- 2007 diluted EPS of $1.04 versus $0.72 in the prior year NEW

YORK, Feb. 20 /PRNewswire-FirstCall/ -- Iconix Brand Group, Inc.

(NASDAQ:ICON) ("Iconix" or the "Company"), today announced

financial results for the fourth quarter and full year ended

December 31, 2007. Full Year 2007 results: Revenue for the full

year 2007 increased 98% to approximately $160.0 million, as

compared to approximately $80.7 million in 2006. EBITDA for 2007

increased 128% to approximately $127.6 million, as compared to

approximately $56.1 million and free cash flow increased 123% to

approximately $99.2 million, as compared to approximately $44.5

million in the prior year. Net income as reported on the Company's

income statement for 2007 increased 96% to approximately $63.8

million, as compared to $32.5 million the prior year and diluted

earnings per share as reported on the Company's income statement

was $1.04 versus $0.72 in the prior year. The Company recognized

non-cash tax benefits in the prior year compared to being fully

taxed for 2007 and therefore comparing net income on a tax-effected

basis, the Company reported net income of approximately $63.8

million for 2007, as compared to approximately $26.3 million

(tax-effected) in the prior year. In comparing diluted earnings per

share on a tax-effected basis, the Company reported diluted

earnings per share of $1.04 in 2007, as compared to $0.58

(tax-effected) in 2006. Full year 2007 results include a one-time

pre-tax gain equal to approximately $3.2 million or $0.03 diluted

earnings per share associated with the Company's Unzipped

litigation. The gain is reflected on the Company's income statement

as a benefit of approximately $6.0 million (net of related legal

expenses incurred in the year) and is offset by an increase of

approximately $2.8 million in additional interest expense recorded

in connection with the litigation. EBITDA, free cash flow, and tax

effected earnings per share are non-GAAP metrics and reconciliation

tables for all three are attached to this press release. 4Q 2007

results: Revenue for the fourth quarter of 2007 increased 76% to

approximately $47.4 million, as compared to approximately $26.9

million in the fourth quarter of 2007. EBITDA for the fourth

quarter increased 109% to approximately $42.2 million, as compared

to approximately $20.2 million in the prior year quarter, and free

cash flow for the quarter increased 72% to approximately $26.2

million, as compared to approximately $15.2 million in the prior

year quarter. Net income for the fourth quarter increased 117% to

approximately $19.2 million versus approximately $8.9 million in

the prior year quarter and diluted EPS increased to approximately

$0.31 versus $0.18 in the prior year quarter. For the fourth

quarter, the pre-tax gain related to the Unzipped litigation

amounted to approximately $4.3 million (net of related legal

expenses incurred in the quarter). Neil Cole, Chairman and CEO of

Iconix Brand Group commented, "2007 was our third year solely as a

brand management business and the third consecutive year in which

we doubled licensing revenue and earnings. The fact that we were

able to achieve this in what has become a very challenging retail

environment demonstrates the resilience of our business model,

which has no inventory exposure and is supported by contractually

guaranteed revenue and a diverse portfolio of 16 brands. We are

currently working on many exciting organic growth initiatives both

in the U.S. and increasingly around the world and we will continue

to execute our acquisition strategy. We are cognizant of the

challenges that exist in the market, but are confident that the

Iconix business model is positioned to permit us to capitalize on

market opportunities and continue to achieve revenue and earnings

growth." 2008 Guidance: The Company is re-affirming its previously

issued 2008 guidance of diluted earnings per share of between $1.35

and $1.40 while raising its revenue guidance to a range of

$250-$260 million. The new guidance reflects new revenue

opportunities the Company is forecasting for based on its core

business and acquisition strategy coupled with increased

investments in infrastructure and compensation. Iconix Brand Group

Inc. (NASDAQ:ICON) owns, licenses and markets a growing portfolio

of consumer brands including CANDIE'S (R), BONGO (R), BADGLEY

MISCHKA (R), JOE BOXER (R) RAMPAGE (R) MUDD (R), LONDON FOG (R),

MOSSIMO (R) OCEAN PACIFIC(R), DANSKIN (R) ROCA WEAR(R), CANNON (R),

ROYAL VELVET (R), FIELDCREST (R), CHARISMA (R) and STARTER (R). The

Company licenses it brands to a network of leading retailers and

manufacturers that touch every major segment of retail distribution

from the luxury market to the mass market in both the U.S. and

around the world. Iconix, through its in-house advertising,

promotion and public relations agency, markets its brands to

continually drive greater consumer awareness and equity. Safe

Harbor Statement under the Private Securities Litigation Reform Act

of 1995. The statements that are not historical facts contained in

this press release are forward looking statements that involve a

number of known and unknown risks, uncertainties and other factors,

all of which are difficult or impossible to predict and many of

which are beyond the control of the Company, which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward looking

statements. Such factors include, but are not limited to,

uncertainty regarding the results of the Company's acquisition of

additional licenses, continued market acceptance of current

products and the ability to successfully develop and market new

products particularly in light of rapidly changing fashion trends,

the impact of supply and manufacturing constraints or difficulties

relating to the Company's licensees' dependence on foreign

manufacturers and suppliers, uncertainties relating to customer

plans and commitments, the ability of licensees to successfully

market and sell branded products, competition, uncertainties

relating to economic conditions in the markets in which the Company

operates, the ability to hire and retain key personnel, the ability

to obtain capital if required, the risks of litigation and

regulatory proceedings, the risks of uncertainty of trademark

protection, the uncertainty of marketing and licensing acquired

trademarks and other risks detailed in the Company's SEC filings.

The words "believe", "anticipate," "expect", "confident",

"project", provide "guidance" and similar expressions identify

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward looking statements, which speak

only as of the date the statement was made. Contact Information:

David Conn Executive Vice President Iconix Brand Group 212.730.0030

Joseph Teklits Integrated Corporate Relations 203.682.8200 Iconix

Brand Group, Inc. and Subsidiaries Condensed Consolidated Income

Statements (in thousands, except earnings per share data) Three

Months Ended Dec 31, Year Ended Dec 31, _________________________

_________________________ 2007 2006 2007 2006

_________________________ _________________________ (Unaudited)

(Unaudited) Licensing revenue $47,411 $26,903 $160,004 $80,694

Selling, general and administrative expenses 14,122 6,955 44,254

24,527 Special charges - net (7,094) 594 (6,039) 2,494

_________________________ _________________________ Operating

income 40,383 19,354 121,789 53,673 Other expenses: Interest

expense - net 11,258 5,846 25,512 13,837 _________________________

_________________________ Income before income taxes 29,125 13,508

96,277 39,836 _________________________ _________________________

Income taxes 9,898 4,655 32,522 7,335 _________________________

_________________________ Net income $19,227 $8,853 $63,755 $32,501

========================= ========================= Earnings per

share: Basic $0.34 $0.19 $1.12 $0.81 =========================

========================= Diluted $0.31 $0.18 $1.04 $0.72

========================= ========================= Weighted

average number of common shares outstanding: Basic 57,067 45,464

56,694 39,937 ========================= =========================

Diluted 61,860 50,292 61,426 45,274 =========================

========================= Selected Balance Sheet Items: 12/31/2007

12/31/2006 Total Assets $1,327,300 $701,052 Total Liabilities

$799,380 $235,595 Stockholders' Equity $527,920 $465,457 The

following table details unaudited reconciliations from non-GAAP

amounts to U.S. GAAP and effects of these items: (in thousands)

Three Months Ended Year Ended ___________________

___________________ Dec 31, Dec 31, Dec 31, Dec 31, 2007 2006 2007

2006 ________ ________ ________ ________ EBITDA (1) $42,193 $20,195

$127,585 $56,075 ======== ======== ======== ======== Reconciliation

of EBITDA: Operating income 40,383 19,354 121,789 53,673 Add:

Depreciation and amortization of certain intangibles 1,810 841

5,796 2,402 ________ ________ ________ ________ EBITDA $42,193

$20,195 $127,585 $56,075 ======== ======== ======== ======== (1)

EBITDA, a non-GAAP financial measure, represents income from

operations before interest, other income, income taxes,

depreciation and amortization expenses. The Company believes EBITDA

provides additional information for determining its ability to meet

future debt service requirements, investing and capital

expenditures. Free Cash Flow (2) $29,240 $15,220 $102,292 $44,451

======== ======== ======== ======== Reconciliation of Free Cash

Flow: Net income $19,227 $8,853 $63,755 $32,501 Add: Depreciation,

amortization of intangibles and deferred financing costs, the

change in the reserve for accounts receivable, and non-cash

compensation expense 3,593 1,794 11,190 4,865 Add: Estimated

Non-cash income taxes 9,713 4,655 30,708 7,335 Less: Non-cash

portion Unzipped litigation 6,330 - 6,330 - Less: Capital

expenditures 66 82 134 250 ________ ________ ________ ________ Free

Cash Flow $26,137 $15,220 $99,189 $44,451 ======== ========

======== ======== (2) Free Cash Flow, a non-GAAP financial measure,

represents net income before depreciation, amortization, the change

in the reserve for accounts receivable and excluding estimated

non-cash income taxes and capital expenditures. The Company

believes Free Cash Flow is useful for evaluating our financial

condition because it represents the amount of cash generated from

the operations that is available for repaying debt and investing.

Reconciliation of effective tax rate Year Ended Reconciliation to

GAAP: Dec 31, 2006 Net income, GAAP, as reported $ 32,501 Add: GAAP

income taxes, as reported 7,335 ________ Income before income

taxes, as reported 39,836 Less: 34% effective tax provision

(13,544) ________ Net income, as adjusted with 34% tax rate $

26,292 Number of dilutive shares 45,274 Dilutive EPS, as adjusted

with 34% Effective tax rate $ 0.58 DATASOURCE: Iconix Brand Group,

Inc. CONTACT: David Conn, Executive Vice President, Iconix Brand

Group, +1-212-730-0030; Joseph Teklits, Integrated Corporate

Relations, +1-203-682-8200 Web site: http://iconixbrand.com/

Copyright

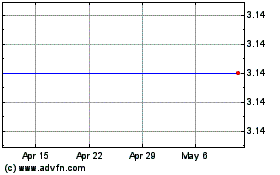

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jun 2024 to Jul 2024

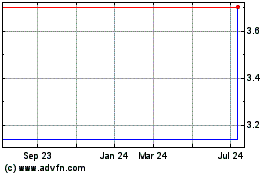

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jul 2023 to Jul 2024