0001711754

false

0001711754

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 14, 2023

| INMUNE BIO INC. |

| (Exact name of registrant as specified in charter) |

| Nevada |

|

001-38793 |

|

47-5205835 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

225 NE Mizner Boulevard, Suite 640, Boca Raton, FL 33432

(Address of Principal Executive Offices) (Zip Code)

(858) 964-3720

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

INMB |

|

The NASDAQ Stock Market LLC |

Item 1.01. Entry into a Material Definitive Agreement.

On December 30, 2020, the Board of Directors (the “Board”)

of INmune Bio Inc., a Nevada corporation (the “Company”), approved and adopted the Rights Agreement, dated as of December

30, 2020 (the “Rights Agreement”), by and between the Company and VStock Transfer, LLC, as rights agent. The Company entered

into Amendment No. 1 to the Rights Agreement (“Amendment No. 1”) on December 20, 2021 to extend the expiration of the

Rights Agreement to December 30, 2022 and entered into Amendment No. 2 (“Amendment No.2”) to the Rights Agreement on December

9, 2022 to extend the expiration of the Rights Agreement to December 30, 2023.

On December 14, 2023, the Company and VStock Transfer,

LLC entered into Amendment No. 3 to the Rights Agreement (“Amendment No. 3”). Pursuant to Amendment No. 3, the Rights Agreement

extended the expiration of the Rights Agreement to December 30, 2024 and updated the notices authorized by the Rights Agreement.

The Rights are in all

respects subject to and governed by the provisions of the Rights Agreement, as amended by Amendment No. 1, Amendment No. 2 and Amendment

No. 3.

The foregoing description

of the Amendment No. 3 does not purport to be complete and is qualified in its entirety by reference to the complete text of the Amendment

No. 3, a copy of which is attached as Exhibit 4.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 3.03 Material

Modification to Rights of Security Holders

The information set forth

under “Item 1.01 Entry into a Material Definitive Agreement” of this Current Report on Form 8-K is incorporated into this

Item 3.03 by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 18, 2023 |

INMUNE BIO INC. |

| |

|

| |

By: |

/s/ David Moss |

| |

|

David Moss |

| |

|

Chief Financial Officer |

2

Exhibit 4.1

INMUNE

BIO INC.

AMENDMENT NO. 3 TO RIGHTS AGREEMENT

This Amendment No. 3 (this

“Amendment”), dated as of December 13, 2023, to the Rights Agreement, dated December 30, 2020, as amended on December

20, 2021 and December 9, 2022 (the “Rights Agreement”), between INmune Bio Inc., a Nevada corporation (the “Company”),

and VStock Transfer LLC, as rights agent (the “Rights Agent”).

WHEREAS, the Company and the Rights Agent have

executed and entered into the Rights Agreement;

WHEREAS, Section 27

of the Rights Agreement provides, the Company, by action of the Board, may from time to time and in its sole and absolute discretion,

and the Rights Agent shall if the Company so directs, supplement or amend the Rights Agreement in any respect without the approval of

any holders of Rights, including, without limitation to shorten or lengthen any time period provided in the Rights Agreement;

WHEREAS, to the knowledge of the Company, no Person

has become an Acquiring Person;

WHEREAS, the Board of Directors

of the Company has deemed it advisable and in the best interests of the Company and its stockholders to amend certain provisions of the

Rights Agreement as set forth herein; and

WHEREAS, pursuant to and

in accordance with Section 27 of the Rights Agreement, the Company desires to amend the Rights Agreement as set forth below.

NOW THEREFORE, in consideration

of the foregoing and the mutual agreements set forth in the Rights Agreement and this Amendment, the parties hereto hereby agree as follows:

1.

Section 7(a) of the Rights Agreement is hereby amended and restated as follows:

“(a) Subject to Section 7(e) hereof or as

otherwise provided in this Agreement, at any time after the Distribution Date the registered holder of any Rights Certificate may exercise

the Rights evidenced thereby (except as otherwise provided herein including, without limitation, the restrictions on exercisability set

forth in Section 9(c), Section 11(a)(iii), and Section 23(a) hereof) in whole or in part upon surrender of the Rights Certificate, with

the form of election to purchase and the certificate contained therein properly completed and duly executed, to the Rights Agent at the

office or offices of the Rights Agent designated for such purpose, accompanied by a signature guarantee and such other documentation as

the Rights Agent may reasonably request, together with payment of the aggregate Purchase Price with respect to the total number of one

one-thousandths of a Preferred Share (or, following the occurrence of a Triggering Event, Common Shares, other securities, cash or other

assets, as the case may be) as to which such surrendered Rights are then exercisable, at or prior to the earliest of (i) the Close of

Business on December 30, 2024 (the “Final Expiration Date”), (ii) the time at which the Rights are redeemed as provided

in Section 23 hereof (the “Redemption Date”), and (iii) the time at which the Rights are exchanged in full as provided

in Section 24 hereof (the earliest of (i), (ii), and (iii) being herein referred to as the “Expiration Date”). Except

for those provisions herein that expressly survive the termination of this Agreement, this Agreement shall terminate at such time as the

Rights are no longer exercisable hereunder.”

2.

Section 26 of the Rights Agreement is hereby amended and restated as follows:

Section 26. Notices. Notices or demands authorized

by this Agreement to be given or made by the Rights Agent or by the holder of any Rights Certificate to or on the Company will be sufficiently

given or made if in writing and sent by a recognized national overnight delivery service, or first-class mail, postage prepaid, addressed

(until another address is filed in writing with the Rights Agent by the Company) as follows:

INmune Bio Inc.

225 NE Mizner Blvd., Suite 640

Boca Raton, Florida 33432

Attention: David Moss, Chief Financial Officer

with copies (which will not constitute notice)

to:

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st floor, New York

10036

trose@srfc.law

Attention: Thomas A. Rose, Esq.

Subject to the provisions of Section 21 hereof,

any notice or demand authorized by this Agreement to be given or made by the Company, or by the registered holder of any Rights Certificate

to or on the Rights Agent shall be sufficiently given or made if sent by (i) first-class mail, postage prepaid, (ii) a recognized national

overnight delivery service, prepaid, or (iii) courier or messenger service, in each case addressed (until another address is filed in

writing by the Rights Agent with the Company) as follows:

Vstock Transfer, LLC

18 Lafayette Place

Woodmere, NY 11598

Phone: (212) 828- 8436

Notices or demands authorized by this Agreement

to be given or made by the Company or the Rights Agent to the registered holder of any Rights Certificate or, if prior to the Distribution

Date, to the registered holder of the Common Shares shall be sufficiently given or made if sent by first-class mail, postage prepaid,

addressed to such holder at the address of such holder as shown on the registry books of the Rights Agent or, if prior to the Distribution

Date, as shown on the registry books of the transfer agent for the Common Shares.

3. Exhibit

B. Exhibit B to the Rights Agreement is hereby amended by deleting all references therein to “December 30, 2023” and inserting

“December 30, 2024” in place thereof.

4. Exhibit

C. Exhibit C to the Rights Agreement is hereby amended by deleting the reference therein to “December 30, 2023” in Section

4 and inserting “December 30, 2024” in place thereof.

5. Full

Force and Effect. Except as expressly amended hereby, the Rights Agreement shall continue in full force and effect in accordance with

the provisions thereof.

6. Governing

Law. This Amendment shall be deemed to be a contract made under

the laws of the State of Nevada and for all purposes shall be governed by and construed in accordance with the laws of such State applicable

to contracts to be made and performed entirely within such State; provided, that all provisions regarding the rights, duties, liabilities

and obligations of the Rights Agent shall be governed by and construed in accordance with the laws of the State of New York applicable

to contracts made and to be performed entirely within the State of New York.

7. Counterparts;

Facsimiles and PDFs; Effectiveness. This Amendment may be executed in any number of counterparts and each of such counterparts will

for all purposes be deemed to be an original, and all such counterparts will together constitute one and the same instrument, it being

understood that all parties need not sign the same counterpart. A signature to this Amendment executed or transmitted electronically

(including by facsimile and a portable document format signature) will have the same authority, effect and enforceability as

an original signature. No party hereto may raise the use of such electronic execution or transmission to deliver a signature, or the fact

that any signature or agreement or instrument was transmitted or communicated through such electronic transmission, as a defense to the

formation of a contract, and each party forever waives any such defense, except to the extent such defense relates to lack of authenticity. This

Amendment shall be effective as of the date hereof.

8. Descriptive

Headings. Descriptive headings of the several sections of this Amendment are inserted for convenience only and shall not control or

affect the meaning or construction of any of the provisions of this Amendment.

9. Rights

Agreement as Amended. From and after the date hereof, any reference to the Rights Agreement shall mean the Rights Agreement as amended

hereby.

10. Severability.

If any term, provision, covenant or restriction of this Amendment is held by a court of competent jurisdiction or other authority to

be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Amendment shall remain

in full force and effect and shall in no way be affected, impaired or invalidated.

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed as of the day and year first above written.

| |

INMUNE BIO INC. |

| |

|

|

| |

By: |

/s/ David Moss |

| |

Name: |

David Moss |

| |

Title: |

Chief Financial Officer |

| |

VSTOCK TRANSFER, LLC, AS RIGHTS AGENT |

| |

|

|

| |

By: |

/s/ Young D. Kim |

| |

Name: |

Young D. Kim |

| |

Title: |

Compliance Officer |

4

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

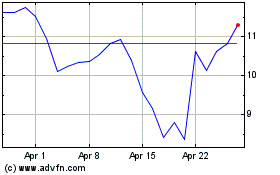

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

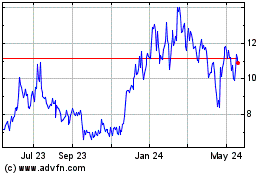

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Apr 2023 to Apr 2024