Northwest Pipe Company (NASDAQ: NWPX)

Highlights:

- Net sales were $140.6 million, down 1.1% from

first quarter 2012

- Operating income was $14.8 million, up

61.5%

- Net income was $9.5 million, or $1.00 per

diluted share, up 100%

Northwest Pipe Company (NASDAQ: NWPX) today announced its first

quarter 2013 financial results. The Company will broadcast its

first quarter 2013 earnings conference call on Tuesday, May 7,

2013, at 8:00 am PDT.

First Quarter 2013 Results

Net sales for the quarter ended March 31, 2013 decreased 1.1% to

$140.6 million compared to $142.2 million in the quarter ended

March 31, 2012. Gross profit was $21.2 million (15.1% of net sales)

in the first quarter of 2013, an increase from $16.5 million (11.6%

of net sales) in the first quarter of 2012. Net income for the

first quarter of 2013 was $9.5 million or $1.00 per diluted share

compared to $4.7 million or $0.50 per diluted share for the first

quarter of 2012.

Water Transmission sales increased by 34.5% to $78.6 million in

the first quarter of 2013 from $58.4 million in the first quarter

of 2012. The increase in net sales was due to a 53% increase in

tons produced, offset by a 12% decrease in the average selling

price per ton. Water Transmission gross profit increased to $19.9

million (25.3% of segment net sales) in the first quarter of 2013

from $9.7 million (16.6% of segment net sales) in the same period

of 2012. The 25.3% gross profit as a percent of segment net sales

is a quarterly record for the Company.

Tubular Products sales decreased 26.0% to $62.0 million in the

first quarter of 2013 from $83.7 million in the first quarter of

2012, driven by a 9% decrease in average selling price per ton and

a 19% decrease in tons sold from 66,600 tons in the first quarter

of 2012 to 53,900 tons in the first quarter of 2013. Tubular

Products gross profit decreased by 80.4% to $1.3 million (2.2% of

segment net sales) in the first quarter of 2013 from $6.8 million

(8.1% of segment net sales) in the first quarter of 2012.

As of March 31, 2013, the backlog of orders in the Water

Transmission segment was approximately $136 million compared to a

backlog of orders of $161 million as of March 31, 2012. The backlog

contains confirmed orders, including the balance of projects in

process, and projects for which the Company has been notified that

we are the successful bidder even though a binding agreement has

not been executed.

Outlook

"Based on current market conditions, we believe the first

quarter will be our strongest quarter in 2013. The Water

Transmission segment had a record quarter for gross profit as a

percentage of net sales. The first quarter net sales and gross

profit were driven by a number of large projects, including Lake

Texoma, the largest project in Company history," said Scott

Montross, President and Chief Executive Officer of the Company. "As

expected, Tubular Products net sales and margins were significantly

lower compared to the first quarter of 2012 as we experience

continued high levels of imports and a falling rig count. In the

second quarter of 2013, we anticipate that Water Transmission will

have lower net sales, gross profit and gross profit as a percentage

of sales compared with the first quarter of 2013. In Tubular

Products we expect to see gross profit levels that are near

breakeven as high levels of imports continue to negatively impact

segment earnings for the near term."

Conference Call

The Company will hold its first quarter 2013 earnings conference

call on Tuesday, May 7, 2013 at 8 am PDT. The live call can be

accessed by dialing 1-888-810-4934 passcode NWPIPE. For those

unable to attend the live call, a replay will be available

approximately one hour after the event and will remain available

for 30 days by dialing 1-800-583-8102 passcode 6301.

About Northwest Pipe Company

Northwest Pipe Company manufactures welded steel pipe and other

products in two business groups. Its Water Transmission Group is

the leading supplier of large diameter, high-pressure steel pipe

products that are used primarily for water infrastructure in North

America. Its Tubular Products Group manufactures smaller diameter

steel pipe for a wide range of products including energy,

construction, agriculture and industrial systems. The Company is

headquartered in Vancouver, Washington and has nine manufacturing

facilities across the United States and Mexico.

Forward-Looking Statements

Statements in this press release by Scott Montross are

"forward-looking" statements within the meaning of the Securities

Litigation Reform Act of 1995 and Section 21E of the Exchange Act

that are based on current expectations, estimates and projections

about our business, management's beliefs, and assumptions made by

management. These statements are not guarantees of future

performance and involve risks and uncertainties that are difficult

to predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements as a result of a variety of important

factors. While it is impossible to identify all such factors, those

that could cause actual results to differ materially from those

estimated by us include changes in demand and market prices for our

products, product mix, bidding activity, the timing of customer

orders and deliveries, production schedules, the price and

availability of raw materials, excess or shortage of production

capacity, international trade policy and regulations and other

risks discussed in our Annual Report on Form 10-K for the year

ended December 31, 2012 and from time to time in our other

Securities and Exchange Commission filings and reports. Such

forward-looking statements speak only as of the date on which they

are made and we do not undertake any obligation to update any

forward-looking statement to reflect events or circumstances after

the date of this release. If we do update or correct one or more

forward-looking statements, investors and others should not

conclude that we will make additional updates or corrections with

respect thereto or with respect to other forward-looking

statements.

NORTHWEST PIPE COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Dollar and share amounts in thousands, except per share amounts)

Three Months Ended

March 31,

----------------------

2013 2012

---------- ----------

Net sales:

Water Transmission $ 78,613 $ 58,431

Tubular Products 61,984 83,744

---------- ----------

Net sales 140,597 142,175

Cost of sales:

Water Transmission 58,743 48,732

Tubular Products 60,650 76,943

---------- ----------

Total cost of sales 119,393 125,675

Gross profit:

Water Transmission 19,870 9,699

Tubular Products 1,334 6,801

---------- ----------

Total gross profit 21,204 16,500

Selling, general, and administrative expense 6,384 7,321

---------- ----------

Operating income (loss):

Water Transmission 18,033 8,024

Tubular Products 666 6,196

Corporate (3,879) (5,041)

---------- ----------

Operating income 14,820 9,179

Other expense 41 36

Interest income (183) (41)

Interest expense 1,049 1,640

---------- ----------

Income before income taxes 13,913 7,544

Provision for income taxes 4,407 2,810

---------- ----------

Net income $ 9,506 $ 4,734

========== ==========

Basic earnings per share $ 1.01 $ 0.51

========== ==========

Diluted earnings per share $ 1.00 $ 0.50

========== ==========

Shares used in per share calculations:

Basic 9,437 9,369

========== ==========

Diluted 9,484 9,412

========== ==========

NORTHWEST PIPE COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollar amounts in thousands)

March 31, December 31,

2013 2012

------------- -------------

Assets:

Cash and cash equivalents $ 47 $ 46

Trade and other receivables, net 65,415 41,498

Costs and estimated earnings in excess of

billings on uncompleted contracts 70,018 73,314

Inventories 109,604 113,545

Other current assets 8,390 7,735

------------- -------------

Total current assets 253,474 236,138

Property and equipment, net 158,796 152,545

Other assets 33,644 33,739

------------- -------------

Total assets $ 445,914 $ 422,422

============= =============

Liabilities:

Current maturities of long-term debt $ 9,012 $ 9,009

Accounts payable 33,598 21,042

Accrued liabilities 30,225 32,217

Billings in excess of cost and estimated

earnings on uncompleted contracts 2,792 6,478

------------- -------------

Total current liabilities 75,627 68,746

Note payable to financial institution 56,236 47,533

Other long-term debt, less current maturities 11,902 15,536

Other long-term liabilities 33,312 31,175

------------- -------------

Total liabilities 177,077 162,990

Stockholders' equity 268,837 259,432

------------- -------------

Total liabilities and stockholders' equity $ 445,914 $ 422,422

============= =============

CONTACT: Robin Gantt Chief Financial Officer 360-397-6250

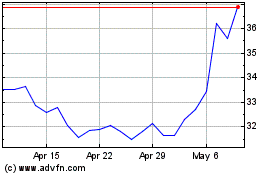

Northwest Pipe (NASDAQ:NWPX)

Historical Stock Chart

From Jun 2024 to Jul 2024

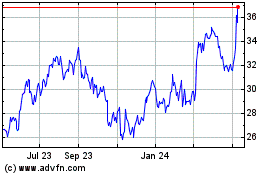

Northwest Pipe (NASDAQ:NWPX)

Historical Stock Chart

From Jul 2023 to Jul 2024