UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 11, 2014

__________________________________________

Lakeland Industries, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

0-15535 |

13-3115216 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

701 Koehler Avenue, Suite 7, Ronkonkoma,

New York 11779-7410

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (631) 981-9700

Not

Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement. |

On October 11, 2014, Lakeland Industries,

Inc.’s (the “Company”) China subsidiary, Weifang Lakeland Safety Products Co., Ltd (“WF” or “Borrower”),

and Bank of China Anqiu Branch (“Lender”) entered into a loan agreement to obtain a line of credit for financing in

the amount RMB 5,000,000 (approximately USD $816,000) (the “Loan Agreement”). Borrower intends to draw down most of

the line of credit amount, if not all, within a relatively short period of time. Below is a summary of the material terms of the

loan facility:

o Amount

of loan: RMB 5,000,000

o Life

of loan: Due October 10, 2015

o Purpose

of loan: Purchase of materials.

| o | Collateral is inventory owned by WF |

| o | Interest rate of loan and calculation: |

| o | Interest to be at 123% of the benchmark rate supplied by Lender (which is currently 6% per annum). |

| o | Effective

per annum interest rate: 7.38% per annum; |

| o | Repayment of loan: within a one year period, optional payment periods, quarterly or monthly. |

| o | As of this date, no borrowings have been drawn down from this facility. |

The foregoing description of the Loan Agreement

does not purport to be complete and is qualified in its entirety by reference to the Loan Agreement, which is attached hereto as

Exhibit 10.1 and incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosures set forth in Item 1.01 are

incorporated by reference to this item.

| Item 5.02 | Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On October 13, 2014, the Company entered

into an Employment Agreement (the “Agreement”) with Gary Pokrassa, its Chief Financial Officer. The term of the Agreement

is eighteen (18) months from February 1, 2015 through July 31, 2016 (the “Term”). Mr. Pokrassa’s current employment

agreement expires on January 31, 2015.

The Agreement provides for a base salary

of $250,000 per year. Mr. Pokrassa may also be awarded an annual incentive bonus of between 80% and 120% of his target bonus amount

of $85,000, subject to adjustment by the Compensation Committee of the Company’s Board of Directors (the “Compensation

Committee”) based upon the Company’s achievement of certain earnings per share targets established by the Compensation

Committee with input by Mr. Pokrassa. Payment of the annual bonus, if any, will be made in accordance with the Company’s

normal payroll procedures, but no later than June 1st following the year for which the annual bonus was earned. The

annual bonus will be calculated each May during the Term commencing in May 2015. In the event that Mr. Pokrassa’s employment

is terminated on or after July 31, 2016 during the fiscal year ending January 31, 2017, for any reason other than Cause (as such

term is defined in the Agreement), then he shall be paid a pro-rata portion of any annual bonus for such fiscal year up to the

date of termination, which shall be determined in good faith by the Compensation Committee.

Also under the Agreement, if the Company

terminates Mr. Pokrassa’s employment without Cause or he resigns for Good Reason (as such term is defined in the Agreement),

in either such case, the Company (subject to certain restrictions) shall pay Mr. Pokrassa (i) all accrued obligations of the Company

through the date of termination, (ii) twelve (12) months of his then current base salary, and (iii) a pro rata portion of the annual

bonus, if any, for the year of termination up to and including the date of termination. If Mr. Pokrassa is terminated for Cause,

he will be entitled to receive his base salary through the date of termination and any awarded but unpaid bonus. If Mr. Pokrassa’s

employment is terminated as a result of his death or “total disability” (as defined in the Agreement), either he or

his beneficiary or estate, as the case may be, will be entitled to receive his base salary through the date of termination, the

pro rata portion of any annual bonus for the year of termination up to the date of termination, and any accrued obligations of

the Company.

Also under the Agreement, Mr. Pokrassa is

subject to non-competition and non-solicitation restrictions during the Term and for a period of one year thereafter.

The foregoing description of the Agreement

does not purport to be complete and is qualified in its entirety by reference to the Agreement, which is attached hereto as Exhibit

10.3 and incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) |

Exhibits. |

|

| |

|

|

| |

10.1 |

Loan Agreement, dated October 11, 2014, between the China subsidiary of Lakeland Industries, Weifang Lakeland Safety Products Inc., Ltd., and Bank of China Anqiu Branch. |

| |

|

|

| |

10.2 |

Summary of Exhibit 10.1 in English. |

| |

|

|

| |

10.3 |

Employment Agreement, dated October 13, 2014, between Lakeland Industries, Inc. and Gary Pokrassa. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LAKELAND INDUSTRIES, INC. |

| |

|

| |

/s/ Christopher J. Ryan |

| |

Christopher J. Ryan |

| |

Chief Executive Officer & President |

| |

|

| |

Date: October 14, 2014 |

EXHIBIT INDEX

| Exhibit |

|

|

| Number |

|

Description |

| |

|

|

| 10.1 |

|

Loan Agreement, dated October 11, 2014, between the China subsidiary of Lakeland Industries, Weifang Lakeland Safety Products Inc., Ltd., and Bank of China Anqiu Branch. |

| |

|

|

| 10.2 |

|

Summary of Exhibit 10.1 in English. |

| |

|

|

| 10.3 |

|

Employment Agreement, dated October 13, 2014, between Lakeland Industries, Inc. and Gary Pokrassa. |

Exhibit 10.1

D—02:流动资金借款合同——适用于单笔,及A类、B类之单项流动资金借款业务

流 动 资 金 借

款 合 同

编号:中小企业2014年安丘借字054号

借款人:潍坊雷克兰劳保用品有限公司

营业执照号码: 370700400004469

法定代表人/负责人:克里斯托福J.袁

住所地:安丘市华安路南首硝市居委会驻地

邮编: 262100

开户金融机构及账号:中国银行安丘支行

231219162014

电话:

0536-4264606 传真:0536-4264606

贷款人:中国银行股份有限公司安丘支行

法定代表人/负责人:

刘永成

住所地:安丘市兴安路128号

邮编: 262100

电话: 0536-4225720 传真:

0536-4225720

借款人、贷款人经平等协商,就贷款人向借款人发放流动资金贷款事宜达成一致,特订立本合同。

第一条 借款金额

借款币种:人民币。

借款金额:(大写)伍佰万元整;

(小写)5,000,000.00。

第二条 借款期限

借款期限:12个月,自实际提款日起算;若为分期提款,则自第一个实际提款日起算。

借款人应严格按照约定提款时间提款,实际提款日晚于约定提款时间的,借款人仍应按照本合同约定的还款时间还款。

第三条 借款用途

借款用途:购原材料。

未经贷款人书面同意,借款人不得改变借款用途,包括但不限于借款人不得将贷款用于固定资产、股权等投资,不得用于国家禁止生产、经营的领域和用途。

第四条 借款利率与计结息

1、借款利率

借款利率为下列第(2)种:

(1)固定利率,年利率

/ %。借款期限内合同利率不变。

(2)浮动利率,以实际提款日(若为分笔提款,则为第一个实际提款日)为起算日,每

12 个月为一个浮动周期,重新定价一次。重新定价日为下一个浮动周期的首日,即起算日在重新定价当月的对应日,当月没有对应日的则为当月最后一日。

就每笔提款:

A.首期(自其实际提款日起至本浮动周期届满之日)利率为实际提款日中国人民银行公布施行的六个月至一年(含一年)期贷款基准利率上浮

23 %;

B. 在重新定价日,与其它分笔提款一并按当日中国人民银行公布施行的同档次贷款基准利率上浮

23 %进行重新定价,作为该浮动周期的适用利率。

2、利息计算

利息从借款人实际提款日起算,按实际提款额和用款天数计算。

利息计算公式:利息=本金×实际天数×日利率。

日利率计算基数为一年360天,换算公式:日利率=年利率/360。

3、结息方式

借款人按下列第

(2) 种方式结息:

(1)按季结息,每季度末月的20日为结息日,21日为付息日。

(2)按月结息,每月的20日为结息日,21日为付息日。

若贷款本金的最后一期清偿日不在付息日,则该贷款本金的最后一期清偿日为付息日,借款人应付清全部应付利息。

4、罚息

(1)对逾期或未按合同约定用途使用借款的,从逾期或挪用之日起,就逾期或挪用部分,按本款约定的罚息利率计收罚息,直至清偿本息为止。

对既逾期又挪用的贷款,按照较高的罚息利率计收罚息。

(2)对借款人不能按期支付的利息以及罚息,以本条第3款约定的结息方式,按本款约定的罚息利率计收复利。

(3)罚息利率

按本条第1款约定的浮动周期及方式浮动。逾期贷款罚息利率为该浮动利率水平上加收__50__%,挪用贷款罚息利率为该浮动利率水平上加收__100__%。

第五条 提款条件

借款人提款须满足下列条件:

1、本合同及其附件已生效;

2、借款人已按贷款人要求提供担保,担保合同已生效并完成法定的审批、登记或备案手续;

3、借款人已向贷款人预留与订立和履行本合同有关的借款人文件、单据、印鉴、人员名单、签字样本,并填妥有关凭证;

4、借款人已按贷款人要求开立履行本合同所必需的账户;

5、于提款前

/ 个银行工作日,向贷款人提交书面提款申请及有关借款用途证明文件,办理相关提款手续;

6、借款人已向贷款人提交董事会或其他有权部门同意签订和履行本合同的决议书和授权书;

7、法律规定及双方约定的其他提款条件 /

。

上述提款条件未满足,贷款人有权拒绝借款人的提款申请,但贷款人同意放款的除外。

第六条 提款时间及方式

1、借款人应按下列第

(1) 种时间和方式提款:

(1)于2014年10月11日一次性提款。

(2)自 / 年 / 月 / 日起 / 内提清借款。

(3)按下列时间分期提款:

2、超过上述时间未提用的部分,贷款人有权拒绝借款人的提款申请。

第七条 借款资金支付

借款人在贷款人处开立如下账户作为借款发放账户,借款的发放和支付应通过本账户办理。

户名:潍坊雷克兰劳保用品有限公司

账号:231219162014

2、借款资金支付方式

(1)借款资金支付方式应按照法律法规、监管规定及本合同的约定执行,单笔提款的借款资金支付方式应在提款申请书中予以确认,贷款人认为提款申请书中选择的借款资金支付方式不符合要求的,有权变更支付方式或停止借款资金的发放和支付。

(2)贷款人受托支付,即贷款人根据借款人的提款申请和支付委托,将借款资金支付给符合本合同约定用途的借款人交易对手。根据银监会相关规定和贷款人内部管理规定,符合下列条件之一的贷款资金支付,应采用贷款人受托支付方式:

A.贷款人与借款人新建立信贷业务关系,且借款人信用评级未达到贷款人内部要求;

B.提款申请时支付对象明确(有明确的账户、户名)且单笔金额超过10万元(不含,外币按实际提款日

/ 汇率折算);

C. 贷款人规定或与借款人约定的其他情形: / 。

(3)借款人自主支付,即贷款人根据借款人的提款申请将借款资金发放至借款人账户后,由借款人自主支付给符合合同约定用途的借款人交易对手。除前款约定应采用贷款人受托支付方式的情形外,其他借款资金的支付方式为借款人自主支付。

(4)支付方式变更。提交提款申请书后,如借款人对外款项支付、信用评级等条件发生变化,对自主支付的借款资金,满足本条第2款第(2)项约定条件的,应变更借款资金支付方式。变更支付方式或受托支付方式下对外支付金额、支付对象、借款用途等发生变更的,借款人应向贷款人提供书面的变更申请说明,重新提交提款申请书和证明资金用途的相关交易资料。

3、借款资金受托支付具体要求

(1)支付委托。符合贷款人受托支付条件的,借款人在提款申请书中应有明确的支付委托,即授权和委托贷款人在将借款资金划入指定的借款人账户后,直接将借款资金支付给符合本合同约定用途的借款人指定的交易对手账户,并应提供收款的交易对手名称、交易对手账户、支付金额等必要付款信息。

(2)交易资料提供。符合贷款人受托支付条件的,借款人应在每次提款时向贷款人提供其放款账户、交易对手账户信息及证明本次提款符合借款合同约定用途的证明材料。借款人应保证提供给贷款人的所有资料都是真实、完整和有效的。因借款人提供的相关交易资料不真实、不准确、不完整导致贷款人的受托支付义务未能及时完成的,贷款人不承担任何责任,借款人在本合同项下已经产生的还款义务不受影响。

(3)贷款人受托支付义务的履行

A. 采用贷款人受托支付的,借款人提交支付委托及相关交易资料等后,贷款人审核同意后将借款资金通过借款人账户支付给借款人交易对手。

B.贷款人经审核发现借款人提供的用途证明材料等相关交易材料不符合本合同约定或存在其他瑕疵的,有权要求借款人补充、替换、说明或重新提交相关材料,在借款人提交贷款人认为合格的相关交易材料前,贷款人有权拒绝相关款项的发放和支付。

C. 若发生交易对手账户开户行退款,导致贷款人无法及时按照借款人支付委托将借款资金支付给其交易对手的,贷款人不承担任何责任,借款人在本合同项下已经产生的还款义务不受影响。对于交易对手账户开户行退回的款项,借款人在此授权贷款人予以冻结。在此情形下,借款人应重新提交支付委托及用途证明材料等相关交易资料。

(4)借款人不得以化整为零的方式规避贷款人受托支付。

4、借款资金发放后,借款人应根据贷款人的要求及时提供借款资金使用记录和资料,应提供的前述材料包括但不限于每月帐户资金收支明细。

5、发生下列情形之一,贷款人有权重新确定借款发放和支付条件或停止借款资金的发放与支付:

(1)借款人违反本合同约定,以化整为零方式规避贷款人受托支付;

(2)借款人信用状况下降或主营业务盈利能力不强;

(3)借款资金使用出现异常;

(4)借款人未按贷款人要求及时提供借款资金使用记录和资料;

(5)借款人违反本条约定支付借款资金。

第八条 还款

1、借款人指定以下账户作为资金回笼账户,借款人资金回笼应进入该账户。借款人应及时提供该账户资金进出情况。贷款人有权要求借款人说明资金回笼账户中大额及异常资金流入流出情况并对该账户进行监管。

户名:潍坊雷克兰劳保用品有限公司

账号:231219162014

2、除双方另有约定外,借款人须按下列第(1)项还款计划归还本合同项下借款:

(1)借款期限届满日归还本合同项下全部借款。

(2)按下列还款计划归还本合同项下借款:

(3)其他还款计划: / 。

借款人如需变更上述还款计划,须在相应贷款到期

5 个银行工作日前向贷款人提出书面申请,还款计划的变更须经双方共同书面确认。

3、除双方另有约定外,在借款人同时拖欠借款本金及利息的情况下,贷款人有权决定偿还本金或偿还利息的顺序;在分期还款情形下,若本合同项下存在多笔到期借款、逾期借款的,贷款人有权决定借款人某笔还款的清偿顺序;借款人与贷款人之间存在多笔已到期借款合同的,贷款人有权决定借款人每笔还款所履行的合同顺序。

4、除双方另有约定外,借款人可以提前还款,但应提前

5 个银行工作日书面通知贷款人。提前还款的金额首先用来偿还最后到期的贷款,按照倒序还款。

5、借款人按下列第

1 种方式还款。

(1)借款人不迟于每一笔本息到期前

1 个银行工作日在下述还款账户中存入足额资金以备还款,贷款人有权于每一笔本息到期日主动从此账户中扣收款项。

还款账户户名:潍坊雷克兰劳保用品有限公司。

账号:231219162014。

(2)双方约定的其它还款方式: / 。

第九条 担保

1、本合同项下债务的担保方式为:

本合同属于担保人

潍坊雷克兰劳保用品有限公司 与贷款人签订的编号为中小企业2014年安丘总抵字054-1号《最高额抵押合同》项下的主合同,由其提供最高额担保。

本合同属于担保人

潍坊雷克兰劳保用品有限公司 与贷款人签订的编号为中小企业2014年安丘总抵字054-2号《最高额抵押合同》项下的主合同,由其提供最高额担保。

2、若借款人或担保人发生贷款人认为可能影响其履约能力的事件,或担保合同变为无效、被撤销或解除,或借款人、担保人财务状况恶化或涉入重大诉讼或仲裁案件,或因其他原因而可能影响其履约能力,或担保人在担保合同或与贷款人之间的其他合同项下发生违约,或担保物贬值、毁损、灭失、被查封,致使担保价值减弱或丧失时,贷款人有权要求,且借款人有义务提供新的担保、更换保证人等以担保本合同项下债务。

第十条 声明与承诺

1、借款人声明如下:

(1)借款人依法注册并合法存续,具备签订和履行本合同所需的完全民事权利能力和行为能力;

(2)签署和履行本合同系基于借款人的真实意思表示,已经按照其章程或者其它内部管理文件的要求取得合法、有效的授权,且不会违反对借款人有约束力的任何协议、合同和其他法律文件;借款人已经或将会取得签订和履行本合同所需的一切有关批准、许可、备案或者登记;

(3)借款人在本合同项下向贷款人提供的全部文件、财务报表、凭证及其他资料是真实、完整、准确和有效的;

(4)借款人申请向贷款人叙作业务的交易背景真实、合法,未用于洗钱等非法目的;

(5)借款人未向贷款人隐瞒可能影响其和担保人财务状况和履约能力的事件;

(6)借款人及贷款项目达到国家环保标准,非国家相关部门公布和认定的耗能、污染问题突出且整改不力的企业和项目,不存在耗能、污染风险;

(7)借款人声明的其它事项:/

2、借款人承诺如下:

(1)按照贷款人要求,定期或及时向贷款人报送其财务报表(包括但不限于年报、季报和月报表)及其他相关资料;借款人确保其持续满足下述财务指标要求: / ;

(2)如果借款人已经或将与本合同保证人就其保证义务签订反担保协议或类似协议,该协议将不会损害贷款人在本合同项下的任何权利;

(3)接受贷款人的信贷检查与监督,并给予足够的协助和配合;借款人自主支付的,应按照贷款人要求定期汇总报告贷款资金支付、使用情况,具体汇总报告时间为:

/ ;

(4)如借款人发生进行合并、分立、减资、股权转让、对外投资、实质性增加债务融资、重大资产和债权转让以及其他可能对借款人的偿债能力产生不利影响的事项时,须事先征得贷款人的书面同意;

若发生下列情形,借款人应及时通知贷款人:

| A. | 借款人或担保人公司章程、经营范围、注册资本、法定代表人变更; |

| B. | 进行任何形式的联营、与外商合资、合作、承包经营、重组、改制、计划上市等经营方式的变更; |

| C. | 涉入重大诉讼或仲裁案件,或财产或担保物被查封、扣押或监管,或在担保物上设置新的担保; |

| D. | 歇业、解散、清算、停业整顿、被撤销、被吊销营业执照、(被)申请破产等; |

| E. | 股东、董事和现任高级管理人员涉嫌重大案件或经济纠纷; |

(5)借款人对贷款人债务的清偿顺序优先于借款人股东对其的借款,并且不亚于其他债权人的同类债务;

(6)在有关会计年度的税后净利润为零或负数,或者税后利润不足以弥补以往会计年度累计亏损的情况下,或者税前利润未用于清偿借款人在该会计年度内应清偿的本金、利息和费用或者税前利润不足以清偿下一期本金、利息和费用时,借款人不以任何形式向股东分配股息、红利;

(7)借款人不以降低其偿债能力的方式处置自有资产。并承诺其对外担保的总额不高于其自身净资产的

1 倍,且对外担保的总额及单项担保的数额不超过其公司章程所规定的限额;

(8)除符合本合同约定的用途或经贷款人同意外,借款人不得向同名账户和关联方账户划转本合同项下贷款资金。

对于借款人同名账户划转或关联方账户划转,借款人应提供相应的证明资料。

(9)就本合同项下贷款,借款人向贷款人提供的担保条件、贷款利率定价、偿债顺序等贷款条件,不低于现在或将来给予任何其它金融机构的条件。

(10)贷款人有权根据借款人资金回笼情况提前收回贷款;

(11)借款人承诺的其它事项: / 。

第十一条 借款人所在集团内部关联交易披露

双方约定适用下述第

1 项条款:

1、借款人不属于贷款人依据《商业银行集团客户授信业务风险管理指引》(简称“《指引》”)确定的集团客户。

2、借款人属于贷款人依据《商业银行集团客户授信业务风险管理指引》(简称“《指引》”)确定的集团客户。借款人应及时向贷款人报告净资产10%以上关联交易的情况,包括交易各方的关联关系、交易项目和交易性质、交易的金额或相应的比例、定价政策(包括没有金额或只有象征性金额的交易)。

借款人有下列情形之一,贷款人有权单方决定停止支付借款人尚未使用的贷款,并提前收回部分或全部贷款本息:利用与关联方之间的虚假合同,以无实际贸易背景的应收票据、应收账款等债权到银行贴现或质押,套取银行资金或授信的;出现重大兼并、收购重组等情况,贷款人认为可能影响到贷款安全的;通过关联交易,有意逃废银行债权;《指引》第十八条规定的其他情形。

第十二条 违约事件及处理

下列事项之一即构成或视为借款人在本合同项下违约事件:

1、借款人未按本合同的约定履行对贷款人的支付和清偿义务;

2、借款人未按本合同的约定方式支用贷款资金或未将获得的资金用于本合同约定的用途;

3、借款人在本合同中所做的声明不真实,或违反其在本合同中所做的承诺;

4、发生本合同第十条第2款第(4)项等规定的情况,贷款人认为可能影响借款人或担保人的财务状况和履约能力,而借款人不按本合同的规定提供新的担保、更换保证人;

5、借款人信用状况下降,或借款人的盈利能力、偿债能力、营运能力和现金流量等财务指标恶化,突破本合同约定的指标约束或其他财务约定;

6、借款人在与贷款人或中国银行股份有限公司其他机构之间的其他合同项下发生违约事件;借款人与其他金融机构之间的授信合同项下发生违约事件;

7、担保人违反担保合同的约定,或在与贷款人或中国银行股份有限公司其他机构之间的其他合同项下发生违约事件;

8、借款人终止营业或者发生解散、撤销或破产事件。

9、借款人涉及或可能涉及重大经济纠纷、诉讼、仲裁,或其资产被查封、扣押或被强制执行,或被司法机关或税务、工商等行政机关依法立案查处或依法采取处罚措施,已经或可能影响到其在本合同项下义务的履行的;

10、借款人主要投资者个人、关键管理人员异常变动、失踪或被司法机关依法调查或限制人身自由,已经或可能影响到其在本合同项下义务的履行的;

11、贷款人每年(即本合同生效之日起每满一年)对借款人的财务状况和履约能力进行审核时,发现存在可能影响借款人或担保人财务状况和履约能力的情况;

12、指定资金回笼账户出现大额及异常资金流入流出情况且借款人不能提供贷款人认可的解释材料的;

13、借款人违反本合同中关于当事人权利义务的其他约定。

出现前款规定的违约事件时,贷款人有权视具体情形分别或同时采取下列措施:

1、要求借款人、担保人限期纠正其违约行为;

2、全部、部分调减、中止或取消、终止对借款人的授信额度;

3、全部、部分中止或终止受理借款人在本合同、借款人与贷款人之间的其他合同项下的提款等业务申请;对于尚未发放的贷款、尚未办理的贸易融资,全部、部分中止或取消、终止发放、支付和办理;

4、宣布本合同、借款人与贷款人之间的其他合同项下尚未偿还的贷款/贸易融资款项本息和其他应付款项全部或部分立即到期;

5、终止或解除本合同,全部、部分终止或解除借款人与贷款人之间的其他合同;

6、要求借款人赔偿因其违约而给贷款人造成的损失;

7、将借款人在贷款人及中国银行股份有限公司其它机构开立的账户内的款项扣划以清偿借款人在本合同项下对贷款人所负全部或部分债务。账户中的未到期款项视为提前到期。账户币种与贷款人业务计价货币不同的,按扣收时贷款人适用的外汇牌价汇率折算;

8、行使担保物权;

9、要求保证人承担保证责任;

10、贷款人认为必要和可能的其他措施。

第十三条 权利保留

一方若未行使本合同项下部分或全部权利,或未要求另一方履行、承担部分或全部义务、责任,并不构成该方对该权利的放弃或对该义务、责任的豁免。

一方对另一方的任何宽容、展期或者延缓行使本合同项下的权利,均不影响其根据本合同及法律、法规而享有的任何权利,亦不视为其对该权利的放弃。

第十四条 变更、修改与终止

本合同经双方协商一致,可以书面形式进行变更或修改,任何变更或修改均构成本合同不可分割的组成部分。

除法律、法规另有规定或当事人另有约定外,本合同在其项下权利义务全部履行完毕前不得终止。

除法律、法规另有规定或当事人另有约定外,本合同任何条款的无效均不影响其他条款的法律效力。

第十五条 法律适用、争议解决

本合同适用中华人民共和国法律。

在本合同生效后,因订立、履行本合同所发生的或与本合同有关的一切争议,双方可协商解决。协商不成的,任何一方可以采取下列第

2 种方式加以解决:

1、提交 / 仲裁委员会,按提交仲裁申请时该会有效之仲裁规则,在

/ (仲裁地点)进行仲裁。

2、依法向贷款人或者依照本合同、单项协议行使权利义务的中国银行股份有限公司其他机构住所地的人民法院起诉。

3、依法向有管辖权的人民法院起诉。

在争议解决期间,若该争议不影响本合同其他条款的履行,则该其他条款应继续履行。

第十六条 附件

下列附件及经双方共同确认的其它附件构成本合同不可分割的组成部分,具有与本合同相同的法律效力。

1、提款申请书;

第十七条 其他约定

1、未经贷款人书面同意,借款人不得将本合同项下任何权利、义务转让予第三人。

2、若贷款人因业务需要须委托中国银行股份有限公司其他机构履行本合同项下权利及义务,或将本合同项下借款业务划归中国银行股份有限公司其他机构承接并管理,借款人对此表示认可。贷款人授权的中国银行股份有限公司其他机构、或承接本合同项下借款业务的中国银行股份有限公司其他机构有权行使本合同项下全部权利,有权就本合同项下纠纷以该机构名义向法院提起诉讼、提交仲裁机构裁决或申请强制执行。

3、在不影响本合同其他约定的情形下,本合同对双方及各自依法产生的承继人和受让人均具有法律约束力。

4、除另有约定外,双方指定本合同载明的住所地为通讯及联系地址,并承诺在通讯及联系地址发生变更时,以书面形式及时通知对方。

5、本合同项下交易基于各自独立利益进行。如按相关法律、法规和监管要求,交易其他各方构成贷款人的关联方或关联人士,各方均不谋求利用此种关联关系影响交易的公允性。

6、本合同中的标题和业务名称仅为指代的方便而使用,不得用于对条款内容及当事方权利义务的解释。

7、贷款人有权根据有关法律法规、监管规定,将与本合同有关的信息和借款人其他相关信息提供给中国人民银行征信系统和其他依法设立的信用信息数据库,供具有适当资格的机构或个人依法查询和使用。贷款人也有权为本合同订立和履行之目的,通过中国人民银行征信系统和其他依法设立的信用信息数据库查询借款人的相关信息。

8、提款日、还款日如遇法定节假日,则顺延至节假日后的第一个工作日。

9、贷款人因法律法规、监管规定变化或者监管部门要求,不能履行协议或不能按照协议约定履行的,贷款人有权终止或依据法律法规、监管规定变化或监管部门要求变更履行本协议及其项下单项协议。因该种原因致协议终止或变更使贷款人不能履行或不能按照协议约定履行的,贷款人免除责任。

第十八条 合同生效

本合同经借贷双方的法定代表人(负责人)或其授权签字人签署并加盖公章之日起生效。

本合同一式

叁 份,借贷双方及登记机关各执 壹

份,具有同等法律效力。

借款人:潍坊雷克兰劳保用品有限公司

贷款人:中国银行股份有限公司安丘支行

有权签字人:

有权签字人:

年 月 日 年

月 日

Exhibit 10.2

Loan Agreement Summary

Borrower: Weifang Lakeland Safety Products

Co., Ltd. (“WF”)

Lender: Bank of China Anqiu Branch (“BOCAB)

| 2. | The borrowing amounts limit: RMB 5 million, WF can select the borrowing amounts within RMB 5 million. |

| 3. | Borrowing method: Trading financial, WF mortgaged inventory valued at RMB 18,357,925 to the bank.

The bank hired a professional firm to supervise WF’s inventory flow, which WF will pay at a yearly rate of RMB 40,000. |

| 4. | Interest: Interest based on 123% of the benchmark rate. Payment requirements are the 21st

of each month. |

| 5. | Borrowing period: up to one year. The longest borrowing period is one year, WF can select the borrowing

period (ex. three months, six months, etc.) |

Exhibit 10.3

October 13, 2014

Mr. Gary Pokrassa

143 Westwood Circle

East Hills, NY 11577

Dear Mr. Pokrassa:

The purpose of this letter is to confirm

your continuing employment with Lakeland Industries, Inc. on the following terms and conditions:

1.

THE PARTIES

This is an Agreement, effective as of February

1, 2015 (the “Effective Date”), between Gary Pokrassa, residing at 143 Westwood Circle, East Hills, NY 11577 (hereinafter

referred to as “you”), and Lakeland Industries, Inc., a Delaware corporation, with a principal place of business located

at 701 Koehler Avenue, Suite 7, Ronkonkoma, NY 11779-7410 (hereinafter the “Company”).

2.

TERM

The term of the Agreement shall be for

a 18 month period from the Effective Date through and including July 31, 2016 unless sooner terminated as provided herein (the

“Term”).

3.

CAPACITY

You shall be employed in the capacity of

Chief Financial Officer of Lakeland Industries, Inc. with such responsibilities and duties as may be assigned from time to time

by the Company as are consistent in all material respects with the responsibilities and duties typically assigned to a Chief Financial

Officer.

You agree to devote your full time and

attention and best efforts to the faithful and diligent performance of your duties to the Company and shall serve and further the

best interests and enhance the reputation of the Company to the best of your ability.

4.

COMPENSATION

As full compensation for your services,

you shall receive the following from the Company:

| (a) | An annual base salary of $250,000 payable bi-weekly (the “Base Salary”); and |

| (b) | Participation, if and when eligible, in such pension

plans, profit sharing plans, medical and disability plans, stock appreciation rights plans, stock option plans, ESOP or 401(k)

plans as are generally maintained by the Company for its employees from time to time when any such plans are or become effective;

and |

| (c) | Such benefits as are provided from time to time by the

Company to its officers and employees; provided however that your annual vacation shall be for a period of 4 weeks, with no more

than 2 such weeks taken at any one time; and |

| (d) | An automobile allowance in the amount of $750 per month,

subject to on-going review and discretion of the Company; and |

| (e) | Reimbursement for any dues and expenses incurred by you

that are necessary and proper in the conduct of the Company’s business; and |

| (f) | An annual bonus as set forth in Section 5 of this Agreement (the “Annual Bonus”). |

5. ANNUAL

BONUS

During the Term, in addition to Base Salary,

you have the opportunity to earn an Annual Bonus under an incentive compensation plan as determined by the Compensation Committee

of the Board of Directors of the Company (the “Board”). In May of each year during the Term commencing in 2015, you

may be awarded an Annual Bonus of between 80% and 120% of your target bonus amount of $85,000, subject to adjustment by the Compensation

Committee from time to time (the “Target Bonus Amount”). Such Annual Bonus shall be calculated based upon the Company’s

actual earnings per share (“EPS”) as compared to an EPS target amount (the “FY EPS Target”), EPS threshold

amount (the “FY EPS Threshold”) or EPS maximum amount (the “FY EPS Maximum”) for such year set by the Compensation

Committee with input from you; provided, however, the Compensation Committee shall have final decision-making authority. More particularly,

(i) 80% of the Target Bonus Amount will be awarded to you as an Annual Bonus if the Company’s actual EPS equals or exceeds

the FY EPS Threshold but is less than the FY EPS Target, (ii) 100% of the Target Bonus Amount will be awarded to you as an Annual

Bonus if the Company’s actual EPS equals or exceeds the FY EPS Target but is less than the FY EPS Maximum, and (iii) 120%

of the Target Bonus Amount will be awarded to you as an Annual Bonus if the Company’s actual EPS equals or exceeds the FY

EPS Maximum. Payment of the Annual Bonus, if any, due you, shall be made in accordance with the Company’s normal payroll

procedures, but no later than June 1 following the year for which the Annual Bonus was earned. The Annual Bonus will be calculated

each May during the Term. In the event that your employment is terminated on or after July 31, 2016 during the fiscal year ending

January 31, 2017, for a reason other than Cause, you shall be paid a pro-rata portion of the Annual Bonus, if any, for such fiscal

year up to the date of termination, which shall be determined in good faith by the Compensation Committee of the Board.

6. NON-COMPETITION/SOLICITATION/CONFIDENTIALITY

During your employment with the Company

and for one year thereafter, you shall not, either directly or indirectly, as an agent, employee, partner, stockholder, director,

investor or otherwise, engage in any business in competition with the business of the Company within the Company’s market

area(s). You shall also abide by the Code of Ethics Agreement and other Corporate Governance Rules. You shall disclose

prior to the execution of this Agreement (or later on as the case may be) all business relationships you presently have or contemplate

entering into or enter into in the future that might affect your responsibilities or loyalties to the Company.

During your employment with the Company

and for one year thereafter, you shall not, directly or indirectly, hire, offer to hire or otherwise solicit the employment or

services of, any employee of the Company on behalf of yourself or any other person, firm or entity.

Except as may be required to perform your

duties on behalf of the Company, you agree that during your employment with the Company and for a period of one year thereafter,

you shall not, directly or indirectly, solicit, service, or accept business from, on your own behalf or on behalf of any other

person, firm or entity, any customers or potential customers of the Company with whom you had contact during your employment or

about whom you acquired confidential information during your employment.

Except as required in your duties to the

Company, you shall not at any time during or after your employment, directly or indirectly, use or disclose any confidential or

proprietary information relating to the Company or its business or customers which is disclosed to you or known by you as a consequence

of or through your employment by the Company and which is not otherwise generally obtainable by the public at large.

In the event that any of the provisions

in this Section 6 shall ever be adjudicated to exceed limitations permitted by applicable law, you agree that such provisions shall

be modified and enforced to the maximum extent permitted under applicable law.

7. TERMINATION

You or the Company may terminate your employment

prior to the end of the Term upon written notice to the other party in accordance with the following provisions:

| (a) | Voluntary Termination. You may terminate your

employment voluntarily at any time during the Term by providing the Company with 60 days prior written notice. If you do so, except

for Good Reason (as defined below), you shall be entitled to receive from the Company your (i) accrued and unpaid Base Salary

through the date of termination (which shall be on the date that is 60 days after the date on which you give notice of resignation

to the Company), (ii) any Annual Bonus earned for the year completed prior to the year of termination but not yet paid, and (iii)

any other employee benefits generally paid by the Company up to the date of termination (collectively (i), (ii), and (iii), the

“Accrued Obligations”). |

| (b) | Death. This Agreement shall automatically terminate on the date of your death without

further obligation to you other than for payment by the Company to your estate or designated beneficiaries, as designated in writing

to the Company, of (i) the Accrued Obligations through the last day of the month in which your death occurs, and (ii) a pro-rata

portion of the Annual Bonus, if any, for the year of termination up to and including the date of death which shall be determined

in good faith by the Compensation Committee of the Board. Your estate or beneficiaries, as applicable, shall also be entitled to

all other benefits generally paid by the Company on an employee’s death. |

| (c) | Disability. This Agreement and your employment

shall terminate without any further obligation to you if you become “totally disabled” (as defined below) other than

for payment by the Company of (i) the Accrued Obligations though the last day of the month in which you are deemed to be totally

disabled and (ii) a pro-rata portion of the Annual Bonus, if any, for the year of termination up to and including the date you

are deemed to be totally disabled as determined in good faith by the Compensation Committee of the Board. |

| | You shall be deemed to be “totally disabled” in you are unable, for any reason, to

perform any of your duties and obligations to the Company, with or without a reasonable accommodation, for a period of 90 consecutive

days or for periods aggregating 120 days in any period of 180 consecutive days. |

| (d) | Cause. The Company may terminate your employment

at any time for “Cause” (as defined below) and this Agreement shall terminate immediately with no further obligations

to you other than the Company shall pay you, within thirty days of such termination, the Accrued Obligations up to the date of

such termination for Cause. |

| (e) | Termination by the Company Without Cause or by you

for Good Reason. If, during the Term, the Company terminates your employment without Cause or you terminate your employment

for Good Reason (as defined below), you shall be entitled to receive from the Company, subject to your continued compliance with

the restrictive covenants contained in Section 6 hereof and, in the case of subparagraphs (ii) and (iii) of this paragraph your

execution and non-revocation of a release of claims substantially in the form attached hereto as Annex A, which release

in any case must be effective and non-revocable by no later than 60 days after the date of termination, (i) the Accrued Obligations

payable within 15 days after the date of termination (or, in the case of the prior year’s Annual Bonus, at such time such

bonus is payable pursuant hereto), (ii) an additional 12 months of your then current Base Salary, payable in equal monthly installments

beginning with the first payroll date after the date on which the release of claims becomes effective and can no longer be revoked,

and (iii) a pro rata portion of the Annual Bonus, if any, for the year of termination up to and including the date of termination

which shall be determined in good faith by the Compensation Committee of the Board and paid at such time as such bonus is payable

pursuant hereto. |

| (f) | Notwithstanding the foregoing, if your severance payments

payable hereunder constitute nonqualified deferred compensation subject to 409A of the Internal Revenue Code of 1986, as amended

(the “Code”), and the period in which you must execute the release begins in one calendar year and ends in another,

the severance payments will be made in the later calendar year. |

| (g) | For purposes of this Agreement: |

(i) “Cause”

shall mean termination based upon: (A) your failure to substantially perform your material duties and responsibilities with the

Company, after a written demand for such performance is delivered to you by the Company, which identifies the manner in which you

have not performed your duties or responsibilities, (ii) your commission of an act of fraud, theft, misappropriation, dishonesty

or embezzlement, (iii) your conviction for a felony or pleading nolo contendere to a felony, (iv) your willful and continuing

failure or refusal to carry out, or comply with, in any material respect any reasonable directive of the President or the Board

consistent with the terms of this Agreement, or (v) your material breach of any provision of this Agreement.

(ii)

“Good Reason” shall mean the occurrence of any of the following events without your prior written consent:

(A) the failure of the Company to pay your Base Salary or

Annual Bonus when due and if earned, other than an inadvertent administrative error or failure, within 10 days of receipt of notice

by you,

(B)

a reduction by the Company in your Base Salary,

(C) failure of the Company to maintain its principal headquarters

within the greater Long Island areas,

(D) a material diminution in your authority or responsibilities

from those described herein,

(E) any material breach of this Agreement by the Company,

or

(F) a failure of the Company to have any successor assume

in writing the obligations under this Agreement.

Notwithstanding the foregoing,

Good Reason shall not be deemed to exist unless you give the Company written notice within 30 days after the occurrence of the

event which you believe constitutes the basis for Good Reason, specifying the particular act or failure to act which you believe

constitutes the basis for Good Reason. If the Company fails to cure such act or failure to act, if curable, within 30 days

after receipt of such notice, you may terminate your employment for Good Reason. For the avoidance of doubt, if such act

is not curable, you may terminate your employment for Good Reason upon providing such notice.

8.

NOTICES

Any notices required to be given under

this Agreement shall, unless otherwise agreed to by you and the Company, be in writing and delivered either personally, by overnight

courier service (such as Federal Express) or sent by certified mail, return receipt requested and addressed as follows: if to the

Company, at its headquarters at 701 Koehler Avenue, Suite 7, Ronkonkoma, NY 11779-7410, or if to you, at your address at

143 Westwood Circle, East Hills, NY 11577; or to such other address as either party shall have furnished to the other in writing

in accordance herewith. Notice shall be effective when actually received by the addressee.

9.

ASSIGNMENT AND SUCCESSORS

The rights and obligations of the Company

under this Agreement shall inure to the benefit of and shall be binding upon the successors and assigns of the Company. This

Agreement may not be assigned by the Company unless the assignee or successor (as the case may be) expressly assumes the Company’s

obligations hereunder in writing. In the event of a successor to the Company or the assignment of the Agreement, the term

“Company” as used herein shall include any such successor or assignee.

10. AMENDMENT, WAIVER OR MODIFICATION

No amendment, waiver or modification in

whole or in part of this Agreement or any term or condition hereof shall be effective against any party unless in writing and duly

signed by the party sought to be bound. Any waiver of any breach of any provision hereof or right or power by any party on

one occasion shall not be construed as a waiver of or a bar to the exercise of such right or power on any other occasion or as

a waiver of any subsequent breach.

11.

SEPARABILITY

Any provision of this Agreement which is

unenforceable or invalid in any respect in any jurisdiction shall be ineffective in such jurisdiction to the extent that it is

unenforceable or invalid without effecting the remaining provisions hereof, which shall continue in full force and effect.

The unenforceability or invalidity of any provision of the Agreement in one jurisdiction shall not invalidate or render unenforceable

such provision in any other jurisdiction.

12.

GOVERNING LAW AND ARBITRATION

This Agreement shall be interpreted and

construed in accordance with the laws of the State of New York without regard to its choice of law principles. Any dispute,

controversy or claim of any kind arising under, in connection with, or relating to this Agreement or your employment with the Company

shall be resolved exclusively by binding arbitration. Such arbitration shall be conducted in New York City in accordance

with the rules of the American Arbitration Association (“AAA”) then in effect. The costs of the arbitration (fees

to the AAA and for the arbitrator(s)) shall be shared equally by the parties, subject to apportionment or shifting in the arbitration

award. In addition, the prevailing party in arbitration shall be entitled to reimbursement by the other party for its reasonable

attorney’s fees incurred. Judgment may be entered on the arbitration award in any court of competent jurisdiction.

13. SECTION 409A

It is the intent of the parties to this

Agreement that all compensation and benefits payable or provided to you under this Agreement not be subject to the additional tax

imposed pursuant to Section 409A of the Code. To the extent such potential payments or benefits could become subject to Section

409A of the Code, the parties shall cooperate to amend this Agreement with the goal of giving you the economic benefits described

herein in a manner that does not result in such tax being imposed.

If, as of the date of your “separation from service”

from the Company, you are a “specified employee” (within the meaning of Section 409A of the Code), then each installment

of the severance payments (including any lump sum payments) and benefits due under this Agreement, that would not otherwise be

exempt from Section 409A of the Code (either pursuant to a short-term deferral exception, the exception for separation pay upon

an involuntary separation from service or otherwise), above and that would, absent this subsection, be paid within the six-month

period following your “separation from service” from the Company shall not be paid until the date that is six months

and one day after such separation from service (or, if earlier, your death), with any such installments that are required to be

delayed being accumulated during the six-month period and paid in a lump sum on the date that is six months and one day following

your separation from service and any subsequent installments, if any, being paid in accordance with the dates and terms set forth

herein.

14.

HEADINGS

The headings contained in this Agreement

are for convenience only and shall not effect, restrict or modify the interpretation of this Agreement.

This Agreement may be signed by facsimile

or electronically, and may be signed in one or more counterparts.

[Signature Page Follows]

| |

|

LAKELAND INDUSTRIES, INC. |

| |

|

|

|

| |

|

By: |

/s/ Christopher J. Ryan |

| |

|

|

Christopher J. Ryan |

| |

|

|

President and CEO |

| |

|

|

|

| AGREED AND ACCEPTED: |

|

By: |

/s/ Thomas McAteer |

| |

|

|

Thomas McAteer |

| |

|

|

Chairman of the Compensation |

| |

|

|

Committee of the Board |

| /s/ Gary Pokrassa |

|

|

|

| Gary Pokrassa |

|

|

|

| Chief Financial Officer |

|

|

|

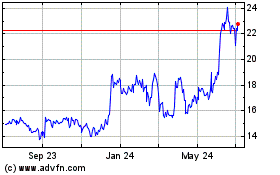

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2024 to Aug 2024

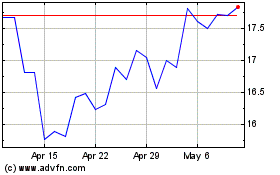

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Aug 2023 to Aug 2024