Hope Bancorp Announces New $50 Million Stock Repurchase Program

July 26 2021 - 4:15PM

Business Wire

Hope Bancorp, Inc. (the “Company”) (NASDAQ: HOPE), the holding

company of Bank of Hope (the “Bank”), today announced that its

board of directors has approved a new stock repurchase program

authorizing the Company to repurchase up to $50 million of its

common stock.

“This stock repurchase program underscores our board and

management’s growing confidence in the sustainability of our

improved operational performance following the COVID-19 pandemic

and commitment to returning capital to our shareholders,” said

Kevin S. Kim, Chairman, President and Chief Executive Officer of

Hope Bancorp, Inc. “At current valuations, we believe the

repurchase of our shares represents an attractive investment

opportunity to redeploy excess capital and liquidity and enhances

long-term shareholder value.”

The stock repurchase authorization does not have any expiration

date and may be modified, amended, suspended or discontinued at the

Company’s discretion at any time without notice. Stock repurchases

may be made in open-market transactions, in block transactions on

or off an exchange, in privately negotiated transactions or by

other means as determined by the Company’s management and in

accordance with the regulations of the Securities and Exchange

Commission. The timing of repurchases and the number of shares

repurchased under the program will depend on a variety of factors

including price, trading volume, corporate and regulatory

requirements and market conditions. Repurchases may also be made

under a trading plan under Rule 10b5-1, which would permit shares

to be repurchased when the Company might otherwise be precluded

from doing so because of self-imposed trading blackout periods or

other regulatory restrictions.

About Hope Bancorp, Inc.

Hope Bancorp, Inc. is the holding company of Bank of Hope, the

first and only super regional Korean-American bank in the United

States with $17.47 billion in total assets as of June 30, 2021.

Headquartered in Los Angeles and serving a multi-ethnic population

of customers across the nation, Bank of Hope operates 53

full-service branches in California, Washington, Texas, Illinois,

New York, New Jersey, Virginia and Alabama. The Bank also operates

SBA loan production offices in Seattle, Denver, Dallas, Atlanta,

Portland, Oregon, New York City, Northern California and Houston;

commercial loan production offices in Northern California and

Seattle; residential mortgage loan production offices in Southern

California; and a representative office in Seoul, Korea. Bank of

Hope specializes in core business banking products for small and

medium-sized businesses, with an emphasis in commercial real estate

and commercial lending, SBA lending and international trade

financing. Bank of Hope is a California-chartered bank, and its

deposits are insured by the FDIC to the extent provided by law.

Bank of Hope is an Equal Opportunity Lender. For additional

information, please go to bankofhope.com. By including the

foregoing website address link, the Company does not intend to and

shall not be deemed to incorporate by reference any material

contained or accessible therein.

Forward-Looking Statements

Some statements in this press release may constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to, among other things, expectations regarding

the business environment in which we operate, projections of future

performance, perceived opportunities in the market and statements

regarding our business strategies, objectives and vision.

Forward-looking statements include, but are not limited to,

statements preceded by, followed by or that include the words

“will,” “believes,” “expects,” “anticipates,” “intends,” “plans,”

“estimates” or similar expressions. With respect to any such

forward-looking statements, the Company claims the protection

provided for in the Private Securities Litigation Reform Act of

1995. These statements involve risks and uncertainties. The

Company’s actual results, performance or achievements may differ

significantly from the results, performance or achievements

expressed or implied in any forward-looking statements. The risks

and uncertainties include, but are not limited to: the timing of

repurchases and the number of shares repurchased under the stock

repurchase program; possible deterioration in economic conditions

in our areas of operation; interest rate risk associated with

volatile interest rates and related asset-liability matching risk;

liquidity risks; risk of significant non-earning assets, and net

credit losses that could occur, particularly in times of weak

economic conditions or times of rising interest rates; the failure

of or changes to assumptions and estimates underlying the Company’s

allowances for credit losses, regulatory risks associated with

current and future regulations; and the COVID-19 pandemic and its

impact on our financial position, results of operations, liquidity,

and capitalization. For additional information concerning these and

other risk factors, see the Company’s most recent Annual Report on

Form 10-K. The Company does not undertake, and specifically

disclaims any obligation, to update any forward-looking statements

to reflect the occurrence of events or circumstances after the date

of such statements except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210726005705/en/

Alex Ko Senior EVP & Chief Financial Officer 213-427-6560

alex.ko@bankofhope.com Angie Yang SVP, Director of Investor

Relations & Corporate Communications 213-251-2219

angie.yang@bankofhope.com

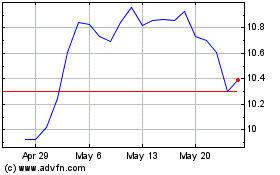

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Oct 2024 to Nov 2024

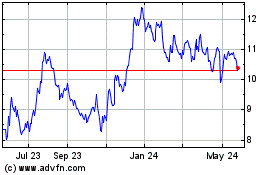

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Nov 2023 to Nov 2024