Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333‑249637

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 3, 2020)

Up to $50,000,000

Common Stock

We have entered into an Open Market Sale Agreement SM (the “Sales Agreement”) with Jefferies LLC (“Jefferies”) relating to shares of our common stock, par value $0.01 per share, offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Sales Agreement, under this prospectus, we may offer and sell shares of our common stock having an aggregate offering price of up to $50,000,000 from time to time through Jefferies acting as our agent.

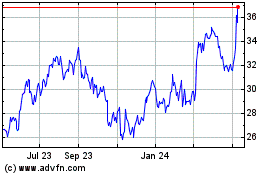

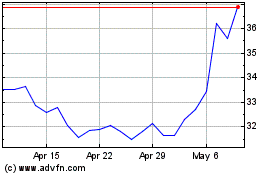

Our common stock is traded on the Nasdaq Global Select Market under the symbol “NWPX.” The last reported sales price of our common stock on the Nasdaq Global Select Market on August 30, 2022 was $32.37 per share.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Jefferies is not required to sell any specific number or dollar amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on terms mutually agreed between Jefferies and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to Jefferies for sales of common stock sold pursuant to the Sales Agreement will be an amount up to 3.0% of the gross proceeds of any shares of common stock sold under the Sales Agreement. In connection with the sale of the common stock on our behalf, Jefferies may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Jefferies may be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Jefferies with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended (the “Exchange Act”). See “Plan of Distribution” beginning on page S‑4 regarding the compensation to be paid to Jefferies.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “Risk Factors” on page S‑2 of this prospectus supplement as well as those contained in the accompanying prospectus and any related free writing prospectus or prospectus supplement we prepare or authorize in connection with this offering, and in the other documents that are incorporated by reference into this prospectus supplement or the accompanying prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Jefferies

The date of this prospectus supplement is September 2, 2022

TABLE OF CONTENTS

Page

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S‑3 that we filed with the U.S. Securities and Exchange Commission utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein and therein. References in this prospectus supplement to the “accompanying prospectus” are to the accompanying prospectus, as amended by the prospectus supplement dated September 2, 2022. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference in the accompanying prospectus - the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein. We have not, and Jefferies has not, authorized any other person to provide you with different information. The information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein or therein is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation By Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When we refer to “NW Pipe,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Northwest Pipe Company and its wholly-owned subsidiaries, unless otherwise specified.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, other than purely historical information, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), that are based on current expectations, estimates, and projections about our business, management’s beliefs, and assumptions made by management. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “forecasts,” “should,” “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements as a result of a variety of important factors. While it is impossible to identify all such factors, those that could cause actual results to differ materially from those estimated by us include:

| |

●

|

changes in demand and market prices for our products;

|

| |

●

|

product mix;

|

| |

●

|

bidding activity and order cancelations;

|

| |

●

|

timing of customer orders and deliveries;

|

| |

●

|

production schedules;

|

| |

●

|

price and availability of raw materials;

|

| |

●

|

excess or shortage of production capacity;

|

| |

●

|

international trade policy and regulations;

|

| |

●

|

changes in tariffs and duties imposed on imports and exports and related impacts on us;

|

| |

●

|

interest rate risk and changes in market interest rates;

|

| |

●

|

our ability to identify and complete internal initiatives and/or acquisitions in order to grow our business;

|

| |

●

|

our ability to effectively integrate Park Environmental Equipment, LLC (“ParkUSA”) and other acquisitions into our business and operations and achieve significant administrative and operational cost synergies and accretion to financial results;

|

| |

●

|

impacts of U.S. tax reform legislation on our results of operations;

|

| |

●

|

adequacy of our insurance coverage;

|

| |

●

|

supply chain challenges;

|

| |

●

|

labor shortages;

|

| |

●

|

ongoing military conflicts in Ukraine and related consequences;

|

| |

●

|

operating problems at our manufacturing operations including fires, explosions, inclement weather, and floods and other natural disasters;

|

| |

●

|

impacts of pandemics, epidemics, or other public health emergencies, such as coronavirus disease 2019;

|

| |

●

|

the use of proceeds, if any, from this offering; and

|

| |

●

|

other risks discussed in Part I — Item 1A. “Risk Factors” of our Annual Report on Form 10‑K for the fiscal year ended December 31, 2021 and from time to time in our other SEC filings and reports.

|

Such forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this prospectus supplement. If we do update or correct one or more forward-looking statements, investors and others should not conclude that we will make additional updates or corrections with respect thereto or with respect to other forward-looking statements.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus supplement and the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information you should consider before investing in our common stock. For a more complete understanding of our company and this offering, you should carefully read this entire prospectus supplement and the accompanying prospectus, including the information incorporated herein and therein and any free writing prospectus that we may authorize for use in connection with this offering, including the “Risk Factors” section beginning on page S‑2 of this prospectus supplement, along with our annual consolidated financial statements and quarterly (unaudited) condensed consolidated financial statements, notes to those financial statements and the other documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

Company Overview

Northwest Pipe Company is a leading manufacturer of water related infrastructure products. In addition to being the largest manufacturer of engineered steel water pipeline systems in North America, we manufacture high-quality precast and reinforced concrete products; water, wastewater, and stormwater equipment; steel casing pipe, bar-wrapped concrete cylinder pipe, and one of the largest offerings of pipeline system joints, fittings, and specialized components. Strategically positioned to meet growing water and wastewater infrastructure needs, we provide solution-based products for a wide range of markets under the ParkUSA, Geneva Pipe and Precast, Permalok®, and Northwest Pipe Company lines. Our diverse team is committed to quality and innovation while demonstrating our core values of accountability, commitment, and teamwork. We are headquartered in Vancouver, Washington, and have 13 manufacturing facilities across North America.

Our water infrastructure products are sold generally to installation contractors, who include our products in their bids to federal, state, and municipal agencies, privately-owned water companies, or developers for specific projects. We believe our sales are substantially driven by spending on urban growth and new water infrastructure with a recent trend towards spending on water infrastructure replacement, repair, and upgrade. Within the total range of products, our steel pipe tends to fit the larger-diameter, higher-pressure pipeline applications, while our precast concrete products mainly serve stormwater and sanitary sewer systems.

With steady population growth and regional community expansion, as well as continued drought conditions, existing water sources have become stressed, and we see continued opportunities for growth in North American infrastructure.

Corporate Information

We are an Oregon corporation headquartered in Vancouver, Washington. Our principal executive offices are located at 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684, and our telephone number is (360) 397‑6250. Our website address is http://www.nwpipe.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus supplement.

|

THE OFFERING

|

|

Common stock offered by us

|

Shares of our common stock having an aggregate offering price of up to $50,000,000.

|

|

Common stock to be outstanding immediately after this offering

|

The actual number of shares to be issued in this offering, and the common stock to be outstanding immediately after this offering, will vary depending on the sales prices under this offering. As a result, the actual number of shares issued in this offering, and the common stock to be outstanding immediately after this offering, are not determinable at this time. As more fully described in the notes following this table, if all sales in this offering were made at $32.37, which was the last reported sale price of our common shares on the Nasdaq Global Select Market on August 30, 2022, it would result in the sale of 1,544,640 shares of our common stock in the offering, and 11,472,000 shares outstanding immediately after the offering.

|

|

Plan of Distribution

|

“At the market offering” that may be made from time to time through our sales agent, Jefferies LLC. See the section entitled “Plan of Distribution” on page S‑4 of this prospectus supplement.

|

|

Use of Proceeds

|

We currently intend to use the net proceeds of this offering for general corporate purposes, which may include making capital expenditures, funding working capital and repaying indebtedness which may include repaying borrowings under our Credit Agreement dated June 30, 2021, as amended, with Wells Fargo Bank, National Association, as administrative agent, and the lenders from time to time party thereto. Pending any such use, we may temporarily invest the net proceeds from this offering in short-term or long-term, investment-grade, interest-bearing securities. See the section entitled “Use of Proceeds” on page S‑3 of this prospectus supplement.

|

|

Risk Factors

|

Investing in our common stock involves significant risks. See the disclosure under the heading “Risk Factors” on page S‑2 in this prospectus supplement and under similar headings in other documents incorporated by reference into this prospectus supplement.

|

|

Nasdaq Global Select Market symbol

|

“NWPX”

|

|

The number of shares of our common stock shown in the example above to be outstanding after this offering is based on 9,927,360 shares of our common stock outstanding as of June 30, 2022, and assumes the issuance and sale of 1,544,640 shares of our common stock at $32.37 per share, which was the last reported sale price of our common shares on the Nasdaq Global Select Market on August 30, 2022, and excludes:

|

| ● |

200,924 shares for future issuance pursuant to previously awarded but unvested restricted stock units (“RSUs”) and performance share awards (“PSAs”), with PSAs being reserved for at target under the Company’s 2007 Stock Incentive Plan, as amended (the “2007 Plan”) and the Company’s 2022 Stock Incentive Plan (the “2022 Plan”) as of June 30, 2022; |

| ● |

873,402 shares of common stock reserved and available for future issuance from time to time, under the Company’s 2022 Stock Incentive Plan. |

RISK FACTORS

Investment in any securities offered pursuant to this prospectus supplement and the accompanying prospectus involves risks. You should carefully consider the risk factors described below, in our Annual Report on Form 10‑K for the year ended December 31, 2021, incorporated by reference in this prospectus supplement, any amendment or update thereto reflected in subsequent filings with the SEC, including in our Annual Reports on Form 10‑K and Quarterly Reports on Form 10‑Q, and all other information contained or incorporated by reference in this prospectus supplement, as updated by our subsequent filings under the Exchange Act. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Risks Relating to this Offering

You may experience dilution.

Because the sales of the shares offered hereby will be made directly into the market or in negotiated transactions, the prices at which we sell these shares will vary and these variations may be significant. The offering price per share in this offering may be less than the net tangible book value per share of our common stock outstanding prior to this offering. Purchasers of the shares we sell, as well as our existing shareholders, will experience significant dilution if we sell shares at prices significantly below net tangible book value.

We will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other shareholders may not approve.

Our management will have broad discretion in the use of the net proceeds, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure of our management to use these funds effectively could have a material adverse effect on our business and cause the market price of our common stock to decline. Pending their use, we may temporarily invest the net proceeds from this offering in short-term or long-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our shareholders.

The actual number of shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to Jefferies at any time throughout the term of the Sales Agreement. The number of shares that are sold, if any, by Jefferies after delivering a placement notice will fluctuate based on the market price of our common stock during the sales period and limits we set with Jefferies. Because the sale of any shares is uncertain, and the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

The common stock offered hereby will be sold in “at the market offerings”, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no maximum sales price, and the minimum sales price set by our board may be changed or waived by it. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

There may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

We are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after this offering or the perception that such sales could occur.

Resales of our common stock in the public market during this offering by our shareholders may cause the market price of our common stock to fall.

We may issue common stock from time to time in connection with this offering. This issuance from time to time of these new shares of our common stock, or our ability to issue these shares of common stock in this offering, could result in resales of our common stock by our current shareholders concerned about the potential dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our common stock.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $50,000,000 from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under the Sales Agreement with Jefferies.

We currently intend to use any net proceeds from the sale of securities under this prospectus supplement and the accompanying prospectus for general corporate purposes, which may include making capital expenditures, funding working capital and repaying indebtedness which may include repaying borrowings under our Credit Agreement dated June 30, 2021 with Wells Fargo Bank, National Association (“Wells Fargo”), as administrative agent, and the lenders from time to time party thereto, including the initial sole lender, Wells Fargo (the “Lenders”), as amended by the Incremental Amendment dated October 22, 2021 and the Second Amendment to the Credit Agreement dated April 29, 2022 (together, the “Amended Credit Agreement”).

The Amended Credit Agreement provides for a revolving loan, swingline loan, and letters of credit in the aggregate amount of up to $125 million (“Revolver Commitment”). The Amended Credit Agreement will expire, and all obligations outstanding will mature, on June 30, 2024. Revolving loans under the Amended Credit Agreement bear interest at rates related to, at our option and subject to the provisions of the Amended Credit Agreement, either: (i) Base Rate (as defined in the Amended Credit Agreement) plus the Applicable Margin; (ii) Adjusted Term Secured Overnight Financing Rate (“SOFR”) (as defined in the Amended Credit Agreement) plus the Applicable Margin; or (iii) Adjusted Daily Simple SOFR (as defined in the Amended Credit Agreement) plus the Applicable Margin. The “Applicable Margin” is 1.75% to 2.35%, depending on our Consolidated Senior Leverage Ratio (as defined in the Amended Credit Agreement) and the interest rate option chosen. Interest on outstanding revolving loans is payable quarterly. Swingline loans under the Amended Credit Agreement bear interest at the Base Rate plus the Applicable Margin. Interest on outstanding revolving loans is payable quarterly. The Amended Credit Agreement requires the payment of a commitment fee of between 0.30% and 0.40%, based on the amount by which the Revolver Commitment exceeds the average daily balance of outstanding borrowings (as defined in the Amended Credit Agreement). Such fee is payable quarterly in arrears. We are also obligated to pay additional fees customary for credit facilities of this size and type. We may prepay outstanding amounts in its discretion without penalty at any time, subject to applicable notice requirements. We have borrowed funds under the Amended Credit Agreement to, among other purposes, fund the acquisition of 100% of Park Environmental Equipment, LLC (“ParkUSA”), which was completed on October 5, 2021. As of June 30, 2022 under the Amended Credit Agreement, we had $86.7 million of outstanding revolving loan borrowings, $1.1 million of outstanding letters of credit, and additional borrowing capacity of approximately $37 million.

Pending any such use, we may temporarily invest the net proceeds from this offering in short-term or long-term, investment-grade, interest-bearing securities.

We have not determined the amounts we plan to spend on the areas listed above or the timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common shares. We currently anticipate that we will retain all available funds and future earnings for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable future.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with Jefferies, under which we may offer and sell up to $50,000,000 of our shares of common stock from time to time through Jefferies acting as agent. Sales of our shares of common stock, if any, under this prospectus supplement and the accompanying prospectus will be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act.

Each time we wish to issue and sell shares of common stock under the Sales Agreement, we will notify Jefferies of the number of shares to be issued, the dates on which such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which sales may not be made. Once we have so instructed Jefferies, unless Jefferies declines to accept the terms of such notice, Jefferies has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of Jefferies under the Sales Agreement to sell our shares of common stock are subject to a number of conditions that are specified in the Sales Agreement.

The settlement of sales of shares between us and Jefferies is generally anticipated to occur on the second trading day following the date on which the sale was made. Sales of our shares of common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Jefferies may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Jefferies a commission of up to 3.0% of the aggregate gross proceeds we receive from each sale of our shares of common stock. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. In addition, we have agreed to reimburse Jefferies for the fees and disbursements of its counsel, payable upon execution of the Sales Agreement, in an amount not to exceed $75,000, in addition to certain ongoing disbursements of its legal counsel unless we and Jefferies otherwise agree. We estimate that the total expenses for the offering, excluding any commissions or expense reimbursement payable to Jefferies under the terms of the Sales Agreement, will be approximately $200,000. The remaining sale proceeds, after deducting any other transaction fees, will constitute our net proceeds from the sale of such shares.

Jefferies will provide written confirmation to us before the open on the Nasdaq Global Select Market on the day following each day on which shares of common stock are sold under the Sales Agreement. Each confirmation will include the number of shares sold on that day, the aggregate gross proceeds of such sales and the proceeds to us.

In connection with the sale of the shares of common stock on our behalf, Jefferies may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of Jefferies may be deemed to be underwriting commissions or discounts. We have agreed to indemnify Jefferies against certain civil liabilities, including liabilities under the Securities Act. We have also agreed to contribute to payments Jefferies may be required to make in respect of such liabilities.

The offering of our shares of common stock pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the Sales Agreement, or (ii) the termination of the Sales Agreement as permitted therein. We and Jefferies may each terminate the Sales Agreement at any time upon ten days’ prior notice.

This summary of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Sales Agreement has been filed as an exhibit to a current report on Form 8‑K filed under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and incorporated by reference in this prospectus supplement.

Jefferies and its affiliates may in the future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates, for which services they may in the future receive customary fees. In the course of its business, Jefferies may actively trade our securities for its own account or for the accounts of customers, and, accordingly, Jefferies may at any time hold long or short positions in such securities.

D.A. Davidson & Co. is acting as our financial advisor in connection with this offering and will receive reasonable and customary fees for such services.

A copy of this prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Jefferies, and Jefferies may distribute the prospectus supplement and the accompanying prospectus electronically.

LEGAL MATTERS

Buchalter, a Professional Corporation, Portland, Oregon, will pass upon certain legal matters relating to the issuance and sale of the securities offered hereby on behalf of Northwest Pipe Company. Jefferies LLC is being represented in connection with this offering by Goodwin Procter LLP, New York, New York.

EXPERTS

The consolidated financial statements and related financial statement schedule incorporated in this prospectus supplement by reference from our Annual Report on Form 10‑K for the year ended December 31, 2021, and the effectiveness of internal control over financial reporting as of December 31, 2021, have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their report which is incorporated herein by reference. Such consolidated financial statements and financial statement schedule have been so incorporated in reliance upon the report of such firm given upon their authority as experts in auditing and accounting.

INCORPORATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus supplement or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

We incorporate by reference in this prospectus supplement the following documents that we have previously filed with the SEC (excluding any information furnished under Items 2.02 or 7.01 of Form 8‑K or related exhibits furnished pursuant to Item 9.01 of Form 8‑K):

| |

●

|

our annual report on Form 10‑K for the year ended December 31, 2021, filed with the SEC on March 16, 2022;

|

| |

●

|

our quarterly report on Form 10‑Q for the quarters ended March 31, 2022 and June 30, 2022 filed with the SEC on May 6, 2022 and August 9, 2022, respectively;

|

| |

●

|

our definitive proxy statement on Schedule 14A filed with the SEC on April 28, 2022;

|

| |

●

|

our current reports on Form 8‑K filed with the SEC on March 9, 2022, April 13, 2022, June 23, 2022, and June 29, 2022; and

|

| |

●

|

the description of our common stock contained in our registration statement on Form 8‑A, filed with the SEC on July 1, 1999, as amended on June 19, 2009 and July 3, 2019, as updated by the description of our common stock contained in Exhibit 4.1 to our Annual Report on Form 10‑K for the fiscal year ended December 31, 2021, and as amended by any subsequent amendment or any report filed for the purpose of updating such description.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished under Items 2.02 or 7.01 of Form 8‑K or related exhibits furnished pursuant to Item 9.01 of Form 8‑K) from the date of this prospectus supplement and prior to the termination of this offering shall also be deemed to be incorporated by reference in this prospectus supplement. These documents include periodic reports, which include Annual Reports on Form 10‑K and Quarterly Reports on Form 10‑Q, as well as Current Reports on Form 8‑K and proxy statements.

You may request a free copy of any of the documents incorporated by reference in this prospectus supplement by writing or telephoning us at the following address:

Northwest Pipe Company

201 NE Park Plaza Drive, Suite 100

Vancouver, Washington 98684

(360) 397-6250

Attention: Corporate Secretary

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus supplement. You should rely only on the information incorporated by reference or provided in this prospectus supplement. We have not authorized anyone else to provide you with different or additional information. An offer of these securities is not being made in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus supplement is accurate as of any date other than the date on the front of those documents.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC. This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities we are offering under this prospectus supplement, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. You should rely only on the information contained in this prospectus supplement or incorporated by reference in this prospectus supplement. We have not authorized anyone else to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus supplement is accurate as of any date other than the date on the front page of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of the securities offered by this prospectus supplement.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial document retrieval services and over the Internet at the SEC’s website at http://www.sec.gov.

Copies of certain information filed by us with the SEC are also available on our website at http://www.nwpipe.com. Information contained in or accessible through our website does not constitute a part of this prospectus supplement and is not incorporated by reference in this prospectus supplement.

PROSPECTUS

$150,000,000

COMMON STOCK

PREFERRED STOCK

DEBT SECURITIES

WARRANTS

UNITS

From time to time, we may offer and sell our common stock, preferred stock, debt securities, and warrants that have an aggregate initial offering price of up to $150,000,000 in one or more offerings. We may offer these securities separately, together, or as units with other securities in any combination. This prospectus provides you with a general description of the securities we may offer. Each time we sell shares of our common stock, shares of our preferred stock, debt securities, or warrants, we will provide a supplement to this prospectus that contains specific information about the offering. The supplement may also add, update, or change information contained in this prospectus.

We may offer our securities through agents, underwriters, or dealers or directly to investors. Each prospectus supplement will provide the amount, price, and terms of the plan of distribution relating to the securities to be sold pursuant to such prospectus supplement. We will set forth the names of any underwriters or agents in the accompanying prospectus supplement, as well as the net proceeds we expect to receive from such sale. In addition, the underwriters, if any, may over-allot a portion of the securities.

You should carefully read this prospectus and all prospectus supplements before you invest in the securities described in the prospectus. This prospectus may not be used to sell securities unless it is accompanied by a prospectus supplement that describes those securities.

Our common stock is quoted on the Nasdaq Global Select Market under the symbol “NWPX.” On October 22, 2020, the last reported sale price of our common stock on the Nasdaq Global Select Market was $29.30.

Investing in the securities being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the discussion under the heading “Risk Factors” beginning on page 2 regarding information included and incorporated by reference in this prospectus and the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is November 3, 2020

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing the “shelf” registration process. Under this registration statement, we may sell up to a total dollar amount of $150,000,000 of any combination of the securities described in this prospectus from time to time and in one or more offerings. When we use the term “securities” in this prospectus or in any supplement to this prospectus, we mean any of the securities that we may offer under this prospectus, unless we say otherwise. This prospectus only provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a supplement to this prospectus that contains specific information about the terms of that sale. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any free writing prospectus we may authorize to be provided to you may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference in this prospectus. Before purchasing the securities, you should carefully read this prospectus, any applicable prospectus supplement, and any related free writing prospectus, together with the additional information incorporated by reference herein as described under the headings “Where You Can Find More Information” and “Information Incorporated By Reference.”

You should rely only on the information contained in or incorporated by reference into this prospectus and any applicable prospectus supplement. We have not authorized any other person to provide you with information in addition to, or different from, that contained in this prospectus, any applicable prospectus supplement, and any related free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where their offer or sale is not permitted. You should assume that the information contained in this prospectus, any applicable prospectus supplement, or any related free writing prospectus is accurate only as of the date on the front cover of the document (unless the information specifically indicates that another date applies) and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any related free writing prospectus or of any sale of the securities.

When used in this prospectus or in any applicable prospectus supplement, the terms “the Company,” “we,” “our” and “us” refer to Northwest Pipe Company and its consolidated subsidiaries, unless otherwise specified.

ABOUT NORTHWEST PIPE COMPANY

Northwest Pipe Company is a leading manufacturer for water related infrastructure products. In addition to being the largest manufacturer of engineered steel water pipeline systems in North America, we produce high-quality precast and reinforced concrete products, Permalok® steel casing pipe, bar-wrapped concrete cylinder pipe, as well as custom linings, coatings, joints, and one of the largest offerings of fittings and specialized components. Our solution-based products serve a wide range of markets including water transmission and infrastructure, water and wastewater plant piping, structural stormwater and sewer systems, trenchless technology, and pipeline rehabilitation. Our prominent position is based on a widely-recognized reputation for quality, service, and manufacturing to meet performance expectations in all categories including highly-corrosive environments. Our manufacturing facilities are strategically positioned to meet growing water and wastewater infrastructure needs. These pipeline systems are produced from several manufacturing facilities which are located in Portland, Oregon; Adelanto, California; Saginaw, Texas; Tracy, California; Parkersburg, West Virginia; Salt Lake City, Utah; Orem, Utah; St. George, Utah; St. Louis, Missouri; and San Luis Río Colorado, Mexico.

With steady population growth and regional community expansion, as well as continued drought conditions, existing water sources have become stressed. We believe our sales are substantially driven by spending on urban growth and new water infrastructure with a recent trend towards spending on water infrastructure replacement, repair, and upgrade. Our water infrastructure products are sold generally to installation contractors, who include our products in their bids to federal, state, and municipal agencies, privately-owned water companies, or developers for specific projects. Within the range of products, our precast products mainly serve stormwater and sanitary sewer systems, while our steel pipe tends to fit the larger-diameter, higher-pressure pipeline applications.

Our principal executive offices are located at 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684 and our telephone number is 360‑397‑6250. Our website address is www.nwpipe.com. Information contained on our website is not part of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described under the heading “Risk Factors” contained in any applicable prospectus supplement and any applicable free writing prospectus, as well as the risk factors set forth in our most recently filed Annual Report on Form 10‑K and any material changes to those risk factors set forth in a Quarterly Report on Form 10‑Q. You should also refer to the other information in this prospectus and any applicable prospectus supplement, including our financial statements and the related notes incorporated by reference into this prospectus. Additional risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus and in the documents that we incorporate by reference into this prospectus contains, and supplements to this prospectus may contain, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are based on current expectations, estimates, and projections about our business, management’s beliefs, and assumptions made by management. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “forecasts,” “should,” “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that we make in this prospectus, in a prospectus supplement, and in the documents that we incorporate by reference into this prospectus are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. In particular, statements that we make in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” relating to our revenues, profitability, and the sufficiency of capital to meet working capital and capital expenditures requirements are forward-looking statements. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements as a result of a variety of important factors. While it is impossible to identify all such factors, those that could cause actual results to differ materially from those estimated by us include:

| |

●

|

changes in demand and market prices for our products;

|

| |

●

|

product mix;

|

| |

●

|

bidding activity;

|

| |

●

|

the timing of customer orders and deliveries;

|

| |

●

|

production schedules;

|

| |

●

|

the price and availability of raw materials;

|

| |

●

|

price and volume of imported product;

|

| |

●

|

excess or shortage of production capacity;

|

| |

●

|

international trade policy and regulations;

|

| |

●

|

changes in tariffs and duties imposed on imports and exports and related impacts on us;

|

| |

●

|

our ability to identify and complete internal initiatives and/or acquisitions in order to grow our business;

|

| |

●

|

our ability to effectively integrate Geneva Pipe and Precast (fka Geneva Pipe Company, Inc.) and other acquisitions into our business and operations and achieve significant administrative and operational cost synergies and accretion to financial results;

|

| |

●

|

the impacts of recent U.S. tax reform legislation on our results of operations;

|

| |

●

|

the adequacy of our insurance coverage;

|

| |

●

|

operating problems at our manufacturing operations including fires, explosions, inclement weather, and natural disasters;

|

| |

●

|

the impact of pandemics, epidemics, or other public health emergencies, such as the recent outbreak of coronavirus disease 2019; and

|

| |

●

|

other risks discussed in our Annual Report on Form 10‑K for the year ended December 31, 2019, in any applicable prospectus supplement related hereto, any applicable free writing prospectus, and from time to time in our other SEC filings and reports.

|

Such forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date hereof. If we do update or correct one or more forward-looking statements, investors and others should not conclude that we will make additional updates or corrections with respect thereto or with respect to other forward-looking statements.

USE OF PROCEEDS

Except as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities for working capital and other general corporate purposes, including, without limitation, making acquisitions of assets, businesses, or securities, share repurchases, repayment or refinancing of debt, payment of obligations under outstanding leases, and capital expenditures. When a particular series of securities is offered, the prospectus supplement relating thereto will set forth our intended use of the net proceeds we receive from the sale of the securities. Pending the application of the net proceeds, we may invest our net proceeds temporarily.

GENERAL DESCRIPTION OF SECURITIES WE MAY SELL

We, directly or through agents, dealers or underwriters that we may designate, may offer and sell, from time to time, up to $150,000,000 aggregate initial offering price of shares of our common stock, shares of our preferred stock, warrants to purchase shares of our common stock, preferred stock, or debt securities, debt securities, which may be either senior debt securities or subordinated debt securities, in each case consisting of notes or other evidence of indebtedness, or any combination of these securities. We may offer and sell these securities either separately, together, or as units, each on terms to be determined at the time of the offering. We may issue debt securities and/or preferred stock that are exchangeable for and/or convertible into common stock or any of the other securities that may be sold under this prospectus. When particular securities are offered, a supplement to this prospectus will be delivered with this prospectus, which will describe the terms of the offering and sale of the offered securities.

DESCRIPTION OF CAPITAL STOCK

We are authorized to issue 15,000,000 shares of common stock, par value $0.01 per share, and 10,000,000 shares of preferred stock, par value $0.01 per share. As of September 30, 2020, there were 9,805,437 shares of common stock outstanding, and no shares of preferred stock outstanding.

This section describes the general terms and provisions of the common stock that we may offer separately, upon exercise of a warrant, upon conversion or exchange of a debt security, or upon conversion or exchange of our preferred stock, as well as the general terms and provisions of our preferred stock that we may issue separately or upon exercise of a warrant or upon conversion or exchange of a debt security. The following description of our common stock and preferred stock is summarized from, and qualified in its entirety by reference to, our Second Restated Articles of Incorporation, as amended, a copy of which has been filed with the SEC and is incorporated by reference as an exhibit to the registration statement of which this prospectus is a part. This summary is not intended to give full effect to provisions of statutory or common law. We urge you to review the following documents because they, and not this summary, define your rights as a holder of shares of common stock:

| |

●

|

the Oregon Business Corporation Act, as it may be amended from time to time;

|

| |

●

|

our Second Restated Articles of Incorporation, as amended to date and as may be amended or restated from time to time; and

|

| |

●

|

our Third Amended and Restated Bylaws, as amended to date and as may be amended or restated from time to time.

|

Common Stock

Holders of common stock are entitled to receive such dividends as may from time to time be declared by our board of directors out of funds legally available therefor, subject to any preferential dividend rights granted to the holders of any outstanding series of preferred stock. We currently intend to retain our earnings for use in our business and, therefore, we do not anticipate paying any cash dividends in the foreseeable future. We have never declared or paid any cash dividends on our capital stock. In the future, the decision to pay any cash dividends will depend upon our results of operations, financial condition, and capital expenditure plans, as well as such other factors as our board of directors, in its sole discretion, may consider relevant. Holders of common stock are entitled to one vote per share on all matters on which the holders of common stock are entitled to vote and do not have any cumulative voting rights. Holders of common stock have no preemptive, conversion, redemption, or sinking fund rights. In the event of our liquidation, dissolution, or winding up, holders of common stock are entitled to share equally and ratably in our assets, if any, remaining after the payment of all of our debts and liabilities and the liquidation preference of any outstanding class or series of preferred stock. The outstanding shares of common stock are, and the shares of common stock offered by us hereby when issued will be, fully paid and nonassessable. The rights, preferences, and privileges of holders of common stock are subject to any series of preferred stock that we may issue in the future as described below.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “NWPX.”

Preferred Stock

We may issue shares of our preferred stock from time to time, in one or more series. Under our Articles of Incorporation, our board of directors has the authority, without further action by shareholders, to designate up to 10,000,000 shares of preferred stock, $0.01 par value per share, in one or more series and to fix the rights, preferences, privileges, qualifications, and restrictions granted to or imposed upon the preferred stock, including but not limited to dividend rights, conversion rights, voting rights, rights and terms of redemption, liquidation preference, and sinking fund terms, any or all of which may be greater than the rights of the common stock.

If we issue preferred stock, we will fix the rights, preferences, privileges, qualifications, and restrictions of the preferred stock of each series that we sell under this prospectus and applicable prospectus supplements in an amendment to the Articles of Incorporation. We will also incorporate by reference into the registration statement, of which this prospectus is a part, the form of any amendment to the Articles of Incorporation that describes the terms of the series of preferred stock we are offering before the issuance of the related series of preferred stock. We urge you to read the prospectus supplement related to any series of preferred stock we may offer, as well as the complete amendment to the Articles of Incorporation that contains the terms of the applicable series of preferred stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock upon the rights of holders of our common stock until our board of directors determines the specific rights of the holders of the preferred stock. However, these effects might include restricting dividends on the common stock, diluting the voting power of the common stock, impairing the liquidation rights of the common stock, and delaying or preventing a change in control of our company.

Anti-takeover Effects of Certain Provisions of Oregon Law, the Articles and Bylaws

We are subject to the Oregon Business Combination Act (“Business Combination Act”). The Business Combination Act generally provides that in the event a person or entity acquires 15% or more of the voting stock of an Oregon corporation, thereby becoming an “interested shareholder,” the corporation and the interested shareholder, or any affiliated entity, may not engage in certain business combination transactions for a period of three years following the date the person became an interested shareholder. Business combination transactions for this purpose include:

| |

●

|

a merger or plan of share exchange;

|

| |

●

|

any sale, lease, exchange, mortgage, pledge, transfer, or other disposition of the assets of the corporation where the assets have an aggregate market value equal to 10% or more of the aggregate market value of the corporation’s assets or outstanding capital stock; or

|

| |

●

|

certain transactions that result in the issuance of capital stock of the corporation to the interested shareholder.

|

These restrictions imposed by the Business Combination Act are not applicable if:

| |

●

|

as a result of the transaction in which a person became an interested shareholder, the interested shareholder will own at least 85% of the outstanding voting stock of the corporation (excluding shares owned by directors who are also officers and certain employee benefit plans);

|

| |

●

|

the board of directors approves the business combination or transaction that resulted in the person becoming an interested shareholder; or

|

| |

●

|

the board of directors and the holders of at least two-thirds of the outstanding voting stock of the corporation (excluding shares owned by the interested shareholder) approve the business combination after the interested shareholder has acquired 15% or more of the corporation’s voting stock.

|

We are also subject to provisions of Oregon law that may restrict the ability of our significant shareholders to exercise voting rights. The Oregon Control Share Act generally applies to a person who acquires voting stock of an Oregon corporation in a transaction that results in that person holding more than one-fifth, one-third, or one-half of the total voting power of the voting shares of the corporation. If such a transaction occurs, the person cannot vote the shares acquired in the acquisition unless voting rights are restored to those shares by a vote of:

| |

●

|

the holders of a majority of the outstanding voting shares of each voting group entitled to vote; and

|

| |

●

|

the holders of a majority of the outstanding voting shares, excluding the acquired shares and shares held by the corporation’s officers and inside directors.

|

The restricted shareholder may, but is not required to, submit to the corporation a statement setting forth information about itself and its plans with respect to the corporation. The statement may request that the corporation call a special meeting of shareholders to determine whether voting rights will be granted to the shares acquired. If a special meeting of shareholders is not requested, the issue of voting rights of the acquired shares will be considered at the next annual or special meeting of shareholders that is held more than 60 days after the date the shares are acquired.

Our Second Restated Articles of Incorporation, as amended, contain provisions that (i) classify the board of directors into three classes, each of which serves for a three-year term with one class elected each year, (ii) provide that directors may be removed by shareholders only for cause and only upon the affirmative vote of 75% of the outstanding shares of common stock, (iii) permit the board of directors to issue preferred stock in one or more series and to fix the number of shares constituting any such series, the voting powers, and all other rights and preferences of any such series, without any further vote or action by our shareholders, and (iv) require the approval of the holders of not less than sixty-seven percent (67%) of the outstanding shares of the Company for any agreement of merger or consolidation, sale of all or substantially all of the Company’s assets, or dissolution or liquidation of the Company.

Our Third Amended and Restated Bylaws, as amended, contain provisions requiring that (i) any action to be taken by our shareholders must be effected at a duly called annual or special meeting of shareholders, except where such action is taken by the unanimous written consent of all shareholders entitled to vote on such action; and (ii) any shareholder seeking to present proposals before a meeting of shareholders or to nominate candidates for election to the board of directors at a meeting of shareholders must provide notice in writing in a timely manner in advance of any such action.

The staggered terms for directors, the provisions allowing the removal of directors only for cause, the availability of preferred stock for issuance without shareholder approval, the limitation on shareholder action by less than unanimous written consent, and the advance notice requirement for proposals and nominations by shareholders may have the effect of lengthening the time required for a person to acquire control of us through a proxy contest or the election of a majority of the board of directors and may deter any potential unfriendly offers or other efforts to obtain control. This could deprive our shareholders of opportunities to realize a premium for their common stock and could make removal of incumbent directors more difficult. At the same time, these provisions may have the effect of inducing any persons seeking control of us to negotiate terms acceptable to the board of directors.

Transfer Agent

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of common stock, preferred stock, or debt securities. Warrants may be issued independently or together with any other securities pursuant to any prospectus supplement and may be attached to or separate from such securities. Each series of warrants will be issued under a separate warrant agreement between us and the warrant recipient or, if the recipients are numerous, a warrant agent identified in the applicable prospectus supplement. The terms of any warrants to be issued and a description of the material provisions of the applicable warrant agreement will be set forth in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below. We urge you to read the applicable prospectus supplement, as well as the complete warrant agreements and warrant certificates that contain the terms of the warrants.

The applicable prospectus supplement will describe the terms of any warrants in respect of which this prospectus is being delivered, including, where applicable, the following:

| |

●

|

the title of such warrants;

|

| |

●

|

the aggregate number of such warrants;

|

| |

●

|

the price or prices at which and the currency or currencies in which such warrants will be issued;

|

| |

●

|

the designation, number, and terms of the securities purchasable upon exercise of such warrants;

|

| |

●

|

the date, if any, on and after which such warrants and the securities will be separately transferable;

|

| |

●

|

the price at which and the currency or currencies in which the securities purchasable upon exercise of such warrants may be purchased;

|

| |

●

|

the minimum or maximum amount of such warrants that may be exercised at any one time;

|

| |

●

|

any provisions for adjustment of the number or amount of the securities receivable upon exercise of the warrants or the exercise price of the warrants;

|

| |

●

|

the dates or periods during which the warrants are exercisable;

|

| |

●

|

the designation and terms of any securities with which the warrants are issued;

|

| |

●

|

the rights, if any, we have to redeem the warrants;

|

| |

●

|

any terms, procedures, and limitations relating to the transferability, exchange, or exercise of the warrants;

|

| |

●

|

the name of the warrant agent;

|

| |

●

|

information with respect to book-entry procedures, if any;

|

| |

●

|

a discussion of certain federal income tax considerations applicable to the warrants; and

|

| |

●

|

any other material terms of such warrants.

|

Before exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including the right to receive dividends, if any, or payments upon our liquidation, dissolution, or winding up or to exercise voting rights, if any.

Each warrant will entitle the holder thereof to purchase for cash the amount of debt securities or number of shares of preferred stock or common stock at the exercise price as will in each case be set forth in, or be determinable as set forth in, the applicable prospectus supplement. Warrants may be exercised at any time up to the close of business on the expiration date set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information we include in any applicable prospectus supplement, summarizes certain general terms and provisions of the debt securities that we may offer under this prospectus. When we offer to sell a particular series of debt securities, we will describe the specific terms of the series in a supplement to this prospectus. We will also indicate in the supplement to what extent the general terms and provisions described in this prospectus apply to a particular series of debt securities.

We may issue debt securities either separately, or together with, or upon the conversion or exercise of or in exchange for, other securities described in this prospectus. Debt securities may be our senior, senior subordinated, or subordinated obligations and, unless otherwise specified in a supplement to this prospectus, the debt securities will be our direct, unsecured obligations and may be issued in one or more series.

The debt securities will be issued under an indenture between us and a third party to be identified therein as trustee. We have summarized select portions of the indenture below. The summary is not complete. The form of the indenture has been filed as an exhibit to the registration statement and you should read the indenture for provisions that may be important to you. Capitalized terms used in the summary and not defined herein have the meanings specified in the indenture.

General

The terms of each series of debt securities will be established by or pursuant to a resolution of our board of directors and set forth or determined in the manner provided in a resolution of our board of directors, in an officer’s certificate, or by a supplemental indenture. The particular terms of each series of debt securities will be described in a prospectus supplement relating to such series.

We can issue an unlimited amount of debt securities under the indenture that may be in one or more series with the same or various maturities, at par, at a premium or at a discount. We will set forth in a prospectus supplement relating to any series of debt securities being offered, the aggregate principal amount and the following terms of the debt securities, if applicable:

| |

●

|

the title and ranking of the debt securities (including the terms of any subordination provisions);

|

| |

●

|

the price or prices (expressed as a percentage of the principal amount) at which we will sell the debt securities;

|

| |

●

|

any limit on the aggregate principal amount of the debt securities;

|

| |

●

|

the date or dates on which the principal of the securities of the series is payable;

|

| |

●

|

the rate or rates (which may be fixed or variable) per annum or the method used to determine the rate or rates (including any commodity, commodity index, stock exchange index or financial index) at which the debt securities will bear interest, the date or dates from which interest will accrue, the date or dates on which interest will commence and be payable and any regular record date for the interest payable on any interest payment date;

|

| |

●

|

the place or places where principal of, and interest, if any, on the debt securities will be payable (and the method of such payment), where the securities of such series may be surrendered for registration of transfer or exchange, and where notices and demands to us in respect of the debt securities may be delivered;

|

| |

●

|

the period or periods within which, the price or prices at which and the terms and conditions upon which we may redeem the debt securities;

|

| |

●

|

any obligation we have to redeem or purchase the debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder of debt securities and the period or periods within which, the price or prices at which and in the terms and conditions upon which securities of the series shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

|

| |

●

|

the dates on which and the price or prices at which we will repurchase debt securities at the option of the holders of debt securities and other terms and provisions of these repurchase obligations;

|

| |

●

|

the denominations in which the debt securities will be issued, if other than denominations of $1,000 and any integral multiple thereof;

|

| |

●

|

whether the debt securities will be issued in the form of certificated debt securities or global debt securities;

|

| |

●

|

the portion of principal amount of the debt securities payable upon declaration of acceleration of the maturity date, if other than the principal amount;

|

| |

●

|

the currency of denomination of the debt securities, which may be United States Dollars or any foreign currency, and if such currency of denomination is a composite currency, the agency or organization, if any, responsible for overseeing such composite currency;

|

| |

●

|

the designation of the currency, currencies, or currency units in which payment of principal of, premium, if any, and interest on the debt securities will be made;

|

| |

●

|

if payments of principal of, premium, if any, or interest on the debt securities will be made in one or more currencies or currency units other than that or those in which the debt securities are denominated, the manner in which the exchange rate with respect to these payments will be determined;

|

| |

●

|

the manner in which the amounts of payment of principal of, premium, if any, or interest on the debt securities will be determined, if these amounts may be determined by reference to an index based on a currency or currencies or by reference to a commodity, commodity index, stock exchange index, or financial index;

|

| |

●

|

any provisions relating to any security provided for the debt securities;

|

| |

●

|

any addition to, deletion of, or change in the Events of Default described in this prospectus or in the indenture with respect to the debt securities and any change in the acceleration provisions described in this prospectus or in the indenture with respect to the debt securities;

|

| |

●

|

any addition to, deletion of, or change in the covenants described in this prospectus or in the indenture with respect to the debt securities;

|

| |

●

|

any depositaries, interest rate calculation agents, exchange rate calculation agents, or other agents with respect to the debt securities;

|

| |

●

|

the provisions, if any, relating to conversion or exchange of any debt securities of such series, including if applicable, the conversion or exchange price and period, provisions as to whether conversion or exchange will be mandatory, the events requiring an adjustment of the conversion or exchange price, and provisions affecting conversion or exchange;

|

| |

●

|

any other terms of the debt securities, which may supplement, modify, or delete any provision of the indenture as it applies to that series, including any terms that may be required under applicable law or regulations or advisable in connection with the marketing of the securities; and

|

| |

●

|

whether any of our direct or indirect subsidiaries will guarantee the debt securities of that series, including the terms of subordination, if any, of such guarantees.

|

We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture. We will provide you with information on the United States federal income tax considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement.

Transfer and Exchange

Each debt security will be represented by either one or more global securities registered in the name of a depositary (we will refer to any debt security represented by a global debt security as a “book-entry debt security”), or a certificate issued in definitive registered form (we will refer to any debt security represented by a certificated security as a “certificated debt security”) as set forth in the applicable prospectus supplement.

Certificated Debt Securities. You may transfer or exchange certificated debt securities at any office we maintain for this purpose in accordance with the terms of the indenture. No service charge will be made for any transfer or exchange of certificated debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with a transfer or exchange. You may affect the transfer of certificated debt securities and the right to receive the principal of, premium, if any, and interest on certificated debt securities only by surrendering the certificate representing those certificated debt securities and either reissuance by us or the trustee of the certificate to the new holder or the issuance by us or the trustee of a new certificate to the new holder.

Global Debt Securities and Book-Entry System. Each global debt security representing book-entry debt securities will be deposited with, or on behalf of, a depositary, registered in the name of the depositary or a nominee of the depositary, and follow the applicable procedures of the depositary. Please see “Forms of Securities.”

Covenants

We will set forth in the applicable prospectus supplement any restrictive covenants applicable to any issue of debt securities.

Consolidation, Merger, and Sale of Assets

We may not consolidate with or merge with or into, or convey, transfer, or lease all or substantially all of our properties and assets to any person (a “successor person”) unless:

| |

●

|