Current Report Filing (8-k)

May 21 2021 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 19, 2021

MEDIACO HOLDING INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Indiana

|

|

001-39029

|

|

84-2427771

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

ONE EMMIS PLAZA

40 MONUMENT CIRCLE

SUITE

700

INDIANAPOLIS, INDIANA 46204

(Address of principal executive offices and Zip Code)

(317) 266-0100

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A common stock, $0.01 par value

|

|

MDIA

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule

405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Amendment No. 4 to Senior Credit Facility

On May 19,

2021, MediaCo Holding Inc. (“MediaCo” or “the Company”) entered into Amendment No. 4 and Waiver (“Amendment No. 4”) to its amended and restated term loan agreement (such agreement, as so amended, the “Senior Credit

Facility”). Under the terms of Amendment No. 4:

|

|

•

|

|

the Company’s majority shareholder, SG Broadcasting LLC (“SG Broadcasting”), agreed to contribute

up to $7.0 million to the Company in the form of subordinated debt, with $3.0 million contributed at closing, $1.0 million to be contributed by June 1, 2021, and up to an additional $3.0 million to be contributed through June 30, 2022, if necessary,

to satisfy certain conditions described in Amendment No. 4;

|

|

|

•

|

|

the Company made a principal payment of $3.0 million to reduce borrowings outstanding under the Senior Credit

Facility;

|

|

|

•

|

|

no quarterly scheduled principal payments are required through and including the quarter ending March 31, 2022;

|

|

|

•

|

|

the Minimum Consolidated Fixed Charge Coverage Ratio (as defined in the Senior Credit Facility) was reduced to

1.00:1.00 from April 1, through and including December 31, 2022, with it increasing to 1.10:1.00 on and after January 1, 2023;

|

|

|

•

|

|

for purposes of calculating compliance with the Minimum Consolidated Fixed Charge Coverage Ratio, Consolidated

EBITDA (as defined in the Senior Credit Facility) includes certain amounts contributed by SG Broadcasting in the form of subordinated debt or equity, including those described above;

|

|

|

•

|

|

for purposes of calculating the Company’s borrowing base under the Senior Credit Facility, the multiple

applied to Billboard Cash Flow (as defined in the Senior Credit Facility) increased from 3.5 to 5.0 and the advance rate applied to the radio stations’ FCC licenses increased from 60% to 70%;

|

|

|

•

|

|

at any time the multiple applied to Billboard Cash Flow exceeds 3.5 or the advance rate applied to the radio

stations’ FCC licenses exceeds 60%, an incremental annual interest rate of 1% applies and is paid in kind monthly;

|

|

|

•

|

|

certain specified events of default were waived; and

|

|

|

•

|

|

an amendment fee of $0.4 million was paid in cash.

|

Convertible Promissory Note

Also on May 19, 2021, the

Company issued to SG Broadcasting a subordinated convertible promissory note (the “May 2021 SG Broadcasting Promissory Note”), in return for which SG Broadcasting contributed $3.0 million to the Company to make the prepayment of Senior

Credit Facility debt required under Amendment No. 4. Up to $7.0 million may be borrowed pursuant to the May 2021 SG Broadcasting Promissory Note. The May 2021 SG Broadcasting Promissory Note carries interest at a base rate equal to the interest on

any senior credit facility, or if no senior credit facility is outstanding, of 6.0%, and an additional increase of 1.0% on November 25, 2021 and additional annual increases of 1.0% following each successive anniversary thereafter. The May 2021 SG

Broadcasting Promissory Note matures on May 25, 2025 and interest is payable in kind through maturity. Subject to prior shareholder approval of the issuance of the shares, the May 2021 SG Broadcasting Promissory Note is convertible into MediaCo

Class A common stock at the option of SG Broadcasting at a strike price equal to the thirty day volume weighted average price of the MediaCo Class A common stock on the date of conversion.

As of May 19, 2021, SG Broadcasting is the controlling shareholder of the Company, beneficially owning more than 91.03% of the outstanding common stock of the

Company, including 100% of the outstanding Class B Common Stock, par value $0.01 per share (the “Class B Stock”), of the Company, which percentages of Class A Stock and Class B Stock collectively represent approximately 97.42% of the

combined voting power of the outstanding voting securities of the Company.

The foregoing descriptions are qualified in their entireties by reference to

the complete terms and conditions of Amendment No. 4 and the May 2021 SG Broadcasting Promissory Note, which are filed as Exhibits 10.1 and 10.2 hereto, respectively, and which are incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a

Registrant.

|

The information provided with respect to Amendment No. 4 and the May 2021 SG Broadcasting Promissory Note under Item

1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangement of Certain Officers.

|

On May 21, 2021, the Compensation Committee of the board of directors of the Company

increased the annual base salary for Brad A. Tobin, our Chief Operating Officer, from $200,000 to $350,000.

The Company is filing this Current Report on Form 8-K to present in modified form certain information in its Annual Report on Form 10-K for the fiscal year

ended December 31, 2020, filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2021 (the “2020 Form 10-K”). The modified information includes the risk factors included in the 2020 Form 10-K, the

Company’s consolidated balance sheet as of December 31, 2020, and the notes to consolidated and combined financial statements (the “Notes”). In addition, the Company is presenting in modified form its Management’s Discussion

and Analysis of Financial Condition and Results of Operations.

The modifications are being presented in light of the fact that since the date of

completion by the Company’s Independent Registered Public Accounting Firm of the audit of the Company’s consolidated and combined financial statements, and the initial issuance of the Independent Registered Public Accounting Firm’s

report thereon dated March 30, 2021, which contained an explanatory paragraph regarding the Company’s ability to continue as a going concern, the Company, as discussed in Notes 1, 6 and 16 of the Notes, has completed an amendment of its

senior credit facility and obtained additional capital contributions from its majority stockholder. Therefore, the conditions described in the 2020 Form 10-K that raised substantial doubt about whether the Company will continue as a going concern no

longer exist.

The following information included in the 2020 Form 10-K has been modified from the previous presentation:

|

|

•

|

|

Part I, Item 1A. Risk Factors

|

|

|

•

|

|

Part II, Item 7. Management Discussion’s and Analysis of Financial Condition and Results of Operations

|

|

|

•

|

|

Part II, Item 8. Financial Statements and Supplementary Data

|

The modified consolidated financial information contained in the exhibit hereto does not represent a restatement of MediaCo’s previously issued

consolidated and combined financial statements that were included in the 2020 Form 10-K.

Except as specifically noted herein and in the attached

exhibits, this Current Report on Form 8-K does not reflect events or developments that occurred after March 30, 2021, the date on which MediaCo filed the 2020 Form 10-K with the SEC, and does not modify or update the disclosures in any way other

than as described above and set forth in the exhibits hereto. Without limiting the foregoing, this filing does not purport to update or amend the information contained in the 2020 Form 10-K for any information, uncertainties, transactions, risks,

events or trends occurring or known to management. More current information is or will be contained in MediaCo’s Quarterly Report on Form 10-Q for the period ended March 31, 2021 and other filings with the SEC. The information in this Current

Report on Form 8-K should be read in conjunction with the 2020 Form 10-K. Revisions to the 2020 Form 10-K included in this Current Report on Form 8-K as noted above supersede the corresponding portions of the 2020 Form 10-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

See the Exhibit Index below, which is

incorporated by reference herein.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Amendment No. 4 and Waiver to Amended and Restated Term Loan Agreement, dated as of May 19, 2021, by and among MediaCo Holding Inc., the other parties designated as borrowers thereto, the financial institutions

from time to time party thereto, and GACP Finance Co., LLC, a Delaware limited liability company, as administrative agent and collateral agent.

|

|

|

|

|

10.2

|

|

Unsecured Convertible Promissory Note, dated as of May 19, 2021, by MediaCo Holding Inc. in favor of SG Broadcasting LLC.

|

|

|

|

|

23.1

|

|

Consent of Ernst & Young LLP

|

|

|

|

|

99.1

|

|

Updates, where applicable, to Part I, Item 1A. Risk Factors; Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; and Part II, Item 8. “Financial

Statements and Supplementary Data” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, as filed with the Securities and Exchange Commission on March 30, 2021.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDIACO HOLDING INC.

|

|

Date: May 21, 2021

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ J. Scott Enright

|

|

|

|

|

|

|

|

J. Scott Enright, Executive Vice President,

|

|

|

|

|

|

|

|

General Counsel and Secretary

|

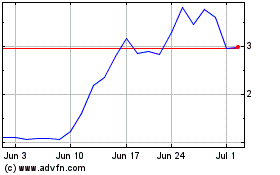

Mediaco (NASDAQ:MDIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

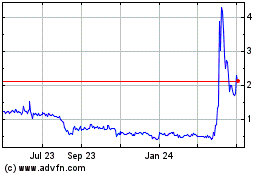

Mediaco (NASDAQ:MDIA)

Historical Stock Chart

From Apr 2023 to Apr 2024