- Report of Foreign Issuer (6-K)

March 15 2012 - 12:43PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of March 2012

FORMULA SYSTEMS (1985) LTD.

(Translation of Registrant's Name into English)

5 HaPlada st., Or-Yehuda, Israel

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F

Form 20-F

S

Form 40-F

£

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

£

No

S

If "Yes" is marked indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82- ....................

Attached to Registrant's Form 6-K for the month of March 2012

and incorporated by reference herein is the Registrant's immediate report dated March 15, 2012.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to signed on its behalf by the undersigned, thereunto duly authorized.

FORMULA SYSTEMS (1985) LTD.

(Registrant)

By:/s/ Guy Bernstein

Guy Bernstein CEO

dated: March 15, 2012

FOR IMMEDIATE RELEASE

Formula Systems Reports Fiscal Year Results for 2011 with

an Increase of 17% in Revenues and an Increase of 134% in Net Income

2011 Revenues Increased 17% Year over Year to Reach $640.6 Million

with Net Income of $43.0 Million

Or Yehuda, Israel, March 15, 2011

–

Formula Systems (1985) Ltd. (NASDAQ: FORTY) a leading provider of software consulting services, computer-based business solutions,

and proprietary software products, today announced its results for the fourth quarter of 2011 and the full fiscal year ended December 31,

2011.

Financial Highlights for the Fourth

Quarter of 2011

|

|

·

|

Revenues for the fourth quarter ended on December 31,

2011, increased by 2.6% year over year to $157.3 million compared to $153.3 million in the same period last year. The

acquisition by Sapiens International Corporation N.V (NASDAQ and TASE: SPNS) of IDIT I.D.I. Technologies Ltd. and FIS Software

Ltd. Consummated on August 21, 2011, resulted in Formula’s loss of its controlling interest in Sapiens and the deconsolidation

of Sapiens’ results from Formula’s reports. Since August 21, 2011, the Company recorded Sapiens’ results under

the ‘equity in gains of affiliated company’ line in accordance with the equity method. Results for the corresponding

quarter in 2010 included Sapiens’ results on a consolidated basis for the full quarter.

|

|

|

·

|

Operating income for the fourth quarter ended December

31, 2011 decreased by 18.5% year over year to $10.7 million, compared to $13.1 million in the same period last year.

The decrease resulted primarily from Formula’s loss of control in Sapiens.

|

|

|

·

|

Net income for the fourth quarter decreased by 15.5%

year over year to $4.1 million compared to $4.9 million in the respective period last year.

|

Financial Highlights for the Full

Year Ended December 31, 2011

|

|

·

|

Revenues for the fiscal year ended December 31, 2011,

increased by 17% to $640.6 million compared to $549.7 million

in 2010. The acquisition

by Sapiens of IDIT I.D.I. Technologies Ltd. and FIS Software Ltd. consummated on August 21, 2011, resulted in Formula’s

loss of its controlling interest in Sapiens and the deconsolidation of Sapiens’ results from Formula’s reports. Since

August 21, 2011, the Company recorded Sapiens’ results under the ‘equity in gains of affiliated company’ line

in accordance with the equity method. Results for 2010 included Sapiens’ results on a consolidated basis for the full year.

Excluding Sapiens’ results, revenues increased by 21% compared to 2010.

|

|

|

·

|

Operating income for the fiscal year ended December 31,

2011, increased by 4% to $49.2 million compared to $47.2 million in 2010. Excluding Sapiens’ results, operating

income increased by 11% compared to 2010.

|

|

|

·

|

Net income for the fiscal year ended December 31, 2011,

increased by 134% to $43.0 million compared to $18.4 million in 2010. Net income for 2011 included income of $25.8 million

recorded in connection with the consummation of the acquisition by Sapiens of IDIT I.D.I. Technologies Ltd and FIS Software Ltd.

|

|

|

·

|

Formula’s consolidated cash and short-term and

long-term investments in marketable securities totaled approximately $111.0 million, as of December 31, 2011, of which Formula’s

standalone net cash and short-term and long-term investments totaled $1.7 million.

|

|

|

·

|

Total equity on December 31, 2011 was $354.8 million,

representing 53% of the total balance sheet.

|

|

|

·

|

On January 27, 2012, the Company consummated the purchase

of Sapiens common shares, resulting in the Company’s interest in Sapiens’ outstanding common share increasing to 52.1%,

restoring the Company’s controlling interest in Sapiens.

|

Comments of Management

Commenting on the results, Guy Bernstein,

CEO of Formula Systems, said: “The Formula group has concluded 2011 seeing the growth and improved operational performance

of Matrix, Magic, and Sapiens. We achieved significant increase in the group’s recorded profit, despite the deconsolidation

of Sapiens’ results (due to its merger with IDIT and FIS). In the first quarter of 2012 we have restored our controlling

interest in Sapiens through our acquisition of shares in the company. Magic also continue strengthening its standing after purchasing

BluePhoenix’s AppBuilder activity. Therefore, we enter 2012 with optimism regarding the performance of our three main companies,

which are continuing to increase their revenues organically, while also constantly pursuing opportunities for M&A activities

that will accelerate growth in the future.”

About Formula

Formula Systems Ltd. is a global information

technology company principally engaged, through its subsidiaries and affiliates, in providing software consulting services, developing

proprietary software products, and providing computer-based business solutions.

For more information, visit www.formulasystems.com.

Statements made in this press release that are not historical

facts are forward-looking statements. Such statements involve various risks that may cause actual results to differ materially.

These risks and uncertainties include, but are not limited to: market demand for the company’s products, dependence on strategic

partners, integration of new business, successful implementation of Formula’s products, economic and competitive factors,

international market conditions, management of growth, technological developments, the ability to finance operations and other

factors which are detailed in Formula’s Securities and Exchange Commission filings, including its most recent report on Form

20-F. Formula undertakes no obligation to publicly release any revision to any forward-looking statement.

Contact:

Formula Systems (1985) Ltd.

+972-3-5389487

ir@formula.co.il

FORMULA SYSTEMS (1985) LTD.

CONSOLIDATED CONDENSED STATEMENTS OF INCOME

U.S. dollars in thousands (except per share

data)

|

|

|

Three months ended

|

|

|

Year ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

2010

|

|

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

|

|

|

Revenues

|

|

|

157,329

|

|

|

|

153,337

|

|

|

|

640,617

|

|

|

|

549,694

|

|

|

Cost of revenues

|

|

|

123,739

|

|

|

|

115,133

|

|

|

|

492,886

|

|

|

|

412,463

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

33,590

|

|

|

|

38,204

|

|

|

|

147,731

|

|

|

|

137,231

|

|

|

Research and development costs, net

|

|

|

488

|

|

|

|

1,510

|

|

|

|

5,148

|

|

|

|

5,503

|

|

|

Selling, general and administrative expenses

|

|

|

22,400

|

|

|

|

23,566

|

|

|

|

93,340

|

|

|

|

84,510

|

|

|

Operating income

|

|

|

10,702

|

|

|

|

13,128

|

|

|

|

49,243

|

|

|

|

47,218

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses, net

|

|

|

1,541

|

|

|

|

1,617

|

|

|

|

6,500

|

|

|

|

4,371

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,161

|

|

|

|

11,511

|

|

|

|

42,743

|

|

|

|

42,847

|

|

|

Other income (expenses), net

|

|

|

(24

|

)

|

|

|

(379

|

)

|

|

|

207

|

|

|

|

(231

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxes on income

|

|

|

9,137

|

|

|

|

11,132

|

|

|

|

42,950

|

|

|

|

42,616

|

|

|

Taxes on income

|

|

|

(89

|

)

|

|

|

1,455

|

|

|

|

5,689

|

|

|

|

6,544

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,226

|

|

|

|

9,677

|

|

|

|

37,261

|

|

|

|

36,072

|

|

|

Gain derived from deconsolidation of subsidiary and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

equity in gains (losses) of affiliated companies, net

|

|

|

424

|

|

|

|

(421

|

)

|

|

|

25,870

|

|

|

|

(1,070

|

)

|

|

Net income

|

|

|

9,650

|

|

|

|

9,256

|

|

|

|

63,131

|

|

|

|

35,002

|

|

|

Net income attributable to non-controlling interests

|

|

|

5,534

|

|

|

|

4,386

|

|

|

|

20,169

|

|

|

|

16,623

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Formula's shareholders

|

|

|

4,116

|

|

|

|

4,870

|

|

|

|

42,962

|

|

|

|

18,379

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per share atributable Formula:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

0.31

|

|

|

|

0.36

|

|

|

|

3.17

|

|

|

|

1.37

|

|

|

Diluted

|

|

|

0.30

|

|

|

|

0.36

|

|

|

|

3.11

|

|

|

|

1.36

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

used in computing net earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

13,563

|

|

|

|

13,431

|

|

|

|

13,514

|

|

|

|

13,382

|

|

|

Diluted

|

|

|

13,678

|

|

|

|

13,530

|

|

|

|

13,669

|

|

|

|

13,523

|

|

FORMULA SYSTEMS (1985) LTD.

CONSOLIDATED CONDENSED BALANCE SHEETS

U.S. dollars in thousands

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

88,172

|

|

|

|

110,508

|

|

|

Marketable securities

|

|

|

14,347

|

|

|

|

38,170

|

|

|

Short-term deposits

|

|

|

5,170

|

|

|

|

24

|

|

|

Trade receivables

|

|

|

163,219

|

|

|

|

154,366

|

|

|

Other accounts receivable

|

|

|

33,635

|

|

|

|

23,140

|

|

|

Inventories

|

|

|

2,450

|

|

|

|

5,601

|

|

|

Total current assets

|

|

|

306,993

|

|

|

|

331,809

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM INVESTMENTS:

|

|

|

|

|

|

|

|

|

|

Marketable securities

|

|

|

3,264

|

|

|

|

2,828

|

|

|

Deferred Taxes

|

|

|

11,630

|

|

|

|

13,135

|

|

|

Investments in affiliated company

|

|

|

79,202

|

|

|

|

3,209

|

|

|

Prepaid expenses and other assets

|

|

|

3,885

|

|

|

|

5,493

|

|

|

Total long-Term Investments

|

|

|

97,981

|

|

|

|

24,665

|

|

|

|

|

|

|

|

|

|

|

|

|

SEVERANCE PAY FUND

|

|

|

49,507

|

|

|

|

55,286

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY, PLANTS AND EQUIPMENT, NET

|

|

|

19,165

|

|

|

|

12,411

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INTANGIBLE ASSETS AND GOODWILL

|

|

|

198,188

|

|

|

|

199,596

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

671,834

|

|

|

|

623,767

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Liabilities to banks

|

|

|

13,120

|

|

|

|

6,684

|

|

|

Trade payables

|

|

|

40,060

|

|

|

|

53,177

|

|

|

Deferred revenues

|

|

|

22,653

|

|

|

|

26,845

|

|

|

Employees and payroll accrual

|

|

|

40,814

|

|

|

|

40,704

|

|

|

Other accounts payable

|

|

|

27,693

|

|

|

|

30,693

|

|

|

Dividend payable to non controling interests

|

|

|

29

|

|

|

|

-

|

|

|

Liability in respect of business combinations

|

|

|

3,718

|

|

|

|

3,963

|

|

|

Debentures

|

|

|

31,472

|

|

|

|

15,927

|

|

|

Total current liabilities

|

|

|

179,559

|

|

|

|

177,993

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Debentures

|

|

|

15,246

|

|

|

|

31,854

|

|

|

Deferred taxes

|

|

|

4,836

|

|

|

|

2,654

|

|

|

Customer advances

|

|

|

2,094

|

|

|

|

3,520

|

|

|

Liabilities to banks and others

|

|

|

37,985

|

|

|

|

3,154

|

|

|

Liability in respect of business combinations

|

|

|

2,502

|

|

|

|

4,758

|

|

|

Accrued severance pay

|

|

|

63,321

|

|

|

|

65,450

|

|

|

Total long-term liabilities

|

|

|

125,984

|

|

|

|

111,390

|

|

|

|

|

|

|

|

|

|

|

|

|

REDEEMABLE NON-CONTROLING INTEREST

|

|

|

11,469

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

Formula shareholders' equity

|

|

|

221,281

|

|

|

|

197,615

|

|

|

Non-controlling interests

|

|

|

133,541

|

|

|

|

136,769

|

|

|

Total equity

|

|

|

354,822

|

|

|

|

334,384

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY

|

|

|

671,834

|

|

|

|

623,767

|

|

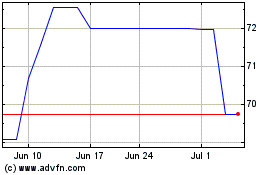

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Jul 2023 to Jul 2024