Life Disappoints on All Fronts - Analyst Blog

July 28 2011 - 11:51AM

Zacks

Life Technologies Corporation (LIFE) reported

an EPS of 89 cents in the second quarter of fiscal 2011, missing

the Zacks Consensus Estimate by 5 cents and reporting 2 cents lower

than the year-ago quarter. Shares of the company were down by 9.11%

in pre-market trading.

Revenues increased 4% year over year to $945 million, missing

the Zacks Consensus Estimate of $961 million. Excluding the impact

of foreign exchange movement, revenue growth for the quarter was

3%. On a geographical basis, revenue growth was witnessed across

all regions: Europe – 2%, Asia-Pacific – 3% and the Americas – 3%

and Japan 8%.

According to the company, second quarter results were lower than

expectation on the back of tighter budget for academic and

government funded research in both the US and Europe, delays in the

launch of the 5500 Genetic Analyzer in Japan due to earthquake and

temporary slack in business in China.

However, the company is addressing these challenges and expects

to recover in the second half of 2011. Life Technologies is also

adopting a number of cost saving initiatives.

Adjusted gross margin during the quarter was 64.2%, down

350 basis points (bps) from the year-ago quarter due to the

negative impact from currency and mix that got partially offset by

the positive impact of price. Moreover, adjusted operating margin

was 27.8% in the reported quarter, 230 bps lower than the prior

year quarter due to lower sales and gross margin.

Operating expenses (adjusted basis) were $343.9 million compared

to $340.6 million in the year-ago quarter, owing to a 1% rise in

selling, general and administrative expenses to $253.3 million

though research and development expenses declined by the same

magnitude to $90.6 million.

Although revenues increased 4% during the quarter, EPS dropped

by 2% due to lower margins, higher interest expense (up 21.3% to

$33.9 million), a 34% fall in interest income, partially offset by

lower effective tax rate (27.9% versus 29.5%) and a 6.3% decline in

share count.

Earnings of Life Technologies were also affected by other

expense of $3.6 million during the quarter compared to other income

of $2 million in the corresponding period of last year.

Life Technologies exited the quarter with $565.1 million in the

form of cash and short-term investments, lower than $854.8 million

at the end of December 2010. Free cash flow during the reported

quarter was $187 million with $204 million of cash flow from

operating activities and $17 million of capital expenditure.

Segments

Life Technologies earns revenues primarily from three divisions

– Molecular Biology Systems, Genetic Systems and Cell Systems,

which recorded adjusted revenues of $432 million (less than 1%

decline compared to the year-ago quarter), $265 million (up 12%)

and $243 million (up 5%), respectively.

In the Cell Systems division, while BioProduction business saw

mid-teens growth, the other areas were affected by slower growth

due to funding pressure in the US and Europe and temporary slowdown

in China. The same scenario prevailed in the other divisions as

well.

In case of Molecular Biology systems, strong sales of qPCR

consumables and molecular testing kits sold in applied markets were

offset by sluggish growth in government funded accounts in US and

Europe. Similarly, in Genetic Systems, strong sales of Ion Torrent

PGM and 5500 series Genetic Sequencer were partially offset by

lower demand for CE instruments.

Revises Guidance

Life Technologies revised its outlook for 2011. The company

expects its revenues to increase by 3-5% (previous guidance of

mid-single digit growth) at constant exchange rates resulting in

adjusted EPS of $3.70-$3.80 (previous guidance of $3.80–$3.95).

Revenues in the second half of 2011 is expected to improve based on

higher growth in China, and continued high sales of the Ion Torrent

PGM. For fiscal 2012, Life Technologies expects mid-single digit

growth of revenues (at CER) resulting in double- digit rise in its

earnings.

Recommendation

Life Technologies enjoys a strong position in the life sciences

market. The company was impacted by funding pressures in US and

Europe. Moreover, lower margins over the recent past leaves us

further perturbed. However, the company is undertaking several

strategies to address these challenges. The company also faces

increased competition from players like, Thermo Fisher

Scientific (TMO), Illumina (ILMN) among

others.

We are currently Neutral on the stock, which also corresponds to

the Zacks #3 Rank (Hold) in the short term.

ILLUMINA INC (ILMN): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

Zacks Investment Research

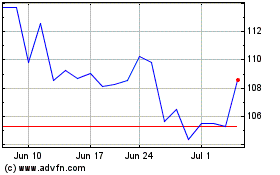

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024