False000104952100010495212024-06-172024-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 17, 2024

Mercury Systems, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Massachusetts | | 000-23599 | | 04-2741391 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| | | | |

| 50 Minuteman Road, | Andover, | Massachusetts | | 01810 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (978) 256-1300 Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 | MRCY | Nasdaq Global Select Market |

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 17, 2024, Mercury Systems, Inc. (the “Company” or “we”) publicly announced the implementation of a plan to consolidate our Mission Systems and Microelectronics divisions into one unified structure incorporating multiple business units and functions under the leadership of a Chief Operating Officer, as well as the elimination of a number of positions. This consolidation is designed to simplify our organizational structure, facilitate clearer accountability, align to our priorities to drive growth and value for all stakeholders, and reinvest in key growth areas of our business. We have continued the organizational structure effort that we implemented in the initial phase in January and have progressed deeper into the organization at the business unit and global function levels.

On June 17, 2024, we approved the next phase of this effort, and implemented a workforce reduction that will eliminate approximately 100 positions, resulting in expected restructuring charges of approximately $5 million for employee separation costs, which costs will be classified as restructuring and other charges within our statement of operations and other comprehensive income for the fiscal quarter ending June 28, 2024. The headcount savings, combined with other non-headcount savings, including discretionary and third-party spend primarily within R&D and cost of revenues, are expected to yield annualized savings of approximately $15 million, a portion of which is expected to be reinvested in the business with the remainder supporting improved profitability and operating leverage for our 2025 fiscal year.

Item 7.01 Regulation FD Disclosure.

In a press release dated June 18, 2024, furnished as exbibit 99.1 hereto, we discussed the cost reductions and other efficiencies created by the second phase of our strategic reorganization.

The press release is furnished as exhibit 99.1 hereto. The information provided in Item 7.01 of this Current Report on Form 8-K and the attached exhibit 99.1 shall not be deemed ‘filed’ for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms or other words of similar meaning. You should carefully read forward-looking statements, including statements that contain these words, because they discuss our future expectations or state other “forward-looking” information. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties which change over time. We caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement.

Forward-looking statements include, but are not limited to, statements about the amount of anticipated cost savings and/or expenses from a workforce reduction. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in our filings with the U.S. Securities and Exchange Commission (“SEC”). These risks and uncertainties include, without limitation, that the anticipated cost savings will not be realized or the expenses will be larger than anticipated; the risk that implementation will be materially delayed or will be more difficult than expected; the challenges of retaining key employees; diversion of management’s attention from ongoing business operations and opportunities; and general competitive, economic, political, defense budget, and market conditions and fluctuations.

For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see our SEC filings, including, but not limited to, our most recent Annual Report on Form 10-K for the fiscal year ended June 30, 2023, as filed with the SEC on August 15, 2023. These filings are available in the Investor Relations section of our website. We caution you not to place undue

reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made. Except for any obligations to disclose material information under the federal securities laws, we undertake no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date of this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Dated: June 18, 2024 | | | | MERCURY SYSTEMS, INC. |

| | | |

| | | By: | /s/ David E. Farnsworth |

| | | | | | David E. Farnsworth |

| | | | | | Executive Vice President, Chief Financial Officer |

50 Minuteman Road, Andover, Massachusetts 01810 USA | +1 (978) 256-1300 | www.mrcy.com | twitter: @MRCY //// Mercury Appoints Senior Vice President of Operations, Completes Second Phase of Organizational Restructuring ANDOVER, Mass. – June 18, 2024 – Mercury Systems, Inc. (NASDAQ: MRCY, www.mrcy.com), a technology company that delivers mission-critical processing power to the edge, today announced the appointment of Tod Brindlinger as Senior Vice President of Operations, effective June 10, 2024. The company also announced the completion of the second phase of an organizational restructuring that began in January to improve performance and accelerate growth by consolidating and simplifying its operations. Reporting to Chief Operating Officer Roger Wells, Brindlinger is responsible for the company’s global manufacturing, facilities, and supply chain. He has more than 30 years of leadership experience in business development, operations, engineering, supply chain, and quality roles, most recently serving as Vice President of Global Operations, Quality, and Supply Chain in L3Harris Technologies’ Commercial Aerospace Sector. Brindlinger previously held executive positions at Paradigm Precision, Ducommun, and United Technologies Corporation. “I am exceptionally pleased for Tod Brindlinger to join the Mercury Leadership Team, rounding out a series of significant changes to further integrate and align our business,” said Roger Wells. “His leadership will be instrumental in our ongoing efforts to eliminate silos in our critical functions, improve the quality and timeliness of the mission-critical products and solutions we deliver to our customers, and drive operational performance that will contribute meaningfully to our financial results.” In January, Mercury announced a strategic reorganization of its business to streamline and simplify its operations, consolidating two divisions into a single integrated structure that unified all lines of business and matrixed business functions under the Chief Operating Officer. As part of this reorganization, the company realigned its U.S.-based businesses into two product-oriented business units – Signal Technologies and Processing Technologies – and a third business unit focused on more comprehensive solutions – Integrated Processing Solutions; the Engineering, Operations, and Mission Assurance functions were centralized; and an Advanced Concepts group was stood up to focus on driving innovation and strategic growth pursuits. As the second phase of strategic reorganization concludes, the company has identified cost reductions and other efficiencies of approximately $15 million, a portion of which is expected to be reinvested in the business with the remainder supporting improved profitability and operating leverage for the company’s 2025 fiscal year. “As we have previously discussed, we are driving integration across the business to align with our strategy,” said Bill Ballhaus, Mercury’s Chairman and CEO. “This announcement reflects further progress in our integration to unlock the functional efficiencies and growth potential of the businesses that we have acquired over time. As we enter fiscal year 2025 having made significant progress against the transient challenges in the business, our structure is now better optimized to innovate and advance our processing

50 Minuteman Road, Andover, Massachusetts 01810 USA | +1 (978) 256-1300 | www.mrcy.com | twitter: @MRCY //// platform, expand our content across A&D platforms, and deliver uncompromising performance for all of our stakeholders.” Mercury Systems – Innovation that matters® Mercury Systems is a technology company that delivers mission-critical processing power to the edge, making advanced technologies profoundly more accessible for today’s most challenging aerospace and defense missions. The Mercury Processing Platform allows customers to tap into innovative capabilities from silicon to system scale, turning data into decisions on timelines that matter. Mercury’s products and solutions are deployed in more than 300 programs and across 35 countries, enabling a broad range of applications in mission computing, sensor processing, command and control, and communications. Mercury is headquartered in Andover, Massachusetts, and has 24 locations worldwide. To learn more, visit mrcy.com. (Nasdaq: MRCY) Forward-Looking Safe Harbor Statement This press release contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the Company's focus on enhanced execution of the Company's strategic plan under a refreshed Board and leadership team. You can identify these statements by the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of any U.S. federal government shutdown or extended continuing resolution, effects of geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in or cost increases related to completing development, engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. government’s interpretation of, federal export control or procurement rules and regulations, changes in, or in the interpretation or enforcement of, environmental rules and regulations, market acceptance of the Company's products, shortages in or delays in receiving components, supply chain delays or volatility for critical components such as semiconductors, production delays or unanticipated expenses including due to quality issues or manufacturing execution issues, capacity underutilization, increases in scrap or inventory write-offs, failure to achieve or maintain manufacturing quality certifications, such as AS9100, the impact of supply chain disruption, inflation and labor shortages, among other things, on program execution and the resulting effect on customer satisfaction, inability to fully realize the expected benefits from acquisitions, restructurings, and operational efficiency initiatives or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, effects of shareholder activism, increases in interest rates, changes to industrial security and cyber-security regulations and requirements and impacts from any cyber or insider threat events, changes in tax rates or tax regulations, such as the deductibility of internal research and development, changes to interest rate swaps or other cash flow hedging arrangements, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, litigation, including the dispute arising with the former CEO over his resignation, unanticipated costs under fixed-price service and

50 Minuteman Road, Andover, Massachusetts 01810 USA | +1 (978) 256-1300 | www.mrcy.com | twitter: @MRCY //// system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward looking statement to reflect events or circumstances after the date on which such statement is made. INVESTOR CONTACT Nelson Erickson Senior Vice President, Strategy and Corporate Development Nelson.Erickson@mrcy.com MEDIA CONTACT Turner Brinton Senior Director, Corporate Communications Turner.Brinton@mrcy.com

v3.24.1.1.u2

Cover

|

Jun. 17, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 17, 2024

|

| Entity Registrant Name |

Mercury Systems, Inc.

|

| Entity Incorporation, State or Country Code |

MA

|

| Entity File Number |

000-23599

|

| Entity Tax Identification Number |

04-2741391

|

| Entity Address, Address Line One |

50 Minuteman Road,

|

| Entity Address, City or Town |

Andover,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01810

|

| City Area Code |

978

|

| Local Phone Number |

256-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

MRCY

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001049521

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

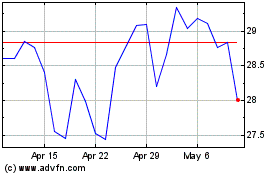

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From May 2024 to Jun 2024

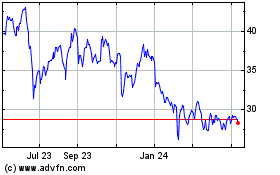

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Jun 2023 to Jun 2024