Highlights for the three months ended September 30,

2012

- Book value per common share(4) of $12.14, up 14.1%

versus year-end 2011 and up 6.4% versus June 30, 2012

- Annualized operating return on common equity(1) of 9.1%

compared to 11.1% in the third quarter of 2011

- Net operating earnings (1) of $19.5 million, or $0.27

per diluted common share compared with $21.4 million, or $0.29 per

diluted common share in the third quarter of 2011

- Net investment income rose to $21.6 million or an

increase of 14.9% compared to the third quarter of

2011

- Total investments increased 9.1% in the third quarter

of 2012 to $2.6 billion

- Net premiums written increased 6.4% to $455.8 million

versus the same period last year

- Combined ratio of 98.2% compared to

97.4% in the third quarter of 2011

- Issued $150 million 8.25% Non-Cumulative Perpetual

Preference Shares in August

Highlights for the nine months ended September 30,

2012

- Annualized operating return on common equity(1) of 9.5%

compared to 9.2% in the first nine months of last

year

- Net operating earnings (1) of $58.6 million, or $0.80

per diluted common share compared with $52.4 million, or $0.72 per

diluted common share in the first nine months of 2011

- Combined ratio of 98.0% compared to 98.0% in the first

nine months of 2011

- Net investment income was $60.1 million, an increase of

4.1% compared to the first nine months of 2011

- Total investments increased 29.2% in the first nine

months of 2012 to $2.6 billion

- Net premiums written increased 10.9% to $1.5 billion

versus the same period last year; excluding a one-time $45.9

million unearned premium transfer in the second quarter of 2011,

net premiums written would have increased 14.8%

- Capital raised year-to-date 2012 totals $250 million,

including $100 million 30-Year, 8% Senior Notes issued in March and

$150 million of 8.25% Preference Shares issued in

August

Maiden Holdings, Ltd. (Nasdaq:MHLD) today reported third quarter

2012 net operating earnings(1) of $19.5 million, or $0.27 per

diluted common share compared with $21.4 million, or $0.29 per

diluted common share in the comparative quarter in 2011. Net income

totaled $21.9 million, or $0.30 per diluted common share compared

with net income of $16.0 million, or $0.22 per diluted common share

in the third quarter of 2011.

Commenting on the Company's earnings, Art Raschbaum, Chief

Executive Officer of Maiden Holdings, said: "The quarter reflects

solid performance with robust growth in book value and

capitalization, profitable underwriting results and continued

expansion of our unique diversified underwriting

portfolio. Since year end 2011, Maiden's total equity has

grown by 34% to just over $1 billion. We believe that our

strong capitalization positions Maiden to benefit from continued

improvements in the operating environment."

Results for the three months ended September 30,

2012

Net operating earnings(1) for the third quarter of 2012 were

$19.5 million, or $0.27 per diluted common share compared with

$21.4 million, or $0.29 per diluted common share in the comparative

quarter in 2011. Net income was $21.9 million, or $0.30 per

diluted common share compared with net income of $16.0 million or

$0.22 per diluted common share in the third quarter of

2011.

In the third quarter of 2012 net premiums written totaled $455.8

million, an increase of 6.4% compared to the third quarter of

2011. Net premiums written increased in all three business

segments. The Diversified Reinsurance segment net premiums

written were up 2.8% to $193.9 million versus the third quarter of

2011 primarily due to new business during the quarter and to a

lesser extent, the growth of existing client business. In the

AmTrust Quota Share Reinsurance segment, net premiums written

increased by 7.4% to $186.3 million compared to the third quarter

of 2011, with the most significant premium increases coming from

worker's compensation, warranty and European hospital liability

lines. Net premiums written from the ACAC Quota Share increased by

13.9% to $75.6 million compared to the same period in 2011 due to

the successful targeting of new business.

Net premiums earned of $449.0 million increased 6.8%, or $28.7

million compared to the third quarter of 2011. Earned

premiums increased across all business segments with Diversified

Reinsurance up 1.1%, AmTrust Quota Share Reinsurance up 11.0% and

ACAC Quota Share up 14.1%.

Net investment income of $21.6 million in the third quarter of

2012 increased 14.9% compared to the third quarter of

2011. Total investments increased $590.0 million or 29.2% to

$2.6 billion versus December 31, 2011. The

average yield on the fixed income portfolio (excluding cash) is

3.42% with an average duration of 3.32 years.

Net loss and loss adjustment expenses of $309.1 million were up

$34.6 million compared to the third quarter of 2011. The

loss ratio(6) increased by 3.9 percentage points to 68.5% versus

the third quarter of 2011.

Commission and other acquisition expenses together with general

and administrative expenses of $134.5 million decreased $4.8

million in the third quarter of 2012 from the year ago quarter,

while the total expense ratio improved to 29.7% in the third

quarter of 2012 compared with 32.8% in the same quarter last year.

General and administrative expenses for the third quarter of

2012 totaled $13.6 million compared with $12.5 million in the third

quarter of 2011. The general and administrative expense ratio(8)

decreased to 2.9% versus 3.0% in the third quarter of

2011.

The combined ratio(9) for the third quarter of 2012 totaled

98.2% compared with 97.4% in the third quarter of 2011.

The impact of the updated accounting guidance issued by the

Financial Accounting Standards Board which limits the

capitalization of costs incurred to acquire or renew insurance

contracts to those that are incremental direct costs of successful

contract acquisitions was to decrease third quarter 2012 earnings

by approximately $0.5 million or $0.01 per diluted common share.

The impact on the Company's combined ratio for the quarter was an

increase of approximately 0.1%.

Total assets increased 16.3% to $3.9 billion at September 30,

2012 compared to $3.4 billion at year-end 2011. Total

cash on hand at September 30, 2012, was $182.2 million, comprised

of cash and cash equivalents of $66.9 million, down 64.4% from the

end of 2011, and restricted cash and cash equivalents of $115.3

million, which is up 0.4% compared to the end of

2011. Shareholders' equity was $1.0 billion, an increase

of 33.7% compared to December 31, 2011. Book value

per common share was $12.14 at the end of the third quarter of 2012

or 14.1% higher than at December 31, 2011.

During the third quarter of 2012, the Board of Directors

declared a dividend of $0.08 per common share.

Results for the nine months ended September 30,

2012

Net income for the nine months ended September 30, 2012 was

$56.8 million compared to net income of $11.0 million in the first

three quarters of 2011. During the second quarter of 2011,

Maiden's net income was impacted by a number of non-operating

expenses, including charges related to the repurchase of junior

subordinated debt with proceeds from the June 2011 Senior Notes

offering. Second quarter 2011 results included $15.1

million of junior subordinated debt repurchase expenses and $20.3

million of accelerated amortization of junior subordinated debt

discount and issuance costs.

Net operating earnings(1) were $58.6 million, or $0.80 per

diluted common share compared to $52.4 million or $0.72 per diluted

common share in the first nine months of

2011. Year-to-date annualized operating return on common

equity(1) was 9.5% compared to 9.2% for the first three quarters of

2011.

Net premiums written rose 10.9% or $143.6 million to $1.5

billion in the first nine months of 2012 compared to the same

period in 2011. Net premiums written for the Diversified

Reinsurance segment increased 3.4% compared to the first nine

months of 2011 to $626.2 million in the first three quarters of

2012. Net premiums written for the AmTrust Quota Share

Reinsurance segment was $607.9 million, up 17.7% compared to the

first three quarters of 2011 (however, excluding the impact of the

one-time unearned premium transfer of $45.9 million in the second

quarter of 2011 related to the European hospitality liability

business, the net premiums written in the AmTrust Quota Share

Reinsurance segment would have increased 29.1% compared to the

first three quarters of 2011). Net premiums written for

the ACAC Quota Share rose 16.4%, to $224.5 million compared to the

first nine months of 2011.

Net premiums earned in the first nine months of $1.3 billion

increased 16.7% or $190.0 million compared to the first nine months

of 2011. Earned premiums grew in all business segments

with Diversified Reinsurance up 11.3%, AmTrust Quota Share

Reinsurance up 25.0% and ACAC Quota Share up 14.4% in the first

nine months of 2012.

Net investment income in the first nine months of 2012 was $60.1

million, up 4.1% compared to the same period in 2011. This

reflects the $712.8 million increase in total investments at the

end of the third quarter 2012 compared to the end of the third

quarter of 2011, offset by a decrease in book yield (excluding

cash) to 3.42% from 3.84% at the end of September 2011.

Net loss and loss adjustment expenses for the first nine months

of 2012 were $897.5 million, up $151.2 million compared to the same

period in 2011. The loss ratio(6) increased 2.2

percentage points to 67.3% versus the first nine months of

2011.

Commission and other acquisition expenses together with general

and administrative expenses of $410.5 million increased $33.2

million compared to the first nine months of 2011 and reflected a

total expense ratio of 30.7% compared with 32.9%. General and

administrative expenses for the first nine months of 2012 totaled

$42.6 million compared with $37.6 million in the first three

quarters of 2011. These results reflected a general and

administrative expense ratio(8) of 3.1% in the first nine months of

2012 and 3.3% in the comparative period last year.

The combined ratio(9) for the first nine months of 2012 was

98.0%, which was equal to the combined ratio(9) for the first nine

months of last year.

The impact of the updated accounting guidance issued by the

Financial Accounting Standards Board which limits the

capitalization of costs incurred to acquire or renew insurance

contracts to those that are incremental direct costs of successful

contract acquisitions was to decrease earnings for the first nine

months of 2012 by approximately $2.5 million or $0.03 per diluted

common share. The impact on the Company's combined ratio for the

first nine months of 2012 was an increase of approximately

0.2%.

(1)(4) Please see the Non-GAAP Financial Measures table for

additional information on these non-GAAP financial measures and

reconciliation of these measures to GAAP measures.

(6)(8)(9) Loss ratio, general and administrative expense ratio

and combined ratio are operating metrics. Please see the additional

information on these measures under Segment information tables.

Conference Call

Maiden's CEO Art Raschbaum and CFO John Marshaleck will review

the third quarter 2012 results tomorrow morning via teleconference

and live audio webcast beginning at 8:30 a.m. ET.

| To participate in the conference call, please

access one of the following no later than 8:25 a.m. ET: |

| U.S.Callers: 1.877.734.5373 |

| Outside U.S. Callers: 1.973.200.3059 |

| Passcode:47870194 |

| Webcast:

http://www.maiden.bm/presentations_conferences |

A replay of the conference call will be available beginning

11:00 a.m. ET on November 8, 2012 through midnight on November 15,

2012. To listen to the replay, please dial toll free:

1.800.585.8367 (U.S. Callers) or toll: 1.404.537.3406 (callers

outside the U.S.) and enter the Passcode: 47870194; or access

http://www.maiden.bm/presentations_conferences

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed

in 2007. Through its subsidiaries, which are each A- rated

(excellent) by A.M. Best, the Company is focused on providing

non-catastrophic, customized reinsurance products and services to

small and mid-size insurance companies in the United States and

Europe. As of September 30, 2012, Maiden had $3.9 billion

in assets and shareholders' equity of $1.0 billion.

The Maiden Holdings, Ltd. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=5006

Forward Looking Statements

This release contains "forward-looking statements" which are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements are based on the Company's current expectations and

beliefs concerning future developments and their potential effects

on the Company. There can be no assurance that actual developments

will be those anticipated by the Company. Actual results may differ

materially from those projected as a result of significant risks

and uncertainties, including non-receipt of the expected payments,

changes in interest rates, effect of the performance of financial

markets on investment income and fair values of investments,

developments of claims and the effect on loss reserves, accuracy in

projecting loss reserves, the impact of competition and pricing

environments, changes in the demand for the Company's products, the

effect of general economic conditions and unusual frequency of

storm activity, adverse state and federal legislation, regulations

and regulatory investigations into industry practices, developments

relating to existing agreements, heightened competition, changes in

pricing environments, and changes in asset valuations. Additional

information about these risks and uncertainties, as well as others

that may cause actual results to differ materially from those

projected is contained in Item 1A. Risk Factors in the Company's

Annual Report on Form 10-K for the year ended December 31, 2011 as

updated in periodic filings with the SEC. The Company undertakes no

obligation to publicly update any forward-looking statements,

except as may be required by law.

| Maiden Holdings,

Ltd. |

| Balance

Sheet |

| (in thousands (000's),

except per share data) |

| |

|

|

| |

|

|

| |

September 30, 2012

(Unaudited) |

December 31, 2011

(Audited) |

| Assets |

|

|

| Fixed maturities, available-for-sale, at fair

value (Amortized cost 2012: $2,472,806; 2011: $1,957,106) |

$ 2,610,012 |

$ 2,020,661 |

| Other investments, at fair value (Cost 2012:

$2,530; 2011: $1,955) |

2,826 |

2,192 |

| Total investments |

2,612,838 |

2,022,853 |

| Cash and cash equivalents |

66,877 |

188,082 |

| Restricted cash and cash equivalents |

115,324 |

114,895 |

| Accrued investment income |

21,329 |

13,215 |

| Reinsurance balances receivable,

net |

449,186 |

423,355 |

| Funds withheld |

41,927 |

42,605 |

| Prepaid reinsurance premiums |

43,621 |

35,381 |

| Reinsurance recoverable on unpaid losses |

29,110 |

20,289 |

| Loan to related party |

167,975 |

167,975 |

| Deferred commission and other acquisition

costs |

274,587 |

248,436 |

| Goodwill and intangible assets, net |

95,484 |

98,755 |

| Other assets |

30,857 |

19,270 |

| Total Assets |

$ 3,949,115 |

$ 3,395,111 |

| Liabilities

and Equity |

|

|

| Liabilities |

|

|

| Reserve for loss and loss adjustment

expenses |

$ 1,547,103 |

$ 1,398,438 |

| Unearned premiums |

976,689 |

832,047 |

| Accrued expenses and other liabilities |

63,318 |

161,883 |

| Senior notes |

207,500 |

107,500 |

| Junior subordinated debt |

126,303 |

126,263 |

| Total Liabilities |

2,920,913 |

2,626,131 |

| |

|

|

| Equity: |

|

|

| Preference Shares - Series A |

150,000 |

-- |

| Common shares |

732 |

732 |

| Additional paid-in capital |

575,293 |

579,004 |

| Accumulated other comprehensive

income |

137,441 |

64,059 |

| Retained earnings |

168,141 |

128,648 |

| Treasury stock, at cost |

(3,801) |

(3,801) |

| Total Maiden Shareholders'

Equity |

1,027,806 |

768,642 |

| Noncontrolling interest in

subsidiaries |

396 |

338 |

| Total Equity |

1,028,202 |

768,980 |

| Total Liabilities and

Equity |

$ 3,949,115 |

$ 3,395,111 |

| |

|

|

| |

|

|

| Book value per common share

(4) |

$ 12.14 |

$ 10.64 |

| |

|

|

| Common shares

outstanding |

72,282,489 |

72,221,428 |

| |

| |

| Maiden Holdings,

Ltd. |

| Income

Statement |

| (in thousands (000's),

except per share data) |

|

(Unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

For the Three Months Ended

September 30, 2012 |

For the Three Months Ended

September 30, 2011 |

For the Nine Months Ended September

30, 2012 |

For the Nine Months Ended September

30, 2011 |

| Revenues: |

|

|

|

|

| Gross premiums written |

$ 478,515 |

$ 451,130 |

$ 1,536,955 |

$ 1,384,302 |

| |

|

|

|

|

| Net premiums written |

$ 455,847 |

$ 428,586 |

$ 1,458,640 |

$ 1,315,052 |

| Change in unearned premiums |

(6,874) |

(8,309) |

(134,055) |

(180,457) |

| Net premiums earned |

448,973 |

420,277 |

1,324,585 |

1,134,595 |

| Other insurance revenue |

2,622 |

4,530 |

9,650 |

11,364 |

| Net investment income |

21,550 |

18,749 |

60,072 |

57,708 |

| Net realized and unrealized gains (losses) on

investment |

2,410 |

(2,900) |

836 |

(2,262) |

| Total revenues |

475,555 |

440,656 |

1,395,143 |

1,201,405 |

| Expenses: |

|

|

|

|

| Net loss and loss adjustment

expenses |

309,146 |

274,504 |

897,498 |

746,285 |

| Commission and other acquisition

expenses |

120,923 |

126,777 |

367,844 |

339,673 |

| General and administrative expenses |

13,578 |

12,475 |

42,617 |

37,607 |

| Total expenses |

443,647 |

413,756 |

1,307,959 |

1,123,565 |

| |

|

|

|

|

| Income from operations

(2) |

31,908 |

26,900 |

87,184 |

77,840 |

| |

|

|

|

|

| Other expenses |

|

|

|

|

| Amortization of intangible assets |

(1,090) |

(1,258) |

(3,271) |

(3,775) |

| Foreign exchange gains (losses) |

1,213 |

(1,103) |

1,318 |

898 |

| Interest and amortization expenses |

(9,569) |

(8,178) |

(26,815) |

(26,588) |

| Accelerated amortization of junior

subordinated debt discount and issuance cost |

-- |

-- |

-- |

(20,313) |

| Junior subordinated debt repurchase

expense |

-- |

-- |

-- |

(15,050) |

| Total other

expenses |

(9,446) |

(10,539) |

(28,768) |

(64,828) |

| |

|

|

|

|

| Income before income

taxes |

22,462 |

16,361 |

58,416 |

13,012 |

| Income taxes: |

|

|

|

|

| Current tax expense |

397 |

203 |

880 |

1,299 |

| Deferred tax expense |

131 |

156 |

618 |

738 |

| Income tax expense |

528 |

359 |

1,498 |

2,037 |

| |

|

|

|

|

| Net income |

21,934 |

16,002 |

56,918 |

10,975 |

| Less: (income) loss attributable to

noncontrolling interest |

(15) |

2 |

(81) |

5 |

| Net income attributable to Maiden

common shareholders |

$ 21,919 |

$ 16,004 |

$ 56,837 |

$ 10,980 |

| Net operating earnings attributable

to Maiden common shareholders (1) |

$ 19,517 |

$ 21,429 |

$ 58,572 |

$ 52,411 |

| |

|

|

|

|

| Basic earnings per common share

attributable to Maiden shareholders |

$ 0.30 |

$ 0.22 |

$ 0.79 |

$ 0.15 |

| Diluted earnings per common share

attributable to Maiden shareholders |

$ 0.30 |

$ 0.22 |

$ 0.78 |

$ 0.15 |

| Basic operating earnings per common

share attributable to Maiden shareholders |

$ 0.27 |

$ 0.30 |

$ 0.81 |

$ 0.73 |

| Diluted operating earnings per common

share attributable to Maiden shareholders |

$ 0.27 |

$ 0.29 |

$ 0.80 |

$ 0.72 |

| Dividends declared per common

share |

$ 0.08 |

$ 0.08 |

$ 0.24 |

$ 0.22 |

| |

|

|

|

|

| Weighted average number of basic

shares outstanding |

72,270,052 |

72,182,759 |

72,251,711 |

72,136,366 |

| |

|

|

|

|

| Weighted average number of diluted

shares outstanding |

73,138,961 |

72,921,968 |

73,088,533 |

72,883,334 |

| |

|

|

|

|

| Net loss and loss adjustment expense

ratio (6) |

68.5% |

64.6% |

67.3% |

65.1% |

| Commission and other acquisition

expense ratio (7) |

26.8% |

29.8% |

27.6% |

29.6% |

| General and administrative

expense ratio (8) |

2.9% |

3.0% |

3.1% |

3.3% |

| Combined ratio (9) |

98.2% |

97.4% |

98.0% |

98.0% |

| Annualized return on

equity |

10.2% |

8.3% |

9.2% |

1.9% |

| Annualized return on equity on

operating earnings |

9.1% |

11.1% |

9.5% |

9.2% |

| |

| |

| Maiden Holdings,

Ltd. |

| Non - GAAP Financial

Measure |

| (in thousands (000's),

except per share data) |

|

(Unaudited) |

| |

|

|

|

|

| |

For the Three Months Ended

September 30, 2012 |

For the Three Months Ended

September 30, 2011 |

For the Nine Months Ended September

30, 2012 |

For the Nine Months Ended September

30, 2011 |

| |

|

|

|

|

| Reconciliation of net income

attributable to Maiden common shareholders to net operating

earnings: |

|

|

|

|

| Net income attributable to Maiden common

shareholders |

$ 21,919 |

$ 16,004 |

$ 56,837 |

$ 10,980 |

| Add (subtract) |

|

|

|

|

| Net realized and unrealized (gains)

losses on investment |

(2,410) |

2,900 |

(836) |

2,262 |

| Foreign exchange (gains)

losses |

(1,213) |

1,103 |

(1,318) |

(898) |

| Amortization of intangible assets |

1,090 |

1,258 |

3,271 |

3,775 |

| Accelerated amortization of junior

subordinated debt discount and issuance cost |

-- |

-- |

-- |

20,313 |

| Junior subordinated debt repurchase

expense |

-- |

-- |

-- |

15,050 |

| Non-recurring general and administrative

expenses relating to IIS Acquisition |

-- |

8 |

-- |

191 |

| Non-cash deferred tax charge |

131 |

156 |

618 |

738 |

| Net operating earnings attributable to Maiden

common shareholders (1) |

$ 19,517 |

$ 21,429 |

$ 58,572 |

$ 52,411 |

| |

|

|

|

|

| Operating earnings per common share

attributable to Maiden shareholders: |

|

|

|

|

| |

|

|

|

|

| Basic earnings per common share attributable

to Maiden shareholders |

$ 0.27 |

$ 0.30 |

$ 0.81 |

$ 0.73 |

| Diluted earnings per common share

attributable to Maiden shareholders |

$ 0.27 |

$ 0.29 |

$ 0.80 |

$ 0.72 |

| |

|

|

|

|

| Reconciliation of net income

attributable to Maiden common shareholders to income from

operations: |

|

|

|

|

| Net income attributable to Maiden common

shareholders |

$ 21,919 |

$ 16,004 |

$ 56,837 |

$ 10,980 |

| Add (subtract) |

|

|

|

|

| Foreign exchange (gains) losses |

(1,213) |

1,103 |

(1,318) |

(898) |

| Amortization of intangible assets |

1,090 |

1,258 |

3,271 |

3,775 |

| Interest and amortization expenses |

9,569 |

8,178 |

26,815 |

26,588 |

| Accelerated amortization of junior

subordinated debt discount and issuance cost |

-- |

-- |

-- |

20,313 |

| Junior subordinated debt repurchase

expense |

-- |

-- |

-- |

15,050 |

| Income tax expense |

528 |

359 |

1,498 |

2,037 |

| Income (loss) attributable to

noncontrolling interest |

15 |

(2) |

81 |

(5) |

| Income from operations (2) |

$ 31,908 |

$ 26,900 |

$ 87,184 |

$ 77,840 |

| |

|

|

|

|

| |

September 30, 2012 |

December 31, 2011 |

|

|

| Investable assets: |

|

|

|

|

| Total investments |

$ 2,612,838 |

$ 2,022,853 |

|

|

| Cash and cash equivalents |

66,877 |

188,082 |

|

|

| Restricted cash and cash equivalents |

115,324 |

114,895 |

|

|

| Funds withheld (3) |

28,443 |

29,783 |

|

|

| Loan to related party |

167,975 |

167,975 |

|

|

| Total investable assets (3) |

$ 2,991,457 |

$ 2,523,588 |

|

|

| |

|

|

|

|

| |

September 30, 2012 |

December 31, 2011 |

|

|

| Capital: |

|

|

|

|

| Senior notes |

$ 207,500 |

$ 107,500 |

|

|

| Junior subordinated debt |

126,303 |

126,263 |

|

|

| Total Maiden shareholders' equity |

1,027,806 |

768,642 |

|

|

| Total capital (5) |

$ 1,361,609 |

$ 1,002,405 |

|

|

| |

|

|

|

|

| |

| (1) Net operating earnings

is a non-GAAP financial measure defined by the Company as net

income attributable to Maiden common shareholders excluding

realized and unrealized investment gains and losses, foreign

exchange gains and losses, amortization of intangible assets,

accelerated amortization of junior subordinated debt discount and

issuance cost, junior subordinated debt repurchase expense,

non-recurring general and administrative expenses relating to

acquisitions and non-cash deferred tax charge and should not be

considered as an alternative to net income. The Company's

management believes that net operating earnings is a useful

indicator of trends in the Company's underlying operations. The

Company's measure of net operating earnings may not be comparable

to similarly titled measures used by other companies. |

| |

| (2) Income from Operations

is a non-GAAP financial measure defined by the Company as net

income attributable to Maiden common shareholders excluding foreign

exchange gains and losses, amortization of intangible assets,

interest and amortization expenses, accelerated amortization of

junior subordinated debt discount and issuance cost, junior

subordinated debt repurchase expense, income tax expense and income

or loss attributable to noncontrolling interest and should not be

considered as an alternative to net income. The Company's

management believes that income from operations is a useful measure

of the Company's underlying earnings fundamentals based on its

underwriting and investment income before financing costs. This

income from operations enables readers of this information to more

clearly understand the essential operating results of the Company.

The Company's measure of income from operations may not be

comparable to similarly titled measures used by other

companies. |

| |

| (3) Investable assets is

the total of the Company's investments, cash and cash equivalents,

loan to a related party and the portion of the funds withheld

balance that comprises fixed maturity securities and cash and cash

equivalents. |

| |

| (4) Calculated by dividing

total Maiden shareholders' equity less the preference shares -

series A by total common shares outstanding. |

| |

| (5) Capital is the total of

the Company's senior notes, junior subordinated debt and Maiden

shareholders' equity. |

| |

| Maiden Holdings,

Ltd. |

| Supplemental Financial

Data - Segment Information |

| (in thousands

(000's)) |

|

(Unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| For the Three Months Ended September

30, 2012 |

Diversified

Reinsurance |

AmTrust Quota Share

Reinsurance |

ACAC Quota

Share |

Total |

| Net premiums written |

$ 193,943 |

$ 186,258 |

$ 75,646 |

$ 455,847 |

| Net premiums earned |

$ 200,020 |

$ 177,293 |

$ 71,660 |

$ 448,973 |

| Other insurance revenue |

2,622 |

-- |

-- |

2,622 |

| Net loss and loss adjustment expenses |

(141,625) |

(120,942) |

(46,579) |

(309,146) |

| Commissions and other acquisition

expenses |

(47,801) |

(50,525) |

(22,597) |

(120,923) |

| General and administrative expenses |

(9,256) |

(535) |

(199) |

(9,990) |

| Underwriting income |

$ 3,960 |

$ 5,291 |

$ 2,285 |

$ 11,536 |

| |

|

|

|

|

| Reconciliation to net income

attributable to Maiden common shareholders |

|

|

|

|

| Net investment income and realized gains on

investment |

|

|

|

23,960 |

| Amortization of intangible assets |

|

|

|

(1,090) |

| Foreign exchange gains |

|

|

|

1,213 |

| Interest and amortization expenses |

|

|

|

(9,569) |

| Other general and administrative

expenses |

|

|

|

(3,588) |

| Income tax expense |

|

|

|

(528) |

| Income attributable to noncontrolling

interest |

|

|

|

(15) |

| Net income attributable to Maiden

common shareholders |

|

|

|

$ 21,919 |

| |

|

|

|

|

| Net loss and loss adjustment expense ratio

(6) |

69.9% |

68.2% |

65.0% |

68.5% |

| Commission and other acquisition expense

ratio (7) |

23.6% |

28.5% |

31.5% |

26.8% |

| General and administrative expense ratio

(8) |

4.5% |

0.3% |

0.3% |

2.9% |

| Combined ratio (9) |

98.0% |

97.0% |

96.8% |

98.2% |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| For the Three Months Ended September

30, 2011 |

Diversified

Reinsurance |

AmTrust Quota Share

Reinsurance |

ACAC Quota

Share |

Total |

| Net premiums written |

$ 188,652 |

$ 173,502 |

$ 66,432 |

$ 428,586 |

| Net premiums earned |

$ 197,803 |

$ 159,668 |

$ 62,806 |

$ 420,277 |

| Other insurance revenue |

4,530 |

-- |

-- |

4,530 |

| Net loss and loss adjustment expenses |

(123,267) |

(110,727) |

(40,510) |

(274,504) |

| Commissions and other acquisition

expenses |

(62,032) |

(44,845) |

(19,900) |

(126,777) |

| General and administrative expenses |

(8,468) |

(538) |

(408) |

(9,414) |

| Underwriting income |

$ 8,566 |

$ 3,558 |

$ 1,988 |

$ 14,112 |

| |

|

|

|

|

| Reconciliation to net income

attributable to Maiden common shareholders |

|

|

|

|

| Net investment income and realized and

unrealized gains (losses) on investment |

|

|

|

15,849 |

| Amortization of intangible assets |

|

|

|

(1,258) |

| Foreign exchange losses |

|

|

|

(1,103) |

| Interest and amortization expenses |

|

|

|

(8,178) |

| Other general and administrative

expenses |

|

|

|

(3,061) |

| Income tax expense |

|

|

|

(359) |

| Loss attributable to noncontrolling

interest |

|

|

|

2 |

| Net income attributable to Maiden

common shareholders |

|

|

|

$ 16,004 |

| |

|

|

|

|

| Net loss and loss adjustment expense

ratio (6) |

60.9% |

69.3% |

64.5% |

64.6% |

| Commission and other acquisition expense

ratio (7) |

30.7% |

28.1% |

31.7% |

29.8% |

| General and administrative expense ratio

(8) |

4.2% |

0.4% |

0.6% |

3.0% |

| Combined ratio (9) |

95.8% |

97.8% |

96.8% |

97.4% |

| |

|

|

|

|

| |

|

|

|

|

| (6) Calculated by dividing net

loss and loss adjustment expenses by net premiums earned and other

insurance revenue. |

| (7) Calculated by dividing

commission and other acquisition expenses by net premiums earned

and other insurance revenue. |

| (8) Calculated by dividing

general and administrative expenses by net premiums earned and

other insurance revenue. |

| (9) Calculated by adding together

net loss and loss adjustment expense ratio, commission and other

acquisition expense ratio and general and administrative

expense ratio. |

| |

| |

| Maiden Holdings,

Ltd. |

| Supplemental Financial

Data - Segment Information |

| (in thousands

(000's)) |

|

(Unaudited) |

| |

|

|

|

|

| For the Nine Months Ended September

30, 2012 |

Diversified

Reinsurance |

AmTrust Quota Share

Reinsurance |

ACAC Quota

Share |

Total |

| Net premiums written |

$ 626,220 |

$ 607,902 |

$ 224,518 |

$ 1,458,640 |

| Net premiums earned |

$ 603,613 |

$ 512,988 |

$ 207,984 |

$ 1,324,585 |

| Other insurance revenue |

9,650 |

-- |

-- |

9,650 |

| Net loss and loss adjustment expenses |

(412,437) |

(350,553) |

(134,508) |

(897,498) |

| Commissions and other acquisition

expenses |

(159,895) |

(142,284) |

(65,665) |

(367,844) |

| General and administrative expenses |

(31,849) |

(1,444) |

(566) |

(33,859) |

| Underwriting income |

$ 9,082 |

$ 18,707 |

$ 7,245 |

$ 35,034 |

| |

|

|

|

|

| Reconciliation to net income

attributable to Maiden common shareholders |

|

|

|

|

| Net investment income and realized gains on

investment |

|

|

|

60,908 |

| Amortization of intangible assets |

|

|

|

(3,271) |

| Foreign exchange gains |

|

|

|

1,318 |

| Interest and amortization expenses |

|

|

|

(26,815) |

| Other general and administrative

expenses |

|

|

|

(8,758) |

| Income tax expense |

|

|

|

(1,498) |

| Income attributable to noncontrolling

interest |

|

|

|

(81) |

| Net income attributable to Maiden

common shareholders |

|

|

|

$ 56,837 |

| |

|

|

|

|

| Net loss and loss adjustment expense ratio

(6) |

67.3% |

68.3% |

64.7% |

67.3% |

| Commission and other acquisition expense

ratio (7) |

26.1% |

27.7% |

31.6% |

27.6% |

| General and administrative expense ratio

(8) |

5.1% |

0.4% |

0.2% |

3.1% |

| Combined ratio (9) |

98.5% |

96.4% |

96.5% |

98.0% |

| |

|

|

|

|

| |

|

|

|

|

| For the Nine Months Ended September

30, 2011 |

Diversified

Reinsurance |

AmTrust Quota Share

Reinsurance |

ACAC Quota

Share |

Total |

| Net premiums written |

$ 605,490 |

$ 516,665 |

$ 192,897 |

$ 1,315,052 |

| Net premiums earned |

$ 542,325 |

410,441 |

181,829 |

$ 1,134,595 |

| Other insurance revenue |

11,364 |

-- |

-- |

11,364 |

| Net loss and loss adjustment expenses |

(349,999) |

(279,006) |

(117,280) |

(746,285) |

| Commissions and other acquisition

expenses |

(161,709) |

(120,198) |

(57,766) |

(339,673) |

| General and administrative expenses |

(24,805) |

(1,802) |

(1,423) |

(28,030) |

| Underwriting income |

$ 17,176 |

$ 9,435 |

$ 5,360 |

$ 31,971 |

| |

|

|

|

|

| Reconciliation to net income

attributable to Maiden common shareholders |

|

|

|

|

| Net investment income and realized and

unrealized gains (losses) on investment |

|

|

|

55,446 |

| Amortization of intangible assets |

|

|

|

(3,775) |

| Foreign exchange gains |

|

|

|

898 |

| Interest and amortization expenses |

|

|

|

(26,588) |

| Accelerated amortization of junior

subordinated debt discount and issuance cost |

|

|

|

(20,313) |

| Junior subordinated debt repurchase

expense |

|

|

|

(15,050) |

| Other general and administrative

expenses |

|

|

|

(9,577) |

| Income tax expense |

|

|

|

(2,037) |

| Loss attributable to noncontrolling

interest |

|

|

|

5 |

| Net income attributable to Maiden

common shareholders |

|

|

|

$ 10,980 |

| |

|

|

|

|

| Net loss and loss adjustment expense

ratio (6) |

63.2% |

68.0% |

64.5% |

65.1% |

| Commission and other acquisition expense

ratio (7) |

29.2% |

29.3% |

31.8% |

29.6% |

| General and administrative expense ratio

(8) |

4.5% |

0.4% |

0.8% |

3.3% |

| Combined ratio (9) |

96.9% |

97.7% |

97.1% |

98.0% |

| |

|

|

|

|

| |

|

|

|

|

| (6) Calculated by dividing net

loss and loss adjustment expenses by net premiums earned and other

insurance revenue. |

| (7) Calculated by dividing

commission and other acquisition expenses by net premiums earned

and other insurance revenue. |

| (8) Calculated by dividing

general and administrative expenses by net premiums earned and

other insurance revenue. |

| (9) Calculated by adding together

net loss and loss adjustment expense ratio, commission and other

acquisition expense ratio and general and administrative

expense ratio. |

CONTACT: Noah Fields, Vice President, Investor Relations

Maiden Holdings, Ltd.

Phone: 441.298.4927

E-mail: nfields@maiden.bm

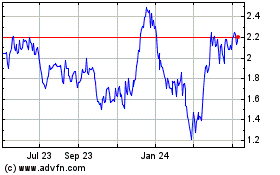

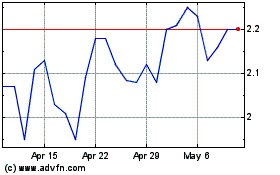

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From May 2024 to Jun 2024

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jun 2023 to Jun 2024