Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 08 2017 - 3:50PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-207904

Dated June 8, 2017

Maiden Holdings, Ltd.

6.700% Non-Cumulative Preference Shares,

Series D

|

Issuer:

|

|

Maiden Holdings, Ltd.

|

|

|

|

|

|

Security:

|

|

6.700% Non-Cumulative Preference Shares, Series D (“Series D Preference Shares”)

|

|

|

|

|

|

Offering Format:

|

|

SEC Registered

|

|

|

|

|

|

Anticipated Rating (S&P):*

|

|

BB

|

|

|

|

|

|

Size:

|

|

$150,000,000; 6,000,000 shares

|

|

|

|

|

|

Overallotment Amount:

|

|

None

|

|

|

|

|

|

Trade Date:

|

|

June 8, 2017

|

|

|

|

|

|

Settlement Date:

|

|

June 15, 2017 (T+5)

|

|

|

|

|

|

Maturity:

|

|

Perpetual

|

|

|

|

|

|

Liquidation Preference:

|

|

$25.00 per share

|

|

|

|

|

|

Dividend Payment Dates:

|

|

Holders of Series D Preference Shares will be entitled to receive dividend payments only when, as and if declared by the board of directors or a duly authorized committee of the board. Any such dividends will be payable from, and including, the date of original issue on a non-cumulative basis, quarterly in arrears on the 15th day of March, June, September and December of each year, commencing on September 15, 2017.

|

|

|

|

|

|

Dividend Rate:

|

|

6.700% of the $25.00 per share liquidation preference per annum, when, as and if declared by the board of directors, on a non-cumulative basis.

|

|

|

|

|

|

Optional Redemption:

|

|

The Series D Preference Shares may not be redeemed prior to June 15, 2022, except in specified circumstances relating to certain corporate, tax or capital disqualification events as described in the preliminary prospectus supplement, subject to the satisfaction of all other applicable conditions to redemption. On or after that date, the Issuer may, at its option, redeem the Series D Preference Shares, for cash, in whole or in part, at a redemption price of $25.00 per Series D Preference Share, plus declared and unpaid dividends, if any, to, but excluding, the date of redemption, without accumulation of any undeclared dividends; provided that no redemption may occur prior to June 15, 2027 unless (1) the Issuer has sufficient funds in order to meet the Bermuda Monetary Authority’s (the “BMA”) Enhanced Capital Requirement (the “ECR”) and the BMA (or its successor, if any) approves of the redemption or (2) the Issuer replaces the capital represented by the Series D Preference Shares with capital having equal or better capital treatment as the Series D Preference Shares under the ECR.

|

|

|

|

|

|

Public Offering Price:

|

|

$25.00 per share; $150,000,000 total

|

|

|

|

|

|

Underwriting Discounts:

|

|

$0.7875 per Series D Preference Share; $4,725,000 total

|

|

|

|

|

Use of Proceeds:

|

|

The Issuer expects to receive approximately $

145,275,000

in net proceeds from the sale of the Series D Preference Shares issued in this offering, after deducting the underwriting discount but before deducting the Issuer’s estimated offering expenses. The Issuer expects to use the net proceeds of this offering to repay Maiden Holdings North America, Ltd.’s outstanding $100.0 million aggregate principal amount of 8.00% notes due 2042, for continued support and development of its reinsurance business and for other general corporate purposes.

|

|

|

|

|

|

Expected Listing:

|

|

The Issuer intends to apply to list the Series D Preference Shares on the NYSE under the symbol “MHPRD.” If the application is approved, the Issuer expects trading to commence 30 days following the initial issuance of the Series D Preference Shares.

|

|

|

|

|

|

CUSIP / ISIN:

|

|

G5753U 146 / BMG5753U1466

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Morgan Stanley & Co. LLC

UBS Securities LLC

|

|

|

|

|

|

|

|

|

|

Co-Managers:

|

|

FBR Capital Markets & Co.

JMP Securities LLC

Compass Point Research & Trading LLC

|

|

|

|

|

* An explanation of the significance of ratings may be obtained

from the rating agency. Generally, rating agencies base their ratings on such material and information, and such of their own investigations,

studies and assumptions, as they deem appropriate. The anticipated rating of the Series D Preference Shares should be evaluated

independently from similar ratings of other securities. A credit rating of a security is not a recommendation to buy, sell or hold

securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

The Issuer has filed a registration statement (including

a prospectus and a preliminary prospectus supplement) with the SEC for the offering to which this communication relates. Before

you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents

the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents

for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating

in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith

Incorporated toll–free at 1-800-294-1322; Morgan Stanley & Co. LLC toll–free at 1-800-584-6837 or UBS Securities

LLC toll-free at 1-888-827-7275.

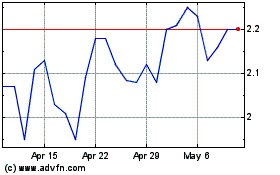

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From May 2024 to Jun 2024

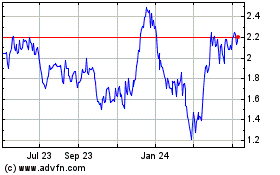

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jun 2023 to Jun 2024