The Honest Company (NASDAQ: HNST), a personal care company

dedicated to creating clean- and sustainably-designed products,

today reported financial results for the three and six months ended

June 30, 2024 compared to the three and six months ended

June 30, 2023.

“This quarter, it is evident that our team’s commitment to our

three Transformation Pillars of Brand Maximization, Margin

Enhancement, and Operating Discipline is working, resulting in

outstanding performance that has exceeded our expectations. In

addition to delivering our highest quarterly revenue of $93 million

in the second quarter, we continued to increase profitability and

achieved gross margin of 38%. This strong performance and momentum

give us confidence to raise our financial outlook for the full

year,” said Chief Executive Officer, Carla Vernón. “At Honest, we

are a company of builders. And, with a stronger financial

foundation in place, this team is fully enrolled in helping to

expand and strengthen the Honest brand and the portfolio of

products that our community loves and trusts.”

Second Quarter

Results(All comparisons are versus the

second quarter of

2023)

| |

For the three months endedJune

30, |

| |

2024 |

|

2023 |

|

Change |

|

| (In thousands,

except percentages) |

|

|

|

|

|

|

Revenue |

$ |

93,049 |

|

|

$ |

84,544 |

|

|

$ |

8,505 |

|

|

|

Gross margin |

|

38.3 |

|

% |

|

27.1 |

|

% |

|

11.2 |

|

% |

|

Operating expenses |

$ |

39,657 |

|

|

$ |

36,285 |

|

|

$ |

3,372 |

|

|

|

Net loss |

$ |

(4,077 |

) |

|

$ |

(13,416 |

) |

|

$ |

9,339 |

|

|

|

Adjusted EBITDA(1) |

$ |

7,595 |

|

|

$ |

(4,099 |

) |

|

$ |

11,694 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue was $93 million, an increase of 10%,

compared to the second quarter of 2023 driven by strong performance

across our baby products and wipes portfolios. Tracked channel

consumption(2) for the Company grew 7% compared to the comparative

categories which were down 0.3% in the same period.

______________(1) See the reconciliation of adjusted EBITDA, a

non-GAAP financial measure, to net loss in the table under “Use of

Non-GAAP Financial Measures” below in this press release.(2)

According to independent third-party tracked channel consumption

data. Reflects consumption for diapers, wipes, baby personal care,

skin care and cosmetics items for the latest 12 weeks ended June

16, 2024.

Gross margin was 38.3% compared to 27.1% in the

second quarter of 2023. Gross margin increased by 1,120 basis

points compared to the second quarter of 2023 driven by

improvements across the entire cost structure, including supply

chain and product costs, as well as price increases and efficient

trade spend.

Operating expenses increased $3 million, driven

by deeper investments in marketing, reflecting a decrease of 30

basis points as a percentage of revenue compared to the second

quarter of 2023. Selling, general & administrative expenses as

a percentage of revenue decreased 120 basis points compared to the

second quarter of 2023.

Net loss was $4 million compared to a net loss

of $13 million in the second quarter of 2023.

Adjusted EBITDA(1) was positive $8 million

compared to negative $4 million in the second quarter of 2023. This

represents the Company’s third consecutive quarter of positive

adjusted EBITDA.________________(1) See the reconciliation of

adjusted EBITDA, a non-GAAP financial measure, to net loss in the

table under “Use of Non-GAAP Financial Measures” below in this

press release.

Balance Sheet and Cash Flow

The Company ended the second quarter of 2024 with $37 million in

cash and cash equivalents, an increase of $19 million as compared

to the second quarter of 2023. The Company had no debt on our

balance sheet as of June 30, 2024.

Net cash provided by operating activities was $3 million,

compared to net cash provided by operating activities of $4 million

for the second quarter of 2023.

Updated Full Year 2024

Outlook

Based on better than expected performance in the first half of

the year, we are increasing our full year 2024 outlook for both

revenue and Adjusted EBITDA.

|

|

|

Current Outlook |

|

Prior Outlook |

|

Revenue |

|

Mid-to-High Single Digit percentage growth(versus Full Year

2023) |

|

Low-to-Mid Single Digit percentage growth(versus Full Year

2023) |

|

Adjusted EBITDA(1) |

|

$15 million to $18 million range |

|

Positive Low-Single Digit to Mid-Single Digit millions range |

____________

(1) We do not provide guidance for the most directly comparable

GAAP measure, net loss, and similarly cannot provide a

reconciliation between our adjusted EBITDA outlook and net loss

without unreasonable effort due to the unavailability of reliable

estimates for certain components of net loss, including interest

and other (income) expense, net, and the respective

reconciliations. These items are not within our control and may

vary greatly between periods and could significantly impact our

financial results calculated in accordance with GAAP.

Webcast and Conference Call Information

A webcast and conference call to discuss second quarter 2024

results is scheduled for today, August 8, 2024, at 1:30 p.m.

Pacific time/4:30 p.m. Eastern time. Those interested in

participating in the conference call by phone, please go to this

link

https://register.vevent.com/register/BIc70caf9a8613457c891252c4e4a84653 and

you will be provided with dial in details. A live webcast of the

conference call will be available online at:

https://investors.honest.com or

https://edge.media-server.com/mmc/p/z8bqvihd. A replay of the

webcast will be available on the Company’s website for one

year.

Forward-Looking Statements

This press release and earnings call referencing this press

release contain forward-looking statements about us and our

industry that involve substantial risks and uncertainties. All

statements other than statements of historical facts contained in

this press release are forward-looking statements. Such statements

may address the Company’s expectations regarding revenue, profit

margin or other future financial performance and liquidity, other

performance measures and cost savings, strategic initiatives and

future operations or operating results. In some cases, you can

identify forward-looking statements because they contain words such

as “anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “will” or “would” or the

negative of these words or other similar terms or expressions.

These forward-looking statements include, but are not limited to,

statements concerning our expectations regarding future results of

operations and financial condition, including our revenue and

adjusted EBITDA outlook for 2024; our ability to achieve or sustain

profitability; momentum in our business; our ability to execute on,

and the continued benefits of, our Transformation Pillars of Brand

Maximization, Margin Enhancement, and Operating Discipline; and

other business strategies, plans and objectives of management for

future operations.

You should not rely on forward-looking statements as predictions

of future events. We have based the forward-looking statements

contained in this press release and the earnings call referencing

this press release primarily on our current expectations and

projections about future events and trends that we believe may

affect our business, financial condition and operating results.

The outcome of the events described in these forward-looking

statements is subject to risks, uncertainties and other factors

described in the section titled “Risk Factors” in the Annual

Report, on Form 10-K for the year ended December 31, 2023, filed

with the Securities and Exchange Commission on March 8, 2024, and

subsequent filings with the Securities and Exchange Commission. New

risks and uncertainties emerge from time to time, and it is not

possible for us to predict all risks and uncertainties that could

have an impact on the forward-looking statements contained in this

press release or the earnings call referencing this press release.

The results, events and circumstances reflected in the

forward-looking statements may not be achieved or occur, and actual

results, events or circumstances could differ materially from those

described in the forward-looking statements.

In addition, statements that contain “we believe” and similar

statements reflect our beliefs and opinions on the relevant

subject. These statements are based on information available to us

as of the date of this press release. While we believe that

information provides a reasonable basis for these statements, that

information may be limited or incomplete. Our statements should not

be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all relevant information. These statements are

inherently uncertain, and investors are cautioned not to unduly

rely on these statements.

The forward-looking statements made in this press release and

the earnings call referencing this press release relate only to

events as of the date on which the statements are made. We

undertake no obligation to update any forward-looking statements

made in this press release to reflect events or circumstances after

the date of this press release or to reflect new information or the

occurrence of unanticipated events, except as required by law. We

may not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Our

forward-looking statements do not reflect the potential impact of

any future acquisitions, mergers, dispositions, joint ventures or

investments.

About The Honest Company

The Honest Company (NASDAQ: HNST) is a personal care company

dedicated to creating clean- and sustainably-designed products

spanning categories across diapers, wipes, baby personal care,

beauty, apparel, household care and wellness. Founded in 2012, the

Company is on a mission to challenge ingredients, ideals, and

industries through the power of the Honest brand, the Honest team,

and the Honest Standard. Honest products are available via

Honest.com, leading online retailers and approximately 50,000

retail locations across the United States and Canada. For more

information about the Honest Standard and the Company, please visit

www.honest.com.

Investor

Inquiries:investors@thehonestcompany.com

Media Contact: Brenna Israel Mast

bisrael@thehonestcompany.com

| |

|

The Honest Company, Inc.Condensed

Consolidated Statements of Comprehensive

Loss(Unaudited)(in thousands, except share and per share

amounts) |

| |

|

|

|

| |

For the three months ended June 30, |

|

For the six months ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

Revenue |

$ |

93,049 |

|

|

$ |

84,544 |

|

|

$ |

179,266 |

|

|

$ |

167,933 |

|

| Cost of revenue |

|

57,437 |

|

|

|

61,646 |

|

|

|

111,772 |

|

|

|

124,832 |

|

|

Gross profit |

|

35,612 |

|

|

|

22,898 |

|

|

|

67,494 |

|

|

|

43,101 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

26,431 |

|

|

|

25,032 |

|

|

|

48,850 |

|

|

|

50,849 |

|

|

Marketing |

|

11,512 |

|

|

|

9,261 |

|

|

|

20,608 |

|

|

|

19,495 |

|

|

Restructuring |

|

— |

|

|

|

397 |

|

|

|

— |

|

|

|

1,747 |

|

|

Research and development |

|

1,714 |

|

|

|

1,595 |

|

|

|

3,395 |

|

|

|

3,054 |

|

|

Total operating expenses |

|

39,657 |

|

|

|

36,285 |

|

|

|

72,853 |

|

|

|

75,145 |

|

| Operating loss |

|

(4,045 |

) |

|

|

(13,387 |

) |

|

|

(5,359 |

) |

|

|

(32,044 |

) |

| Interest and other income

(expense), net |

|

(19 |

) |

|

|

(9 |

) |

|

|

(82 |

) |

|

|

(198 |

) |

| Loss before provision for

income taxes |

|

(4,064 |

) |

|

|

(13,396 |

) |

|

|

(5,441 |

) |

|

|

(32,242 |

) |

| Income tax provision |

|

13 |

|

|

|

20 |

|

|

|

38 |

|

|

|

40 |

|

| Net loss |

$ |

(4,077 |

) |

|

$ |

(13,416 |

) |

|

$ |

(5,479 |

) |

|

$ |

(32,282 |

) |

| Net loss per share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.04 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.34 |

) |

| Weighted-average shares used

in computing net loss per share attributable to common

stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

99,078,930 |

|

|

|

94,103,266 |

|

|

|

97,676,049 |

|

|

|

93,607,425 |

|

| |

|

|

|

|

|

|

|

| Other comprehensive income

(loss) |

|

|

|

|

|

|

|

|

Unrealized gain (loss) on short-term investments, net of taxes |

|

— |

|

|

|

13 |

|

|

|

— |

|

|

|

33 |

|

|

Comprehensive loss |

$ |

(4,077 |

) |

|

$ |

(13,403 |

) |

|

$ |

(5,479 |

) |

|

$ |

(32,249 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

The Honest Company, Inc.Condensed

Consolidated Balance Sheets(Unaudited)(in thousands,

except share and per share amounts) |

| |

|

|

|

| |

June 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

36,593 |

|

|

$ |

32,827 |

|

|

Accounts receivable, net |

|

43,341 |

|

|

|

43,084 |

|

|

Inventories |

|

73,673 |

|

|

|

73,490 |

|

|

Prepaid expenses and other current assets |

|

8,611 |

|

|

|

8,371 |

|

|

Total current assets |

|

162,218 |

|

|

|

157,772 |

|

| Operating lease right-of-use

asset |

|

20,528 |

|

|

|

23,683 |

|

| Property and equipment,

net |

|

12,304 |

|

|

|

13,486 |

|

| Goodwill |

|

2,230 |

|

|

|

2,230 |

|

| Intangible assets, net |

|

272 |

|

|

|

309 |

|

| Other assets |

|

2,602 |

|

|

|

4,141 |

|

|

Total assets |

$ |

200,154 |

|

|

$ |

201,621 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

19,922 |

|

|

$ |

22,289 |

|

|

Accrued expenses |

|

31,332 |

|

|

|

32,209 |

|

|

Deferred revenue |

|

1,682 |

|

|

|

2,212 |

|

|

Total current liabilities |

|

52,936 |

|

|

|

56,710 |

|

| Long term liabilities |

|

|

|

|

Operating lease liabilities, net of current portion |

|

17,537 |

|

|

|

21,738 |

|

|

Other long-term liabilities |

|

— |

|

|

|

34 |

|

|

Total liabilities |

|

70,473 |

|

|

|

78,482 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity |

|

|

|

|

Preferred stock, $0.0001 par value, 20,000,000 shares authorized at

June 30, 2024 and December 31, 2023, none issued or

outstanding as of June 30, 2024 and December 31,

2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value, 1,000,000,000 shares authorized at

June 30, 2024 and December 31, 2023; 100,156,974 and

95,868,421 shares issued and outstanding as of June 30, 2024

and December 31, 2023, respectively |

|

9 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

614,220 |

|

|

|

602,198 |

|

|

Accumulated deficit |

|

(484,548 |

) |

|

|

(479,068 |

) |

|

Total stockholders’ equity |

|

129,681 |

|

|

|

123,139 |

|

|

Total liabilities and stockholders’ equity |

$ |

200,154 |

|

|

$ |

201,621 |

|

|

|

|

|

|

|

|

|

|

| |

|

The Honest Company, Inc.Condensed

Consolidated Statements of Cash Flows(Unaudited)(in

thousands) |

| |

|

| |

For the six months ended June 30, |

| |

2024 |

|

2023 |

| Cash flows from

operating activities |

|

|

|

|

Net loss |

$ |

(5,479 |

) |

|

$ |

(32,282 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

1,426 |

|

|

|

1,340 |

|

|

Stock-based compensation |

|

11,428 |

|

|

|

10,185 |

|

|

Other |

|

4,664 |

|

|

|

3,108 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

(257 |

) |

|

|

6,460 |

|

|

Inventories |

|

(182 |

) |

|

|

33,561 |

|

|

Prepaid expenses and other assets |

|

(211 |

) |

|

|

7,389 |

|

|

Accounts payable, accrued expenses and other long-term

liabilities |

|

(3,609 |

) |

|

|

(23,104 |

) |

|

Deferred revenue |

|

(529 |

) |

|

|

908 |

|

|

Operating lease liabilities |

|

(3,970 |

) |

|

|

(3,807 |

) |

|

Net cash provided by operating activities |

|

3,281 |

|

|

|

3,758 |

|

| Cash flows from

investing activities |

|

|

|

|

Proceeds from maturities of short-term investments |

|

— |

|

|

|

5,683 |

|

|

Purchases of property and equipment |

|

(91 |

) |

|

|

(1,186 |

) |

|

Net cash (used in) provided by investing activities |

|

(91 |

) |

|

|

4,497 |

|

| Cash flows from

financing activities |

|

|

|

|

Proceeds from exercise of stock options |

|

508 |

|

|

|

4 |

|

|

Proceeds from 2021 ESPP |

|

86 |

|

|

|

102 |

|

|

Payments on finance lease liabilities |

|

(18 |

) |

|

|

(33 |

) |

|

Net cash provided by financing activities |

|

576 |

|

|

|

73 |

|

|

Net increase in cash and cash equivalents |

|

3,766 |

|

|

|

8,328 |

|

| Cash and cash

equivalents |

|

|

|

| Beginning of the period |

|

32,827 |

|

|

|

9,517 |

|

| End of the period |

$ |

36,593 |

|

|

$ |

17,845 |

|

| |

|

|

|

| Supplemental

disclosures of noncash activities |

|

|

|

|

Capital expenditures included in accounts payable and accrued

expenses |

$ |

155 |

|

|

$ |

25 |

|

|

|

|

|

|

|

|

|

|

| |

|

The Honest Company, Inc.Use of Non-GAAP

Financial Measures |

| |

We prepare and present our condensed consolidated financial

statements in accordance with GAAP. However, management believes

that adjusted EBITDA, which is a non-GAAP financial measure,

provides investors with additional useful information in evaluating

our performance.

We calculate adjusted EBITDA as net income (loss), adjusted to

exclude: (1) interest and other (income) expense, net;

(2) income tax provision; (3) depreciation and

amortization; (4) stock-based compensation expense, including

payroll tax; (5) litigation and settlement fees associated with

certain non-ordinary course securities litigation claims; (6) Chief

Executive Officer (“CEO”) and founder and former Chief Creative

Officer (“CCO”) transition expenses and (7) restructuring expenses

in connection with the Transformation Initiative.

Adjusted EBITDA is a financial measure that is not required by,

or presented in accordance with GAAP. We believe that adjusted

EBITDA, when taken together with our financial results presented in

accordance with GAAP, provides meaningful supplemental information

regarding our operating performance and facilitates internal

comparisons of our historical operating performance on a more

consistent basis by excluding certain items that may not be

indicative of our business, results of operations or outlook. In

particular, we believe that the use of adjusted EBITDA is helpful

to our investors as it is a measure used by management in assessing

the health of our business, determining incentive compensation and

evaluating our operating performance, as well as for internal

planning and forecasting purposes.

Adjusted EBITDA is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not

be considered in isolation or as a substitute for financial

information presented in accordance with GAAP. Some of the

limitations of adjusted EBITDA include that (1) it does not

reflect capital commitments to be paid in the future;

(2) although depreciation and amortization are non-cash

charges, the underlying assets may need to be replaced and adjusted

EBITDA does not reflect these capital expenditures; (3) it

does not consider the impact of stock-based compensation expense;

(4) it does not reflect other non-operating expenses,

including interest expense; (5) it does not reflect tax

payments that may represent a reduction in cash available to us;

and (6) does not include certain non-ordinary cash expenses

that we do not believe are representative of our business on a

steady-state basis, such as CEO and founder/CCO transition expenses

and restructuring expenses in connection with the Transformation

Initiative. In addition, our use of adjusted EBITDA may not be

comparable to similarly titled measures of other companies because

they may not calculate adjusted EBITDA in the same manner, limiting

its usefulness as a comparative measure. Because of these

limitations, when evaluating our performance, you should consider

adjusted EBITDA alongside other financial measures, including our

revenue, net income (loss) and other results stated in accordance

with GAAP.

The following table presents a reconciliation of net income

(loss), the most directly comparable financial measure stated in

accordance with GAAP, to adjusted EBITDA, for each of the periods

presented:

| |

For the three months ended June 30, |

|

For the six months ended June 30, |

| (In thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Reconciliation of Net

Loss to Adjusted EBITDA |

|

|

|

|

|

|

|

|

Net loss |

$ |

(4,077 |

) |

|

$ |

(13,416 |

) |

|

$ |

(5,479 |

) |

|

$ |

(32,282 |

) |

|

Interest and other (income) expense, net |

|

19 |

|

|

|

9 |

|

|

|

82 |

|

|

|

198 |

|

|

Income tax provision |

|

13 |

|

|

|

20 |

|

|

|

38 |

|

|

|

40 |

|

|

Depreciation and amortization |

|

709 |

|

|

|

672 |

|

|

|

1,426 |

|

|

|

1,340 |

|

|

Stock-based compensation |

|

8,905 |

|

|

|

6,413 |

|

|

|

11,428 |

|

|

|

10,185 |

|

|

Securities litigation expense |

|

1,268 |

|

|

|

1,773 |

|

|

|

1,670 |

|

|

|

2,951 |

|

|

CEO and founder/CCO transition expense(1) |

|

700 |

|

|

|

— |

|

|

|

858 |

|

|

|

1,277 |

|

|

Restructuring costs(2) |

|

— |

|

|

|

397 |

|

|

|

— |

|

|

|

1,747 |

|

|

Payroll tax expense related to stock-based compensation |

|

58 |

|

|

|

33 |

|

|

|

216 |

|

|

|

112 |

|

| Adjusted EBITDA |

$ |

7,595 |

|

|

$ |

(4,099 |

) |

|

$ |

10,239 |

|

|

$ |

(14,432 |

) |

__________________

(1) Includes sign-on bonus and relocation costs related to the

appointment of our CEO and separation costs related to the

termination of our former founder and CCO. (2) Restructuring costs

included employee and asset-related costs and contract

terminations.

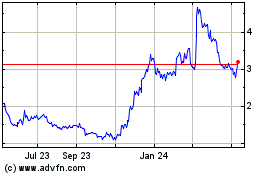

Honest (NASDAQ:HNST)

Historical Stock Chart

From Oct 2024 to Nov 2024

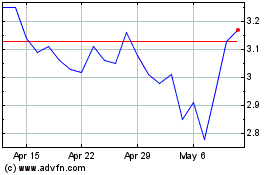

Honest (NASDAQ:HNST)

Historical Stock Chart

From Nov 2023 to Nov 2024