false

0001435508

0001435508

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): February 6, 2024

FIRST SAVINGS FINANCIAL GROUP, INC.

(Exact Name of Registrant as Specified in

Charter)

| Indiana |

001-34155 |

37-1567871 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File No.) |

(I.R.S. Employer

Identification No.) |

| 702 North Shore Drive, Suite 300, Jeffersonville, Indiana |

47130 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (812) 283-0724

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

FSFG |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.07. | Submission of Matters to a Vote of Security Holders |

The 2024 Annual Meeting of Shareholders of First

Savings Financial Group, Inc. (the “Company”) was held on February 6, 2024. The final results of the vote on each matter submitted

to a vote of shareholders are as follows:

| 1. | The following individuals were elected as directors of the Company, each to serve for a three-year term or until his successor is

duly elected and qualified, by the following vote: |

| |

|

For |

|

Withhold |

|

Broker Non-Votes |

| |

|

|

|

|

|

|

| Pamela Bennett-Martin |

|

3,715,248 |

|

478,295 |

|

1,555,174 |

| Martin A. Padgett |

|

3,621,764 |

|

571,779 |

|

1,555,174 |

| John E. Colin |

|

3,051,803 |

|

1,141,740 |

|

1,555,174 |

| 2. | The appointment of FORVIS, LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending

September 30, 2024, was ratified by the following non-binding advisory vote: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| |

|

|

|

|

|

|

| 4,965,566 |

|

735,739 |

|

47,412 |

|

0 |

| 3. | A resolution to approve the compensation of the Company’s named executive officers, as disclosed in the proxy statement, was

approved by the following non-binding advisory vote: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| |

|

|

|

|

|

|

| 3,400,149 |

|

673,507 |

|

119,887 |

|

1,555,174 |

| Item 7.01. | Regulation FD Disclosure. |

President and Chief Executive Officer, Larry W.

Myers, delivered remarks at the 2024 Annual Meeting of Shareholders. The text of his remarks is furnished as Exbibit 99.1 hereto and is

incorporated into this Item 7.01 by reference.

Item 9.01. Financial Statements and Exhibits.

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FIRST SAVINGS FINANCIAL GROUP, INC. |

| |

|

|

| |

|

|

| Date:February 6, 2024 |

By: |

/s/ Tony A. Schoen |

| |

|

Tony A. Schoen |

| |

|

Chief Financial Officer |

Exhibit 99.1

REMARKS DELIVERED BY PRESIDENT AND CHIEF EXECUTIVE

OFFICER, LARRY W. MYERS, AT THE 2024 ANNUAL MEETING OF SHAREHOLDERS OF FIRST SAVINGS FINANCIAL GROUP, INC.

Jeffersonville, Indiana — February 6, 2024.

Larry W. Myers, President and Chief Executive Officer of First Savings Financial Group, Inc. (NASDAQ: FSFG - news) (the "Company"),

the holding company for First Savings Bank (the "Bank"), and the Bank, delivered the following remarks at the Company’s

2024 Annual Meeting of Shareholders held on February 6, 2024.

Welcome once again to the annual meeting of shareholders of First Savings

Financial Group, Inc.

Our performance in 2023 can be summarized in one word – unacceptable.

It was unacceptable to our shareholders, to our community stakeholders, and most importantly, it is unacceptable to our team. This is

not who we are or who we strive to be. We have spent the last 15 years building an incredible bank. To have a year like 2023 was, well,

just unacceptable.

I can provide this audience with plenty of excuses for 2023’s

performance, some of which are very good. However, excuses are a feeble attempt to pass responsibility. Accepting responsibility is the

starting point for moving forward. We have accepted that responsibility to get us back on the path of success.

During 2023, we recognized the storm that was headed our direction.

We took a number of significant steps toward improving our performance. Early in the year, we tightened our lending standards, shying

away from out-of-market activities in order to preserve liquidity for our core banking clients and decelerating the overall growth of

the Bank. In June, we sold approximately $80 million in lower yielding securities, using the proceeds to repay high-cost borrowings. Throughout

the year, we worked persistently to right-size our mortgage banking unit, bringing the staffing levels down from a peak of 430 to 134

employees in September, before finally ceasing operations in November. Along with that decision we sold the mortgage servicing rights

portfolio, which was priced near the top of the market and closed in November of 2023. While the exit from mortgage banking was difficult,

our short time with this business line was very beneficial for our shareholders. All of these steps during 2023 were part of our overall

strategy to de-lever and decrease risk for our institution.

2023 was also a year of moving mountains. We began the year with a

new external auditor FORVIS, which included a heightened level of expectations. Our accounting team worked diligently to satisfy these

new expectations, with additional work to be done. At this point, I would like to take the opportunity to recognize and thank Monroe Shine

for their 50 plus years of service to our organization as auditor and tax counsel. They have been a great partner and advisor. In August,

we completed our core operating system conversion, which was the culmination of an 18-month project that required thousands of hours of

effort across multiple departments. When fully deployed the new system will improve our business intelligence and create efficiencies.

In October 2023, we adopted CECL, which required an incredible amount of work from our accounting and credit administration staff. The

end result bolstered our reserves for credit losses on an already strong loan portfolio.

Looking to 2024, there are still a number of significant challenges.

The competition for deposits will be fierce. The current interest rate environment will continue to pressure on our net interest margin

NIM. This tight NIM will challenge us to be more efficient and seek cost savings at every turn. Also, this could be the year when the

long-anticipated recession finally occurs, potentially impacting credit quality.

On the positive side for 2024, our loan portfolios are well positioned

for any downturn. Currently, we have the lowest classified credits to capital ratio the Bank has ever reported. Our credit discipline

in prior years is paying dividends today. We continue to experience good profitability in our core banking unit. Recently we have seen

a number of successes in deposit gathering, bringing in nearly $40 million in new relationships in January. Our Small Business Lending

unit is fully staffed and producing at an increasingly robust level, currently with largest pipeline in this business line’s history.

In closing, I want to thank the staff and the Board of Directors for

keeping their focus in a challenging year. I thank our shareholders for bearing with us as we navigate these choppy waters. In 2024, we

must do better, and we will.

v3.24.0.1

Cover

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity File Number |

001-34155

|

| Entity Registrant Name |

FIRST SAVINGS FINANCIAL GROUP, INC.

|

| Entity Central Index Key |

0001435508

|

| Entity Tax Identification Number |

37-1567871

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity Address, Address Line One |

702 North Shore Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Jeffersonville

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

47130

|

| City Area Code |

812

|

| Local Phone Number |

283-0724

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FSFG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

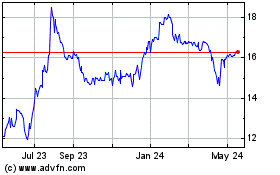

First Savings Financial (NASDAQ:FSFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

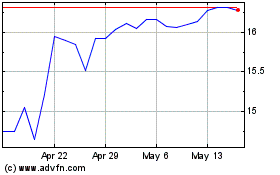

First Savings Financial (NASDAQ:FSFG)

Historical Stock Chart

From Apr 2023 to Apr 2024