0001418135FALSE00014181352023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2023

Keurig Dr Pepper Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33829 | | 98-0517725 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

53 South Avenue, Burlington, Massachusetts 01803

(Address of principal executive offices, including zip code)

781-418-7000

(Registrant’s telephone number including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-14(c) under the Exchange Act (17 CFR 240.13e-14(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock | | KDP | | The Nasdaq Stock Market LLC |

Item 2.02. Results of Operations and Financial Condition.

The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

On July 27, 2023, Keurig Dr Pepper Inc. (the "Company") issued a press release announcing the Company's financial results for the second quarter and first six months ended June 30, 2023. A copy of such press release is attached as Exhibit 99.1 and is also available on the Company’s web site at http://www.keurigdrpepper.com.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| | Keurig Dr Pepper Inc. Press Release dated July 27, 2023 - "Keurig Dr Pepper Reports Q2 2023 Results, Raises Full Year Net Sales Outlook and Reaffirms EPS Guidance" |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | KEURIG DR PEPPER INC. | |

Dated: July 27, 2023 | | |

| | By: | /s/ Anthony Shoemaker |

| | | Name: | Anthony Shoemaker |

| | | Title: | Chief Legal Officer, General Counsel and Secretary |

Keurig Dr Pepper Reports Q2 2023 Results, Raises Full Year Net Sales Outlook and Reaffirms EPS Guidance

Strong Q2 Net Sales Growth Led by U.S. Refreshment Beverages and International

Full Year Net Sales Outlook Increased to 5% to 6%

BURLINGTON, MA and FRISCO, TX (July 27, 2023) – Keurig Dr Pepper Inc. (NASDAQ: KDP) today reported results for the second quarter ended June 30, 2023, raised its full year constant currency net sales growth outlook to 5% to 6% and reaffirmed its guidance for Adjusted diluted EPS growth of 6% to 7%.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Reported GAAP Basis | | Adjusted Basis1 |

| | Q2 | | YTD | | Q2 | | YTD |

| Net Sales | | $3.79 bn | | $7.14 bn | | $3.79 bn | | $7.14 bn |

| % vs prior year | | 6.6% | | 7.7% | | 6.1% | | 7.4% |

| | | | | | | | |

| Diluted EPS | | $0.36 | | $0.69 | | $0.42 | | $0.76 |

| % vs prior year | | 140.0% | | 23.2% | | 7.7% | | 5.6% |

| | | | | | | | |

Commenting on the announcement, Chairman and CEO Bob Gamgort stated, “Our second quarter results demonstrated the strength of KDP’s brand portfolio and our high-quality retail execution. We saw continued momentum in the U.S. Refreshment Beverages and International segments, as well as encouraging intraquarter developments in U.S. Coffee, where we expect a sequential recovery in revenue and a meaningful inflection in margins in the back half. On a consolidated basis, we continue to drive healthy growth while reinvesting in our business and are increasingly confident in our full year outlook, which now reflects even stronger underlying EPS results.”

Second Quarter Consolidated Results

Net sales for the second quarter of 2023 increased 6.6% to $3.79 billion, compared to $3.55 billion in the year-ago period. On a constant currency basis, net sales advanced 6.1%, reflecting net price realization of 8.2%, only slightly offset by lower volume/mix of 2.1%. The resilient volume/mix performance reflected the continued strength of the Company’s brand portfolio and in-market execution, as well as continued modest elasticities across most categories.

KDP in-market performance in the U.S. Liquid Refreshment Beverages (LRB) category remained strong, with retail dollar consumption2 advancing 10.7% and market share gains in categories representing approximately 85% of the Company’s cold beverage retail sales base. The performance was led by CSDs3, seltzers, coconut waters, energy, apple juice and fruit drinks and was driven by Dr Pepper and Squirt in CSDs, as well as Polar seltzers, Evian, Vita Coco, C4 Energy, Mott’s and Hawaiian Punch.

U.S. retail dollar consumption2 of KDP Manufactured K-Cup® Pods decreased 2.3% in IRi tracked channels in the quarter, and KDP Manufactured dollar share was approximately 79%. Total at-home coffee category trends during the second quarter continued to be impacted by greater consumer mobility versus the prior year, though the Company observed sequential improvement in category consumption towards the end of the second quarter, which continued into the third quarter. The single serve segment continued to gain volume share of the at-home coffee category throughout the period.

_________________________________________

1 Adjusted financial metrics presented in this release are non-GAAP and with growth rates presented on a constant currency basis. See reconciliations of GAAP results to Adjusted results on a constant currency basis in the accompanying tables.

2 Retail consumption data based on Keurig Dr Pepper’s custom IRi category definitions for the 13-week period ending 7/2/2023.

3 CSDs refer to “Carbonated Soft Drinks”.

GAAP operating income increased 34.4% to $769 million, compared to $572 million in the year-ago period, reflecting growth in gross profit, as the strong net sales growth and productivity more than offset continued input cost inflation. Also impacting the comparison was the favorable year-over-year impact of items affecting comparability.

Excluding items affecting comparability, Adjusted operating income increased 4.4% to $873 million, including a strong double-digit increase in marketing investment, reflecting the strong growth in net sales and Adjusted gross profit, which more than offset transportation, warehousing and labor inflation. On a percent of net sales basis, Adjusted operating income was 23.0%.

GAAP net income for the quarter increased 130.7% to $503 million, or $0.36 per diluted share, compared to $218 million, or $0.15 per diluted share, in the year-ago period. This performance reflected a favorable year-over-year impact of items affecting comparability and the increase in Adjusted operating income, partially offset by a higher GAAP effective tax rate. Excluding items affecting comparability, Adjusted net income for the quarter advanced 7.0% to $596 million, and Adjusted diluted EPS increased 7.7% to $0.42.

Free cash flow for the second quarter was $295 million, reflecting lower operating cash flow and higher capital expenditures versus prior year.

During the quarter, the Company repurchased approximately 7 million KDP shares at a weighted average price per share of $32.34, totaling approximately $226 million. The Company has approximately $3.2 billion remaining under its share repurchase authorization expiring on December 31, 2025.

Second Quarter Segment Results

U.S. Refreshment Beverages

Net sales for the second quarter increased 11.8% to $2.3 billion, compared to $2.1 billion in the year-ago period, reflecting net price realization of 12.0% and a slight decrease in volume/mix of 0.2%. This strong performance continued to reflect the strength of the portfolio, including incrementality from recent innovation, and exceptional in-market execution, as well as the contribution from our sales and distribution partnership with Nutrabolt for C4 Energy.

GAAP operating income increased a very strong 19.1% to $629 million, compared to $528 million in the year-ago period, reflecting the net sales growth, productivity and a modest year-over-year benefit from items affecting comparability. These drivers were partially offset by continued broad-based input cost inflation and a significant increase in marketing investment. Excluding items affecting comparability, Adjusted operating income increased 18.1% to $646 million and, on a percent of net sales basis, totaled 27.7%.

U.S. Coffee

Net sales for the second quarter decreased 5.7% to $970 million, compared to $1,029 million in the year-ago period, reflecting net price realization of 1.6% and a volume/mix decline of 7.3%.

At-home coffee consumption in the quarter continued to be impacted by year-over-year changes in mobility, with sequential improvement in category volume trends observable each month of the quarter. Pod revenue declined 4.6%, driven by a shipment decline of 7.7% that primarily reflected mobility-driven category softness, the exit of some lower-margin private label contracts and an unfavorable comparison in the prior year during which the Company rebuilt trade inventory levels following supply chain constraints. On a trailing twelve-month basis versus the pre-pandemic Q2 2019 period, at-home pod shipments grew 16.9%, representing a mid-single digit compound annual growth rate (CAGR).

Brewer shipments totaled 9.9 million for the twelve months ending June 30, 2023, representing an 11.0% decline year-over-year. Compared against pre-pandemic levels represented by the twelve months ending June 30, 2019, brewer shipments grew 17.8%, representing a mid-single digit CAGR. Brewer shipments in the second quarter continued to be impacted by trade inventory adjustments, which the Company believes are now mostly complete, and slower discretionary spending for small appliances.

GAAP operating income decreased 15.3% to $250 million, compared to $295 million in the year-ago period, reflecting broad-based inflationary pressures, the decline in volume/mix and a significant increase in marketing investment. Partially offsetting these drivers were the benefits of productivity, higher net price realization and a modest year-over-year benefit of items affecting comparability. Excluding these items, Adjusted operating income decreased 14.6% to $292 million and, on a percent of net sales basis, totaled 30.1%.

International

Net sales for the second quarter increased 10.9% to $489 million, compared to $441 million in the year-ago period and, on a constant currency basis, net sales advanced 7.0%. This strong performance was driven by higher net price realization of 6.1% and volume/mix growth of 0.9%, and reflected broad-based momentum in both Mexico and Canada.

GAAP operating income increased a strong 14.3% to $112 million, compared to $98 million in the year-ago period, largely reflecting the benefits of the higher net sales, increased productivity and the year-over-year benefit of items affecting comparability, partially offset by inflationary pressures and a significant increase in marketing investment. Excluding items affecting comparability, Adjusted operating income increased 7.7% to $116 million and, on a percent of net sales basis, totaled 23.7%.

2023 Guidance

The 2023 guidance provided below is presented on a constant currency, non-GAAP basis. The Company does not provide reconciliations of such forward-looking non-GAAP measures to GAAP measures, due to the inability to predict the amount and timing of impacts outside of the Company's control on certain items, such as non-cash gains or losses resulting from mark-to-market adjustments of derivative instruments, among others, which could be material.

On a constant currency basis, KDP now expects net sales growth of 5% to 6% for 2023. The company’s outlook for Adjusted diluted EPS growth of 6% to 7% in 2023 remains unchanged.

Investor Contacts:

Jane Gelfand

T: 888-340-5287 / jane.gelfand@kdrp.com

Chethan Mallela

T: 888-340-5287 / chethan.mallela@kdrp.com

Media Contact:

Katie Gilroy

T: 781-418-3345 / katie.gilroy@kdrp.com

ABOUT KEURIG DR PEPPER

Keurig Dr Pepper (KDP) is a leading beverage company in North America, with annual revenue of more than $14 billion and approximately 28,000 employees. KDP holds leadership positions in liquid refreshment beverages, including soft drinks, specialty coffee and tea, water, juice and juice drinks and mixers, and markets the #1 single serve coffee brewing system in the U.S. and Canada. The Company’s portfolio of more than 125 owned, licensed and partner brands is designed to satisfy virtually any consumer need, any time, and includes Keurig®, Dr Pepper®, Canada Dry®, Clamato®, CORE®, Green Mountain Coffee Roasters®, Mott's®, Snapple®, and The Original Donut Shop®. Through its powerful sales and distribution network, KDP can deliver its portfolio of hot and cold beverages to nearly every point of purchase for consumers. The Company’s Drink Well. Do Good. corporate responsibility platform is focused on the greatest opportunities for impact in the environment, its supply chain, the health and well-being of consumers and with its people and communities. For more information, visit www.keurigdrpepper.com.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are “forward-looking statements” within the meaning of applicable securities laws and regulations. These forward-looking statements can generally be identified by the use of words such as “outlook,” “guidance,” “anticipate,” “expect,” “believe,” “could,” “estimate,” “feel,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “target,” “will,” “would,” and similar words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. These statements are based on the current expectations of our management, are not predictions of actual performance, and actual results may differ materially.

Forward-looking statements are subject to a number of risks and uncertainties, including the factors disclosed in our Annual Report on Form 10-K and subsequent filings with the SEC. We are under no obligation to update, modify or withdraw any forward-looking statements, except as required by applicable law.

NON-GAAP FINANCIAL MEASURES

This release includes certain non-GAAP financial measures including Adjusted gross profit, Adjusted operating income, Adjusted net income, Adjusted diluted EPS, free cash flow and financial measures presented on a constant currency basis, which differ from results using U.S. Generally Accepted Accounting Principles (GAAP). These non-GAAP financial measures should be considered as supplements to the GAAP reported measures, should not be considered replacements for, or superior to, the GAAP measures and may not be comparable to similarly named measures used by other companies. Non-GAAP financial measures typically exclude certain charges, including one-time costs that are not expected to occur routinely in future periods. The Company uses non-GAAP financial measures internally to focus management on performance excluding these special charges to gauge our business operating performance. Management believes this information is helpful to investors because it increases transparency and assists investors in understanding the underlying performance of the Company and in the analysis of ongoing operating trends. Additionally, management believes that non-GAAP financial measures are frequently used by analysts and investors in their evaluation of companies, and their continued inclusion provides consistency in financial reporting and enables analysts and investors to perform meaningful comparisons of past, present and future operating results. The most directly comparable GAAP financial measures and reconciliations to non-GAAP financial measures are set forth in the appendix to this release and included in the Company’s filings with the SEC.

To the extent that the Company provides guidance, it does so only on a non-GAAP basis and does not provide reconciliations of such forward-looking non-GAAP measures to GAAP due to the inability to predict the amount and timing of impacts outside of the Company’s control on certain items, such as non-cash gains or losses resulting from mark-to-market adjustments of derivative instruments, among others, which could be material.

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Second Quarter | | First Six Months |

| (in millions, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

Net sales | $ | 3,789 | | | $ | 3,554 | | | $ | 7,142 | | | $ | 6,632 | |

| Cost of sales | 1,748 | | | 1,778 | | | 3,357 | | | 3,206 | |

| Gross profit | 2,041 | | | 1,776 | | | 3,785 | | | 3,426 | |

| Selling, general and administrative expenses | 1,272 | | | 1,204 | | | 2,437 | | | 2,222 | |

| | | | | | | |

| Gain on litigation settlement | — | | | — | | | — | | | (299) | |

| Other operating income, net | — | | | — | | | (5) | | | (35) | |

| Income from operations | 769 | | | 572 | | | 1,353 | | | 1,538 | |

| Interest expense | 172 | | | 175 | | | 195 | | | 363 | |

| Loss on early extinguishment of debt | — | | | 169 | | | — | | | 217 | |

| Gain on sale of equity method investment | — | | | — | | | — | | | (50) | |

| Impairment of investments and note receivable | — | | | 6 | | | — | | | 12 | |

| Other (income) expense, net | (16) | | | 9 | | | (36) | | | 18 | |

| Income before provision for income taxes | 613 | | | 213 | | | 1,194 | | | 978 | |

| Provision (benefit) for income taxes | 110 | | | (5) | | | 224 | | | 175 | |

| Net income including non-controlling interest | 503 | | | 218 | | | 970 | | | 803 | |

| Less: Net loss attributable to non-controlling interest | — | | | — | | | — | | | — | |

Net income attributable to KDP | $ | 503 | | | $ | 218 | | | $ | 970 | | | $ | 803 | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 0.36 | | | $ | 0.15 | | | $ | 0.69 | | | $ | 0.57 | |

| Diluted | 0.36 | | | 0.15 | | | 0.69 | | | 0.56 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 1,400.3 | | | 1,417.5 | | | 1,403.2 | | | 1,417.8 | |

| Diluted | 1,409.1 | | | 1,428.6 | | | 1,413.1 | | | 1,429.2 | |

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | |

| | June 30, | | December 31, |

| (in millions, except share and per share data) | 2023 | | 2022 |

| Assets |

| Current assets: | | | |

| Cash and cash equivalents | $ | 278 | | | $ | 535 | |

| | | |

| Trade accounts receivable, net | 1,311 | | | 1,484 | |

| Inventories | 1,384 | | | 1,314 | |

| Prepaid expenses and other current assets | 597 | | | 471 | |

| Total current assets | 3,570 | | | 3,804 | |

| Property, plant and equipment, net | 2,489 | | | 2,491 | |

| Investments in unconsolidated affiliates | 1,019 | | | 1,000 | |

| Goodwill | 20,194 | | | 20,072 | |

| Other intangible assets, net | 23,344 | | | 23,183 | |

| Other non-current assets | 1,153 | | | 1,252 | |

| Deferred tax assets | 32 | | | 35 | |

| Total assets | $ | 51,801 | | | $ | 51,837 | |

| Liabilities and Stockholders' Equity |

| Current liabilities: | | | |

| Accounts payable | 4,601 | | | 5,206 | |

| Accrued expenses | 1,030 | | | 1,153 | |

| Structured payables | 126 | | | 137 | |

| Short-term borrowings and current portion of long-term obligations | 2,635 | | | 895 | |

| Other current liabilities | 664 | | | 685 | |

| Total current liabilities | 9,056 | | | 8,076 | |

| Long-term obligations | 9,934 | | | 11,072 | |

| Deferred tax liabilities | 5,736 | | | 5,739 | |

| Other non-current liabilities | 1,808 | | | 1,825 | |

| Total liabilities | 26,534 | | | 26,712 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Preferred stock, $0.01 par value, 15,000,000 shares authorized, no shares issued | — | | | — | |

Common stock, $0.01 par value, 2,000,000,000 shares authorized, 1,396,909,564 and 1,408,394,293 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 14 | | | 14 | |

| Additional paid-in capital | 21,009 | | | 21,444 | |

| Retained earnings | 3,948 | | | 3,539 | |

| Accumulated other comprehensive income | 297 | | | 129 | |

| Total stockholders' equity | 25,268 | | | 25,126 | |

| Non-controlling interest | (1) | | | (1) | |

| Total equity | 25,267 | | | 25,125 | |

| Total liabilities and stockholders' equity | $ | 51,801 | | | $ | 51,837 | |

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| | First Six Months |

| (in millions) | 2023 | | 2022 |

| Operating activities: | | | |

| Net income attributable to KDP | $ | 970 | | | $ | 803 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation expense | 201 | | | 205 | |

| Amortization of intangibles | 69 | | | 67 | |

| Other amortization expense | 91 | | | 86 | |

| Provision for sales returns | 26 | | | 25 | |

| Deferred income taxes | (26) | | | (52) | |

| Employee stock-based compensation expense | 57 | | | 12 | |

| Loss on early extinguishment of debt | — | | | 217 | |

| Gain on sale of equity method investment | — | | | (50) | |

| Gain on disposal of property, plant and equipment | (2) | | | (33) | |

| Unrealized (gain) loss on foreign currency | (13) | | | 2 | |

| Unrealized (gain) loss on derivatives | (31) | | | 187 | |

| Settlements of interest rate contracts | — | | | 125 | |

| Equity in (earnings) loss of unconsolidated affiliates | (14) | | | 5 | |

| | | |

| Impairment on investments and note receivable of unconsolidated affiliates | — | | | 12 | |

| Other, net | (9) | | | 22 | |

| Changes in assets and liabilities: | | | |

| Trade accounts receivable | 162 | | | (206) | |

| Inventories | (61) | | | (346) | |

| Income taxes receivable and payables, net | (70) | | | (245) | |

| Other current and non-current assets | (147) | | | (340) | |

| Accounts payable and accrued expenses | (762) | | | 680 | |

| Other current and non-current liabilities | 11 | | | 163 | |

| Net change in operating assets and liabilities | (867) | | | (294) | |

| Net cash provided by operating activities | 452 | | | 1,339 | |

| Investing activities: | | | |

| | | |

| | | |

| Proceeds from sale of investment in unconsolidated affiliates | — | | | 50 | |

| Purchases of property, plant and equipment | (149) | | | (186) | |

| Proceeds from sales of property, plant and equipment | 8 | | | 78 | |

| Purchases of intangibles | (55) | | | (10) | |

| Issuance of related party note receivable | — | | | (18) | |

| Investments in unconsolidated affiliates | (8) | | | (48) | |

| Other, net | 1 | | | 3 | |

| Net cash (used in) provided by investing activities | (203) | | | (131) | |

| Financing activities: | | | |

Proceeds from issuance of Notes | — | | | 3,000 | |

Repayments of Notes | — | | | (3,365) | |

| Proceeds from issuance of commercial paper | 18,187 | | | 500 | |

| Repayments of commercial paper | (17,598) | | | (649) | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from structured payables | 61 | | | 79 | |

| Repayments of structured payables | (72) | | | (75) | |

| Cash dividends paid | (563) | | | (531) | |

| Repurchases of common stock | (457) | | | (88) | |

| | | |

| Tax withholdings related to net share settlements | (32) | | | (8) | |

| Payments on finance leases | (49) | | | (41) | |

| | | |

| Other, net | — | | | (43) | |

| Net cash used in financing activities | (523) | | | (1,221) | |

| Cash, cash equivalents, and restricted cash and cash equivalents: | | | |

| Net change from operating, investing and financing activities | (274) | | | (13) | |

| Effect of exchange rate changes | 17 | | | (1) | |

| Beginning balance | 535 | | | 568 | |

| Ending balance | $ | 278 | | | $ | 554 | |

KEURIG DR PEPPER INC.

RECONCILIATION OF SEGMENT INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter | | First Six Months |

| (in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Net Sales | | | | | | | |

| U.S. Refreshment Beverages | $ | 2,330 | | | $ | 2,084 | | | $ | 4,337 | | | $ | 3,865 | |

| U.S. Coffee | 970 | | | 1,029 | | | 1,901 | | | 1,972 | |

| International | 489 | | | 441 | | | 904 | | | 795 | |

| Total net sales | $ | 3,789 | | | $ | 3,554 | | | $ | 7,142 | | | $ | 6,632 | |

| | | | | | | |

| Income from Operations | | | | | | | |

| U.S. Refreshment Beverages | $ | 629 | | | $ | 528 | | | $ | 1,119 | | | $ | 1,232 | |

| U.S. Coffee | 250 | | | 295 | | | 482 | | | 550 | |

| International | 112 | | | 98 | | | 192 | | | 162 | |

| Unallocated corporate costs | (222) | | | (349) | | | (440) | | | (406) | |

| Total income from operations | $ | 769 | | | $ | 572 | | | $ | 1,353 | | | $ | 1,538 | |

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN NON-GAAP INFORMATION

(UNAUDITED)

The company reports its financial results in accordance with U.S. GAAP. However, management believes that certain non-GAAP financial measures that reflect the way management evaluates the business may provide investors with additional information regarding the company's results, trends and ongoing performance on a comparable basis.

Specifically, investors should consider the following with respect to our financial results:

Adjusted: Defined as certain financial statement captions and metrics adjusted for certain items affecting comparability.

Items affecting comparability: Defined as certain items that are excluded for comparison to prior year periods, adjusted for the tax impact as applicable. Tax impact is determined based upon an approximate rate for each item. For each period, management adjusts for (i) the unrealized mark-to-market impact of derivative instruments not designated as hedges in accordance with U.S. GAAP that do not have an offsetting risk reflected within the financial results, as well as the unrealized mark-to-market impact of our Vita Coco investment; (ii) the amortization associated with definite-lived intangible assets; (iii) the amortization of the deferred financing costs associated with the DPS Merger; (iv) the amortization of the fair value adjustment of the senior unsecured notes obtained as a result of the DPS Merger; (v) stock compensation expense and the associated windfall tax benefit attributable to the matching awards made to employees who made an initial investment in KDP; (vi) non-cash changes in deferred tax liabilities related to goodwill and other intangible assets as a result of tax rate or apportionment changes; and (vii) other certain items that are excluded for comparison purposes to prior year periods.

For the second quarter and first six months of 2023, the other certain items excluded for comparison purposes include (i) productivity expenses and (ii) costs related to significant non-routine legal matters, specifically the antitrust litigation. Additionally, the non-cash changes in deferred tax liabilities related to goodwill and other intangible assets included an immaterial correction of an error during the second quarter of 2023 related to the valuation of the foreign deferred tax liabilities related to goodwill and other intangible assets.

For the second quarter and first six months of 2022, the other certain items excluded for comparison purposes include (i) restructuring and integration expenses related to significant business combinations; (ii) productivity expenses; (iii) costs related to significant non-routine legal matters, specifically the antitrust litigation; (iv) the loss on early extinguishment of debt related to the redemption of debt; (v) incremental costs to our operations related to risks associated with the COVID-19 pandemic, which were incurred to either maintain the health and safety of our front-line employees or temporarily increase compensation to such employees to ensure essential operations continue during the pandemic; (vi) the gain on the sale of our investment in BodyArmor as a result of the settlement of the associated holdback liability; (vii) the gain on the settlement of our prior litigation with BodyArmor, excluding recoveries of previously incurred litigation expenses which were included in our adjusted results; (viii) losses recognized with respect to our equity method investment in Bedford as a result of funding our share of their wind-down costs; (ix) transaction costs for significant business combinations (completed or abandoned); and (x) foundational projects, which are transformative and non-recurring in nature.

Constant currency adjusted: Defined as certain financial statement captions and metrics adjusted for certain items affecting comparability, calculated on a constant currency basis by converting our current period local currency financial results using the prior period foreign currency exchange rates.

For the second quarter and first six months of 2023 and 2022, the supplemental financial data set forth below includes reconciliations of adjusted and constant currency adjusted financial measures to the applicable financial measure presented in the unaudited condensed consolidated financial statements for the same period.

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN NON-GAAP INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Cost of sales | | Gross profit | | Gross margin | | Selling, general and administrative expenses | | | | | | Other operating income, net | | Income from operations | | Operating margin |

| For the Second Quarter of 2023 | | | | | | | | | | | | | | | | | | | |

| Reported | | | $ | 1,748 | | | $ | 2,041 | | | 53.9 | % | | $ | 1,272 | | | | | | | $ | — | | | $ | 769 | | | 20.3 | % |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | | | (9) | | | 9 | | | | | 5 | | | | | | | — | | | 4 | | | |

| Amortization of intangibles | | | — | | | — | | | | | (35) | | | | | | | — | | | 35 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock compensation | | | — | | | — | | | | | (4) | | | | | | | — | | | 4 | | | |

| | | | | | | | | | | | | | | | | | | |

| Productivity | | | (26) | | | 26 | | | | | (32) | | | | | | | — | | | 58 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-routine legal matters | | | — | | | — | | | | | (3) | | | | | | | — | | | 3 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted | | | $ | 1,713 | | | $ | 2,076 | | | 54.8 | % | | $ | 1,203 | | | | | | | $ | — | | | $ | 873 | | | 23.0 | % |

| Impact of foreign currency | | | | | | | (0.1) | % | | | | | | | | | | | | — | % |

| Constant currency adjusted | | | | | | | 54.7 | % | | | | | | | | | | | | 23.0 | % |

| | | | | | | | | | | | | | | | | | | |

| For the Second Quarter of 2022 | | | | | | | | | | | | | | | | | | | |

| Reported | | | $ | 1,778 | | | $ | 1,776 | | | 50.0 | % | | $ | 1,204 | | | | | | | $ | — | | | $ | 572 | | | 16.1 | % |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | | | (138) | | | 138 | | | | | — | | | | | | | — | | | 138 | | | |

| Amortization of intangibles | | | — | | | — | | | | | (33) | | | | | | | — | | | 33 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock compensation | | | — | | | — | | | | | (5) | | | | | | | — | | | 5 | | | |

| Restructuring and integration costs | | | — | | | — | | | | | (23) | | | | | | | 1 | | | 22 | | | |

| Productivity | | | (28) | | | 28 | | | | | (24) | | | | | | | — | | | 52 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-routine legal matters | | | — | | | — | | | | | (3) | | | | | | | — | | | 3 | | | |

| COVID-19 | | | (3) | | | 3 | | | | | (1) | | | | | | | — | | | 4 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Transaction costs | | | — | | | — | | | | | (1) | | | | | | | — | | | 1 | | | |

| | | | | | | | | | | | | | | | | | | |

| Foundational projects | | | — | | | — | | | | | (2) | | | | | | | — | | | 2 | | | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted | | | $ | 1,609 | | | $ | 1,945 | | | 54.7 | % | | $ | 1,112 | | | | | | | $ | 1 | | | $ | 832 | | | 23.4 | % |

| | | | | | | | | | | | | | | | | | | |

Refer to page A-8 for reconciliations of reported net sales to constant currency net sales and adjusted income from operations to constant currency adjusted income from operations. A-6

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN NON-GAAP INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | Loss on early extinguishment of debt | | | | Impairment of investments and note receivable | | Other (income) expense, net | | Income before provision for income taxes | | Provision (benefit) for income taxes | | Effective tax rate | | Net income attributable to KDP | | Diluted earnings per share |

| For the Second Quarter of 2023 | | | | | | | | | | | | | | | | | | | |

| Reported | $ | 172 | | | $ | — | | | | | $ | — | | | $ | (16) | | | $ | 613 | | | $ | 110 | | | 17.9 | % | | $ | 503 | | | $ | 0.36 | |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | (53) | | | — | | | | | — | | | 9 | | | 48 | | | 15 | | | | | 33 | | | 0.02 | |

| Amortization of intangibles | — | | | — | | | | | — | | | — | | | 35 | | | 6 | | | | | 29 | | | 0.02 | |

| Amortization of deferred financing costs | (1) | | | — | | | | | — | | | — | | | 1 | | | — | | | | | 1 | | | — | |

| Amortization of fair value debt adjustment | (5) | | | — | | | | | — | | | — | | | 5 | | | 1 | | | | | 4 | | | — | |

| Stock compensation | — | | | — | | | | | — | | | — | | | 4 | | | 1 | | | | | 3 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| Productivity | — | | | — | | | | | — | | | — | | | 58 | | | 12 | | | | | 46 | | | 0.03 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-routine legal matters | — | | | — | | | | | — | | | — | | | 3 | | | 1 | | | | | 2 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | | | — | | | | | — | | | — | | | — | | | 25 | | | | | (25) | | | (0.02) | |

| Adjusted | $ | 113 | | | $ | — | | | | | $ | — | | | $ | (7) | | | $ | 767 | | | $ | 171 | | | 22.3 | % | | $ | 596 | | | $ | 0.42 | |

| Impact of foreign currency | | | | | | | | | | | | | | | (0.2) | % | | | | |

| Constant currency adjusted | | | | | | | | | | | | | | | 22.1 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| For the Second Quarter of 2022 | | | | | | | | | | | | | | | | | | | |

| Reported | $ | 175 | | | $ | 169 | | | | | $ | 6 | | | $ | 9 | | | $ | 213 | | | $ | (5) | | | (2.3) | % | | $ | 218 | | | $ | 0.15 | |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | (63) | | | — | | | | | — | | | 1 | | | 200 | | | 49 | | | | | 151 | | | 0.11 | |

| Amortization of intangibles | — | | | — | | | | | — | | | — | | | 33 | | | 8 | | | | | 25 | | | 0.02 | |

| Amortization of deferred financing costs | (1) | | | — | | | | | — | | | — | | | 1 | | | — | | | | | 1 | | | — | |

| Amortization of fair value of debt adjustment | (4) | | | — | | | | | — | | | — | | | 4 | | | 1 | | | | | 3 | | | — | |

| Stock compensation | — | | | — | | | | | — | | | — | | | 5 | | | (2) | | | | | 7 | | | — | |

| Restructuring and integration costs | — | | | — | | | | | — | | | — | | | 22 | | | 5 | | | | | 17 | | | 0.01 | |

| Productivity | — | | | — | | | | | — | | | — | | | 52 | | | 10 | | | | | 42 | | | 0.03 | |

| | | | | | | | | | | | | | | | | | | |

| Impairment of investment | — | | | — | | | | | (6) | | | — | | | 6 | | | — | | | | | 6 | | | — | |

| Loss on early extinguishment of debt | — | | | (169) | | | | | — | | | — | | | 169 | | | 43 | | | | | 126 | | | 0.09 | |

| Non-routine legal matters | — | | | — | | | | | — | | | — | | | 3 | | | 1 | | | | | 2 | | | — | |

| COVID-19 | — | | | — | | | | | — | | | — | | | 4 | | | 1 | | | | | 3 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Transaction costs | — | | | — | | | | | — | | | — | | | 1 | | | — | | | | | 1 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| Foundational projects | — | | | — | | | | | — | | | — | | | 2 | | | — | | | | | 2 | | | — | |

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | | | — | | | | | — | | | — | | | — | | | 50 | | | | | (50) | | | (0.03) | |

| Adjusted | $ | 107 | | | $ | — | | | | | $ | — | | | $ | 10 | | | $ | 715 | | | $ | 161 | | | 22.5 | % | | $ | 554 | | | $ | 0.39 | |

| | | | | | | | | | | | | | | | | | | |

| Change - adjusted | 5.6 | % | | | | | | | | | | | | | | | | 7.6 | % | | 7.7 | % |

| Impact of foreign currency | — | % | | | | | | | | | | | | | | | | (0.6) | % | | — | % |

| Change - constant currency adjusted | 5.6 | % | | | | | | | | | | | | | | | | 7.0 | % | | 7.7 | % |

Diluted earnings per common share may not foot due to rounding.

A-7

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN NON-GAAP INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | |

| (in millions) | Reported | | Items Affecting Comparability | | Adjusted |

| For the second quarter of 2023 | | | | | |

| Income from operations | | | | | |

| U.S. Refreshment Beverages | $ | 629 | | | $ | 17 | | | $ | 646 | |

| U.S. Coffee | 250 | | | 42 | | | 292 | |

| International | 112 | | | 4 | | | 116 | |

| Unallocated corporate costs | (222) | | | 41 | | | (181) | |

| Total income from operations | $ | 769 | | | $ | 104 | | | $ | 873 | |

| | | | | |

| For the second quarter of 2022 | | | | | |

| Income from operations | | | | | |

| U.S. Refreshment Beverages | $ | 528 | | | $ | 19 | | | $ | 547 | |

| U.S. Coffee | 295 | | | 47 | | | 342 | |

| International | 98 | | | 6 | | | 104 | |

| Unallocated corporate costs | (349) | | | 188 | | | (161) | |

| Total income from operations | $ | 572 | | | $ | 260 | | | $ | 832 | |

| | | | | | | | | | | | | | | | | | | | |

| | Reported | | Impact of Foreign Currency | | Constant Currency |

| For the second quarter of 2023 | | | | | | |

| Net sales | | | | | | |

| U.S. Refreshment Beverages | | 11.8 | % | | — | % | | 11.8 | % |

| U.S. Coffee | | (5.7) | | | — | | | (5.7) | |

| International | | 10.9 | | | (3.9) | | | 7.0 | |

| Total net sales | | 6.6 | | | (0.5) | | | 6.1 | |

| | | | | | | | | | | | | | | | | | | | |

| | Adjusted | | Impact of Foreign Currency | | Constant Currency Adjusted |

| For the second quarter of 2023 | | | | | | |

| Income from operations | | | | | | |

| U.S. Refreshment Beverages | | 18.1 | % | | — | % | | 18.1 | % |

| U.S. Coffee | | (14.6) | | | — | | | (14.6) | |

| International | | 11.5 | | | (3.8) | | | 7.7 | |

| Total income from operations | | 4.9 | | | (0.5) | | | 4.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Reported | | Items Affecting Comparability | | Adjusted | | Impact of Foreign Currency | | Constant Currency Adjusted |

| For the second quarter of 2023 | | | | | | | | | | |

| Operating margin | | | | | | | | | | |

| U.S. Refreshment Beverages | | 27.0 | % | | 0.7 | % | | 27.7 | % | | — | % | | 27.7 | % |

| U.S. Coffee | | 25.8 | | | 4.3 | | | 30.1 | | | — | | | 30.1 | |

| International | | 22.9 | | | 0.8 | | | 23.7 | | | — | | | 23.7 | |

| Total operating margin | | 20.3 | | | 2.7 | | | 23.0 | | | — | | | 23.0 | |

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN NON-GAAP INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Cost of sales | | Gross profit | | Gross margin | | Selling, general and administrative expenses | | | | Gain on litigation settlement | | Other operating income, net | | Income from operations | | Operating margin |

| For the First Six Months of 2023 | | | | | | | | | | | | | | | | | | | |

| Reported | | | $ | 3,357 | | | $ | 3,785 | | | 53.0 | % | | $ | 2,437 | | | | | $ | — | | | $ | (5) | | | $ | 1,353 | | | 18.9 | % |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | | | 5 | | | (5) | | | | | (7) | | | | | — | | | — | | | 2 | | | |

| Amortization of intangibles | | | — | | | — | | | | | (69) | | | | | — | | | — | | | 69 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock compensation | | | — | | | — | | | | | (9) | | | | | — | | | — | | | 9 | | | |

| | | | | | | | | | | | | | | | | | | |

| Productivity | | | (64) | | | 64 | | | | | (72) | | | | | — | | | — | | | 136 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-routine legal matters | | | — | | | — | | | | | (3) | | | | | — | | | — | | | 3 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted | | | $ | 3,298 | | | $ | 3,844 | | | 53.8 | % | | $ | 2,277 | | | | | $ | — | | | $ | (5) | | | $ | 1,572 | | | 22.0 | % |

| Impact of foreign currency | | | | | | | — | % | | | | | | | | | | | | — | % |

| Constant currency adjusted | | | | | | | 53.8 | % | | | | | | | | | | | | 22.0 | % |

| | | | | | | | | | | | | | | | | | | |

| For the First Six Months of 2022 | | | | | | | | | | | | | | | | | | | |

| Reported | | | $ | 3,206 | | | $ | 3,426 | | | 51.7 | % | | $ | 2,222 | | | | | $ | (299) | | | $ | (35) | | | $ | 1,538 | | | 23.2 | % |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | | | (79) | | | 79 | | | | | 26 | | | | | — | | | — | | | 53 | | | |

| Amortization of intangibles | | | — | | | — | | | | | (67) | | | | | — | | | — | | | 67 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock compensation | | | — | | | — | | | | | 2 | | | | | — | | | — | | | (2) | | | |

| Restructuring and integration costs | | | — | | | — | | | | | (56) | | | | | — | | | (2) | | | 58 | | | |

| Productivity | | | (56) | | | 56 | | | | | (46) | | | | | — | | | — | | | 102 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-routine legal matters | | | — | | | — | | | | | (7) | | | | | — | | | — | | | 7 | | | |

| COVID-19 | | | (7) | | | 7 | | | | | (2) | | | | | — | | | — | | | 9 | | | |

| Gain on litigation | | | — | | | — | | | | | — | | | | | 271 | | | — | | | (271) | | | |

| | | | | | | | | | | | | | | | | | | |

| Transaction costs | | | — | | | — | | | | | (1) | | | | | — | | | — | | | 1 | | | |

| | | | | | | | | | | | | | | | | | | |

| Foundational projects | | | — | | | — | | | | | (2) | | | | | — | | | — | | | 2 | | | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted | | | $ | 3,064 | | | $ | 3,568 | | | 53.8 | % | | $ | 2,069 | | | | | $ | (28) | | | $ | (37) | | | $ | 1,564 | | | 23.6 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Refer to page A-11 for reconciliations of reported net sales to constant currency net sales and adjusted income from operations to constant currency adjusted income from operations. A-9

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN NON-GAAP INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | Loss on early extinguishment of debt | | Gain on sale of equity method investment | | Impairment of investments and note receivable | | Other (income) expense, net | | Income before provision for income taxes | | Provision (benefit) for income taxes | | Effective tax rate | | Net income attributable to KDP | | Diluted earnings per share |

| For the First Six Months of 2023 | | | | | | | | | | | | | | | | | | | |

| Reported | $ | 195 | | | $ | — | | | $ | — | | | $ | — | | | $ | (36) | | | $ | 1,194 | | | $ | 224 | | | 18.8 | % | | $ | 970 | | | $ | 0.69 | |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | 40 | | | — | | | — | | | — | | | 18 | | | (56) | | | (14) | | | | | (42) | | | (0.03) | |

| Amortization of intangibles | — | | | — | | | — | | | — | | | — | | | 69 | | | 16 | | | | | 53 | | | 0.04 | |

| Amortization of deferred financing costs | (1) | | | — | | | — | | | — | | | — | | | 1 | | | — | | | | | 1 | | | — | |

| Amortization of fair value debt adjustment | (9) | | | — | | | — | | | — | | | — | | | 9 | | | 2 | | | | | 7 | | | 0.01 | |

| Stock compensation | — | | | — | | | — | | | — | | | — | | | 9 | | | 3 | | | | | 6 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| Productivity | — | | | — | | | — | | | — | | | — | | | 136 | | | 33 | | | | | 103 | | | 0.07 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-routine legal matters | — | | | — | | | — | | | — | | | — | | | 3 | | | 1 | | | | | 2 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | | | — | | | — | | | — | | | — | | | — | | | 25 | | | | | (25) | | | (0.02) | |

| Adjusted | $ | 225 | | | $ | — | | | $ | — | | | $ | — | | | $ | (18) | | | $ | 1,365 | | | $ | 290 | | | 21.2 | % | | $ | 1,075 | | | $ | 0.76 | |

| Impact of foreign currency | | | | | | | | | | | | | | | 0.1 | % | | | | |

| Constant currency adjusted | | | | | | | | | | | | | | | 21.3 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| For the First Six Months of 2022 | | | | | | | | | | | | | | | | | | | |

| Reported | $ | 363 | | | $ | 217 | | | $ | (50) | | | $ | 12 | | | $ | 18 | | | $ | 978 | | | $ | 175 | | | 17.9 | % | | $ | 803 | | | $ | 0.56 | |

| Items Affecting Comparability: | | | | | | | | | | | | | | | | | | | |

| Mark to market | (134) | | | — | | | — | | | — | | | (2) | | | 189 | | | 47 | | | | | 142 | | | 0.10 | |

| Amortization of intangibles | — | | | — | | | — | | | — | | | — | | | 67 | | | 17 | | | | | 50 | | | 0.04 | |

| Amortization of deferred financing costs | (2) | | | — | | | — | | | — | | | — | | | 2 | | | — | | | | | 2 | | | — | |

| Amortization of fair value of debt adjustment | (9) | | | — | | | — | | | — | | | — | | | 9 | | | 2 | | | | | 7 | | | — | |

| Stock compensation | — | | | — | | | — | | | — | | | — | | | (2) | | | (3) | | | | | 1 | | | — | |

| Restructuring and integration costs | — | | | — | | | — | | | — | | | — | | | 58 | | | 14 | | | | | 44 | | | 0.03 | |

| Productivity | — | | | — | | | — | | | — | | | — | | | 102 | | | 22 | | | | | 80 | | | 0.06 | |

| | | | | | | | | | | | | | | | | | | |

| Impairment of investment | — | | | — | | | — | | | (12) | | | — | | | 12 | | | — | | | | | 12 | | | — | |

| Loss on early extinguishment of debt | — | | | (217) | | | — | | | — | | | — | | | 217 | | | 54 | | | | | 163 | | | 0.12 | |

| Non-routine legal matters | — | | | — | | | — | | | — | | | — | | | 7 | | | 2 | | | | | 5 | | | — | |

| COVID-19 | — | | | — | | | — | | | — | | | — | | | 9 | | | 2 | | | | | 7 | | | — | |

| Gain on litigation | — | | | — | | | — | | | — | | | — | | | (271) | | | (68) | | | | | (203) | | | (0.14) | |

| Gain on sale of equity-method investment | — | | | — | | | 50 | | | — | | | — | | | (50) | | | (12) | | | | | (38) | | | (0.03) | |

| Transaction costs | — | | | — | | | — | | | — | | | — | | | 1 | | | — | | | | | 1 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| Foundational projects | — | | | — | | | — | | | — | | | — | | | 2 | | | — | | | | | 2 | | | — | |

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | | | — | | | — | | | — | | | — | | | — | | | 50 | | | | | (50) | | | (0.03) | |

| Adjusted | $ | 218 | | | $ | — | | | $ | — | | | $ | — | | | $ | 16 | | | $ | 1,330 | | | $ | 302 | | | 22.7 | % | | $ | 1,028 | | | $ | 0.72 | |

| | | | | | | | | | | | | | | | | | | |

| Change - adjusted | 3.2 | % | | | | | | | | | | | | | | | | 4.6 | % | | 5.6 | % |

| Impact of foreign currency | — | % | | | | | | | | | | | | | | | | (0.5) | % | | — | % |

| Change - Constant currency adjusted | 3.2 | % | | | | | | | | | | | | | | | | 4.1 | % | | 5.6 | % |

Diluted earnings per common share may not foot due to rounding.

A-10

KEURIG DR PEPPER INC.

RECONCILIATION OF CERTAIN FINANCIAL MEASURES BY SEGMENT TO CONSTANT CURRENCY ADJUSTED FINANCIAL MEASURES BY SEGMENT

(UNAUDITED)

| | | | | | | | | | | | | | | | | |

| (in millions) | Reported | | Items Affecting Comparability | | Adjusted |

| For the first six months of 2023: | | | | | |

| Income from operations | | | | | |

| U.S. Refreshment Beverages | $ | 1,119 | | | $ | 35 | | | $ | 1,154 | |

| U.S. Coffee | 482 | | | 95 | | | 577 | |

| International | 192 | | | 8 | | | 200 | |

| Unallocated corporate costs | (440) | | | 81 | | | (359) | |

| Total income from operations | $ | 1,353 | | | $ | 219 | | | $ | 1,572 | |

| | | | | |

| For the first six months of 2022: | | | | | |

| Income from operations | | | | | |

| U.S. Refreshment Beverages | $ | 1,232 | | | $ | (230) | | | $ | 1,002 | |

| U.S. Coffee | 550 | | | 93 | | | 643 | |

| International | 162 | | | 13 | | | 175 | |

| Unallocated corporate costs | (406) | | | 150 | | | (256) | |

| Total income from operations | $ | 1,538 | | | $ | 26 | | | $ | 1,564 | |

| | | | | | | | | | | | | | | | | | | | |

| | Reported | | Impact of Foreign Currency | | Constant Currency |

| For the first six months of 2023: | | | | | | |

| Net sales | | | | | | |

| U.S. Refreshment Beverages | | 12.2 | % | | — | % | | 12.2 | % |

| U.S. Coffee | | (3.6) | | | — | | | (3.6) | |

| International | | 13.7 | | | (2.4) | | | 11.3 | |

| Total net sales | | 7.7 | | | (0.3) | | | 7.4 | |

| | | | | | | | | | | | | | | | | | | | |

| | Adjusted | | Impact of Foreign Currency | | Constant Currency Adjusted |

| For the first six months of 2023: | | | | | | |

| Income from operations | | | | | | |

| U.S. Refreshment Beverages | | 15.2 | % | | — | % | | 15.2 | % |

| U.S. Coffee | | (10.3) | | | — | | | (10.3) | |

| International | | 14.3 | | | (2.3) | | | 12.0 | |

| Total income from operations | | 0.5 | | | (0.2) | | | 0.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Reported | | Items Affecting Comparability | | Adjusted | | Impact of Foreign Currency | | Constant Currency Adjusted |

| For the first six months of 2023: | | | | | | | | | | |

| Operating margin | | | | | | | | | | |

| U.S. Refreshment Beverages | | 25.8 | % | | 0.8 | % | | 26.6 | % | | — | % | | 26.6 | % |

| U.S. Coffee | | 25.4 | | | 5.0 | | | 30.4 | | | — | | | 30.4 | |

| International | | 21.2 | | | 0.9 | | | 22.1 | | | — | | | 22.1 | |

| Total operating margin | | 18.9 | | | 3.1 | | | 22.0 | | | — | | | 22.0 | |

Diluted earnings per common share may not foot due to rounding.

A-11

KEURIG DR PEPPER INC.

RECONCILIATION OF ADJUSTED EBITDA AND MANAGEMENT LEVERAGE RATIO

(UNAUDITED)

| | | | | |

| (in millions, except for ratio) | |

| ADJUSTED EBITDA RECONCILIATION - LAST TWELVE MONTHS | |

| Net income attributable to KDP | $ | 1,603 | |

| Interest expense | 525 | |

| Provision for income taxes | 333 | |

| Other (income) expense, net | (40) | |

| Depreciation expense | 395 | |

| Other amortization | 177 | |

| Amortization of intangibles | 140 | |

| EBITDA | $ | 3,133 | |

| Items affecting comparability: | |

| |

| |

| |

| Impairment of intangible assets | $ | 477 | |

| |

| Restructuring and integration expenses | 114 | |

| Productivity | 225 | |

| |

| Non-routine legal matters | 9 | |

| Stock compensation | 16 | |

| COVID-19 | 5 | |

| |

| |

| Foundational projects | 2 | |

| Mark to market | 99 | |

| Adjusted EBITDA | $ | 4,080 | |

| |

| June 30, |

| 2023 |

| Principal amounts of: | |

| Commercial paper notes | $ | 988 | |

| Senior unsecured notes | 11,743 | |

| Total principal amounts | 12,731 | |

| Less: Cash and cash equivalents | 278 | |

| Total principal amounts less cash and cash equivalents | $ | 12,453 | |

| |

| June 30, 2023 Management Leverage Ratio | 3.1 | |

Diluted earnings per common share may not foot due to rounding.

A-12

KEURIG DR PEPPER INC.

RECONCILIATION OF ADJUSTED EBITDA - LAST TWELVE MONTHS

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | | THIRD QUARTER OF 2022 | | FOURTH QUARTER OF 2022 | | FIRST SIX MONTHS OF 2023 | | LAST TWELVE MONTHS |

| Net income attributable to KDP | | | $ | 180 | | | $ | 453 | | | $ | 970 | | | $ | 1,603 | |

| Interest expense | | | 207 | | | 123 | | | 195 | | | 525 | |

| Provision for income taxes | | | 4 | | | 105 | | | 224 | | | 333 | |

| Other (income) expense, net | | | 4 | | | (8) | | | (36) | | | (40) | |

| Depreciation expense | | | 96 | | | 98 | | | 201 | | | 395 | |

| Other amortization | | | 43 | | | 43 | | | 91 | | | 177 | |

| Amortization of intangibles | | | 33 | | | 38 | | | 69 | | | 140 | |

| EBITDA | | | $ | 567 | | | $ | 852 | | | $ | 1,714 | | | $ | 3,133 | |

| Items affecting comparability: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Impairment of intangible assets | | | $ | 311 | | | $ | 166 | | | $ | — | | | $ | 477 | |

| | | | | | | | | |

| Restructuring and integration expenses | | | 33 | | | 81 | | | — | | | 114 | |

| Productivity | | | 50 | | | 64 | | | 111 | | | 225 | |

| | | | | | | | | |

| Nonroutine legal matters | | | 2 | | | 4 | | | 3 | | | 9 | |

| Stock compensation | | | 5 | | | 2 | | | 9 | | | 16 | |

| COVID-19 | | | 5 | | | — | | | — | | | 5 | |

| | | | | | | | | |

| Foundational projects | | | 1 | | | 1 | | | — | | | 2 | |

| | | | | | | | | |

| Mark to market | | | 106 | | | (9) | | | 2 | | | 99 | |

| Adjusted EBITDA | | | $ | 1,080 | | | $ | 1,161 | | | $ | 1,839 | | | $ | 4,080 | |

Diluted earnings per common share may not foot due to rounding.

A-13

KEURIG DR PEPPER INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(UNAUDITED)

Free cash flow is defined as net cash provided by operating activities adjusted for purchases of property, plant and equipment, proceeds from sales of property, plant and equipment, and certain items excluded for comparison to prior year periods. For the first six months of 2023 and 2022, there were no certain items excluded for comparison to prior year periods.

| | | | | | | | | | | | | | |

| | First Six Months |

| (in millions) | | 2023 | | 2022 |

| Net cash provided by operating activities | | $ | 452 | | | $ | 1,339 | |

| Purchases of property, plant and equipment | | (149) | | | (186) | |

| Proceeds from sales of property, plant and equipment | | 8 | | | 78 | |

| Free Cash Flow | | $ | 311 | | | $ | 1,231 | |

Diluted earnings per common share may not foot due to rounding.

A-14

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

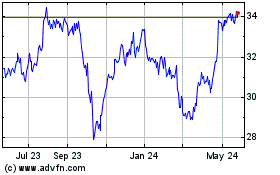

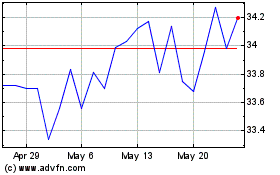

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From May 2024 to Jun 2024

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Jun 2023 to Jun 2024