Insert before the About Laser Photonics Corporation section:

Webcast Info: Management will host a webcast at 9 AM ET to discuss

today’s results, which can be accessed here:

https://viavid.webcasts.com/starthere.jsp?ei=1698029&tp_key=b4fad4c0de

The updated release reads:

INSERTING and REPLACING LASER PHOTONICS

ANNOUNCES THIRD QUARTER 2024 RESULTS

Laser Photonics Corporation (NASDAQ: LASE), (“LPC”), a leading

global developer of CleanTech laser systems for laser cleaning and

other material applications, today announced results for its third

quarter ended September 30, 2024.

Wayne Tupuola, CEO of Laser Photonics, commented on the third

quarter:

“Looking at the quarter, we navigated a challenging period

marked by increased investment in HR, Sales, and administrative

functions—strategic moves that, while impacting our short-term

performance, are essential for our future growth. We also secured

several key deals, such as a sale of our CleanTech Industrial

Roughening Laser 3050 to Acuren, another sale to the U.S. Navy, and

an expansion with Brokk into the Asia-Pacific region. Each of these

highlights our ongoing commitment to driving growth and value

across strategic verticals.”

“Looking to our future, we're excited about the advancement of

our innovative product concepts, including the Laser Shield

Anti-Drone System (LSAD) and the Next-Gen CleanTech Robotic Cell,

both poised to play critical roles in defense and industrial

markets.”

Control Micro Systems (CMS) Acquisition

Tupuola continued, “I’m also thrilled to share details about our

recent acquisition of CMS, which was finalized shortly after the

third quarter. This acquisition represents a transformative

opportunity for Laser Photonics by extending our footprint into the

healthcare and pharmaceutical industries, particularly in

controlled-release drug delivery and counterproofing pills, while

also bringing synergies to our industrial markets. CMS specializes

in custom precision laser systems, including laser drilling for

controlled-release pharmaceuticals and anti-counterfeiting

solutions, aligning perfectly with our vision to innovate in

critical, high-growth sectors.

“The CMS acquisition diversifies our portfolio, enhancing our

resilience against economic cycles and providing stability to our

CleanTech revenue stream. CMS already serves some of the world’s

largest pharmaceutical companies, giving us a platform to

strengthen relationships with industry leaders and expand our

client base. By leveraging LPC’s sales and marketing capabilities,

we see significant potential to unlock value in CMS's offerings,

supported by over $2 million in unbilled contracted revenue.”

Financial Highlights: (Q324 vs. Q323)

- Revenue: $0.8 million compared to $1.3 million;

- Gross Profit: $0.6 million compared to $1.0 million;

- Operating Loss: ($1.7) million compared to ($0.9) million;

- Net Loss: ($1.6) million from ($0.9) million;

- Loss per Share: ($0.13) compared to ($0.11).

Third Quarter Business Highlights

Announced CleanTech Customer Orders:

- Acuren - a leader in nondestructive testing services, selected

LPC’s CleanTech laser systems to support critical inspection and

maintenance processes;

- Semiconductor and Solar - A leading poly-silicon manufacturer

is using CleanTech to enhance its manufacturing process;

- Oil & Gas: A global company in the oil and gas sector.

Announced DefenseTech Customer Orders:

- U.S. Navy - The Pearl Harbor Naval Shipyard and Intermediate

Maintenance Facility integrated LPC’s DefenseTech laser system for

the removal of corrosion from naval vessels.

Partnerships:

- Expanded partnership with Brokk to its Australian subsidiary to

bring laser cleaning and cutting technology to the mining,

tunneling, construction, metal processing, and military ecosystems

in Australia, New Zealand and throughout the Asia-Pacific

region.

Products:

- Released concept video for Laser Shield Anti-Drone System

(LSAD) prototype at LPC's testing facility. The LSAD is a

cutting-edge solution in development for the deterrence of

unauthorized drone activity;

- Released concept for Next Gen Robotic Clean Cell.

Webcast Info: Management will host a webcast at 9 AM ET to

discuss today’s results, which can be accessed here:

https://viavid.webcasts.com/starthere.jsp?ei=1698029&tp_key=b4fad4c0de

About Laser Photonics Corporation

Laser Photonics is a vertically-integrated manufacturer and

R&D Center of Excellence for industrial laser technologies and

systems. LPC seeks to disrupt the $46 billion, centuries-old sand

and abrasives blasting markets, focusing on surface cleaning, rust

removal, corrosion control, de-painting and other laser-based

industrial applications. LPC's new generation of leading-edge laser

blasting technologies and equipment also addresses the numerous

health, safety, environmental, and regulatory issues associated

with the old methods. As a result, LPC has quickly gained a

reputation as an industry leader for industrial laser systems with

a brand that stands for quality, technology and product innovation.

Currently, world-renowned and Fortune 1000 manufacturers in the

aerospace, automotive, defense, energy, industrial, maritime, space

exploration and shipbuilding industries are using LPC's

"unique-to-industry" systems. For more information, visit

www.laserphotonics.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains "forward-looking statements" (within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended), including statements regarding the Company's plans,

prospects, potential results and use of proceeds. These statements

are based on current expectations as of the date of this press

release and involve a number of risks and uncertainties, which may

cause results and uses of proceeds to differ materially from those

indicated by these forward-looking statements. These risks include,

without limitation, those described under the caption "Risk

Factors" in the Registration Statement. Any reader of this press

release is cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company undertakes no obligation to revise or

update any forward-looking statements to reflect events or

circumstances after the date of this press release except as

required by applicable laws or regulations.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value data)

(unaudited)

As of September 30, 2024

(Unaudited)

As of December 31, 2023

(Restated)

Current Assets:

Cash and Cash Equivalents

$

2,121,760

$

6,201,137

Accounts Receivable, Net

725,780

816,364

Account Receivable (related parties)

47,515

Inventory

1,830,725

2,237,455

Other Assets

357,166

39,190

Total Current Assets

5,082,946

9,294,146

Property, Plant, & Equipment, Net

1,258,488

952,811

Intangible Assets, Net

4,026,820

4,279,987

Operating Lease Right-of-Use Asset

252,558

597,143

Total Assets

$

10,620,812

$

15,124,087

Liabilities & Stockholders’

Equity

Current Liabilities:

Accounts Payable

$

533,938

$

223,040

Deferred Revenue

116,564

213,114

Current Portion of Operating Lease

206,212

434,152

Accrued Expenses

30,083

161,538

Total Current Liabilities

886,796

1,031,844

Long Term Liabilities:

Lease liability - less current

46,346

162,991

Total Long Term Liabilities

46,346

162,991

Total Liabilities

933,143

1,194,835

Stockholders’ Equity:

Preferred stock Par value $0.001:

10,000,000 shares authorized. 0 Issued: shares were outstanding as

of June 30, 2024 and December 31, 2023

-

-

Common Stock Par Value $0.001: 100,000,000

shares authorized; 12,270,427 and 9,253,419 issued, 12,245,490 and

9,228,482 outstanding as of June 30, 2024, and December 31,

2023

13,832

9,253

Additional Paid in Capital

18,039,795

19,180,725

Retained Earnings (Deficit)

(8,340,719)

(5,235,486)

Treasury Stock

(25,240)

(25,240)

Total Stockholders’ Equity

9,687,669

13,929,252

Total Liabilities & Stockholders’

Equity

$

10,620,812

$

15,124,087

STATEMENTS OF PROFIT AND

LOSS

(in thousands, except per

share data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

(Unaudited)

September 30, 2023 (Restated)

September 30, 2024

(Unaudited)

September 30, 2023 (Restated)

Net Sales

$

716,697

$

1,303,205

$

2,083,123

$

2,944,837

Cost of Sales

107,277

333,325

772,481

887,086

Gross Profit

609,420

969,880

1,310,642

2,057,751

Operating Expenses:

Sales & Marketing

554,667

677,026

957,558

1,462,868

General & Administrative

1,053,124

608,647

1,845,166

1,936,521

Depreciation & Amortization

238,617

152,210

652,657

336,294

Payroll Expenses

406,107

347,461

853,264

993,572

Research and Development Cost

62,802

75,431

170,725

155,889

Total Operating Expenses

2,315,316

1,860,774

4,479,370

4,885,144

Operating Income (Loss)

(1,705,896)

(890,894)

(3,168,728)

(2,827,393)

Other Income (Expenses):

Total Other Income (Loss)

80,629

(4,215)

80,666

(4,215)

Income (Loss) Before Tax

(1,625,267)

(895,109)

(3,088,062)

(2,831,608)

Tax Provision

-

-

-

-

Net Income (Loss)

$

(1,625,267)

$

(895,109)

$

(3,088,062)

$

(2,831,608)

Deemed Dividend from Software

Acquisition

0

0

(6,615,000)

0

Net Comprehensive loss attributed to

Common Shareholders

(1,625,267)

(895,109)

(9,703,062)

(2,831,608)

Earning (Loss) per Share:

Basic and Diluted

$

(0.13)

$

(0.11)

$

(0.28)

$

(0.35)

Loss per share (attributable to common

shareholders)

(0.13)

(0.11)

(0.89)

(0.35)

Weighted Average of Shares Outstanding

12,671,166

8,253,417

10,847,009

8,107,584

Statement of Cash

Flows

(in thousands)

(unaudited)

Nine Months Ended

September 30, 2024

(Restated)

September 30, 2023

(Restated)

OPERATING ACTIVITIES

Net Loss

$

(3,105,233)

$

(2,831,608)

Adjustments to Reconcile Net Loss to Net

Cash Flow from Operating Activities:

Bad Debt

208,351

Shares issued for compensation

33,336

-

Distribution to affiliate

(3,822,037)

Depreciation & Amortization

669,828

336,294

Change in Operating Assets &

Liabilities:

Accounts Receivable

(165,282)

(36,083)

Inventory

(26,979)

(640,180)

Prepaids & Other Current Assets

(15,976)

5,591

Accounts Payable

311,873

30,140

Accrued Expenses

(132,431)

(338,605)

Deposits

(302,000)

Deferred Revenue

(96,549)

-

Net Cash Used in Operating

Activities

(6,443,099)

(3,474,451)

INVESTING ACTIVITIES

Purchase of Property, Plant an

Equipment

(57,550)

(124,833)

Purchase of Research & Development

Equipment

(5,295)

-

Vehicles

(144,096)

Licenses & Patents

(2,875)

Purchase of Operational Software &

Website

-

(34,069)

Invest in Leasehold Improvements

(225,783)

(19,707)

Net Cash Used in Investing

Activities

(288,628)

(325,580)

FINANCING ACTIVITIES

Common stock .01 x 100,000,000

(92,533)

Common stock .001 x 100,000,000

13,832

Additional Paid in Capital

2,731,051

(71,250)

Net Cash Used in Financing

Activities

2,652,350

(71,250)

Net Cash Flow for Period

(4,079,377)

(3,871,281)

Cash and Cash Equivalents - Beginning of

Period

6,201,137

12,181,799

Cash and Cash Equivalents- End of

Period

$

2,121,760

$

8,310,518

NON-CASH INVESTING AND FINANCING

ACTIVITIES

Shares issued on conversion of debt

-

-

Share issued for purchase of license

6,615,000

-

Common Stock to be issued for cashless

exercise of warrants

62

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114737203/en/

Investor Relations Contact: Brian Siegel, IRC, MBA Senior

Managing Director Hayden IR (346) 396-8696 laser@haydenir.com

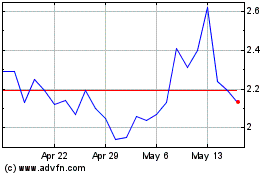

Laser Photonics (NASDAQ:LASE)

Historical Stock Chart

From Oct 2024 to Nov 2024

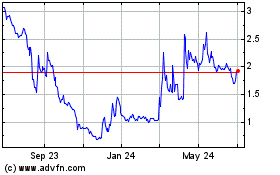

Laser Photonics (NASDAQ:LASE)

Historical Stock Chart

From Nov 2023 to Nov 2024