Northwest Pipe Company (NASDAQ: NWPX)

Highlights:

- Net sales were a record $524.5 million in

2012, up from the previous record of $511.7 million in

2011

- Operating income was $27.6 million

- Net income was $16.2 million, or $1.72 per

diluted share

Northwest Pipe Company (NASDAQ: NWPX) today announced its 2012

financial results including record net sales in 2012. The Company

will broadcast its 2012 earnings conference call on Friday, March

15, 2013, at 8:00 am PDT.

Full Year 2012 Results

Net sales for the year ended December 31, 2012 increased 2.5% to

$524.5 million compared to $511.7 million in the year ended

December 31, 2011. Gross profit was $56.2 million (10.7% of net

sales) in 2012, a decrease from $59.1 million (11.6% of net sales)

in 2011. Net income for 2012 was $16.2 million or $1.72 per diluted

share compared to $12.7 million or $1.35 per diluted share for

2011.

Water Transmission sales decreased by 1.0% to $269.2 million in

2012 from $271.9 million in 2011. The minor decrease in net sales

was due to an 8.9% decrease in the average selling price per ton

which was offset by an 8.7% increase in tons produced. Water

Transmission gross profit increased to $45.1 million (16.7% of

segment net sales) in 2012 from $43.2 million (15.9% of segment net

sales) in the prior year.

Tubular Products sales increased 6.5% to $255.3 million in 2012

from $239.8 million in 2011, driven by a 4% increase in average

selling price per ton and a 2% increase in tons sold from 202,400

tons in 2011 to 206,200 tons in 2012. Tubular Products gross profit

decreased by 30.1% to $11.1 million (4.4% of segment net sales) in

2012 from $16.0 million (6.7% of segment net sales) in 2011.

As of December 31, 2012, the backlog of orders in the Water

Transmission segment was approximately $173 million. This compared

to a backlog of orders of $138 million as of December 31, 2011. The

backlog includes confirmed orders, including the balance of

projects in process, and projects for which the Company has been

notified that we are the successful bidder even though a binding

agreement has not been executed.

Outlook

"The Water Transmission segment had higher margins in 2012

compared to 2011, although net sales stayed relatively the same.

The fourth quarter was the strongest quarter of 2012 in Water

Transmission, and was the highest quarter ever in Water

Transmission in both net sales and gross profit. This was due, in

part, to production on the Lake Texoma project, the largest project

in our history," said Scott Montross, President and Chief Executive

Officer of the Company. "As expected, we saw lower margins in the

Tubular Products segment in 2012 as compared to 2011 with the

competition from increased quantities of imported energy pipe,

particularly in the third and fourth quarters. The Tubular Products

segment was also negatively impacted by lower drilling activity, as

seen in the decrease in rig counts, and lower natural gas prices.

In Water Transmission, we anticipate that the first quarter of 2013

will have similar profitability as the fourth quarter of 2012,

although with lower net sales. In Tubular Products, we expect to be

near breakeven as competition from imports of energy products will

continue to negatively impact profitability for the Tubular

Products segment in the near term."

Conference Call

The Company will hold its 2012 earnings conference call on

Friday, March 15, 2013 at 8 am PDT. The live call can be accessed

by dialing 1-888-810-4934, passcode NWPIPE. For those unable to

attend the live call, a replay will be available approximately one

hour after the event and will remain available for 30 days by

dialing 1-888-566-0507 passcode 6301.

About Northwest Pipe Company

Northwest Pipe Company manufactures welded steel pipe and other

products in two business groups. Its Water Transmission Group is

the leading supplier of large diameter, high-pressure steel pipe

products that are used primarily for water infrastructure in North

America. Its Tubular Products Group manufactures smaller diameter

steel pipe for a wide range of products including energy,

construction, agriculture and industrial systems. The Company is

headquartered in Vancouver, Washington and has nine manufacturing

facilities across the United States and Mexico.

Forward-Looking Statements

Statements in this press release by Scott Montross are

"forward-looking" statements within the meaning of the Securities

Litigation Reform Act of 1995 and Section 21E of the Exchange Act

that are based on current expectations, estimates and projections

about our business, management's beliefs, and assumptions made by

management. These statements are not guarantees of future

performance and involve risks and uncertainties that are difficult

to predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements as a result of a variety of important

factors. While it is impossible to identify all such factors, those

that could cause actual results to differ materially from those

estimated by us include changes in demand and market prices for our

products, product mix, bidding activity, the timing of customer

orders and deliveries, production schedules, the price and

availability of raw materials, excess or shortage of production

capacity, international trade policy and regulations and other

risks discussed in our Annual Report on Form 10-K for the year

ended December 31, 2011 and from time to time in our other

Securities and Exchange Commission filings and reports. Such

forward-looking statements speak only as of the date on which they

are made and we do not undertake any obligation to update any

forward-looking statement to reflect events or circumstances after

the date of this release. If we do update or correct one or more

forward-looking statements, investors and others should not

conclude that we will make additional updates or corrections with

respect thereto or with respect to other forward-looking

statements.

NORTHWEST PIPE COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Dollar and share amounts in thousands, except per share amounts)

Three Months Ended Full Year Ended

December 31, December 31,

------------------ ------------------

2012 2011 2012 2011

-------- -------- -------- --------

Net sales:

Water Transmission $ 88,235 $ 61,828 $269,203 $271,885

Tubular Products 47,953 55,316 255,300 239,783

-------- -------- -------- --------

Net sales 136,188 117,144 524,503 511,668

Cost of sales:

Water Transmission 70,713 53,416 224,152 228,703

Tubular Products 50,954 52,543 244,153 223,827

-------- -------- -------- --------

Total cost of sales 121,667 105,959 468,305 452,530

Gross profit:

Water Transmission 17,522 8,412 45,051 43,182

Tubular Products (3,001) 2,773 11,147 15,956

-------- -------- -------- --------

Total gross profit 14,521 11,185 56,198 59,138

Selling, general, and administrative

expense 7,139 6,956 28,638 26,315

-------- -------- -------- --------

Operating income (loss):

Water Transmission 15,155 5,963 36,278 34,113

Tubular Products (3,646) 2,158 8,335 12,660

Corporate (4,127) (3,892) (17,053) (13,950)

-------- -------- -------- --------

Operating income 7,382 4,229 27,560 32,823

Other expense (income), net 288 (9) 339 1,338

Interest income (38) (72) (160) (99)

Interest expense 1,145 1,866 5,616 9,306

-------- -------- -------- --------

Income before income taxes 5,987 2,444 21,765 22,278

(Benefit from) provision for income

taxes 1,477 977 5,521 9,618

-------- -------- -------- --------

Net income $ 4,510 $ 1,467 $ 16,244 $ 12,660

======== ======== ======== ========

Basic earnings per share $ 0.48 $ 0.16 $ 1.73 $ 1.36

======== ======== ======== ========

Diluted earnings per share $ 0.48 $ 0.15 $ 1.72 $ 1.35

======== ======== ======== ========

Shares used in per share

calculations:

Basic 9,383 9,353 9,377 9,333

======== ======== ======== ========

Diluted 9,479 9,472 9,445 9,384

======== ======== ======== ========

NORTHWEST PIPE COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollar amounts in thousands)

December 31,

----------------------

2012 2011

---------- ----------

Assets:

Cash and cash equivalents $ 46 $ 182

Trade and other receivables, net 41,498 69,894

Costs and estimated earnings in excess of billings

on uncompleted contracts 73,314 38,029

Inventories 113,545 107,169

Other current assets 7,735 11,649

---------- ----------

Total current assets 236,138 226,923

Property and equipment, net 152,545 152,846

Other assets 33,739 33,604

---------- ----------

Total assets $ 422,422 $ 413,373

========== ==========

Liabilities:

Current maturities of long-term debt $ 9,009 $ 9,072

Accounts payable 21,042 20,248

Accrued liabilities 32,217 19,175

Billings in excess of cost and estimated earnings

on uncompleted contracts 6,478 7,814

---------- ----------

Total current liabilities 68,746 56,309

Note payable to financial institution 47,533 62,000

Other long-term debt, less current maturities 15,536 24,418

Other long-term liabilities 31,175 30,379

---------- ----------

Total liabilities 162,990 173,106

Stockholders' equity 259,432 240,267

---------- ----------

Total liabilities and stockholders' equity $ 422,422 $ 413,373

========== ==========

CONTACT: Robin Gantt Chief Financial Officer 360-397-6250

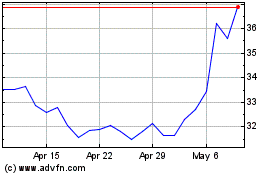

Northwest Pipe (NASDAQ:NWPX)

Historical Stock Chart

From Jun 2024 to Jul 2024

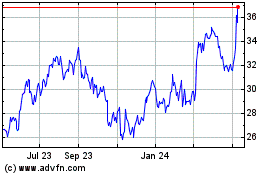

Northwest Pipe (NASDAQ:NWPX)

Historical Stock Chart

From Jul 2023 to Jul 2024