Current Report Filing (8-k)

June 17 2021 - 7:02AM

Edgar (US Regulatory)

false1211 AVENUE OF THE AMERICAS000156470800015647082021-06-152021-06-150001564708us-gaap:CommonClassAMember2021-06-152021-06-150001564708us-gaap:CommonClassBMember2021-06-152021-06-150001564708us-gaap:PreferredClassAMember2021-06-152021-06-150001564708us-gaap:PreferredClassBMember2021-06-152021-06-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): June 15, 2021

NEWS CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

Delaware

|

001-35769

|

46-2950970

|

|

(STATE OR OTHER JURISDICTION OF INCORPORATION)

|

(COMMISSION FILE NO.)

|

(IRS EMPLOYER IDENTIFICATION NO.)

|

1211 Avenue of the Americas, New York, New York 10036

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES, INCLUDING ZIP CODE)

(212) 416-3400

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

Class A Common Stock, par value $0.01 per share

|

|

|

|

The Nasdaq Global Select Market

|

Class B Common Stock, par value $0.01 per share

|

|

|

|

The Nasdaq Global Select Market

|

|

Class A Preferred Stock Purchase Rights

|

|

N/A

|

|

The Nasdaq Global Select Market

|

|

Class B Preferred Stock Purchase Rights

|

|

N/A

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On June 16, 2021, News Corporation (the “Company”) executed a fourth amended and restated rights agreement (the “Rights Agreement”), between the Company and Computershare

Trust Company, N.A., as Rights Agent, which will be effective as of June 18, 2021. The Rights Agreement was entered into pursuant to the determination by a special committee of the Company’s Board of Directors (the “Board”) comprising all of the

Board’s independent directors to amend and restate the existing rights agreement, dated as of June 18, 2018, under which the rights were originally set to expire on June 18, 2021. Under the Rights Agreement, the expiration date of the rights is now

5:00 P.M. (New York City time) on June 18, 2022. The Rights Agreement also provides for certain immaterial technical and administrative amendments. The Rights Agreement otherwise retains all other terms and provisions of the existing rights

agreement.

The foregoing description of the Rights Agreement is qualified in its entirety by reference to the full text of the Rights Agreement, attached hereto as Exhibit 4.1 and

incorporated herein by reference.

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

See the description set forth herein under “Item 1.01. Entry into a Material Definitive Agreement,” which is incorporated into this Item 3.03 by reference.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On June 15, 2021, the Company and David B. Pitofsky, Executive Vice President, General Counsel and Chief Compliance Officer of the Company, entered into an Amended and Restated Employment

Agreement, effective as of July 1, 2021 (the “Amended and Restated Pitofsky Agreement”). The Amended and Restated Pitofsky Agreement extends Mr. Pitofsky’s term of employment until June 30, 2024 and provides for an annual base salary of not less

than $1,200,000; (ii) an annual bonus with a target of not less than $1,200,000; and (iii) an annual long-term equity incentive award with a target of not less than $1,600,000. These amounts represent an increase over Mr. Pitofsky’s fiscal 2021

annual base salary, annual performance-based bonus target and annual performance-based equity incentive award target of approximately 9%, 20% and 14%, respectively, with approximately 70% of Mr. Pitofsky’s target compensation being “at risk.” All

bonus payments and equity grants are subject to the Company’s claw-back policies.

If Mr. Pitofsky’s employment is terminated by the Company other than for cause (as defined in the Amended and Restated Pitofsky Agreement) or due

to Mr. Pitofsky’s death or disability, or by Mr. Pitofsky for Good Reason (as defined in the Amended and Restated Pitofsky Agreement), the Amended and Restated Pitofsky Agreement provides that Mr. Pitofsky will receive (i) the greater of (A) his

then-current base salary and target annual bonus paid in the same manner as though Mr. Pitofsky continued to be employed through June 30, 2024 and (B) his then-current base salary and target annual bonus paid in the same manner as though he

continued to be employed for the successive 24 months following the date of termination; (ii) a pro rata portion of the annual bonus he would have earned for the fiscal year of termination had no termination occurred (a “Pro-rated Annual Bonus”);

(iii) continued vesting of equity incentive awards granted prior to the date of termination in the same manner as though he continued to be employed through the later of June 30, 2024 or one year following the date of termination, based on

Company performance, where applicable, and payable at the conclusion of the applicable vesting periods; and (iv) Company-paid premiums under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, for the executive and his

eligible dependents for the successive 18 months following the date of termination. If Mr. Pitofsky’s employment is terminated due to his death or disability, he or his surviving spouse or estate, as applicable, would be entitled to: (i) salary

continuation for up to 12 months (and, in the case of disability, continuation of other benefits as well); (ii) any Pro-rated Annual Bonus; and (iii) (A) in the case of disability, treatment of his outstanding equity incentive awards pursuant to

the terms of applicable plan documents or (B) in the case of death, continued vesting of equity incentive awards granted prior to the date of termination in the same manner as though he continued to be employed for a period of one year following

the date of termination. If, following the completion of the term under the Amended and Restated Pitofsky Agreement on June 30, 2024, Mr. Pitofsky is not offered a new employment agreement by the Company on terms at least as favorable to him as

the terms set forth in the Amended and Restated Pitofsky Agreement, and Mr. Pitofsky is subsequently terminated without cause, then he will be entitled to receive the payments and benefits summarized above with respect to a termination other than

for cause (using the same base salary and target annual bonus as in effect immediately prior to the expiration of the term on June 30, 2024). Payment of any compensation or benefits upon termination is subject to Mr. Pitofsky’s execution of the

Company’s then-standard separation agreement and general release and continued compliance with the terms therein. The Amended and Restated Pitofsky Agreement continues to have confidentiality and other covenants to protect the Company.

In addition, the Amended and Restated Pitofsky Agreement provides that if Mr. Pitofsky is entitled to receive any “excess parachute payments” under

Section 280G of the Internal Revenue Code of 1986, as amended, in connection with a change in control, those payments will either be (i) reduced below the applicable threshold, or (ii) paid in full, whichever is more favorable for Mr. Pitofsky on

a net after-tax basis. Mr. Pitofsky is not entitled to any golden parachute excise tax or other tax “gross-up” payments.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

Number

|

|

Description

|

|

4.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

NEWS CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Michael L. Bunder

|

|

|

|

Michael L. Bunder

|

|

|

|

Senior Vice President, Deputy General Counsel and Corporate Secretary

|

Dated: June 17, 2021

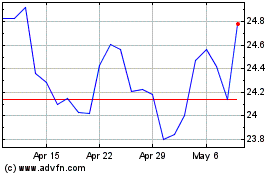

News (NASDAQ:NWSA)

Historical Stock Chart

From Aug 2024 to Sep 2024

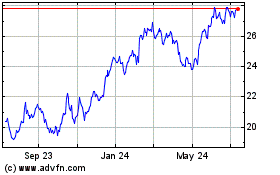

News (NASDAQ:NWSA)

Historical Stock Chart

From Sep 2023 to Sep 2024