Equinix, Inc. (Nasdaq:EQIX), the leading provider of

network-neutral data centers and Internet exchange services, today

reported quarterly results for the period ended September 30, 2008.

Revenues were $183.7 million for the third quarter, a 7% increase

over the previous quarter and a 77% increase over the same quarter

last year, which includes an approximate negative $2.5 million

impact as a result of a strengthening U.S. dollar during the

quarter. Recurring revenues, consisting primarily of colocation,

interconnection and managed services, were $173.5 million, a 6%

increase over the prior quarter and a 75% increase over the same

quarter last year. Non-recurring revenues were $10.2 million in the

quarter. Cost of revenues were $109.9 million for the third

quarter, an 8% increase over the previous quarter and a 75%

increase over the same quarter last year. Cost of revenues,

excluding depreciation, amortization, accretion and stock-based

compensation of $39.3 million, were $70.6 million for the third

quarter, a 7% increase over the previous quarter and a 75% increase

over the same quarter last year. Cash gross margins, defined as

gross profit plus depreciation, amortization, accretion and

stock-based compensation, divided by revenues, for the quarter were

62%, the same as the previous quarter and up from 61% the same

quarter last year. Selling, general and administrative expenses

were $51.5 million for the third quarter, including $11.3 million

of stock-based compensation, a 9% decrease from the previous

quarter and a 48% increase over the same quarter last year.

Selling, general and administrative expenses, excluding

depreciation, amortization and stock-based compensation of $15.4

million, were $36.1 million for the third quarter, a 2% decrease

over the previous quarter and a 58% increase over same quarter last

year. Net income for the third quarter was $7.4 million, including

stock-based compensation expense of $12.6 million. This represents

a basic net income per share of $0.20 based on a weighted average

share count of 37.0 million and a diluted net income per share of

$0.19 based on a weighted average share count of 37.9 million for

the third quarter of 2008. EBITDA, defined as income or loss from

operations before depreciation, amortization, accretion,

stock-based compensation expense and restructuring charges, for the

third quarter was $77.0 million, up from $69.1 million the previous

quarter and up from $40.6 million the same quarter last year.

�Despite the challenging economic environment, Equinix delivered

another strong quarter,� said Steve Smith, president and CEO of

Equinix.��While we continue to closely monitor all aspects of the

business, we believe that the strength of our continued demand and

focus on business execution will allow us to extend our market

leadership position.� Capital expenditures in the third quarter

were $95.4 million, of which $13.5 million was attributed to

ongoing capital expenditures and $81.9 million was attributed to

expansion capital expenditures. The Company generated cash from

operating activities of $62.7 million as compared to $66.5 million

in the previous quarter. Cash used in investing activities was

$85.2 million as compared to $108.4 million in the previous

quarter. As of September 30, 2008, the Company�s cash, cash

equivalents and investments were $330.2 million, as compared to

$324.7 million at the end of the previous quarter. Other Company

Developments Completed on-schedule expansions in the Amsterdam,

Frankfurt, and Hong Kong markets, adding approximately 650 cabinet

equivalents in Europe and 550 cabinet equivalents in Asia Announced

plans to build a new 300,000 square foot data center in London and

a new 110,000 square foot data center in Singapore. Total capital

investment for the initial phases of the London and Singapore

expansions is expected to be in the range of approximately $125.0 -

$135.0 million Company Metrics Cabinet capacity as of September 30,

2008, and excluding the Europe region, was approximately 33,800

cabinets, including 27,100 in the U.S., and 6,700 in Asia The total

number of cabinets billing as of September 30, 2008, and excluding

the Europe region, was approximately 26,400 representing an

approximate utilization rate of�78%, a net increase of

approximately 1,250 cabinets in the quarter Cabinet and MRR churn,

excluding the Europe region, was approximately 2.0% in the quarter

On a weighted average basis as of September 30, 2008, and excluding

the Europe region, the number of cabinets billing was

approximately�26,100 representing an approximate utilization rate

of�78%. In the U.S., this result was 20,800 representing an

approximate utilization rate of 77%. In Asia, this result was 5,300

representing an approximate utilization rate of 84% Weighted

average monthly recurring revenue (MRR) per cabinet as of September

30, 2008, and excluding the Europe region, was $1,654. In the U.S.,

the MRR per cabinet was $1,756 and in Asia, the MRR per cabinet was

$1,254 U.S. interconnection service revenues were 19% of U.S.

recurring revenues for the quarter. Interconnection services

represented approximately 14% of total worldwide recurring revenues

for the quarter The total number of U.S. cross connects that were

billing as of September 30, 2008 was 21,522 The total number of

exchange ports sold as of September 30, 2008 was 740, which

included 136 in Asia and 70 in Europe, and 155 were 10 gigabits per

second Ethernet ports Added 178 new customers in the quarter

bringing the total number of customers worldwide to 2,228, which

excludes approximately 475 customers related to a portion of the

Netherlands operations Business Outlook For the full year of 2008,

total revenues are expected to be in the range of $702.0 to $706.0

million, including an approximate $12.0 million negative impact

from a strengthening U.S. dollar. Total year cash gross margins are

expected to range between 61% and 62%. Cash selling, general and

administrative expenses are expected to be approximately $145.0

million. EBITDA for the year is expected to be between $287.0 and

$289.0 million. Capital expenditures for 2008 are expected to be

$450.0 to $460.0 million, including approximately $60.0 million of

ongoing capital expenditures. For the full year of 2009, total

revenues are expected to be in the range of $870.0 to $892.0

million. EBITDA for the year is expected to be between $365.0 and

$385.0 million. Capital expenditures for 2009 are expected to be in

a range of $325.0 to $375.0 million, comprised of approximately

$60.0 million of ongoing capital expenditures, and $265.0 to $315.0

million of expansion capital expenditures. The Company will discuss

its results and guidance on its quarterly conference call on

Wednesday, October 22, 2008, at 5:30 p.m. EDT (2:30 p.m. PDT). To

hear the conference call live, please dial 210-234-0004 (domestic

and international) and reference the passcode (EQIX). A

simultaneous live Webcast of the call will be available over the

Internet at www.equinix.com, under the Investor Relations heading.

A replay of the call will be available beginning on Wednesday,

October 22, 2008, at 7:30 p.m. (ET) through November 22, 2008 by

dialing 203-369-0943. In addition, the Webcast will be available on

the company's Web site at www.equinix.com. No password is required

for either method of replay. About Equinix Equinix is the leading

global provider of network-neutral data center and interconnection

services, offering premium colocation, traffic exchange and

outsourced IT infrastructure solutions. Global enterprises, content

companies, systems integrators and network service providers look

to Equinix Internet Business Exchange (IBX�) centers for

world-class reliability and network diversity. Equinix IBX centers

serve as critical, core hubs for IP networks and Internet

operations worldwide. With 41 IBX centers located in 18 strategic

markets across North America, Europe and Asia-Pacific, Equinix

enables customers to reliably operate their mission-critical

infrastructure on a global basis. Important information about

Equinix is routinely posted on the investor relations page of its

website located at www.equinix.com. We encourage you to check

Equinix�s website regularly for the most up-to-date information.

This press release contains forward-looking statements that involve

risks and uncertainties. Actual results may differ materially from

expectations discussed in such forward-looking statements. Factors

that might cause such differences include, but are not limited to,

the challenges of acquiring, operating and constructing IBX centers

and developing, deploying and delivering Equinix services;

unanticipated costs or difficulties relating to the integration

of�companies�we have or will acquire into Equinix; a failure to

receive significant revenue from customers in recently built out or

acquired�data centers; failure to complete any financing

arrangements contemplated from time to time; competition from

existing and new competitors; the ability to generate sufficient

cash flow or otherwise obtain funds to repay new or outstanding

indebtedness; the loss or decline in business from our key

customers; and other risks described from time to time in Equinix's

filings with the Securities and Exchange Commission. In particular,

see Equinix's recent quarterly and annual reports filed with the

Securities and Exchange Commission, copies of which are available

upon request from Equinix. Equinix does not assume any obligation

to update the forward-looking information contained in this press

release. Equinix and IBX are registered trademarks of Equinix, Inc.

Internet Business Exchange is a trademark of Equinix, Inc. Non-GAAP

Financial Measures Equinix continues to provide all information

required in accordance with generally accepted accounting

principles (GAAP), but it believes that evaluating its ongoing

operating results may be difficult if limited to reviewing only

GAAP financial measures. Accordingly, Equinix uses non-GAAP

financial measures, such as EBITDA, cash cost of revenues, cash

gross margins, cash operating expenses (also known as cash selling,

general and administrative expenses or cash SG&A), free cash

flow and adjusted free cash flow to evaluate its operations. In

presenting these non-GAAP financial measures, Equinix excludes

certain non-cash or non-recurring items that it believes are not

good indicators of the Company's current or future operating

performance. These non-cash or non-recurring items are

depreciation, amortization, accretion, stock-based compensation,

restructuring charges and, with respect to 2007 results, the loss

from conversion and extinguishment of debt and gain on EMS sale.

Recent legislative and regulatory changes encourage use of and

emphasis on GAAP financial metrics and require companies to explain

why non-GAAP financial metrics are relevant to management and

investors. Equinix excludes these non-cash or non-recurring items

in order for Equinix's lenders, investors, and industry analysts

who review and report on the Company, to better evaluate the

Company's operating performance and cash spending levels relative

to its industry sector and competitor base. Equinix excludes

depreciation expense as these charges primarily relate to the

initial construction costs of our IBX centers and do not reflect

our current or future cash spending levels to support our business.

Our IBX centers are long-lived assets, and have an economic life

greater than ten years. The construction costs of our IBX centers

do not recur and future capital expenditures remain minor relative

to our initial investment. This is a trend we expect to continue.

In addition, depreciation is also based on the estimated useful

lives of our IBX centers. These estimates could vary from actual

performance of the asset, are based on historic costs incurred to

build out our IBX centers, and are not indicative of current or

expected future capital expenditures. Therefore, Equinix excludes

depreciation from its operating results when evaluating its

operations. In addition, in presenting the non-GAAP financial

measures, Equinix excludes amortization expense related to certain

intangible assets, as it represents a cost that may not recur and

is not a good indicator of the Company's current or future

operating performance. Equinix excludes accretion expense, both as

it relates to its asset retirement obligations as well as its

accrued restructuring charge liabilities, as these expenses

represent costs, which Equinix believes are not meaningful in

evaluating the Company's current operations. Equinix excludes

non-cash stock-based compensation expense as it represents expense

attributed to stock awards that have no current or future cash

obligations. As such, we, and our investors and analysts, exclude

this stock-based compensation expense when assessing the cash

generating performance of our operations. Equinix excludes

restructuring charges from its non-GAAP financial measures. The

restructuring charges relate to the Company's decision to exit

leases for excess space adjacent to several of our IBX centers,

which we do not intend to build out now or in the future. With

respect to its 2007 results, Equinix excludes the loss from

conversion and extinguishment of debt and the gain from EMS sale.

The loss from conversion and extinguishment of debt represents

activity that is not typical for the company. The gain on EMS sale

represents a unique transaction for the Company and future sales of

other service offerings are not expected. Management believes such

items as restructuring charges, the gain on the sale of a service

offering and the loss from conversion and extinguishment of debt

are unique transactions that are not expected to recur, and

consequently, does not consider these items as a normal component

of expenses or income related to current and ongoing operations.

Our management does not itself, nor does it suggest that investors

should, consider such non-GAAP financial measures in isolation

from, or as a substitute for, financial information prepared in

accordance with GAAP. However, we have presented such non-GAAP

financial measures to provide investors with an additional tool to

evaluate our operating results in a manner that focuses on what

management believes to be our core, ongoing business operations.

Management believes that the inclusion of these non-GAAP financial

measures provide consistency and comparability with past reports

and provide a better understanding of the overall performance of

the business and its ability to perform in subsequent periods.

Equinix believes that if it did not provide such non-GAAP financial

information, investors would not have all the necessary data to

analyze Equinix effectively. Investors should note, however, that

the non-GAAP financial measures used by Equinix may not be the same

non-GAAP financial measures, and may not be calculated in the same

manner, as that of other companies. In addition, whenever Equinix

uses such non-GAAP financial measures, it provides a reconciliation

of non-GAAP financial measures to the most closely applicable GAAP

financial measure. Investors are encouraged to review the related

GAAP financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measure. Equinix does not provide forward-looking guidance for

certain financial data, such as depreciation, amortization,

accretion, net income (loss) from operations, cash generated from

operating activities and cash used in investing activities, and as

a result, is not able to provide a reconciliation of GAAP to

non-GAAP financial measures for forward-looking data. Equinix

intends to calculate the various non-GAAP financial measures in

future periods consistent with how it was calculated for the three

and nine months ended September 30, 2008 and 2007, presented within

this press release. � � � � � EQUINIX, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS - GAAP PRESENTATION (in thousands, except

per share detail) (unaudited) � � � Three Months Ended Nine Months

Ended September 30, June 30, September 30, September 30, September

30, � 2008 � � 2008 � � 2007 � � 2008 � � 2007 � � Recurring

revenues $ 173,517 $ 163,395 $ 99,288 $ 487,271 $ 268,078

Non-recurring revenues � 10,218 � � 8,649 � � 4,494 � � 26,726 � �

12,650 � Revenues 183,735 172,044 103,782 513,997 280,728 � Cost of

revenues � 109,863 � � 102,008 � � 62,891 � � 306,357 � � 171,265 �

Gross profit � 73,872 � � 70,036 � � 40,891 � � 207,640 � � 109,463

� � Operating expenses: Sales and marketing 16,009 15,290 9,630

46,650 27,602 General and administrative 35,529 41,445 25,182

111,350 72,122 Restructuring charges � 799 � � - � � - � � 799 � �

407 � Total operating expenses � 52,337 � � 56,735 � � 34,812 � �

158,799 � � 100,131 � � Income from operations � 21,535 � � 13,301

� � 6,079 � � 48,841 � � 9,332 � � Interest and other income

(expense): Interest income 441 2,411 3,309 6,293 10,340 Interest

expense (13,880 ) (12,823 ) (5,662 ) (40,297 ) (15,240 ) Other

income (expense) (520 ) (918 ) 3,167 602 3,168 Loss on conversion

and extinguishment of debt � - � � - � � (2,554 ) � - � � (5,949 )

Total interest and other, net � (13,959 ) � (11,330 ) � (1,740 ) �

(33,402 ) � (7,681 ) � Net income (loss) before income taxes 7,576

1,971 4,339 15,439 1,651 � Income taxes (187 ) 258 (215 ) (400 )

(766 ) � � � � � Net income (loss) $ 7,389 � $ 2,229 � $ 4,124 � $

15,039 � $ 885 � � Net income (loss) per share: � Basic net income

(loss) per share $ 0.20 � $ 0.06 � $ 0.13 � $ 0.41 � $ 0.03 � �

Diluted net income (loss) per share $ 0.19 � $ 0.06 � $ 0.12 � $

0.40 � $ 0.03 � � Shares used in computing basic net income (loss)

per share � 36,972 � � 36,572 � � 31,683 � � 36,608 � � 30,845 � �

Shares used in computing diluted net income (loss) per share �

37,932 � � 37,844 � � 33,112 � � 37,731 � � 32,339 � � � EQUINIX,

INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - NON-GAAP

PRESENTATION (in thousands) (unaudited) � � � � � � Three Months

Ended Nine Months Ended September 30, June 30, September 30,

September 30, September 30, 2008 2008 2007 2008 2007 � Recurring

revenues $ 173,517 $ 163,395 $ 99,288 $ 487,271 $ 268,078

Non-recurring revenues 10,218 8,649 4,494 26,726 12,650 Revenues

(1) 183,735 172,044 103,782 513,997 280,728 � Cash cost of revenues

(2) 70,601 66,088 40,240 198,450 105,910 Cash gross profit (3)

113,134 105,956 63,542 315,547 174,818 � Cash operating expenses

(4): Cash sales and marketing expenses(5) 12,082 10,911 7,283

34,470 20,834 Cash general and administrative expenses (6) 24,079

25,911 15,620 72,701 45,656 Total cash operating expenses (7)

36,161 36,822 22,903 107,171 66,490 � EBITDA (8) $ 76,973 $ 69,134

$ 40,639 $ 208,376 $ 108,328 � � Cash gross margins (9) 62% 62% 61%

61% 62% � EBITDA flow-through rate (10) 67% 50% 45% 48% 50% � � �

(1) The geographic split of our revenues on a services basis is

presented below: � United States Revenues: Colocation $ 87,988 $

83,053 $ 62,232 $ 246,338 $ 172,736 Interconnection 20,756 20,106

17,448 59,881 49,991 Managed infrastructure 545 503 547 1,602 1,663

Rental 133 117 356 498 989 Recurring revenues 109,422 103,779

80,583 308,319 225,379 Non-recurring revenues 5,437 3,468 3,102

12,983 9,082 Revenues 114,859 107,247 83,685 321,302 234,461 �

Asia-Pacific Revenues: Colocation 14,592 13,485 8,583 39,888 23,479

Interconnection 1,897 1,648 1,126 5,080 2,956 Managed

infrastructure 3,432 3,525 3,816 10,619 11,084 Rental - - - - -

Recurring revenues 19,921 18,658 13,525 55,587 37,519 Non-recurring

revenues 1,658 1,946 1,118 4,769 3,294 Revenues 21,579 20,604

14,643 60,356 40,813 � Europe Revenues: Colocation 39,358 36,436

4,467 110,035 4,467 Interconnection 1,704 1,638 224 4,936 224

Managed infrastructure 2,991 2,805 467 8,080 467 Rental 121 79 22

314 22 Recurring revenues 44,174 40,958 5,180 123,365 5,180

Non-recurring revenues 3,123 3,235 274 8,974 274 Revenues 47,297

44,193 5,454 132,339 5,454 � Worldwide Revenues: Colocation 141,938

132,974 75,282 396,261 200,682 Interconnection 24,357 23,392 18,798

69,897 53,171 Managed infrastructure 6,968 6,833 4,830 20,301

13,214 Rental 254 196 378 812 1,011 Recurring revenues 173,517

163,395 99,288 487,271 268,078 Non-recurring revenues 10,218 8,649

4,494 26,726 12,650 Revenues $ 183,735 $ 172,044 $ 103,782 $

513,997 $ 280,728 � (2) We define cash cost of revenues as cost of

revenues less depreciation, amortization, accretion and stock-based

compensation as presented below: � Cost of revenues $ 109,863 $

102,008 $ 62,891 $ 306,357 $ 171,265 Depreciation, amortization and

accretion expense (38,005) (34,712) (21,773) (104,472) (62,336)

Stock-based compensation expense (1,257) (1,208) (878) (3,435)

(3,019) Cash cost of revenues $ 70,601 $ 66,088 $ 40,240 $ 198,450

$ 105,910 � The geographic split of our cash cost of revenues is

presented below: � U.S. cash cost of revenues $ 37,506 $ 33,587 $

30,677 $ 104,099 $ 85,074 Asia-Pacific cash cost of revenues 8,848

8,872 6,536 25,489 17,809 Europe cash cost of revenues 24,247

23,629 3,027 68,862 3,027 Cash cost of revenues $ 70,601 $ 66,088 $

40,240 $ 198,450 $ 105,910 � (3) We define cash gross profit as

revenues less cash cost of revenues (as defined above). � (4) We

define cash operating expenses as operating expenses less

depreciation, amortization, stock-based compensation, restructuring

charges and gains on asset sales. We also refer to cash operating

expenses as cash selling, general and administrative expenses or

"cash SG&A". � (5) We define cash sales and marketing expenses

as sales and marketing expenses less depreciation, amortization and

stock-based compensation as presented below: � Sales and marketing

expenses $ 16,009 $ 15,290 $ 9,630 $ 46,650 $ 27,602 Depreciation

and amortization expense (1,560) (1,626) (298) (4,759) (328)

Stock-based compensation expense (2,367) (2,753) (2,049) (7,421)

(6,440) Cash sales and marketing expenses $ 12,082 $ 10,911 $ 7,283

$ 34,470 $ 20,834 � (6) We define cash general and administrative

expenses as general and administrative expenses less depreciation,

amortization and stock-based compensation as presented below: �

General and administrative expenses $ 35,529 $ 41,445 $ 25,182 $

111,350 $ 72,122 Depreciation and amortization expense (2,512)

(2,447) (2,000) (7,554) (4,893) Stock-based compensation expense

(8,938) (13,087) (7,562) (31,095) (21,573) Cash general and

administrative expenses $ 24,079 $ 25,911 $ 15,620 $ 72,701 $

45,656 � (7) Our cash operating expenses, or cash SG&A, as

defined above, is presented below: � Cash sales and marketing

expenses $ 12,082 $ 10,911 $ 7,283 $ 34,470 $ 20,834 Cash general

and administrative expenses 24,079 25,911 15,620 72,701 45,656 Cash

SG&A $ 36,161 $ 36,822 $ 22,903 $ 107,171 $ 66,490 � The

geographic split of our cash operating expenses, or cash SG&A,

is presented below: � U.S. cash SG&A $ 22,728 $ 22,846 $ 17,565

$ 65,628 $ 53,964 Asia-Pacific cash SG&A 4,638 4,686 3,953

14,358 11,141 Europe cash SG&A 8,795 9,290 1,385 27,185 1,385

Cash SG&A $ 36,161 $ 36,822 $ 22,903 $ 107,171 $ 66,490 � (8)

We define EBITDA as income (loss) from operations less

depreciation, amortization, accretion, stock-based compensation

expense, restructuring charges and gains on asset sales as

presented below: � Income (loss) from operations $ 21,535 $ 13,301

$ 6,079 $ 48,841 $ 9,332 Depreciation, amortization and accretion

expense 42,077 38,785 24,071 116,785 67,557 Stock-based

compensation expense 12,562 17,048 10,489 41,951 31,032

Restructuring charges 799 - - 799 407 Gains on asset sales - - - -

- EBITDA $ 76,973 $ 69,134 $ 40,639 $ 208,376 $ 108,328 � The

geographic split of our EBITDA is presented below: � U.S. income

(loss) from operations $ 16,252 $ 15,310 $ 6,386 $ 44,840 $ 8,000

U.S. depreciation, amortization and accretion expense 27,275 24,615

20,175 75,110 60,240 U.S. stock-based compensation expense 10,299

10,889 8,882 30,826 26,776 U.S. restructuring charges 799 - - 799

407 U.S. gain on asset sale - - - - - U.S. EBITDA 54,625 50,814

35,443 151,575 95,423 � Asia-Pacific income (loss) from operations

2,119 1,138 312 3,932 1,951 Asia-Pacific depreciation, amortization

and accretion expense 4,419 4,449 2,584 12,492 6,005 Asia-Pacific

stock-based compensation expense 1,555 1,459 1,258 4,085 3,907

Asia-Pacific restructuring charges - - - - - Asia-Pacific gain on

asset sale - - - - - Asia-Pacific EBITDA 8,093 7,046 4,154 20,509

11,863 � Europe income (loss) from operations 3,164 (3,147) (619)

69 (619) Europe depreciation, amortization and accretion expense

10,383 9,721 1,312 29,183 1,312 Europe stock-based compensation

expense 708 4,700 349 7,040 349 Europe restructuring charges - - -

- - Europe gain on asset sale - - - - - Europe EBITDA 14,255 11,274

1,042 36,292 1,042 � EBITDA $ 76,973 $ 69,134 $ 40,639 $ 208,376 $

108,328 � (9) We define cash gross margins as cash gross profit

divided by revenues. � Our cash gross margins by geographic region

is presented below: � U.S. cash gross margins 67% 69% 63% 68% 64% �

Asia-Pacific cash gross margins 59% 57% 55% 58% 56% � Europe cash

gross margins 49% 47% 44% 48% 44% � (10) We define EBITDA

flow-through rate as incremental EBITDA growth divided by

incremental revenue growth as follows: � EBITDA - current period $

76,973 $ 69,134 $ 40,639 $ 208,376 $ 108,328 Less EBITDA - prior

period (69,134) (62,269) (35,311) (123,012) (79,237) EBITDA growth

$ 7,839 $ 6,865 $ 5,328 $ 85,364 $ 29,091 � Revenues - current

period $ 183,735 $ 172,044 $ 103,782 $ 513,997 $ 280,728 Less

revenues - prior period (172,044) (158,218) (91,837) (334,333)

(222,046) Revenue growth $ 11,691 $ 13,826 $ 11,945 $ 179,664 $

58,682 � EBITDA flow-through rate 67% 50% 45% 48% 50% � � EQUINIX,

INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands)

(unaudited) � � � � Assets September 30, December 31, � 2008 � �

2007 � � Cash, cash equivalents and investments $ 330,199 $ 383,900

Accounts receivable, net 62,376 60,089 Property and equipment, net

1,346,982 1,162,720 Goodwill and other intangible assets, net

473,459 510,133 Debt issuance costs, net 18,453 21,333 Deposits

15,543 16,731 Restricted cash 15,681 1,982 Prepaid expenses 14,191

11,070 Deferred tax assets 6,434 6,404 Taxes receivable 2,295 3,437

Other assets � 6,322 � � 4,069 � Total assets $ 2,291,935 � $

2,181,868 � � Liabilities and Stockholders' Equity � Accounts

payable $ 11,797 $ 14,816 Accrued expenses 59,437 50,280 Accrued

property and equipment 56,537 76,504 Accrued restructuring charges

11,468 12,140 Capital lease and other financing obligations 99,081

97,412 Mortgage and loans payable 416,358 330,496 Convertible debt

678,236 678,236 Deferred rent 29,901 26,912 Deferred installation

revenue 34,958 26,537 Deferred tax liabilities 21,785 25,955

Deferred recurring revenue 8,951 9,556 Asset retirement obligations

11,280 8,759 Customer deposits 11,686 8,844 Other liabilities �

3,210 � � 989 � Total liabilities � 1,454,685 � � 1,367,436 � �

Common stock 37 37 Additional paid-in capital 1,445,363 1,376,915

Accumulated other comprehensive income (64,557 ) (3,888 )

Accumulated deficit � (543,593 ) � (558,632 ) Total stockholders'

equity � 837,250 � � 814,432 � � Total liabilities and

stockholders' equity $ 2,291,935 � $ 2,181,868 � � � � � � � � � �

Ending headcount by geographic region is as follows: � U.S.

headcount 618 546 Asia-pacific headcount 176 187 Europe headcount �

268 � � 178 � Total headcount � 1,062 � � 911 � � � EQUINIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - GAAP PRESENTATION

(in thousands) (unaudited) � � � � � � � � � � Three Months Ended

Nine Months Ended September 30, June 30, September 30, September

30, September 30, � 2008 � � 2008 � � 2007 � � 2008 � � 2007 � �

Net cash provided by operating activities $ 63,321 $ 64,958 $

48,427 $ 191,263 $ 106,139 Net cash used in investing activities

(82,435 ) (216,215 ) (721,257 ) (434,850 ) (951,206 ) Net cash

provided by financing activities 26,428 41,924 783,240 112,950

1,107,012 Effect of foreign currency exchange rates on cash and

cash equivalents � 2,243 � � (374 ) � (1,556 ) � 689 � � (1,056 )

Net increase (decrease) in cash and cash equivalents 9,557 (109,707

) 108,854 (129,948 ) 260,889 Cash and cash equivalents at beginning

of period � 151,128 � � 260,834 � � 234,598 � � 290,633 � � 82,563

� Cash and cash equivalents at end of period $ 160,685 � $ 151,127

� $ 343,452 � $ 160,685 � $ 343,452 � � � In addition to the above

condensed consolidated statements of cash flows presented on a GAAP

basis, the Company presents non-GAAP condensed consolidated

statements of cash flows which combine the Company's short-term and

long-term investments with our cash and cash equivalents in an

effort to present our total unrestricted cash and equivalent

balances as presented herein in our condensed consolidated balance

sheets. � � Following is a reconciliation of our cash and cash

equivalents to our cash, cash equivalents and investments, which is

the basis of how our non-GAAP condensed consolidated statements of

cash flows are presented on the following page: � � Cash and cash

equivalents $ 160,685 $ 151,127 $ 343,452 $ 160,685 $ 343,452

Short-term investments 101,892 64,980 64,005 101,892 64,005

Long-term investments � 67,622 � � 108,642 � � 28,905 � � 67,622 �

� 28,905 � Cash, cash equivalents and investments as presented on

condensed balance sheet presented herein $ 330,199 � $ 324,749 � $

436,362 � $ 330,199 � $ 436,362 � � � EQUINIX, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS - NON-GAAP PRESENTATION (1)

(in thousands) (unaudited) � � � � � � Three Months Ended Nine

Months Ended September 30, June 30, September 30, September 30,

September 30, 2008 2008 2007 2008 2007 � Cash flows from operating

activities: Net income (loss) $ 7,389 $ 2,229 $ 4,124 $ 15,039 $

885 Adjustments to reconcile net income (loss) to net cash provided

by operating activities: Depreciation, amortization and accretion

42,077 38,785 24,071 116,785 67,557 Stock-based compensation 12,562

17,048 10,489 41,951 31,032 Debt issuance costs 1,172 1,178 812

3,753 1,985 Restructuring charges 799 - - 799 407 Gain on foreign

currency hedge - - (1,494) - (1,494) Other reconciling items 353

268 (529) 1,154 (384) Changes in operating assets and liabilities:

Accounts receivable (2,252) (4,037) (5,658) (3,783) (7,068)

Accounts payable and accrued expenses (522) 4,430 17,786 5,015

23,079 Accrued restructuring charges (594) (695) (3,203) (2,034)

(10,100) Other assets and liabilities 1,729 7,275 2,275 13,647

1,008 Net cash provided by operating activities 62,713 66,481

48,673 192,326 106,907 Cash flows from investing activities:

Purchase of IXEurope, less cash acquired - - (541,729) - (541,729)

Purchase of Virtu, less cash acquired - - - (23,241) - Purchase of

Los Angeles IBX property - - (19) - (49,059) Purchase of San Jose

IBX property - - (64,971) - (71,471) Purchases of other property

and equipment (95,445) (84,458) (88,921) (305,546) (295,809)

Accrued property and equipment 10,226 (23,176) (23,939) (16,015)

23,940 Other investing activities - (732) 1,347 (13,901) 877 Net

cash used in investing activities (85,219) (108,366) (718,232)

(358,703) (933,251) Cash flows from financing activities: Proceeds

from employee equity awards 6,849 12,000 10,406 26,087 27,568

Proceeds from follow-on common stock offering - - 339,946 - 339,946

Proceeds from convertible debt - - 395,986 - 645,986 Proceeds from

mortgage and loans payable 24,576 35,643 49,491 102,101 118,754

Repayment of capital lease and other financing obligations (956)

(952) (500) (2,874) (1,445) Repayment of mortgage and loans payable

(4,034) (4,330) (543) (11,456) (1,573) Debt issuance costs (7)

(437) (11,546) (908) (22,224) Net cash provided by financing

activities 26,428 41,924 783,240 112,950 1,107,012 Effect of

foreign currency exchange rates on cash and cash equivalents 1,528

(816) (1,285) (274) (787) Net increase (decrease) in cash, cash

equivalents and investments 5,450 (777) 112,396 (53,701) 279,881

Cash, cash equivalents and investments at beginning of period

324,749 325,526 323,966 383,900 156,481 Cash, cash equivalents and

investments at end of period $ 330,199 $ 324,749 $ 436,362 $

330,199 $ 436,362 � � Free cash flow (2) $ (22,506) $ (41,885) $

(669,559) $ (166,377) $ (826,344) � Adjusted free cash flow (3) $

(22,506) $ (41,885) $ (62,840) $ (143,136) $ (164,085) � � � (1)

The cash flow statements presented herein combine our short-term

and long-term investments with our cash and cash equivalents in an

effort to present our total unrestricted cash and equivalent

balances. In our quarterly filings with the SEC on Forms 10-Q and

10-K, the purchases, sales and maturities of our short-term and

long-term investments will be presented as activities within the

investing activities portion of the cash flow statements. � (2) We

define free cash flow as net cash provided by operating activities

plus net cash used in investing activities (excluding the

purchases, sales and maturities of short-term and long-term

investments) as presented below: � Net cash provided by operating

activities as presented above $ 62,713 $ 66,481 $ 48,673 $ 192,326

$ 106,907 Net cash used in investing activities as presented above

(85,219) (108,366) (718,232) (358,703) (933,251) Free cash flow $

(22,506) $ (41,885) $ (669,559) $ (166,377) $ (826,344) � (3) We

define adjusted free cash flow as free cash flow (as defined above)

excluding any purchases or sales of real estate and acquisitions

and proceeds from asset sales as presented below: � Free cash flow

(as defined above) $ (22,506) $ (41,885) $ (669,559) $ (166,377) $

(826,344) Less purchase of IXEurope, less cash acquired - - 541,729

- 541,729 Less purchase of Virtu, less cash acquired - - - 23,241 -

Less purchase of Los Angeles IBX property - - 19 - 49,059 Less

purchase of San Jose IBX property - - 64,971 - 71,471 Adjusted free

cash flow $ (22,506) $ (41,885) $ (62,840) $ (143,136) $ (164,085)

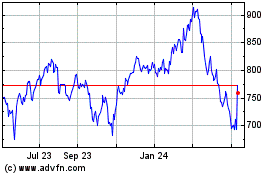

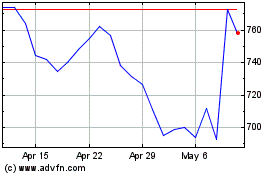

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Nov 2023 to Nov 2024