assets and

liabilities acquisition -- -- 3,831 6,250 6,617 9,196 OPERATING

INCOME (LOSS) 666 (864) (3,860) Interest income, net 23 104 190

Impairment of short-term (1,366) -- -- investments NET LOSS FOR THE

PERIOD (677) (760) (3,670) Loss per share (0.04) (0.05) (0.19)

Shares used for calculation of loss per share 19,256 16,771 19,026

NOVA MEASURING INSTRUMENTS LTD. QUARTERLY CONSOLIDATED STATEMENTS

OF CASH FLOWS Three months ended December 31, December September

2007 31, 2006 30, 2007 CASH FLOW - OPERATING ACTIVITIES Net loss

for the period (677) (760) (3,670) Adjustments to reconcile net

loss to net cash used in operating activities: Depreciation and

amortization 367 402 484 Impairment if intangibles and fixed -- --

3,918 assets Amortization of deferred stock-based 283 451 246

compensation Increase in liability for employee termination

benefits, net 116 86 32 Impairment of short-term investments 1,366

-- -- Net recognized losses (gains) on 10 (5) (9) investments

Decrease (increase) in trade accounts 1,109 (1,347) (1,526)

receivables Decrease (increase) in inventories (1,947) 161 855

Decrease (increase) in other current and long term assets 80 (479)

378 Decrease (increase) in trade accounts payables and other long

term liabilities 2,165 (175) 223 Increase in current liabilities

1,099 1,995 4,664 Increase (decrease) in short and long term

deferred income 46 (754) (4,997) Net cash from (used in) operating

4,017 (425) 598 activities CASH FLOW - INVESTMENT ACTIVITIES

Decrease in short-term interest-bearing -- 412 117 bank deposits

Decrease (increase) in short-term -- (2,400) 4,249 investments

Proceeds from held to maturity 900 1,739 -- securities Investment

in long-term (44) (401) (34) interest-bearing bank deposits

Additions to fixed assets (364) (496) (569) Net cash from (used in)

investment 492 (1,146) 3,763 activities CASH FLOW - FINANCING

ACTIVITIES Shares issued under employee 111 45 89 share-based plans

Net cash from (used in) financing 111 45 89 activities Increase

(decrease) in cash and cash 4,620 (1,526) 4,450 equivalents Cash

and cash equivalents - beginning 10,704 5,702 6,254 of period Cash

and cash equivalents - end of period 15,324 4,176 10,704 NOVA

MEASURING INSTRUMENTS LTD. DISCLOSURE OF NON-GAAP YEARLY NET INCOME

(LOSS) (U.S. dollars in thousands, except per share data) Year

ended 2007 2006 2005 GAAP Net loss for the year (3,917) (1,934)

(8,414) Non-GAAP Adjustments: Stock based compensation expenses

1,052 662 -- Amortization of intangible assets 326 173 -- Inventory

write-off related to Hypernex assets and liabilities acquisition

303 -- -- Impairment loss on intangibles and equipment related to

Hypernex assets and liabilities acquisition 3,831 -- -- Impairment

of short-term investments 1,366 -- -- Non-GAAP Net income (loss)

for the year 2,961 (1,099) (8,414) Non-GAAP net income (loss) per

share: Basic 0.16 (0.07) (0.55) Diluted 0.16 Shares used for

calculation of non-GAAP net income (loss) per share: Basic 18,606

15,976 15,394 Diluted 18,966 NOVA MEASURING INSTRUMENTS LTD.

DISCLOSURE OF NON-GAAP QUARTERLY NET INCOME (LOSS) (U.S. dollars in

thousands, except per share data) Three months ended December 31,

December September 2007 31, 2006 30, 2007 GAAP Net loss for the

quarter (677) (760) (3,670) Non-GAAP Adjustments: Stock based

compensation expenses 282 450 246 Amortization of intangible assets

-- 109 110 Inventory write-off related to Hypernex assets and

liabilities acquisition -- -- 303 Impairment loss on intangibles

and equipment related to Hypernex assets and liabilities

acquisition -- -- 3,831 Impairment of short-term investments 1,366

-- -- Non-GAAP Net income (loss) for the quarter 971 (201) 820

Non-GAAP net income (loss) per share: Basic 0.05 (0.01) 0.04

Diluted 0.05 0.04 Shares used for calculation of non-GAAP net

income (loss) per share: Basic 19,256 16,771 19,026 Diluted 19,572

19,632 Company Contact: Dror David, Chief Financial Officer Nova

Measuring Instruments Ltd. Tel: +972-8-938-7505 E-mail:

http://www.nova.co.il/ Investor relations Contacts: Ehud Helft /

Kenny Green GK Investor Relations Tel: +1-646-201-9246 Email:

DATASOURCE: Nova Measuring Instruments Ltd CONTACT: Company

Contact: Dror David, Chief Financial Officer, Nova Measuring

Instruments Ltd., Tel: +972-8-938-7505, E-mail: ,

http://www.nova.co.il/; Investor relations Contacts: Ehud Helft /

Kenny Green, GK Investor Relations, Tel: +1-646-201-9246, Email:

Copyright

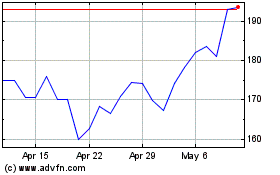

Nova (NASDAQ:NVMI)

Historical Stock Chart

From May 2024 to Jun 2024

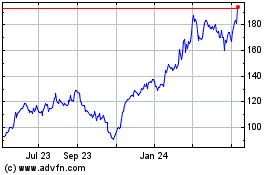

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2023 to Jun 2024