Gilead Sciences, Inc. (Nasdaq: GILD) announced today its results

of operations for the quarter ended September 30, 2011. Total

revenues for the third quarter of 2011 were $2.12 billion, up 9

percent compared to total revenues of $1.94 billion for the third

quarter of 2010. Net income for the third quarter of 2011 was

$741.1 million, or $0.95 per diluted share, compared to net income

for the third quarter of 2010 of $704.9 million, or $0.83 per

diluted share. Non-GAAP net income for the third quarter of 2011,

which excludes after-tax acquisition-related, restructuring and

stock-based compensation expenses, was $795.2 million, or $1.02 per

diluted share, compared to non-GAAP net income for the third

quarter of 2010 of $759.7 million, or $0.90 per diluted share.

Product Sales

Product sales increased 11 percent to $2.07 billion for the

third quarter of 2011, compared to $1.87 billion in the third

quarter of 2010. This increase in sales was driven primarily by

Gilead’s antiviral franchise, due to strong growth in sales of

Atripla® (efavirenz 600 mg/emtricitabine 200 mg/tenofovir

disoproxil fumarate 300 mg) and Truvada® (emtricitabine 200

mg/tenofovir disoproxil fumarate 300 mg).

Antiviral Franchise

Antiviral product sales increased 9 percent to $1.79 billion in

the third quarter of 2011, up from $1.65 billion for the same

quarter of 2010.

Sales of Atripla for the treatment of HIV infection increased 7

percent to $794.7 million for the third quarter of 2011, up from

$742.7 million in the third quarter of 2010, driven primarily by

sales volume growth in Europe and the United States.

Sales of Truvada for the treatment of HIV infection increased 11

percent to $744.7 million for the third quarter of 2011, up from

$668.7 million in the third quarter of 2010, driven primarily by

sales volume growth in Europe and the United States.

Sales of Viread® (tenofovir disoproxil fumarate) for the

treatment of HIV infection and chronic hepatitis B increased 5

percent to $192.9 million for the third quarter of 2011, up from

$184.3 million in the third quarter of 2010. Sales increases in

Europe and the United States were partially offset by lower sales

in Latin America.

Sales of our newest product, Complera® (emtricitabine 200

mg/rilpilvirine 25 mg/tenofovir disoproxil fumarate 300 mg) for the

treatment of HIV infection, were $19.0 million for the third

quarter of 2011. On August 10, 2011, the U.S. Food and Drug

Administration (FDA) approved Complera, a new once-daily, complete

single-tablet HIV treatment regimen for treatment-naïve adults.

Letairis

Sales of Letairis® (ambrisentan) for the treatment of pulmonary

arterial hypertension increased 31 percent to $79.0 million for the

third quarter of 2011, up from $60.4 million for the third quarter

of 2010, driven primarily by sales volume growth.

Ranexa

Sales of Ranexa® (ranolazine) for the treatment of chronic

angina increased 36 percent to $82.0 million for the third quarter

of 2011, up from $60.3 million for the third quarter of 2010,

driven primarily by sales volume growth.

Other Products

Sales of other products were $153.6 million for the third

quarter of 2011 compared to $149.1 million for the third quarter of

2010 and included AmBisome® (amphotericin B) liposome for injection

for the treatment of severe fungal infections, Hepsera® (adefovir

dipivoxil) for the treatment of chronic hepatitis B, Emtriva®

(emtricitabine) for the treatment of HIV infection and Cayston®

(aztreonam for inhalation solution) for the improvement of

respiratory symptoms in cystic fibrosis patients with Pseudomonas

aeruginosa (P. aeruginosa). Sales of Cayston were $23.6 million for

the third quarter of 2011, up from $14.7 million in the same

quarter of 2010 driven by sales volume growth in the United

States.

Royalty, Contract and Other

Revenues

Royalty, contract and other revenues from collaborations were

$55.8 million in the third quarter of 2011, down 23 percent from

$72.1 million in the third quarter of 2010. This decrease was due

to an 89 percent decrease in Tamiflu royalties from F. Hoffmann-La

Roche Ltd to $3.7 million in the third quarter of 2011 from $34.5

million in the third quarter of 2010, as pandemic planning

initiatives worldwide have declined.

Research and Development

Research and development (R&D) expenses in the third quarter

of 2011 were $290.1 million, compared to $230.4 million for the

third quarter of 2010. Non-GAAP R&D expenses for the third

quarter of 2011, which exclude acquisition-related, restructuring

and stock-based compensation expenses, were $269.3 million,

compared to $203.2 million for the third quarter of 2010. The

increase in non-GAAP R&D expenses was due primarily to

increased clinical activities and expenses associated with

acquisitions and collaborations.

Selling, General and

Administrative

Selling, general and administrative (SG&A) expenses in the

third quarter of 2011 were $295.9 million, compared to $250.6

million for the third quarter of 2010. Non-GAAP SG&A expenses

for the third quarter of 2011, which exclude acquisition-related,

restructuring and stock-based compensation expenses, were $265.1

million, compared to $220.6 million for the third quarter of 2010.

The increase in non-GAAP SG&A expenses was driven primarily by

the impact of the pharmaceutical excise tax resulting from U.S.

healthcare reform, expansion of commercial activities and legal

expenses.

Net Foreign Currency Exchange

Impact

The net foreign currency exchange impact on third quarter 2011

revenues and pre-tax earnings, which includes revenues and expenses

generated from outside the United States, was a favorable $19.9

million and $2.6 million, respectively, compared to the third

quarter of 2010.

Cash, Cash Equivalents and Marketable

Securities

As of September 30, 2011, Gilead had cash, cash equivalents and

marketable securities of $5.48 billion compared to $5.32 billion as

of December 31, 2010. Gilead generated $2.66 billion of operating

cash flow during the first nine months of 2011 including $897.1

million generated in the third quarter of 2011.

Share Repurchase Update

During the quarter, Gilead repurchased and retired a total of

$883.6 million or 22.4 million shares of common stock. The company

has completed its May 2010 $5.00 billion share repurchase program,

which retired a total of 135.5 million common shares at an average

price of $36.89 per share, and commenced its January 2011

three-year $5.00 billion share repurchase program. Since January

2010, Gilead repurchased and retired $6.18 billion or 164.2 million

common shares or 18 percent of the company’s common stock

outstanding at December 31, 2009.

Corporate Highlights

In July, Gilead announced an expansion of its access initiatives

for its antiretrovirals in resource-limited countries. The company

established new licensing terms with four India-based drug

manufacturers – Hetero Drugs Ltd., Matrix Laboratories Ltd.,

Ranbaxy Laboratories Ltd. and Strides Arcolab Ltd. – for three of

its late-stage HIV pipeline products. In addition, Gilead became

the first pharmaceutical company to enter a licensing agreement

with the Medicines Patent Pool Foundation.

In August, Gilead announced the purchase of a clinical biologics

manufacturing facility and certain process development assets

located in Oceanside, California from Genentech, a member of the

Roche Group. This transaction was completed in September 2011.

Initially, Gilead will use the facility for the process development

and manufacture of its investigational monoclonal antibody

candidates.

Also in August, Gilead announced that it had resolved all

outstanding issues raised in a Warning Letter issued by the U.S.

FDA in September 2010 related to its San Dimas, California

manufacturing facility.

Product and Pipeline

Update

Antiviral Franchise

In July, Gilead announced Phase 3 clinical trial results from

the pivotal Study 145 showing that its investigational

antiretroviral elvitegravir, a novel oral integrase inhibitor being

evaluated for the treatment of HIV-1 infection, was non-inferior to

the integrase inhibitor raltegravir after 48 weeks of therapy in

treatment-experienced patients. The data were presented at the 6th

International AIDS Society Conference on HIV Pathogenesis,

Treatment and Prevention (IAS 2011) in Rome, Italy.

In August, Gilead announced that the FDA had approved Complera,

a complete single-tablet regimen for the treatment of HIV-1

infection in treatment-naïve adults.

Also in August, Gilead announced that a Phase 3 clinical trial

(Study 102) of its investigational fixed-dose, single-tablet “Quad”

regimen of elvitegravir, cobicistat, emtricitabine and tenofovir

disoproxil fumarate, being evaluated for HIV-1 infection in

treatment-naïve patients, met its primary objective of

non-inferiority at week 48 as compared to Atripla.

In September, Gilead announced that the second pivotal Phase 3

clinical trial (Study 103) of the “Quad” in treatment-naïve HIV-1

infected patients met its primary objective of non-inferiority at

week 48 as compared to ritonavir-boosted atazanavir plus Truvada.

Upon this announcement, Gilead updated its timelines for filing for

U.S. regulatory approval to take place prior to the end of this

year.

Also in September, Gilead announced that the Committee for

Medicinal Products for Human Use (CHMP), the scientific committee

of the European Medicines Agency, had adopted a positive opinion on

the company’s Marketing Authorisation Application for the

once-daily single-tablet regimen, Eviplera®, launched first as

Complera in the United States and is a combination of Gilead’s

Truvada and Tibotec Pharmaceuticals’ non-nucleoside reverse

transcriptase inhibitor Edurant® (rilpivirine (as hydrochloride))

for the treatment of HIV-1 infection in antiretroviral-naïve adults

with a viral load less than or equal to 100,000 HIV-1 RNA

copies/mL.

Conference Call

At 5:00 p.m. Eastern Time today, Gilead’s management will host a

conference call and a simultaneous webcast to discuss results from

its third quarter 2011 as well as provide a general business

update. To access the webcast live via the internet, please connect

to the company’s website at www.gilead.com 15 minutes prior to the

conference call to ensure adequate time for any software download

that may be needed to hear the webcast. Alternatively, please call

1-866-730-5765 (U.S.) or 1-857-350-1589 (international) and dial

the participant passcode 52967950 to access the call.

A replay of the webcast will be archived on the company’s

website for one year, and a phone replay will be available

approximately two hours following the call through October 30,

2011. To access the phone replay, please call 1-888-286-8010 (U.S.)

or 1-617-801-6888 (international) and dial the participant passcode

50031971.

About Gilead

Gilead Sciences is a biopharmaceutical company that discovers,

develops and commercializes innovative therapeutics in areas of

unmet medical need. Gilead’s mission is to advance the care of

patients suffering from life-threatening diseases worldwide.

Headquartered in Foster City, California, Gilead has operations in

North America, Europe and Asia Pacific.

Non-GAAP Financial

Information

Gilead has presented certain financial information in accordance

with GAAP and also on a non-GAAP basis for the third quarter of

2011 and 2010. Management believes this non-GAAP information is

useful for investors, taken in conjunction with Gilead’s GAAP

financial statements, because management uses such information

internally for its operating, budgeting and financial planning

purposes. Non-GAAP information is not prepared under a

comprehensive set of accounting rules and should only be used to

supplement an understanding of Gilead’s operating results as

reported under U.S. GAAP. A reconciliation between GAAP and

non-GAAP financial information is provided in the table on page

7.

Forward-looking

Statements

Statements included in this press release that are not

historical in nature are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Gilead cautions readers that forward-looking statements are subject

to certain risks and uncertainties that could cause actual results

to differ materially. These risks and uncertainties include:

Gilead’s ability to achieve its anticipated full year 2011

financial results, including the possibility that its full year

2011 guidance may be revised at a later date; Gilead’s ability to

sustain growth in revenues for its antiviral, cardiovascular and

respiratory franchises; unpredictable variability of Tamiflu

royalties and the strong relationship between this royalty revenue

and global pandemic planning and supply; the availability of

funding for state AIDS Drug Assistance Programs (ADAPs) and their

ability to purchase at levels to support the number of patients

that rely on ADAPs; the levels of inventory held by wholesalers and

retailers which may cause fluctuations in Gilead’s earnings;

Gilead’s ability to submit New Drug Applications for new product

candidates in the timelines currently anticipated, including for

elvitegravir and cobicistat; Gilead’s ability to receive regulatory

approvals in a timely manner or at all, for new and current

products, including the Quad; Gilead’s ability to successfully

commercialize its products, including the risk that physicians may

not see advantages of Complera over other therapies and may

therefore be reluctant to prescribe the product; Gilead’s ability

to successfully develop its respiratory, cardiovascular and

oncology franchises; safety and efficacy data from clinical studies

may not warrant further development of Gilead’s product candidates;

initiating and completing clinical trials may take longer or cost

more than expected; the potential for additional austerity measures

in European countries that may increase the amount of discount

required on Gilead’s products; fluctuations in the foreign exchange

rate of the U.S. dollar that may cause an unfavorable foreign

currency exchange impact on Gilead’s future revenues and pre-tax

earnings; Gilead’s ability to complete the $5.00 billion share

repurchase program due to changes in its stock price, corporate or

other market conditions; and other risks identified from time to

time in Gilead’s reports filed with the U.S. Securities and

Exchange Commission. In addition, Gilead makes estimates and

judgments that affect the reported amounts of assets, liabilities,

revenues and expenses and related disclosures. Gilead bases its

estimates on historical experience and on various other

market-specific and other relevant assumptions that it believes to

be reasonable under the circumstances, the results of which form

the basis for making judgments about the carrying values of assets

and liabilities that are not readily apparent from other sources.

Actual results may differ significantly from these estimates. You

are urged to consider statements that include the words “may,”

“will,” “would,” “could,” “should,” “might,” “believes,”

“estimates,” “projects,” “potential,” “expects,” “plans,”

“anticipates,” “intends,” “continues,” “forecast,” “designed,”

“goal,” or the negative of those words or other comparable words to

be uncertain and forward-looking. Gilead directs readers to its

Quarterly Report on Form 10-Q for the quarter ended June 30, 2011

and other subsequent disclosure documents filed with the Securities

and Exchange Commission and press releases. Gilead claims the

protection of the Safe Harbor contained in the Private Securities

Litigation Reform Act of 1995 for forward-looking statements. All

forward-looking statements are based on information currently

available to Gilead, and Gilead assumes no obligation to update any

such forward-looking statements.

Truvada, Viread, Hepsera, Complera, Emtriva,

AmBisome, Letairis, Cayston, and Ranexa are registered trademarks

of Gilead Sciences, Inc.

Atripla is a registered trademark of

Bristol-Myers Squibb & Gilead Sciences, LLC.

Tamiflu is a registered trademark of F.

Hoffmann-La Roche Ltd.

For more information on Gilead Sciences, Inc.,

please visit www.gilead.com or call the Gilead Public Affairs

Department at 1-800-GILEAD-5 (1-800-445-3235).

GILEAD SCIENCES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (unaudited) (in thousands, except per

share amounts)

Three Months Ended Nine Months Ended September 30, September 30,

2011 2010 2011 2010 Revenues: Product sales $ 2,065,859 $ 1,865,559

$ 5,969,025 $ 5,459,683 Royalty, contract and other revenues

55,801 72,097 215,982

491,050 Total revenues 2,121,660

1,937,656 6,185,007 5,950,733

Costs and expenses: Cost of goods sold 531,989 477,584 1,539,963

1,373,539 Research and development 290,066 230,440 826,915 680,170

Selling, general and administrative 295,927

250,559 895,764 764,183 Total

costs and expenses 1,117,982 958,583

3,262,642 2,817,892 Income from

operations 1,003,678 979,073 2,922,365 3,132,841 Interest and other

income, net 14,406 15,593 40,216 49,523 Interest expense

(43,097 ) (33,620 ) (130,420 ) (68,339 )

Income before provision for income taxes 974,987 961,046 2,832,161

3,114,025 Provision for income taxes 237,449

258,883 704,861 850,641 Net

income 737,538 702,163 2,127,300 2,263,384 Net loss attributable to

noncontrolling interest 3,586 2,713

11,192 8,454 Net income attributable to

Gilead $ 741,124 $ 704,876 $ 2,138,492 $

2,271,838

Net income per share attributable to

Gilead common stockholders - basic

$ 0.97 $ 0.85 $ 2.72 $ 2.61

Net income per share attributable to

Gilead common stockholders - diluted

$ 0.95 $ 0.83 $ 2.66 $ 2.55 Shares used

in per share calculation - basic 767,033

833,006 787,272 871,887 Shares

used in per share calculation - diluted 781,312

847,228 802,762 890,216

GILEAD SCIENCES, INC. RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL INFORMATION (unaudited) (in

thousands, except percentages and per share amounts)

Three Months Ended Nine Months Ended

September 30, September 30, 2011 2010 2011 2010

Cost of goods

sold reconciliation: GAAP cost of goods sold $ 531,989 $

477,584 $ 1,539,963 $ 1,373,539 Acquisition-related amortization of

inventory mark-up - - - (7,020 ) Acquisition-related amortization

of purchased intangibles (17,407 ) (14,981 ) (52,222 ) (44,946 )

Stock-based compensation expenses (2,234 ) (2,728 )

(7,765 ) (8,548 ) Non-GAAP cost of goods sold $

512,348 $ 459,875 $ 1,479,976 $ 1,313,025

Product gross margin reconciliation: GAAP

product gross margin 74.3 %

74.4 % 74.3 % 74.9 % Acquisition-related amortization of inventory

mark-up - - - 0.1 % Acquisition-related amortization of purchased

intangibles 0.8 % 0.8 % 0.9 % 0.8 % Stock-based compensation

expenses 0.1 % 0.1 % 0.1 % 0.2 %

Non-GAAP product gross margin (1) 75.3 %

75.4 % 75.3 % 76.0 %

Research and

development expenses reconciliation: GAAP research and

development expenses $ 290,066 $ 230,440 $ 826,915 $ 680,170

Acquisition-related transaction costs - - (446 ) -

Acquisition-related remeasurement of contingent consideration

(1,616 ) - (1,198 ) - Restructuring expenses (806 ) (6,315 ) (1,360

) (10,545 ) Stock-based compensation expenses (18,389 )

(20,946 ) (54,529 ) (62,536 ) Non-GAAP

research and development expenses $ 269,255 $ 203,179

$ 769,382 $ 607,089

Selling, general and

administrative expenses reconciliation: GAAP selling, general

and administrative expenses $ 295,927 $ 250,559 $ 895,764 $ 764,183

Acquisition-related transaction costs (535 ) (387 ) (1,278 ) (387 )

Restructuring expenses (4,388 ) (1,413 ) (6,054 ) (14,903 )

Stock-based compensation expenses (25,897 ) (28,128 )

(83,821 ) (75,606 ) Non-GAAP selling, general and

administrative expenses $ 265,107 $ 220,631 $ 804,611

$ 673,287

Operating margin

reconciliation: GAAP operating margin 47.3 % 50.5 % 47.2 % 52.6

% Acquisition-related transaction costs 0.0 % 0.0 % 0.0 % 0.0 %

Acquisition-related amortization of inventory mark-up - - - 0.1 %

Acquisition-related amortization of purchased intangibles 0.8 % 0.8

% 0.8 % 0.8 % Acquisition-related remeasurement of contingent

consideration 0.1 % - 0.0 % - Restructuring expenses 0.2 % 0.4 %

0.1 % 0.4 % Stock-based compensation expenses 2.2 %

2.7 % 2.4 % 2.5 % Non-GAAP operating margin (1)

50.7 % 54.4 % 50.6 % 56.4 %

Net income attributable to Gilead reconciliation: GAAP net

income attributable to Gilead $ 741,124 $ 704,876 $ 2,138,492 $

2,271,838 Acquisition-related transaction costs 535 388 1,724 388

Acquisition-related amortization of inventory mark-up - - - 5,090

Acquisition-related amortization of purchased intangibles 13,172

10,951 39,225 32,680 Acquisition-related remeasurement of

contingent consideration 1,213 - 900 - Restructuring expenses 3,908

5,639 5,569 18,488 Stock-based compensation expenses 35,221

37,812 109,750 106,620

Non-GAAP net income attributable to Gilead $ 795,173

$ 759,666 $ 2,295,660 $ 2,435,104

Diluted earnings per share reconciliation: GAAP diluted

earnings per share $ 0.95 $ 0.83 $ 2.66 $ 2.55 Acquisition-related

transaction costs 0.00 0.00 0.00 0.00 Acquisition-related

amortization of inventory mark-up - - - 0.01 Acquisition-related

amortization of purchased intangibles 0.02 0.01 0.05 0.04

Acquisition-related remeasurement of contingent consideration 0.00

- 0.00 - Restructuring expenses 0.01 0.01 0.01 0.02 Stock-based

compensation expenses 0.05 0.04

0.14 0.12 Non-GAAP diluted earnings per share

(1) $ 1.02 $ 0.90 $ 2.87 $ 2.74

Shares used in per share calculation (diluted)

reconciliation: GAAP shares used in per share calculation

(diluted) 781,312 847,228 802,762 890,216 Share impact of current

stock-based compensation guidance (2,096 ) (2,208 )

(2,007 ) (1,621 ) Non-GAAP shares used in per share

calculation (diluted) 779,216 845,020

800,755 888,595

Non-GAAP

adjustment summary: Cost of goods sold adjustments $ 19,641 $

17,709 $ 59,987 $ 60,514 Research and development expenses

adjustments 20,811 27,261 57,533 73,081 Selling, general and

administrative expenses adjustments 30,820

29,928 91,153 90,896 Total

non-GAAP adjustments before tax 71,272 74,898 208,673 224,491

Income tax effect (17,223 ) (20,108 ) (51,505

) (61,225 ) Total non-GAAP adjustments after tax $ 54,049

$ 54,790 $ 157,168 $ 163,266

Note: (1) Amounts may not sum due to rounding

GILEAD

SCIENCES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands) September 30, December 31, 2011

2010 (unaudited) (Note 1) Cash, cash equivalents and

marketable securities $ 5,482,116 $ 5,318,071 Accounts receivable,

net 1,867,092 1,621,966 Inventories 1,337,751 1,203,809 Property,

plant and equipment, net 761,190 701,235 Intangible assets

2,111,003 1,425,592 Other assets 1,080,746 1,321,957

Total assets $ 12,639,898 $ 11,592,630 Current liabilities $

2,224,431 $ 2,464,950 Long-term liabilities 4,182,261 3,005,843

Stockholders’ equity (Note 2) 6,233,206 6,121,837

Total liabilities and stockholders’ equity $ 12,639,898 $

11,592,630 Notes: (1) Derived from audited

consolidated financial statements at that date. (2) As of

September 30, 2011, there were 756,094 shares of common stock

issued and outstanding.

GILEAD SCIENCES, INC.

PRODUCT SALES SUMMARY (unaudited) (in thousands)

Three Months Ended Nine Months Ended

September 30, September 30, 2011 2010 2011 2010 Antiviral

products: Atripla – U.S. $ 501,576 $ 491,645 $ 1,474,580 $

1,414,365 Atripla – Europe 254,957 222,727 775,167 661,424 Atripla

– Other International 38,166 28,320 111,456

75,579 794,699 742,692 2,361,203

2,151,368 Truvada – U.S. 357,660 325,545 1,011,837 969,884

Truvada – Europe 319,149 292,028 940,312 867,929 Truvada – Other

International 67,918 51,168 176,990

130,409 744,727 668,741 2,129,139

1,968,222 Viread – U.S. 87,712 82,431 240,420 239,225 Viread

– Europe 82,927 72,489 245,062 216,636 Viread – Other International

22,248 29,343 61,517 85,260

192,887 184,263 546,999 541,121 Hepsera

– U.S. 14,170 19,055 42,809 60,090 Hepsera – Europe 18,223 25,095

60,293 87,021 Hepsera – Other International 3,238

3,369 9,281 9,866 35,631 47,519

112,383 156,977 Complera - U.S. 19,044 - 19,044 -

Complera - Europe - - - - Complera - Other - -

- - 19,044 - 19,044 -

Emtriva – U.S. 4,666 3,966 12,482 12,345 Emtriva – Europe 1,772

1,657 5,162 5,216 Emtriva – Other International 1,229

1,073 3,331 3,036 7,667 6,696

20,975 20,597 Total Antiviral products – U.S. 984,828

922,642 2,801,172 2,695,909 Total Antiviral products – Europe

677,028 613,996 2,025,996 1,838,226 Total Antiviral products –

Other International 132,799 113,273 362,575

304,150 1,794,655 1,649,911 5,189,743

4,838,285 AmBisome 82,241 75,132 249,372 230,355

Letairis 78,954 60,446 214,765 176,293 Ranexa 81,983 60,312 236,353

172,015 Other products 28,026 19,758 78,792

42,735 271,204 215,648 779,282

621,398 Total product sales $ 2,065,859 $ 1,865,559 $

5,969,025 $ 5,459,683

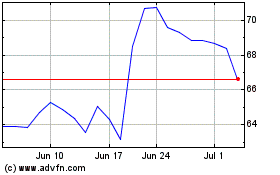

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From May 2024 to Jun 2024

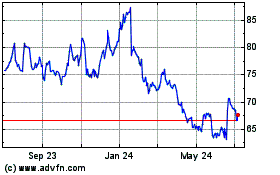

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Jun 2023 to Jun 2024