UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 20, 2023

Kaival Brands Innovations Group, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

000-56016 |

83-3492907 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

4460 Old Dixie Highway

Grant-Valkaria, Florida 32949

(Address of principal executive office, including

zip code)

Telephone: (833) 452-4825

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

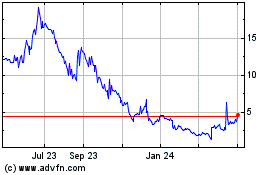

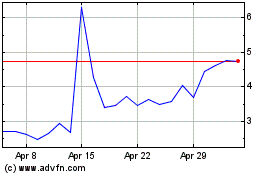

KAVL |

The Nasdaq Stock Market, LLC |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On September 20, 2023, Kaival Brands Innovations

Group, Inc. (the “Company”) issued a press release announcing its financial results for the third fiscal quarter

ended July 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is

incorporated herein by reference.

In accordance with General Instruction B.2

of Form 8-K, the information contained in or incorporated into Item 2.02 of this Current Report on Form 8-K, including Exhibit

99.1, are furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) or be otherwise subject to the liabilities

of that section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in any such filing.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| Dated: September 20, 2023 |

By: |

/s/ Eric Mosser |

| |

|

Eric Mosser |

| |

|

Chief Executive Officer and President |

0001762239

false

0001762239

2023-09-19

2023-09-20

0001762239

2023-07-31

0001762239

2022-10-31

0001762239

us-gaap:SeriesAPreferredStockMember

2023-07-31

0001762239

us-gaap:SeriesAPreferredStockMember

2022-10-31

0001762239

us-gaap:SeriesBPreferredStockMember

2023-07-31

0001762239

us-gaap:SeriesBPreferredStockMember

2022-10-31

0001762239

2023-05-01

2023-07-31

0001762239

2022-05-01

2022-07-31

0001762239

2022-11-01

2023-07-31

0001762239

2021-11-01

2022-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

EXHIBIT 99.1

Kaival Brands Reports Fiscal 2023 Third Quarter

Financial Results

Stable Revenues and Improving Gross and Net

Profits

Expanding Distribution, Revised Licensing

Agreement and More Favorable Regulatory Environment Expected to Serve as Strong Tailwinds for Improving Financial Performance

GRANT-VALKARIA, Fla., September 20, 2023

/PRNewswire/ -- Kaival Brands Innovations Group, Inc. (NASDAQ: KAVL) (“Kaival Brands,” the “Company,”

or “we”), the exclusive U.S. distributor of all products manufactured by Bidi Vapor, LLC (“Bidi Vapor”),

including the BIDI® Stick, which are intended for adults 21 and over, today announced its financial results for

the fiscal 2023 third quarter ended July 31, 2023.

Recent Business Highlights

| · | Added more than 1,500 store locations to Circle K rollout bringing the total locations to more

than 2,700 in the South Atlantic and Midwest regions |

| · | Shipped an initial order of BIDI® Sticks to over 900 Kwik Trip and Mapco locations |

| · | Amended agreement with Phillip Morris International (PMI) for distribution of Bidi Vapor products

internationally, simplifying payment structure thereby reducing costs and accelerating royalty payments. On September 8, 2023,

the Company received both a net reconciliation payment from PMI of approximately $135,000 pursuant to this amendment, and also

received a royalty payment earned from July 1, 2023 through July 31, 2023, in the amount of approximately $121,000 |

| · | Appointed Thomas J. Metzler to the role of Chief Financial Officer |

| · | Promoted Eric Mosser to the role of Chief Executive Officer |

| · | Promoted Stephen Sheriff to role of Chief Operating Officer |

Management Comments

Eric Mosser, Chief Executive Officer and President

of Kaival Brands, stated, “We are increasingly encouraged by the renewed BIDI® Stick interest and order flow

from our distribution partners and increased enforcement of compliance regulations by the U.S. Food and Drug Administration (FDA).

Over the past several months, we have increased placements with several large-scale C-store brands including Kwik Trip and Circle

K, both of which are focused on ID-verification and youth-access prevention, and engaged a prominent national broker and one of

the largest retail distributors in the U.S. We are pushing distribution into more channels and expect the impact will be evident

in our financial results in the coming periods. Sales in September are on pace to double sales in August, a solid proof point of

the momentum that is building.

“We recently renegotiated the licensing

agreement with PMI in light of regulation changes in international markets and given the lessons learned during the first year

of the agreement. Importantly, the revised agreement simplifies the payment terms, provides us with incremental cost savings and

improves visibility into our future revenue and cash flows. We anticipate an acceleration of royalty payments, which will also

serve as a catalyst for improving financial performance in the coming periods.”

Financial Results for Fiscal Third Quarter

2023

Revenues: Revenues for the third quarter

of fiscal year 2023 were $3.6 million, compared to $3.8 million in the same period of the prior fiscal year. Revenues were flat

in the third quarter of 2023, primarily due to credits/discounts/rebates issued to customers. The Company does not anticipate this

trend to continue as renewed distribution ramps up and sales of non-tobacco flavored BIDI® Sticks increase, and even more so

now that the PMTA denial order has been vacated by the 11th Circuit Court of Appeals, which allows it to continue marketing

and selling BIDI ® Sticks, subject to the FDA’s enforcement discretion.

Cost of Revenue, Net, and Gross Profit:

Gross profit in the third quarter of fiscal year 2023 was $1.3 million, or 36.3% of revenues, net, compared to approximately $442,000

gross profit, or 11.5% of revenues, net, for the third quarter of fiscal year 2022. Total cost of revenue, net was $2.3 million,

or 63.7% of revenue, net for the third quarter of fiscal year 2023, compared to $3.4 million, or 88.5% of revenue, net for the

third quarter of fiscal year 2022. The increase in gross profit was primarily driven by improved cost per sticks during the third

quarter of fiscal year 2023.

Operating Expenses: Total operating

expenses were $3.0 million for the third quarter of fiscal year 2023, compared to $4.3 million for the third quarter of fiscal

year 2022. For the third quarter of fiscal year 2023, operating expenses consisted of advertising and promotion fees of $578,000

compared to $658,000 in the prior year quarter, and general and administrative expenses of $2.4 million compared to $3.6 million

in the prior year quarter. The reduction in general and administrative expenses was primarily the result of lower stock option

expenses and professional fees, which was partially offset by an increase in other general and administrative expenses. The Company

expects future operating expenses to increase while it increases the footprint of its business and generates increased sales growth.

Net Loss: Net loss for the third quarter

of fiscal year 2023 was $1.8 million, or $0.03 basic and diluted net loss per share, compared to a net loss of $3.9 million, or

$0.09 basic and diluted net loss per share, for the third quarter of fiscal year 2022. The decrease in the net loss for the third

quarter of fiscal year 2023, as compared to the third quarter of fiscal year 2022, is primarily attributable to increased gross

margins on sold products and a reduction in general & administrative expenses.

Cash Position: As of July 31, 2023,

the Company had working capital of $2.4 million and total cash of $1.0 million.

Additional information regarding the Company’s

results of operations for the third quarter ended July 31, 2023 is available in the Company’s Quarterly Report on Form 10-Q

for such reporting period, which has been filed with the Securities and Exchange Commission.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands

is a company focused on incubating innovative and profitable adult-focused products into mature and dominant brands, with a current

focus on the distribution of electronic nicotine delivery systems (ENDS) also known as “e-cigarettes” for adult smokers

and tobacco users 21 and over. Our business plan is to seek to diversify into distributing other nicotine and non-nicotine delivery

system products (including those related to hemp-derived cannabidiol (known as CBD) products). Kaival Brands and Philip Morris

Products S.A. (via sublicense from Kaival Brands) are the exclusive global distributors of all products manufactured by Bidi Vapor.

Learn more about Kaival Brands at https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT KAIVAL LABS

Based in Grant-Valkaria, Florida, Kaival Labs

is a 100% wholly-owned subsidiary of Kaival Brands focused on developing new branded and white-label products and services in the

vaporizer and inhalation technology sectors. Kaival Labs’ current patent portfolio consists of 12 existing and 46 pending

with novel technologies across extrusion dose control, product preservation, tracking and tracing usage, multiple modalities and

child safety. The patents and patent applications cover territories including the United States, Australia, Canada, China, the

European Patent Organisation, Israel, Japan, Mexico, New Zealand and South Korea. The portfolio also includes a fully-functional

proprietary mobile device software application that is used in conjunction with certain patents in the portfolio.

Learn more about Kaival Labs at https://kaivallabs.com.

ABOUT BIDI VAPOR

Based in Melbourne, Florida, Bidi Vapor maintains

a commitment to responsible, adult-focused marketing, supporting age-verification standards and sustainability through its BIDI

® Cares recycling program. Bidi Vapor’s premier device, the BIDI ® Stick, is a premium product made with high-quality

components, a UL-certified battery and technology designed to deliver a consistent vaping experience for adult smokers 21 and over.

Bidi Vapor is also adamant about strict compliance with all federal, state and local guidelines and regulations. At Bidi Vapor,

innovation is key to its mission, with the BIDI® Stick promoting environmental sustainability, while providing a

unique vaping experience to adult smokers.

Nirajkumar Patel, the Company’s Chief

Science and Regulatory Officer and director, owns and controls Bidi Vapor. As a result, Bidi Vapor is considered a related party

of the Company.

For more information, visit www.bidivapor.com.

Contact:

Brett Maas, Managing Partner

Hayden IR

(646) 536-7331

brett@haydenir.com

Kaival Brands Media & Press Relations:

Stephen Sheriff, COO and Investor Relations

Officer

Kaival Brands

(646) 572-7086

investors@kaivalbrands.com

-- Tables Follow –

| | |

| | | |

| | |

| | |

July 31, 2023 | |

October 31, 2022 |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash | |

$ | 1,003,212 | | |

$ | 3,685,893 | |

| Accounts receivable, net | |

| 710,608 | | |

| 574,606 | |

| Other receivable - related party - current portion | |

| 1,136,452 | | |

| 1,539,486 | |

| Inventories | |

| 3,591,991 | | |

| 1,239,725 | |

| Prepaid expenses | |

| 172,601 | | |

| 426,407 | |

| Income tax receivable | |

| — | | |

| 1,607,302 | |

| Total current assets | |

| 6,614,864 | | |

| 9,073,419 | |

| Fixed assets, net | |

| 3,016 | | |

| — | |

| Intangible assets, net | |

| 11,664,909 | | |

| — | |

| Other receivable - related party - net of current portion | |

| 1,840,475 | | |

| 2,164,646 | |

| Right of use asset - operating lease | |

| 1,056,767 | | |

| 1,198,969 | |

| TOTAL ASSETS | |

$ | 21,180,031 | | |

$ | 12,437,034 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDER EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 125,011 | | |

$ | 40,023 | |

| Accounts payable - related party | |

| 2,308,373 | | |

| — | |

| Accrued expenses | |

| 540,516 | | |

| 1,099,157 | |

| Customer deposits | |

| — | | |

| 44,973 | |

| Customer refund due | |

| 618,403 | | |

| — | |

| Deferred revenue | |

| — | | |

| 235,274 | |

| Loans payable, net | |

| 483,078 | | |

| — | |

| Operating lease obligation - short term | |

| 179,861 | | |

| 166,051 | |

| Total current liabilities | |

| 4,255,242 | | |

| 1,585,478 | |

| | |

| | | |

| | |

| LONG TERM LIABILITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Operating lease obligation, net of current portion | |

| 914,761 | | |

| 1,050,776 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 5,170,003 | | |

| 2,636,254 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred stock; 5,000,000 shares authorized | |

| | | |

| | |

| Series A Convertible Preferred stock ($0.001 par value, 3,000,000 shares authorized, none issued and outstanding as of July 31, 2023, and October 31, 2022, respectively) | |

| — | | |

| — | |

| Series B Convertible Preferred stock ($0.001 par value, 900,000 shares authorized, 900,000 and none issued and outstanding as of July 31, 2023, and October 31, 2022, respectively) | |

| 900 | | |

| — | |

| | |

| | | |

| | |

| Common stock | |

| | | |

| | |

| ($.001 par value, 1,000,000,000 shares authorized, 58,261,090 and 56,169,090 shares issued and outstanding as of July 31, 2023, and October 31, 2022, respectively) | |

| 58,261 | | |

| 56,169 | |

| | |

| | | |

| | |

| Additional paid-in capital | |

| 44,339,243 | | |

| 29,375,787 | |

| | |

| | | |

| | |

| Accumulated deficit | |

| (28,388,376 | ) | |

| (19,631,176 | ) |

| Total Stockholders’ Equity | |

| 16,010,028 | | |

| 9,800,780 | |

| TOTAL LIABILITIES & EQUITY | |

$ | 21,180,031 | | |

$ | 12,437,034 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

For the Three Months Ended July 31, | |

For the Nine Months Ended July 31, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Revenues, net | |

$ | 3,228,099 | | |

$ | 3,854,012 | | |

$ | 8,710,591 | | |

$ | 9,788,368 | |

| Revenues - related party | |

| 1,165 | | |

| 29,319 | | |

| 7,878 | | |

| 60,469 | |

| Royalty revenue | |

| 385,685 | | |

| — | | |

| 491,257 | | |

| — | |

| Excise tax on products | |

| (31,356 | ) | |

| (36,070 | ) | |

| (79,913 | ) | |

| (99,669 | ) |

| Total revenues, net | |

| 3,583,593 | | |

| 3,847,261 | | |

| 9,129,813 | | |

| 9,749,168 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue - related party | |

| 2,282,601 | | |

| 3,365,010 | | |

| 7,414,053 | | |

| 9,477,060 | |

| Cost of revenue - other | |

| — | | |

| 40,186 | | |

| — | | |

| 133,283 | |

| Total cost of revenue | |

| 2,282,601 | | |

| 3,405,196 | | |

| 7,414,053 | | |

| 9,610,343 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 1,300,992 | | |

| 442,065 | | |

| 1,715,760 | | |

| 138,825 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Advertising and promotion | |

| 577,991 | | |

| 657,561 | | |

| 1,827,033 | | |

| 2,011,131 | |

| General and administrative expenses | |

| 2,376,057 | | |

| 3,641,495 | | |

| 8,510,792 | | |

| 9,784,616 | |

| Total operating expenses | |

| 2,954,048 | | |

| 4,299,056 | | |

| 10,337,825 | | |

| 11,795,747 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (147,087 | ) | |

| — | | |

| (135,135 | ) | |

| — | |

| Total other expense | |

| (147,087 | ) | |

| — | | |

| (135,135 | ) | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| 5,807 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (1,800,143 | ) | |

| (3,856,991 | ) | |

| (8,757,200 | ) | |

| (11,651,115 | ) |

| Preferred stock dividends | |

| (45,000 | ) | |

| — | | |

| (45,000 | ) | |

| — | |

| Net loss attributable to common shareholders | |

$ | (1,845,143 | ) | |

$ | (3,856,991 | ) | |

$ | (8,802,200 | ) | |

$ | (11,651,115 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share - basic and diluted | |

$ | (0.03 | ) | |

$ | (0.09 | ) | |

$ | (0.16 | ) | |

$ | (0.34 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic and diluted | |

| 57,578,916 | | |

| 41,493,644 | | |

| 56,645,943 | | |

| 34,259,009 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.3

Consolidated Balance Sheets (Unaudited) - USD ($)

|

Jul. 31, 2023 |

Oct. 31, 2022 |

| CURRENT ASSETS: |

|

|

| Cash |

$ 1,003,212

|

$ 3,685,893

|

| Accounts receivable, net |

710,608

|

574,606

|

| Other receivable - related party - current portion |

1,136,452

|

1,539,486

|

| Inventories |

3,591,991

|

1,239,725

|

| Prepaid expenses |

172,601

|

426,407

|

| Income tax receivable |

0

|

1,607,302

|

| Total current assets |

6,614,864

|

9,073,419

|

| Fixed assets, net |

3,016

|

0

|

| Intangible assets, net |

11,664,909

|

0

|

| Other receivable - related party - net of current portion |

1,840,475

|

2,164,646

|

| Right of use asset - operating lease |

1,056,767

|

1,198,969

|

| TOTAL ASSETS |

21,180,031

|

12,437,034

|

| CURRENT LIABILITIES: |

|

|

| Accounts payable |

125,011

|

40,023

|

| Accounts payable - related party |

2,308,373

|

0

|

| Accrued expenses |

540,516

|

1,099,157

|

| Customer deposits |

0

|

44,973

|

| Customer refund due |

618,403

|

0

|

| Deferred revenue |

0

|

235,274

|

| Loans payable, net |

483,078

|

0

|

| Operating lease obligation - short term |

179,861

|

166,051

|

| Total current liabilities |

4,255,242

|

1,585,478

|

| LONG TERM LIABILITIES: |

|

|

| Operating lease obligation, net of current portion |

914,761

|

1,050,776

|

| TOTAL LIABILITIES |

5,170,003

|

2,636,254

|

| STOCKHOLDERS’ EQUITY: |

|

|

| Common stock ($.001 par value, 1,000,000,000 shares authorized, 58,261,090 and 56,169,090 shares issued and outstanding as of July 31, 2023, and October 31, 2022, respectively) |

58,261

|

56,169

|

| Additional paid-in capital |

44,339,243

|

29,375,787

|

| Accumulated deficit |

(28,388,376)

|

(19,631,176)

|

| Total Stockholders’ Equity |

16,010,028

|

9,800,780

|

| TOTAL LIABILITIES & EQUITY |

21,180,031

|

12,437,034

|

| Series A Preferred Stock [Member] |

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

| Preferred Stock, Value, Issued |

0

|

0

|

| Series B Preferred Stock [Member] |

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

| Preferred Stock, Value, Issued |

$ 900

|

$ 0

|

| X |

- References

+ Details

| Name: |

kavl_IntangibleAssetsNonCurrent |

| Namespace Prefix: |

kavl_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

kavl_LongTermDebtAndCapitalLeaseObligation |

| Namespace Prefix: |

kavl_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionCarrying value as of the balance sheet date of liabilities incurred (and for which invoices have typically been received) and payable to vendors for goods and services received that are used in an entity's business. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19(a))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AccountsPayableCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount, after allowance for credit loss, of right to consideration from customer for product sold and service rendered in normal course of business, classified as current. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 310

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 2

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481990/310-10-45-2

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 310

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 9

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481990/310-10-45-9

| Name: |

us-gaap_AccountsReceivableNetCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionCarrying value as of the balance sheet date of obligations incurred and payable, pertaining to costs that are statutory in nature, are incurred on contractual obligations, or accumulate over time and for which invoices have not yet been received or will not be rendered. Examples include taxes, interest, rent and utilities. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.20)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AccruedLiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of excess of issue price over par or stated value of stock and from other transaction involving stock or stockholder. Includes, but is not limited to, additional paid-in capital (APIC) for common and preferred stock. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AdditionalPaidInCapital |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are recognized. Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 12

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-12

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(12))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(8))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 13: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 14: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 19: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 20: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 21: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 22: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 23: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

Reference 24: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 25: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (d)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 26: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 942

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-03(11))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479853/942-210-S99-1

| Name: |

us-gaap_Assets |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are expected to be realized in cash, sold, or consumed within one year (or the normal operating cycle, if longer). Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483467/210-10-45-1

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(9))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 10: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 11: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 13: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 14: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 19: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 20: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

| Name: |

us-gaap_AssetsCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

us-gaap_AssetsCurrentAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of currency on hand as well as demand deposits with banks or financial institutions. Includes other kinds of accounts that have the general characteristics of demand deposits. Excludes cash and cash equivalents within disposal group and discontinued operation. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 12

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-12

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(2))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(4))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section 45

-Paragraph 21

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480555/946-210-45-21

Reference 6: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Name Accounting Standards Codification

-Section 45

-Paragraph 20

-SubTopic 210

-Topic 946

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480555/946-210-45-20

| Name: |

us-gaap_Cash |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionAggregate par or stated value of issued nonredeemable common stock (or common stock redeemable solely at the option of the issuer). This item includes treasury stock repurchased by the entity. Note: elements for number of nonredeemable common shares, par value and other disclosure concepts are in another section within stockholders' equity. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(22))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(29))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_CommonStockValue |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe current portion of money or property received from customers which is either to be returned upon satisfactory contract completion or applied to customer receivables in accordance with the terms of the contract or the understandings. Reference 1: http://fasb.org/us-gaap/role/ref/otherTransitionRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.20)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_CustomerDepositsCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionCurrent regulatory liabilities generally represent obligations to make refunds to customers for various reasons including overpayment.

| Name: |

us-gaap_CustomerRefundLiabilityCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of deferred income and obligation to transfer product and service to customer for which consideration has been received or is receivable. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(26)(c))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_DeferredRevenue |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount after valuation and LIFO reserves of inventory expected to be sold, or consumed within one year or operating cycle, if longer. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2003/role/exampleRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483467/210-10-45-1

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(6))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_InventoryNet |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all liabilities that are recognized. Liabilities are probable future sacrifices of economic benefits arising from present obligations of an entity to transfer assets or provide services to other entities in the future. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 12

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-12

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(14))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 10: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 13: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 14: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 19: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

Reference 20: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

Reference 21: http://www.xbrl.org/2003/role/exampleRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (d)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 22: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19-26)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_Liabilities |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of liabilities and equity items, including the portion of equity attributable to noncontrolling interests, if any. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(25))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 3: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 942

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-03(23))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479853/942-210-S99-1

Reference 7: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(32))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_LiabilitiesAndStockholdersEquity |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionTotal obligations incurred as part of normal operations that are expected to be paid during the following twelve months or within one business cycle, if longer. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 5

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483467/210-10-45-5

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 10: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 13: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 14: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 19: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

Reference 20: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

Reference 21: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.21)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_LiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

us-gaap_LiabilitiesCurrentAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |