0001435508

false

0001435508

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): July 27, 2023

FIRST SAVINGS FINANCIAL GROUP, INC.

(Exact Name of Registrant as Specified in

Charter)

| Indiana |

001-34155 |

37-1567871 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File No.) |

(I.R.S. Employer

Identification No.) |

| 702 North Shore Drive, Suite 300, Jeffersonville, Indiana |

47130 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (812) 283-0724

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

FSFG |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition |

On July 27, 2023, First Savings Financial Group,

Inc. announced its financial results for the three and nine months ended June 30, 2023. The press

release announcing the financial results for the three and nine months ended June 30, 2023 is furnished as Exhibit 99.1 and incorporated

herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FIRST SAVINGS FINANCIAL GROUP, INC. |

| |

|

| |

|

| Date:

July 27, 2023 |

By: |

/s/

Tony A. Schoen |

| |

|

Tony A. Schoen |

| |

|

Chief Financial Officer |

Exhibit 99.1

FIRST SAVINGS FINANCIAL GROUP, INC. REPORTS FINANCIAL RESULTS FOR THE

THIRD FISCAL QUARTER ENDED JUNE 30, 2023

Jeffersonville, Indiana — July 27, 2023.

First Savings Financial Group, Inc. (NASDAQ: FSFG - news) (the "Company"), the holding company for First Savings Bank (the "Bank"),

today reported net income of $2.3 million, or $0.34 per diluted share, for the quarter ended June 30, 2023 compared to net income of $2.6

million, or $0.37 per diluted share, for the quarter ended June 30, 2022.

During the June 2023 quarter, the Company repurchased

$2.0 million of subordinated debt that was issued by the Company in March 2022 at a discount during the 2023 period, which resulted in

a $660,000 gain. The Company used this gain as an opportunity to sell $78.5 million of available-for-sale securities during the quarter

for a net loss of $540,000. The sale of these securities was a strategic initiative to improve the Company’s liquidity posture and

remove an inefficient portion of the Company’s balance sheet in which the cost of funding was higher than the yield earned on the

securities. The proceeds from the sale of the securities were used to reduce FHLB borrowings in the June 2023 quarter.

Commenting on the Company’s performance,

Larry W. Myers, President and CEO, stated “This challenging environment for the banking industry will pass, but as it persists we’re

active to realign the balance sheet, stabilize the margin, manage expenses and make select investments in opportunities that will be fruitful

in future quarters and years. We continue to focus on core banking; asset quality; selective high-quality lending; lesser reliance on

wholesale funding; improvement of liquidity, capital and interest rate sensitivity positions; and evaluation of options and opportunities

to achieve such. We have acted to protect from persistently higher interest rates, which has adversely affected the current margin, while

still remaining well-positioned to benefit from a potential rates-down environment. The underperformance of the mortgage banking and SBA

lending segments are recognized but the macroeconomic environment for these businesses to perform well continues to improve. We are focused

on managing through the remainder of this economic dislocation and positioning the company for enhanced shareholder value.”

Results of Operations for the Three Months

Ended June 30, 2023 and 2022

Net interest income decreased $1.0 million, or

6.6%, to $14.9 million for the three months ended June 30, 2023 as compared to the same period 2022. The decrease in net interest income

was due to a $9.4 million increase in interest expense, partially offset by an $8.3 million increase in interest income. Interest income

increased due to an increase in the average balance of interest-earning assets of $372.9 million, from $1.74 billion for 2022 to $2.11

billion for 2023, and an increase in the weighted-average tax-equivalent yield, from 4.36% for 2022 to 5.20% for 2023. The increase in

the average balance of interest-earning assets was primarily due to an increase in the average balance of total loans of $334.1 million.

Interest expense increased due to an increase in the average balance of interest-bearing liabilities of $387.8 million, from $1.37 billion

for 2022 to $1.76 billion for 2023, and an increase in the average cost of interest-bearing liabilities, from 0.75% for 2022 to 2.71%

for 2023. The increase in the average cost of interest-bearing liabilities for 2023 was due primarily to higher rates paid for FHLB borrowings,

brokered deposits and money market deposit accounts primarily due to the increase in market interest rates.

The Company recognized a provision for loan losses

of $441,000 for the three months ended June 30, 2023 due primarily to loan portfolio growth, compared to a provision for loan losses of

$532,000 for the same period in 2022. The Company recognized net charge-offs of $61,000 for the three months ended June 30, 2023, compared

to net charge-offs of $27,000 in 2022.

Noninterest income decreased $2.8 million for

the three months ended June 30, 2023 as compared to the same period in 2022. The decrease was due primarily to a $2.4 million decrease

in mortgage banking income in 2023 compared to the same period in 2022 and the aforementioned $540,000 net loss on sale of available-for-sale

securities compared to a $476,000 gain recognized in 2022, partially offset by the aforementioned $660,000 gain on the repurchase of subordinated

debt. The decrease in mortgage banking income was primarily due to lower origination and sales volume in 2023 compared to 2022. Mortgage

loans originated for sale were $199.9 million in the three months ended June 30, 2023 as compared to $421.4 million for the same period

in 2022.

Noninterest expense decreased $3.9 million for

the three months ended June 30, 2023 as compared to the same period in 2022. The decrease was due primarily to a decrease in compensation

and benefits of $4.1 million. The decrease in compensation and benefits expense was due primarily to a reduction in staff and incentive

compensation for the Company’s mortgage banking segment as a result of decreased mortgage banking income.

The

Company recognized income tax expense of $331,000 for the three months ended June 30, 2023 compared to income tax benefit of $61,000

for the same period in 2022. The effective tax rate for the 2023 period was 12.5%. The increase in the effective tax rate was primarily

due to Company’s utilization of capital loss carryovers during the 2022 period with no corresponding utilization in the 2023 period.

Results of Operations for the Nine Months Ended

June 30, 2023 and 2022

The Company reported net income of $8.9 million,

or $1.29 per diluted share, for the nine months ended June 30, 2023 compared to net income of $14.0 million, or $1.95 per diluted share,

for the nine months ended June 30, 2022.

Net interest income increased $2.2 million, or

5.0%, to $46.0 million for the nine months ended June 30, 2023 as compared to the same period 2022. The increase in net interest income

was due to a $25.1 million increase in interest income, partially offset by a $22.8 million increase in interest expense. Interest income

increased due to an increase in the average balance of interest-earning assets of $429.9 million, from $1.61 billion for 2022 to $2.04

billion for 2023, and an increase in the weighted-average tax-equivalent yield, from 4.25% for 2022 to 5.03% for 2023. The increase in

the average balance of interest-earning assets was primarily due to increases in the average balance of total loans and investment securities

of $324.7 million and $109.7 million, respectively. Interest expense increased due to an increase in the average balance of interest-bearing

liabilities of $417.2 million, from $1.27 billion for 2022 to $1.68 billion for 2023, and an increase in the average cost of interest-bearing

liabilities, from 0.65% for 2022 to 2.30% for 2023. The increase in the average cost of interest-bearing liabilities for 2023 was due

primarily to higher rates for FHLB borrowings, brokered deposits and money market deposit accounts as a result of increases in market

interest rates.

The Company recognized a provision for loan losses

of $1.8 million for the nine months ended June 30, 2023 due primarily to loan portfolio growth, compared to $1.0 million for the same

period in 2022. Nonperforming loans, which consist of nonaccrual loans and loans over 90 days past due and still accruing interest, increased

$851,000 from $10.9 million at September 30, 2022 to $11.7 million at June 30, 2023. The Company recognized net charge-offs of $319,000

for the nine months ended June 30, 2023, of which $264,000 was related to unguaranteed portions of SBA loans, compared to net charge-offs

of $349,000 in 2022, of which $218,000 was related to unguaranteed portions of SBA loans.

Noninterest income decreased $26.8 million for

the nine months ended June 30, 2023 as compared to the same period in 2022. The decrease was due primarily to decreases in mortgage banking

income and net gain on sale of SBA loans of $24.8 million and $1.3 million, respectively. The decrease in mortgage banking income was

primarily due to lower origination and sales volume in the 2023 period compared to 2022. Mortgage loans originated for sale were $392.2

million in the nine months ended June 30, 2023 as compared to $1.42 billion in 2022. The decrease in net gain on sales of SBA loans was

due primarily to decreased sales volume from the SBA lending segment and lower premiums in the secondary market.

Noninterest expense decreased $18.7 million for

the nine months ended June 30, 2023 as compared to the same period in 2022. The decrease was due primarily to a decrease in compensation

and benefits, advertising expense and professional fees of $17.8 million, $1.1 million and $1.0 million, respectively. The decrease in

compensation and benefits expense was due primarily to a reduction in staff and incentive compensation for the Company’s mortgage

banking segment as a result of decreased mortgage banking activity. The decreases in professional fees and advertising expense were related

to the reduced activity and loan origination volume of the mortgage banking segment.

The

Company recognized income tax expense of $747,000 for the nine months ended June 30, 2023 compared to tax expense of $2.4 million

for the same period in 2022. The effective tax rate for the 2023 period was 7.7%, which was a decrease from the effective tax rate of

14.5% in 2022. The decrease was due to recognition of investment tax credits related to solar projects in 2023 and lower pre-tax income

in 2023 as compared to 2022.

Comparison of Financial Condition at June 30,

2023 and September 30, 2022

Total assets increased $166.7 million, from $2.09

billion at September 30, 2022 to $2.26 billion at June 30, 2023. Net loans held for investment increased $216.7 million during the nine

months ended June 30, 2023 due primarily to growth in residential mortgage loans and single-tenant net lease commercial real estate loans.

Available-for-sale securities decreased $68.1 million during the nine months ended June 30, 2023 due primarily to the sale of $78.5 million

of securities in June 2023

Total liabilities increased $153.2 million due

primarily to increases in total deposits and FHLB borrowings of $143.9 million and $37.7 million, respectively, partially offset by a

$39.8 million decrease in other borrowings primarily due to the reversal of secured borrowings recorded at September 30, 2022. The increase

in total deposits was primarily due to a $121.9 million increase in brokered deposits, partially offset by a $24.6 million decrease in

noninterest-bearing deposits. The increases in deposits and FHLB borrowings were primarily used to fund loan growth. As of June 30, 2023,

deposits exceeding the FDIC insurance limit of $250,000 per insured account were estimated to be not greater than 19.6% of total deposits.

The amount is believed to be less than 19.6% of total deposits due to certain accounts being structured to achieve a level of insurance

above the FDIC limit, but is difficult to quantify.

Common stockholders’ equity increased $13.5

million, from $151.6 million at September 30, 2022 to $165.1 million at June 30, 2023, due primarily to a decrease in accumulated other

comprehensive loss and increase in retained net income of $9.5 million and $6.1 million, respectively. The decrease in accumulated other

comprehensive loss was primarily due to decreasing long term market interest rates during the nine months ended June 30, 2023, which resulted

in an increase in the fair value of the available-for-sale securities portfolio. At June 30, 2023 and September 30, 2022, the Bank was

considered “well-capitalized” under applicable regulatory capital guidelines.

First Savings Bank is an entrepreneurial community

bank headquartered in Jeffersonville, Indiana, which is directly across the Ohio River from Louisville, Kentucky, and operates fifteen

depository branches within Southern Indiana. The Bank also has three national lending programs, including single-tenant net lease commercial

real estate, SBA lending and residential mortgage banking, with offices located throughout the United States. The Bank is a recognized

leader, both in its local communities and nationally for its lending programs. The employees of First Savings Bank strive daily to achieve

the organization’s vision, We Expect To Be The BEST community BANK, which fuels our success. The Company’s common shares

trade on The NASDAQ Stock Market under the symbol “FSFG.”

This release may contain forward-looking statements

within the meaning of the federal securities laws. These statements are not historical facts; rather, they are statements based on the

Company's current expectations regarding its business strategies and their intended results and its future performance. Forward-looking

statements are preceded by terms such as "expects," "believes," "anticipates," "intends" and similar

expressions.

Forward-looking statements are not guarantees

of future performance. Numerous risks and uncertainties could cause or contribute to the Company's actual results, performance and achievements

to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to

these differences include, without limitation, changes in general economic conditions; changes in market interest rates; changes in monetary

and fiscal policies of the federal government; legislative and regulatory changes; and other factors disclosed periodically in the Company's

filings with the Securities and Exchange Commission.

Because of the risks and uncertainties inherent

in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere

from time to time by the Company or on its behalf. Except as may be required by applicable law or regulation, the Company assumes no obligation

to update any forward-looking statements.

Contact:

Tony A. Schoen, CPA

Chief Financial Officer

812-283-0724

FIRST SAVINGS FINANCIAL GROUP, INC.

CONSOLIDATED FINANCIAL HIGHLIGHTS

(Unaudited)

| | |

Three Months Ended | | |

Nine Months Ended | |

| OPERATING DATA: | |

June 30, | | |

June 30, | |

| (In thousands, except share and per share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Total interest income | |

$ | 26,798 | | |

$ | 18,479 | | |

$ | 75,092 | | |

$ | 50,042 | |

| Total interest expense | |

| 11,933 | | |

| 2,568 | | |

| 29,054 | | |

| 6,215 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

| 14,865 | | |

| 15,911 | | |

| 46,038 | | |

| 43,827 | |

| Provision for loan losses | |

| 441 | | |

| 532 | | |

| 1,797 | | |

| 1,028 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net interest income after provision for loan losses | |

| 14,424 | | |

| 15,379 | | |

| 44,241 | | |

| 42,799 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total noninterest income | |

| 7,196 | | |

| 10,033 | | |

| 19,900 | | |

| 46,696 | |

| Total noninterest expense | |

| 18,965 | | |

| 22,835 | | |

| 54,475 | | |

| 73,148 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 2,655 | | |

| 2,577 | | |

| 9,666 | | |

| 16,347 | |

| Income tax expense (benefit) | |

| 331 | | |

| (61 | ) | |

| 747 | | |

| 2,369 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 2,324 | | |

$ | 2,638 | | |

$ | 8,919 | | |

$ | 13,978 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share, basic | |

$ | 0.34 | | |

$ | 0.37 | | |

$ | 1.30 | | |

$ | 1.97 | |

| Weighted average shares outstanding, basic | |

| 6,816,608 | | |

| 7,073,204 | | |

| 6,858,739 | | |

| 7,082,034 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share, diluted | |

$ | 0.34 | | |

$ | 0.37 | | |

$ | 1.29 | | |

$ | 1.95 | |

| Weighted average shares outstanding, diluted | |

| 6,819,748 | | |

| 7,145,288 | | |

| 6,893,766 | | |

| 7,166,632 | |

| | |

| | | |

| | | |

| | | |

| | |

| Performance ratios (annualized) | |

| | | |

| | | |

| | | |

| | |

| Return on average assets | |

| 0.41 | % | |

| 0.55 | % | |

| 0.54 | % | |

| 1.04 | % |

| Return on average equity | |

| 5.60 | % | |

| 6.06 | % | |

| 7.41 | % | |

| 10.33 | % |

| Return on average common stockholders' equity | |

| 5.60 | % | |

| 6.06 | % | |

| 7.41 | % | |

| 10.33 | % |

| Net interest margin (tax equivalent basis) | |

| 2.94 | % | |

| 3.77 | % | |

| 3.13 | % | |

| 3.73 | % |

| Efficiency ratio | |

| 85.97 | % | |

| 88.02 | % | |

| 82.62 | % | |

| 80.81 | % |

| | |

| | |

| | |

QTD | | |

| | |

FYTD | |

| FINANCIAL CONDITION DATA: | |

June 30, | | |

March 31, | | |

Increase | | |

September 30, | | |

Increase | |

| (In thousands, except per share data) | |

2023 | | |

2023 | | |

(Decrease) | | |

2022 | | |

(Decrease) | |

| Total assets | |

$ | 2,260,421 | | |

$ | 2,239,606 | | |

$ | 20,815 | | |

$ | 2,093,725 | | |

$ | 166,696 | |

| Cash and cash equivalents | |

| 42,475 | | |

| 41,810 | | |

| 665 | | |

| 41,665 | | |

| 810 | |

| Investment securities | |

| 249,788 | | |

| 336,317 | | |

| (86,529 | ) | |

| 318,075 | | |

| (68,287 | ) |

| Loans held for sale | |

| 63,142 | | |

| 48,783 | | |

| 14,359 | | |

| 60,462 | | |

| 2,680 | |

| Gross loans | |

| 1,708,127 | | |

| 1,614,898 | | |

| 93,229 | | |

| 1,489,904 | | |

| 218,223 | |

| Allowance for loan losses | |

| 16,838 | | |

| 16,458 | | |

| 380 | | |

| 15,360 | | |

| 1,478 | |

| Interest earning assets | |

| 2,048,891 | | |

| 2,032,610 | | |

| 16,281 | | |

| 1,898,051 | | |

| 150,840 | |

| Goodwill | |

| 9,848 | | |

| 9,848 | | |

| - | | |

| 9,848 | | |

| - | |

| Core deposit intangibles | |

| 614 | | |

| 668 | | |

| (54 | ) | |

| 775 | | |

| (161 | ) |

| Loan servicing rights | |

| 64,139 | | |

| 65,045 | | |

| (906 | ) | |

| 67,194 | | |

| (3,055 | ) |

| Noninterest-bearing deposits | |

| 315,602 | | |

| 318,869 | | |

| (3,267 | ) | |

| 340,172 | | |

| (24,570 | ) |

| Interest-bearing deposits (1) | |

| 1,344,163 | | |

| 1,224,013 | | |

| 120,150 | | |

| 1,175,662 | | |

| 168,501 | |

| Federal Home Loan Bank borrowings | |

| 345,000 | | |

| 437,795 | | |

| (92,795 | ) | |

| 307,303 | | |

| 37,697 | |

| Subordinated debt and other borrowings, net of issuance costs | |

| 48,387 | | |

| 50,330 | | |

| (1,943 | ) | |

| 88,206 | | |

| (39,819 | ) |

| Total liabilities | |

| 2,095,353 | | |

| 2,072,708 | | |

| 22,645 | | |

| 1,942,160 | | |

| 153,193 | |

| Accumulated other comprehensive income (loss) | |

| (17,565 | ) | |

| (14,199 | ) | |

| (3,366 | ) | |

| (27,079 | ) | |

| 9,514 | |

| Stockholders' equity, net of noncontrolling interests | |

| 165,068 | | |

| 166,898 | | |

| (1,830 | ) | |

| 151,565 | | |

| 13,503 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Book value per share | |

$ | 24.04 | | |

$ | 24.31 | | |

$ | (0.27 | ) | |

$ | 21.74 | | |

$ | 2.30 | |

| Tangible book value per share (2) | |

| 22.52 | | |

| 22.78 | | |

| (0.26 | ) | |

| 20.22 | | |

| 2.30 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-performing assets: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonaccrual loans - SBA guaranteed | |

$ | 5,753 | | |

$ | 5,456 | | |

$ | 297 | | |

$ | 5,474 | | |

$ | 279 | |

| Nonaccrual loans - unguaranteed | |

| 5,954 | | |

| 6,993 | | |

| (1,039 | ) | |

| 5,382 | | |

| 572 | |

| Total nonaccrual loans | |

$ | 11,707 | | |

$ | 12,449 | | |

$ | (742 | ) | |

$ | 10,856 | | |

$ | 851 | |

| Accruing loans past due 90 days | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total non-performing loans | |

| 11,707 | | |

| 12,449 | | |

| (742 | ) | |

| 10,856 | | |

| 851 | |

| Foreclosed real estate | |

| 30 | | |

| - | | |

| 30 | | |

| - | | |

| 30 | |

| Troubled debt restructurings classified as performing loans | |

| 2,373 | | |

| 2,446 | | |

| (73 | ) | |

| 2,714 | | |

| (341 | ) |

| Total non-performing assets | |

$ | 14,110 | | |

$ | 14,895 | | |

$ | (785 | ) | |

$ | 13,570 | | |

$ | 540 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset quality ratios: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowance for loan losses as a percent of total gross loans | |

| 0.99 | % | |

| 1.02 | % | |

| (0.03 | %) | |

| 1.03 | % | |

| (0.04 | %) |

| Allowance for loan losses as a percent of nonperforming loans | |

| 143.83 | % | |

| 132.20 | % | |

| 11.63 | % | |

| 141.49 | % | |

| 2.34 | % |

| Nonperforming loans as a percent of total gross loans | |

| 0.69 | % | |

| 0.77 | % | |

| (0.09 | %) | |

| 0.73 | % | |

| (0.04 | %) |

| Nonperforming assets as a percent of total assets | |

| 0.62 | % | |

| 0.67 | % | |

| (0.04 | %) | |

| 0.65 | % | |

| (0.03 | %) |

| (1) | Includes $414.2 million, $337.0 million and $292.5 million of

brokered certificates of deposit at June 30, 2023, March 31, 2023 and September 30, 2022, respectively. |

| (2) | See reconciliation of GAAP and non-GAAP financial measures for

additional information relating to calculation of this item. |

RECONCILIATION OF GAAP AND NON-GAAP FINANCIAL MEASURES (UNAUDITED):

The following non-GAAP financial measures

used by the Company provide information useful to investors in understanding the Company's performance. The Company

believes the financial measures presented below are important because of their widespread use by investors as a means to evaluate

capital adequacy and earnings. The following table summarizes the non-GAAP financial measures derived from amounts

reported in the Company's consolidated financial statements and reconciles those non-GAAP financial measures with the comparable

GAAP financial measures.

| | |

| | |

| | |

QTD | | |

| | |

FYTD | |

| Tangible Book Value Per Share | |

June 30, | | |

March 31, | | |

Increase | | |

September 30, | | |

Increase | |

| (In thousands, except share and per share data) | |

2023 | | |

2023 | | |

(Decrease) | | |

2023 | | |

(Decrease) | |

| Stockholders' equity, net of noncontrolling interests (GAAP) | |

$ | 165,068 | | |

$ | 166,898 | | |

$ | (1,830 | ) | |

$ | 151,565 | | |

$ | 13,503 | |

| Less: goodwill and core deposit intangibles | |

| (10,462 | ) | |

| (10,516 | ) | |

| 54 | | |

| (10,623 | ) | |

| 161 | |

| Tangible equity (non-GAAP) | |

$ | 154,606 | | |

$ | 156,382 | | |

$ | (1,776 | ) | |

$ | 140,942 | | |

$ | 13,664 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Outstanding common shares | |

| 6,865,921 | | |

| 6,865,921 | | |

| - | | |

| 6,970,631 | | |

| (104,710 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible book value per share (non-GAAP) | |

$ | 22.52 | | |

$ | 22.78 | | |

$ | (0.26 | ) | |

$ | 20.22 | | |

$ | 2.30 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Book value per share (GAAP) | |

$ | 24.04 | | |

$ | 24.31 | | |

$ | (0.27 | ) | |

$ | 21.74 | | |

$ | 2.30 | |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED): | |

As of | |

| Summarized Consolidated Balance Sheets | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands, except per share data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Total cash and cash equivalents | |

$ | 42,475 | | |

$ | 41,810 | | |

$ | 38,278 | | |

$ | 41,665 | | |

$ | 37,468 | |

| Total investment securities | |

| 249,788 | | |

| 336,317 | | |

| 330,683 | | |

| 318,075 | | |

| 309,027 | |

| Total loans held for sale | |

| 63,142 | | |

| 48,783 | | |

| 44,281 | | |

| 60,462 | | |

| 188,031 | |

| Total loans, net of allowance for loan losses | |

| 1,691,289 | | |

| 1,598,440 | | |

| 1,582,940 | | |

| 1,474,544 | | |

| 1,267,816 | |

| Loan servicing rights | |

| 64,139 | | |

| 65,045 | | |

| 65,598 | | |

| 67,194 | | |

| 69,039 | |

| Total assets | |

| 2,260,421 | | |

| 2,239,606 | | |

| 2,196,919 | | |

| 2,093,725 | | |

| 2,006,666 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Retail deposits | |

$ | 1,245,534 | | |

$ | 1,206,154 | | |

$ | 1,211,677 | | |

$ | 1,223,330 | | |

$ | 1,186,582 | |

| Brokered deposits | |

| 414,231 | | |

| 336,728 | | |

| 326,164 | | |

| 292,504 | | |

| 159,125 | |

| Total deposits | |

| 1,659,765 | | |

| 1,542,882 | | |

| 1,537,841 | | |

| 1,515,834 | | |

| 1,345,707 | |

| Federal Home Loan Bank borrowings | |

| 345,000 | | |

| 437,795 | | |

| 377,643 | | |

| 307,303 | | |

| 404,098 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock and additional paid-in capital | |

$ | 27,518 | | |

$ | 27,443 | | |

$ | 27,425 | | |

$ | 26,848 | | |

$ | 27,236 | |

| Retained earnings - substantially restricted | |

| 168,015 | | |

| 166,652 | | |

| 163,890 | | |

| 161,927 | | |

| 161,438 | |

| Accumulated other comprehensive income (loss) | |

| (17,565 | ) | |

| (14,199 | ) | |

| (19,000 | ) | |

| (27,079 | ) | |

| (12,560 | ) |

| Unearned stock compensation | |

| (1,113 | ) | |

| (1,211 | ) | |

| (1,361 | ) | |

| (969 | ) | |

| (1,075 | ) |

| Less treasury stock, at cost | |

| (11,787 | ) | |

| (11,787 | ) | |

| (10,810 | ) | |

| (9,162 | ) | |

| (5,826 | ) |

| Total stockholders' equity | |

| 165,068 | | |

| 166,898 | | |

| 160,144 | | |

| 151,565 | | |

| 169,213 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Outstanding common shares | |

| 6,865,921 | | |

| 6,865,921 | | |

| 6,917,921 | | |

| 6,970,631 | | |

| 7,110,706 | |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| Summarized Consolidated Statements of Income | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands, except per share data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Total interest income | |

$ | 26,798 | | |

$ | 24,811 | | |

$ | 23,483 | | |

$ | 21,152 | | |

$ | 18,479 | |

| Total interest expense | |

| 11,933 | | |

| 9,899 | | |

| 7,222 | | |

| 4,327 | | |

| 2,568 | |

| Net interest income | |

| 14,865 | | |

| 14,912 | | |

| 16,261 | | |

| 16,825 | | |

| 15,911 | |

| Provision for loan losses | |

| 441 | | |

| 372 | | |

| 984 | | |

| 880 | | |

| 532 | |

| Net interest income after provision for loan losses | |

| 14,424 | | |

| 14,540 | | |

| 15,277 | | |

| 15,945 | | |

| 15,379 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total noninterest income | |

| 7,196 | | |

| 7,516 | | |

| 5,188 | | |

| 4,531 | | |

| 10,033 | |

| Total noninterest expense | |

| 18,965 | | |

| 17,999 | | |

| 17,511 | | |

| 19,514 | | |

| 22,835 | |

| Income before income taxes | |

| 2,655 | | |

| 4,057 | | |

| 2,954 | | |

| 962 | | |

| 2,577 | |

| Income tax expense (benefit) | |

| 331 | | |

| 333 | | |

| 83 | | |

| (446 | ) | |

| (61 | ) |

| Net income | |

$ | 2,324 | | |

$ | 3,724 | | |

$ | 2,871 | | |

$ | 1,408 | | |

$ | 2,638 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share, basic | |

$ | 0.34 | | |

$ | 0.54 | | |

$ | 0.42 | | |

$ | 0.20 | | |

$ | 0.37 | |

| Weighted average shares outstanding, basic | |

| 6,816,608 | | |

| 6,842,897 | | |

| 6,915,909 | | |

| 6,988,873 | | |

| 7,073,204 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share, diluted | |

$ | 0.34 | | |

$ | 0.54 | | |

$ | 0.41 | | |

$ | 0.20 | | |

$ | 0.37 | |

| Weighted average shares outstanding, diluted | |

| 6,819,748 | | |

| 6,881,496 | | |

| 6,972,055 | | |

| 7,056,138 | | |

| 7,145,288 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| Consolidated Performance Ratios (annualized) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Return on average assets | |

| 0.41 | % | |

| 0.68 | % | |

| 0.54 | % | |

| 0.28 | % | |

| 0.55 | % |

| Return on average equity | |

| 5.60 | % | |

| 9.15 | % | |

| 7.50 | % | |

| 3.30 | % | |

| 6.06 | % |

| Return on average common stockholders' equity | |

| 5.60 | % | |

| 9.15 | % | |

| 7.50 | % | |

| 3.30 | % | |

| 6.06 | % |

| Net interest margin (tax equivalent basis) | |

| 2.94 | % | |

| 3.06 | % | |

| 3.41 | % | |

| 3.75 | % | |

| 3.77 | % |

| Efficiency ratio | |

| 85.97 | % | |

| 80.25 | % | |

| 81.64 | % | |

| 91.37 | % | |

| 88.02 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

As of or for the Three Months Ended | |

| | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| Consolidated Asset Quality Ratios | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Nonperforming loans as a percentage of total loans | |

| 0.69 | % | |

| 0.77 | % | |

| 0.72 | % | |

| 0.73 | % | |

| 0.77 | % |

| Nonperforming assets as a percentage of total assets | |

| 0.62 | % | |

| 0.67 | % | |

| 0.64 | % | |

| 0.65 | % | |

| 0.63 | % |

| Allowance for loan losses as a percentage of total loans | |

| 0.99 | % | |

| 1.02 | % | |

| 1.01 | % | |

| 1.03 | % | |

| 1.17 | % |

| Allowance for loan losses as a percentage of nonperforming loans | |

| 143.83 | % | |

| 132.20 | % | |

| 139.55 | % | |

| 141.49 | % | |

| 151.59 | % |

| Net charge-offs to average outstanding loans | |

| 0.00 | % | |

| 0.00 | % | |

| 0.02 | % | |

| 0.03 | % | |

| 0.00 | % |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| Segmented Statements of Income Information | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands, except per share data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Core Banking Segment: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

$ | 13,407 | | |

$ | 13,632 | | |

$ | 15,008 | | |

$ | 14,994 | | |

$ | 13,848 | |

| Provision for loan losses | |

| 880 | | |

| 422 | | |

| 701 | | |

| 769 | | |

| 910 | |

| Net interest income after provision for loan losses | |

| 12,527 | | |

| 13,210 | | |

| 14,307 | | |

| 14,225 | | |

| 12,938 | |

| Noninterest income | |

| 1,965 | | |

| 1,733 | | |

| 1,928 | | |

| 1,808 | | |

| 2,379 | |

| Noninterest expense | |

| 11,010 | | |

| 10,651 | | |

| 9,797 | | |

| 10,499 | | |

| 10,187 | |

| Income before income taxes | |

| 3,482 | | |

| 4,292 | | |

| 6,438 | | |

| 5,534 | | |

| 5,130 | |

| Income tax expense | |

| 561 | | |

| 401 | | |

| 946 | | |

| 735 | | |

| 568 | |

| Net income | |

$ | 2,921 | | |

$ | 3,891 | | |

$ | 5,492 | | |

$ | 4,799 | | |

$ | 4,562 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| SBA Lending Segment (Q2): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

$ | 1,098 | | |

$ | 1,093 | | |

$ | 995 | | |

$ | 1,182 | | |

$ | 1,449 | |

| Provision (credit) for loan losses | |

| (439 | ) | |

| (50 | ) | |

| 283 | | |

| 111 | | |

| (378 | ) |

| Net interest income after provision (credit) for loan losses | |

| 1,537 | | |

| 1,143 | | |

| 712 | | |

| 1,071 | | |

| 1,827 | |

| Noninterest income | |

| 580 | | |

| 1,636 | | |

| 754 | | |

| 480 | | |

| 584 | |

| Noninterest expense | |

| 2,107 | | |

| 2,662 | | |

| 1,924 | | |

| 1,891 | | |

| 2,341 | |

| Income (loss) before income taxes | |

| 10 | | |

| 117 | | |

| (458 | ) | |

| (340 | ) | |

| 70 | |

| Income tax expense (benefit) | |

| (21 | ) | |

| 20 | | |

| (107 | ) | |

| (123 | ) | |

| 26 | |

| Net income (loss) | |

$ | 31 | | |

$ | 97 | | |

$ | (351 | ) | |

$ | (217 | ) | |

$ | 44 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mortgage Banking Segment: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

| 360 | | |

$ | 187 | | |

$ | 258 | | |

$ | 649 | | |

$ | 614 | |

| Provision for loan losses | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net interest income after provision for loan losses | |

| 360 | | |

| 187 | | |

| 258 | | |

| 649 | | |

| 614 | |

| Noninterest income | |

| 4,651 | | |

| 4,147 | | |

| 2,506 | | |

| 2,243 | | |

| 7,070 | |

| Noninterest expense | |

| 5,848 | | |

| 4,686 | | |

| 5,790 | | |

| 7,124 | | |

| 10,307 | |

| Loss before income taxes | |

| (837 | ) | |

| (352 | ) | |

| (3,026 | ) | |

| (4,232 | ) | |

| (2,623 | ) |

| Income tax benefit | |

| (209 | ) | |

| (88 | ) | |

| (756 | ) | |

| (1,058 | ) | |

| (655 | ) |

| Net loss | |

$ | (628 | ) | |

$ | (264 | ) | |

$ | (2,270 | ) | |

$ | (3,174 | ) | |

$ | (1,968 | ) |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| Segmented Statements of Income Information | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands, except per share data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Net Income (Loss) Per Share by Segment | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share, basic - Core Banking | |

$ | 0.43 | | |

$ | 0.57 | | |

$ | 0.80 | | |

$ | 0.68 | | |

$ | 0.64 | |

| Net income (loss) per share, basic - SBA Lending (Q2) | |

| - | | |

| 0.01 | | |

| (0.05 | ) | |

| (0.03 | ) | |

| 0.01 | |

| Net loss per share, basic - Mortgage Banking | |

| (0.09 | ) | |

| (0.04 | ) | |

| (0.33 | ) | |

| (0.45 | ) | |

| (0.28 | ) |

| Total net income per share, basic | |

$ | 0.34 | | |

$ | 0.54 | | |

$ | 0.42 | | |

$ | 0.20 | | |

$ | 0.37 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss) Per Diluted Share by Segment | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share, diluted - Core Banking | |

$ | 0.43 | | |

$ | 0.57 | | |

$ | 0.79 | | |

$ | 0.68 | | |

$ | 0.64 | |

| Net income (loss) per share, diluted - SBA Lending (Q2) | |

| - | | |

| 0.01 | | |

| (0.05 | ) | |

| (0.03 | ) | |

| 0.01 | |

| Net loss per share, diluted - Mortgage Banking | |

| (0.09 | ) | |

| (0.04 | ) | |

| (0.33 | ) | |

| (0.45 | ) | |

| (0.28 | ) |

| Total net income per share, diluted | |

$ | 0.34 | | |

$ | 0.54 | | |

$ | 0.41 | | |

$ | 0.20 | | |

$ | 0.37 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on Average Assets by Segment (annualized) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Core Banking | |

| 0.61 | % | |

| 0.85 | % | |

| 1.17 | % | |

| 1.08 | % | |

| 1.12 | % |

| SBA Lending | |

| 0.15 | % | |

| 0.42 | % | |

| (1.38 | %) | |

| (0.85 | %) | |

| 0.17 | % |

| Mortgage Banking | |

| (2.24 | %) | |

| (1.14 | %) | |

| (9.31 | %) | |

| (9.44 | %) | |

| (4.50 | %) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Efficiency Ratio by Segment (annualized) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Core Banking | |

| 71.62 | % | |

| 69.32 | % | |

| 57.85 | % | |

| 62.49 | % | |

| 62.78 | % |

| SBA Lending | |

| 125.57 | % | |

| 97.54 | % | |

| 110.01 | % | |

| 113.78 | % | |

| 115.15 | % |

| Mortgage Banking | |

| 116.70 | % | |

| 108.12 | % | |

| 209.48 | % | |

| 246.33 | % | |

| 134.14 | % |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| Noninterest Expense Detail by Segment | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Core Banking Segment: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation (3) | |

$ | 4,978 | | |

$ | 5,578 | | |

$ | 5,275 | | |

$ | 4,444 | | |

$ | 5,995 | |

| Occupancy | |

| 1,738 | | |

| 1,401 | | |

| 1,443 | | |

| 1,374 | | |

| 1,412 | |

| Advertising | |

| 334 | | |

| 298 | | |

| 213 | | |

| 272 | | |

| 284 | |

| Other | |

| 3,960 | | |

| 3,374 | | |

| 2,866 | | |

| 4,409 | | |

| 2,496 | |

| Total Noninterest Expense | |

$ | 11,010 | | |

$ | 10,651 | | |

$ | 9,797 | | |

$ | 10,499 | | |

$ | 10,187 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| SBA Lending Segment (Q2): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation | |

$ | 1,803 | | |

$ | 1,800 | | |

$ | 1,622 | | |

$ | 1,690 | | |

$ | 1,619 | |

| Occupancy | |

| 70 | | |

| 70 | | |

| 54 | | |

| 41 | | |

| 60 | |

| Advertising | |

| 11 | | |

| 8 | | |

| 2 | | |

| 8 | | |

| 3 | |

| Other | |

| 223 | | |

| 784 | | |

| 246 | | |

| 152 | | |

| 659 | |

| Total Noninterest Expense | |

$ | 2,107 | | |

$ | 2,662 | | |

$ | 1,924 | | |

$ | 1,891 | | |

$ | 2,341 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mortgage Banking Segment: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation (3) | |

$ | 4,357 | | |

$ | 3,029 | | |

$ | 3,788 | | |

$ | 5,091 | | |

$ | 7,601 | |

| Occupancy | |

| 469 | | |

| 449 | | |

| 363 | | |

| 491 | | |

| 597 | |

| Advertising | |

| 191 | | |

| 213 | | |

| 203 | | |

| 319 | | |

| 519 | |

| Other | |

| 831 | | |

| 995 | | |

| 1,436 | | |

| 1,223 | | |

| 1,590 | |

| Total Noninterest Expense | |

$ | 5,848 | | |

$ | 4,686 | | |

$ | 5,790 | | |

$ | 7,124 | | |

$ | 10,307 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| (3) Compensation includes increases for Core Banking and corresponding decreases for Mortgage Banking segment that represent intersegment allocations for loans originated by the Mortgage Banking segment to be held for investment in the Core Banking loan portfolio of: | |

$ | 1,440 | | |

$ | 1,328 | | |

$ | 1,192 | | |

$ | 945 | | |

$ | 1,164 | |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| Mortgage Banking Noninterest Expense Fixed vs. Variable | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| (In thousands) | |

| | |

| | |

| | |

| | |

| |

| Noninterest Expense - Fixed Expenses | |

$ | 3,715 | | |

$ | 3,513 | | |

$ | 4,561 | | |

$ | 5,724 | | |

$ | 6,989 | |

| Noninterest Expense - Variable Expenses (4) | |

| 2,133 | | |

| 1,173 | | |

| 1,229 | | |

| 1,400 | | |

| 3,318 | |

| Total Noninterest Expense | |

$ | 5,848 | | |

$ | 4,686 | | |

$ | 5,790 | | |

$ | 7,124 | | |

$ | 10,307 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended | |

| SBA Lending (Q2) Data | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands, except percentage data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Final funded loans guaranteed portion sold, SBA | |

$ | 7,721 | | |

$ | 15,337 | | |

$ | 11,293 | | |

$ | 3,772 | | |

$ | 5,364 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross gain on sales of loans, SBA | |

$ | 780 | | |

$ | 1,293 | | |

$ | 936 | | |

$ | 393 | | |

$ | 592 | |

| Weighted average gross gain on sales of loans, SBA | |

| 10.10 | % | |

| 8.43 | % | |

| 8.29 | % | |

| 10.42 | % | |

| 11.04 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net gain on sales of loans, SBA (5) | |

$ | 497 | | |

$ | 907 | | |

$ | 775 | | |

$ | 249 | | |

$ | 486 | |

| Weighted average net gain on sales of loans, SBA | |

| 6.44 | % | |

| 5.91 | % | |

| 6.86 | % | |

| 6.60 | % | |

| 9.06 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended | |

| Mortgage Banking Data | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands, except percentage data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Mortgage originations for sale in the secondary market | |

$ | 199,601 | | |

$ | 115,011 | | |

$ | 77,605 | | |

$ | 185,981 | | |

$ | 421,426 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mortgage sales | |

$ | 185,557 | | |

$ | 99,711 | | |

$ | 96,177 | | |

$ | 241,804 | | |

$ | 426,200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross gain on sales of loans, mortgage banking (6) | |

$ | 3,570 | | |

$ | 2,308 | | |

$ | 1,217 | | |

$ | 2,630 | | |

$ | 7,419 | |

| Weighted average gross gain on sales of loans, mortgage banking | |

| 1.92 | % | |

| 2.31 | % | |

| 1.27 | % | |

| 1.09 | % | |

| 1.74 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mortgage banking income (7) | |

$ | 4,668 | | |

$ | 4,149 | | |

$ | 2,496 | | |

$ | 2,246 | | |

$ | 7,093 | |

| (4) | Variable expenses include incentive compensation and advertising

expenses. |

| (5) | Inclusive of gains on servicing assets and net of commissions,

referral fees, SBA repair fees and discounts on unguaranteed portions held-for-investment. |

| (6) | Inclusive of gains on capitalized mortgage servicing rights,

realized hedging gains and loan fees, and net of lender credits and other investor expenses. |

| (7) | Inclusive of loan fees, servicing income, gains or losses on

mortgage servicing rights, fair value adjustments and gains or losses on derivative instruments, and net of lender credits and other

investor expenses. |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| Summarized Consolidated Average Balance Sheets | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Interest-earning assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average balances: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits with banks | |

$ | 20,661 | | |

$ | 27,649 | | |

$ | 19,379 | | |

$ | 28,318 | | |

$ | 25,068 | |

| Loans, excluding PPP loans | |

| 1,719,733 | | |

| 1,621,147 | | |

| 1,583,182 | | |

| 1,479,167 | | |

| 1,385,637 | |

| Investment securities - taxable | |

| 109,319 | | |

| 110,373 | | |

| 111,936 | | |

| 94,836 | | |

| 103,536 | |

| Investment securities - nontaxable | |

| 234,118 | | |

| 242,530 | | |

| 241,504 | | |

| 230,312 | | |

| 202,534 | |

| FRB and FHLB stock | |

| 24,509 | | |

| 23,289 | | |

| 20,063 | | |

| 19,890 | | |

| 18,691 | |

| Total interest-earning assets | |

$ | 2,108,340 | | |

$ | 2,024,988 | | |

$ | 1,976,064 | | |

$ | 1,852,523 | | |

$ | 1,735,466 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income (tax equivalent basis): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits with banks | |

$ | 267 | | |

$ | 192 | | |

$ | 144 | | |

$ | 97 | | |

$ | 37 | |

| Loans | |

| 23,279 | | |

| 21,339 | | |

| 20,222 | | |

| 18,029 | | |

| 15,965 | |

| Investment securities - taxable | |

| 984 | | |

| 957 | | |

| 955 | | |

| 740 | | |

| 769 | |

| Investment securities - nontaxable | |

| 2,456 | | |

| 2,533 | | |

| 2,505 | | |

| 2,352 | | |

| 1,987 | |

| FRB and FHLB stock | |

| 423 | | |

| 364 | | |

| 220 | | |

| 265 | | |

| 169 | |

| Total interest income (tax equivalent basis) | |

$ | 27,409 | | |

$ | 25,385 | | |

$ | 24,046 | | |

$ | 21,483 | | |

$ | 18,927 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average yield (tax equivalent basis, annualized): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits with banks | |

| 5.17 | % | |

| 2.78 | % | |

| 2.97 | % | |

| 1.37 | % | |

| 0.59 | % |

| Loans | |

| 5.41 | % | |

| 5.27 | % | |

| 5.11 | % | |

| 4.88 | % | |

| 4.61 | % |

| Investment securities - taxable | |

| 3.60 | % | |

| 3.47 | % | |

| 3.41 | % | |

| 3.12 | % | |

| 2.97 | % |

| Investment securities - nontaxable | |

| 4.20 | % | |

| 4.18 | % | |

| 4.15 | % | |

| 4.08 | % | |

| 3.92 | % |

| FRB and FHLB stock | |

| 6.90 | % | |

| 6.25 | % | |

| 4.39 | % | |

| 5.33 | % | |

| 3.62 | % |

| Total interest-earning assets | |

| 5.20 | % | |

| 5.01 | % | |

| 4.87 | % | |

| 4.64 | % | |

| 4.36 | % |

| SUMMARIZED FINANCIAL INFORMATION (UNAUDITED) (CONTINUED): | |

Three Months Ended | |

| Summarized Consolidated Average Balance Sheets | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | |

| (In thousands) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| Interest-bearing liabilities | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average balances: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits | |

$ | 1,278,776 | | |

$ | 1,251,080 | | |

$ | 1,213,419 | | |

$ | 1,125,659 | | |

$ | 998,868 | |

| Fed funds purchased | |

| 11 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Federal Home Loan Bank borrowings | |

| 434,182 | | |

| 374,593 | | |

| 311,146 | | |

| 301,027 | | |

| 325,460 | |

| Subordinated debt and other borrowings | |

| 49,339 | | |

| 50,293 | | |

| 88,304 | | |

| 50,179 | | |

| 50,152 | |

| Total interest-bearing liabilities | |

$ | 1,762,308 | | |

$ | 1,675,966 | | |

$ | 1,612,869 | | |

$ | 1,476,865 | | |

$ | 1,374,480 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits | |

$ | 7,791 | | |

$ | 6,265 | | |

$ | 4,158 | | |

$ | 2,306 | | |

$ | 1,047 | |

| Fed funds purchased | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Federal Home Loan Bank borrowings | |

| 3,446 | | |

| 2,915 | | |

| 1,919 | | |

| 1,111 | | |

| 811 | |

| Subordinated debt and other borrowings | |

| 696 | | |

| 719 | | |

| 1,145 | | |

| 714 | | |

| 710 | |

| Total interest expense | |

$ | 11,933 | | |

$ | 9,899 | | |

$ | 7,222 | | |

$ | 4,131 | | |

$ | 2,568 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average cost (annualized): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits | |

| 2.44 | % | |

| 2.00 | % | |

| 1.37 | % | |

| 0.82 | % | |

| 0.42 | % |

| Federal Home Loan Bank borrowings | |

| 3.17 | % | |

| 3.11 | % | |

| 2.47 | % | |

| 1.48 | % | |

| 1.00 | % |

| Subordinated debt and other borrowings | |

| 5.64 | % | |

| 5.72 | % | |

| 5.19 | % | |

| 5.69 | % | |

| 5.66 | % |

| Total interest-bearing liabilities | |

| 2.71 | % | |

| 2.36 | % | |

| 1.79 | % | |

| 1.12 | % | |

| 0.75 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income (taxable equivalent basis) | |

$ | 15,476 | | |

$ | 15,486 | | |

$ | 16,824 | | |

$ | 17,352 | | |

$ | 16,359 | |

| Less: taxable equivalent adjustment | |

| (611 | ) | |

| (574 | ) | |

| (563 | ) | |

| (527 | ) | |

| (448 | ) |

| Net interest income | |

$ | 14,865 | | |

$ | 14,912 | | |

$ | 16,261 | | |

$ | 16,825 | | |

$ | 15,911 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest rate spread (tax equivalent basis, annualized) | |

| 2.49 | % | |

| 2.65 | % | |

| 3.08 | % | |

| 3.52 | % | |

| 3.61 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest margin (tax equivalent basis, annualized) | |

| 2.94 | % | |

| 3.06 | % | |

| 3.41 | % | |

| 3.75 | % | |

| 3.77 | % |

v3.23.2

Cover

|

Jul. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity File Number |

001-34155

|

| Entity Registrant Name |

FIRST SAVINGS FINANCIAL GROUP, INC.

|

| Entity Central Index Key |

0001435508

|

| Entity Tax Identification Number |

37-1567871

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity Address, Address Line One |

702 North Shore Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Jeffersonville

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

47130

|

| City Area Code |

812

|

| Local Phone Number |

283-0724

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FSFG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

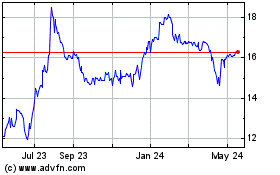

First Savings Financial (NASDAQ:FSFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

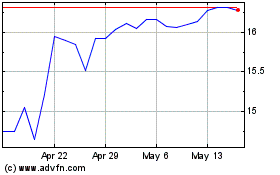

First Savings Financial (NASDAQ:FSFG)

Historical Stock Chart

From Apr 2023 to Apr 2024