0001762239

false

0001762239

2023-08-28

2023-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 28, 2023 (August 22, 2023)

Kaival

Brands Innovations Group, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

000-56016 |

83-3492907 |

(State

or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer

Identification No.) |

4460 Old Dixie Highway

Grant-Valkaria, Florida 32949

(Address of principal executive office, including

zip code)

Telephone: (833) 452-4825

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

KAVL |

The

Nasdaq Stock Market, LLC |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation

of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Appointment of Stephen Sheriff as Chief Operating Officer

Effective as of August 22, 2023, the Board of Directors

(the “Board”) of Kaival Brands Innovations Group, Inc. (the “Company”) appointed Stephen Sheriff

as the Company’s Chief Operating Officer and Investor Relations Officer. As Chief Operating Officer, Mr. Sheriff succeeds Eric Mosser,

who had served as the Company’s Chief Operating Officer prior to his recent promotion to Chief Executive Officer of the Company.

Prior to his promotion, Mr. Sheriff served as the Company’s Director of Administration and Investor Relations.

Mr. Sheriff, 34, brings over a decade of finance and

entrepreneurial leadership to his role as Chief Operating Officer at the Company. Since August 2022, he has served as the Company’s

Director of Administration & Communications. In this role, he managed the Company’s investor, public relations and human resource

programs in addition to overall responsibility for the development and implementation of key programs and initiatives, including customer

and vendor relations. Since January 2022, he has also served as co-founder and Managing Partner of Riverhill Group, a management consulting

firm focused on assisting early-stage companies the areas of funding, scaling and expanding operations.

Since 2012, he has also been a Managing Partner at Riverhill Ventures, a socially conscious, strategic investment and consulting firm

primarily focused on quick service restaurants, natural foods and consumer brands. Through his Riverhill-related experiences, Mr. Sheriff

has been and investor in and advisor to several early-stage companies. From September 2018 to September 2020, he also was an Associate

at Solebury Trout (now Solebury Strategic Communications), a leading life sciences-focused

investor relations firm based in New York City. Mr. Sheriff received his Bachelor of Arts in Counseling Psychology from Delaware

Valley University.

The Company believes Mr. Sheriff is qualified

to be Chief Operating Officer based on his prior work history with the Company and his business experience in management consulting

and public and private capital markets advisory work.

There is no arrangement or understanding between

Mr. Sheriff and any other person pursuant to which he was selected as Chief Operating Officer. Mr. Sheriff has no family relationships

with any of our directors or executive officers, and has no direct or indirect material interest in any transaction required to

be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with Mr. Sheriff’s promotion,

Mr. Sheriff entered into an employment agreement with the Company effective as of August 22, 2023 (the “Sheriff Employment

Agreement”). Pursuant to the Sheriff Employment Agreement, the Company shall pay to Mr. Sheriff a base salary of $225,000.

The Company may, in its sole discretion, grant to Mr. Sheriff a bonus for the calendar year 2023. Beginning in the 2024 calendar

year, the Company may, in its sole discretion, grant to Mr. Sheriff an annual incentive bonus based upon targets set by the Board

and its Compensation Committee. Beginning in 2024 and thereafter, Mr. Sheriff’s bonus target shall be up to 30% of his base

salary.

Pursuant to the Sheriff Employment Agreement,

the Company has also granted to Mr. Sheriff, effective August 22, 2023, an option to purchase 158,000 shares of the Company’s

common stock with an exercise price of $0.44 per share (the “Sheriff Option”). The Sheriff Option shall

vest over four years. One-quarter of the Sheriff Option shall vest on the first anniversary of the grant date and shall vest afterward

monthly at the rate of 1/36 per month until fully vested. The Sheriff Option and its vesting shall be subject to, and governed

by, the terms and conditions of the Company’s 2020 Stock and Incentive Compensation Plan (the “Incentive Plan”)

as amended from time to time, and the award agreement issued by the Incentive Plan.

The Sheriff Employment Agreement contains customary

clawback language, which states that any incentive-based compensation granted to Mr. Sheriff, including any annual incentive bonus

and the Sheriff Option, that is subject to recovery under any law, government rule or regulation, or stock exchange listing requirement

(“Clawback Rules”), will be subject to such deductions and clawback as may be required to be made pursuant to

such Clawback Rules or any policy adopted by the Company pursuant to any such Clawback Rules.

Mr. Sheriff’s employment is at will,

meaning that either he or the Company may terminate the employment at any time for any reason or no reason. The Sheriff Employment

Agreement also allows for termination by the Company for “Cause” or by Mr. Sheriff without “Good Reason,”

as defined in the Sheriff Employment Agreement. If the Company terminates Mr. Sheriff’s employment for Cause, or if he terminates

without Good Reason, Mr. Sheriff will be entitled to receive the following: (i) any unpaid base salary accrued up to the termination

date, (ii) reimbursement for business expenses, and (iii) employee benefits and equity compensation under the Company’s benefit

plans as of the termination date, without any additional severance or termination payments. If the Company terminates Mr. Sheriff

without Cause, or if he terminates for Good Reason, Mr. Sheriff will be entitled to receive: (i) the previously mentioned accrued

amounts, (ii) severance pay equal to two (2) months of his base salary, increasing to six (6) months after one (1) year of employment,

and (iii) any rights to option or equity grants as defined in the Incentive Plan.

The Sheriff Employment Agreement also contains

customary provisions for confidentiality and matters related to intellectual property and Company property.

The foregoing description of the Sheriff Employment

Agreement contained herein does not purport to be complete and is qualified in its entirety by reference thereto, which is attached

to this Report as Exhibit 10.1 and is incorporated herein by reference.

On August 25, 2023, the Company issued a press

release announcing the appointment of Mr. Sheriff as the Company’s Chief Operating Officer. The full text of the press release

is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| Dated: August 28, 2023 |

By: |

/s/ Eric Mosser |

| |

|

Eric Mosser |

| |

|

Chief Executive Officer and President |

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT

AGREEMENT (this “Agreement”) is made and entered into by and between Kaival Brands Innovations Group, Inc.

(the “Company”) located at 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949, and Mr. Stephen Sheriff (“Executive”)

(each a “Party” and collectively the “Parties”) on this 22nd day of August 2023 (“Effective

Date”).

WHEREAS, the Company

wishes to employ Executive on the terms set forth in this Agreement; and

WHEREAS, Executive

wishes to become employed on the terms set forth herein;

NOW, THEREFORE,

in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency

of which are acknowledged, the Parties agree as follows:

1. Employment Term/Prior

Agreements.

a) Employment Term.

Executive’s employment is at will, meaning that either party may terminate the employment at any time for any reason or no

reason. Nothing in this Agreement is intended to create a promise or representation of continued employment or employment for a

fixed period of time. The period of time between the Effective Date and the termination of the Executive’s employment shall

be referred as the “Term.”

b) Prior Agreements.

Any and all prior agreements under which Executive performed work for, or provided services to, the Company, its parent company,

or any affiliate, shall terminate, and be of no further force or effect as of the Effective Date. Nothing herein shall, however,

be considered a waiver of any vested compensation Executive earned under any prior agreement.

2. Position and Duties.

a) Title.

The Company hereby agrees to employ the Executive to serve as Chief Operating Officer of the Company. The Executive shall also

serve as the Company’s Investor Relations Officer.

b) Duties.

Executive shall report to the Company’s Chief Executive Officer (the “CEO”). Executive shall perform all

duties and have all powers incident to the office he holds. Subject to the oversight of the CEO, Executive shall have overall responsibility

for the Company’s day-to-day operations and supervision of its mid-level executives and supervisors. During the Term, the

Executive shall be employed by the Company on a full-time basis and shall perform such duties and responsibilities on behalf of

the Company and all persons and entities directly or indirectly controlling, controlled by, or under common control with, the Company.

Executive shall perform such other duties and may exercise such other powers as may be assigned by the CEO from time to time that

are consistent with his title and status.

c) Board Service.

The Company may nominate Executive to serve as a member of the boards of directors of Company affiliates or subsidiaries. If requested,

Executive agrees, for no additional compensation, to serve on such boards. Upon the end of the Term for any reason, Executive shall

resign from any such boards and from any other offices he holds with the Company, or its parent company, affiliates or subsidiaries.

d) Full-Time Commitment/Policies.

Throughout the Executive’s employment, the Executive shall devote substantially all of his professional time to the performance

of his duties of employment with the Company (except as otherwise provided herein) and shall faithfully and industriously perform

such duties. The Executive will be required to comply with all Company policies

as may exist and be in effect from time to time.

e) Executive

Representations. The Executive represents and warrants to the Company that he is under

no obligation or commitments, whether contractual or otherwise, that are inconsistent with his obligations under this Agreement.

The Executive represents and warrants that he will not use or disclose, in connection with his employment by the Company, any trade

secrets or proprietary information or intellectual property in which any other person or entity has any right, title or interest

and that his employment by the Company as contemplated by this Agreement will not infringe or violate the rights of any other person.

3. Compensation and Benefits.

a) Base Salary.

In consideration for his work under the terms of this Agreement, the Executive shall earn a base salary in the gross amount

of $225,000 (Two Hundred Twenty-Five Thousand Dollars) per year (“Base Salary”). Executive’s Base Salary

shall be paid in equal semi-monthly installments, in accordance with the regular payroll practices of the Company.

b) Annual Bonus.

For the calendar year 2023, the Company may, in its sole discretion, grant Executive an annual incentive bonus. Beginning in calendar

year 2024, Executive shall be eligible for an annual incentive bonus based upon targets set by the Board and its Compensation Committee

in their sole and absolute discretion in an executive bonus plan, by January 30, 2024 and January 30 of each succeeding year. Beginning

in 2024, and thereafter, Executive’s bonus target shall be up to 30% (thirty percent) of Executive’s Base Salary.

c) Option Grants.

On the Effective Date, the Company shall grant Executive an option (to be characterized as an incentive stock option) to purchase

158,000 (one hundred fifty-eight thousand) common shares of the Company at a strike price equal to the fair market value on the

date of grant (the “Option”). The Option shall vest over four years. One-quarter of the Option shall vest on

the first anniversary of the grant date and afterward shall vest monthly at the rate of 1/36 per month until fully vested. The

Option and its vesting shall be subject to, and governed by, the terms and conditions of the Company’s 2020 Stock and Incentive

Compensation Plan as amended from time to time (the “Incentive Plan”), and the Company’s customary

award agreement for the issuance of incentive stock options under the Incentive Plan.

d) Clawback Rules.

Notwithstanding any other provisions in this Agreement to the contrary, any incentive-based compensation, including any annual

incentive bonus and the Option, paid to the Executive under this Agreement, the Incentive Plan, or any other agreement or arrangement

with the Company, which is subject to recovery under any law, government rule or regulation, or stock exchange listing requirement

(“Clawback Rules”), will be subject to such deductions and clawback as may be required to be made pursuant to

such Clawback Rules or any policy adopted by the Company pursuant to any such Clawback Rules. The Company shall decide, in its

sole and absolute discretion, what policies it must adopt in order to comply with such Clawback Rules.

e) Benefits and

Perquisites. Executive shall be eligible for any fringe benefits offered by the Company on the same terms and conditions

as other executives. Such benefits may include group health benefits and a 401k retirement plan. The Company reserves the right,

in its sole discretion, to amend or terminate any employee benefit plan in accordance with applicable law.

f) Paid Time Off.

Executive will be entitled to 20 (twenty) paid vacation days per calendar year, pro-rated for partial years. Vacation days shall

accrue at the rate of 1/24 per pay period. Executive shall be entitled to an additional vacation day each succeeding year up to

a maximum accrual rate of 30 vacation days per year. The maximum vacation accrual shall be 1.75 times Executive’s annual

vacation allotment, at which point Executive shall not accrue any additional vacation days until Executive’s accrual balance

is reduced below that amount. Executive shall also be entitled to five paid sick days and those paid holidays recognized by the

Company. All paid time off shall be governed by the Company’s policies which the Company may, in its sole and absolute discretion,

change from time to time.

g) Taxes-Withholdings.

All compensation paid or provided under this Agreement shall be subject to such deductions and withholdings for taxes and such

other amounts as are required by law or elected by the Executive.

4. Business Expenses.

The Company will reimburse or advance all reasonable business expenses that Executive incurs in connection with the performance

of his duties under this Agreement, including travel expenses, in accordance with the Company’s policies as established from

time to time.

5. Termination of

Employment. The Executive’s employment hereunder may be terminated by either the Company or the Executive at any

time and for any reason. On termination of the Executive’s employment, the Executive shall be entitled to the compensation

and benefits described in this Section 5 and shall have no further rights to any compensation or any other benefits from the Company

or any of its affiliates.

a) For

Cause, or Without Good Reason. The Executive’s employment hereunder may be terminated by the

Company for Cause, or by the Executive without Good Reason. If the Executive’s employment is terminated by the Company for

Cause, or by the Executive without Good Reason, the Executive shall be entitled to receive:

i) any

accrued but unpaid Base Salary which shall be paid on the pay date immediately following the Termination Date (as defined below)

in accordance with the Company’s customary payroll procedures;

ii) reimbursement

for unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the

Company’s expense reimbursement policy; and

iii)

such employee benefits (including equity compensation), if any, to which the Executive may be entitled under the Company’s

employee benefit plans as of the Termination Date; provided that, in no event shall the Executive be entitled to any payments

in the nature of severance or termination payments except as specifically provided herein.

Items 5.1(a)(i)

through 5.1(a)(iii) are referred to herein collectively as the “Accrued Amounts”.

b) Cause.

For purposes of this Agreement, but not for purposes of the Incentive Plan, “Cause” shall mean the Executive:

i) intentionally

or negligently fails to perform his duties under this Agreement;

ii) refuses

to comply with a lawful order of the CEO;

iii) materially

breaches a material term of this Agreement;

iv) willfully

and materially violates a written Company policy;

v) is

indicted for, convicted of, or pleads guilty or no contest to, a felony or crime involving moral turpitude;

vi)

engages in conduct that constitutes gross negligence or willful misconduct in carrying out his duties;

vii) materially

violates a federal or state law that the Company reasonably determines has had, or is reasonably likely to have, a material detrimental

effect on the Company’s reputation or business; or

viii) commits

an act of fraud or dishonesty in the performance of his job duties;

provided, however,

that in the case of (i) - (iv), if curable, the Executive shall have fifteen (15) days from the delivery of written notice by the

Company within which to cure any acts or omissions constituting Cause.

c) Good Reason.

For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following, in each case

during the Term without the Executive’s written consent:

i) a reduction

in the Executive’s Base Salary, other than a general reduction in Base Salary of no more than ten percent (10%) that affects

all similarly situated executives in substantially the same proportions;

ii) a

relocation of the Executive’s principal place of employment by more than 50 (fifty) miles;

iii) any

material breach by the Company of any material provision of this Agreement, including failure to provide any material payment or

benefit required to be provided to Executive under this Agreement; or

iv) a

material, adverse change in the Executive’s authority, duties, or responsibilities (other than temporarily while the Executive

is physically or mentally incapacitated or as required by applicable law, and other than a change in the Executive’s status

as the Company’s Investor Relations Officer);

Executive cannot

terminate employment for Good Reason unless Executive has provided written notice to the Company of the existence of the circumstances

providing grounds for termination for Good Reason within thirty (30) days after the initial existence of such grounds and the Company

has had thirty (30) days from the date on which such notice is provided to cure such circumstances. If Executive does not terminate

his employment for Good Reason within sixty-five (65) days after Executive learns of the first occurrence of the applicable grounds,

then Executive will be deemed to have waived the right to terminate for Good Reason with respect to such grounds.

d) Termination

Without Cause or Resignation for Good Reason.

If Executive’s employment is terminated by the Company without Cause, or by the Executive for Good Reason,

the Executive shall be entitled to receive:

i)

The Accrued Amounts;

ii)

Severance pay in an amount equal to two months of Executive’s then-applicable Base

Salary (the “Severance Pay”). On the first anniversary of the

Effective Date, Executive’s Severance Pay amount will increase to six months of Executive’s then-applicable Base Salary.

The Severance Pay will be paid to Executive in a lump sum within fourteen (14) days after the Release (defined below) becomes

effective; and

iii)

Whatever rights with respect to any option or equity grants

that are afforded to Executive under the Incentive Plan, including the Incentive Plan’s definition of “Cause”

for termination of employment.

e) Release.

The Company’s obligation to pay Severance Pay, is expressly conditioned upon

Executive’s execution of and delivery to the Company (and non-revocation) of a release (as drafted by the Company at the

time of Executive’s termination of employment) which will include an unconditional release of all rights to any claims,

charges, complaints, grievances, arising from or relating to Executive’s employment or its termination plus any other potential

claims, known or unknown to Executive, against the Company, its affiliates or assigns, or any of their officers, directors, employees

and agents, through to the date of Executive’s termination from employment (the “Release”).

The Release shall not be mutual but may contain mutual confidentiality and non-disparagement provisions and requirements that

certain features of this Agreement remain in effect. The Release shall not require Executive to waive or release any rights to

vested or earned compensation of any kind or to waive any rights as a shareholder, option holder, unitholder, or as a participant

in the Company’s Incentive Plan.

f) Notice

of Termination. Any termination of the Executive’s employment hereunder by the Company or by

Executive during the Term (other than termination on account of Executive’s death) shall be communicated by written notice

of termination (“Notice of Termination”) to the other party hereto. The Notice of Termination shall specify:

i) The termination

provision of this Agreement relied upon;

ii) To the

extent applicable, the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under

the provision so indicated; and

iii) The

applicable Termination Date.

g) Termination

Date. The Executive’s “Termination Date” shall be:

i) If

Executive’s employment hereunder terminates on account of Executive’s death, the date of the Executive’s death;

ii) If

the Company terminates Executive’s employment hereunder for any reason, the date the Notice of Termination is delivered to

the Executive;

iii) If

Executive terminates his employment hereunder with or without Good Reason, the date specified in the Executive’s Notice of

Termination.

6. Confidentiality.

a) Confidential

Information. The Executive acknowledges that the Executive will occupy a position of trust and confidence. The Company,

from time to time, may disclose to the Executive, and the Executive will require access to and may generate confidential and proprietary

information (no matter how created or stored) concerning the business practices, products, services, and operations of the Company

which is not known to its competitors or within its industry generally and which is of great competitive value to it, including,

but not limited to: (i) Trade Secrets (as defined herein), inventions, mask works, ideas, concepts, drawings, materials, documentation,

procedures, diagrams, specifications, models, processes, formulae, source and object codes, data, software, programs, other works

of authorship, know-how, improvements, discoveries, developments, designs and techniques; (ii) information regarding research,

development, products, marketing plans, market research and forecasts, bids, proposals, quotes, business plans, budgets, financial

information and projections, overhead costs, profit margins, pricing policies and practices, accounts, processes, planned collaborations

or alliances, licenses, suppliers and customers; (iii) operational information including deployment plans, means and methods of

performing services, operational needs information, and operational policies and practices; and (iv) any information obtained by

the Company from any third party that the Company treats or agrees to treat as confidential or proprietary information of the third

party (collectively, “Confidential Information”). The Executive acknowledges and agrees that Confidential Information

includes Confidential Information disclosed to the Executive prior to entering into this Agreement.

b) Trade Secrets.

“Trade Secrets” means any information, including any data, plan, drawing, specification, pattern, procedure,

method, computer data, system, program or design, device, list, tool, or compilation, that relates to the present or planned business

of the Company and which: (i) derives economic value, actual or potential, from not being generally known to, and not readily ascertainable

by proper means to, other persons who can obtain economic value from their disclosure or use; and (ii) is the subject of efforts

that are reasonable under the circumstances to maintain their secrecy. To the extent that the foregoing definition is inconsistent

with a definition of “trade secret” under applicable law, the latter definition shall control.

c) Restrictions

On Use and Disclosure of Confidential Information. The Executive agrees during his employment and after his employment

ends, the Executive will hold the Confidential Information in strict confidence and will neither use the information nor disclose

it to anyone, except to the extent necessary to carry out the Executive’s responsibilities as an employee of the Company

or as specifically authorized in writing by a duly authorized officer of the Company. Nothing in this Agreement shall be deemed

to prohibit the Executive from disclosing any concerns about suspected unlawful conduct to any proper government authority subject

to proper jurisdiction. This provision shall survive the termination of the Executive’s employment for so long as the Company

maintains the secrecy of the Confidential Information and the Confidential Information has competitive value; and to the extent

such information is otherwise protected by statute for a longer period, for example and not by way of limitation, the Defend Trade

Secrets Act of 2016 (“DTSA”), then until such information ceases to have statutory protection.

d) Defend Trade

Secrets Act. Misappropriation of a Trade Secret of the Company in breach of this Agreement may subject the Executive to

liability under the DTSA, entitle the Company to injunctive relief, and require the Executive to pay compensatory damages, double

damages, and attorneys’ fees to the Company. Notwithstanding any other provision of this Agreement, Executive hereby is notified

in accordance with the DTSA that Executive will not be held criminally or civilly liable under a federal or state law for the disclosure

of a trade secret that is made in confidence to a federal, state or local government official, either directly or indirectly, or

to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or is made in a complaint

or other document filed in a lawsuit or other proceeding, if such filing is made under seal. If the Executive files a lawsuit for

retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the trade secret to the Executive’s

attorney and use the trade secret information in the court proceeding, provided that the Executive must file any document containing

the trade secret under seal, and must not disclose the trade secret, except pursuant to court order.

7. Inventions and Proprietary Information.

a) Definitions.

i) Intellectual

Property Rights. “Intellectual Property Rights” means all rights in and to United States and

foreign (A) patents, patent disclosures, and inventions (whether patentable or not), (B) trademarks, service marks, trade dress,

trade names, logos, corporate names, and domain names, and other similar designations of source or origin, together with the goodwill

symbolized by any of the foregoing, (C) copyrights and works of authorship (whether copyrightable or not), including computer programs,

mask works, and rights in data and databases, (D) trade secrets, know-how, and other confidential information, (E) all other intellectual

property rights, in each case whether registered or unregistered, and including all rights of priority in and all rights to apply

to register for such rights, all registrations and applications for, and renewals or extensions of, such rights, and all similar

or equivalent rights or forms of protection in any part of the world, (F) any and all royalties, fees, income, payments, and other

proceeds with respect to any and all of the foregoing, and (G) any and all claims and causes of action with respect to any of the

foregoing, including all rights to recover for infringement, misappropriation, or dilution of the foregoing, and all rights corresponding

thereto throughout the world.

ii) Work

Product. “Work Product” means, without limitation, any and all ideas, concepts, information, materials,

processes, methods, data, programs, know-how, technology, improvements, discoveries, developments, works of authorship, designs,

artwork, formulae, other copyrightable works, and techniques and all Intellectual Property Rights that presently exist or may come

to exist in the future in any of the items listed above.

b) Work

Product.

i) All right,

title, and interest in and to all Work Product as well as any and all Intellectual Property Rights therein and all improvements

thereto shall be the sole and exclusive property of the Company.

ii) The

Company shall have the unrestricted right (but not any obligation), in its sole and absolute discretion, to (A) use, commercialize,

or otherwise exploit any Work Product or (B) file an application for patent, copyright registration, or registration of any other

Intellectual Property Rights, and prosecute or abandon such application prior to issuance or registration. No royalty or other

consideration shall be due or owing to the Executive now or in the future as a result of such activities.

iii) The

Work Product is and shall at all times remain the Confidential Information of the Company.

c) Work

Made for Hire; Assignment; Limitations.

i) The Executive

acknowledges that, by reason of being employed by the Company at the relevant times, to the extent permitted by law, all Work Product

consisting of copyrightable subject matter is “work made for hire” as defined in the Copyright Act of 1976 (17 U.S.C.

§ 101), and such copyrights are therefore owned by the Company. To the extent that the foregoing does not apply, the Executive

hereby irrevocably assigns to the Company, and its successors and assigns, for no additional consideration, the Executive’s

entire right, title, and interest, in and to all Work Product and Intellectual Property Rights therein, including without limitation

the right to sue, counterclaim, and recover for all past, present, and future infringement, misappropriation, or dilution thereof,

and all rights corresponding thereto throughout the world. Nothing contained in this Agreement shall be construed to reduce or

limit the Company’s right, title, or interest in any Work Product or Intellectual Property Rights so as to be less in any

respect than the Company would have had in the absence of this Agreement.

ii) To

the extent that the Executive has not separately assigned any Prior Inventions, the Executive hereby irrevocably assigns to the

Company, and its successors and assigns, for no additional consideration, the Executive’s entire right, title, and interest

in and to all Prior Inventions, including without limitation the right to sue, counterclaim, and recover for all past, present,

and future infringement, misappropriation, or dilution thereof, and all rights corresponding thereto throughout the world. Nothing

contained in this Agreement shall be construed to reduce or limit the Company’s right, title, or interest in any Prior Inventions

so as to be less in any respect than the Company would have had in the absence of this Agreement.

8. Return of Property/Post-Employment

Representations. On the date of the Executive’s termination of employment with the Company for any reason (or at

any time prior thereto at the Company’s request), the Executive shall return all property belonging to the Company and not

retain any copies, including, but not limited to, any keys, access cards, badges, laptops, computers, cell phones, wireless electronic

mail devices, USB drives, other equipment, documents, reports, files, and other property provided by or belonging to the Company.

Executive shall provide all usernames and passwords to all electronic devices, documents, and accounts, including any social media

accounts Executive used in connection with his duties. Upon request made within thirty days after the Executive’s employment

terminates, Executive shall make any cellular phone or personal computer he has used for business purposes available upon request

to allow for Company-related documents and data to be retrieved and saved at Company’s expense. The Company shall not be

responsible for any personal data, information or photographs that may be lost or rendered inaccessible by the Company or its vendors.

On and after the Termination Date, Executive shall no longer represent to anyone that he remains employed by the Company and shall

take affirmative action to amend any statements to the contrary on any social media sites, including but not limited to Linked-in

and Facebook.

9. Restrictive

Covenants.

a) Acknowledgement.

The Executive understands that the nature of the Executive’s position gives the Executive access to and knowledge of Confidential

Information and places the Executive in a position of trust and confidence with the Company. The Executive further understands

and acknowledges that the Company’s ability to reserve these for the exclusive knowledge and use of the Company is of great

competitive importance and commercial value to the Company.

b) Non-Competition.

Because of the Company’s legitimate business interest as described herein and the good and valuable consideration offered

to the Executive, during the Term and for six (6) months thereafter, to run consecutively, beginning on the last day of the Executive’s

employment with the Company, regardless of the reason for the termination and whether employment is terminated at the option of

the Executive or the Company, the Executive agrees and covenants not to engage in Prohibited Activity within the United States

of America.

c) Prohibited

Activity. “Prohibited Activity” is activity in which the Executive contributes the Executive’s

knowledge, directly or indirectly, in whole or in part, as an employee, employer, owner, operator, manager, advisor, consultant,

agent, employee, partner, director, stockholder, officer, volunteer, intern, or any other similar capacity to an entity engaged

in the same or similar business as the Company, including those engaged in the business of developing, manufacturing, marketing,

distributing, or selling, vaping products. Prohibited Activity also includes activity that may require or inevitably requires disclosure

of the Company’s trade secrets, proprietary information, or Confidential Information.

d) Ownership

of Competing Business. Nothing herein shall prohibit the Executive from purchasing or owning less than five percent (5%)

of the publicly traded securities of any corporation, provided that such ownership represents a passive investment, and that the

Executive is not a controlling person of, or a member of a group that controls, such corporation.

10. Non-Solicitation

of Employees. The Executive agrees and covenants not to directly or indirectly solicit, hire, recruit, attempt

to hire or recruit, or induce the termination of employment of any employee of the Company, or attempt to do so, during the Term

and for twelve (12) months thereafter, to run consecutively, beginning on the last day of the Executive’s employment with

the Company.

11. Non-Solicitation

of Customers. The Executive understands and acknowledges that because of the Executive’s experience

with, and relationship to, the Company the Executive will have access to and learn about the Company’s customer information.

“Customer Information” includes, but is not limited to, names, phone numbers, addresses, email addresses, order

history, order preferences, chain of command, decisionmakers, pricing information, and other information identifying facts and

circumstances specific to the customer and to the relevant services. The Executive understands and acknowledges that loss of this

customer relationship and/or goodwill will cause significant and irreparable harm. The Executive agrees and covenants, during the

Term and for (12) months thereafter, to run consecutively, beginning on the last day of the Executive’s employment with the

Company, not to directly or indirectly solicit, contact (including but not limited to email, regular mail, express mail, telephone,

fax, instant message, or social media), attempt to contact, or meet with the Company’s current, former. or prospective customers

for purposes of offering or accepting goods or services similar to or competitive with those offered by the Company.

12. Use of Name

and Likeness. Executive grants the Company permission to use his name, voice, image or likeness, for the purposes of advertising

and promoting the Company, or for other purposes deemed appropriate by the Company in its reasonable discretion, except to the

extent expressly prohibited by law for the duration of the Term and for a period of one year after the Term ends.

13. Survival of

Provisions. The respective rights and obligations of the parties hereunder shall survive any termination of this Agreement

hereunder for any reason to the extent necessary to the intended provision of such rights and the intended performance of such

obligations.

14. Notices.

For the purposes of this Agreement, notices, demands and all other communications provided for in the Agreement shall be in writing

and shall be deemed to have been given when delivered by email with return receipt requested, upon the obtaining of a valid return

receipt from the recipient, by hand, or mailed by nationally recognized overnight delivery service, addressed to the Parties’

addresses specified below or to such other address as any Party may have furnished to the other in writing in accordance herewith,

except that notices of change of address shall be effective only upon receipt:

| To the Company: |

To the Executive: |

| |

|

| Kaival Brands Innovations Group, Inc. |

Mr. Stephen Sheriff |

| Attn: Mr. Eric Mosser |

107 Lakeview Drive |

| Chief Executive Officer |

New Hope, PA 18938 |

| 4460 Old Dixie Highway |

Email: ssheriff89@gmail.com |

| Grant-Valkaria, Florida 32949 |

|

| Email: eric@kaivalbrands.com |

|

| |

|

| With a copy that will not constitute notice to: |

|

| |

|

| Lawrence A. Rosenbloom, Esq. |

|

| Ellenoff Grossman & Schole LLP |

|

| 1345 Avenue of the Americas, 11th Floor |

|

| New York, New York 10105 |

|

| Email: lrosenbloom@egsllp.com |

|

15. Tax Matters.

The Company may withhold from any and all amounts payable under this Agreement or otherwise such federal, state and local taxes

as may be required to be withheld pursuant to any applicable law or regulation.

16. Assignment.

The Executive may not assign any part of the Executive’s rights or obligations under this Agreement. The Executive agrees

and hereby consents that the Company may assign this Agreement to a third party that acquires or succeeds to the Company’s

business, that the provisions hereof are enforceable against the Executive by such assignee or successor in interest, and that

this Agreement shall become an obligation of, inure to the benefit of, and be assigned to, any legal successor or successors to

the Company.

17. Governing Law/Venue/Jury

Trial Waiver. This Agreement, the rights and obligations of the Parties hereto, and any claims or disputes relating thereto,

shall be governed by, and construed in accordance with the laws of the State of Florida (without regard to its conflicts of laws

provisions). The exclusive venue for any and all disputes arising from or concerning this Agreement, Executive’s employment

with the Company, or the termination thereof, shall be the courts of the State of Florida located in the County of Brevard and/or

the United States District Court for the Middle District of Florida. To ensure expeditious resolution of all such disputes the

parties hereby WAIVE TRIAL BY JURY in all such disputes.

18. Headings.

Titles or captions of sections or paragraphs contained in this Agreement are intended solely for the convenience of reference,

and shall not serve to define, limit, extend, modify, or describe the scope of this Agreement or the meaning of any provision hereof.

The language used in this Agreement is deemed to be the language chosen by the Parties to express their mutual intent, and no rule

of strict construction will be applied against any person.

19. Severability.

The provisions of this Agreement are severable. The unenforceability or invalidity of any provision or portion of this Agreement

in any jurisdiction shall not affect the validity, legality, or enforceability of the remainder of this Agreement, it being intended

that all rights and obligations of the Parties hereunder shall be enforceable to the full extent permitted by applicable law.

20. Waiver; Modification.

No provision of this Agreement may be modified, waived, or discharged unless such waiver, modification or discharge is agreed

to in writing and signed by the Executive and a duly authorized officer of the Company. No waiver by either Party hereto at any

time of any breach by the other Party hereto of, or compliance with, any condition or provision of this Agreement to be performed

by such other Party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent

time.

21. Recitals; Entire

Agreement. The Recitals are hereby incorporated into this Agreement. This Agreement sets forth the entire agreement of

the Parties with respect to the subject matter contained herein and supersedes any and all prior agreements or understandings between

the Executive and the Company with respect to the subject matter hereof. No agreements, inducements, or representations, oral or

otherwise, express, or implied, with respect to the subject matter hereof have been made by either Party which are not expressly

set forth in this Agreement.

22. Counterparts.

This Agreement may be executed in counterparts, and each executed counterpart shall have the efficacy

of a signed original and may be transmitted by facsimile or email. Each copy, facsimile copy, or emailed copy of any such signed

counterpart may be used in lieu of the original for any purpose.

IN WITNESS WHEREOF, the

Parties hereto have executed this Executive Employment Agreement effective as of the date first written above.

KAIVAL BRANDS INNOVATIONS GROUP, INC.

| By: |

/s/ Eric Mosser |

|

| |

Eric Mosser |

|

| |

Chief Executive Officer and President |

|

EXECUTIVE

| /s/ Stephen Sheriff |

|

| Mr. Stephen Sheriff |

|

13

Exhibit 99.1

Kaival Brands Promotes Stephen Sheriff to

Chief Operating Officer

Current Director

of Administration & Communications brings over a decade of operational and institutional communications & investor relations

experience

GRANT-VALKARIA, Fla., August 28, 2023 /PRNewswire/

-- Kaival Brands Innovations Group, Inc. (NASDAQ: KAVL) (“Kaival Brands,” the “Company,” or “we”),

the exclusive U.S. distributor of all vaping products manufactured by Bidi Vapor, LLC (“Bidi Vapor”), which are intended

for adults 21 and over, today announced the promotion of Stephen Sheriff to the role of Chief Operating Officer (COO), effective

as of August 22, 2023.

Mr. Sheriff succeeds Eric Mosser, who was recently

promoted to Chief Executive Officer of the Company and joins Mr. Mosser and recently appointed Chief Financial Officer Thomas Metzler

as a part of Kaival Brands’ expanded senior management team.

Eric Mosser, Chief Executive Officer and President

of Kaival Brands, stated, “Promoting Stephen to the role of Chief Operating Officer was a natural and logical next step given

his contributions to the success of Kaival Brands to date and his experience helping businesses navigate through rapid periods

of growth and change. He has a strong entrepreneurial spirit and will be instrumental in helping us take our business to the next

level. With a deep understanding of our operations, the capital markets and what it takes to develop and execute a strategy with

proven results, he is a great addition to our C-suite leadership team.”

Mr. Sheriff brings over a decade of finance

and entrepreneurial leadership to the role of Chief Operating Officer. Most recently, he served as the Director of Administration

& Communications at Kaival Brands. In this role, he managed the Company’s investor and public relations and human resource

programs in addition to overall responsibility for the development and implementation of key programs and initiatives, including

customer and vendor relations. Mr. Sheriff’s expanded mandate will be to design and implement corporate policies and procedures

that seek to optimize the day-to-day functioning of Kaival’s operational units as well as the Company’s compliance

with applicable laws, rules and regulations. He will continue to lead the Company’s investor relations and communications

efforts as part of his expanded role.

Prior to Kaival Brands, Mr. Sheriff co-founded

Riverhill Group, LLC, a capital markets advisory and consulting firm that leverages the power of relationships and collective thinking

to bring qualitative capital and operations solutions to founders and companies in the most effective and efficient manner. Riverhill

assists clients in developing key strategies, business development plans, branding strategies and operations management systems.

Prior to Riverhill Group, in 2012, Mr. Sheriff founded Riverhill Ventures, LLC,

where he developed a broad portfolio, including quick and full-service restaurants, natural foods and consumer brands, health and wellness,

and health tech investments. In addition to Riverhill Group and Riverhill Ventures, Mr. Sheriff previously an Associate at Solebury Trout

(now Solebury Strategic Communications) where he gained valuable experience in capital markets, investor relations and public company

finance and compliance matters.

He received his Bachelor of Arts in Counseling

Psychology from Delaware Valley University.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands

is a company focused on incubating innovative and profitable adult-focused products into mature and dominant brands, with a current

focus on the distribution of electronic nicotine delivery systems (ENDS) also known as “e-cigarettes”. Our business

plan is to seek to diversify into distributing other nicotine and non-nicotine delivery system products (including those related

to hemp-derived cannabidiol (known as CBD) products). Kaival Brands and Philip Morris Products S.A. (via sublicense from Kaival

Brands) are the exclusive global distributors of all products manufactured by Bidi Vapor.

Learn more about Kaival Brands at https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT KAIVAL LABS

Based in Grant-Valkaria, Florida, Kaival Labs

is a 100% wholly-owned subsidiary of Kaival Brands focused on developing new branded and white-label products and services in the

vaporizer and inhalation technology sectors. Kaival Labs’ current patent portfolio consists of 12 existing and 46 pending

with novel technologies across extrusion dose control, product preservation, tracking and tracing usage, multiple modalities and

child safety. The patents and patent applications cover territories including the United States, Australia, Canada, China, the

European Patent Organisation, Israel, Japan, Mexico, New Zealand and South Korea. The portfolio also includes a fully-functional

proprietary mobile device software application that is used in conjunction with certain patents in the portfolio.

Learn more about Kaival Labs at https://kaivallabs.com.

ABOUT BIDI VAPOR

Based in Melbourne, Florida, Bidi Vapor maintains

a commitment to responsible, adult-focused marketing, supporting age-verification standards and sustainability through its BIDI®

Cares recycling program. Bidi Vapor’s premier device, the BIDI® Stick, is a premium product made with high-quality

components, a UL-certified battery and technology designed to deliver a consistent vaping experience for adult smokers 21 and over.

Bidi Vapor is also adamant about strict compliance with all federal, state and local guidelines and regulations. At Bidi Vapor,

innovation is key to its mission, with the BIDI® Stick promoting environmental sustainability, while providing a

unique vaping experience to adult smokers.

Nirajkumar Patel, the Company’s Chief

Science and Regulatory Officer and director, owns and controls Bidi Vapor. As a result, Bidi Vapor is considered a related party

of the Company.

For more information, visit www.bidivapor.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release and the statements of the

Company’s management and partners included herein and related to the subject matter herein includes statements that constitute

“forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended), which are statements other than historical facts. You can identify forward-looking

statements by words such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “plan,” “position,”

“should,” “strategy,” “target,” “will,” and similar words. All forward-looking

statements speak only as of the date of this press release. Although we believe that the plans, intentions, and expectations reflected

in or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions, or expectations

will be achieved. Therefore, actual outcomes and results (including, without limitation, the anticipated benefits of the Company’s

new Chief Operating Officer as described herein) could materially and adversely differ from what is expressed, implied, or forecasted

in such statements. Our business (and our new Chief Operating Officer’s ability to achieve the Company’s goals) may

be influenced by many factors that are difficult to predict, involve uncertainties that may materially affect results, and are

often beyond our control. Factors that could cause or contribute to such differences include, but are not limited to: (i) future

actions by the FDA in response to the 11th Circuit Court’s August 2022 decision that could impact our business and prospects,

(ii) the outcome of FDA’s scientific review of Bidi Vapor’s pending FDA Premarket

Tobacco Product Applications, (iii) the results of international marketing and sales efforts by Philip Morris International,

the Company’s international distribution partner, (iv) how quickly domestic and international markets adopt our products,

(v) the scope of future FDA enforcement of regulations in the ENDS industry, (vi) the FDA’s approach to the regulation of

synthetic nicotine and its impact on our business, (vii) potential federal and state flavor bans and other restrictions on ENDS

products, (viii) the duration and scope of the COVID-19 pandemic and impact on the demand for the products we distribute, (ix)

general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth,

(x) the effects of steps that we may take to raise new capital and reduce operating costs, (xi) our inability to generate and sustain

profitable sales growth, including sales growth in U.S. and international markets, (xii) circumstances or developments that may

make us unable to implement or realize anticipated benefits, or that may increase the costs, of our current and planned business

initiatives (including, without limitation, the development of vaporization intellectual property we acquired in late April 2023),

(xiii) significant changes in our relationships with our distributors or sub-distributors and (xiv) other factors detailed by us

in our public filings with the Securities and Exchange Commission, including the disclosures under the heading “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended October 31, 2022, filed with the Securities and Exchange Commission

on January 27, 2023, as well as all of our subsequent SEC filings, all of which are accessible at www.sec.gov. All forward-looking

statements included in this press release are expressly qualified in their entirety by such cautionary statements. Except as required

under the federal securities laws and the Securities and Exchange Commission’s rules and regulations, we do not have any

intention or obligation to update any forward-looking statements publicly, whether as a result of new information, future events,

or otherwise.

Kaival Brands Investor Relations:

Brett Maas, Managing Partner

Hayden IR

(646) 536-7331

brett@haydenir.com

Kaival Brands Media & Press Relations:

Stephen Sheriff, COO and Investor Relations Officer

Kaival Brands

(646) 572-7086

investors@kaivalbrands.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

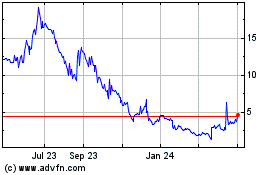

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

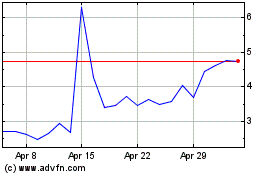

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024