Form 8-K - Current report

February 06 2024 - 2:03PM

Edgar (US Regulatory)

0001670076FALSE00016700762024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 6, 2024

___________________________________

Frontier Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-40304 | 46-3681866 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

4545 Airport Way

Denver, CO 80239

(720) 374-4550

(Address of principal executive offices, including zip code, and Registrant's telephone number, including area code)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | ULCC | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Results of Operations and Financial Condition.

On February 6, 2024, Frontier Group Holdings, Inc. (the “Company”) provided a presentation to investors that includes information regarding the Company's financial performance, market opportunity, competitive position and economic model, and that relates to the Company's financial outlook for the first quarter of 2024 and full year 2024 and targeted financial performance for 2025. This investor presentation, located on the “Investor Relations” section of the Company's website at https://ir.flyfrontier.com, is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The Company makes reference to non-GAAP financial information in the presentation. A reconciliation of these non-GAAP financial measures to their nearest GAAP equivalents is provided in the presentation.

The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | FRONTIER GROUP HOLDINGS, INC. |

| | | |

| | | |

| | | |

Date: February 6, 2024 | By: | /s/ Howard M. Diamond |

| | | Howard M. Diamond |

| | | Executive Vice President, Legal and Corporate Affairs |

Fourth quarter & FY2023 Financial Update February 6, 2024

2 Disclaimer This presentation (including the accompanying oral presentation) is being delivered on behalf of Frontier Group Holdings, Inc. ("Frontier") ("we", "our", "us", or the "Company"). Before you invest, you should read the documents that the Company has filed with the Securities and Exchange Commission ("SEC") for more complete information about the Company. You may get these documents for free by visiting the SEC’s website at www.sec.gov. This presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities and may not be relied upon in connection with the purchase or sale of any security. Non-GAAP Financial Measures In addition to financial information prepared in accordance with generally accepted accounting principles in the United States ("GAAP"), this presentation includes certain non-GAAP financial measures. We believe these non-GAAP financial measures are useful supplemental indicators of our operating performance. We believe the non-GAAP numbers provided are well recognized performance measurements in the airline industry that are frequently used by our management, as well as by investors, securities analysts and other interested parties in comparing the operating performance of companies in our industry. Reconciliations of such information to the most directly comparable GAAP financial measures are included in the Appendix to these slides. The non-GAAP measures have limitations and may not be comparable across all carriers, and you should not consider them in isolation or as a substitute for our GAAP financial information. Cautionary Statement Regarding Forward-Looking Statements and Information Certain statements in this presentation should be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward- looking statements are based on the Company’s current expectations and beliefs with respect to certain current and future events and anticipated financial and operating performance. Words such as "expects," "will," "plans," "intends," "anticipates," "indicates," "remains," "believes," "estimates," "forecast," "guidance," "outlook," "goals," "targets" and similar expressions are intended to identify forward-looking statements. Additionally, forward- looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. All forward-looking statements in this presentation are based upon information available to the Company on the date of this presentation. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as required by applicable law.

3 Disclaimer Cautionary Statement Regarding Forward-Looking Statements and Information (continued) Actual results could differ materially from these forward-looking statements due to numerous risks and uncertainties relating to the Company's operations and business environment including, without limitation, the following: unfavorable economic and political conditions in the states where the Company operates and globally, including an inflationary environment and potential recession, and the resulting impact on cost inputs and/or consumer demand for air travel; the highly competitive nature of the global airline industry and susceptibility of the industry to price discounting and changes in capacity; the Company's ability to attract and retain qualified personnel at reasonable costs; the potential future impacts of the COVID-19 pandemic, and possible outbreaks of another disease or similar public health threat in the future, on the Company’s business, operating results, financial condition, liquidity and near-term and long-term strategic operating plan, including possible additional adverse impacts resulting from the duration and spread of the pandemic; high and/or volatile fuel prices or significant disruptions in the supply of aircraft fuel, including as a result of the war between Russia and Ukraine; the Company's reliance on technology and automated systems to operate its business and the impact of any significant failure or disruption of, or failure to effectively integrate and implement, the technology or systems; the Company’s reliance on third-party service providers and the impact of any failure of these parties to perform as expected, or interruptions in the Company's relationships with these providers or their provision of services; adverse publicity and/or harm to the Company's brand or reputation; reduced travel demand and potential tort liability as a result of an accident, catastrophe or incident involving the Company, its codeshare partners or another airline; terrorist attacks, international hostilities or other security events, or the fear of terrorist attacks or hostilities, even if not made directly on the airline industry; increasing privacy and data security obligations or a significant data breach; further changes to the airline industry with respect to alliances and joint business arrangements or due to consolidations; changes in the Company's network strategy or other factors outside its control resulting in less economic aircraft orders, costs related to modification or termination of aircraft orders or entry into less favorable aircraft orders; the Company's reliance on a single supplier for its aircraft and two suppliers for its engines, and the impact of any failure to obtain timely deliveries, additional equipment or support from any of these suppliers; the impacts of union disputes, employee strikes or slowdowns, and other labor-related disruptions on the Company's operations; extended interruptions or disruptions in service at major airports where the Company operates; the impacts of seasonality and other factors associated with the airline industry; the Company's failure to realize the full value of its intangible assets or its long-lived assets, causing the Company to record impairments; the costs of compliance with extensive government regulation of the airline industry; costs, liabilities and risks associated with environmental regulation and climate change; the Company's inability to accept or integrate new aircraft into the Company's fleet as planned; the impacts of the Company's significant amount of financial leverage from fixed obligations, the possibility the Company may seek material amounts of additional financial liquidity in the short-term and the impacts of insufficient liquidity on the Company's financial condition and business; failure to comply with the covenants in the Company's financing agreements or failure to comply with financial and other covenants governing the Company's other debt; changes in, or failure to retain, the Company's senior management team or other key employees; current or future litigation and regulatory actions, or failure to comply with the terms of any settlement, order or arrangement relating to these actions; increases in insurance costs or inadequate insurance coverage; and other risks and uncertainties set forth from time to time under sections captioned "Risk Factors" in the Company's reports and other documents filed with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 22, 2023. Statistical Data, Estimates and Forecasts This presentation contains statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation. Frontier Airlines®, Frontier®, the Frontier Flying F logo, FlyFrontier.com®, Discount Den®, Low Fares Done Right®, LFDR®, Save More. Get More®, The Sky is for Everyone®, myFrontier®, EarlyReturns®, Frontier Miles℠, The Works℠, The Perks℠, Kids Fly Free℠, Friends Fly Free℠, and GoWild℠ are trademarks or servicemarks of Frontier in the United States and other countries.

Barry Biffle, Chief Executive Officer

5 Industry Oversupply in Leisure Markets Negatively Impacting ULCC and LCC RASMs Las Vegas & Orlando Total Industry Capacity Total U.S. domestic capacity Total U.S. domestic ASMs grew 4.4% in 2023 compared to 2019, but LAS and MCO capacity increased ~5x faster over the same period and continues to grow 4.4% 20% Industry ASMs FY23 vs FY19

6 Frontier Aggressively Pivoting Away from Oversupply June 2023 June 2024 LAS/MCO ASMs expected to decline 11ppt LAS + MCO 34% LAS + MCO 23%

7 2024 Network Focused on Higher-fare Markets and Increasing Revenue Pool >50% $59 $89 Summer 2023 Summer 2024ETicket Revenue MM MM We need a smaller share of a bigger revenue pool with higher fares $157 $165 Industry Avg Fare Summer 2023 Industry Avg Fare Summer 2024E Higher Average Industry Fares in Underserved Markets Total Ticket Revenue Pool

On track to achieve target of >80% out-and-back flying by peak summer 2024 - Further expands industry leading utilization with reliable operations 8 Network Simplification Expected to Mitigate Elevated Air Traffic Control Ground-delay Programs Momentum going into March 2024 schedule, which is at ~2/3rd out-and-back, up from ~1/3rd in Summer 2023 Expansion of crew base footprint - Cleveland, Cincinnati, Chicago (ORD/MDW) and San Juan Note: utilization reflects reported mainline utilization for LTM 9/30/23 where available, and U.S. DOT data where unavailable Source: Company filings, U.S. DOT

7.84 12.79 Industry Avg. 9 Cost Advantage Widening A d j. C A S M + N et In te re st (S LA 1 ,0 0 0 )2 2019 1 9.43 16.01 Industry Avg. 2023 1 We expect to maintain or widen our cost advantage relative to the industry • $200 million expected annual run rate cost benefit to be implemented by the end of 2024 tied to network simplification • Up-gauging • Two-thirds of our remaining orderbook is for the 240-seat Airbus A321neo aircraft • Expecting 2024 adj. CASM-ex fuel SLA 1,0002 (non-GAAP) to be down 1 to 3% Y/Y 39% LOWER vs industry avg 41% LOWER vs industry avg 2024+ 1. For the year ended December 31, 2019 and for the year ended December 31, 2023; excludes JBLU and ALGT non-airline costs and DAL third-party refinery costs; includes LUV, UAL & DAL profit sharing; includes UAL third-party business expenses; includes ALGT employee recognition bonus; includes other non-operating costs for the industry. For FY2023, SAVE costs are based on First Call consensus retrieved on January 29, 2024 Refer to the Appendix for a reconciliation of adjusted CASM + net interest 2. Stage Length Adjusted (SLA): Adjusted CASM excluding fuel* Square root (stage length / 1,000); stage length for ALK, DAL, HA, and UAL reflects L12M 12/31/23 schedule data

10 Diverse Revenue Initiatives Designed to Drive Significant RASM Growth by 2025 1 3 NETWORK Growth is focused on higher-fare VFR-markets Reducing exposure in oversupplied leisure markets Improving reliability and recoverability through network simplification Lower share of much larger revenue pool needed BRAND & DISTRIBUTION 2 PRODUCT BizFare introduction Premium Economy Revenue-based FRONTIER MILES ℠ program with faster path to Elite Highest earn rate on purchases with FRONTIER Barclays World Mastercard New website New mobile application New Distribution Capability launch Weaponizing our costs to enable “Get it All for Less” campaign

GUIDANCE 11 Network, Revenue and Cost Initiatives Designed to Drive Profitability 5 - 7 % Q1-2024 Adj. Pre-tax Margin1 (non-GAAP) Capacity Growth (y/y) 3 - 6 % 12 - 15 % FY2024 (4) - (7) % 1 Adjusted pre-tax margin, adjusted non-fuel cost and adjusted CASM-ex (SLA) exclude, among other things, special items. We are unable to reconcile these forward-looking projections to GAAP as the nature or amount of such special items cannot be determined at this time. See slides 2 and 3 for a cautionary statement regarding forward-looking statements. 2 Fuel prices are as of the forward pricing curve on February 2, 2024 3Stage Length Adjusted (SLA): Adjusted CASM excluding fuel* Square root (stage length / 1,000) $2.85 - $2.95Fuel Cost (per gallon)2 $2.70 - $2.80 1 - 3 % Adj. Pre-tax Margin1 (non-GAAP) Capacity Growth (y/y) Fuel Cost (per gallon)2 Adj. Non-fuel Cost1 (non-GAAP) (MM) Adj. CASM-ex (SLA)1,3 (non-GAAP) (y/y) $645 - $660 Down

TARGET 12 Full-year 2025 Target Adj. Pre-tax Margin1 (non-GAAP) FY2025 1 Adjusted pre-tax margin excludes, among other things, special items. We are unable to reconcile these forward-looking projections to GAAP as the nature or amount of such special items cannot be determined at this time. See slides 2 and 3 for a cautionary statement regarding forward-looking statements. 10 - 14 % Based on the current operating environment, we are targeting margin expansion in 2025 as we realize a full year of benefits from network, revenue and cost initiatives

Jimmy Dempsey, President

Mark Mitchell, SVP & CFO

Analyst Q&A

Appendix

17 CASM to CASM (excluding fuel), Adjusted CASM (excluding fuel), Adjusted CASM and Adjusted CASM Including Net Interest, Non-GAAP Reconciliation The Company is providing below a reconciliation of GAAP financial information to the non-GAAP financial information provided. The non-GAAP financial information is included to provide supplemental disclosures because the Company believes they are useful additional indicators of, among other things, its operating and cost performance. These non-GAAP financial measures have limitations as analytical tools. Because of these limitations, determinations of the Company’s operating performance or CASM adjusted for special items should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. These non-GAAP financial measures may be presented on a different basis than other companies using similarly titled non-GAAP financial measures.

16 Footnotes to Accompany CASM to CASM (excluding fuel), Adjusted CASM (excluding fuel), Adjusted CASM and Adjusted CASM Including Net Interest, Non-GAAP Reconciliation

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

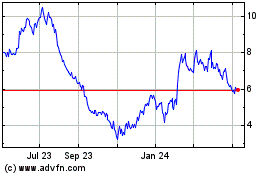

Frontier (NASDAQ:ULCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Frontier (NASDAQ:ULCC)

Historical Stock Chart

From Apr 2023 to Apr 2024