Affymetrix Scoops up eBioscience - Analyst Blog

December 06 2011 - 8:00AM

Zacks

Genetic products maker

Affymetrix (AFFX) recently announced that it has

agreed to acquire privately-held eBioscience, a global leader in

immunology and oncology flow cytometry reagents, in a deal

worth $330 million.

San Diego, California-based

eBioscience offers a vast selection of antibodies, enzyme-linked

immunosorbent assays (ELISAs) and proteins for life science

research and diagnostics. It is an industry leader in flow

cytometry (a technique for analysing microscopic particles) and

immunoassay reagents for immunology and oncology research and

diagnostics.

The transaction, which is subject

to customary closing conditions, is expected to consummate in late

fourth-quarter 2011. Affymetrix will fund the acquisition using a

combination of roughly 50% in cash and balance in committed debt.

The purchase price represents roughly 4.5 times of eBioscience’s

revenues for 2011, which is forecast to exceed $70 million.

The acquisition will significantly

boost Affymetrix’s foothold in the fast-growing immunology,

oncology and translational medicine markets, representing nearly $3

billion annual opportunity. It will diversify the company’s revenue

base, expand its product range (to include a vast array of

reagents) and reinforce its growing molecular diagnostics

business.

Affymetrix is a leading provider of

microarray-based products and services to the global research

community. Along with Illumina Inc. (ILMN), it is

one of the two major providers of microarray technologies,

primarily used in the field of genetic research. Affymetrix holds a

leading position in the gene expression products and services

market.

Affymetrix is pursuing a number of

strategies (including expansion into new markets such as

cytogenetics and cancer research) aimed at expanding its top line.

The company is shifting its R&D focus from discovery and

exploration markets to the faster-growing validation and routine

testing markets.

However, Affymetrix is operating in

an intensely competitive industry and faces risks associated with

lower R&D spending by its customers due to a soft economy and

government actions including budget cuts.

Affymetrix is exposed to a volatile

funding environment. Decline in government research grants may

substantially affect the company’s revenues. We are currently

Neutral on Affymetrix, which is in tandem with a short-term Zacks

#3 Rank (Hold).

AFFYMETRIX INC (AFFX): Free Stock Analysis Report

ILLUMINA INC (ILMN): Free Stock Analysis Report

Zacks Investment Research

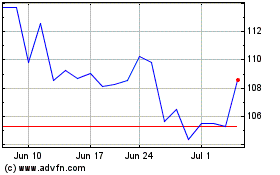

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024