NYSE Euronext Turns On NJ Data Center As E-Migration Begins

August 25 2010 - 5:15PM

Dow Jones News

NYSE Euronext this week flipped the "on" switch for its new data

center facility, shifting all trading systems for its New York

Stock Exchange and Amex equities markets to a nondescript building

35 miles from the exchange's Wall Street trading floor.

The parent of the Big Board is the second major U.S. exchange

company to set up shop in its own data center this month, after

Chicago-based CME Group Inc. (CME) last week moved its

futures-trading engines into a proprietary facility in suburban

Illinois.

The migration comes as exchanges seek to sell a broader range of

technology services to a market that has become almost entirely

electronic, while exerting control over the increasingly valuable

space that houses their systems.

"From a lot of perspectives, this is an important milestone for

us," said Lawrence Leibowitz, chief operating officer of NYSE

Euronext, which aims to build its technology arm into a $1 billion

business over the next five years.

NYSE Euronext's Mahwah, N.J., data center, part of a $500

million build-out that includes a sister facility in Basildon,

Essex in the U.K., is distinguished by a handful of buttonwood

trees planted to evoke the exchange's formation under such a tree

in 1792.

The facility, as big as seven football fields, gives the

exchange company at least two decades' room to grow, according to

Leibowitz. Space is being sold to hedge funds, banks and

high-frequency trading firms looking to situate their servers as

close to the exchange's trading engines as possible, to maximize

speed.

Hundreds of customers so far have signed on for such co-location

services, Leibowitz said. CME aims to begin offering similar

capabilities in 2012.

In the coming months, NYSE Euronext will shift its options

markets and electronic Arca stock platform into the Mahwah

facility, with the move-in seen completing early next year.

NYSE Euronext's U.K. futures market and European stock systems

are expected to migrate into the U.K. data center beginning in

October, finishing in the first half of 2011.

Exchanges' development of data centers puts them into a new

business dominated by companies like Savvis Inc. (SVVS), Telx Group

and Equinix Inc. (EQIX), which operate facilities that house other

exchanges' systems alongside those of mobile-phone companies,

websites and other network operators.

These units allow customers to benefit from being close to a

wide range of networks and information sources--a shopping mall of

potential connections. The exchange-operated facilities function

like an outlet store, giving trading-minded customers the most

direct electronic path to markets.

"Efficiency has always been something that markets strive for,"

said Alasdair Moore, co-owner of Fixnetix, among the biggest

providers of high-speed trading connections to European investors

and trading firms.

"On the NYSE floor you had runners who went between pits

collecting prices, and the people who could assimilate information

the quickest could update their prices more effectively and make

more money--that principle has never gone away," he said.

NYSE Euronext will use its New Jersey and U.K. units as

platforms to sell an array of data services, like managing

customers' connection to other trading venues and packaging

historical price information. A small number of staff works on-site

in case servers need rebooting or hard drives must be swapped

out.

A larger security detail guards the building, which was built to

withstand explosions. Both NYSE Euronext and CME declined to detail

the exact location of their units, citing security concerns.

At one of Equinix's Chicago facilities, visitors are escorted

past bulletproof glass and through a series of doors secured with

hand-scan devices before entering the climate-controlled halls of

cabinets that house network systems.

Customers can be as fixated on security as the data-center

operators. Telx Chief Executive Eric Shepcaro encountered one

financial-services firm that hired a company to attempt both

physical and virtual break-ins on a Telx facility, to measure its

defenses.

"We passed the test, and they're now a customer," Shepcaro

said.

-By Jacob Bunge, Dow Jones Newswires; (312) 750 4117;

jacob.bunge@dowjones.com

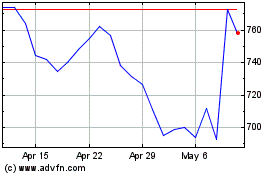

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2024 to Jun 2024

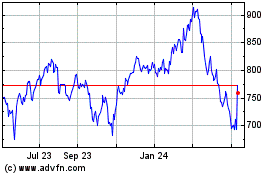

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Jun 2023 to Jun 2024