Life Technologies Remains Neutral - Analyst Blog

August 18 2011 - 12:21PM

Zacks

Recently, we reaffirmed our Neutral recommendation on

Life Technologies (LIFE) with a target price of

$41.00.

Life Technologies reported an EPS of 89 cents in the second

quarter of fiscal 2011, missing the Zacks Consensus Estimate by 5

cents and 2 cents lower than the year-ago quarter.

Revenues increased 4% year over year to $945 million, missing

the Zacks Consensus Estimate of $961 million. Excluding the impact

of foreign exchange movement, revenue growth for the quarter was

3%. On a geographical basis, revenue growth was witnessed across

all regions: Europe 2%, Asia-Pacific 3%, the Americas 3% and Japan

8%.

However, the reported quarter was disappointing due to tighter

budgets for academic and government-funded research in both the US

and Europe, delays in the launch of the 5500 Genetic Analyzer in

Japan due to the earthquake and temporary slack in business in

China.

In order to drive growth in emerging markets, the company adopts

strategies such as investment in infrastructure, increasing sales

force and maximizing eCommerce capability. The company has opened

the India Distribution Center (IDC) in Bangalore to cater to

customer demand in the South Asian Region.

These strategies coupled with continuous investments in

AsiaPacific and Latin America should enable the company to capture

the immense potential of these fast-growing regions. Although

business in China witnessed some slackness during the reported

quarter, the company is confident of higher growth over the next

few quarters.

Life Technologies continues to experience lower demand from

academic and government-funded researchers in the US and Europe.

Although the company does not expect the funding situation to

worsen, it has adopted a cautious stand and expects soft demand in

both the US and Europe government-funded research for the rest of

2011. To ease the impact of this scenario on the bottom lime, Life

Technologies has taken the cost structure optimization route to

boost efficiency.

The company is stepping up a number of cost savings initiatives

that were originally planned to begin later in 2011, so that it

emerges stronger in 2012. These initiatives are expected to result

in margin expansion gradually based on which Life Technologies

expects to record mid-single- digit revenue growth and double-digit

earnings growth in 2012.

Although the global economic condition is improving gradually,

any hiccup in the recovery process could act as a deterrent.

Moreover, Life Technologies faces tough competition from players

such as Thermo Fisher Scientific (TMO) and

Illumina (ILMN) among others.

ILLUMINA INC (ILMN): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

Zacks Investment Research

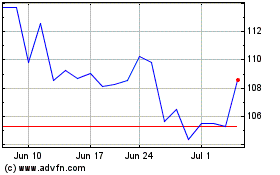

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024