Leggett Misses, Lowers Guidance - Analyst Blog

October 28 2011 - 11:30AM

Zacks

Leggett & Platt Inc. (LEG), the

manufacturer of diversified engineered products and components,

recently posted second-quarter 2011 results that missed the Zacks

Consensus Estimates.

The company's quarterly earnings of 31 cents a share fell short

of the Zacks Consensus Estimate of 36 cents. However, quarterly

earnings were flat compared with the prior-year quarter.

Total sales of the company climbed 8.6% in the quarter to $940.9

million compared with $866.5 million a year ago, primarily backed

by sales growth in items that brought little incremental profit.

Moreover, increased pricing and favorable currency translations

mainly accounted for the growth. Total revenue of the company beats

the Zacks Consensus Estimate of $931.0 million.

Margins

Despite flat volume growth, gross profit for the quarter inched

up 1.0% to $170.4 million. However, gross margin contracted 140

basis points to 18.1%, reflecting higher cost of goods sold.

Operating income dropped 5.3% to $71.6 million, and operating

margin shrunk 110 basis points to 7.6% due to an increase of 7.2%

in Selling & Administrative Expenses.

The company has anticipated that the demand will pick up in the

second half of fiscal 2011. However, it came in the opposite

direction and analysts believe that it will take much longer time

than anticipated to see favorable economic scenario.

By Segment

Residential Furnishings revenue upped 6.4% to

$472.3 million in the quarter due to increased prices, units sold

and favorable foreign currency translations. However, increased

material costs, unfavorable sales mix and competitive pricing

resulted in a fall in operating income by 12.5% to $33.5

million.

Total sales of Commercial Fixturing &

Components moved down 5.2% to $141.7 million, primarily

due to a decline of 7.0% in unit volume. Consequently, operating

income plummeted 33.0% to $6.7 million.

Industrial Materials logged a total sales

increase of 18.3% to $216.7 million, backed by an increase in

prices and a shift in sales from intra-segment to trades sales.

However, operating income plunged 19.9% to $11.7 million due to

lower wire and tubing volumes and increased raw material costs.

Specialized Products segment witnessed a

significant growth of 17.4% to $187.7 million with operating income

increasing robustly by 7.3% to $20.6 million, primarily due to

increase in volumes partially offset by increased raw material

costs.

Leggett Enhances Return

Leggett remains committed to returning value to shareholders.

Fiscal 2011 marked the 40th consecutive year of a hiked dividend,

which has been increasing at a CAGR of 14.0%. The board of

directors has increased the quarterly dividend by a penny to 28

cents a share.

During the quarter under review, the company repurchased 2.6

million shares at an average price of $19.72 per share. The total

number of shares purchased during the fiscal has reached to 9.4

million. Year-to-date, the company has issued 2.9 million shares

under employee benefit and stock purchase plan.

Looking ahead, management plans to buy back a total of 10

million shares, its maximum authorization in a year, and issue

around 4 million shares in fiscal 2011.

Other Financial Details

Leggett exited the quarter with cash and cash equivalents of

$218.8 million, long-term debt of $897.3 million, and shareholders'

equity of $1,338.1 million. Leggett expects to generate more than

$300 million in cash from operations in 2011.

Guidance

Anticipating a lower market growth expectation, the company has

lowered its sales guidance for fiscal 2011 from the range of $3.5 –

$3.7 billion to $3.6 billion. On the back of promising sales,

Leggett also lowered and narrowed its forecasted 2011 EPS in the

range of $1.15 – $1.20 per share from $1.25 – $1.40 per share.

Leggett faces stiff competition from its rivals, such as

Flexsteel Industries Inc. (FLXS), Genuine

Parts Company (GPC) and Steelcase Inc.

(SCS), The company currently retains a Zacks #3 Rank, which

translates to a short-term Hold rating. However, our long-term

recommendation on the stock remains Neutral.

GENUINE PARTS (GPC): Free Stock Analysis Report

LEGGETT & PLATT (LEG): Free Stock Analysis Report

STEELCASE INC (SCS): Free Stock Analysis Report

Zacks Investment Research

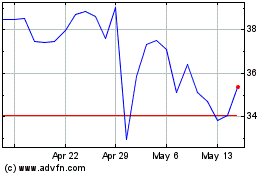

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jun 2024 to Jul 2024

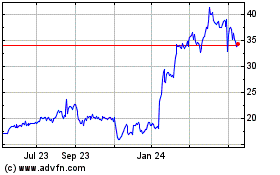

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jul 2023 to Jul 2024