true

--09-30

2023

FY

This Form 10-K/A is filed to amend Part IV, Item 15 (Exhibits and Financial Statement Schedules) of the Annual Report on Form 10-K for the fiscal year ended September 30, 2023, as filed on December 20, 2023 (the "Original Form 10-K"), to include as an exhibit the First Savings Financial Group, Inc. Clawback Policy.

0001435508

0001435508

2022-10-01

2023-09-30

0001435508

2023-03-31

0001435508

2023-12-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year

ended September 30, 2023

OR

¨ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition

period from _____________ to _____________

Commission File Number: 1-34155

FIRST SAVINGS FINANCIAL GROUP, INC.

(Exact name of registrant as

specified in its charter)

| |

|

|

| Indiana |

|

37-1567871 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 702 North Shore Drive, Suite 300, Jeffersonville, Indiana |

|

47130 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (812) 283-0724

Securities registered pursuant

to Section 12(b) of the Act:

| |

|

|

|

|

| Common Stock, par value $0.01 per share |

|

FSFG |

|

NASDAQ Stock Market, LLC |

| (Title of each class) |

|

(Trading symbol(s)) |

|

(Name of each exchange on which registered) |

Securities registered pursuant

to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨

No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, small reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

|

| Large Accelerated Filer ¨ |

Accelerated Filer x |

| Non-accelerated Filer ¨ |

Smaller Reporting Company x |

| Emerging Growth Company ¨ |

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report. x

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate

by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value

of the voting and non-voting common equity held by nonaffiliates was $136.0 million, based upon the closing price of $16.09 per share

as quoted on the NASDAQ Stock Market as of the last business day of the registrant’s most recently completed second fiscal quarter

ended March 31, 2023.

The number of shares outstanding

of the registrant’s common stock as of December 4, 2023 was 6,917,921.

DOCUMENTS INCORPORATED

BY REFERENCE

Portions

of the Proxy Statement for the 2024 Annual Meeting of Stockholders are incorporated by reference in Part III of the Form 10-K.

| Auditor

Name |

|

Firm

ID |

|

Location |

| FORVIS,

LLP |

|

686 |

|

Louisville, Kentucky |

EXPLANATORY NOTE

This Form 10-K/A is

filed to amend Part IV, Item 15 (Exhibits and Financial Statement Schedules) of the Annual Report on Form 10-K for the fiscal year

ended September 30, 2023, as filed on December 20, 2023 (the "Original Form 10-K"), to include as an exhibit the First

Savings Financial Group, Inc. Clawback Policy.

Except as described above, this Form 10-K/A does not modify or update disclosure in, or exhibits to, the Original Form 10-K. Furthermore,

this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the

Original Form 10-K. As such, information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time

the Original Form 10-K was filed. Accordingly, this Form 10-K/A should be read in conjunction with the Original Form 10-K and other filings

of First Savings Financial Group, Inc. with the Securities and Exchange Commission.

PART IV

Item

15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

| (1) | The financial statements required in response to this item are incorporated by reference from Item 8 of this Annual Report on Form

10-K. |

| (2) | All financial statement schedules are omitted because they are not required or applicable, or the required information is shown in

the consolidated financial statements or the notes thereto. |

| No. |

|

Description |

| |

|

|

| 3.1 |

|

Articles of Incorporation of First Savings Financial Group, Inc. (1) |

| 3.2 |

|

Articles of Amendment to the Articles of Incorporation for the Series A Preferred Stock (8) |

| 3.3 |

|

Bylaws of First Savings Financial Group, Inc. (1) |

| 4.0 |

|

Specimen Stock Certificate of First Savings Financial Group, Inc. (1) |

| 10.1 |

|

Amended and Restated Employment Agreement by and among First Savings Financial Group, Inc., First Savings Bank and Larry W. Myers, dated October 7, 2009* (3) |

| 10.2 |

|

Change in Control Agreement by and between First Savings Bank and Jackie R. Journell dated October 7, 2019 (6) |

| 10.3 |

|

Amended and Restated Employment Agreement by and among First Savings Financial Group, Inc., First Savings Bank and Anthony A. Schoen, dated October 7, 2009* (3) |

| 10.4 |

|

First Savings Bank, F.S.B. Employee Severance Compensation Plan* (4) |

| 10.5 |

|

First Savings Bank, F.S.B. Supplemental Executive Retirement Plan* (4) |

| 10.6 |

|

Agreement and Plan of Reorganization dated July 21, 2017 (2) |

| 10.7 |

|

Amended and Restated Director Deferred Compensation Agreement* (1) |

| 10.8 |

|

Subordinated Note Purchase Agreement dated September 20, 2018 (5) |

| 10.9 |

|

Subordinated Note Purchase Agreement dated March 18, 2022 (7) |

| 21.0 |

|

Subsidiaries of the Registrant (9) |

| 23.0 |

|

Consent of FORVIS, LLP (9) |

| 23.1 |

|

Consent of Monroe Shine & Co., Inc. (9) |

| 31.1 |

|

Rule 13a-14(a)/15d-14(a) Certificate of Chief Executive Officer |

| 31.2 |

|

Rule 13a-14(a)/15d-14(a) Certificate of Chief Financial Officer |

| 32.0 |

|

Section 1350 Certificate of Chief Executive Officer and Chief Financial Officer |

| 97.0 |

|

First Savings Financial Group, Inc. Clawback Policy |

| 101.0 |

|

The following materials from the Company’s Annual Report on Form 10-K for the year ended September 30, 2023, formatted in XBRL (Extensible Business Reporting Language): (i) the Consolidated Balance Sheets, (ii) the Consolidated Statements of Income, (iii) the Consolidated Statement of Changes in Stockholders’ Equity, (iv) the Consolidated Statements of Cash Flows and (v) the Notes to the Consolidated Financial Statements. |

| 104.0 |

|

Cover Page Interactive Data File (Formatted in Inline XBRL) |

| * | Management contract or compensatory plan, contract or arrangement |

| (1) | Incorporated herein by reference to the exhibits to the Company’s Registration Statement on Form

S-1 (File No. 333-151636), as amended, initially filed with the Securities and Exchange Commission on June 13, 2008. |

| (2) | Incorporated by reference to the exhibits to the Company’s Current Report on Form 8-K filed with

the Securities and Exchange Commission on July 26, 2017. |

| (3) | Incorporated herein by reference to the exhibits to the Company’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on October 8, 2009. |

| (4) | Incorporated herein by reference to the exhibits to the Company’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on October 10, 2008. |

| (5) | Incorporated herein by reference to the exhibits to the Company’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on September 24, 2018. |

| (6) | Incorporated herein by reference to the exhibits to the Company’s Annual Report on Form 10-K filed

with the Securities and Exchange Commission on December 17, 2020. |

| (7) | Incorporated herein by reference to the exhibits to the Company’s Current Report on form 8-K filed

with the Securities and Exchange Commission on March 21, 2022. |

| (8) | Incorporated herein by reference to the exhibits to the Company’s Current Report on form 8-K filed

with the Securities and Exchange Commission on August 17, 2011. |

| | (9) | Incorporated herein by reference to the exhibits to the Company’s Annual Report on Form 10-K filed with the Securities and Exchange

Commission on December 20, 2023. |

SIGNATURES

Pursuant to the requirements

of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

| |

FIRST SAVINGS FINANCIAL GROUP, INC. |

| |

|

| Date: February 29, 2024 |

By: |

/s/ Larry W. Myers |

| |

|

Larry W. Myers |

| |

|

President, Chief Executive Officer and Director |

EXHIBIT 31.1

CERTIFICATION

I, Larry W. Myers,

certify that:

| 1. | I have reviewed this Annual Report on Form 10-K/A of First Savings Financial Group, Inc.: |

| 2. | Based on my knowledge, this annual report does not contain any untrue statement of a material fact or

omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made,

not misleading with respect to the period covered by this annual report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this annual

report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of,

and for, the periods presented in this annual report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining

disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to

be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries,

is made known to us by others within those entities, particularly during the period in which this annual report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial

reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the

preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented

in this annual report our conclusions about the effectiveness of the disclosure controls and procedures, as the end of the period covered

by this annual report based on such evaluation; |

| (d) | Disclosed in this report any change in the registrant's internal control over financial reporting that

occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that

has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation

of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of

directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over

financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report

financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant

role in the registrant’s internal control over financial reporting. |

| |

|

| Date: February 29, 2024 |

/s/ Larry W. Myers |

| |

Larry W. Myers |

| |

President and Chief Executive Officer |

| |

(principal executive officer) |

EXHIBIT 31.2

CERTIFICATION

I, Anthony A.

Schoen, certify that:

| 1. | I have reviewed this Annual Report on Form 10-K/A of First Savings Financial Group, Inc.: |

| 2. | Based on my knowledge, this annual report does not contain any untrue statement of a material fact or

omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made,

not misleading with respect to the period covered by this annual report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this annual

report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of,

and for, the periods presented in this annual report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining

disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to

be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries,

is made known to us by others within those entities, particularly during the period in which this annual report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial

reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the

preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented

in this annual report our conclusions about the effectiveness of the disclosure controls and procedures, as the end of the period covered

by this annual report based on such evaluation; |

| (d) | Disclosed in this report any change in the registrant's internal control over financial reporting that

occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that

has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation

of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of

directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over

financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report

financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant

role in the registrant’s internal control over financial reporting. |

| |

|

| Date: February 29, 2024 |

/s/ Anthony A. Schoen |

| |

Anthony A. Schoen |

| |

Chief Financial Officer |

| |

(principal financial and accounting officer) |

EXHIBIT 32.0

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADDED BY

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual

Report of First Savings Financial Group, Inc. (the “Company”) on Form 10-K/A for the year ended September 30, 2023 as filed

with the Securities and Exchange Commission (the “Report”), the undersigned hereby certify, pursuant to 18 U.S.C. §1350,

as added by § 906 of the Sarbanes-Oxley Act of 2002, that:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act

of 1934; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition

and results of operations of the Company as of and for the period covered by the Report. |

| |

/s/ Larry W. Myers |

| |

President and Chief Executive Officer |

| |

(principal executive officer) |

| |

/s/ Anthony A. Schoen |

| |

Anthony A. Schoen |

| |

Chief Financial Officer |

| |

(principal financial and accounting officer) |

February 29, 2024

EXHIBIT 97.0

FIRST SAVINGS FINANCIAL GROUP, INC.

CLAWBACK POLICY

The Board of Directors (the

“Board”) of First Savings Financial Group, Inc. (the “Company”) believes that it is in the best interests of the

Company and its shareholders to adopt this Clawback Policy (this “Policy”), which provides for the recovery of Erroneously

Awarded Compensation in the event the Company is required to prepare an Accounting Restatement.

The Company has adopted this

Policy as a supplement to any other clawback policies or provisions in effect now or in the future at the Company. To the extent this

Policy applies to compensation payable to a person covered by this Policy, it shall supersede any other conflicting provision or policy

maintained by the Company and shall be the only clawback policy applicable to such compensation and no other clawback policy shall apply;

provided that, if such other policy or provision provides that a greater amount of such compensation shall be subject to clawback, such

other policy or provision shall apply to the amount in excess of the amount subject to clawback under this Policy.

This Policy shall be interpreted

to comply with the clawback rules found in 17 C.F.R. §240.10D-1 promulgated under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”) and the related listing rules of the national securities exchange or national securities association

(the “Exchange”) on which the Company has listed securities, and, to the extent this Policy is in any manner deemed inconsistent

with such rules, this Policy shall be treated as retroactively amended to be compliant with such rules.

| (a) | “Accounting Restatement” means an accounting restatement due to the

material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting

restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements,

or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. |

| (b) | “Accounting Restatement Date” means the earlier to occur of: (i) the

date the Board, a committee of the Board, or the officer or officers of the Company authorized to take such action if Board action is

not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement or (ii)

the date a court, regulatory agency, or other legally authorized body directs the Company to prepare an Accounting Restatement. |

| (c) | “Erroneously Awarded Compensation” means, in the event of an Accounting

Restatement, the amount of Incentive-Based Compensation previously received that exceeds the amount of Incentive-Based Compensation that

otherwise would have been received had it been determined based on the restated amounts in such Accounting Restatement. The amount of

Erroneously Awarded Compensation shall be determined on a gross basis without regard to any taxes paid by the relevant Executive Officer;

provided, however, that for Incentive-Based Compensation based on the Company’s stock price or total shareholder return, where the

amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an Accounting

Restatement: (i) the amount of Erroneously Awarded Compensation shall be based on a reasonable estimate of the effect of the Accounting

Restatement on the stock price or total shareholder return upon which the Incentive-Based Compensation was received and (ii) the Company

must maintain documentation of the determination of such reasonable estimate and provide such documentation to the Stock Exchange. |

| (d) | “Executive Officer” means the Company’s president, principal financial officer, principal

accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal

business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function,

or any other person who performs similar policy-making functions for the Company. An executive officer of the Company’s parent or

subsidiary is deemed an “Executive Officer” if the executive officer performs policy making functions for the Company. |

| (e) | “Financial Reporting Measure” means any measure that is determined

and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measure

that is derived wholly or in part from such measure; provided, however, that a Financial Reporting Measure is not required to be presented

within the Company’s financial statements or included in a filing with the Securities and Exchange Commission to qualify as a “Financial

Reporting Measure.” For purposes of this Policy, “Financial Reporting Measure” includes, but is not limited to, stock

price and total shareholder return. |

| (f) | “Incentive-Based Compensation” means any compensation that is granted, earned, or vested based

wholly or in part upon the attainment of a Financial Reporting Measure. |

| (g) | “Received” means incentive-based compensation received in the Company’s fiscal period

during which the financial reporting measure specified in the incentive-based compensation award is attained, even if the payment or grant

of the incentive-based compensation occurs after the end of that period. |

2. Application

of the Policy. This Policy shall only apply in the event that the Company is required to prepare an Accounting Restatement and it

shall apply to all Incentive-Based Compensation Received by a person: (a) after beginning service as an Executive Officer; (b) who served

as an Executive Officer at any time during the performance period for such Incentive-Based Compensation; (c) while the Company had a class

of securities listed on a national securities exchange or a national securities association; and (d) during the three completed fiscal

years immediately preceding the Accounting Restatement Date. In addition to such last three completed fiscal years, the immediately

preceding clause (d) includes any transition period that results from a change in the Company’s fiscal year within or immediately

following such three completed fiscal years; provided, however, that a transition period between the last day of the Company’s previous

fiscal year end and the first day of its new fiscal year that comprises a period of nine to twelve months shall be deemed a completed

fiscal year.

3. Recovery

Period. The Incentive-Based Compensation subject to clawback is the Incentive-Based Compensation Received during the three completed

fiscal years immediately preceding an Accounting Restatement Date; provided that the individual served as an Executive Officer at any

time during the performance period applicable to the Incentive-Based Compensation in question. Notwithstanding the foregoing, the Policy

shall only apply if the Incentive-Based Compensation is Received (1) while the Company has a class of securities listed on an Exchange,

and (2) on or after October 2, 2023.

4. Erroneously

Awarded Compensation. The amount of Incentive-Based Compensation subject to the Policy (“Erroneously Awarded Compensation”)

is the amount of Incentive-Based Compensation Received that exceeds the amount of Incentive Based-Compensation that otherwise would have

been Received had it been determined based on the restated amounts in the Company’s financial statements and shall be computed without

regard to any taxes paid. For Incentive-Based Compensation based on stock price or total shareholder return, where the amount of Erroneously

Awarded Compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement: (1) the

amount shall be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or total shareholder return

upon which the Incentive-Based Compensation was received; and (2) the Company must maintain documentation of the determination of that

reasonable estimate and provide such documentation to the Exchange. The Board shall determine, in its sole discretion, the timing and

method for promptly recouping Erroneously Awarded Compensation hereunder, which may include without limitation (a) seeking reimbursement

of all or part of any cash or equity-based award, (b) cancelling prior cash or equity-based awards, whether vested or unvested or paid

or unpaid, (c) cancelling or offsetting against any planned future cash or equity-based awards, (d) forfeiture of deferred compensation,

subject to compliance with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations

promulgated thereunder and (e) any other method authorized by applicable law or contract. Subject to compliance with any applicable law,

the Board may affect recovery under this Policy from any amount otherwise payable to the Executive Officer, including amounts payable

to such individual under any otherwise applicable Company plan or program, including base salary, bonuses or commissions and compensation

previously deferred by the Executive Officer.

5. Recovery

Exceptions. The Company shall recover reasonably promptly any Erroneously Awarded Compensation except to the extent that the conditions

of paragraphs (a), (b) or (c) below apply. The Compensation Committee of the Board of Directors (the “Committee”) shall determine

the repayment schedule for each amount of Erroneously Awarded Compensation in a manner that complies with this “reasonably promptly”

requirement. Such determination shall be consistent with any applicable legal guidance by the Securities and Exchange Commission, judicial

opinion, or otherwise. The determination of “reasonably promptly” may vary from case to case and the Committee is authorized

to adopt additional rules to further describe what repayment schedules satisfy this requirement.

| (a) | Erroneously Awarded Compensation need not be recovered if the direct expense paid to a third party to

assist in enforcing the Policy would exceed the amount to be recovered and the Committee has made a determination that recovery would

be impracticable. Before concluding that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on

expense of enforcement, the Company shall make a reasonable attempt to recover such Erroneously Awarded Compensation, document such reasonable

attempt(s) to recover, and provide that documentation to the Exchange, as required. |

| (b) | If applicable, Erroneously Awarded Compensation need not be recovered if recovery would violate home country

law where that law was adopted prior to November 28, 2022. Before concluding that it would be impracticable to recover any amount of Erroneously

Awarded Compensation based on violation of home country law, the Company shall obtain an opinion of home country counsel, acceptable to

the Exchange, that recovery would result in such a violation and shall provide such opinion to the Exchange. |

| (c) | Erroneously Awarded Compensation need not be recovered if recovery would likely cause an otherwise tax-qualified

retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of Section 401(a)(13)

or Section 411(a) of the Code and regulations thereunder. |

6. Committee

Decisions. Decisions of the Committee with respect to this Policy shall be final, conclusive and binding on all Executive Officers

subject to this Policy, unless determined by a court of competent jurisdiction to be an abuse of discretion. Any members of the Committee,

and any other members of the Board who assist in the administration of this Policy, shall not be personally liable for any action, determination

or interpretation made with respect to this Policy and shall be fully indemnified by the Company to the fullest extent under applicable

law and Company policy with respect to any such action, determination or interpretation. The foregoing sentence shall not limit any other

rights to indemnification of the members of the Board under applicable law or Company policy.

7. No

Indemnification. Notwithstanding anything to the contrary in any other policy of the Company, the governing documents of the Company

or any agreement between the Company and an Executive Officer, no Executive Officer shall be indemnified by the Company against the loss

of any Erroneously Awarded Compensation. Further, the Company is prohibited from paying or reimbursing an Executive Officer for purchasing

insurance to cover any such loss.

8. Agreement

to Policy by Executive Officers. The Committee shall take reasonable steps to inform Executive Officers of this Policy and the Executive

Officers shall acknowledge receipt and adherence to this Policy in writing.

9. Exhibit

Filing Requirement. A copy of this Policy and any amendments thereto shall be filed as an exhibit to the Company’s Annual Report

on Form 10-K.

10. Amendment.

The Board may amend, modify or supplement all or any portion of this Policy at any time and from time to time in its discretion.

[TO BE SIGNED BY EACH OF THE COMPANY’S

EXECUTIVE OFFICERS]

Clawback Policy Acknowledgment

I, the undersigned, agree and acknowledge that

I am fully bound by, and subject to, all of the terms and conditions of the First Savings Financial Group, Inc. Clawback Policy (as may

be amended, restated, supplemented or otherwise modified from time to time, the “Policy”) and that I have been provided a

copy of the Policy. In the event of any inconsistency between the Policy and the terms of any employment or similar agreement to which

I am a party, or the terms of any compensation plan, program or agreement under which any compensation has been granted, awarded, earned

or paid, the terms of the Policy shall govern. If the Committee determines that any amounts granted, awarded, earned or paid to me must

be forfeited or reimbursed to the Company, I will promptly take any action necessary to effectuate such forfeiture and/or reimbursement.

v3.24.0.1

Cover - USD ($)

$ in Millions |

12 Months Ended |

|

|

Sep. 30, 2023 |

Dec. 04, 2023 |

Mar. 31, 2023 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

This Form 10-K/A is filed to amend Part IV, Item 15 (Exhibits and Financial Statement Schedules) of the Annual Report on Form 10-K for the fiscal year ended September 30, 2023, as filed on December 20, 2023 (the "Original Form 10-K"), to include as an exhibit the First Savings Financial Group, Inc. Clawback Policy.

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Sep. 30, 2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Current Fiscal Year End Date |

--09-30

|

|

|

| Entity File Number |

1-34155

|

|

|

| Entity Registrant Name |

FIRST SAVINGS FINANCIAL GROUP, INC.

|

|

|

| Entity Central Index Key |

0001435508

|

|

|

| Entity Tax Identification Number |

37-1567871

|

|

|

| Entity Incorporation, State or Country Code |

IN

|

|

|

| Entity Address, Address Line One |

702 North Shore Drive, Suite 300,

|

|

|

| Entity Address, City or Town |

Jeffersonville

|

|

|

| Entity Address, State or Province |

IN

|

|

|

| Entity Address, Postal Zip Code |

47130

|

|

|

| City Area Code |

812

|

|

|

| Local Phone Number |

283-0724

|

|

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

|

|

| Trading Symbol |

FSFG

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 136.0

|

| Entity Common Stock, Shares Outstanding |

|

6,917,921

|

|

| ICFR Auditor Attestation Flag |

true

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Auditor Name |

FORVIS,

LLP

|

|

|

| Auditor Firm ID |

686

|

|

|

| Auditor Location |

Louisville, Kentucky

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

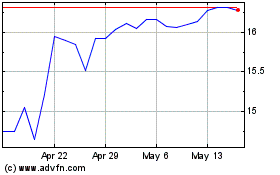

First Savings Financial (NASDAQ:FSFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

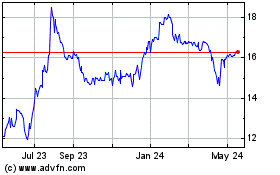

First Savings Financial (NASDAQ:FSFG)

Historical Stock Chart

From Apr 2023 to Apr 2024