UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 6, 2015

KIMBALL ELECTRONICS, INC.

________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Indiana | | 001-36454 | | 35-2047713 |

(State or other jurisdiction of | | (Commission File | | (IRS Employer Identification No.) |

incorporation) | | Number) | | |

|

| | |

| | |

1205 Kimball Boulevard, Jasper, Indiana | | 47546 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (812) 634-4000

|

|

Former Address: 1600 Royal Street, Jasper, Indiana 47549-1001 |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On August 6, 2015, Kimball Electronics, Inc. issued an earnings release for the fourth quarter ended June 30, 2015. The earnings release is attached as Exhibit 99.1 and supplementary information provided for the Company’s earnings conference call is attached as Exhibit 99.2.

The information, including Exhibit 99.1 and Exhibit 99.2, in this Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except as shall otherwise be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are filed as part of this report:

|

| | |

Exhibit | | |

Number | | Description |

99.1 | | Earnings Release dated August 6, 2015 |

99.2 | | Supplementary Information |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| |

| KIMBALL ELECTRONICS, INC. |

| |

By: | /s/ Michael K. Sergesketter |

| MICHAEL K. SERGESKETTER Vice President, Chief Financial Officer |

Date: August 6, 2015

EXHIBIT INDEX

|

| | |

Exhibit | | |

Number | | Description |

99.1 | | Earnings Release dated August 6, 2015 |

99.2 | | Supplementary Information |

Exhibit 99.1

KIMBALL ELECTRONICS, INC. REPORTS FOURTH QUARTER AND FISCAL YEAR 2015 RESULTS

JASPER, IN (August 6, 2015) - Kimball Electronics, Inc. (Nasdaq: KE), a leading global electronic manufacturing services provider for high-quality, durable electronic products, today announced financial results for its fourth quarter and fiscal year ended June 30, 2015.

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Fiscal Year Ended |

| June 30, | | June 30, |

(Amounts in Thousands, except EPS) | 2015 | | 2014 | | 2015 | | 2014 |

Net Sales | $ | 201,126 |

| | $ | 198,949 |

| | $ | 819,350 |

| | $ | 741,530 |

|

Operating Income | $ | 9,050 |

| | $ | 7,721 |

| | $ | 36,355 |

| | $ | 29,930 |

|

Adjusted Operating Income (non-GAAP) | $ | 9,074 |

| | $ | 9,152 |

| | $ | 38,949 |

| | $ | 26,877 |

|

Operating Income % | 4.5 | % | | 3.9 | % | | 4.4 | % | | 4.0 | % |

Adjusted Operating Income (non-GAAP) % | 4.5 | % | | 4.6 | % | | 4.8 | % | | 3.6 | % |

Net Income | $ | 7,394 |

| | $ | 5,359 |

| | $ | 26,205 |

| | $ | 24,613 |

|

Adjusted Net Income (non-GAAP) | $ | 7,410 |

| | $ | 6,790 |

| | $ | 28,631 |

| | $ | 23,548 |

|

Diluted EPS | $ | 0.25 |

| | $ | 0.18 |

| | $ | 0.89 |

| | $ | 0.84 |

|

Adjusted Diluted EPS (non-GAAP) | $ | 0.25 |

| | $ | 0.23 |

| | $ | 0.97 |

| | $ | 0.81 |

|

Donald D. Charron, Chairman and Chief Executive Officer, stated, “After three consecutive quarters of double-digit growth, we experienced some softness in our fourth quarter. Overall, our book of business is relatively stable and we continue to work closely with our customers to understand their expected demand going forward. We have set a mid-range goal of achieving $1 billion in annual sales in fiscal year 2018. Our new business opportunities pipeline remains healthy and we will continue to work diligently to achieve that goal.”

Mr. Charron continued, “We were very pleased with our fiscal year 2015 results. We grew our sales by over 10%, setting a new annual sales record while exceeding our operating income goal of 4%. Our functional teams substantially completed the spin-off related actions necessary to physically separate the information technology systems and office facilities from Kimball International six months ahead of the original schedule. Our operations teams remain focused on disciplined execution and, after our first eight months as a standalone public company, we continue to have good momentum going into fiscal year 2016.”

Fourth Quarter Fiscal Year 2015 Highlights:

| |

• | Net sales increased 1% from the prior year fourth quarter. |

| |

• | Sales related to the exit of JCI were down $16.8 million compared to the same quarter last year. |

| |

• | Spin-off expenses in the current year fourth quarter were insignificant. Prior year fourth quarter spin-off costs were $1.4 million. |

| |

• | Cash flows provided by operating activities for the fourth quarter of fiscal year 2015 were $16.8 million. |

| |

• | Cash and cash equivalents at June 30, 2015 were $65.2 million. |

| |

• | Days sales outstanding, calculated as the average of monthly trade accounts and notes receivable divided by one day’s average net sales, was 61.6 days for the three months ended June 30, 2015 compared to 56.0 days for the three months ended June 30, 2014. |

Fiscal Year 2015 Highlights:

| |

• | Net sales increased 10% from the prior fiscal year. |

| |

• | Sales related to the exit of JCI were down $57.6 million compared to the prior year. |

| |

• | Spin-off expenses totaled $2.6 million and $2.2 million in fiscal years 2015 and 2014, respectively. |

| |

• | The prior fiscal year comparison includes $5.7 million of pre-tax income resulting from settlement proceeds related to two antitrust class action lawsuits of which the Company was a member. |

| |

• | Cash flows provided by operating activities for fiscal year 2015 were $28.1 million. |

| |

• | Capital expenditures were $36.9 million in fiscal year 2015 compared to $20.8 million in fiscal year 2014. |

Kimball Electronics’ financial statements for fiscal year 2015 include an allocation of costs incurred by its former parent company through October 31, 2014, the completion date of the spin-off. As a result, the full year financial statements are not necessarily indicative of the complete future cost structure or expected future financial results of Kimball Electronics as an independent company.

Net Sales by Vertical Market:

|

| | | | | | | | | | |

| Three Months Ended | | |

| June 30, | | |

(Amounts in Millions) | 2015 | | 2014 | | Percent Change |

Automotive | $ | 79.2 |

| | $ | 74.1 |

| | 7 | % |

Medical | 58.0 |

| | 56.5 |

| | 3 | % |

Industrial | 44.9 |

| | 50.7 |

| | (11 | )% |

Public Safety | 15.0 |

| | 14.3 |

| | 5 | % |

Other | 4.0 |

| | 3.3 |

| | 22 | % |

Total Net Sales | $ | 201.1 |

| | $ | 198.9 |

| | 1 | % |

Outlook

| |

• | The China automotive market is expecting to slow as evidenced by the recent lowering of the forecasted growth rate for auto sales in calendar year 2015 by China's Association of Automobile Manufacturers. |

| |

• | Given the slowing China automotive market, incremental costs related to the Romania greenfield start-up, and the ramp up of a significant new product introduction, management is maintaining its operating income goal of 4% for fiscal year 2016. |

| |

• | Capital expenditures, including capital related to the Romania greenfield start-up, for fiscal year 2016 are expected to be slightly higher than fiscal year 2015. |

| |

• | A new mid-range goal of $1 billion in net sales by fiscal year 2018 has been set by Management. |

Forward-Looking Statements

Certain statements contained within this release are considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, our ability to fully realize the expected benefits of the completed spin-off, the global economic conditions, significant volume reductions from key contract customers, loss of key customers or suppliers, financial stability of key customers and suppliers, availability or cost of raw materials, and increased competitive pricing pressures reflecting excess industry capacities. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of the Company are contained in the Company’s Registration Statement filed on Form 10, as amended, and declared effective on October 7, 2014 and other filings with the Securities and Exchange Commission.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States in the statement of income, statement of comprehensive income, balance sheet, statement of cash flows, or statement of equity of the company. The non-GAAP financial measures contained herein include adjustments for spin-off expenses, settlement proceeds from lawsuits, and restructuring charges. Reconciliations of the reported GAAP numbers to these non-GAAP financial measures are included in the financial highlights table below. Management believes it is useful for investors to understand how its core operations performed without the effects of the spin-off expenses, lawsuit income, and costs incurred in executing its restructuring plans. Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the Company’s core operations. Many of the Company’s internal performance measures that management uses to make certain operating decisions exclude these charges to enable meaningful trending of core operating metrics.

|

| | |

Conference Call / Webcast |

| | |

Date: | | August 6, 2015 |

Time: | | 10:00 AM Eastern Time |

Dial-In #: | | 800-992-4934 (International Calls - 937-502-2251) |

Conference ID: | | 82939811 |

The live webcast of the conference call can be accessed at investors.kimballelectronics.com. For those unable to participate in the live webcast, the call will be archived at investors.kimballelectronics.com.

About Kimball Electronics, Inc.

Recognized with a reputation for excellence, Kimball Electronics is committed to a high performance culture that values personal and organizational commitment to quality, reliability, value, speed, and ethical behavior. Kimball Electronics employees know they are part of a company culture that builds lasting relationships and global success for customers while enabling employees to share in the Company’s success through personal, professional, and financial growth.

Kimball Electronics trades under the symbol “KE” on The NASDAQ Stock Market. Kimball Electronics is a global contract electronic manufacturing services (“EMS”) company that specializes in durable electronics for the medical, automotive, industrial, and public safety markets. Kimball Electronics is well recognized by customers and industry trade publications for its excellent quality, reliability, and innovative service. From its manufacturing operations in the United States, Mexico, Thailand, Poland, and China, Kimball Electronics provides engineering, manufacturing, and supply chain services which utilize common production and support capabilities to a variety of industries globally. Kimball Electronics is headquartered in Jasper, Indiana.

To learn more about Kimball Electronics, visit: www.kimballelectronics.com.

Lasting relationships. Global success.

Financial highlights for the fourth quarter and fiscal year ended June 30, 2015 are as follows:

|

| | | | | | | | | | | | | |

Condensed Consolidated Statements of Income | | | | | | |

(Unaudited) | Three Months Ended |

(Amounts in Thousands, except per share data) | June 30, 2015 | | June 30, 2014 |

Net Sales | $ | 201,126 |

| | 100.0 | % | | $ | 198,949 |

| | 100.0 | % |

Cost of Sales | 183,417 |

| | 91.2 | % | | 180,868 |

| | 90.9 | % |

Gross Profit | 17,709 |

| | 8.8 | % | | 18,081 |

| | 9.1 | % |

Selling and Administrative Expenses | 8,659 |

| | 4.3 | % | | 10,360 |

| | 5.2 | % |

Operating Income | 9,050 |

| | 4.5 | % | | 7,721 |

| | 3.9 | % |

Other Income (Expense), net | (355 | ) | | (0.2 | )% | | (378 | ) | | (0.2 | )% |

Income Before Taxes on Income | 8,695 |

| | 4.3 | % | | 7,343 |

| | 3.7 | % |

Provision for Income Taxes | 1,301 |

| | 0.6 | % | | 1,984 |

| | 1.0 | % |

Net Income | $ | 7,394 |

| | 3.7 | % | | $ | 5,359 |

| | 2.7 | % |

| | | | | | | |

Earnings Per Share of Common Stock: | | | | | | | |

Basic | $ | 0.25 |

| | | | $ | 0.18 |

| | |

Diluted | $ | 0.25 |

| | | | $ | 0.18 |

| | |

| | | | | | | |

Average Number of Shares Outstanding: | | | | | | | |

Basic | 29,172 |

| | | | 29,143 |

| | |

Diluted | 29,367 |

| | | | 29,143 |

| | |

|

| | | | | | | | | | | | | |

| | | | | | | |

(Unaudited) | Fiscal Year Ended |

(Amounts in Thousands, except per share data) | June 30, 2015 | | June 30, 2014 |

Net Sales | $ | 819,350 |

| | 100.0 | % | | $ | 741,530 |

| | 100.0 | % |

Cost of Sales | 746,927 |

| | 91.2 | % | | 680,534 |

| | 91.8 | % |

Gross Profit | 72,423 |

| | 8.8 | % | | 60,996 |

| | 8.2 | % |

Selling and Administrative Expenses | 36,068 |

| | 4.4 | % | | 36,352 |

| | 4.9 | % |

Other General Income | — |

| | — | % | | (5,688 | ) | | (0.8 | )% |

Restructuring Expense | — |

| | — | % | | 402 |

| | 0.1 | % |

Operating Income | 36,355 |

| | 4.4 | % | | 29,930 |

| | 4.0 | % |

Other Income (Expense), net | (1,584 | ) | | (0.2 | )% | | 312 |

| | 0.1 | % |

Income Before Taxes on Income | 34,771 |

| | 4.2 | % | | 30,242 |

| | 4.1 | % |

Provision for Income Taxes | 8,566 |

| | 1.0 | % | | 5,629 |

| | 0.8 | % |

Net Income | $ | 26,205 |

| | 3.2 | % | | $ | 24,613 |

| | 3.3 | % |

| | | | | | | |

Earnings Per Share of Common Stock: | | | | | | | |

Basic | $ | 0.90 |

| | | | $ | 0.84 |

| | |

Diluted | $ | 0.89 |

| | | | $ | 0.84 |

| | |

| | | | | | | |

Average Number of Shares Outstanding: | | | | | | | |

Basic | 29,162 |

| | | | 29,143 |

| | |

Diluted | 29,388 |

| | | | 29,143 |

| | |

|

| | | | | | | |

Condensed Consolidated Statements of Cash Flows | Fiscal Year Ended |

(Unaudited) | June 30, |

(Amounts in Thousands) | 2015 | | 2014 |

Net Cash Flow provided by Operating Activities | $ | 28,064 |

| | $ | 39,306 |

|

Net Cash Flow used for Investing Activities | (36,516 | ) | | (19,991 | ) |

Net Cash Flow provided by (used for) Financing Activities | 50,172 |

| | (11,620 | ) |

Effect of Exchange Rate Change on Cash | (2,800 | ) | | 141 |

|

Net Increase in Cash and Cash Equivalents | 38,920 |

| | 7,836 |

|

Cash and Cash Equivalents at Beginning of Year | 26,260 |

| | 18,424 |

|

Cash and Cash Equivalents at End of Year | $ | 65,180 |

| | $ | 26,260 |

|

|

| | | | | | | |

| (Unaudited) | | |

Condensed Consolidated Balance Sheets | June 30,

2015 | | June 30,

2014 |

(Amounts in Thousands) | |

ASSETS | | | |

Cash and cash equivalents | $ | 65,180 |

| | $ | 26,260 |

|

Receivables, net | 139,892 |

| | 128,425 |

|

Inventories | 125,198 |

| | 116,159 |

|

Prepaid expenses and other current assets | 23,922 |

| | 20,490 |

|

Property and Equipment, net | 106,779 |

| | 97,934 |

|

Goodwill | 2,564 |

| | 2,564 |

|

Other Intangible Assets, net | 4,509 |

| | 1,830 |

|

Other Assets | 15,213 |

| | 15,068 |

|

Total Assets | $ | 483,257 |

| | $ | 408,730 |

|

| | | |

LIABILITIES AND SHARE OWNERS’ EQUITY | | | |

Accounts payable | $ | 133,409 |

| | $ | 119,853 |

|

Accrued expenses | 26,545 |

| | 26,602 |

|

Other | 10,854 |

| | 9,903 |

|

Share Owners’ Equity | 312,449 |

| | 252,372 |

|

Total Liabilities and Share Owners’ Equity | $ | 483,257 |

| | $ | 408,730 |

|

|

| | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP Financial Measures | | | | | | |

(Unaudited) | | | | | | | |

(Amounts in Thousands, except per share data) | | | | | | | |

| | | | | | | |

Operating Income excluding Spin-off Expenses, Settlement Proceeds from Lawsuits, and Restructuring Charges | | |

| Three Months Ended | | Fiscal Year Ended |

| June 30, | | June 30, |

Kimball Electronics, Inc. | 2015 | | 2014 | | 2015 | | 2014 |

Operating Income, as reported | $ | 9,050 |

| | $ | 7,721 |

| | $ | 36,355 |

| | $ | 29,930 |

|

Add: Pre-tax Spin-off Expenses | 24 |

| | 1,431 |

| | 2,594 |

| | 2,233 |

|

Less: Pre-tax Settlement Proceeds from Lawsuits | — |

| | — |

| | — |

| | 5,688 |

|

Add: Pre-tax Restructuring Charges | — |

| | — |

| | — |

| | 402 |

|

Adjusted Operating Income | $ | 9,074 |

| | $ | 9,152 |

| | $ | 38,949 |

| | $ | 26,877 |

|

| | | | | | | |

| | | | | | | |

Net Income excluding Spin-off Expenses, Settlement Proceeds from Lawsuits, and Restructuring Charges | | |

| Three Months Ended | | Fiscal Year Ended |

| June 30, | | June 30, |

Kimball Electronics, Inc. | 2015 | | 2014 | | 2015 | | 2014 |

Net Income, as reported | $ | 7,394 |

| | $ | 5,359 |

| | $ | 26,205 |

| | $ | 24,613 |

|

Add: After-tax Spin-off Expenses | 16 |

| | 1,431 |

| | 2,426 |

| | 2,233 |

|

Less: After-tax Settlement Proceeds from Lawsuits | — |

| | — |

| | — |

| | 3,549 |

|

Add: After-tax Restructuring Charges | — |

| | — |

| | — |

| | 251 |

Adjusted Net Income | $ | 7,410 |

| | $ | 6,790 |

| | $ | 28,631 |

| | $ | 23,548 |

|

| | | | | | | |

| | | | | | | |

Diluted Earnings per Share excluding Spin-off Expenses, Settlement Proceeds from Lawsuits, and Restructuring Charges | | |

| Three Months Ended | | Fiscal Year Ended |

| June 30, | | June 30, |

Kimball Electronics, Inc. | 2015 | | 2014 | | 2015 | | 2014 |

Diluted Earnings per Share, as reported | $ | 0.25 |

| | $ | 0.18 |

| | $ | 0.89 |

| | $ | 0.84 |

|

Add: Impact of Spin-off Expenses | 0.00 |

| | 0.05 |

| | 0.08 |

| | 0.08 |

|

Less: Impact of Settlement Proceeds from Lawsuits | — |

| | — |

| | — |

| | 0.12 |

|

Add: Impact of Restructuring Charges | — |

| | — |

| | — |

| | 0.01 |

|

Adjusted Diluted Earnings per Share | $ | 0.25 |

| | $ | 0.23 |

| | $ | 0.97 |

| | $ | 0.81 |

|

Lasting relationships. Global success. Financial Results Fourth Quarter Fiscal Year 2015 Quarter Ended June 30, 2015 Supplementary Information to Kimball Electronics’ August 6, 2015 Earnings Release and Conference Call Exhibit 99.2

Lasting relationships. Global success. Safe Harbor Statement Certain statements contained within this supplementary information and any statements made during our earnings conference call today may be considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, our ability to fully realize the expected benefits of the completed spin-off, the global economic conditions, significant volume reductions from key contract customers, loss of key customers or suppliers, financial stability of key customers and suppliers, availability or cost of raw materials, and increased competitive pricing pressures reflecting excess industry capacities. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of Kimball Electronics, Inc. (the “Company”) are contained in the Company’s Registration Statement filed on Form 10, as amended, and declared effective on October 7, 2014, our earnings release, and other filings with the Securities and Exchange Commission (the “SEC”). This supplementary information contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States in the statement of income, statement of comprehensive income, balance sheet, statement of cash flows, or statement of equity of the company. The non-GAAP financial measures contained herein include Selling & Administrative Expense (%), Adjusted Operating Income, Adjusted Net Income, and Adjusted EBITDA which have been adjusted for restructuring charges, spin-off expenses, and settlement proceeds from lawsuits. Management believes it is useful for investors to understand how its core operations performed without the effects of the costs incurred in executing its restructuring plans, spin-off expenses, and lawsuit income. Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the Company’s core operations. Many of the Company’s internal performance measures that management uses to make certain operating decisions use these and other non-GAAP measures to enable meaningful trending of core operating metrics. 2

Lasting relationships. Global success. $176 $181 $186 $199 $204 $208 $207 $201 $150 $160 $170 $180 $190 $200 $210 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 In M ill io n s Net Sales 3 +1% from Q4’14 (Unaudited)

Lasting relationships. Global success. 36% 36% 39% 37% 35% 36% 36% 39% 28% 27% 30% 28% 30% 30% 29% 29% 27% 28% 22% 26% 26% 24% 25% 22% 7% 7% 7% 7% 7% 8% 7% 8% 2% 2% 2% 2% 2% 2% 3% 2% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Automotive Medical Industrial Public Safety Other Net Sales Mix by Vertical Market 4 % o f S a le s (Unaudited)

Lasting relationships. Global success. Gross Margin % 7.1% 7.7% 8.9% 9.1% 8.8% 8.6% 9.2% 8.8% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 % o f S a le s 5 (Unaudited)

Lasting relationships. Global success. Selling & Administrative Expense (%) (Excludes spin-off costs*) 4.5% 5.0% 4.5% 4.5% 4.5% 3.8% 3.8% 4.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 % o f S a le s *Spin-off costs excluded by quarter were Q3’14 - $0.8M (0.5% of sales), Q4’14 - $1.4M (0.7%), Q1’15 - $1.0M (0.5%), Q2’15 - $1.3M (0.6%), Q3’15 - $0.3M (0.2%). 6 (Unaudited)

Lasting relationships. Global success. Adjusted Operating Income (Excludes restructuring, spin-off costs and anti-trust lawsuit proceeds) $4.7 $4.9 $8.2 $9.2 $8.8 $10.0 $11.1 $9.1 2.7% 2.7% 4.4% 4.6% 4.3% 4.8% 5.4% 4.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 Adj Op Income % of Net Sales % o f Sa le s I n M ill io n s 7 Note: Adjusted Operating Income is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information (Unaudited)

Lasting relationships. Global success. $4.8 $5.2 $6.7 $6.8 $6.4 $7.4 $7.5 $7.4 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 In M ill io n s Adjusted Net Income (Excludes restructuring, spin-off costs and anti-trust lawsuit proceeds) 8 Note: Adjusted Net Income is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information (Unaudited)

Lasting relationships. Global success. $11.1 $9.8 $12.8 $13.4 $13.0 $15.0 $15.0 $13.7 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 In M ill io n s Adjusted EBITDA (Excludes restructuring, spin-off costs and anti-trust lawsuit proceeds) 9 Note: Adjusted EBITDA is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information (Unaudited)

Lasting relationships. Global success. Operating Cash Flow 10 (Unaudited)

Lasting relationships. Global success. Capital Expenditures and Depreciation & Amortization $3.9 $4.5 $5.5 $6.9 $7.9 $9.0 $6.1 $13.9 $4.5 $4.5 $4.3 $4.6 $4.8 $5.0 $4.8 $5.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 $3.0 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 Cap Ex Depr & Amort In M ill io n s 11 Note: Capital Expenditures includes purchases of capitalized software. (Unaudited)

Lasting relationships. Global success. Reconciliation of Non-GAAP Results 12 (Unaudited) Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Operating Income, as Reported 9,306$ 4,881$ 8,022$ 7,721$ 7,787$ 8,697$ 10,821$ 9,050$ Add: Spin-off Expenses 0 0 802 1,431 964 1,285 321 24 Less: Settlement Proceeds from Lawsuits 5,022 0 666 0 0 0 0 0 Add: Restructuring Charges 402 0 0 0 0 0 0 0 Adjusted Operating Income 4,686$ 4,881$ 8,158$ 9,152$ 8,751$ 9,982$ 11,142$ 9,074$ Net Income, as reported 7,698$ 5,200$ 6,356$ 5,359$ 5,391$ 6,229$ 7,191$ 7,394$ Add: Spin-off Expenses 0 0 802 1,431 964 1,168 278 16 Less: Settlement Proceeds from Lawsuits 3,134 0 415 0 0 0 0 0 Add: Restructuring Charges 251 0 0 0 0 0 0 0 Adjusted Net Income 4,815$ 5,200$ 6,743$ 6,790$ 6,355$ 7,397$ 7,469$ 7,410$ Adjusted Net Income 4,815$ 5,200$ 6,743$ 6,790$ 6,355$ 7,397$ 7,469$ 7,410$ Add(Less) Interest, net (13) (12) (5) (9) 0 (7) (10) (8) Add Depreciation & Amortization 4,491 4,518 4,250 4,630 4,794 5,023 4,832 4,958 Add Taxes 1,799 77 1,769 1,984 1,899 2,622 2,744 1,301 Adjusted EBITDA 11,092$ 9,783$ 12,757$ 13,395$ 13,048$ 15,035$ 15,035$ 13,661$

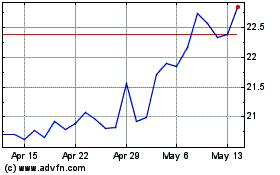

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Jul 2024 to Aug 2024

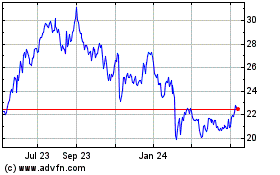

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Aug 2023 to Aug 2024