Masimo Corporation (“Masimo” or the “Company”) (NASDAQ: MASI)

today issued the following statement to address what Masimo

strongly believes is Politan’s campaign of deception and

distraction to deflect attention from its own failures and its

nominees’ shortcomings.

The Company urges investors to choose Masimo’s commitment to

transparency and value creation over what it believes are Politan’s

fabrications and deflections by voting FOR Masimo nominees Joe

Kiani and Christopher Chavez on the GOLD card.

Included below are examples of quotes and assertions by Politan

that Masimo strongly believes are false and misleading, set against

Masimo’s explanation of the true facts and clear explanations. For

more information on why the Company believes Politan should not be

rewarded with votes for its candidates when it is providing

stockholders with inaccurate, incomplete and misleading information

in an effort to gain control of Masimo, please visit

www.ProtectMasimosFuture.com.

“A lie gets halfway around the world before

the truth has got its boots on”

In a desperate attempt to divert shareholders’

attention from the absence of a clear plan, we believe that Politan

continues to misdirect to cover up their own failures.

1. Politan Fiction: Politan’s nominees are “unquestionably

qualified and independent” and had “no prior relationship with

Politan” and were “found via nationally recognized, third-party

search firm”

MISDIRECTION: Politan is attempting to

shift the focus away from Masimo’s independent and highly

experienced directors. Except for the Politan Board members,

Masimo’s Board has deep and relevant expertise, having led numerous

public companies – as CEOs and directors.

FACTS: Mr. Jellison owes his board

position with Anika Therapeutics (a company with a market cap well

under $400 million) to an activist. He was appointed to the board

of Anika in May 2024 through a settlement with activist Caligan

Partners. Caligan Partners shares the same attorney as Politan.1

Mr. Jellison also has a history of questionable financial

investments, including a large investment in Saddle River Advisors,

which turned out to be a Ponzi scheme, undermining his credibility

as a “financial expert”.2

Dr. Solomon’s technical expertise

(Chemistry) is not relevant to Masimo and she does not meet the

director search specification that Masimo’s Nominating Committee –

which includes Politan’s Michelle Brennan – agreed on. Politan

hand-picked Ms. Solomon and Mr. Jellison and is paying them $50,000

each to run as Politan’s nominees, with another $50,000 due if they

are elected or appointed to Masimo’s Board.3

POLITAN’S FAILURE: Even Politan concedes

it has not nominated truly independent directors and its nominees

will vote as a bloc, telling shareholders that a “split vote would

create a deadlocked board that cannot affirmatively act.”

2. Politan Fiction: “Mr. Kiani is pursuing the transaction today

with a single counterparty and no actual Board oversight” and the

transaction “raises the exact same IP concerns and similar related

party concerns the Special Committee objected to”

MISDIRECTION: Politan is diverting

attention from the fact Mr. Koffey failed to deliver any

value-creating solution for the Consumer separation as Chair of the

Special Committee.

FACTS: Mr. Kiani is not pursuing any

transaction without Board oversight. The full Board is overseeing

and will approve any transaction following a sound process that was

outlined and agreed to at the April 30, 2024 Board meeting.

The IP framework Masimo proposed to the

potential JV partner matches what Mr. Koffey proposed to Mr. Kiani

as Chair of the Special Committee. In summary, Masimo would license

certain IP to the JV for use solely within the consumer field. The

license would not extend to the professional healthcare field. As

Politan is aware, the Board has agreed that an independent third

party will review the IP allocation proposed by the company’s IP

counsel.

The Special Committee also did not object

to “related party concerns,” as Politan claims. The Special

Committee was set up specifically to deal with the related party

issues inherent in the terms agreed by Mr. Koffey and Mr. Kiani in

January.4

POLITAN’S FAILURE: Mr. Koffey not only

failed as Chair of the Special Committee, but we believe his

behavior resulted in the resignation of former director Rolf

Classon from the Committee, leading to its subsequent

dissolution.

3. Politan Fiction: “Cercacor was the last time Mr. Kiani

oversaw a separation” and “Mr. Kiani has done this before, with

Cercacor”

MISDIRECTION: Politan is once again

ignoring the fact that Mr. Koffey failed to find any viable options

for the Consumer separation and has no plan to generate shareholder

value.

FACTS: The separation of Masimo and

Cercacor was completed in 1998, nearly a decade before Masimo went

public, and was fully disclosed in the S-1 and subsequent

materials. In 1996, Masimo was considering going public and one of

its new investors who had visitation rights to Board meetings

proposed a separation because he and other investors were not

attributing any value to Masimo’s noninvasive blood constituent

monitoring technology (released several years later as rainbow) as

it had not yet produced revenue and required significant R&D

investments. Mr. Kiani initially opposed the separation, but in

1998 relented. The separation agreement was fully disclosed and

approved by Masimo’s shareholders (mostly Venture Capitalists) at

the time. Mr. Kiani’s ownership share in both companies was the

same, as were those of the other shareholders.

POLITAN’S FAILURE: Nothing about the

Cercacor transaction, which was completed more than 20 years ago,

had any bearing on Mr. Koffey’s inability to deliver the simple

objectives of the Special Committee.

4. Politan Fiction: “No information on R&D, COGS, or

SG&A beyond public disclosures” which Politan claims justifies

the Politan directors’ refusal to sign the Masimo’s Form 10-K and

approve earnings releases

MISDIRECTION: Politan is simply

fabricating excuses to mask their failures on the Board.

FACTS: Politan’s false claims regarding

the directors’ access to information were addressed in Masimo’s

previous press releases dated April 1 and June 20, 2024. As

explained in those releases, in addition to the thousands of pages

of documents management delivered during onboarding, Masimo’s CFO

Micah Young provided a detailed presentation to the full Board on

October 31, 2023. He presented the management plan for 2024 and a

long-range plan through 2033. He included a breakdown of each

business (professional healthcare, consumer health and consumer

audio), including revenue by major product line, cost of goods

sold, gross profit, R&D expenses, SG&A expenses, operating

income, adjusted EBITDA, working capital and capital expenditures

for each business. He followed up by emailing this detailed

information—which goes well beyond what is disclosed publicly—to

Mr. Koffey. The email and attachment that Mr. Young sent to Mr.

Koffey dated October 31, 2023, is available here:

https://protectmasimosfuture.com/plan-email/ (the data in

the spreadsheet is confidential and has been removed).

POLITAN’S FAILURE: Despite having

requested an exorbitant number of documents, and having received

those documents, the Politan directors were still unable to fulfill

even the most basic director duties like signing the Form 10-K and

approving quarterly reports. Indeed, it appears to us that Mr.

Koffey was only issuing these document requests in furtherance of

Politan’s proxy contest to take control of Masimo.

5. Politan Fiction: “Corporate Jet Travel Appears Overwhelmingly

for Personal Use, Even During Periods of Crisis for Company”

MISDIRECTION: Politan is diverting

attention from the fact that it doesn’t understand the business or

the industry in which we operate.

FACTS: Mr. Kiani’s corporate jet travel is

overwhelmingly for business use, and Mr. Kiani pays for his

personal use.

Politan wrongly characterizes a number of

business trips as vacations. For example, Mr. Kiani’s trip to

Anguilla was for Masimo’s CEO Summit, which is an award trip held

annually for the top performing Masimo sales representatives. In

July 2023, Mr. Kiani met with several customers in Spain, including

a senior representative of the Andalusian Health Service to discuss

Masimo technologies, including the telemonitoring technologies that

we recently received significant orders for in Spain.

Mr. Kiani offered to buy the aircraft at

the outset, but Masimo’s advisors determined it would be preferable

for Masimo for the company to own it. Mr. Kiani has told the Board

he is still willing to buy the aircraft at fair market value if the

Board prefers.

POLITAN’S FAILURE: In 12 months on the

Board, including numerous executive sessions and audit committee

meetings without Mr. Kiani present, Mr. Koffey never once raised

Mr. Kiani’s use of the corporate jet as an issue, when it could be

evaluated by the other independent directors. It appears to us he

is only raising it now to support Politan’s efforts to take control

of Masimo and distract from their failure to have a plan or viable

CEO candidate.

6. Politan Assertion: “CEO has lowest employee approval rating

of any peer, evidencing beleaguered employee culture”

MISDIRECTION: Politan is shifting the

focus from their unqualified CEO replacement, Michelle

Brennan.

FACTS: Mr. Kiani has strong support among

current employees. Masimo was certified as a Great Place to Work

for 2020-2021 and 2021-2022 and was one of Fortune’s Best

Workplaces in Manufacturing and Production for 2021, both of which

are based on employee surveys including questions about the CEO and

senior management. More than 300 Masimo engineers and sales leaders

have publicly expressed their support for Mr. Kiani.5

POLITAN’S FAILURE: Politan’s stop-gap

measure, appointing Ms. Brennan, is farcical: she has no CEO

experience, no ability to oversee a large complex company, and

failed to deliver any options for the Consumer separation while on

the Special Committee.

7. Politan Assertion: The Board was not timely notified of the

DOJ and SEC subpoenas

MISDIRECTION: Politan is attempting to

turn the focus away from their inexperience in the

Boardroom.

FACTS: Masimo received the first DOJ

subpoena relating to its Rad-G and Rad-97 devices on February 21,

2024. Management forwarded the subpoena to the Board the same day.

The second DOJ subpoena also related to the Rad-G and Rad-97

devices and both subpoenas were discussed with the Board at the

next regularly scheduled Board meeting. The allegations at issue in

the SEC subpoena were raised with and had already been investigated

by the Audit Committee, Internal Audit, and external auditors in

2023.

POLITAN’S FAILURE: Despite having been

provided an exorbitant amount of information both by at request and

in the Board’s proper functioning, Mr. Koffey continues to fail in

even his most basic duties as a director: to engage with the other

independent directors in good faith for the benefit of Masimo’s

stockholders.

8. Masimo Foundation invested in Mr. Chavez’s Company

MISDIRECTION: Politan is trying to shift

attention away from Mr. Chavez’s strong qualifications.

FACTS: Mr. Chavez does not benefit from –

and was indeed until recently was unaware of – the Foundation’s

investment. Mr. Chavez was CEO of Trivascular, which was acquired

by Endologix in February 2016. As part of the merger agreement, Mr.

Chavez was appointed to the board of directors of Endologix but

only served on the board for two years. Endologix was a public

company and Masimo Foundation purchased Endologix stock in the open

market. Endologix had its headquarters near Masimo and Mr. Kiani

had been introduced to the company years before Mr. Chavez joined

its board. Many investment fund bus trips visited both companies

and Endologix was often discussed as a growing device company,

bringing it to the attention of Masimo Foundation. Mr. Chavez was

not aware that Masimo Foundation had bought Endologix stock until

Politan filed its presentation on June 26, 2024.

POLITAN’S FAILURE: Politan appears to be

uninterested in meaningful director independence. Its opposition to

Mr. Chavez, like its selection criteria for its own nominees,

appears to be rooted in Politan’s lack of any understanding of what

Masimo does, how the medical device industry operates, and where

the future lies. In our view, Politan equates independence with

loyalty to Politan.

1 https://www.srz.com/en/people/ele-klein (see

“Representations”) 2

https://www.sec.gov/enforcement-litigation/litigation-releases/lr-23501

3 Politan’s 2024 Definitive Proxy Statement, page 18 4 Masimo’s

June 20, 2024 Press Release entitled “Masimo Provides Facts in

Response to Politan’s False Narrative”, point #16,

https://investor.masimo.com/news/news-details/2024/Masimo-Provides-Facts-in-Response-to-Politans-False-Narrative/default.aspx

5 https://protectmasimosfuture.com/materials-faqs/

Don’t be fooled by Politan’s numerous

fictions and attempts at misdirection. Don’t put the value of your

investment in Masimo at risk.

Vote FOR Joe Kiani and

Chris Chavez on the GOLD Card

About Masimo

Masimo (NASDAQ: MASI) is a global medical technology company

that develops and produces a wide array of industry-leading

monitoring technologies, including innovative measurements,

sensors, patient monitors, and automation and connectivity

solutions. In addition, Masimo Consumer Audio is home to eight

legendary audio brands, including Bowers & Wilkins, Denon,

Marantz, and Polk Audio. Our mission is to improve life, improve

patient outcomes, and reduce the cost of care. Masimo SET®

Measure-through Motion and Low Perfusion™ pulse oximetry,

introduced in 1995, has been shown in over 100 independent and

objective studies to outperform other pulse oximetry technologies.1

Masimo SET® has also been shown to help clinicians reduce severe

retinopathy of prematurity in neonates,2 improve CCHD screening in

newborns3 and, when used for continuous monitoring with Masimo

Patient SafetyNet™ in post-surgical wards, reduce rapid response

team activations, ICU transfers, and costs.4-7 Masimo SET® is

estimated to be used on more than 200 million patients in leading

hospitals and other healthcare settings around the world,8 and is

the primary pulse oximetry at 9 of the top 10 hospitals as ranked

in the 2022-23 U.S. News and World Report Best Hospitals Honor

Roll.9 In 2005, Masimo introduced rainbow® Pulse CO-Oximetry

technology, allowing noninvasive and continuous monitoring of blood

constituents that previously could only be measured invasively,

including total hemoglobin (SpHb®), oxygen content (SpOC™),

carboxyhemoglobin (SpCO®), methemoglobin (SpMet®), Pleth

Variability Index (PVi®), RPVi™ (rainbow® PVi), and Oxygen Reserve

Index (ORi™). In 2013, Masimo introduced the Root® Patient

Monitoring and Connectivity Platform, built from the ground up to

be as flexible and expandable as possible to facilitate the

addition of other Masimo and third-party monitoring technologies;

key Masimo additions include Next Generation SedLine® Brain

Function Monitoring, O3® Regional Oximetry, and ISA™ Capnography

with NomoLine® sampling lines. Masimo’s family of continuous and

spot-check monitoring Pulse CO-Oximeters® includes devices designed

for use in a variety of clinical and non-clinical scenarios,

including tetherless, wearable technology, such as Radius-7®,

Radius PPG®, and Radius VSM™, portable devices like Rad-67®,

fingertip pulse oximeters like MightySat® Rx, and devices available

for use both in the hospital and at home, such as Rad-97® and the

Masimo W1® medical watch. Masimo hospital and home automation and

connectivity solutions are centered around the Masimo Hospital

Automation™ platform, and include Iris® Gateway, iSirona™, Patient

SafetyNet, Replica®, Halo ION®, UniView®, UniView :60™, and Masimo

SafetyNet®. Its growing portfolio of health and wellness solutions

includes Radius Tº®, Masimo W1 Sport, and Masimo Stork™. Additional

information about Masimo and its products may be found at

www.masimo.com. Published clinical studies on Masimo products can

be found at www.masimo.com/evidence/featured-studies/feature/.

RPVi has not received FDA 510(k) clearance and is not available

for sale in the United States. The use of the trademark Patient

SafetyNet is under license from University HealthSystem

Consortium.

References

- Published clinical studies on pulse oximetry and the benefits

of Masimo SET® can be found on our website at

http://www.masimo.com. Comparative studies include independent and

objective studies which are comprised of abstracts presented at

scientific meetings and peer-reviewed journal articles.

- Castillo A et al. Prevention of Retinopathy of Prematurity in

Preterm Infants through Changes in Clinical Practice and SpO2

Technology. Acta Paediatr. 2011 Feb;100(2):188-92.

- de-Wahl Granelli A et al. Impact of pulse oximetry screening on

the detection of duct dependent congenital heart disease: a Swedish

prospective screening study in 39,821 newborns. BMJ. 2009;Jan

8;338.

- Taenzer A et al. Impact of pulse oximetry surveillance on

rescue events and intensive care unit transfers: a before-and-after

concurrence study. Anesthesiology. 2010:112(2):282-287.

- Taenzer A et al. Postoperative Monitoring – The Dartmouth

Experience. Anesthesia Patient Safety Foundation Newsletter.

Spring-Summer 2012.

- McGrath S et al. Surveillance Monitoring Management for General

Care Units: Strategy, Design, and Implementation. The Joint

Commission Journal on Quality and Patient Safety. 2016

Jul;42(7):293-302.

- McGrath S et al. Inpatient Respiratory Arrest Associated With

Sedative and Analgesic Medications: Impact of Continuous Monitoring

on Patient Mortality and Severe Morbidity. J Patient Saf. 2020 14

Mar. DOI: 10.1097/PTS.0000000000000696.

- Estimate: Masimo data on file.

-

http://health.usnews.com/health-care/best-hospitals/articles/best-hospitals-honor-roll-and-overview.

Forward-Looking Statements

This press release includes forward-looking statements as

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

in connection with the Private Securities Litigation Reform Act of

1995. These forward-looking statements include, among others,

statements regarding the 2024 Annual Meeting of Stockholders (the

“2024 Annual Meeting”) of Masimo and the potential stockholder

approval of the Board’s nominees and the proposed separation of

Masimo’s consumer business. These forward-looking statements are

based on current expectations about future events affecting Masimo

and are subject to risks and uncertainties, all of which are

difficult to predict and many of which are beyond Masimo’s control

and could cause its actual results to differ materially and

adversely from those expressed in its forward-looking statements as

a result of various risk factors, including, but not limited to (i)

uncertainties regarding a potential separation of Masimo’s consumer

business, (ii) uncertainties regarding future actions that may be

taken by Politan in furtherance of its nomination of director

candidates for election at the 2024 Annual Meeting, (iii) the

potential cost and management distraction attendant to Politan’s

nomination of director nominees at the 2024 Annual Meeting and (iv)

factors discussed in the “Risk Factors” section of Masimo’s most

recent periodic reports filed with the Securities and Exchange

Commission (“SEC”), which may be obtained for free at the SEC’s

website at www.sec.gov. Although Masimo believes that the

expectations reflected in its forward-looking statements are

reasonable, the Company does not know whether its expectations will

prove correct. All forward-looking statements included in this

press release are expressly qualified in their entirety by the

foregoing cautionary statements. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of today’s date. Masimo does not undertake any obligation

to update, amend or clarify these statements or the “Risk Factors”

contained in the Company’s most recent reports filed with the SEC,

whether as a result of new information, future events or otherwise,

except as may be required under the applicable securities laws.

Additional Information Regarding the 2024 Annual Meeting of

Stockholders and Where to Find It

The Company has filed a definitive proxy statement containing a

form of GOLD proxy card with the SEC in connection with its

solicitation of proxies for its 2024 Annual Meeting. THE COMPANY’S

STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY

STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND

ACCOMPANYING GOLD PROXY CARD AS THEY WILL CONTAIN IMPORTANT

INFORMATION. Stockholders may obtain the proxy statement, any

amendments or supplements to the proxy statement and other

documents as and when filed by the Company with the SEC without

charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors and certain of its executive officers

and employees may be deemed to be participants in connection with

the solicitation of proxies from the Company’s stockholders in

connection with the matters to be considered at the 2024 Annual

Meeting. Information regarding the direct and indirect interests,

by security holdings or otherwise, of the Company’s directors and

executive officers in the Company is included in the Company’s

definitive proxy statement for the 2024 Annual Meeting (the “2024

Proxy Statement”), which can be found through the SEC’s website at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000937556/000121390024053125/ea0206756-05.htm.

Changes to the direct or indirect interests of Masimo’s securities

by directors and executive officers are set forth in SEC filings on

a Statement of Change in Ownership on Form 4 filed with the SEC on

June 28, 2024, which can be found through the SEC’s website at

https://www.sec.gov/Archives/edgar/data/937556/000093755624000053/xslF345X05/wk-form4_1719606794.xml.

Any other changes to the 2024 Proxy Statement may be found in any

amendments or supplements to the 2024 Proxy Statement and other

documents as and when filed by the Company with the SEC, which can

be found through the SEC’s website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240702444100/en/

Investor Contact: Eli Kammerman (949) 297-7077

ekammerman@masimo.com

Media Contact: Evan Lamb (949) 396-3376

elamb@masimo.com

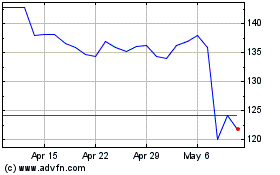

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Jul 2023 to Jul 2024