Keurig Dr Pepper Takes Stake in Nutrabolt, Inks Distribution Deal

December 08 2022 - 9:59AM

Dow Jones News

By Will Feuer

Keurig Dr Pepper Inc. said it has agreed to buy a 30% stake in

Nutrabolt, the company behind energy drinks such as C4 and Xtend,

for $863 million, and has entered into a long-term sales and

distribution agreement.

Keurig will sell and distribute C4 Energy in the majority of its

company-owned direct store distribution territories, which is

expected to meaningfully increase availability and penetration for

the brand. Nutrabolt will continue to distribute C4 Energy directly

and through its existing distribution network to the specialty,

health club and fitness channels, the companies said.

The cash investment from Keurig, expected to close this month,

would make the company Nutrabolt's second-largest investor, only

behind Nutrabolt Founder, Chairman and Chief Executive Doss

Cunningham. Keurig would get preferred equity in privately-held

Nutrabolt with a 5% annual coupon paid in cash or in-kind.

Keurig would have the opportunity to earn more equity based on

in-market execution and would get representation on the Nutrabolt

board.

The deal puts the value of Nutrabolt at at least $2.87 billion,

based on Keurig's roughly 30% stake. Nutrabolt is expected to post

2023 sales of at least $650 million, the companies said.

The North American energy-drinks market has grown rapidly in

recent years. Nutrabolt is backed by private-equity firm MidOcean

Partners as well as consumer-packaged goods veterans Brian Goldberg

and Clayton Christopher, Mr. Doss said.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

December 08, 2022 09:44 ET (14:44 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

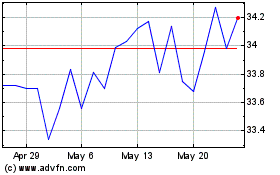

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From May 2024 to Jun 2024

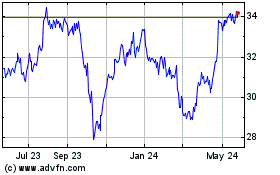

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Jun 2023 to Jun 2024